Global Ports Holding PLC (GPH) Trading statement of twelve

months to 31 March 2022 11-May-2022 / 07:05 GMT/BST Dissemination

of a Regulatory Announcement that contains inside information

according to REGULATION (EU) No 596/2014 (MAR), transmitted by EQS

Group. The issuer is solely responsible for the content of this

announcement.

-----------------------------------------------------------------------------------------------------------------------

Global Ports Holding Plc

Trading Statement for the twelve months to 31 March 2022

Global Ports Holding Plc ("GPH" or "Group"), the world's largest

independent cruise port operator, today issues a trading update

with its unaudited preliminary financials for the period from 1

April 2021 to 31 March 2022.

12 months ended 15 months ended YoY Change 3 months ended 3 months ended

Key Financials1 31-Mar-21

31-Mar-22 31-Mar-21 (%) 31-Mar-22 (Q4)

Unaudited Audited

Total Revenue (USDm) 130.8 79.4 65% 23.5 13.9

Adjusted Revenue (USDm)2 40.3 26.8 50% 12.1 3.9

Segmental EBITDA (USDm) 4 13.0 1.2 1028% 5.0 (1.0)

Adjusted EBITDA (USDm) 6 7.6 (6.7) n/a 3.2 (2.6)

31-Mar-22 31-Mar-21

Gross Debt (IFRS) 597.7 548.9 9%

Gross Debt ex IFRS 16 Finance Lease 534.9 483.0 11%

Net Debt ex IFRS 16 Finance Lease 435.2 312.4 39%

Cash and Cash Equivalents 99.7 170.7 -42%

Key Highlights

-- The strong rebound in cruise activity in the third quarter of

the financial year continued in the fourthquarter, with our

Caribbean ports experiencing a strong pick-up in activity

-- In the 12 months ended 31 March 2022, GPH welcomed 2.4m

cruise passengers, 0.9m of which were welcomed inthe three months

ended 31 March 2022

-- Adjusted revenue for the 12 months recovered strongly to

USD40.3m

-- At the EBITDA level, the group returned to operational

profitability in the transitional post-pandemicperiod of the fiscal

year 2022. With Segmental EBITDA of USD13.0m and Adjusted EBITDA of

USD7.6m compared to a loss ofUSD6.7m for the fifteen months ended

31 March 2021 -- Further delivery of our new port strategy was

achieved in the fourth quarter, with the award of a12-year

concession, plus a 6-year extension option, to manage the services

for cruise passengers at TarragonaCruise Port, Spain. This

agreement followed the recent addition of GPH's first cruise port

in Northern Europe,Kalundborg Cruise Port, Denmark and the awarding

of preferred bidder status to GPH for three cruise ports inthe

Canary Islands

-- Outlook for the year to March 2023 continues to improve, with

the industry now expecting to have allcruise ships back in service

during summer 2022 and occupancy levels to reach historical levels

before the endof the calendar year 2022

12 months ended 15 months ended YoY Change 3 months ended 3 months ended

KPI Highlights1

31-Mar-22 31-Mar-21 (%) 31-Mar-22 31-Mar-21

Passengers (m PAX) 7 2.4 1.3 85% 0.9 0.01

General & Bulk Cargo ('000 tons) 201.4 37.7 429% 60.8 12.7

Container Throughput ('000) TEU) 47.0 54.0 -13% 10.6 12.2

Cruise Revenue ex-IFRIC 12 (USDm) 3 31.7 17.5 81% 10.1 2.0

Commercial Revenue (USDm) 8.6 9.3 -8% 2.1 1.9

Adjusted Revenue (USDm)2 40.3 26.8 50% 12.1 3.9

Cruise EBITDA (USDm) 5 9.6 (1.7) n/a 4.2 (1.6)

Commercial EBITDA (USDm) 3.4 2.9 19% 0.8 0.6

Adjusted EBITDA (USDm) 6 7.6 (6.7) n/a 3.2 (2.6)

Cruise EBITDA Margin (%) 30% n/a 41% n/a

Commercial EBITDA Margin (%) 40% 31% 38% 32%

Adjusted EBITDA Margin (%) 19% n/a 26% n/a

Cruise

-- GPH welcomed 0.9m cruise passengers across the consolidated

cruise port network in the fourth quarter ofits fiscal year 2022,

compared to just 10k in the comparable period last year. While all

cruise port reportingsegments experienced a significant increase,

the most significant increases occurred at Antigua Cruise Port

andNassau Cruise Port, in line with the usual seasonality

-- Excluding the impact of IFRIC-12 Construction revenues at

Nassau Cruise Port, cruise revenue for the12-months to 31 March

2022 was USD31.7m, a significant increase from the USD6.5m for the

12-months to 31 March 2021 -- Cruise revenue for the fourth quarter

was USD8.1m higher than in the same period last year, at

USD10.1m

-- Cruise EBITDA of USD9.6m compares to an EBITDA loss of

USD7.4m for the 12-months to 31 March 2021. Q4Cruise EBITDA was

USD5.8m higher at USD4.2m, representing a Q4 Cruise EBITDA margin

of 41%

-- The experience of our ports in the fourth quarter has been

one of a significant increase in calls butcontinued lower than

normal occupancy levels as cruise lines build back bookings for

calendar year 2022 onshorter lead times than normal and due to

Covid-19- related protocols and short-term cancellations by

cruisepassengers

-- In Q4-2022, passenger volumes across our network on a

like-for-like basis were 48% of the passengervolumes for the same

period in 2019. The omicron variant negatively impacted on-board

occupancy levels in thequarter. However, as the quarter progressed,

occupancy levels rose and in March 2022, on a like-for-like

basis,passenger volumes rose to 62% of 2019 levels

Commercial

-- Total container volumes (TEUs) fell by 13% and General &

Bulk volumes grew 429%, driven by volumes incertain low margin

cargo items

-- Commercial revenues for the 12 months were USD8.6m, with Q4

revenue of USD2.1m

Balance Sheet

At 31 March 2022, IFRS gross debt was USD597.7m (Ex IFRS-16

Finance Leases Gross Debt: USD534.9m), compared to gross debt at 31

March 2021 of USD548.9m (Ex IFRS-16 Finance Leases Gross Debt:

USD483.0m). Net debt Ex IFRS-16 finance leases was USD435.2m

compared to USD312.4m as at 31 March 2021. At 31 March 2022, GPH

had cash and cash equivalents of USD99.7m, compared to USD170.6m at

31 March 2021.

The net debt increase of USD122.8m in the period was primarily

driven by (i) capital expenditure of USD95.8m, with USD91.2m of

this spent on our continued investment into the transformation of

Nassau Cruise Port, (ii) the net effect of the Eurobond

refinancing, in particular, the use of the high level of available

cash as of 31 March 2021 as a result of the sale of Port Akdeniz in

January 2021 in such Eurobond refinancing, and (iii) additional

indebtedness at Nassau Cruise Port to finance the investment

commitment there.

During the period, GPH entered into a five-year, senior secured

loan agreement for up to USD261.3m with Sixth Street, a leading

global investment firm. The loan agreement provides for two term

loan facilities, an initial five-year term facility of USD186.3m

and an additional five-year growth facility of up to USD75.0m. The

latter will be key to the continued success of our growth strategy.

The first enabled the early repayment in July 2021 of the USD250m

8.125% senior secured Eurobond due November 2021 (together with

proceeds from the sale of Port Akdeniz).

Other developments

Despite the significant impact of Covid-19 on the cruise

industry and our cruise operations, we have continued to deliver on

our strategic growth ambitions. In the fourth quarter, we were

awarded a 12-year concession, with a 6-year extension option, to

manage the services for cruise passengers at Tarragona Cruise Port,

Spain.

This agreement follows the recent addition of GPH's first cruise

port in Northern Europe, with Kalundborg Cruise Port, Denmark

joining the PGH network under a 20-year agreement and signing a

20-year concession agreement at Taranto Cruise Port, Italy, as well

as being awarded preferred bidder status to Global Ports Canary

Islands S.L., an 80:20 joint venture between GPH and our local

partner Sepcan S.L., to operate three cruise port concessions in

the Canary Islands.

After the year-end, GPH announced that Emre Sayin, Chief

Executive Officer, is stepping down from his role to pursue new

business opportunities. Emre is expected to leave Global Ports

Holding by the 26th May 2022. Mehmet Kutman, Co-Founder and

Executive Chairman of GPH, will take on the Chief Executive Officer

role as the business continues its path of recovery from the

Covid-19 pandemic.

Outlook

Long term, the outlook for the cruise industry continues to be

positive. The passenger capacity of the industry is forecasted to

grow by 45% by 2027, from 2019 levels. Driven by the 75 cruise

ships currently in the cruise ship order book and due for delivery

by 2027.

(MORE TO FOLLOW) Dow Jones Newswires

May 11, 2022 02:05 ET (06:05 GMT)

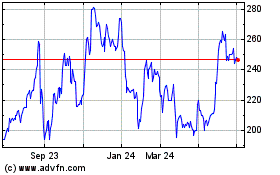

Global Ports (LSE:GPH)

Historical Stock Chart

From Mar 2024 to Apr 2024

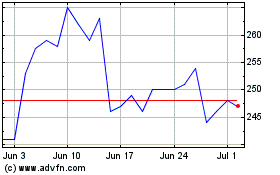

Global Ports (LSE:GPH)

Historical Stock Chart

From Apr 2023 to Apr 2024