TIDMGRG

RNS Number : 5828U

Greggs PLC

02 August 2022

2 August 2022

INTERIM RESULTS FOR THE 26 WEEKSED 2 JULY 2022

Greggs is a leading UK food-on-the-go retailer,

with more than 2,200 retail outlets throughout the country

Trading in line with plan and good strategic progress

First half financial highlights

H1 2022 H1 2021

Total sales GBP694.5m GBP546.2m

---------- ----------

Pre-tax profit GBP55.8m GBP55.5m

---------- ----------

Diluted earnings per share 44.8p 43.2p

---------- ----------

Ordinary interim dividend

per share 15.0p 15.0p

---------- ----------

-- Total sales up 27.1%, with 22.4% LFL* sales growth in first

half of 2022 (Q1: 36.9%, Q2: 11.2%)

-- First half LFL sales 12.3% higher than comparable period

in 2019

-- Flat profit outcome primarily reflects re-introduction of

business rates, increase in VAT and higher levels of cost

inflation

-- Strong cash position and good liquidity, with net cash at

period end of GBP145.7m, having paid a special dividend of

40p per share (GBP40.6m total) in April 2022

* Like-for-like (LFL) company-managed shop sales performance

against comparable period in 2021

Operational and strategic developments

-- Shop opening progress : 70 new shops opened in first half,

12 closures; 2,239 shops as at 2 July 2022. Strong pipeline,

anticipate circa 150 net new shop openings in 2022

-- Growth channels : extension of evening hours going well,

delivery service continuing to prove incremental despite

recovery of 'walk-in' trade

-- Greggs App: strong growth in usage driving loyalty engagement.

New services such as Click + Collect and product customisation

progressing well

-- New product development : menu development focused on healthier

choices, hot food and evening daypart

-- Infrastructure : new manufacturing capacity progressing

well, technology development now focused on digital

-- Greggs Pledge: Science-based targets for emissions submitted

for verification. National Equality Standard accreditation

achieved and first "Eco-Shop" opened to test solutions to

minimise environmental impact of retail operations

-- Chair succession: Matt Davies announced today as Chair Designate,

succeeding Ian Durant from 1 November 2022

"Greggs delivered an encouraging performance in the first half

of the year with sales ahead of 2019 levels. These results

demonstrate the continued strength of the Greggs brand and demand

for our great tasting, quality and value for money offering.

"During the period we continued to make good progress with our

strategic priorities, including expanding our shop estate and

making Greggs more accessible to customers through extended trading

hours and digital channels.

"In a market where consumer incomes are under pressure Greggs

offers exceptional value for customers looking for food and drink

on-the-go. We are well positioned to navigate the widely publicised

challenges affecting the economy and continue to have a number of

exciting growth opportunities ahead, with a clear strategy for

expansion. We remain confident in Greggs' ability to deliver

continued success."

- Roisin Currie, Chief Executive

ENQUIRIES:

Greggs plc Hudson Sandler

Roisin Currie, Chief Executive Wendy Baker / Hattie Dreyfus

Richard Hutton, Finance Director Nick Moore / Emily Brooker

Tel: 0191 281 7721 Tel: 020 7796 4133

An audio webcast of the analysts' presentation will be available

to download later today at http://corporate.greggs.co.uk/

CHIEF EXECUTIVE'S REPORT

Greggs has continued to trade well in 2022 with like-for-like

(LFL) sales in company-managed shops growing by 22.4% (Q1: 36.9%,

Q2: 11.2%) when compared with the equivalent period of 2021 . As

expected, the rate of growth in the second quarter began to

normalise but remained encouraging as we passed the anniversary of

restrictions being lifted in 2021. Total sales for the 26 weeks to

2 July 2022 were GBP694.5 million, an increase of 27.1% (H1 2021:

GBP546.2 million).

We are making good progress with our strategic priorities,

growing the shop estate at a faster pace and making Greggs more

accessible to customers through extended trading hours and digital

channels. At the same time, we continue to invest in further

improving the sustainability of Greggs as a major brand in the

food-on-the-go market.

Operational review

Sales levels were encouraging in the first half of 2022.

Performance in the first quarter was flattered by comparison with

restricted trading conditions in the same period of 2021 but we are

now reporting against a more similar year-on-year base. Comparing

with the pre-pandemic level, first half like-for-like sales in

company-managed shops were 12.3% per cent higher than the

equivalent period of 2019 despite footfall remaining below 2019

levels.

The breadth of the Greggs estate continues to provide

geographical diversification as consumer behaviour adjusts coming

out of the pandemic. Our strong presence in towns and suburbs,

along with a growing portfolio of convenient roadside shops, has

counter-balanced the slower recovery seen in large city centres and

public transport hubs.

Our estate expansion has been focused away from traditional

shopping areas while, at the same time, we have taken the

opportunity to grow in catchments where Greggs has traditionally

been underrepresented, such as central London and rail hubs. In the

first half of 2022 we opened 70 new shops (including 26 franchised

units) and closed 12 shops, giving a total of 2,239 shops (of which

401 are franchised) trading at 2 July 2022.

In June 2022 we opened our 400(th) franchised shop in Selby in

partnership with our newest franchise partner, Rontec, one of the

leading players in the UK forecourt industry. Other notable shop

openings in the first half of 2022 included three 'drive-thru'

sites, of which we have a growing pipeline, and our in-store café

concept in Primark Birmingham. In the most recent two weeks we have

also opened shops in London's Leicester Square and Liverpool Street

Station.

Strategic development

We have a clear plan to address the many attractive growth

opportunities available to Greggs over the coming years. This was

set out at our Capital Markets Day in October 2021 and we have made

good progress in the first half of 2022 as we seek to make Greggs

more accessible to customers across multiple channels and dayparts.

Our strategic investment in the Greggs estate, brand and support

infrastructure over recent years puts us in a strong position to

move forward at pace.

Estate growth

We see a clear opportunity for Greggs to expand its UK estate to

at least 3,000 shops, and have increased the rate at which we are

opening in new locations given the increased availability of good

sites. Our confidence in the scale of opportunity is underpinned by

the success we have already had in catchments where Greggs

currently has a relatively low presence such as retail parks,

railway stations, airports, supermarkets and central London.

The Greggs brand, and our strong, proven covenant is attractive

to landlords and has resulted in a strong pipeline of

opportunities. In 2022 we expect to open 150 net new shops and

believe that this rate of growth is sustainable beyond the current

year. At least a third of this annual growth is expected to be

achieved with franchise partners; we currently have fourteen such

partners covering travel and convenience shopping catchments.

Shop refurbishment will also play a part in enabling the

strategic growth agenda. Our latest shopfitting standard, which is

already being deployed for all new shops and relocations, supports

operational excellence in serving new channels such as delivery and

Click + Collect, as well as presenting an attractive, modern

environment for customers. We expect to refurbish around 100 shops

to this standard in 2022, progressing to 250 annually in the medium

term.

Evening trade

The evening daypart represents the largest segment of the

food-to-go market by value, but is the area where Greggs currently

has the lowest penetration. By extending trading hours, addressing

menu options and offering delivery we believe that Greggs can

increase its participation in the evening market, further

leveraging our investment in facilities that are under-utilised

after 4pm.

In the first half of 2022 we extended trading hours in the

company-managed estate. 300 shops now trade until at least 8pm

(July 2021: 130). In the second half of 2022 we will extend trading

hours in more shops as we better understand the extent of demand in

different locations. The evening daypart is now our

strongest-growing trading time, albeit from a low base.

Ranging trials have reinforced the importance of hot food

options in the evening daypart, as well as the demand for our core

food and drink range. In developing the range our aim is to stock

options that are in demand throughout the day, in order to minimise

operational complexity and maintain strong availability for

customers.

Delivery

Delivery, through our partnership with Just Eat, is now

available across the UK from 1,180 of our shops, up from 1,000 at

the start of the year. Delivery is a channel that presents further

growth potential for Greggs as we learn to serve it more

effectively and increase availability into the evening.

The recovery in out-of-home activity over the past twelve months

has seen a market-wide trend whereby a proportion of delivery

customers have switched their purchases back to the walk-in

channel. It is clear, however, that the majority of the new trade

we have generated through delivery is incremental and that it

offers additional access to Greggs at times when customers are

unable to visit our shops themselves.

Greggs App

The Greggs App, relaunched in 2021, offers a convenient platform

for customers to access additional services from Greggs whilst also

being rewarded for their loyalty. Use of the app has grown

strongly, aided by increased marketing of the benefits. From a

strategic perspective the Greggs App offers:

-- Rewards - our loyalty proposition rewards customers for their

purchases via the accumulation of 'stamps', which can then

be exchanged for free products. The scheme is increasing the

frequency with which app customers visit us whilst enhancing

further Greggs' market-leading reputation for great value.

-- Click + Collect - customers can skip the queue by pre-ordering,

and guarantee availability before they visit. In the first

half of 2022 we launched personalised pizza toppings as an

option for customers who use Click + Collect to pre-order.

In time we expect customisation to be extended to other elements

of our made-in-store range.

-- Deeper customer understanding - our investment in technology

to help us better understand our customers' behaviours and

preferences will enable us to tailor our communications and

experiences with them. Our new CRM platform is now live and

a key step forward in our vision to truly understand our customers'

needs across all of our channels and to enable us to serve

them even better, every day.

Menu development

Menu development supports our strategic growth objectives as

well as the commitments made in the Greggs Pledge.

In the first half of 2022 we broadened our healthier choices

through the launch of two salad meal boxes - Smoky Cajun Rice with

BBQ Chicken & Sweetcorn Fritters and Sweet Potato Bhaji &

Rice, which is a vegan option. Both can be eaten cold or taken away

to heat. We also continued to incentivise healthier choices by

offering fruit pots for just 75 pence as an add-on to our meal

deals.

To meet demand for hot food options we continued to roll out hot

food cabinets, particularly to those shops that are targeting the

evening trade. 867 company-managed shops now have hot food cabinets

and we plan to add a further 400 in the second half of the

year.

To support further our objective of growing the level of trade

in the evening we have added two new pizza flavours, Mexican

Chicken and Pepperoni Hot Shot. Our great-value pizza offer can now

be accessed through the walk-in, Click + Collect and delivery

channels. Customers can customise their pizza toppings when

ordering through our digital channels and we intend to trial the

customisation of sandwich fillings in the second half of 2022.

Supply chain development

The development of our supply chain will support the significant

growth opportunity ahead of us and require additional manufacturing

and logistics capacity. In the third quarter of 2022 we expect to

commission the new pizza manufacturing line that is under

construction at our Enfield manufacturing site. At Balliol Park in

Newcastle, we are undertaking preparatory works ahead of adding a

fourth line to extend capacity for the production of our iconic

savoury products.

Our plans for ambitious growth will require the addition of

further manufacturing and logistics capacity in the years ahead. We

have been exploring site options on which to base this capacity and

expect to make further progress on this in the second half of the

year.

Support systems

In the first half of 2022 we achieved a major milestone with the

completion of the deployment of SAP across our supply chain, a huge

achievement for the teams involved. The focus of our systems

development has now turned to support for our growth ambitions,

particularly our digital capabilities but also the integration of

new channels to our core systems. In a tight labour market, we have

also been working on an upgraded recruitment platform that will

improve current processes and the overall candidate experience.

Greggs Pledge

Our separate sustainability report details the progress made in

2021 on the objectives of the Greggs Pledge, our commitment to

further improve our ESG credentials in ten key areas. In the first

half of 2022 we continued to advance this agenda, and were

delighted to achieve the National Equality Standard, an

industry-recognised standard for diversity and inclusion. This

accreditation reflects the significant progress we have made in

respect of diversity and inclusion whilst supporting us to identify

areas where we can continue to improve. A key element of the

accreditation was having leaders who advocate diversity and

inclusion, supporting people through their employment journey and

having strategies in place to drive change.

We have also been focused on setting science-based targets to

reduce our emissions in line with a 1.5(oC) ambition. These targets

have now been submitted to the Science Based Targets initiative for

verification, and will support our ambition to be Net Zero in

Scopes 1 & 2 by 2035, and in Scope 3 by 2040.

Another notable landmark in early July was the opening of our

first "Eco-Shop" in Northampton. This gives us a platform to

develop and test solutions to minimise our impact on the

environment by cutting down on waste and reducing the use of energy

and water. Successful elements of the trial will be rolled out in

line with our Pledge commitment.

Board changes

Today we have announced the appointment of Matt Davies as an

independent non-executive director and Chair Designate with

immediate effect. Matt will succeed Ian Durant as Chair of the

Board of Greggs on 1st November 2022, when Ian steps down from the

Board. On behalf of the Board I would like to thank Ian for his

support and leadership through what has been a transformational

period for Greggs.

As part of our ongoing plans to ensure smooth succession for

Board roles Lynne Weedall, who joined the Board in May 2022, will

become Chair of our Remuneration Committee with effect from 1

September 2022.

Financial performance

Total sales for the 26 weeks to 2 July 2022 were GBP694.5

million (H1 2021: GBP546.2 million). Like-for-like sales in

company-managed shops grew by 22.4% (Q1: 36.9%, Q2: 11.2%).

Pre-tax profit was GBP55.8 million in the first half of 2022 (H1

2021: GBP55.5 million). The contribution from sales in the period

was significantly stronger than that seen under the more restricted

conditions experienced in the first half of 2021, although the 2021

outcome did benefit from temporary relief from business rates and

reduced rates of VAT. We have worked hard to mitigate the impact of

cost inflation on customers but some further small price increases

have been necessary; these appear not to have impacted transaction

numbers.

The rate of cost inflation increased significantly in the first

half of the year, driven by food, packaging and energy commodities.

We have continued to extend forward our purchasing cover and have

fixed input prices for an average of around five months of our

future requirements across these areas. Across all cost areas we

now estimate that the overall level of cost inflation in 2022 will

be around nine per cent, although some uncertainty remains.

The net financing expense of GBP3.2 million in the period (H1

2021: GBP3.9 million) comprised GBP3.2 million in respect of the

IFRS 16 interest charge on lease liabilities, GBP0.4 million of

facility charges under the Company's (undrawn) financing facilities

and GBP0.4m income relating to interest received on bank deposits,

the Company's defined benefit pension scheme and foreign exchange

gains.

The effective rate of Corporation Tax for the period was 17.7%

(H1 2021: 20.0%) with the year-on-year reduction reflecting the

availability of super-deduction capital allowances.

D iluted earnings per share for the period were 44.8 pence (H1

2021: 43.2 pence).

Capital expenditure and financial position

Capital expenditure during the first half was GBP41.9 million

(H1 2021: GBP23.5 million) as we increased investment in line with

our estate growth and development plans and neared completion of

additional pizza capacity at our Enfield manufacturing site. In the

balance of the year we will continue the development of our retail

estate. We are making good progress with the identification of

potential sites for expansion of our supply chain. The timing of

any land purchase will be material to 2022 capital expenditure and,

in the context of the uncertainty over this, our full year guidance

of circa GBP170 million capital expenditure remains

appropriate.

We continue to carry a higher-than-normal cash position in order

to fund the investment in our significant growth programme and

ended the period with a cash balance of GBP145.7 million (3 July

2021: GBP118.3 million). In addition, the Company has access to a

revolving credit facility that allows it to draw up to GBP100

million in committed funds, subject to it retaining a minimum

liquidity of GBP30 million (i.e. maximum net borrowings are GBP70

million).

Dividends

The previously-declared special dividend of 40.0 pence per share

was paid in April 2022.

The Board has declared an interim dividend of 15.0 pence per

share (2021: 15.0 pence). The overall ordinary dividend for the

year will be proposed in line with our progressive dividend policy,

which targets a full year ordinary dividend that is around two

times covered by underlying earnings.

The interim dividend will be paid on 7 October 2022 to those

shareholders on the register at the close of business on 9

September 2022.

Outlook

Despite market-wide inflationary pressures Greggs has continued

to perform well. Consumer behaviour is still recovering from the

impact of the pandemic and employment levels are high. In a market

where consumer incomes are under pressure Greggs offers exceptional

value for customers looking for food and drink on-the-go. In the

four weeks to 30 July like-for-like sales in company-managed shops

were 13.1% above the equivalent period of 2021.

Clearly there are considerable uncertainties in the economy as a

whole, but we continue to trade in line with our plan and are

making good progress against our strategic objective to become a

larger, multi-channel business. As such, the Board's expectations

for the full year outcome remain unchanged.

Roisin Currie

Chief Executive

2 August 2022

Greggs plc

Consolidated income statement

For the 26 weeks ended 2 July 2022

26 weeks ended 26 weeks ended 52 weeks ended

2 July 2022 3 July 2021 1 January 2022

--------------- --------------- ----------------

Total Total Total

--------------- --------------- ----------------

GBPm GBPm GBPm

Revenue 694.5 546.2 1,229.7

Cost of sales (260.7) (196.3) (447.7)

------------------------------------------------------------------ --------------- --------------- ----------------

Gross profit 433.8 349.9 782.0

Distribution and selling costs (339.3) (257.8) (567.6)

Administrative expenses (35.5) (32.7) (61.2)

Operating profit 59.0 59.4 153.2

Finance expense (net) (3.2) (3.9) (7.6)

Profit before tax 55.8 55.5 145.6

Income tax (9.9) (11.1) (28.1)

Profit for the period attributable to equity holders of the

parent 45.9 44.4 117.5

=============== =============== ================

Basic earnings per share 45.2p 43.8p 115.7p

Diluted earnings per share 44.8p 43.2p 114.3p

Greggs plc

Consolidated statement of comprehensive income

For the 26 weeks ended 2 July 2022

26 weeks ended 26 weeks ended 52 weeks ended

2 July 2022 3 July 2021 1 January 2022

GBPm GBPm GBPm

Profit for the period 45.9 44.4 117.5

Other comprehensive income

Items that will not be recycled to profit and loss:

Remeasurements on defined benefit pension plans 2.2 13.8 7.1

Tax on remeasurements on defined benefit pension plans 0.0 (3.5) (1.7)

Other comprehensive income for the period, net of income tax 2.2 10.3 5.4

--------------- --------------- ----------------

Total comprehensive income for the period 48.1 54.7 122.9

=============== =============== ================

Greggs plc

Consolidated balance sheet

as at 2 July 2022

2 July 2022 3 July 2021 1 January 2022

GBPm GBPm GBPm

ASSETS

Non-current assets

Intangible assets 14.0 15.0 14.9

Property, plant and equipment 355.4 340.3 343.8

Right-of-use assets 271.1 269.2 263.6

Defined benefit pension asset 2.3 4.3 -

642.8 628.8 622.3

Current assets

Inventories 33.1 24.8 27.9

Trade and other receivables 37.3 36.3 37.6

Assets held for resale - - 1.6

Current tax - - 0.4

Cash and cash equivalents 145.7 118.3 198.6

216.1 179.4 266.1

Total assets 858.9 808.2 888.4

------------ ------------ ---------------

LIABILITIES

Current liabilities

Trade and other payables (149.1) (115.5) (153.4)

Current tax liability (5.8) (1.3) -

Lease liabilities (49.7) (49.4) (49.3)

Provisions (3.9) (3.1) (4.2)

(208.5) (169.3) (206.9)

Non-current liabilities

Other payables (3.0) (3.5) (3.2)

Defined benefit pension liability - - (2.4)

Lease liabilities (241.2) (240.1) (233.9)

Deferred tax liability (12.5) (5.9) (10.0)

Long-term provisions (2.1) (3.8) (2.8)

(258.8) (253.3) (252.3)

Total liabilities (467.3) (422.6) (459.2)

------------ ------------ ---------------

Net assets 391.6 385.6 429.2

============ ============ ===============

EQUITY

Capital and reserves

Issued capital 2.0 2.0 2.0

Share premium account 22.3 19.3 20.0

Capital redemption reserve 0.4 0.4 0.4

Retained earnings 366.9 363.9 406.8

Total equity attributable to equity holders of the Parent 391.6 385.6 429.2

============ ============ ===============

Greggs plc

Consolidated statement of changes in equity

For the 26 weeks ended 2 July 2022

26 weeks ended 3 July 2021

Issued Share Capital Retained Total

capital premium redemption earnings

reserve

GBPm GBPm GBPm GBPm GBPm

Balance at 3 January 2021 2.0 15.7 0.4 303.5 321.6

Total comprehensive income for the period

Profit for the period - - - 44.4 44.4

Other comprehensive income - - - 10.3 10.3

Total comprehensive income for the period - - - 54.7 54.7

Transactions with owners, recorded directly in equity

Issue of ordinary shares - 3.6 - - 3.6

Sale of own shares - - - 0.3 0.3

Share-based payment transactions - - - 2.5 2.5

Tax items taken directly to reserves - - - 2.9 2.9

--------- --------- ------------ ---------- ------

Total transactions with owners - 3.6 - 5.7 9.3

--------- --------- ------------ ---------- ------

Balance at 3 July 2021 2.0 19.3 0.4 363.9 385.6

--------- --------- ------------ ---------- ------

52 weeks ended 1 January 2022

Issued Share Capital Retained Total

capital premium redemption earnings

reserve

GBPm GBPm GBPm GBPm GBPm

Balance at 3 January 2021 2.0 15.7 0.4 303.5 321.6

Total comprehensive income

for the period

Profit for the financial year - - - 117.5 117.5

Other comprehensive income - - - 5.4 5.4

--------- --------- ------------ ---------- -------

Total comprehensive income

for the year - - - 122.9 122.9

Transactions with owners,

recorded directly in equity

Issue of ordinary shares - 4.3 - - 4.3

Sale of own shares - - - 0.3 0.3

Purchase of own shares - - - (10.0) (10.0)

Share-based payment transactions - - - 2.2 2.2

Dividends to equity holders - - - (15.3) (15.3)

Tax items taken directly to

reserves - - - 3.2 3.2

--------- --------- ------------ ---------- -------

Total transactions with owners - 4.3 - (19.6) (15.3)

--------- --------- ------------ ---------- -------

Balance at 1 January 2022 2.0 20.0 0.4 406.8 429.2

========= ========= ============ ========== =======

26 weeks ended 2 July 2022

Issued Share Capital Retained Total

capital premium redemption earnings

reserve

GBPm GBPm GBPm GBPm GBPm

Balance at 2 January 2022 2.0 20.0 0.4 406.8 429.2

Total comprehensive income for the period

Profit for the period - - - 45.9 45.9

Other comprehensive income - - - 2.2 2.2

--------- --------- ------------ ---------- -------

Total comprehensive income for the period - - - 48.1 48.1

Transactions with owners, recorded directly in equity

Issue of ordinary shares - 2.3 - - 2.3

Purchase of own shares - - - (3.0) (3.0)

Share-based payment transactions - - - 2.1 2.1

Dividends to equity holders (83.3) (83.3)

Tax items taken directly to reserves - - - (3.8) (3.8)

--------- --------- ------------ ---------- -------

Total transactions with owners - 2.3 - (88.0) (85.7)

--------- --------- ------------ ---------- -------

Balance at 2 July 2022 2.0 22.3 0.4 366.9 391.6

========= ========= ============ ========== =======

Greggs plc

Consolidated statement of cash flows

For the 26 weeks ended 2 July 2022

26 weeks ended 26 weeks ended 52 weeks ended

2 July 2022 3 July 2021 1 January 2022

GBPm GBPm GBPm

Cash flows from operating activities

Cash generated from operations (see page 14) 100.1 130.8 312.1

Income tax paid (5.0) (6.7) (19.2)

Interest paid on lease liabilities (3.2) (3.1) (6.3)

Interest paid on loans and borrowings (0.4) (0.8) (1.1)

Net cash inflow from operating activities 91.5 120.2 285.5

--------------- --------------- ----------------

Cash flows from investing activities

Acquisition of property, plant and equipment (34.6) (17.3) (50.5)

Acquisition of intangible assets (1.5) (1.6) (3.8)

Proceeds from sale of property, plant and equipment 1.9 0.2 0.3

Interest received 0.3 - -

Net cash outflow from investing activities (33.9) (18.7) (54.0)

--------------- --------------- ----------------

Cash flows from financing activities

Proceeds from issue of share capital 2.2 3.6 4.3

Sale of own shares - 0.3 0.3

Purchase of own shares (3.0) - (10.0)

Dividends paid (83.3) - (15.3)

Repayment of principal of lease liabilities (26.4) (23.9) (49.0)

Net cash outflow from financing activities (110.5) (20.0) (69.7)

--------------- --------------- ----------------

Net (decrease) / increase in cash and cash equivalents (52.9) 81.5 161.8

Cash and cash equivalents at the start of the period 198.6 36.8 36.8

Cash and cash equivalents at the end of the period 145.7 118.3 198.6

=============== =============== ================

Greggs plc

Consolidated statement of cash flows (continued)

For the 26 weeks ended 2 July 2022

Cash flow statement - cash generated from operations

26 weeks ended 26 weeks ended 52 weeks ended

2 July 2022 3 July 2021 1 January 2022

GBPm GBPm GBPm

Profit for the period 45.9 44.4 117.5

Amortisation 2.4 2.2 4.5

Depreciation - property, plant and equipment 28.2 26.9 54.2

Depreciation - right-of-use assets 25.9 23.9 48.7

Impairment reversal - property, plant and equipment (0.2) (0.6) (1.9)

Impairment charge/(reversal) - right-of-use assets 0.6 (1.4) (1.6)

Loss on sale of property, plant and equipment 0.5 0.3 0.9

Release of government grants (0.2) (0.2) (0.5)

Share-based payment expenses 2.1 2.5 2.2

Finance expense 3.2 3.9 7.6

Income tax expense 9.9 11.1 28.1

Increase in inventories (5.3) (2.2) (5.4)

Decrease in receivables 0.3 3.1 1.8

(Decrease) / increase in payables (9.7) 19.9 58.9

(Decrease) in provisions (1.0) (0.5) (0.4)

Decrease in pension liability (2.5) (2.5) (2.5)

Cash from operating activities 100.1 130.8 312.1

=============== =============== ================

Notes

1. Basis of preparation

The condensed accounts have been prepared for the 26 weeks ended

2 July 2022. Comparative figures are presented for the 26 weeks

ended 3 July 2021. These condensed accounts have been prepared in

accordance with IAS 34 Interim Financial Reporting as adopted by

the UK. They do not include all the information required for full

annual accounts, and should be read in conjunction with the Group

accounts for the 52 weeks ended 1 January 2022.

These condensed accounts are unaudited and were approved by the

Board of Directors on 2 August 2022.

The comparative figures for the 52 weeks ended 1 January 2022

are not the Company's statutory accounts for that financial year.

Those accounts were reported on by the Company's auditor and

delivered to the Registrar of Companies. The report of the auditors

was (i) unqualified, (ii) did not include a reference to any

matters to which the auditor drew attention by way of emphasis

without qualifying their report; and (iii) did not contain a

statement under section 498(2) or (3) of the Companies Act

2006.

Going concern

The Directors have considered the adoption of the going concern

basis of preparation for these condensed accounts. The Directors

have reviewed cash flow forecasts prepared for a period of 18

months from the date of approval of these condensed accounts.

At the end of the reporting period the Group had GBP215.7

million of available liquidity including GBP145.7 million cash and

cash equivalents and GBP70.0 million of the undrawn revolving

credit facility ('RCF').

In reviewing the cash flow forecasts the Directors considered

the current trading position of the Group and the likely capital

expenditure and working capital requirements of its growth plans.

The cashflow forecasts show that the Group expects to comply with

the covenants included within the RCF agreement throughout the

review period. The main uncertainty for the review period is the

impact of cost inflation on both the Group's cost base and also on

consumer disposable income. Trading to date has been in line with

our plan and given the significant liquidity available we do not

believe this presents a risk to our ability to continue as a going

concern.

Taking into account the current cash level and the committed

facilities the Directors are confident that the Group will have

sufficient funds to allow it to continue to operate. After

reviewing the projections and sensitivity analysis the Directors

believe that it is appropriate to prepare the condensed accounts on

a going concern basis.

Judgements and estimates

In preparing these condensed accounts, management have made

judgements and estimates that affect the application of accounting

policies and the reported amounts of assets and liabilities, income

and expense. Actual results may differ from these estimates. In

addition to the key estimates and judgements disclosed in the

consolidated accounts for the 52 weeks ended 1 January 2022 the

following additional areas have been identified or updated for the

26 weeks ended 2 July 2022.

Impairment

Property, plant and equipment and right-of-use assets are

reviewed for impairment if events or changes in circumstances

indicate that the carrying value may not be recoverable. For

example, shop fittings and right-of-use assets may be impaired if

sales in that shop fall. When a review for impairment is conducted,

the recoverable amount is estimated based on either value- in-use

calculations or fair value less costs of disposal. Value-in-use

calculations are based on management's estimates of future cash

flows generated by the assets and an appropriate discount rate.

Consideration is also given to whether the impairment assessments

made in prior years remain appropriate based on the latest

expectations in respect of recoverable amount. Where it is

concluded that the impairment has reduced, a reversal of the

impairment is recorded.

The Covid-19 pandemic meant that during 2020 and 2021 all shops

had periods of no, or reduced, sales and this was deemed to be an

impairment trigger in both financial years. As a result, assets in

company-managed shops were tested for impairment for the 2020 and

2021 financial years. Sales have performed in line with

expectations for the first 6 months of 2022, however given the

level of impairment previously recognised and with customer

transaction numbers remaining below pre-pandemic levels the

impairment review has been updated as at 2 July 2022 using the

following assumptions:

-- Shops have been categorised into different catchment areas

(e.g. city centres, transport hubs, retail parks) and assumptions

made as to the rate of like-for-like sales recovery for each

catchment;

-- Like-for-like sales excluding price inflation and the

incremental impact of delivery have been assumed to return to a

level equivalent to the pre-Covid-19 levels (on average across the

estate) by June 2023. Like-for-like sales for the period 2023 to

2026 are then assumed to grow by an average of 3% per annum;

-- Where shops are currently used to fulfil orders for delivery,

or are planned to offer delivery in 2022, the net cash flows for

fulfilling these orders are included within the estimated cash

flows for the shop;

-- Earnings before interest, tax, depreciation, amortisation and

rent ('EBITDAR') is used as a proxy for net cash flow excluding

rental payments;

-- Cash flows have been discounted at a pre-tax discount rate

that reflects the current market assessment of the time value of

money, including a risk uplift for uncertainty of future cash

flows. The discount rate as at 2 July 2022 was 9.0% (1 January

2022: 6.9%); and

-- Consideration of the appropriate period over which to

forecast cash flows, including reference to the lease term. Where

considered appropriate cashflows have been included for periods

beyond the lease probable end date (to a maximum of five years in

accordance with IAS 36).

On the basis of these calculations a net impairment charge of

GBP0.6m has been made in respect of 74 shops reflecting the higher

discount rate used in the calculation.

2. Accounting policies

The accounting policies applied by the Group in these condensed

accounts are the same as those applied by the Group in its

consolidated accounts for the 52 weeks ended 2 January 2022 other

than as disclosed below:

-- Amendments to IAS 16: Property, Plant and Equipment - Proceeds before Intended Use;

-- Amendments to IAS 37: Provisions, Contingent Liabilities and

Contingent Assets: Onerous Contracts - Cost of Fulfilling a

Contract; and

-- Annual Improvements 2018-2020.

Their adoption did not have a material effect on the

accounts.

Principal risks and uncertainties

The Directors have considered the principal risks and

uncertainties which could have a material impact on performance for

the remainder of the financial year.

The assessment of principal risks and uncertainties made in the

2021 Annual Report and Accounts remains valid and we do not believe

there to have been any material changes in the profile of those

risks since then.

We have considered whether the Company is facing any new

principal risks since our last report and identified the

following:

-- The war in Ukraine has had the following impacts on our business:

o Additional pressure on supply chains due to increased demand

globally, resulting in increases to input prices.

o Possible increased cyber security risks.

-- Cost of living pressures are impacting the household budgets

of customers. We continue to work hard to ensure that we offer

exceptional value for customers looking for food and drink

on-the-go.

-- Lack of availability of certain ingredients for our products,

which has resulted in the need for us to find alternatives. Our

normal food safety processes ensure the integrity and safety of any

substitute ingredients.

-- We identified climate change as an emerging risk in our

annual report. Work to understand the future impacts of this

continues, and we anticipate including it as a principal risk in

the 2022 Annual Report.

The assessment above should be read in conjunction with the

statement of principal risks described on pages 59-62 in the 2021

Annual Report and Accounts. Other than the matters described above

we believe our exposure to other principal risks faced by the

business is not significantly different to that described in that

statement.

3. Operating segments

The Board is considered to be the 'chief operating decision

maker' of the Group in the context of the IFRS 8 definition. In

addition to its company-managed retail activities, the Group

generates revenues from its business to business channel which

includes franchise and wholesale activities. Both channels were

categorised as reportable segments for the purposes of IFRS 8.

Company-managed retail activities - the Group sells a consistent

range of fresh bakery goods, sandwiches and drinks in its own shops

or via delivery channels. Sales are made to the general public on a

cash basis. All results arise in the UK.

Business to business channel - the Group sells products to

franchise and wholesale partners for sale in their own outlets as

well as charging a licence fee to franchise partners. These sales

and fees are invoiced to the partners on a credit basis. All

results arise in the UK.

All revenue in 2022 and 2021 was recognised at a point in

time.

The Board regularly reviews the revenues and trading profit of

each segment. The Board receives information on overheads, assets

and liabilities on an aggregated basis consistent with the Group

accounts.

26 26 weeks 26 weeks 26 weeks 26 weeks 26 weeks 52 weeks 52 weeks 52

weeks ended ended ended ended ended ended ended weeks

ended 2 July 2 July 3 July 2 July 3 July 1 January 1 ended

2 July 2022 2022 2021 2021 2021 2022 January 1

2022 2022 January

2022

Retail Business Retail Business Retail Business

company-managed to company-managed to company-managed to

shops business Total shops business Total shops business Total

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

Revenue 622.6 71.9 694.5 488.3 57.9 546.2 1,098.2 131.5 1,229.7

================ ========= ========= ================ ========= ========= ================ ========= ========

Trading

profit* 92.2 12.6 104.8 86.9 12.1 99.0 207.1 28.5 235.6

Overheads

including

profit

share (45.8) (39.6) (82.4)

--------- --------- --------

Operating

profit 59.0 59.4 153.2

Finance

expense (3.2) (3.9) (7.6)

--------- --------- --------

Profit

before

tax 55.8 55.5 145.6

========= ========= ========

* Trading profit is defined as gross profit less supply chain

costs and retail costs (including property and direct management

costs) and before central overheads.

4. Defined benefit pension scheme

The valuation of the defined benefit pension scheme for the

purposes of IAS 19 (Revised) as at 1 January 2022 has been updated

as at 2 July 2022 and the movements have been reflected in these

condensed accounts.

5. Taxation

The taxation charge for the 26 weeks ended 2 July 2022 and 3

July 2021 is calculated by applying the Directors' best estimate of

the annual effective tax rate to the profit or loss for the period

using rates substantively enacted by the half year date as required

by IAS34 'Interim Financial Reporting'.

6. Earnings per share

26 weeks ended 2 July 2022 26 weeks ended 3 July 2021 52 weeks ended 1 January

2022

--------------------------- --------------------------- -----------------------------

Total Total Total

--------------------------- --------------------------- -----------------------------

GBPm GBPm GBPm

Profit for the period

attributable to equity

holders of the parent 45.9 44.4 117.5

=========================== =========================== =============================

Basic earnings per share 45.2p 43.8p 115.7p

Diluted earnings per share 44.8p 43.2p 114.3p

Weighted average number of ordinary shares

26 weeks 26 weeks ended 52 weeks ended

ended 2 July 3 July 2021 1 January

2022 2022

Number Number Number

Issued ordinary shares at start

of period 101,897,021 101,426,038 101,426,038

Effect of shares issued 28,515 126,480 284,386

Effect of own shares held (369,828) (168,244) (221,851)

Weighted average number of ordinary

shares during the period 101,555,708 101,384,274 101,488,573

Effect of share options in issue 902,676 1,252,095 1,261,311

Weighted average number of ordinary

shares (diluted) during the period 102,458,384 102,636,369 102,749,884

============== =============== ===============

Issued ordinary shares at end

of period 102,046,258 101,813,986 101,897,021

============== =============== ===============

7. Dividends

The following tables analyse dividends when paid and the year to

which they relate:

Dividend declared 26 weeks ended 26 weeks ended 52 weeks ended

2 July 2022 3 July 2021 1 January 2022

Pence per share Pence per share Pence per share

2021 interim dividend - - 15.0p

2021 special dividend 40.0p - -

2021 final dividend 42.0p - -

---------------- ---------------- ----------------

82.0p - 15.0p

================ ================ ================

26 weeks ended 26 weeks ended 52 weeks ended

2 July 2022 3 July 2021 1 January 2022

GBPm GBPm GBPm

Total dividend payable

2021 interim dividend - - 15.3

2021 special dividend 40.6 - -

2021 final dividend 42.6 - -

Total dividend paid in period 83.2 - 15.3

=============== =============== ================

Dividend proposed at period end and not included as a liability

in the accounts

2021 interim dividend (15.0p per share) - 15.3 -

2021 special dividend (40.0p per share) - - 40.6

2021 final dividend (42.0p per share) - - 42.6

2022 interim dividend (15.0p per share) 15.3 - -

--------------- --------------- ----------------

15.3 15.3 83.2

=============== =============== ================

8. Related party transactions

There have been no related party transactions in the first 26

weeks of the current financial year which have materially affected

the financial position or performance of the Group.

Related parties are consistent with those disclosed in the

Group's Annual Report and Accounts for the 52 weeks ended 1 January

2022.

9. Half year report

The condensed accounts were approved by the Board of Directors

on 2 August 2022. They will be available on the Company's website,

corporate.greggs.co.uk

10. Calculation of Alternative Performance Measures

One-year like-for-like (LFL) sales increase - Like-for-like

(LFL) company-managed shop sales performance against comparable

period in 2021

26 weeks ended

2 July 2022

GBPm

Current year LFL sales 581.0

2021 LFL sales 474.6

Increase 106.4

==============

LFL sales increase percentage 22.4%

Three-year like-for-like (LFL) sales increase - Like-for-like

(LFL) company-managed shop sales performance against comparable

period in 2019

26 weeks ended

2 July 2022

GBPm

Current year LFL sales 532.6

2019 LFL sales 474.1

Increase 58.5

==============

LFL sales increase percentage 12.3%

11. Statement of Directors' responsibilities

The Directors named below confirm on behalf of the Board of

Directors that to the best of their knowledge:

-- the condensed set of accounts has been prepared in accordance

with IAS 34 Interim Financial Reporting as adopted by the UK;

-- the interim management report includes a fair review of the information required by:

(a) DTR4.2.7R of the Disclosure and Transparency Rules, being an

indication of important events that have occurred during the first

26 weeks of the financial year and their impact on the condensed

set of accounts; and a description of the principal risks and

uncertainties for the remaining 26 weeks of the year; and

(b) DTR4.2.8R of the Disclosure and Transparency Rules, being

related party transactions that have taken place in the first 26

weeks of the financial year and that have materially affected the

financial position or performance of the Group during the period;

and any changes in the related party transactions described in the

last annual report that could do so.

The Directors of Greggs plc are listed in the Annual Report and

Accounts for the 52 weeks ended 1 January 2022. On 1 February 2022

Roisin Currie was appointed as an Executive Director and on 17 May

2022 Lynne Weedall was appointed as an independent Non-Executive

Director. On 17 May 2022 Roger Whiteside retired from the

Board.

For and on behalf of the Board of Directors

Roisin Currie Richard Hutton

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR ELLBBLVLLBBD

(END) Dow Jones Newswires

August 02, 2022 02:00 ET (06:00 GMT)

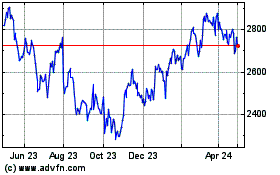

Greggs (LSE:GRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

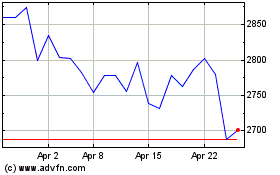

Greggs (LSE:GRG)

Historical Stock Chart

From Apr 2023 to Apr 2024