TIDMGRIT

RNS Number : 5809N

Global Resources Investment Tst PLC

30 September 2021

Global Resources Investment Trust plc

'GRIT' or 'the Company'

Half-year results for the six months ended 30 June 2021

Chairman's statement

I'm pleased to report that the Company has concluded its

preparations for its re-launch as a natural resources investment

trust. As soon as the formalities have been completed, two of the

principal participants in the latest round of funding, Malcolm

Burne and Richard Lockwood, both of whom are veteran fund managers,

with exceptional records in the natural resources sector, will join

the Board.

Set out below is the interim statement covering the six months

ended 30 June 2021. For the first time in a number of years GRIT is

able to report a profit (of GBP366,000 - compared to a loss of

GBP288,000 in the six months ended 30 June 2020). This was achieved

largely as a result of the profit on the sale of the Company's

stake in Siberian Goldfields Limited, but was assisted by the

waiver of fees by directors and by advisers.

Salient events

In January GRIT raised GBP226,000 of additional capital in the

form of new ordinary shares and a convertible loan note.

In April the Company sold its interest in Siberian Goldfields

Limited for GBP488,000.

The proceeds of these transactions enabled the CVA Supervisor to

pay an aggregate 71% dividend to the creditors subject to the

CVA.

On 21 July, following the publication of the 2020 Annual Report,

the suspension of trading in the Company's shares was lifted by the

FCA.

On 2 August the Company raised from existing and new investors

additional capital of GBP599,000 in the form of a convertible loan

note.

On 5 September the Republic of Guinea, the home of the mining

activities of Anglo African Mining plc ('AAM'), GRIT's residual

investment, suffered a military coup. There is no doubt that this

will make the realisation of any of the Company's investment in AAM

even more remote; and further justifies the directors' decision to

make full provision against it in the 2019 financial statements;

and to institute the CVA which has enabled the re-launch of the

Company.

Board of directors

On publication of the 2020 Annual Report, the lifting of the

suspension in trading in the Company's shares and the raising of

additional capital, Stephen Roberts resigned from the Board (as

announced at the time).

As soon as Malcom Burne and Richard Lockwood are appointed to

the Board, I shall also step down from the Board. I joined in

August 2019, with Stephen Roberts and Martin Lampshire, in order to

oversee the transformation of GRIT into a company which could be

re-launched as an active natural resources investment trust.

Although this has been a much harder task than we had anticipated

at the time, I believe that we have now reached that point.

Future plans

Further details on my successors and on their plans for GRIT

(which include proposals for the re-building of a small diverse

portfolio of natural resources investments) will be set out in an

announcement to be published at the time that they are formally

appointed (expected very shortly). I wish them and Martin

Lampshire, who will continue as Executive Director, every success

for the future of GRIT.

James Normand

Chairman

30 September 2021

Executive Director's Review

The six months ended 30 June 2021 saw no investment activity

other than the sale of the Company's interest in Siberian

Goldfields Limited.

The results for the period reflect administrative expenditure

only.

The last two years have been challenging for a number of

reasons, but the Company is now well positioned for future growth

as an Investment Trust focused on the natural resources sector. The

proposed appointments of fund managers Malcolm Burne and Richard

Lockwood will bring a depth of experience to the board which will

prove invaluable in all prospective investment decisions. We look

forward to the future with considerable optimism and believe that

the natural resources sector should present a number of exciting

investment opportunities.

Martin Lampshire

Executive Director

30 September 2021

Enquiries:

Global Resources Investment Trust plc

Martin Lampshire

Tel: +44 (0) 20 3198 2554

Peterhouse Capital Limited

Lucy Williams/Duncan Vasey

Tel: +44 (0)20 7469 0930

Income Statement

Revenue Capital Total

Unaudited Unaudited Unaudited

-------------------------------------- ------ ---------------- ---------- -----------

Notes GBP'000 GBP'000 GBP'000

-------------------------------------- ------ ---------------- ---------- -----------

Six months ended 30 June 2021

Profit on disposal of investments - 488 488

Income - - -

Other expenses (122) - (122)

-------------------------------------- ------ ---------------- ---------- -----------

Net return before finance costs

and taxation (122) 488 366

Interest payable and similar charges - - -

-------------------------------------- ------ ---------------- ---------- -----------

Net return on ordinary activities

before taxation (122) 488 366

Tax on ordinary activities - - -

-------------------------------------- ------ ---------------- ---------- -----------

Net return attributable to equity

shareholders (122) 488 366

-------------------------------------- ------ ================ ========== ===========

Profit (loss) per ordinary share 2 (0.24p) 0.97p 0.73p

-------------------------------------- ------ ---------------- ---------- -----------

Six months ended 30 June 2020

Losses on investments - (28) (28)

Income - - -

Other expenses (256) - (256)

-------------------------------------- ------ ---------------- ---------- -----------

Net return before finance costs

and taxation (256) (28) (284)

Interest payable and similar charges - - -

-------------------------------------- ------ ---------------- ---------- -----------

Net return on ordinary activities

before taxation (256) (28) (284)

Tax on ordinary activities - - -

-------------------------------------- ------ ---------------- ---------- -----------

Net return attributable to equity

shareholders (256) (28) (284)

-------------------------------------- ------ ================ ========== ===========

Loss per ordinary share 2 (0.61p) (0.07p) (0.68p)

-------------------------------------- ------ ---------------- ---------- -----------

Year ended 31 December 2020

Losses on investments - (28) (28)

Income - - -

Other expenses (466) - (466)

-------------------------------------- ------ ---------------- ---------- -----------

Net return before finance costs

and taxation (466) (28) (494)

Interest payable and similar charges - - -

-------------------------------------- ------ ---------------- ---------- -----------

Net return on ordinary activities

before taxation (466) (28) (494)

Tax on ordinary activities - - -

-------------------------------------- ------ ---------------- ---------- -----------

Net return attributable to equity

shareholders (466) (28) (494)

-------------------------------------- ------ ================ ========== ===========

Loss per ordinary share 2 (1.11p) (0.07p) (1.18p)

-------------------------------------- ------ ---------------- ---------- -----------

The 'total' column of this statement represents the Company's

profit and loss account, prepared in accordance with IFRS. All

revenue and capital items in this statement derive from continuing

operations. All of the profit for the period is attributable to the

owners of the Company.

No operations were acquired or discontinued in the year.

A Statement of Total Recognised Gains and Losses is not required

as all gains and losses of the Company have been reflected in the

above Income Statement.

Balance Sheet

As at As at 31 As at

30 June December 30 June

2021 2020 2020

Unaudited Audited Unaudited

---------------------------------- ------ ---------- ---------- ----------

Notes GBP'000 GBP'000 GBP'000

---------------------------------- ------ ---------- ---------- ----------

Fixed assets

Investments - - -

---------------------------------- ------ ---------- ---------- ----------

- - -

---------------------------------- ------ ---------- ---------- ----------

Current assets

Investments - - -

Debtors - - -

Cash at bank and on deposit 30 - -

---------------------------------- ------ ---------- ---------- ----------

30 - -

Creditors: amounts falling due

within one year

Other creditors (338) (900) (685)

---------------------------------- ------ ---------- ---------- ----------

( 900

Net current (liabilities) assets (308) ) (685)

---------------------------------- ------ ---------- ---------- ----------

Creditors: amounts falling due

after one year

Convertible unsecured loan notes (100) - -

---------------------------------- ------ ---------- ---------- ----------

Net (liabilities) assets (408) (900) (685)

---------------------------------- ------ ========== ========== ==========

Capital and reserves

Called up share capital 504 420 420

Share premium 36,922 36,880 36,880

Capital reserve (32,697) (33,185) (33,185)

Revenue reserve (5,137) (5,015) (4,800)

---------------------------------- ------ ---------- ---------- ----------

Equity shareholders' funds (408) (900) (685)

---------------------------------- ------ ========== ========== ==========

Net asset value per share 3 (0.81p) (2.14p) (1.63p)

---------------------------------- ------ ---------- ---------- ----------

Statement of Changes in Equity Share

Share premium Capital Revenue

capital account reserve reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------- --------- --------- --------- --------- --------

For the 6 months to 30 June 2021 (unaudited)

Balance at 31 December 2020 420 36,880 (33,185) (5,015) (900)

Issue of shares 84 42 - - 126

Return on ordinary activities

after taxation - - 488 (122) 366

--------- --------- --------- --------- --------

Balance at 30 June 2021 504 36,922 (32,697) (5,137) (408)

---------------------------------- ========= ========= ========= ========= ========

For the 6 months to 30 June 2020

(unaudited)

---------------------------------- --------- --------- --------- --------- --------

Balance at 31 December 2019 420 36,880 (33,157) (4,544) (401)

Return on ordinary activities

after taxation - - (28) (256) (284)

--------- --------- --------- --------- --------

Balance at 30 June 2020 420 36,880 (33,185) (4,800) (685)

---------------------------------- ========= ========= ========= ========= ========

The revenue reserve represents the amount of the Company's

reserves distributable by way of dividend.

Cash Flow Statement

Six months ended

30 June

---------------------------------------

2021 2020

Unaudited Unaudited

-------------------------------------------------- --------------------------- ----------

GBP'000 GBP'000

-------------------------------------------------- --------------------------- ----------

Operating activities

Profit/(loss) before finance costs and

taxation 366 (284)

(Profit) on disposal of investment (488)

Losses on revaluation of investments - 28

Decrease in other receivables - 13

(Decrease)/increase in other payables (562) 241

-------------------------------------------------- --------------------------- ----------

Net cash outflow from operating activities (684) (2)

-------------------------------------------------- --------------------------- ----------

Investing activities

Proceeds from the sale of investment 488

-------------------------------------------------- --------------------------- ----------

Net cash inflow from investing activities 488

-------------------------------------------------- --------------------------- ----------

Financing activities

Issue of shares 126 -

Issue of convertible unsecured loan notes 100 -

Net cash inflow from financing activities 226 -

-------------------------------------------------- --------------------------- ----------

Increase/(decrease) in cash and cash equivalents 30 (2)

Net cash at the start of the period - 2

-------------------------------------------------- --------------------------- ----------

Net cash at the end of the period 30 -

-------------------------------------------------- --------------------------- ----------

The accompanying notes are an integral part of the financial

statements.

Notes

1. Interim Results

These condensed financial statements have been prepared in

accordance with International Financial Reporting Standards

('IFRS') and IAS 34 'Interim Financial Reporting' as adopted by the

European Union and the accounting policies set out in the statutory

accounts of the Company for the year ended 31 December 2020. The

condensed financial statements do not include all of the

information required for a complete set of IFRS financial

statements and should be read in conjunction with the financial

statements of the Company for the year ended 31 December 2020,

which were prepared under IFRS as adopted by the European Union.

There have been no significant changes to management judgements and

estimates.

2. Going Concern Basis of Accounting

At the time of approving the financial statements, the directors

have a reasonable expectation that the company has adequate

resources to continue in operational existence for the foreseeable

future. Thus the directors continue to adopt the going concern

basis of accounting in preparing the financial statements.

3. Return per Ordinary Share

The revenue loss per ordinary share for the six months ended 30

June 2021 is based on a net loss after taxation of GBP122,000 and

on a weighted average of 50,357,414 ordinary shares in issue during

the period.

The capital loss per ordinary share for the six months ended 30

June 2021 is based on a net capital profit after taxation of

GBP488,000 and on a weighted average of 50,357,414 ordinary shares

in issue during the period.

4. Net Asset Value per Ordinary Share

The net asset value per ordinary share is based on net

liabilities of GBP408,000 (31 December 2020: net liabilities of

GBP900,000) and on 50,357,414 (31 December 2020: 41,964,512)

ordinary shares, being the number of ordinary shares in issue at

the period end.

5. Related Party Transactions

The Board of Directors is considered to be a related party. The

Directors of the Company received fees for their services. Total

fees for the six months to 30 June 2021 were GBP18,750 (six months

ended 30 June 2020: GBP83,207). At 30 June 2021 directors were owed

GBP134,964 (30 June 2020: GBP229,636).

5. Post Balance Sheet Events

Events since the balance sheet date are fully described in the

outgoing Chairman's statement.

Interim Report Statement

The Company's auditor PKF Littlejohn LLP, has not audited or

reviewed the Interim Report to 30 June 2021 pursuant to the

Auditing Practices Board guidance on 'Review of Interim Financial

Information'. These are not full statutory accounts in terms of

Section 434 of the Companies Act 2006 and are unaudited. Statutory

accounts for the year ended 31 December 2020, which received an

unqualified audit report and which did not contain a statement

under Section 498 of the Companies Act 2006, have been lodged with

the Registrar of Companies. No full statutory accounts in respect

of any period after 30 December 2020 have been reported on by the

Company's auditor or delivered to the Registrar of Companies.

Directors' Statement of Principal Risks and Uncertainties

The risks, and the way in which they are managed, are described

in more detail in the Strategic Report contained within the Annual

Report and Financial Statements for the year ended 31 December

2020. In the opinion of the Directors the Company's principal risks

and uncertainties have not changed materially since the date of

that report and did not change materially for the rest of the

Company's financial reporting period to 31 December 2021.

Statement of Directors' Responsibilities in Respect of the

Interim Report

We confirm that to the best of our knowledge:

-- the condensed set of financial statements has been prepared

in accordance with IAS 34 'Interim Financial Reporting' and gives a

true and fair view of the assets, liabilities, financial position

and loss of the Company;

-- the Chairman's Statement and Executive Director's Review

(together constituting the Interim Management Report) include a

fair review of the information required by the Disclosure Guidance

and Transparency Rules ('DTR') 4.2.7R, being an indication of

important events that have occurred during the first six months of

the year and their impact on the financial statements; and

-- other than directors' remuneration, there have been no

related party transactions that materially affected the financial

position or performance of the Company during the period.

On behalf of the Board

James Normand

Chairman

30 September 2021

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BBGDCRXXDGBG

(END) Dow Jones Newswires

September 30, 2021 07:41 ET (11:41 GMT)

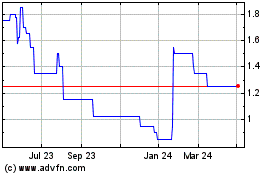

Grit Investment (LSE:GRIT)

Historical Stock Chart

From Mar 2024 to Apr 2024

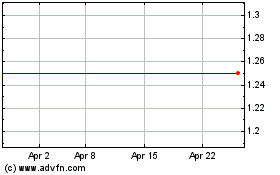

Grit Investment (LSE:GRIT)

Historical Stock Chart

From Apr 2023 to Apr 2024