Global Ports Holding PLC (GPH) Trading statement for nine months

to 31 December 2021 11-March-2022 / 07:00 GMT/BST Dissemination of

a Regulatory Announcement that contains inside information

according to REGULATION (EU) No 596/2014 (MAR), transmitted by EQS

Group. The issuer is solely responsible for the content of this

announcement.

-----------------------------------------------------------------------------------------------------------------------

Global Ports Holding Plc

Trading Statement for the nine months to 31 December 2021

Global Ports Holding Plc ("GPH" or "Group"), the world's largest

independent cruise port operator, today issues a trading update for

the period from 1 April to 31 December 2021, which is the first

nine months of its new 2022 reporting period to 31 March 2022.

9 months ended 9 months ended YoY Change 3 months ended 3 months ended

Key Financials1

31-Dec-21 31-Dec-20 (%) 31-Dec-21 (Q3) 31-Dec-20

Restated8 Restated8

Total Revenue (USDm) 107.2 60.5 77% 46.1 14.1

Adjusted Revenue (USDm)2 28.2 10.2 177% 13.4 3.9

Segmental EBITDA (USDm) 4 8.1 (4.3) n/a 6.0 (0.7)

Adjusted EBITDA (USDm) 6 4.4 (8.8) n/a 4.9 (3.0)

31-Dec-21 31-Mar-21

Gross Debt (IFRS) 589.9 548.9 7%

Gross Debt ex IFRS 16 Finance Lease 526.0 483.0 9%

Net Debt ex IFRS 16 Finance Lease 445.1 312.4 42%

Cash and Cash Equivalents 80.9 170.7 -53%

Notes 1. All USD refers to United States Dollar unless otherwise

stated 2. Adjusted revenue is calculated as total revenue excluding

IFRIC-12 construction revenue at Nassau CruisePort 3. Sum of

revenues of consolidated and managed cruise portfolio excluding

IFRIC-12 construction revenue atNassau Cruise Port 4. Segmental

EBITDA is calculated as income/(loss) before tax after adding back:

interest; depreciation;amortisation; unallocated expenses; and

specific adjusting items 5. EBITDA allocated to the Cruise segment

is the sum of EBITDA of consolidated cruise ports and pro-rata

NetProfit of equity-accounted associates La Goulette, Lisbon,

Singapore and Venice and the contribution frommanagement agreements

6. Adjusted EBITDA calculated as Segmental EBITDA less unallocated

(holding company) expenses 7. Passenger numbers refer to

consolidated and managed portfolio consolidation perimeter; hence

it excludesequity accounted associate ports La Goulette, Lisbon,

Singapore and Venice. 8. Comparative information has been restated,

excluding the contribution from Port Akdeniz due to the saleof the

entity in January 2021.

Key Highlights

-- Strong acceleration in cruise activity in the third quarter

of the current financial year

-- The material increase in cruise activity we reported in the

half-year results statement has acceleratedin the third quarter,

with cruise passenger volumes of 1.5 million for the 9M period

ended 31 December 2021

-- GPH welcomed 1.0 million cruise passengers in the 3M period

ended 31 December 2021, the highest level ofcruise passengers in a

quarter since calendar Q1 2020

-- Strong growth in Adjusted Revenue to USD28.2m, up 177% from

the same period last year, with Cruise Revenuerising by 385% from

the same period last year

-- Q3 Adjusted Revenue grew 244% from the same period last year,

with Adjusted Cruise Revenue growing 542%

-- Segmental EBITDA of USD8.1m compares to a loss of USD4.3m for

the same period last year -- Adjusted EBITDA of USD4.4m compared to

an adjusted EBITDA loss of USD8.8m for the same period last

year

9 months ended 9 months ended YoY Change 3 months ended 3 months ended

KPI Highlights1

31-Dec-21 31-Dec-20 (%) 31-Dec-21 31-Dec-20

Restated8 Restated8

Passengers (m PAX) 7 1.5 0.04 3760% 1.0 0.03

General & Bulk Cargo ('000 tons) 140.2 25 461% 80.1 6.6

Container Throughput ('000) TEU) 36.4 41.8 -13% 10.5 14.6

Cruise Revenue ex-IFRIC 12 (USDm) 3 21.6 4.5 385% 11.3 1.8

Commercial Revenue (USDm) 6.5 5.7 14% 2.0 2.1

Adjusted Revenue (USDm)2 28.2 10.2 177% 13.4 3.9

Cruise EBITDA (USDm) 5 5.5 (6.3) n/a 5.2 (1.6)

Commercial EBITDA (USDm) 2.6 1.9 35% 0.8 0.8

Adjusted EBITDA (USDm) 6 4.4 (8.8) n/a 4.9 (3.0)

Cruise EBITDA Margin (%) 25% n/a 45% n/a

Commercial EBITDA Margin (%) 40% 34% 40% 39%

Adjusted EBITDA Margin (%) 16% n/a 36% n/a

Cruise

-- The increased activity in the third quarter was the result of

a significant increase in cruise calls inthe period. Fiscal Q3

cruise calls increased by 113% on Q2 and 1559% from the same period

last year on alike-for-like basis

-- Cruise calls in the quarter were still down 32% compared to

the same pre-Covid period in 2019. However,this is a significant

improvement compared to -84% at the half-year stage

-- Cruise revenue for the third quarter was USD9.6m higher than

in the same period last year, at USD11.3m andCruise EBITDA was

USD6.7m higher at USD5.2m, representing a Q3 Cruise EBITDA margin

of 45%

-- Total cruise revenue was USD100.7m for the nine months to 31

December 2021. Excluding the impact ofIFRIC-12 Construction

revenues at Nassau Cruise Port cruise revenue was USD21.6m, a

significant increase on the USD4.5mreported for the nine months to

31 December 2020 -- On-board Covid-19 measures continue to impact

occupancy rates across the industry negatively. Thisimpact is

reflected in passenger volumes, which in Q3 on like-for-like basis

were 42% of the passenger volumesfor the same period in 2019.

Nevertheless, this is a material improvement compared to fiscal

H1-2022, werepassenger volumes were only 12% of the passenger

volumes for the same period in 2019

Commercial

-- Total container volumes (TEUs) fell by 13% and General &

Bulk volumes grew 461%, driven by volumes incertain low margin

cargo items

-- Total commercial revenues rose by 14% to USD6.5m for the nine

months to 31 December 2021 vs USD5.7m for thenine months to 31

December 2020

Balance Sheet

At 31 December 2021, IFRS gross debt was USD589.9m (Ex IFRS-16

Finance Leases Gross Debt: USD526m), compared to gross debt at 31

March 2021 of USD548.9m (Ex IFRS-16 Finance Leases Gross Debt:

USD483.0m). Net debt Ex IFRS-16 finance leases was USD445.1m

compared to USD312.4m as at 31 March 2021. At 31 December 2021, GPH

had cash and cash equivalents of USD80.9m, compared to USD170.6m at

31 March 2021.

The net debt increase of USD132.7m in the period was primarily

driven by (i) capital expenditure of USD83.6m, with USD79.5m of

this spent on our continued investment into the transformation of

Nassau Cruise Port, (ii) the use of the high level of available

cash as of 31 March 2021 as a result of the sale of Port Akdeniz in

January 2021 for the Eurobond refinancing, and (iii) additional

indebtedness at Nassau Cruise Port to finance the investment

commitment there. Net cash from operating activities was a negative

USD11.8m in the period, mainly driven by advance contractor

payments for capital expenditure in Nassau.

Net cash from financing activities was a negative USD98.5m,

reflecting the net impact of our early Eurobond repayment, drawdown

on our new loan facility and an additional USD55.0m of debt

issuance by Nassau Cruise Port as well as USD43.1m of interest paid

in the period. Interest cash payments during the period were

notably higher because the first interest payment date on the May

2020 bond issued by Nassau Cruise Port (current outstanding amount

of USD134.4m) was June 2021. All future interest at Nassau Cruise

Port is to be paid semi-annually.

During the period, GPH entered into a five-year, senior secured

loan agreement for up to USD261.3m with Sixth Street, a leading

global investment firm. The loan agreement provides for two term

loan facilities, an initial five-year term facility of USD186.3m

and an additional five-year growth facility of up to USD75.0m. The

latter will be key to the continued success of our growth strategy.

The first enabled the early repayment in July 2021 of the USD250m

8.125% senior secured Eurobond due November 2021 (together with

proceeds from the sale of Port Akdeniz).

Other developments

Despite the significant impact of Covid-19 on the cruise

industry and our cruise operations, we have continued to deliver on

our strategic growth ambitions. GPH added two more cruise ports to

its port network during the period. A 20-year concession agreement

was signed and operations commenced at Taranto Cruise Port, Italy,

and a 20-year lease agreement for Kalundborg Cruise Port, Denmark,

was also signed. Ravenna Cruise Port, which accounted for less than

1% of our cruise passenger volumes in calendar 2019, exited the

portfolio during the period when the concession agreement came to

an end.

(MORE TO FOLLOW) Dow Jones Newswires

March 11, 2022 02:00 ET (07:00 GMT)

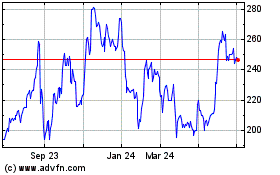

Global Ports (LSE:GPH)

Historical Stock Chart

From Mar 2024 to Apr 2024

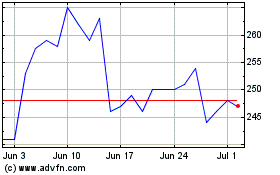

Global Ports (LSE:GPH)

Historical Stock Chart

From Apr 2023 to Apr 2024