TIDMGR1T

RNS Number : 0454T

Grit Real Estate Income Group

22 November 2021

NOT FOR RELEASE, DISTRIBUTION OR PUBLICATION, DIRECTLY OR

INDIRECTLY, IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA, JAPAN

OR ANY OTHER JURISDICTION IN WHICH THE PUBLICATION, DISTRIBUTION OR

RELEASE OF THIS ANNOUNCEMENT WOULD BE UNLAWFUL. PLEASE SEE THE

SECTION ENTITLED "DISCLAIMER" TOWARDS THE OF THIS ANNOUNCEMENT.

This announcement is an advertisement and does not constitute a

prospectus and investors must subscribe for or purchase any shares

referred to in this announcement only on the basis of information

contained in the prospectus to be published by Grit Real Estate

Income Group Limited (the "Prospectus") and not in reliance on this

announcement. A copy of the Prospectus will, subject to certain

access restrictions, be available for inspection on the Company's

website: www.grit.group and at the registered office of the

Company. A copy of the Prospectus will be made available for

viewing at the National Storage Mechanism at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism.This

announcement does not constitute, and may not be construed as, an

offer to sell or an invitation to purchase, investments of any

description, or a recommendation regarding the issue or the

provision of investment advice by any party.

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED TO

CONSTITUTE INSIDE INFORMATION AS STIPULATED UNDER THE MARKET ABUSE

REGULATION (EU NO. 596/2014) (AS AMED) AS IT FORMS PART OF UK

DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018

AND OTHER IMPLEMENTING MEASURES. UPON THE PUBLICATION OF THIS

ANNOUNCEMENT, THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN

THE PUBLIC DOMAIN.

Terms not otherwise defined in this announcement have the

meanings given to them in the Prospectus.

GRIT REAL ESTATE INCOME GROUP LIMITED

(Registered in Guernsey)

(Registration number: 68739)

LSE share code: GR1T

SEM share code: DEL.N0000

ISIN: GG00BMDHST63

LEI: 21380084LCGHJRS8CN05

("Grit" or the "Company" and, together with its subsidiaries, the "Group" )

Proposed Open Offer and Placing for up to 414,647,283 New

Ordinary Shares at US$0.52 per New Ordinary Share

Proposed acquisition of majority stakes in Gateway Real Estate

Africa Limited ("GREA") and Africa Property Development Managers

Limited ("APDM") (the "Proposed Acquisition") and connected smaller

related party transaction

and

Notice of General Meeting

The board of Directors (the "Board" or "Grit Board") of Grit

Real Estate Income Group Limited , a leading pan-African real

estate company focused on investing in and actively managing a

diversified portfolio of assets underpinned by predominantly US$

and Euro denominated long-term leases with high quality

multi-national tenants, today announces:

-- Proposed Open Offer and Placing for up to 414,647,283 New

Ordinary Shares at US$0.52 per New Ordinary Share (the " Open Offer

and Placing "), the Open Offer being on the basis of 1.3011 New

Ordinary Shares for every 1 Existing Ordinary Share held at the

Record Date (the "Open Offer Entitlement");

-- Proposed Acquisition of majority stakes in Gateway Real

Estate Africa Limited (" GREA ") and Africa Property Development

Management Limited ("APDM") (together the " Proposed Acquisition ")

and connected smaller related party transaction; and

-- the convening of a general meeting to be held on 14 December

2021 at which Shareholders will be asked to approve the Proposed

Acquisition (the " General Meeting ").

Key highlights

-- The Company is targeting an issue to raise approximately

US$215.6 million (gross) through the issue of up to 414,647,283 New

Ordinary Shares by way of the Open Offer and Placing (together, the

"Issue") at US$0.52 per New Ordinary Share (the "Issue Price").

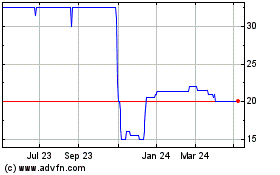

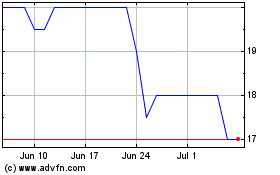

o The Issue Price represents a premium of approximately 4 per

cent. to the average closing price across the LSE and SEM for an

Ordinary Share on 19 November 2021 (LSE: GBP0.3468; SEM: US$0.53).

The Issue Price has been set by the Directors following their

assessment of the prevailing market conditions and anticipated

demand for the New Ordinary Shares, as well as taking into account

the commercial requirements and positive financial impact on the

Grit Group of implementing the deleveraging strategy and

undertaking the Proposed Acquisition. The Grit Board believes that

the Issue Price (including the premium) is appropriate in the

circumstances.

o As at 19 November 2021, Grit had already received written

confirmation from existing Shareholders and new investors of their

intention to subscribe, in aggregate, for in excess of US$65

million pursuant to the Open Offer and Placing, and when combined

with Grit's ability to deliver Ordinary Shares in consideration for

the Proposed Acquisition, in aggregate, demand for approximately 68

per cent. of the total target Issue has been indicated.

-- The net proceeds of the proposed Open Offer and Placing are

expected to reduce Grit's overall indebtedness and leverage levels

and provide future capital for further expansion in its core and

expanded business.

o The Grit Group LTV ratio will fall from 53.1 per cent. as at

30 June 2021 to a pro forma level of 41.3 per cent. if the Issue is

subscribed to the level of the Indicated Minimum Proceeds and 33.6

per cent. if the Issue is fully subscribed.

-- For the year ended 30 June 2021, as a result of slow progress

towards the near term 45% LTV target, the Grit Board withheld the

final dividend. Should the contemplated Issue and the Proposed

Acquisition be successful, the Grit Board expects to resume

dividend payments, distributing out of net operating income

generated from its existing property assets, in line with its

stated policy of paying out at least 80 per cent. of distributable

earnings and is targeting paying a dividend in the current

financial year of between US cents 5 to 6 per share. 1

-- The proceeds of the Issue will also enable Grit to acquire a

controlling shareholding in GREA and a majority shareholding in

APDM, GREA's external management company.

o Following completion of the Proposed Acquisition, Grit will

own a combined direct and indirect majority interest in GREA (51.66

per cent.) and a direct majority interest in APDM (78.95 per

cent.).

o The Proposed Acquisition is expected to materially accelerate

Grit's ability to access development returns from risk mitigated

development projects from GREA's attractive pipeline of development

opportunities and give Grit the additional management resources and

control required to lead the further development of GREA, via APDM.

The acquisition of a controlling interest in APDM offers Grit the

potential for new revenue and fee income streams, asset and

facilities management with respect to OBO and other discrete asset

classes and accelerates Grit's strategy of increasing its exposure

to the provision of professional services to its clients and other

third parties.

o Although Grit remains confident of delivering superior total

returns in the medium to longer term and is well positioned to

capitalise on the significant recovery potential across its unique

high-quality property portfolio, the Grit Board additionally sees

significant further potential value creation through increasing its

capital allocation to limited, risk mitigated development returns

and would expect these to increase the Grit Group's total targeted

shareholder return over time from 12 per cent. to 13 to 15 per

cent. per annum. 2

o Shareholders and other investors should note that completion

of the Proposed Acquisition is conditional on, amongst other

things, the passing of the Proposed Acquisition Resolution at the

General Meeting of the Company and Admission.

o The Company has already received written confirmation from

existing Shareholders, who in aggregate represent greater than 53

per cent. of those entitled to vote at the General Meeting, of

their intention to support the Proposed Acquisition.

Notes

1 Investors should note that the target dividend is a target

only and is not a profit forecast. There may be a number of factors

that adversely affect the Company's ability to achieve its target

dividend and there can be no assurance that it will be met. The

target dividend should not be seen as an indication of the

Company's expected or actual results or returns. Accordingly,

investors should not rely on these targets in deciding whether to

invest in the New Ordinary Shares or assume that the Company will

make any distributions at all.

2 This is a target only and is not guaranteed. It is based on a

number of bases and assumptions which may or may not

materialise.

Reasons for the Issue

The Board is of the opinion that the Grit Group should take

action now to improve the Grit Group LTV and to proactively enhance

the position of the Company for the expected post-pandemic recovery

opportunities rather than wait for the natural recovery of

valuations. This view is based on the following key

considerations:

(a) Grit's debt funders are currently imposing onerous dividend

and debt repayment restrictions on the Grit Group while the LTV

remains elevated, which will continue to constrain the Board in

meeting its distribution targets out of ongoing operational

cashflows;

(b) with the exception of the retail portfolio and slow

collections in the hospitality sector, the current asset portfolio

performed well throughout the COVID-19 pandemic period and

continues to produce strong rent collections and robust operational

and asset performance;

(c) a reduced Grit Group LTV would allow management to focus its

attention on further key operational initiatives to support its

tenants, increase occupancy and maintain strong cash collections

without the constant distraction of managing (non-cash) covenant

considerations;

(d) the Board believes the medium term NAV growth prospects of

the Grit Group can be significantly improved when taking into

account the Proposed Acquisition and further future pipeline

opportunities;

(e) the Board believes that there are significant opportunities

- particularly when taking into account the Proposed Acquisition -

to secure and lock-in longer-term, more cost-effective debt funding

through a consolidated debt strategy (for example, potentially

tapping into the global bond markets) that should be capitalised on

in the short-term (before interest rates potentially rise in the

medium-term) and will be facilitated by a larger, stronger and

pre-emptively corrected balance sheet;

(f) capitalising on these opportunities now is expected to

establish a more sustainable, longer-term capital structure for

Grit (including GREA) that will facilitate multi-year growth;

and

(g) finally, the Grit Group's strengthened balance sheet is

expected to be well positioned for any further known or unforeseen

shocks and/or liabilities arising directly and indirectly as a

result of the pandemic; this includes the potential need to fund

future liabilities and obligations of the Drive in Trading ("DiT")

guarantee.

The Board also reiterates its belief that, over time, the

depressed valuations in the retail and hospitality sectors will

recover. Therefore, the Board views this immediate need to

deleverage the balance sheet as an interim measure as the Grit

Group rides out the remnants of the pandemic.

Benefits of the Proposed Acquisition

The Grit Board believes that the Proposed Acquisition brings the

following benefits for the Grit Group:

-- GREA is the only development company covering every region in

Africa and with a multi asset class focus delivering real estate

solutions for international global tenants within Grit's existing

and target client lists. Gaining control in one transaction

materially accelerates the Grit Group's ability to access

development returns from risk mitigated development projects;

-- GREA's existing pipeline is fully funded through the existing

shareholders' equity contributions (as well as secured construction

debt facilities) and is expected to deliver strong NAV growth as

projects are completed over the next 24 to 36 months;

-- GREA has access to an extensive further pipeline of OBO (US

diplomatic housing) and data centre development opportunities which

are expected to be accretive to NAV, are extremely resilient asset

classes and offer exposure to highly rated tenants to underpin

future income levels;

-- the Proposed Acquisition cements a key strategic relationship

with Africa's largest pension fund, Public Investment Corporation

("PIC"), which has a long-term investment horizon on the continent,

as co investor into GREA;

-- acquiring a majority stake in APDM offers Grit the potential

for new revenue and fee income streams, asset and facilities

management with respect to OBO and other discrete asset classes and

accelerates Grit's strategy of increasing its exposure to the

provision of professional services to its clients and other third

parties;

-- the Proposed Acquisition would further diversify the Grit

Group's geographic exposure (and, in particular, will reduce the

Company's current overexposure to Mozambique);

-- the transaction builds upon an already close working

relationship between the management teams of Grit, GREA and APDM;

however significant benefits may arise under a streamlined group

structure because of current "duplicate functions" within each

business; and

-- debt funding for the Enlarged Group could be further

optimised due to increased geographic and sector diversity and

balance sheet size.

Upon gaining control of GREA, Grit would have the ability to

execute additional value creating activities which include:

-- Grit balance sheet optimisation and disposal of non-core assets

Grit continues to pursue strategies to reduce consolidated

exposures to the retail segment and would look to use its greater

influence in GREA to push through such asset disposals. Such asset

recycling would be expected to free up capital that can be recycled

into new project opportunities within GREA. When combined with

Grit's balance sheet upon consolidation, GREA's current low

leverage is expected to result in a material reduction in

consolidated Grit Group LTV metrics from Completion.

Whilst GREA is expected to remain relatively lowly geared, its

construction debt facilities will be amortising and are relatively

expensive compared to Grit's debt facilities and a consistent and

consolidated Grit Group approach will provide GREA with cheaper

debt funding and, crucially, the ability to recycle operational

cashflow into new projects rather than debt repayments, thereby

securing enhanced levels of growth.

-- Potential for significant Enlarged Group debt restructure

Following completion of the Issue, implementation of the

above-mentioned deleveraging strategy and the Proposed Acquisition,

the Enlarged Group's combined LTV would reduce significantly. The

larger scale and reduced dependence on hospitality and retail,

together with a reduced overall exposure to Mozambique, would

facilitate the possible issuance of a corporate bond by Grit in the

near future, terming out the maturity profile and reducing costs.

Grit is exploring, with its advisers, the possibility of effecting

such a bond issue following completion of the Proposals.

-- Cost savings

Elimination of dual cost structures and redeploying staff could

yield cost savings.

Recommendation and voting intentions

The Board of Grit considers the Issue and the Proposed

Acquisition to be in the best interests of the Grit Group and its

Shareholders as a whole.

Grit's entry into the Interested Party Share Purchase Agreements

is classed as a smaller related party transaction under the Listing

Rules. The Grit Board, which has been so advised by finnCap,

believes that the terms of the Proposed Acquisition and the entry

into the Interested Party Share Purchase Agreements are fair and

reasonable so far as Shareholders are concerned. finnCap has taken

into account the Grit Board's commercial assessment of the effect

of the Proposed Acquisition.

Accordingly, the Directors unanimously recommend Shareholders to

vote in favour of the Proposed Acquisition Resolution, as those

Directors who hold Ordinary Shares intend to do in respect of their

own holdings of Ordinary Shares, representing approximately 7.35

per cent. Of the Existing Ordinary Shares.

The Board has received written confirmations from Shareholders

holding, in aggregate, 53 per cent. Of the Company's issued share

capital as at the date of the Prospectus and Circular, of their

intention to vote in favour of the Proposed Acquisition

Resolution.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Grit Real Estate Income Group Limited

Bronwyn Knight, Chief Executive Officer +230 269 7090

Darren Veenhuis, Chief Strategy Officer

and Investor Relations +44 779 512 3402

Maitland/AMO - Communications Adviser

James Benjamin +44 7747 113 930

Grit-maitland@maitland.co.uk

finnCap Ltd - Sponsor, Sole Global Coordinator

and Bookrunner

William Marle / Teddy Whiley (Corporate

Finance) +44 20 7220 5000

Mark Whitfeld / Pauline Tribe (Sales) +44 20 3772 4697

Monica Tepes (Research) +44 20 3772 4698

Platform 3 - Corporate Adviser

Oliver Hare, Managing Partner oliver.hare@platform3.org

Perigeum Capital Ltd - SEM Authorised

Representative and Sponsor and Mauritian

Transaction Adviser and Placing Agent

Shamin A. Sookia +230 402 0894

Kesaven Moothoosamy +230 402 0898

Baden Hill (a trading name of Northland

Capital Partners) - Bookrunner

Roy Campbell rcampbell@badenhill.northlandcp.co.uk

Matthew Wakefield mwakefield@badenhill.northlandcp.co.uk

NOTES:

Grit Real Estate Income Group Limited is the leading pan-African

real estate company focused on investing in and actively managing a

diversified portfolio of assets in carefully selected African

countries (excluding South Africa). These high-quality assets are

underpinned by predominantly US$ and Euro denominated long-term

leases with a wide range of blue-chip multi-national tenant

covenants across a diverse range of robust property sectors.

The Company is committed to delivering strong and sustainable

income for shareholders, with the potential for income and capital

growth. The Company is targeting net total shareholder return

inclusive of NAV growth of 12.0%+ p.a.*

The Company holds its primary listing on the Main Market of the

London Stock Exchange (LSE: GR1T and a secondary listing on the

Stock Exchange of Mauritius (SEM: DEL.N0000).

Further information on the Company is available at

http://grit.group/

* These are targets only and not a profit forecast and there can

be no assurance that they will be met. Any forward-looking

statements and the assumptions underlying such statements are the

responsibility of the Board of Directors and have not been reviewed

or reported on by the Company's external auditors.

Directors: Peter Todd+ (Chairman), Bronwyn Knight (Chief

Executive Officer)*, Leon van de Moortele (Chief Financial

Officer)*, David Love+, Sir Samuel Esson Jonah+, Nomzamo Radebe,

Catherine McIlraith+, Jonathan Crichton+, Cross Kgosidiile (+) and

Bright Laaka+ (Permanent Alternate Director to Nomzamo Radebe).

(* Executive Director) (+ independent Non-Executive

Director)

Company secretary : Intercontinental Fund Services Limited

Registered address : PO Box 186, Royal Chambers, St Julian's

Avenue, St Peter Port, Guernsey GY1 4HP

Registrar and transfer agent (Mauritius) : Intercontinental

Secretarial Services Limited

UK Transfer secretary : Link Asset Services Limited

SEM authorised representative and sponsor : Perigeum Capital

Ltd

Mauritian sponsoring broker : Capital Markets Brokers Ltd

This notice is issued pursuant to the FCA Listing Rules and SEM

Listing Rule 15.24 and the Mauritian Securities Act 2005. The Board

of the Company accepts full responsibility for the accuracy of the

information contained in this communiqué.

ADDITIONAL INFORMATION

Introduction

Grit's investment strategy of owning high quality real estate

assets across multiple African geographies (excluding South Africa)

and across diversified asset classes has proven to be a robust and

resilient approach. Grit is the only listed real estate owner and

asset management company operating at scale across Africa

(excluding South Africa) offering "cradle to grave" real estate

solutions to multinational tenants. More recently, with the step up

to a premium listing on the Official List of the FCA, Grit has

created a strongly governed investment platform for the further

deployment of capital onto the African continent.

The challenging operating environment and severe

COVID-19-induced lockdowns imposed by national governments in many

countries (in Africa and beyond) have directly impacted the

Company's retail and hospitality assets, which has resulted in

significant asset valuation pressure and in turn a direct impact on

the Company's loan-to-value metrics.

Grit has been reviewing and refining its business model and

strategy to navigate effectively the current environment and to

best position itself for post-pandemic opportunities. The Grit

Board and management have focused on factors within their control,

which have included cost management (with a significant reduction

in operating and administrative costs), the stabilisation of

revenues and the effective management of collections and vacancies.

Management further extensively engaged with the Company's

financiers to ensure the business has sufficient covenant headroom

and cashflow and has successfully agreed the extension of a large

number of its debt facilities. The Company has also aligned with

key tenants to ensure the sustainability and longevity of both

their leases and revenue streams over the course of the pandemic

and into the future.

The Company's near term capital allocation strategies are being

impacted by the following considerations:

-- the Company's need for an immediate reduction in the Grit

Group's LTV, which will allow further time for the recovery of its

property portfolio valuations and also the ability to refinance

certain debt facilities for an extended period;

-- the desire to resume dividend and distribution payments out

of net operating income generated from its property assets;

-- a resolution to the guarantees provided to the Grit Group's

Black Economic Empowerment partners with respect to the original

financing of their Grit share equity ownership;

-- Grit's continued intention to reduce its exposure to the

retail sector and to achieve its asset recycling targets; and

-- the ability to redeploy the Company's capital into net asset

value growth opportunities and to leverage off the asset management

platform that has been created.

Accordingly, Grit has today announced an Open Offer and Placing

to raise up to approximately US$215.6 million. As at the Latest

Practicable Date, Grit had already received written confirmation

from existing Shareholders and new investors of their intention to

subscribe, in aggregate, for in excess of US$65 million pursuant to

the Open Offer and Placing. The proceeds of the proposed Open Offer

and Placing (together, the "Issue") are expected to reduce Grit's

overall indebtedness and leverage levels and provide future capital

for further expansion in its core and expanded business. The

proceeds of the Issue will also enable Grit to acquire a

controlling shareholding in GREA and a majority shareholding in

APDM, GREA's external management company (the "Proposed

Acquisition").

Following completion of the Proposed Acquisition, Grit will own

a combined direct and indirect majority interest in GREA (51.66 per

cent.) and a direct majority interest in APDM (78.95 per cent.).

The Proposed Acquisition will provide Grit with access to GREA's

attractive pipeline of accretive development opportunities and give

Grit the additional management resources and control required to

lead the further development of GREA, via APDM. The acquisition of

a controlling interest in APDM is expected to further allow Grit to

earn substantial development and asset management fees into the

future from internal and third party clients and joint venture

partners. Shareholders and other investors should note that

completion of the Proposed Acquisition is conditional on, amongst

other things, the passing of the Proposed Acquisition Resolution

and Admission.

For the year ended 30 June 2021, as a result of slow progress

towards the near term 45 per cent. LTV target, the Grit Board

withheld the final dividend. Should the contemplated Issue and the

Proposed Acquisition be successful, the Grit Board expects to

resume dividend payments, distributing out of net operating income

generated from its existing property assets, in line with its

stated policy of paying out at least 80 per cent. of distributable

earnings and is targeting paying a dividend in the current

financial year of between US cents 5 to 6 per share*.

* Investors should note that the target dividend is a target

only and is not a profit forecast. There may be a number of factors

that adversely affect the Company's ability to achieve its target

dividend and there can be no assurance that it will be met. The

target dividend should not be seen as an indication of the

Company's expected or actual results or returns. Accordingly,

investors should not rely on these targets in deciding whether to

invest in the New Ordinary Shares or assume that the Company will

make any distributions at all.

The Prospectus and Circular provides further information on the

Issue, the planned deleveraging strategy, the Proposed Acquisition

and related party aspects of the Proposed Acquisition, and also

convenes the General Meeting required to approve the Proposed

Acquisition.

Background to and reasons for the Issue

Deleveraging and asset recycling strategy

As stated ahead of its admission to the main market of the

London Stock Exchange on 31 July 2018 (the "IPO"), Grit's revised

medium-term debt strategy was to reduce its overall LTV to below 40

per cent. and part of the proceeds from the IPO were deployed

towards that strategy. In the 18 months following the IPO, Grit

continued to make good progress on that strategy, with a reported

Grit Group LTV as at 31 December 2019 of 43.9 per cent. (30 June

2018: 51.4 per cent.). As progress was made, Grit further committed

to deliver a revised Grit Group LTV target of 35 per cent. to 40

per cent.

However, the onset of the COVID-19 pandemic has regrettably

reversed that progress. Whilst Grit's geographic footprint has been

far less affected by direct COVID-19 caseloads, and the broader

African continent has significantly lower death rates than Europe,

Asia and North America, the continent has nevertheless borne the

economic impacts felt worldwide and remains vulnerable to broader

global economic developments associated with COVID-19. This

increased risk has been reflected in valuers' assumptions on

property discount rates, capitalisation rates and re-let

assumptions, which in turn has resulted in portfolio valuation

pressures.

Grit's office, light industrial and corporate accommodation

sector assets, which collectively account for more than 50 per

cent. by value of the Grit Group's property portfolio, have

remained relatively unaffected by the pandemic. However, travel and

economic disruption across Africa has inevitably led to depressed

property valuations predominantly in retail and, to a limited

extent, in hospitality sector assets.

As a result, the impact of COVID-19 was to reduce Grit's overall

reported portfolio valuations by over US$114 million since the

onset of the pandemic (as at 30 June 2021), which represents a 14.2

per cent. (like-for-like) reduction compared to 31 December 2019.

Consequently, Grit Group LTV increased to 53.1 per cent. as at 30

June 2021, predominantly as a result of this decrease in

valuations.

Whilst the Grit Group's cash collections as a percentage of

contracted lease income have remained strong throughout the last 18

months, the Grit Group has never expected a rapid recovery in

affected valuations and has not budgeted for such - indeed, the

Grit Group, cautiously, does not expect a rebound in retail

valuations until the financial year ending 30 June 2023 at the very

earliest. The Board does, however, take note of positive trends,

such as reduced vacancies and increased footfall in its retail

assets and the re-opening of the Mauritian borders to overseas

tourists.

The Group has defined an asset recycling strategy whereby it

aims to realise property assets at, or as close as practically

possible to, their fair values and apply these proceeds to further

reduce debt and gearing. The Board has set an asset recycling

target of 20 per cent. of the value of its property portfolio by 31

December 2023 and, to this end, has recently announced the granting

of an exclusivity period for final stage due diligence over

AnfaPlace Mall, the Grit Group's largest retail asset. Further

disposal announcements are expected in due course, and such

disposals are expected to contribute to the reduction of reported

LTV as at 30 June 2021.

Despite the recent positive rent collection trends and

notwithstanding raising gross proceeds of approximately US$9.8

million of fresh equity in late 2020, the other initiatives by the

Grit Group (such as a reduction in operating expenses and the

inherently more medium-term activities associated with asset

recycling) have so far yet to have a positive impact on the Grit

Group LTV. The Grit Group has also taken on additional short-term

working capital facilities to fund rental deferrals provided to

tenants in the hospitality sector, and also to fund capital

expenditure in the normal course of business and GREA capital

calls.

Grit has successfully engaged with its debt providers and has

both increased its lowest applied LTV and interest service cover

ratio covenants and more recently secured maturity extensions for

the bulk of the Grit Group's US$410 million outstanding debt to

beyond April 2023.

The Board is of the opinion that the Grit Group should take

action now to improve the Grit Group LTV and to proactively enhance

the position of the Company for the expected post-pandemic recovery

opportunities rather than wait for the natural recovery of

valuations. This view is based on the following key

considerations:

(a) Grit's debt funders are currently imposing onerous dividend

and debt repayment restrictions on the Grit Group while the LTV

remains elevated, which will continue to constrain the Board in

meeting its distribution targets out of ongoing operational

cashflows;

(b) with the exception of the retail portfolio, the current

asset portfolio performed well throughout the COVID-19 pandemic

period and continues to produce strong rent collections and robust

operational and asset performance;

(c) a reduced Grit Group LTV would allow management to focus its

attention on further key operational initiatives to support its

tenants, increase occupancy and maintain strong cash collections

without the constant distraction of managing (non-cash) covenant

considerations;

(d) the Board believes the medium-term NAV growth prospects of

the Grit Group can be significantly improved when taking into

account the Proposed Acquisition and further future pipeline

opportunities;

(e) the Board believes that there are significant opportunities

- particularly when taking into account the Proposed Acquisition

(further details of which are set out below) - to secure and

lock-in longer-term, more cost-effective debt funding through a

consolidated debt strategy (for example, potentially tapping into

the global bond markets) that should be capitalised on in the

short-term (before interest rates rise in the medium-term) and will

be facilitated by a larger, stronger and pre-emptively corrected

balance sheet;

(f) capitalising on these opportunities now is expected to

establish a more sustainable, longer-term capital structure for

Grit (including GREA) that will facilitate multi-year growth;

and

(g) finally, the Grit Group's strengthened balance sheet is

expected to be well positioned for any further known or unforeseen

shocks and/or liabilities arising directly and indirectly as a

result of the pandemic; this includes the potential need to fund

future liabilities and obligations of the Drive in Trading ("DiT")

guarantee, further details of which are set out below.

The Board also reiterates its belief that, over time, the

depressed valuations in the retail and hospitality sectors will

recover. Therefore, the Board views this immediate need to

deleverage the balance sheet as an interim measure as the Grit

Group rides out the remnants of the pandemic.

The Proposed Acquisition - GREA and APDM

Grit co-founded its development associate GREA, formerly Gateway

Delta, in 2018. At its inception, GREA secured US$175 million of

equity commitments from its four principal shareholders. The

current shareholders of GREA are as follows:

1 Public Investment Corporation of South Africa: 48.52 per cent.

2 Gateway Partners: 28.54 per cent.

3 Grit*: 19.98 per cent.

4 Prudential Investors: 2.85 per cent.

5 Dorado 1 Limited: 0.1 per cent.

* All shareholders are fully paid up on equity commitments

except for Grit, which has until 10 December 2021 to make its

remaining US$17.5 million capital contribution (excluding

interest).

GREA was founded to focus on providing turnkey development and

construction real estate solutions in select African countries for

multinational and Africa-based companies and supranational

institutions and targets internal rates of returns in excess of 16

per cent. GREA does not develop speculatively but rather aligns

with specific tenant requirements and therefore does not hold land

bank or other speculative investments. Projects typically involve

securing land in conjunction with a tenant's lease commitments to

such location, prior to acquisition and development. GREA

materially transfers construction risk to professional construction

partners through fixed price or turnkey contracts and therefore

largely only retains timing and final delivery risks.

GREA was established together with an external management

company, APDM, to which it outsourced the implementation and

management of GREA's full investment mandate and charter. APDM is

owned by:

1 Public Investment Corporation of South Africa: 21.05 per cent.

2 Gateway Partners: 31.58 per cent.

3 Management and Staff (including Greg Pearson, Grit co-founder

and GREA's CEO): 26.32 per cent.

4 Dorado 1 Limited*: 21.05 per cent.

* Dorado 1 Limited is owned 50 per cent. by Grit CEO Bronwyn

Knight and 50 per cent. by Greg Pearson. In total, Greg Pearson

owns (directly and indirectly) 16.05 per cent. of APDM.

APDM provides the full management of GREA and carries the full

operating costs of GREA's operations, which is compensated through

ongoing development management and asset management fees and a 10

per cent. equity carry in GREA which crystalises upon the

achievement of certain targets. The acquisition of a controlling

interest in GREA by Grit crystalises this carry. Grit therefore

believes it is essential that a controlling interest in APDM is

acquired at the same time as the acquisition of a controlling

interest in GREA so that Grit is able to both direct the future

development and management of GREA and maintain a combined direct

and indirect GREA stake greater than 50 per cent. post the dilution

derived from the exercise of APDM's 10 per cent. equity carry.

Furthermore, APDM has the ability to provide development and asset

management services to a range of third party clients and joint

venture partners and is therefore expected to generate significant

additional fee income for the Grit Group into the future.

GREA, through the APDM team, has been very successful at

securing an accretive pipeline of development opportunities, most

notably providing the United States Bureau of Overseas Buildings

Operations ("OBO") with embassy housing across Africa and

developing data centres for leading IT services and solutions

providers in select African countries. GREA has recently called for

the final payment from its shareholders under the original US$175

million equity commitment but now needs to put in place funding for

the next stage in its development. Should Grit not meet its capital

commitment it will be diluted under the terms of the shareholders'

agreement and could be forced to sell its remaining interest in

GREA. As part of the future expansion, and in order to protect its

current interests, the Grit Board believes it appropriate to make

its capital contribution but also to take a controlling

shareholding in GREA (and its manager, APDM) so that Grit can lead

the next stage of GREA's development and benefit from the fully

funded strong asset growth that GREA is expected to generate over

the coming three years.

As a consequence, and after discussion with the other GREA and

APDM shareholders, Grit has agreed to purchase all of the shares in

GREA (28.54 per cent.) and APDM (31.58 per cent.) held by Gateway

Partners, all of the shares in GREA (0.1 per cent.) and APDM (21.05

per cent.) held by Dorado 1 Limited and all of the shares held in

APDM (26.32 per cent.) by the GREA Executive Share Trust (Gateway

Partners, Dorado 1 Limited and the GREA Executive Share Trust

together being the "Selling Shareholders").

The PIC wishes to maintain an on-going involvement directly with

GREA (alongside its investment in Grit) as its investment mandate

includes direct real estate development and investment across

Africa which is why it originally invested in GREA (and Grit). The

Grit Board is pleased to continue its close working relationship

with PIC within GREA.

Summary of GREA's portfolio

In summary, to date, GREA has undertaken (or is about to

undertake), in aggregate, 12 risk mitigated projects on the back of

strong tenant demand across nine African countries which are either

completed, under construction/development or about to begin

construction. In addition, GREA holds a 46.55 per cent. interest in

Acacia Estate, a 76-unit luxury housing complex in Maputo,

Mozambique tenanted by the US Embassy and the oil and gas company

Total and a 39.5 per cent. interest in the AnfaPlace Shopping Mall

in Morocco.

Set out in the table below is a summary of GREA's portfolio of

projects, anchor tenants and estimated

stabilised valuations as at the date of the Prospectus and

Circular:

Completed % of

Projects project Completion Completion/

cost to

be

GREA Project equity value Acquisition

Property Country Sector Anchor Site GBA (m2) GLA (m2) ownership cost (US$ funded** (US$ million) date

tenant area million)

Diplomatic October

OBO Ethiopia Ethiopia Residential US Embassy 6,439 18,215 15,419 50% 52.4 64% 78.9 2021

AnfaPlace Mall

Redevelopment Morocco Retail Carrefour 56, 000 45, 619 31,808 39.5% 23.7 100% 79.5 August 2019

Metroplex

Redevelopment October

Carrefour, 2020

Uganda Retail Woolworths 25,090 16,089 12,994 100% 20.3 49% 25.9 (additional

Halliburton works

Liquid ongoing)

Mud Plant Mozambique Industrial Halliburton 4,877 1,350 1,350 100% 1.5 100% N/A*** March 2019

Under % of project Projected

Construction cost to Completion Target

GREA Project be equity value completion

Property Country Sector Anchor Site GBA (m2) GLA (m2) ownership cost (US$ funded* (US$ million) date

tenant area million)

LOS1.1 Data

Centre Africa Data

Project Nigeria Data centre Centres 4,946 1,168 994 100% 22.64 40% 24.5 Q4 2021

The Precinct

Office Corporate Grit Real (Phase I)

Complex Mauritius Offices Estate 35,932 12,631 8,594 50% 27.1 40% 30.4 Q4 2022

Multi-speciality Polyclinique

St Helene Clinic Mauritius hospital de L'Ouest 3,134 6,087 6,087 48.25% 19.9 32% 24.3 Q1 2023

Ltée

Bollore

Bollore Africa

Warehouse Mozambique Industrial Logistics 11,960 7,883 7,324 0% 5.1 100% N/A**** Q2 2022

Redevelopment

OBO Kenya

Diplomatic Diplomatic

Housing Kenya Residential US Embassy 29,762 22,767 16,038 50% 48.5 48% 56.0 Q3 2022

(Rosslyn Grove)

Adumuah Place

(Rendeavour Ghana Corporate Rendeavour 4,047 2,414 1,996 100% 3.4 56% 3.9* Q1 2022

Group Head offices & Retail Group

Office)

Approved % of project

Projects cost to Target

GREA Project be equity completion

Property Country Sector Anchor Site GBA (m2) GLA (m2) ownership cost (US$ funded* date

tenant area million)

Coromandel

Hospital

Oncology Hospital Polyclinique

OBO Mali Mauritius de L'Ouest 8,968 10,085 10,085 48.25% 38.6 40% Q4 2023

Diplomatic Diplomatic Ltée

Housing Mali Residential US Embassy 9,475 12,362 7,402 92% 52.2 50% Q3 2023

Completion values have been independently prepared by Knight

Frank LLP (except * which is as per a Directors' valuation) and

are

based on ownership of 100 per cent. of an asset.

** Once all of the above projects are complete and based on

stabilised valuations and levels of net debt after completion,

GREA's consolidated

group LTV is expected to be approximately 17-19 per cent .

*** In 2019, GREA (as lessor) entered into a finance leasing

arrangement with Halliburton (as lessee) for the development of a

liquid mud plant in Pemba, Mozambique.The lease term is for 5.5

years, expiring in August 2024. The finance lease income is

allocated to accounting

periods so as to reflect a constant periodic rate of return on

GREA's net investment outstanding in respect of the lease.

Amounts due from the lessee under the finance lease are

recognised as receivables at the amount of GREA's net investment in

the lease.

**** In 2020, Grit Services Ltd, a wholly owned subsidiary of

Grit, appointed Boyzana International Ltd, a wholly owned

subsidiary of GREA,

to manage the execution of the redevelopment of Bollore

Warehouse in Pemba, Mozambique. GREA has no ownership in the asset

being redeveloped.

GREA has visibility for further accretive pipeline development

opportunities, most notably with providing the US Government with

additional embassy housing across Africa and developing further

data centres for leading IT services and solutions providers in

select African countries.

APDM renders asset management, advisory and administrative

services to GREA pursuant to an asset management and advisory

services agreement entered into between GREA and APDM. The APDM

team has over 50 years of collective experience in the development

of real estate across the African continent in over 40 countries,

making it a world-class team backed by extensive experience.

The principal activities of APDM include: (i) considering and,

if considered appropriate, making investments within the ambit of

GREA's investment charter as agent for and on behalf of GREA; (ii)

providing recommendations and advice to the GREA Board with respect

to investments and disposals in accordance with the terms of its

appointment; (iii) making recommendations to the GREA Board on

investment decisions that do not fall within the investment

charter; and (iv) monitoring and reporting to GREA shareholders and

the GREA Board on the performance of investments.

Upon gaining control, Grit intends to use APDM to provide such

development and asset management services to third parties and to

further its fee income generating activities as a trusted supplier

across the African continent.

Further detailed information on GREA and APDM is set out in

Parts III (Business Overview of GREA and APDM) and VII (Financial

Information on GREA) of the Prospectus and Circular.

Drive in Trading - update

By virtue of the Grit Group's historic listing on the

Johannesburg Stock Exchange, and in conjunction with its largest

shareholder, the South African Government Employee Pension Fund

("GEPF") represented by the PIC, the Company facilitated its black

economic empowerment and transformation partner, DiT, in the

acquisition of 23.25 million Ordinary Shares in June 2017.

DiT secured a loan facility, with an initial break clause on 14

August 2020, from the Bank of America Merrill Lynch ("BoAML") with

the PIC providing a guarantee to BoAML in the form of a contingent

repurchase obligation ("CRO"). Separately, Grit indemnified the PIC

for up to 50 per cent. of any potential losses suffered by PIC,

capped at US$17.5 million.

In August 2020, the PIC assumed the position of lender to DiT

following the expiry of the initial BoAML loan facility and

exercise of the CRO by BoAML. Whilst reserving their rights, the

PIC continues to advise Grit that it does not intend calling on the

Grit guarantee at this time, giving DiT the opportunity to conclude

discussions with further potential lenders.

As at 30 June 2021, the value of the residual exposure is

provided for as USD$5.4 million in the Grit 2021 Annual Financial

Statements.

Grit and the PIC remain in negotiations and a proposal has been

put to the PIC for their consideration. The PIC has advised that it

will consult internally about this proposal but that their reply

may take some time. A further announcement regarding the DiT

arrangements will be made in due course.

Rationale for the Proposed Acquisition

Background

The Grit management team has sought to improve the growth rate

of Grit, and specifically views incremental risk mitigated

development returns, limited to no greater than 20 per cent. of the

Grit Group's gross asset value, as being key to achieving this

goal.

Grit's ability to control its own pipeline and fully service its

tenants' needs ranging from real estate conceptualisation,

development, ownership and property management continues to be a

strategic objective of the Company. Although Grit remains confident

of delivering superior total returns in the medium to longer term

and is well positioned to capitalise on the significant recovery

potential across its unique high-quality property portfolio, the

Grit Board additionally sees significant further potential value

creation through increasing its capital allocation to limited, risk

mitigated development returns and would expect these to increase

the Grit Group's total targeted shareholder return over time from

12 per cent. to 13 to 15 per cent. per annum*.

* This is a target only and is not guaranteed. It is based on a

number of bases and assumptions which may or may not

materialise.

APDM has a team of highly skilled development staff and has the

ability to develop in over 15 African countries. With extensive

experience delivering projects across the continent, there exists

opportunities to provide fee generating professional services to

clients external to GREA and to further deliver value to its

shareholders.

The Grit Board believes that the Proposed Acquisition therefore

brings the following benefits for the Grit Group:

-- GREA is the only development company covering every region in

Africa and with a multi asset class focus delivering real estate

solutions for international global tenants within Grit's existing

and target client lists. Gaining control in one transaction

materially accelerates the Grit Group's ability to access

development returns from risk mitigated development projects;

-- GREA's existing pipeline is fully funded through the existing

shareholders' equity contributions (as well as secured construction

debt facilities) and is expected to deliver strong NAV growth as

projects are completed over the next 24 to 36 months;

-- GREA has access to an extensive further pipeline of OBO (US

diplomatic housing) and data centre development opportunities which

are expected to be accretive to NAV, are extremely resilient asset

classes and offer exposure to highly rated tenants to underpin

future income levels;

-- the Proposed Acquisition cements a key strategic relationship

with Africa's largest pension fund, PIC, which has a long-term

investment horizon on the continent, as co investor into GREA;

-- acquiring a majority stake in APDM offers Grit the potential

for new revenue and fee income streams, asset and facilities

management with respect to OBO and other discrete asset classes and

accelerates Grit's strategy of increasing its exposure to the

provision of professional services to its clients and other third

parties;

-- the Proposed Acquisition would further diversify the Grit

Group's geographic exposure (and, in particular, will reduce the

Company's current overexposure to Mozambique);

-- the transaction builds upon an already close working

relationship between the management teams of Grit, GREA and APDM;

however significant benefits may arise under a streamlined group

structure because of current "duplicate functions" within each

business; and

-- debt funding for the Enlarged Group could be further

optimized due to increased geographic and sector diversity and

balance sheet size.

Acquisition benefits and further opportunities

Upon gaining control of GREA, Grit would have the ability to

execute additional value creating activities which include:

-- Grit balance sheet optimisation and disposal of non-core assets

Grit continues to pursue strategies to reduce consolidated

exposures to the retail segment and would look to use its greater

influence in GREA to push through such asset disposals. Such asset

recycling would be expected to free up capital that can be recycled

into new project opportunities within GREA. When combined with

Grit's balance sheet upon consolidation, GREA's current low

leverage is expected to result in a material reduction in

consolidated Grit Group LTV metrics from completion of the Proposed

Acquisition.

Whilst GREA is expected to remain relatively lowly geared, its

construction debt facilities will be amortising and are relatively

expensive compared to Grit's debt facilities and a consistent and

consolidated Grit Group approach will provide GREA with cheaper

debt funding and, crucially, the ability to recycle operational

cashflow into new projects rather than debt repayments, thereby

securing enhanced levels of growth.

-- Potential for significant Enlarged Group debt restructure

Following completion of the Issue, implementation of the

above-mentioned deleveraging strategy and the Proposed Acquisition,

the Enlarged Group's combined LTV would reduce significantly. The

larger scale and reduced dependence on hospitality and retail,

together with a reduced overall exposure to Mozambique, would

facilitate the possible issuance of a corporate bond by Grit in the

near future, terming out the maturity profile and reducing costs.

Grit is exploring, with its advisers, the possibility of effecting

such a bond issue following completion of the Proposals.

-- Cost savings

Elimination of dual cost structures and redeploying staff are

expected to yield cost savings.

Summary of the principal terms of the Proposed Acquisition

Under the terms of the Proposed Acquisition, Grit will become

the holding company of the Enlarged Group, which will include GREA

and APDM.

The consideration due to the Selling Shareholders pursuant to

the terms of the Share Purchase Agreements may be satisfied by the

issue to each Selling Shareholder of such number of New Ordinary

Shares at the Issue Price as is equal to the US Dollar amount of

the consideration payable to such Selling Shareholder pursuant to

the terms of its Share Purchase Agreement. Any New Ordinary Shares

issued to Selling Shareholders will be issued at the same price per

New Ordinary Share as New Ordinary Shares are issued pursuant to

the Open Offer and Placing.

Applications will be made for any New Ordinary Shares issued to

any of the Selling Shareholders pursuant to the Share Purchase

Agreements to be listed on the premium segment of the Official List

and to be admitted to trading on the premium segment of the main

market of the LSE, in each case, upon Completion. Such New Ordinary

Shares will also be admitted to trading on the SEM.

Certain New Ordinary Shares to be issued to the Selling

Shareholders will be subject to lock-up provisions, as more fully

described in the summaries of the Share Purchase Agreements in Part

IV (Terms of the Proposed Acquisition) of the Prospectus and

Circular.

Completion is conditional on, among other things, (i) the

approval of the Proposed Acquisition Resolution; and (ii)

Admission.

As at 30 June 2021, GREA had unaudited net assets of US$193

million, gross assets of US$199 million and pre-tax profits for the

six months ended 30 June 2021 of US$5.7 million. Since that date,

GREA has completed and handed over the OBO US Embassy compound in

Ethiopia which has therefore increased in value from its

construction cost carrying value as at 30 June 2021 of US$34.9

million to a current investment value of US$38.3 million (based on

a completion value for 100 per cent. of the asset of US$76.6

million, as shown in Part IX, Section B (Property Valuation Report

prepared by Knight Frank LLP in respect of certain assets in the

New Portfolio) of the Prospectus and Circular). In addition, GREA

has continued with the construction of the six projects shown as

"Under Construction" in the GREA projects table above. As at 31

October 2021, the carrying value of these projects had increased in

value to US$50.0 million from a carrying value of US$40.3 million

as at 30 June 2021.

In the view of the Grit Board, the impact of these developments

within GREA's portfolio will be to increase GREA's unaudited net

asset value to approximately US$197.2 million by 31 December 2021,

the agreed effective date of the Proposed Acquisition. Accordingly,

Grit has agreed to purchase an additional 25.78 per cent. of GREA's

shares (equal to 50,175,000 GREA Shares) based upon a valuation for

100 per cent. of GREA of US$197.2 million.

In addition, Grit has agreed to purchase 78.95 per cent. of APDM

for US$29.8 million, valuing 100 per cent. of APDM at US$37.7

million. This represents a small discount to Grit's internal

valuation for APDM of US$38.1 million, with its major assets being

a 10 per cent. interest in GREA (valued at US$19.7 million) and its

evergreen contract to manage GREA's assets for a fee of 1.5 per

cent. of gross asset value, in perpetuity (with an estimated value

of US$18.4 million).

Therefore, the aggregate consideration payable by Grit in

connection with the acquisition of GREA and APDM is US$80.61

million.

The Grit Board believes that the consideration payable for GREA

and APDM is appropriate for the following reasons:

-- as shown in Parts IX (Property Valuation Reports prepared by

Knight Frank LLP in relation to certain assets in the Existing

Portfolio and in the New Portfolio) and X (Property Valuation

Report prepared by REC - Real Estate Consulting, LDA in relation to

certain assets in the Existing Portfolio and in the New Portfolio)

of the Prospectus and Circular , the GREA Portfolio has a

stabilised value following completion of the developments of US$280

million compared to a book value as at 30 June 2021 of US$177

million. Grit is therefore acquiring an attractive and accretive

(in the medium term) development portfolio at a valuation that

represents a discount of US$103 million to their completed value in

circumstances where this completion is fully funded by GREA's

existing capital resources and with recourse to only modest levels

of leverage;

-- it delivers control of GREA and APDM to Grit;

-- through the acquisition of APDM, Grit is not only getting

access to an existing contractual income stream but also a

management team with depth of experience in the development of real

estate across the African continent, a team which has already

proven the value of this expertise through its delivery of projects

on behalf of GREA to date; and

-- although there is no committed pipeline beyond the

development projects described in the Prospectus and Circular, the

APDM team has developed the relationships and credentials to secure

potential significant pipeline in the future (both with existing

and potentially new tenants), negotiations towards which are

ongoing.

Gateway Partners has stated that it wishes to remain invested in

the Enlarged Group and has committed to accept, by way of

consideration in settlement for the exchange of its shareholding in

GREA and APDM, a maximum of 137.5 million New Ordinary Shares,

representing an aggregate capital commitment equal to US$71.5

million at the Issue Price. The Grit Board believes that this

commitment demonstrates Gateway's faith in GREA and its pipeline

and welcomes its continued investment. To the extent that

Qualifying Shareholders take up their Open Offer Entitlements in

full, then the consideration payable to Gateway may be satisfied in

Ordinary Shares from a secondary purchase.

The selected financial information for GREA set out above has

been extracted without material adjustment from the unaudited

interim financial information of GREA set out in Part VII

(Financial Information on GREA) of the Prospectus and Circular

.

The Company will announce Completion of the Proposed Acquisition

through an RIS and a SEM announcement as soon as practicable

following Admission.

Further information about the terms of the Proposed Acquisition

is set out in Part IV (Terms of the Proposed Acquisition) of the

Prospectus and Circular. The Share Purchase Agreements are

inter-conditional and each is subject to the satisfaction or, where

applicable, waiver of conditions, including regulatory and

competition approvals, the Placing and Open Offer raising a minimum

of US$135 million and the passing of the Proposed Acquisition

Resolution. There can be no guarantee that the Proposed Acquisition

will proceed if all conditions are not satisfied or, where

applicable, waived.

The entry by the Company into the Dorado Share Purchase

Agreement and GREA Executive Share Trust Share Purchase Agreement

each constitutes a smaller related party transaction (as defined in

the Listing Rules) by virtue of the direct and indirect interests

in GREA and APDM held by Bronwyn Knight (a Director of Grit and a

director of Dorado 1 Limited, one of the Selling Shareholders) and

Greg Pearson (CEO of GREA (in which Grit owns a 19.98 per cent.

interest), a director of several Grit subsidiaries and a director

of Dorado 1 Limited) (Bronwyn Knight and Greg Pearson together

being the "Interested Parties" and each an "Interested Party" and

the Dorado Share Purchase Agreement and the GREA Executive Share

Trust Share Purchase Agreement together being the "Interested Party

Share Purchase Agreements").

The consideration payable (directly and indirectly) to Bronwyn

and Greg pursuant to the Interested Party Share Purchase Agreements

is as follows:

Bronwyn Knight US$2.69 million

Greg Pearson US$4.80 million

Shareholders should note that the consideration payable to them

is expected to be satisfied by way of the issue and allotment of

such number of New Ordinary Shares at the Issue Price as is equal

to the US Dollar amount of the consideration stated above, which

Grit intends to facilitate from any New Ordinary Shares that are

not taken up by Qualifying Shareholders pursuant to the Open Offer.

Such New Ordinary Shares will be subject to lock-up arrangements,

as more fully described in paragraph 2 of Part IV (Terms of the

Proposed Acquisition) of the Prospectus and Circular.

The fundraising

As stated above, it is possible that the Proposed Acquisition

will not complete because the Placing and Open Offer does not raise

the necessary fresh equity capital for Grit and therefore the

conditions attached to the Proposed Acquisition are not satisfied.

Accordingly, Grit has sought and received written confirmations

from certain existing Shareholders and new investors of their

intention to subscribe pursuant to the Placing and Open Offer (the

"Indicated Minimum Proceeds"). These written confirmations, as at

the Latest Practicable Date, total in excess of US$65 million.

However, the written confirmations do not constitute a legally

binding agreement and as such there is a risk that the Indicated

Minimum Proceeds are not ultimately received by the Company.

If the Placing and Open Offer only raises US$65 million and the

Proposed Acquisition does not proceed, Grit intends to use the net

proceeds of the Placing and Open Offer to:

-- make the payment of US$17.9 million for the final capital

contributions in respect of GREA's capital call due in December

2021;

-- seek to resolve matters with the PIC regarding the DiT

guarantee as set out above, where the net exposure to Grit is US$11

million; and

-- reduce Grit's level of indebtedness.

A fuller breakdown of the use of the net proceeds is set out in

paragraph 2 of Part V (The Issue) of the Prospectus and

Circular.

However, it is possible that the Placing and Open Offer will not

raise Indicated Minimum Proceeds of US$65 million required and

therefore neither the Placing and Open Offer nor the Proposed

Acquisition will proceed. Grit would then need to pursue

alternative actions to rectify its working capital position,

including but not limited to the following:

-- Grit would continue its dialogue with PIC in respect of the

DiT obligations, and in particular seek continued assurances from

PIC that it does not intend calling on the Grit Group

guarantee;

-- Grit would seek agreement from GREA to settle the US$17.9

million final capital contribution in respect of GREA's capital

call due in December 2021 by way of a transfer of certain property

assets, instead of by settlement in cash;

-- Grit would continue to seek to refinance the Grit Group's

debt facility due in April 2022 for a net amount of US$47.1

million, for which negotiations are on-going with the relevant

lender as well as other potential lenders; and

-- Grit would seek alternative new debt facility and equity

fundraising opportunities, for which it has certain on-going

discussions with certain potential providers of new debt facilities

and/or new equity fundraisings.

Further details on the above alternative actions are set out in

paragraph 11.2 of Part XII (Additional Information) of the

Prospectus and Circular.

Financial effects of the Proposed Acquisition

Set out in Part VIII ( Unaudited Pro Forma Financial Information

on the Enlarged Group ) of the Prospectus and Circular, the pro

forma statement of net assets shows net assets of the Enlarged

Group, assuming commitments to subscribe for US$140.0 million under

the Open Offer and Placing are received, of US$475.0 million as at

30 June 2021 and the pro forma income statement shows a loss before

tax of the Enlarged Group for the period to 30 June 2021 of US$25.6

million. If the Issue is fully subscribed, the pro forma net assets

will be US$540.2 million as at 30 June 2021.

Post-acquisition integration

GREA has a strong board and, through APDM, an equally strong

executive management team and investment committee comprising

individuals with exceptional track records in creating, raising and

managing property development and investment companies. This will

be supplemented by Grit senior management following completion of

the Proposed Acquisition.

The APDM team is led by Chief Executive Officer, Greg Pearson.

Greg is a co-founder of Grit and was instrumental in sustaining its

rapid growth from its inception in 2014 through to 2018, when he

left Grit to focus his attention on GREA. As a founder of Grit,

Greg recognised the significant demand from multinational companies

looking for quality real estate solutions in Africa and the limited

supply of experienced developers to fulfil their requirements,

which led to the creation of GREA. Greg has successfully completed

a series of developments across the office, retail, leisure,

education and healthcare sectors and also sits on the Board of GREA

as its sole director and de facto CEO.

Further information on the GREA and APDM management team is

contained in paragraph 2.3 of Part III (Business overview of GREA

and APDM) of the Prospectus and Circular, and information on the

revised senior management team structure and responsibilities at

Grit following Completion is set out in Part II (Business Overview

of Grit) of the Prospectus and Circular. Shareholders should note

that all of APDM's management team and staff will become employees

of the Enlarged Group on, essentially, the same employment terms as

they currently enjoy at APDM. The consideration payable by Grit to

the GREA Executive Share Trust pursuant to the GREA Executive Share

Trust Share Purchase Agreement shall be settled by Grit issuing

shares in the issued share capital of Grit equal to the amount of

the consideration. Such shares are to be retained by the GREA

Executive Share Trust, for the benefit of designated participants

under a long-term incentive plan, vesting on a future date or

earlier if sufficient value is achieved in GREA. Certain

participants will also be enrolled to the Grit long-term incentive

plan and awarded shares upon the fulfilment of specific key

performance indicators.

The Issue

Introduction

The Company is targeting an issue of approximately US$215.6

million (gross) through the issue of 414,647,283 New Ordinary

Shares by way of the Open Offer and Placing at US$0.52 per New

Ordinary Share.

The Issue Price represents a premium of approximately 4 per

cent. to the average closing price across the LSE and SEM for an

Ordinary Share on 19 November 2021 (LSE: GBP0.3468; SEM: US$0.53).

The Issue Price has been set by the Directors following their

assessment of the prevailing market conditions and anticipated

demand for the New Ordinary Shares, as well as taking into account

the commercial requirements and positive financial impact on the

Grit Group of implementing the deleveraging strategy and

undertaking the Proposed Acquisition, as described above. The Grit

Board believes that the Issue Price (including the premium) is

appropriate in the circumstances.

The actual number of New Ordinary Shares to be issued pursuant

to the Issue, and therefore the Gross Issue Proceeds, is not known

at the date of the Prospectus and Circular but will be notified by

the Company via an RIS and a SEM announcement prior to Admission.

Following Admission, the New Ordinary Shares to be issued pursuant

to the Issue will rank pari passu in all respects with the Existing

Ordinary Shares and will carry the right to receive all dividends

and distributions declared, made or paid on or in respect of the

Ordinary Shares by reference to a record date after Admission.

It is important to the Grit Board that Shareholders are given

the opportunity to participate in the Issue. Therefore, priority

will be given to applications from Qualifying Shareholders under

the Open Offer. Thereafter, any New Ordinary Shares not taken up

pursuant to Shareholders' applications for their Open Offer

Entitlements will be made available to Qualifying Shareholders

through the Excess Application Facility, to Placees under the

Placing and/or to Selling Shareholders in consideration for Grit's

acquisition of their GREA Shares and/or APDM Shares (as applicable)

pursuant to the terms of the Share Purchase Agreements.

The Open Offer and Placing are conditional on, inter alia, (a)

the Placing and Offer Agreement becoming wholly unconditional (save

as to Admission) and not having been terminated in accordance with

its terms prior to Admission; and (b) Admission occurring by 8.00

a.m. (GMT) on 21 December 2021 or such later time and/or date

(being no later than 7 January 2022) as the Company and finnCap may

agree). If any such conditions are not satisfied or, if applicable,

waived, the Issue will not proceed and application monies will be

refunded to the applicants, by cheque (at the applicant's risk),

without interest as soon as practicable thereafter.

The Open Offer

The Grit Board is offering Qualifying Shareholders the

opportunity to subscribe for New Ordinary Shares on a pre-emptive

basis through the Open Offer pro rata to their holdings as at the

Record Date at the Issue Price on the basis of 1.3011 New Ordinary

Shares for every 1 Existing Ordinary Share held (the "Open Offer

Entitlement"). Fractions of New Ordinary Shares will be disregarded

in calculating Qualifying Shareholders' Open Offer Entitlements and

each Qualifying Shareholder's entitlement to New Ordinary Shares

will be rounded down to the nearest whole number.

The Open Offer provides an opportunity for Qualifying

Shareholders to participate in the fundraising by subscribing for

their respective Open Offer Entitlements. Valid applications under

the Open Offer will be satisfied in full up to applicants' Open

Offer Entitlements. Qualifying Shareholders who wish to subscribe

for more New Ordinary Shares than their Open Offer Entitlement

should make an application under the Excess Application

Facility.

Any New Ordinary Shares not issued to Qualifying Shareholders to

satisfy their Open Offer Entitlements may, at Grit's discretion, be

apportioned between those Qualifying Shareholders who have applied

under the Excess Application Facility, Placees pursuant to the

Placing and/or Selling Shareholders in accordance with the terms of

the Share Purchase Agreements. Applications under the Excess

Application Facility may be scaled back at the Grit Board's

discretion and therefore no assurance can be given that such

applications by Qualifying Shareholders will be met in full or in

part or at all.

Shareholders should note that the Open Offer is not a rights

issue. As such, Qualifying Non-CREST Shareholders should note that

their Open Offer Application Forms are not negotiable documents and

cannot be traded. Qualifying CREST Shareholders should further note

that, although the Open Offer Entitlements and Excess Open Offer

Entitlements will be admitted to CREST and be enabled for

settlement, the Open Offer Entitlements and Excess Open Offer

Entitlements will not be tradeable or listed and applications in

respect of the Open Offer may only be made by the Qualifying

Shareholder originally entitled or by a person entitled by virtue

of a bona fide market claim.

The terms and conditions which apply to the Open Offer are set

out in Part XV (Terms and Conditions of Application under the Open

Offer) of the Prospectus and Circular.

The Placing

finnCap, Baden Hill and Perigeum Capital have each agreed to use

their respective reasonable endeavours to procure subscribers

pursuant to the Placing for the New Ordinary Shares on the terms

and subject to the conditions set out in Part XIV (Terms and

Conditions of Application under the Placing) of the Prospectus and

Circular.

The Placing will close at 3.00p.m. (GMT) in the UK / 3.00p.m.

(MUT) in Mauritius on 17 December 2021 (or such later date as the

Company, finnCap and Baden Hill may agree). If the Placing is

extended, the revised timetable will be notified through an

RIS.

Commitments under the Placing, once made, may not be withdrawn

without the consent of the Grit Board. However, as described above,

the allocation of New Ordinary Shares to investors pursuant to the

Placing will be at Grit's discretion. Under the Issue, priority

will be given to applications for New Ordinary Shares received from

Shareholders pursuant to the Open Offer. If 100 per cent. of

Qualifying Shareholders elect to take up their Open Offer

Entitlement of New Ordinary Shares pursuant to the Open Offer then

no New Ordinary Shares will be placed pursuant to applications

received in connection with the Placing.

As at the Latest Practicable Date, Grit had already received

written confirmation from existing Shareholders and new investors

of their intention to subscribe, in aggregate, for in excess of

US$65 million pursuant to the Open Offer and Placing (including

from certain Shareholders and other investors intending to

subscribe for more than 5 per cent. of the maximum amount of the

Issue). The Company therefore expects to raise a minimum of

approximately US$145.6 million (assuming those indicative

commitments are met and the full consideration for the Proposed

Acquisition of US$80.6 million is satisfied by the issue of New

Ordinary Shares. Dependent upon the level of take up under the Open

Offer and the Placing, Grit may raise additional capital up to the

maximum amount of the Issue, being approximately US$215.6

million.

The terms and conditions which shall apply to any subscription

for New Ordinary Shares procured by finnCap, Baden Hill or Perigeum

Capital are set out in Part XIV (Terms and Conditions of