TIDMGRIT

RNS Number : 8901Q

GRIT Investment Trust PLC

30 June 2022

For immediate release 30 June 2022

GRIT Investment Trust plc

("GRIT" or "Company")

Annual Report and Financial Statements for the year ended 31

December 2021

The Directors are pleased to announce the audited results of the

Company for the year ended 31 December 2021.

A copy of the Annual Report and Financial Statements will be

available for viewing at the Company's website:

http://grinvestmenttrust.com/ and will be also uploaded onto the

National Storage Mechanism

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

Please note that page references in the text below refer to the

page numbers in the Annual Report and Financial Statements.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK Domestic Law by virtue of the European Union (Withdrawal) Act

2018 ("UK MAR").

For further information, please contact:

Enquiries:

GRIT Investment Trust plc

Martin Lampshire Tel: +44 (0)20 3198 2554

Peterhouse Capital Limited (Broker)

Lucy Williams/ Duncan Vasey Tel: +44 (0)20 7469 0930

CHAIRMAN'S STATEMENT

Investments

The Company's principal investment remains its 25% equity

interest in and loans to Anglo-African Minerals plc ("AAM") located

in Guinea. ASX listed-TerraCom Limited, had entered into a 'Binding

Termsheet' for the purchase of AAM but was prevented by the

coronavirus from completing its due diligence process. In September

2021 there was a military coup d'etat in Guinea which stalled

further discussions and the due diligence process.

As any immediate sale appears unlikely and because of the long

history of failed attempts to realise value from the Company's

investment in AAM, we continue to adopt a prudent view and to

reflect the Company's investment in and loans to AAM at a nil

value.

In early 2021 the Company received and subsequently accepted an

offer for its shares in Siberian Goldfields (see note 12 to the

financial statements). The capital surplus of GBP488,000 resulting

from this sale is recognised in the current year.

Net Assets

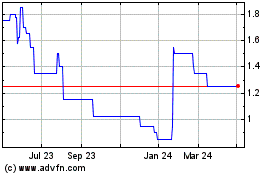

At 31 December 2021 your Company had net liabilities equivalent

to 1.21p deficit per share, a decrease of 43% from the 2.14p

deficit per share at which the Company's net assets stood at 31

December 2020.

Board of Directors

The directors who served during the year were:

Stephen John Roberts (resigned on 2 August 2021)

James Patrick Normand (resigned on 22 October 2021)

Martin Lampshire

Richard Arthur Lockwood (appointed on 22 October 2021)

Malcolm Alec Burne (appointed on 22 October 2021)

Creditors

The sale of the Company's shares in Siberian Goldfields

completed in April 2021 realising a cash consideration GBP488,352.

This, along with the issue of GBP100,000 convertible unsecured loan

notes and placing of shares raising GBP125,893, enabled the CVA

Supervisor to pay a dividend of 76% of the amounts due to creditors

which are the subject of the CVA. This means that those creditors

that the current Board assumed when appointed in August 2019 have

now been settled 84%.

In the interim statement for the six months ended 30 June 2021,

my predecessor, James Normand, outlined the changes in GRIT's

recent history and how the new management team will organise and

run the company, now known as GRIT Investment Trust Plc.

The war in Ukraine and the huge increase in inflation have

caused a major reaction in equity markets with perhaps the biggest

falls seen in the high-tech sectors. We are entering an era when

the emphasis will be on earnings and dividend yield as opposed to

increasing sales at all costs.

The new management believes that the natural resources sectors

represent sound value for money reflecting in many cases low PERs

and high yields. Value for money is very much the maxim in how we

shall base our investment policy with marketability being an

important consideration.

The new team has very considerable experience in fund management

and are confident they can offer shareholders a sound long term

investment portfolio.

Richard Lockwood

Chairman

30 June 2022

PORTFOLIO REVIEW

MCB Resources Limited

MCB Resources Limited ("MCB") is a copper/gold exploration

company, previously active on the Pacific island of Bougainville.

The Company has a residual holding of 500,000 ordinary shares in

MCB. MCB has experienced intractable problems with resuming its

exploration activity and, its listing on the ASX was cancelled on

26 February 2021 because it had failed to pay its annual listing

fee. Accordingly, a full provision was made against the investment

value of these shares.

Anglo-African Minerals plc

Anglo-African Minerals plc ("AAM") is an unlisted advanced

mineral exploration company, incorporated in Ireland, focused on

the progression of its bauxite mining projects located in the

Republic of Guinea, which hosts two-thirds of the world's bauxite.

Bauxite is the composite material that contains alumina, which is

the feedstock for aluminium. AAM was previously in discussions for

the sale of the company to Terracom Limited (as announced in

February 2020). However, due to the coronavirus pandemic and a

military coup d'état in Guinea there was a delay in the due

diligence process resulting from the inability to complete a Guinea

mine site visit. We understand discussions between AAM and Terracom

Limited are on hold and in the light of the continuing

uncertainties, the Company has, in the interests of accounting

prudence, continued to make full provision against both its

investment in AAM's shares and its loans to AAM.

STRATEGIC REVIEW

YEARED 31 DECEMBER 2021

Introduction

This review is part of the Strategic Report being presented by

the Company under updated guidelines for UK-listed companies'

Annual Reports in accordance with the Companies Act 2006; and is

designed to provide information primarily about the Company's

business and results for the twelve months to 31 December 2021. It

should be read in conjunction with the Chairman's Statement on page

3, which provides a detailed review of the investment activities

for the period and outlook for the future.

Grit Investment Trust plc ("GRIT" or "the Company") is an

investment trust established to seek to exploit investment

opportunities in the junior mining and natural resource sectors. On

7 March 2014, GRIT conducted a share exchange issue through which

it acquired an initial portfolio in return for the issue of

ordinary shares. The initial portfolio comprised 41 companies and

had an aggregate value of GBP39,520,012 based on the share exchange

valuation and, pursuant to the share exchange issue, 39,520,012

ordinary shares were issued (credited as fully paid up) and were

admitted to trading on the London Stock Exchange's main market.

At launch, GRIT raised GBP4,850,000 through the issue of 9%

Convertible Unsecured Loan Stocks, which have since been

redeemed.

The Company changed its name to "Grit Investment Trust plc" on

10 January 2022.

Business model

Grit Investment Trust is a self-managed investment trust run by

its Board, which takes all major decisions collectively.

Investment objective

GRIT's investment objective is to generate medium and long-term

capital growth through investing in a diverse portfolio of

primarily small and mid-capitalisation natural resources and mining

companies, which are listed/quoted on a relevant exchange.

Investment policy

GRIT's investment policy is to diversify its investments across

a number of companies, with a range of natural resource assets, in

jurisdictions globally. There are no restrictions as to the

commodity classes and geographical regions into which GRIT may

invest. However, GRIT will invest and manage its assets in a way

which is consistent with its objective of spreading risk. GRIT will

adhere to the following investment restrictions:

-- GRIT may invest up to only 60 per cent. of its Gross Asset

Value (at the time of investment) in non-quoted, seed capital or

pre-IPO companies provided that at any one time such new

investments above a 15 per cent. limit will not be in more than two

companies, with an emphasis in such instances on potentially

large-scale assets that all have the ability to be brought into

production in the succeeding years;

-- GRIT will invest no more than 40 per cent. of its Gross Asset

Value in any one company (measured at the time of investment)

provided that at any one time such new investments above a 15 per

cent limit will not be in more than two companies, with an emphasis

in such instances on potentially large-scale assets that also have

the ability to bring them to production in the succeeding

years;

-- GRIT will not take legal or management control over investments in its portfolio;

-- GRIT will invest no more than 10 per cent., in aggregate, of

its Gross Asset Value in other listed closed-ended investment

funds;

-- Distributable income (if any) will be principally derived

from investments. GRIT will not conduct a trading activity which is

significant in the context of the activities of GRIT as a

whole;

-- GRIT will not enter into derivative transactions for

speculative purposes. GRIT does not expect to enter into any

hedging transactions, although it may do so for the purposes of

efficient portfolio management and to hedge against exposure to

changes in currency rates to the full extent of any such

exposure;

-- GRIT will not incur any debt beyond such amount that is

covered four times by the gross value of its investments at the

time of incurring such debt (i.e. a "4 to 1 cover ratio");

-- GRIT will manage the overall portfolio to ensure that there

is a spread of investments to provide diversification, with a

target of having between 4 and 8 different investments at any one

time;

-- GRIT will hold any uninvested funds in cash, cash equivalents

or other liquid instruments, with a view to maximising the returns

on any such funds.

Going Concern and Outlook

As a result of the Company's operations being cash flow negative

since its inception, the Company has been required to dispose of

investment portfolio assets to generate the cash needed to finance

its operational costs.

The CVA has removed from the Company's balance sheet creditors

which as of 31 December 2021 amount to approximately GBP193,000.

The company is expected to place shares on the London Stock

Exchange and anticipate raising GBP3,000,000 of which GBP550,000

has been committed by the Board. On the strength of this the Board

has adopted a going concern accounting basis for these financial

statements.

Principal Risks and Uncertainties and Risk Mitigation

The sole objective of the retiring management team has been to

realise the value of the Company's remaining investments and to

minimise its administration expenses, with a view to restoring

liquidity to the Company and enabling it to re-set and re-launch

itself as an active Investment Trust.

A conventional report on risks and uncertainties and their

mitigation; on performance; and on Social, Community, Employee

Responsibilities and Environmental Policy is, therefore,

inappropriate to the Company's current position.

The suspension on the trade of the Company's shares have been

lifted, and with the financing arrangements in place, in addition

to the expected fund raise, the Company is optimistic on its

future.

Viability Statement

Normally the Board would have considered a longer-term viability

in excess of the going concern period. However, this is not

currently considered relevant given the liquidity position, as

disclosed in the Going Concern and Outlook section above, whereby

further funds will be required to finance future trading

opportunities.

Section 172 Statement

The Directors believe they have acted in the way most likely to

promote the success of the Company for the benefit of its members

as a whole, as required by s172 of the Companies Act 2006.

The requirements of s172 are for the Directors to:

-- consider the likely consequences of any decision in the long term;

-- act fairly between the members of the Company;

-- maintain a reputation for high standards of business conduct;

-- consider the interests of the Company's employees;

-- foster the Company's relationships with suppliers, customers and others; and

-- consider the impact of the Company's operations on the community and the environment.

The Company's operations and strategic aims are set out

throughout the Strategic Review and in the Chairman's Statement,

and relationships with shareholders are also dealt with in the

Statement of Corporate Governance.

By Order of the Board

Peterhouse Capital Limited

Secretary

30 June 2022

BOARD OF DIRECTORS' GOVERNANCE REPORT

The Board fulfils the functions of the Nomination Committee and

of the Audit Committee. The Board maintains overall control over

the formulation of Company's investment policy and has overall

responsibility for the Company's activities.

The Directors who held office during the year and up to the date

of signing the financial statements were as follows:

Martin Lampshire

James Normand (resigned 22 October 2021)

Stephen Roberts (resigned 2 August 2021)

Richard Arthur Lockwood (appointed on 22 October 2021)

Malcolm Alec Burne (appointed on 22 October 2021)

Martin Lampshire

Director

Martin started his career in Lloyds Bank's Commercial Services

division in 1989 after completing the ACIB qualification. He has

over twenty years' experience in Corporate Broking, working for a

number of city based firms including Teather & Greenwood,

Charles Stanley, Hichens Harrison Stockbrokers and Daniel Stewart

Stockbrokers. He has assisted many companies in a variety of equity

raises including IPO's, secondary fundraisings, vendor and private

placings across a variety of sectors. He has also worked in a

number of overseas financial centres including Hong Kong,

Singapore, Kuala Lumpur and Dubai

Remuneration: GBP40,000 per annum

Shared Directorships with any other Trust Directors: None.

Shareholding in Company: None.

Richard Arthur Lockwood

Non-Executive Chairman

Richard has forged a successful career in fund management and

mining investment and was the founder of New City Investment

Management, of which he ran the specialist Geiger Counter Limited

Uranium Fund. Mr Lockwood was formerly a Director of AIM-listed

Kalahari Minerals which was acquired by CGNPC Uranium Resources Co.

Ltd. Formerly a mining investment partner for Hoare Govett and

McIntosh Securities he was involved in the development and

financing of several gold and base metals projects in Europe,

Australia and Africa. Mr Lockwood's intimate knowledge and

experience in the mining and uranium industries is an asset to the

Company during its current growth phase.

Remuneration: GBPnil

Shared Directorships with any other Trust Directors: None

Shareholding in Company: 223,611 shares equal to 4.44% of the

issued share capital as at 28 June 2022.

Malcolm Alec Burne

Executive Director

Malcolm is a former stockbroker and financial journalist with

The Financial Times. He has controlled and managed fund management,

venture capital and investment banking companies in London,

Australia, Hong Kong and North America. He has been a director of

more than 20 companies, many of which have been in the mineral

resource and gold exploration fields. In 1997, he founded Golden

Prospect plc and was executive chairman until 2007 when the company

changed its name to Ambrian Capital plc. In addition, he was

executive chairman of the Australian Bullion Company (Pty) Limited,

which at the time was Australia's leading gold dealer and member of

the Sydney Futures Exchange.

Remuneration: GBPnil

Shared Directorships with any other Trust Directors: None

Shareholding in Company: 223,611 shares equal to 4.44% of the

issued share capital as at 28 June 2022.

REPORT OF THE DIRECTORS

The Directors present their Annual Report and the audited

financial statements for the year ended 31 December 2021.

Results

The Company had gains on the sale of investments of GBP488,000

(2020: nil) in the period under review; and incurred costs of

GBP391,000 (2020 - GBP466,000).

Principal Activity and Status

The Company is registered as a public limited company in terms

of the Companies Act 2006 (number: 8256031). It is an investment

company as defined by Section 833 of the Companies Act 2006. It

carries on the business of an investment trust and has been

approved as such by HM Revenue & Customs. The Company's shares

are eligible for inclusion in a New Individual Savings Account

('NISA').

Capital Structure

As at 31 December 2021 there were 50,357,414 ordinary shares of

one penny each in issue. The ordinary shares give shareholders the

entitlement to all of the capital growth in the Company's net

assets and to all the Company's income that is resolved to be

distributed.

Substantial Interests in Share Capital

At 28 June 2022, the only persons known to the Company who,

directly or indirectly, were interested in 3 per cent or more of

the Company's issued share capital were as follows:

Ordinary shares Number held % held

Philip J Milton 1,273,814 25.28

Richard Lockwood 223,611 4.44

Malcolm Burne 233,611 4.44

Armstrong Investments Ltd 300,000 5.96

Some of the shareholdings listed above refer to funds managed on

behalf of clients of the groups named.

Financial Statements

The Directors' responsibilities regarding the financial

statements and safeguarding of assets are set out on page 10.

Annual General Meeting

A notice of the Annual General Meeting will be posted to

shareholders in due course.

Directors' Remuneration Policy and Report

Among the resolutions to be put to the Annual General Meeting as

ordinary business will be one approving the Directors' Remuneration

Policy. This vote is binding. It is also mandatory for listed

companies to put their Directors' Remuneration Report to an

advisory shareholder vote.

Induction and Training

New Directors appointed to the Board are required to have an

understanding of the Company pre-dating their appointment, which is

deepened and expanded through individual discussion and contact

with the other Directors and, in particular, participation at Board

meetings. Relevant training is available to Directors as

required.

Statement Regarding Annual Report and Accounts

Following a detailed review of the Annual Report and Accounts by

the Board (acting as the Audit Committee), the Directors consider

that, taken as a whole, it is fair, balanced and understandable and

provides the information necessary for shareholders to assess the

Company's performance, business model and strategy. In reaching

this conclusion, the Directors have assumed that the reader of the

Annual Report and Accounts has a reasonable level of knowledge of

the investment industry in general and investment trusts in

particular.

Energy and Carbon Usage

The Company has not disclosed information in respect of

greenhouse has emissions, energy consumption and energy efficiency

action as its energy consumption in the United Kingdom for the year

is lower than 40,000kWh.

Disclosure of Information to the Auditor

The Directors confirm that, so far as each of the Directors is

aware, there is no relevant information of which the Company's

auditors are unaware and the Directors have taken all the steps

that they ought to have taken as Directors to make themselves aware

of any relevant audit information and to establish that the

Company's auditors are aware of that information.

Independent Auditor

PKF Littlejohn LLP has indicated its willingness to continue in

office. The Directors will place a Resolution before the Annual

General Meeting for the reappointment of PKF Littlejohn LLP as

independent auditor of the Company for the ensuing year and to

authorise the Directors to determine its remuneration.

By Order of the Board

Peterhouse Capital Limited

Secretary

30 June 2022

STATEMENT OF DIRECTORS' RESPONSIBILITIES

The Directors are responsible for preparing the Annual Report

and the Company financial statements in accordance with applicable

law and regulations.

Company law requires the Directors to prepare Company financial

statements for each financial year. Under that law they are

required to prepare the financial statements in accordance with UK

adopted international accounting standards and applicable law and

have elected to prepare the financial statements on the same

basis.

Under company law the Directors must not approve the financial

statements unless they are satisfied that they give a true and fair

view of the state of affairs of the Company and of its profit or

loss for that period. In preparing the Company financial

statements, the Directors are required to:

-- select suitable accounting policies and then apply them consistently;

-- make judgements and estimates that are reasonable, relevant and reliable;

-- state whether they have been prepared in accordance with UK

adopted international accounting standards

-- assess the Company's ability to continue as a going concern,

disclosing, as applicable, matters related to going concern;

and

-- use the going concern basis of accounting unless they either

intend to liquidate the Company or to cease operations or have no

realistic alternative but to do so.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Company's

transactions and disclose with reasonable accuracy at any time the

financial position of the Company and enable them to ensure that

its financial statements comply with the Companies Act 2006. They

are responsible for such internal control as they determine is

necessary to enable the preparation of financial statements that

are free from material misstatement, whether due to fraud or error,

and have general responsibility for taking such steps as are

reasonably open to them to safeguard the assets of the Company and

to prevent and detect fraud and other irregularities.

Under applicable law and regulations, the Directors are also

responsible for preparing a Strategic Report, Directors' Report,

Directors' Remuneration Report and Corporate Governance Statement

that complies with that law and those regulations.

The Directors are responsible for the maintenance and integrity

of the corporate and financial information included on the

Company's website. Legislation in the UK governing the preparation

and dissemination of financial statements may differ from

legislation in other jurisdictions.

Responsibility Statement of the Directors in respect of the

Annual Financial Report

We confirm that to the best of our knowledge:

-- the financial statements, prepared in accordance with the

applicable set of accounting standards, give a true and fair view

of the assets, liabilities, financial position and profit or loss

of the Company; and

-- the strategic report includes a fair review of the

development and performance of the business and the position of the

Company, together with a description of the principal risks and

uncertainties that they face.

We consider the annual report and accounts, taken as a whole, is

fair, balanced and understandable; and provides the information

necessary for shareholders to assess the Company's position and

performance, business model and strategy.

On behalf of the Board

Richard Lockwood

Chairman

30 June 2022

STATEMENT OF CORPORATE GOVERNANCE

Introduction

The UK Listing Authority requires all listed companies to

describe how they have complied with the principles of the UK

Corporate Governance Code 2018 (the 'UK Governance Code'). which is

available on the Financial Reporting Council's website:

www.frc.org.uk. The UK Governance Code covers in particular the

annual re-appointment of Directors, Board diversity, external

evaluation, the Board's responsibilities in relation to risk, and a

clear explanation of business model and strategy.

The Association of Investment Companies also published a Code of

Corporate Governance, which is available on the AIC's website:

www.theaic.co.uk. The AIC Code addresses all of the principles set

out in Section 1 of the UK Governance Code as well as setting out

additional principles and recommendations on issues that are of

specific relevance to investment companies. The Company has adopted

the 2019 AIC Code.

Application of the Principles of the Codes

The Company has complied with the provisions of the AIC Code and

the UK Governance Code, except for the UK Governance Code

provisions relating to:

-- the role of the chief executive;

-- independence of directors; and

-- the need for an internal audit function.

As indicated by the AIC Code, the above exceptions are not

believed to be applicable to a self-managed investment company. The

Company will seem to make appropriate independent appointments once

the restructuring of the Company is complete.

The Board

The Board consists of three Directors. The Directors are not

currently considered to be independent; Mr Lockwood is Chairman and

is responsible for leadership of the Board and ensuring its

effectiveness on all aspects of its role.

There are no relationships or circumstances which the Board

considers likely to affect the judgement of the Directors.

The Board takes the view that independence is not compromised by

length of tenure and that experience and continuity can add

significantly to the Board's strength.

Since taking office the current Board has operated as a

three-man team; and virtually all actions taken and decisions made

have followed consultation between all the members of the

Board.

There is an agreed procedure for Directors to take independent

professional advice if necessary and at the Company's expense.

Nomination Committee

Malcolm Burne and Richard Lockwood joined the Board on 22

October 2021. At that time the Nominations Committee consisted of

James Normand and Martin Lampshire who, having reviewed the

respective experience and background of the two proposed directors,

considered them both valuable additions to the GRIT Board.

Relations with Shareholders

The Directors place a great deal of importance on communication

with shareholders. The Annual Report and Accounts are widely

distributed to other parties who have an interest in the Company's

performance. Shareholders and investors may obtain up-to-date

information on the Company through the Company's website. The

Company responds to letters from shareholders on a wide range of

issues.

A regular dialogue is maintained with the Company's principal

shareholders. Reference to significant holdings in the Company's

ordinary shares can be found under 'Substantial Interests' on page

8.

All shareholders have the opportunity to put questions to the

Board at the Company's Annual General Meeting. The Company

Secretary is available to answer general shareholder queries at any

time throughout the year.

By Order of the Board

Peterhouse Capital Limited

Secretary

30 June 2022

REPORT OF THE AUDIT COMMITTEE

Composition of the Audit Committee

Because, during the period under review, the activity of the

Company has been confined to attempting the sale of its remaining

investments, there has been no cause to form or convene an Audit

Committee.

Review of Auditor

As part of its review of the scope and results of the audit,

during the year the Board considered and approved PKF Littlejohn

LLP's plan for the audit of the financial statements for the year

to 31 December 2021. PKF Littlejohn LLP issued an unqualified audit

report which is included on pages 17 to 21.

No non-audit services have been provided by PKF Littlejohn LLP

in the year.

As part of the review of auditor independence and effectiveness,

PKF Littlejohn LLP has confirmed that it is independent of the

Company and has complied with relevant auditing standards. In

appointing PKF Littlejohn LLP, the Board (in the absence of an

Audit Committee) took into consideration the standing, skills and

experience of the firm and the audit team; and remains satisfied

that PKF Littlejohn LLP continues to provide effective independent

challenge in carrying out its responsibilities.

Audit Tenure

Following professional guidelines, the audit Responsible

Individual rotates after five years. The current Responsible

Individual is in the third year of his appointment. PKF Littlejohn

LLP was appointed auditor in 2020 for the 2019 financial statements

and the Board recommends its continuing appointment. PKF Littlejohn

LLP's performance will continue to be reviewed annually, taking

into account all relevant guidance and best practice.

Internal Controls

The Board is ultimately responsible for the Company's system of

internal control and for reviewing its effectiveness. Following

publication of the Financial Reporting Council's 'Internal Control:

Revised Guidance for Directors on the Combined Code' (the 'FRC

guidance') the Board confirms that there is an ongoing process for

identifying, evaluating and managing the significant risks faced by

the Company. This process has been in place for the year under

review and up to the date of approval of this Annual Report and is

regularly reviewed by the Board and accords with the FRC

Guidance.

The Board has reviewed the effectiveness of the system of

internal control. In particular, it has overseen the process for

identifying and evaluating the significant risks affecting the

Company and policies by which these risks are managed. The

significant risks faced by the Company are as follows:

-- investment and strategy; market;

-- liquidity; sector; earnings;

-- financial sustainability; operational; and regulatory.

The key components designed to provide effective internal

control are outlined below:

-- Peterhouse Capital Limited ('Peterhouse') as Company

Secretary and Administrator prepares forecasts and management

accounts which allow the Board to assess the Company's activities

and review its performance;

-- the Board has agreed clearly defined investment criteria,

specified levels of authority and exposure limits. Reports on these

issues, including performance statistics and investment valuations

are reviewed regularly by the Board;

-- written agreements are in place which specifically define the

roles and responsibilities Board and, where applicable, other

third-party service providers;

-- the Board has considered the need for an internal audit

function but, given the limited nature of the activities during the

year, this was concluded as not currently required. This will

continue to be reviewed in the future.

Internal control systems are designed to meet the Company's

particular needs and the risks to which it is exposed. Accordingly,

the internal control systems are designed to manage rather than

eliminate the risk of failure to achieve business objectives and by

their nature can only provide reasonable and not absolute assurance

against mis-statement and loss.

The principal risks and uncertainties affecting the Company are

disclosed on page 6.

Richard Lockwood

Chairman of the Board of Directors

30 June 2022

DIRECTORS' REMUNERATION REPORT

Remuneration Committee

For the same reasons that there is not currently an Audit

Committee, neither is there a Remuneration Committee.

The Board has prepared this report in accordance with the

requirements of Section 421 of the Companies Act 2006. An ordinary

resolution for the approval of this Report will be put to the

members at the forthcoming Annual General Meeting. This Report has

been divided into separate sections for unaudited and audited

information.

Policy on Directors' Remuneration

The Board's policy is that the remuneration of Directors should

reflect the experience of the Board as a whole and be comparable to

that of other relevant investment trusts that are similar in size.

However, given the restructuring currently in process, the

Directors have agreed to take no remuneration until that process is

complete and the Company has implemented its investment policy.

New Directors are provided with a letter of appointment. Every

Director will offer himself for re-election annually. The

requirements for the retirement of Directors are also contained in

the Company's Articles of Association. There is no notice period

and no provision for compensation upon early termination of

appointment.

Annual Report on Directors' Remuneration

Directors' Emoluments (audited)

The Directors who served in the twelve months to 31 December

2021 (and, for comparative purposes those who served in the twelve

months ended 31 December 2020) were awarded the following fees and

have similar investment objectives and structures. Furthermore, the

level of remuneration should be sufficient to attract and retain

the Directors needed to oversee properly the Company and to reflect

the specific circumstances of the Company, the duties and

responsibilities of the Directors and the value and amount of time

committed to the Company's affairs. The fees for the Directors are

determined within the limits set out in the Company's Articles of

Association. The present limit is GBP200,000 per annum in aggregate

and the approval of shareholders in a general meeting would be

required to change this limit. At the prevailing level of

Directors' fees, the aggregate amount payable to the Company's

Directors during the year to 31 December 2021 was GBP59,950 (2020:

GBP181,125). Non-executive Directors are not eligible for bonuses,

pension benefits, share options, long-term incentive schemes or

other benefits.

The Company has not been able to obtain Directors' and Officers'

liability insurance.

The terms of Directors' appointments provide that Directors are

obliged to retire by rotation, and to offer themselves for re-

election by shareholders at least every three years after that.

2021 2020

Additional Additional

Standard contracted Standard contracted

Name fee services Total fee services Total

James Normand 19,950 - 19,950 35,000 27,000 62,000

Martin Lampshire 30,000 - 30,000 40,000 33,000 73,000

Stephen Roberts 10,000 - 10,000 30,000 16,125 46,125

Richard Arthur - - - - - -

Lockwood

Malcolm Alec Burne - - - - - -

Unpaid Fees

As at 31 December 2021 a significant proportion of these fees

remained unpaid, as follows:

James Normand GBP19,950

Martin Lampshire GBP30,000

Stephen Roberts GBP10,000

Directors' Interests

Biographies of the Directors are shown on page 7.

Save as disclosed, Directors who held office in the year,

Richard Lockwood and Malcolm Burne, hold ordinary shares in the

Company as at 31 December 2021. No Directors held convertible loan

stock in the Company as at 31 December 2021.

Save as disclosed, there has been no change in the ordinary

share holdings of the Directors from 31 December 2021 up to the

signing date.

Voting at Annual General Meeting

An ordinary resolution for the approval of this Directors'

Remuneration Report will be put to an advisory shareholder vote at

the forthcoming Annual General Meeting.

Approval

The Directors' Remuneration Report on pages 15 and 16 was

approved by the Board of Directors and signed on its behalf on 30

June 2022.

Richard Lockwood

Chairman of the Board of Directors

INDEPENT AUDITOR'S REPORT

INDEPENT AUDITOR'S REPORT TO THE MEMBERS OF GRIT INVESTMENT

TRUST PLC

Opinion

We have audited the financial statements of GRIT Investment

Trust Plc (the 'company') for the year ended 31 December 2021 which

comprise the Income Statement, the Statement of Changes in Equity,

the Balance Sheet, the Cash Flow Statement and notes to the

financial statements, including significant accounting policies.

The financial reporting framework that has been applied in their

preparation is applicable law and UK-adopted international

accounting standards.

In our opinion, the financial statements:

-- give a true and fair view of the state of the company's

affairs as at 31 December 2021 and of its profit for the year then

ended;

-- have been properly prepared in accordance with UK-adopted

international accounting standards; and

-- have been prepared in accordance with the requirements of the Companies Act 2006.

Basis for opinion

We conducted our audit in accordance with International

Standards on Auditing (UK) (ISAs (UK)) and applicable law. Our

responsibilities under those standards are further described in the

Auditor's responsibilities for the audit of the financial

statements section of our report. We are independent of the company

in accordance with the ethical requirements that are relevant to

our audit of the financial statements in the UK, including the

FRC's Ethical Standard as applied to listed public interest

entities, and we have fulfilled our other ethical responsibilities

in accordance with these requirements. We believe that the audit

evidence we have obtained is sufficient and appropriate to provide

a basis for our opinion.

Material uncertainty related to going concern

We draw attention to note 1 in the financial statements, which

indicates that company is reliant on future funding in order to

continue as a going concern. As stated in note 1, these events or

conditions, along with the other matters as set forth in note 1,

indicate that a material uncertainty exists that may cast

significant doubt on the company's ability to continue as a going

concern. Our opinion is not modified in respect of this matter.

In auditing the financial statements, we have concluded that the

director's use of the going concern basis of accounting in the

preparation of the financial statements is appropriate. Our

evaluation of the directors' assessment of the company's ability to

continue to adopt the going concern basis of accounting included

obtaining and reviewing the management's going concern assessment

and associated cashflow forecast for the period off 12 months from

the date of the approval of the financial statements. We assessed

assumptions used and held discussions with management regarding

future plans, committed costs and the availability of funding.

In relation to the company's reporting on how it has applied the

UK Corporate Governance Code, we have nothing material to add or

draw attention to in relation to:

-- the directors' statement in the financial statements about

whether the directors considered it appropriate to adopt the going

concern basis of accounting; and

-- the directors' identification in the financial statements of

the material uncertainty related to the entity's ability to

continue as a going concern over a period of at least twelve months

from the date of approval of the financial statements.

Our responsibilities and the responsibilities of the directors

with respect to going concern are described in the relevant

sections of this report.

Our application of materiality

Materiality for the financial statements was set at GBP5,100

(2020: GBP6,800) determined with reference to a benchmark of 1.5%

of expenses. Expenses are deemed the primary driver for the Company

in the current year as it seeks to recapitalise, seek additional

investment opportunities and reduce the cost base commensurate with

current levels of activity. All investments and investee

receivables held by the company are fully impaired. There were no

revisions to the materiality as the audit progressed.

Performance materiality was GBP3,570 (2020: GBP4,760) being 70%

of materiality. This reflects the low risk nature of the audit with

minimal transactions in the year.

We agreed to report to the Board any corrected or uncorrected

identified misstatements exceeding GBP255 (2020: GBP340), in

addition to other identified misstatements that warranted reporting

on qualitative grounds.

Our approach to the audit

As part of designing our audit, we determined materiality and

assessed the risk of material misstatement in the Financial

Statements. In particular, we looked at areas involving significant

accounting estimates and judgement by the directors and considered

future events that are inherently uncertain, such as the valuation

of investments. We also addressed the risk of management override

of internal controls, including among other matters consideration

of whether there was evidence of bias that represented a risk of

material misstatement due to fraud.

Key audit matters

Except for the matter described in the Material uncertainty

related to going concern section, we have determined that there are

no other key audit matters to communicate in our report.

Other information

The other information comprises the information included in the

annual report, other than the financial statements and our

auditor's report thereon. The directors are responsible for the

other information contained within the annual report. Our opinion

on the financial statements does not cover the other information

and, except to the extent otherwise explicitly stated in our

report, we do not express any form of assurance conclusion thereon.

Our responsibility is to read the other information and, in doing

so, consider whether the other information is materially

inconsistent with the financial statements or our knowledge

obtained in the course of the audit, or otherwise appears to be

materially misstated. If we identify such material inconsistencies

or apparent material misstatements, we are required to determine

whether this gives rise to a material misstatement in the financial

statements themselves. If, based on the work we have performed, we

conclude that there is a material misstatement of this other

information, we are required to report that fact.

We have nothing to report in this regard.

Opinions on other matters prescribed by the Companies Act

2006

In our opinion the part of the directors' remuneration report to

be audited has been properly prepared in accordance with the

Companies Act 2006.

In our opinion, based on the work undertaken in the course of

the audit:

-- the information given in the strategic report and the

directors' report for the financial year for which the financial

statements are prepared is consistent with the financial

statements; and

-- the strategic report and the directors' report have been

prepared in accordance with applicable legal requirements.

Matters on which we are required to report by exception

In the light of the knowledge and understanding of the company

and its environment obtained in the course of the audit, we have

not identified material misstatements in the strategic report or

the directors' report.

We have nothing to report in respect of the following matters in

relation to which the Companies Act 2006 requires us to report to

you if, in our opinion:

-- adequate accounting records have not been kept, or returns

adequate for our audit have not been received from branches not

visited by us; or

-- the financial statements and the part of the directors'

remuneration report to be audited are not in agreement with the

accounting records and returns; or

-- certain disclosures of directors' remuneration specified by law are not made; or

-- we have not received all the information and explanations we require for our audit.

Corporate governance statement

We have reviewed the directors' statement in relation to going

concern, longer-term viability and that part of the Corporate

Governance Statement relating to the company's compliance with the

provisions of the UK Corporate Governance Code specified for our

review by the Listing Rules.

Based on the work undertaken as part of our audit, we have

concluded that each of the following elements of the Corporate

Governance Statement is materially consistent with the financial

statements or our knowledge obtained during the audit:

-- Directors' statement with regards the appropriateness of

adopting the going concern basis of accounting and any material

uncertainties identified set out on page 6;

-- Directors' explanation as to their assessment of the

company's prospects, the period this assessment covers and why the

period is appropriate set out on page 6;

-- Directors' statement on whether they have a reasonable

expectation that the company will be able to continue in operation

and meets its liabilities set out on page 6;

-- Directors' statement that they consider the annual report and

the financial statements, taken as a whole, to be fair, balanced

and understandable set out on page 10;

-- Board's confirmation that it has carried out a robust

assessment of the emerging and principal risks set out on page

6;

-- The section of the annual report that describes the review of

effectiveness of risk management and internal control systems set

out on pages 13-14; and

-- The section describing the work of the audit committee set out on pages 13.

Responsibilities of directors

As explained more fully in the directors' responsibilities

statement, the directors are responsible for the preparation of the

financial statements and for being satisfied that they give a true

and fair view, and for such internal control as the directors

determine is necessary to enable the preparation of financial

statements that are free from material misstatement, whether due to

fraud or error.

In preparing the financial statements, the directors are

responsible for assessing the company's ability to continue as a

going concern, disclosing, as applicable, matters related to going

concern and using the going concern basis of accounting unless the

directors either intend to liquidate the company or to cease

operations, or have no realistic alternative but to do so.

Auditor's responsibilities for the audit of the financial

statements

Our objectives are to obtain reasonable assurance about whether

the financial statements as a whole are free from material

misstatement, whether due to fraud or error, and to issue an

auditor's report that includes our opinion. Reasonable assurance is

a high level of assurance but is not a guarantee that an audit

conducted in accordance with ISAs (UK) will always detect a

material misstatement when it exists. Misstatements can arise from

fraud or error and are considered material if, individually or in

the aggregate, they could reasonably be expected to influence the

economic decisions of users taken on the basis of these financial

statements.

Irregularities, including fraud, are instances of non-compliance

with laws and regulations. We design procedures in line with our

responsibilities, outlined above, to detect material misstatements

in respect of irregularities, including fraud. The extent to which

our procedures are capable of detecting irregularities, including

fraud is detailed below:

-- We obtained an understanding of the company and the industry

in which it operates to identify laws and regulations that could

reasonably be expected to have a direct effect on the financial

statements. We obtained our understanding in this regard through

discussions with management and including consideration of known or

suspected instances of non-compliance with laws and regulations and

fraud.

-- We determined the principal laws and regulations relevant to

the company in this regard to be those arising from FCA Listing

Rules, Companies Act 2006, UK Corporate Governance Code,

Association of Investment Companies Code of Corporate Governance

and UK-adopted international accounting standards.

-- We designed our audit procedures to ensure the audit team

considered whether there were any indications of non-compliance by

the company with those laws and regulations. These procedures

included, but were not limited to: enquiries of management; review

of minutes of meetings; review of Regulatory News Service

announcements and other applicable correspondence.

-- We have discussed among the engagement team regarding how and

where fraud might occur and any potential indicators of fraud. In

particular. we challenged the assumptions made by management in

their assessment of going concern (see key audit matter).

-- We addressed the risk of fraud arising from management

override of controls by performing audit procedures which included,

but were not limited to: the testing of journals; reviewing

accounting estimates for evidence of bias; and evaluating the

business rationale of any significant transactions that are unusual

or outside the normal course of business.

Because of the inherent limitations of an audit, there is a risk

that we will not detect all irregularities, including those leading

to a material misstatement in the financial statements or

non-compliance with regulation. This risk increases the more that

compliance with a law or regulation is removed from the events and

transactions reflected in the financial statements, as we will be

less likely to become aware of instances of non-compliance. The

risk is also greater regarding irregularities occurring due to

fraud rather than error, as fraud involves intentional concealment,

forgery, collusion, omission or misrepresentation.

A further description of our responsibilities for the audit of

the financial statements is located on the Financial Reporting

Council's website at: www.frc.org.uk/auditorsresponsibilities. This

description forms part of our auditor's report.

Other matters which we are required to address

We were appointed by the Directors on 3 April 2020 to audit the

financial statements for the year ended 31 December 2019 and

subsequent financial periods. Our total uninterrupted period of

engagement is three years, covering the periods ended 31 December

2019 to 31 December 2021.

The non-audit services prohibited by the FRC's Ethical Standard

were not provided to the company and we remain independent of the

company in conducting our audit.

Our audit opinion is consistent with the additional report to

the Board.

Use of our report

This report is made solely to the company's members, as a body,

in accordance with Chapter 3 of Part 16 of the Companies Act 2006.

Our audit work has been undertaken so that we might state to the

company's members those matters we are required to state to them in

an auditor's report and for no other purpose. To the fullest extent

permitted by law, we do not accept or assume responsibility to

anyone, other than the company and the company's members as a body,

for our audit work, for this report, or for the opinions we have

formed.

David Thompson (Senior Statutory Auditor) 15 Westferry

Circus

For and on behalf of PKF Littlejohn LLP Canary Wharf

Statutory Auditor London E14 4HD

30 June 2022

GRIT INVESTMENT TRUST PLC INCOME STATEMENT

YEARED 31 DECEMBER 2021

Year ended Year ended

31 December 2021 31 December 2020

Revenue Capital Total Revenue Capital Total

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Gains/(losses) on investments 5 - 488 488 - (28) (28)

Other expenses 2 (391) - (391) (466) - (466)

______ ______ ______ _____ ______ ______

Net Gain/(Loss) before Finance

Costs and Taxation (391) 488 97 (466) (28) (494)

Interest payable and similar - - - - - -

charges

______ ______ ______ _____ ______ ______

Net Gain/(Loss) on Ordinary

Activities before Taxation (391) 488 97 (466) (28) (494)

Taxation on ordinary activities 3 - - - - - -

______ ______ ______ _____ ______ ______

Net Gain/(Loss) Attributable

to Equity Shareholders (391) 488 97 (466) (28) (494)

______ ______ ______ _____ ______ ______

Gain/(Loss) per Ordinary

Share 4 (0.86p) 1.08p 0.22p (1.11p) (0.07p) (1.18p)

______ ______ ______ _____ ______ ______

The total column of this statement represents the Company's

profit or loss account, prepared in accordance with IFRS.

All revenue and capital items in this statement derive from

continuing operations.

All of the gains and losses for the year are attributable to the

owners of the Company.

No operations were acquired or discontinued in the year.

A Statement of Other Comprehensive Income is not required as all

gains and losses of the Company have been reflected in the above

Income Statement.

The accompanying notes are an integral part of the financial

statements.

GRIT INVESTMENT TRUST PLC STATEMENT OF CHANGES IN EQUITY

YEARED 31 DECEMBER 2021

Share Revenue

Share premium Capital reserve Other

For the year ended 31 December capital account reserve deficit reserve Total

2021 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 31 December 2020 420 36,880 (33,185) (5,015) - (900)

Profit/(Loss) on ordinary

activities after taxation - - 488 (391) - 97

___ ______ ______ _____ _____ ___

Total comprehensive income

for the year 420 36,880 (32,697) (5,406) - (803)

Shares issued during the

year 84 42 - - - 126

Equity component of CLN - - - - 68 68

___ ______ ______ _____ _____ ___

Balance at 31 December

2021 504 36,922 (32,697) (5,406) 68 (609)

___ ______ ______ _____ _____ ___

For the year ended 31 December

2020

Balance at 31 December 2019 420 36,880 (33,157) (4,549) - (406)

Loss on ordinary activities

after taxation - - (28) (466) - (494)

___ ______ ______ _____ _____ _____

Balance at 31 December

2020 420 36,880 (33,185) (5,015) - (900)

___ ______ ______ _____ _____ _____

The revenue reserve represents the amount of the Company's

reserves distributable by way of dividend.

The accompanying notes are an integral part of the financial

statements.

GRIT INVESTMENT TRUST PLC BALANCE SHEET

AT 31 DECEMBER 2021

2021 2020

Notes GBP'000 GBP'000

Current Assets

Investments 5 - -

Cash at bank 488 -

___ ___

488 -

Creditors : amounts falling due within

one year

Trade and other payables 6 (437) (900)

Convertible Unsecured Loans 7 (660) -

___ ___

Net Liabilities (609) (900)

___ ___

Capital and Reserves

Called up share capital 8 504 420

Share premium 36,922 36,880

Capital reserve (32,697) (33,185)

Revenue reserve (5,406) (5,015)

Other reserve 7 68 -

______ ______

Equity Shareholders' Funds Deficit (609) (900)

______ ______

Net Deficit per Share 9 (1.21p) (2.14p)

______ ______

The financial statements were approved by the Board of Directors

and authorised for issue on 30 June 2022 and were signed on its

behalf by:

Richard Lockwood

Chairman

The accompanying notes are an integral part of the financial

statements.

GRIT INVESTMENT TRUST PLC CASH FLOW STATEMENT

YEARED 31 DECEMBER 2021

Year ended Year ended

31 December 31 December

2021 2020

Notes GBP'000 GBP'000

Operating Activities

Profit/(Loss) before taxation 97 (494)

(Profit)/Loss on investments 5 (488) 28

Other interest expense 7 29 -

Decrease in receivables - 13

(Decrease)/Increase in payables (463) 452

_____ _____

Net Cash Outflow from Operating Activities

Before

and After Taxation (825) (2)

_____ _____

Investing Activities

Sales of investments 488 -

____ ____

Net Cash Inflow from Investing Activities 488 -

____ ____

Financing Activities

Issue of Shares 126 -

Convertible Unsecured Loans 699 -

____ ____

Net Cash Inflow from Financing Activities 825 -

____ ____

Increase in Cash in the Year 488 (2)

Net cash at the start of the year - 2

____ ____

Net Cash at the End of the Year 488 -

____ ____

The accompanying notes are an integral part of the financial

statements.

NOTES TO THE FINANCIAL STATEMENTS

YEARED 31 DECEMBER 2021

1. Accounting Policies

The Company is a public company limited by shares which is

incorporated in England. The registered office of the Company is 80

Cheapside, London EC2V 6EE.

The principal activity of the Company is to undertake the

business of an investment trust.

(a) Basis of accounting

The financial statements of the Company have been prepared in

accordance with UK-adopted international accounting standards.

The financial statements have also been prepared in accordance

with the Statement of Recommended Practice (SORP) "Financial

Statements of Investment Trust Companies and Venture Capital

Trusts" issued in November 2014 and updated in February 2018 with

consequential amendments, to the extent that it is consistent with

IFRS.

The functional and reporting currency of the Company is pounds

sterling because that is the primary economic environment in which

the Company operates. The notes and financial statements are

presented in pounds sterling and are rounded to the nearest

thousand except where otherwise indicated.

In order to better reflect the activities of an investment trust

company and in accordance with guidance issued by the AIC,

supplementary information which analyses the Income Statement

between items of a revenue and capital nature has been presented

alongside the Income Statement. Additionally, the net revenue of

the Company is the measure the Directors believe appropriate in

assessing its compliance with certain requirements set out in

Sections 1158 - 1159 of the Corporation Tax Act 2010.

Changes in accounting policy and disclosures

New standards or amendments and interpretations to existing

standards that are not yet effective. The following are newly

issued but not yet effective standards, interpretations and

amendments, Mandatory for accounting periods commencing on or after

1 April 2021

o IFRS 16 (amendment) Covid 19 Related Rent Concessions beyond

30 June 2021.

The following are newly issued but not yet effective standards,

interpretations and amendments, Mandatory for accounting periods

commencing on or after 1 January 2022:

o Annual Improvements to IFRS Standards 2018-2020 Cycle. Minor

amendments to IFRS , IRFS 9 and IAS 41

o IAS 16 (amendments) Property, Plant and Equipment : Proceeds

before Intended Use

o IAS 37 (amendment) Onerous Contracts : Costs of Fulfilling a

Contract

o IFRS 3 (amendments) Reference to Conceptual Framework

o IAS 1 (amendment) Classification of Liabilities as Current or

Non Current

o IAS 1 and IFRS Practice Statement 2 (amendments) Disclosure of

Accounting Policies

o IAS 8 (amendments) Definition of Accounting Estimates

o IAS 12 (amendments) Deferred Tax related to Assets and

Liabilities arising from a Single Transaction

o IFRS 17 Insurance Contracts

There are no new Accounting Standards which came into effect on

1 January 2022 which are relevant to the Company's financial

statements. There are no new standards and interpretations issued

but not effective and not early adopted that are expected to have a

material impact on the Company.

(a) Basis of accounting (continued)

Going Concern

For the reasons outlined in the Strategic Review, particularly

with regard to the CVA arrangement and expected placing of shares

on the London Stock Exchange, the Board has concluded that it is

appropriate to prepare the financial statements on a going concern

basis which presumes that the Company will be able to meet its

obligations as they fall due for at the least the next twelve

months from the date of the signing the financial statements.

In assessing whether the going concern assumption is

appropriate, the Directors have taken into account all relevant

available information about the current and future position of the

Company, including the current level of resources, access to

finance, investor commitments and the level of contracted and

committed expenditure over the going concern period. The Company

recorded a profit for the year and, as at 31 December 2021, had net

current liabilities of GBP609,000.

The Company meets its working capital requirements from its cash

and cash equivalents. To date, the Company has raised finance

through equity placings, receipt of convertible loans and the sale

of investments. Further funding will be required either through

equity raisings or other financial arrangements to fund future

activities.

Having prepared forecasts based on current resources, the

Directors believe the Company will be able to raise sufficient

finance to meet its obligations for a period of at least 12 months

from the date of approval of these financial statements. The

financial statements do not include the adjustments that would be

required should the going concern basis of preparation no longer be

appropriate.

Critical accounting estimates and judgements

The preparation of the financial statements necessarily requires

the exercise of judgement both in application of accounting

policies which are set out below and in the selection of

assumptions used in the calculation of estimates. These estimates

and judgements are reviewed on an ongoing basis and are continually

evaluated based on historical experience and other factors.

However, actual results may differ from these estimates. The most

significant judgement concerns the valuation of unlisted

investments. This is described in note 1(b) with further analysis

provided in note 5.

A summary of the principal accounting policies which have been

applied to all periods presented in these financial statements is

set out below.

(b) Investments

Purchases or sales of investments are recognised on the date the

Company commits to purchase or sell the investments. Investments

are classified at fair value through profit and loss on initial

recognition with any resultant gain or loss recognised in the

Income Statement. Listed securities are valued at bid price or last

traded price, depending on the convention of the exchange on which

the investment is listed, adjusted for accrued income where it is

reflected in the market price. Unlisted investments are valued at

fair value by the Directors on the basis of all information

available to them at the time of valuation and in accordance with

the methodologies consistent with the International Private Equity

and Venture Capital Valuation guideline ("IPEV"). This includes a

review of the financial and trading information of the investee

company, covenant compliance and ability to repay interest and cash

balances. Where no reliable fair value can be estimated,

investments are carried at cost less any provision for

impairment.

Realised gains or losses on the disposal of investments and

permanent impairments in the value of investments are taken to the

capital reserve. Gains and losses arising from changes in the fair

value of investments are included in the Income Statement as a

capital item (see note (h) below).

(c) Income

Dividends receivable on equity shares are recognised as income

on the date that the related investments are marked ex-dividend.

Dividends receivable on equity shares where no ex-dividend date is

quoted are recognised as income when the Company's right to receive

payment is established. Fixed returns on non-equity shares are

recognised on a time apportioned basis so as, if material, to

reflect the effective interest rate on those instruments. Other

returns on non-equity shares are recognised when the right to the

return is established. The fixed return on a debt security is

recognised on a time apportioned basis so as to reflect the

effective interest rate on each such security.

Interest receivable (less any provision for doubtful receipt) is

recognised as it accrues.

(d) Taxation

The charge for taxation is based on net revenue for the period.

The tax effect of different items of income/gain and

expenditure/loss is allocated between capital and revenue on the

same basis as the particular item to which it relates.

Deferred tax is provided, using the liability method, on all

temporary differences at the balance sheet date between the tax

basis of assets and liabilities and their carrying amounts for

financial reporting purposes. Deferred tax liabilities are measured

at the tax rates that are expected to apply to the period when the

liability is settled, based on tax rates (and tax laws) that have

been enacted or substantively enacted at the balance sheet date.

Deferred tax assets are only recognised if it is considered more

likely than not that there will be suitable profits from which the

future reversal of underlying timing differences can be

deducted.

Because the Company intends each year to qualify as an

investment trust under Chapter 4 of Part 24 of the Corporation Tax

Act 2010 (previously s842 of the Income and Corporation Taxes Act

1988), no provision is made for deferred taxation in respect of the

capital gains that have been realised, or are expected in the

future to be realised, on the sale of fixed asset investments.

Based on the smaller portfolio of the Company, after taking

advice, it remains the position of the Board that the Company

continues to qualify under these rules.

(e) Expenses

All expenses are accounted for on an accruals basis. Expenses

are charged through the Income Statement as revenue items except as

follows:

-- expenses which are incidental to the acquisition of an

investment are included within the cost of the investment;

-- expenses which are incidental to the disposal of an

investment are deducted from the disposal proceeds of the

investment;

-- expenses where a connection with the maintenance or

enhancement of the value of the investments can be demonstrated are

aggregated with the cost of the related investments.

(f) Finance costs

Finance costs are accounted for on an accruals basis. Finance

costs of debt, insofar as they relate to the financing of the

Company's investments or to financing activities aimed at

maintaining or enhancing the value of the Company's investments,

are allocated between revenue and capital in accordance with the

Board's expected long-term split of returns, in the form of income

and capital gains respectively, from the Company's investment

portfolio.

(g) Reserves

(a) Share premium - the surplus of net proceeds received from

the issuance of new shares over their par value is credited to this

account and the related issue costs are deducted from this account.

This reserve is non-distributable.

(b) Capital reserve - the following are accounted for in this reserve:

-- gains and losses on the realisation of investments;

-- realised and unrealised exchange differences on transactions of a capital nature;

-- capitalised expenses and finance costs, together with the related taxation effect; and

-- increases and decreases in the valuation of investments held.

This reserve is non-distributable.

(c) Revenue reserve - the net profit or loss arising in the

revenue column of the Income Statement is added to or deducted from

this reserve. This reserve, if positive, is available for paying

dividends.

(h) Segmental information

The Directors are of the opinion that the Company is engaged in

a single segment of business, being investment.

(i) Investments in Associates

As an Investment Trust, the Company considers that it is an

Investment Entity under UK-adopted International Accounting

Standards and therefore investments which would ordinarily be

considered associates and require to be equity accounted are

accounted on a fair value basis in the Income Statement.

2. Other expenses

2021 2021 2021 2020 2020 2020

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Directors' fees 59 - 59 181 - 181

Auditors' remuneration 30 - 30 30 - 30

Other costs 312 - 312 255 - 255

____ ____ ____ ____ ____ _____

391 - 391 466 - 466

____ ____ ____ ____ ____ _____

Since 1 September 2019 secretarial and administration services

have been provided by Peterhouse Capital Limited. During the period

the total fees payable to Peterhouse these services were GBP99,000.

The balance due to Peterhouse, for all services provided, at the

year-end was GBP107,000.

3. Tax on Ordinary Activities

Reconciliation of Tax Charge/(Credit)

A reconciliation of the current tax charge/(credit) is set out

below:

2021 2020

Total Total

GBP'000 GBP'000

Gain/(Loss) on ordinary activities before

taxation 97 (494)

_____ _____

Corporation tax at standard rate 19 %

(2020: 19%) 18 (94)

_____ _____

Effects of:

Non-taxable losses - 5

Excess management expenses (18) 89

_____ _____

Current year tax charge/(credit) - -

_____ _____

Due to the Company's status as an Investment Trust, and the

intention to continue meeting the conditions required to obtain

approval in the foreseeable future, the Company has not provided

for deferred tax on capital gains and losses arising on the

revaluation or disposal of investments.

At 31 December 2021 the Company had surplus management expenses

of approximately GBP3,637,946 (2020: GBP3,734,946) which have not

been recognised as a deferred tax asset, and non-trade loan

relationship deficits of GBP876,151 (2020: 876,151).

Factors that may affect future tax charges

The Finance Act 2021 enacted on 10 June 2021 confirmed an

increase in the UK rate of corporation tax to 25% from 19% from 1

April 2023.

4. Return per Ordinary Share

Return per ordinary share attributable to shareholders reflects

the overall performance of the Company in the year.

Year ended Year ended

31 December 31 December

2021 2020

Revenue return (0.86p) (1.11p)

Capital return 1.08p (0.07p)

______ ______

Total return 0.22p (1.18p)

______ ______

Number Number

Weighted average ordinary shares in issue 45,298,679 41,964,512

_________ _________

5. Investments

2021 2020

Total Total

GBP'000 GBP'000

Investments listed/quoted on a recognised investment

exchange - -

Unquoted investments - -

___ ___

- -

___ ___

The whole of the value of investments is attributable to equity

shares.

The fair value of investments is assessed at each balance sheet

and all gains and losses arising from these assessments are

reflected in the capital section of the Income Statement.

International Financial Reporting Standard ("IFRS") "Financial

Instruments: Disclosures" requires an analysis of investments

valued at fair value, based on the reliability and significance of

information used to measure their fair value. The level is

determined by the lowest (that is the least reliable or

independently observable) level of input that is significant to the

fair value measurement for the individual investment in its

entirety as follows:

Level 1 - investments quoted in an active market;

Level 2 - investments whose fair value is based directly on

observable current market prices or indirectly being derived from

market prices;

Level 3 - investments whose fair value is determined using a

valuation technique based on assumptions that are not supported by

observable current market prices or based on observable market

data.

Level 1 Level 2

Listed Listed 2021 2020

overseas in UK Level 3 Total Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Opening book cost 181 - 4,855 5,036 5,036

Opening fair value adjustment (181) - (4,855) (5,036) (5,008)

_____ ____ _____ ______ ______

Opening valuation - - - - 28

Sales - proceeds - - (488) (488) -

Sales - realised loss - - (1,702) (1,702) -

Fair value adjustment - - 2,190 2,190 (28)

_____ ____ _____ ______ ______

Closing Valuation - - - - -

_____ ____ _____ ______ ______

Closing book cost 181 - 2,665 2,846 5,036

Closing fair value adjustment (181) - (2,665) (2,846) (5,036)

_____ ____ _____ _____ ______

Closing Valuation - - - - -

_____ ____ _____ _____ ______

The gains and losses included in the below table have all been

recognised within gains/(losses) on investments in the Income

Statement on page 22.

2021 2020

Gains/(Losses) on Investments GBP'000 GBP'000

Realised gains on sale 488 -

Movement in fair value - (28)

_____ _____

Gains/(Losses) on Investments 488 (28)

_____ _____

During the year the Company did not incur any transaction costs

on purchases or sales.

6. Creditors: Amounts falling due within one year

2021 2020

GBP'000 GBP'000

Trade Creditors 126 28

Directors' Loan 60 -

Accruals 58 71

Other Creditors 193 801

_____ _____

437 900

___ ___

7. Convertible Unsecured Loans