TIDMGRL

RNS Number : 0203S

Goldstone Resources Ltd

11 November 2021

11 November 2021

GOLDSTONE RESOURCES LIMITED

("GoldStone" or the "Company")

Placing to raise GBP1m

GoldStone Resources Limited (AIM: GRL), is pleased to announce

that the Company has raised approximately GBP1 million (before

expenses) by way of a placing of 8,695,652 new ordinary shares of 1

pence each in the Company (the "Placing Shares") at a price of 11.5

pence per Placing Share (the "Placing Price") with a new

institutional shareholder (the "Placing").

Use of Proceeds

The net proceeds of the Placing will be used predominantly to

expediate the exploration, including a drilling programme, at the

former underground mine at Akrokeri, formerly known as the Akrokeri

Ashanti Mine Ltd (the "Akrokeri Mine"). The Akrokeri Mine was

closed in 1909, having produced 75,000 ounces of gold at a final

recovered average grade of 0.73 oz/t, equivalent to approximately

24 g/t, and was abruptly closed following an ingress of water. Work

will expand upon previous drilling comprising nineteen Diamond

Drill holes totalling 5,200 metres of core, which the Company

re-logged in 2018 to discover high grade quartz veins up to 8 g/t

including 1.5m @ 52.1 g/t and 17m @ 11 g/t, with individual assays

up to 25 g/t.

In addition, the Placing proceeds will be used for costs

associated with the expansion of the Mining Lease Area for the

Homase Mine, announced on 3 December 2020, which includes an

Environmental Impact Assessment and crop compensation, and in

expanding the Mineable Resource of the Homase Mine as defined in

the Definitive Economic Plan, 19 June 2019.

The Placing proceeds will also support the recommencement of

mining, which includes moving to double shift, and for the ramp up

of gold production, with first production expected to commence by

the end of November 2021.

Emma Priestley, Chief Executive Officer, commented :

"By completing this financing now, we can execute early on our

objective for our planned exploration on the former underground

mine at Akrokeri and other activities that can add value to the

Homase Mine.

"We are look forward to providing further updates on the

commencement of gold production, which is on track to commence

before the end of November 2021."

Admission and Total Voting Rights

Application has been made for the 8,695,652 Placing Shares to be

admitted to trading on AIM ("Admission") and Admission is expected

to take place on or around 17 November 2021.

Upon Admission, the Company's issued ordinary share capital will

consist of 459,033,996 ordinary Shares of 1 pence each in the

Company ("Ordinary Shares") with one voting right each. The Company

does not hold any Ordinary Shares in treasury. Therefore, the total

number of Ordinary Shares and voting rights in the Company will be

459,033,996. With effect from Admission, this figure may be used by

shareholders in the Company as the denominator for the calculations

by which they will determine if they are required to notify their

interest in, or a change to their interest in, the share capital of

the Company under the FCA's Disclosure Guidance and Transparency

Rules.

For further information, please contact:

GoldStone Resources Limited

Bill Trew / Emma Priestley Tel: +44 (0)1534 487 757

Strand Hanson Limited

James Dance / James Bellman Tel: +44 (0)20 7409 3494

S. P. Angel Corporate Finance

LLP

Ewan Leggat / Charlie Bouverat Tel: +44 (0)20 3470 0501

About GoldStone Resources Limited

GoldStone Resources Limited (AIM: GRL) is an AIM quoted

exploration and development company with projects in Ghana that

range from grassroots exploration to development.

The Company is focused on developing the Akrokeri-Homase project

in south-western Ghana, which hosts a JORC Code compliant 602,000

oz gold resource at an average grade of 1.77 g/t. The existing

resource is confined to a 4km zone of the Homase Trend, including

Homase North, Homase Pit and Homase South.

The project hosts two former mines, the Akrokerri Ashanti Mine

Ltd, which produced 75,000 oz gold at 24 g/t recovered grade in the

early 1900s, and the Homase Pit which AngloGold Ashanti developed

in 2002/03 producing 52,000 oz gold at 2.5 g/t recovered. It is the

Company's intention to build a portfolio of high-quality gold

projects in Ghana, with a particular focus on the highly

prospective Ashanti Gold Belt.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

United Kingdom domestic law by virtue of the European Union

(Withdrawal) Act 2018.

IMPORTANT INFORMATION

The information contained in this Announcement does not

constitute an offering of securities for sale in the United States

of America and no securities have been or will be registered under

the United States Securities Act 1933, as amended (the "Securities

Act") or under the securities laws of any state or other

jurisdiction in the United States of America nor will they qualify

for distribution under any of the relevant securities laws of

Australia, Canada, Japan or the Republic of South Africa, nor has

any prospectus in connection with the securities been lodged with

or registered by the Australian Securities and Investments

Commission. The securities may not be offered or sold in the United

States of America. This Announcement is not for distribution

directly or indirectly in or into the United States of America,

Australia, Canada, Japan or the Republic of South Africa or in any

other jurisdiction in which such publication or distribution is

unlawful.

This Announcement, does not constitute a prospectus or

prospectus equivalent document for the purposes of the prospectus

rules and has not been, and will not be, approved by, or filed

with, the Financial Conduct Authority ("FCA"). It does not

constitute or form part of, and should not be construed as, an

offer to sell or issue, or a solicitation of any offer of or

invitation to buy or subscribe for, any securities, nor shall it

(or any part of it), or the fact of its distribution, form the

basis of, or be relied on in connection with, or act as an

inducement to enter into, any contract or commitment whatsoever.

Any failure to comply with these restrictions may constitute a

violation of the applicable securities laws in such jurisdiction.

This Announcement does not constitute a recommendation regarding

any securities.

This Announcement contains (or may contain) certain

forward-looking statements with respect to certain of the Company's

plans and its current goals and expectations relating to its future

financial condition and performance and which involve a number of

risks and uncertainties. The Company cautions readers that no

forward-looking statement is a guarantee of future performance and

that actual results could differ materially from those contained in

the forward-looking statements. These forward-looking statements

can be identified by the fact that they do not relate only to

historical or current facts. Forward-looking statements sometimes

use words such as "aim", "anticipate", "target", "expect",

"estimate", "intend", "plan", "goal", "believe", or other words of

similar meaning. By their nature, forward-looking statements

involve risk and uncertainty because they relate to future events

and circumstances, including, but not limited to, economic and

business conditions, the effects of continued volatility in credit

markets, market-related risks such as changes in the price of

commodities or changes in interest rates and foreign exchange

rates, the policies and actions of governmental and regulatory

authorities, changes in legislation, the further development of

standards and interpretations under International Financial

Reporting Standards (IFRS) applicable to past, current and future

periods, evolving practices with regard to the interpretation and

application of standards under IFRS, the outcome of pending and

future litigation or regulatory investigations, the success of

future explorations, acquisitions and other strategic transactions

and the impact of competition. A number of these factors are beyond

the Company's control. As a result, the Company's actual future

results may differ materially from the plans, goals, and

expectations set forth in the Company's forward-looking statements.

Any forward-looking statements made in this Announcement by or on

behalf of the Company speak only as of the date they are made.

Except as required by the FCA, the London Stock Exchange or

applicable law, the Company expressly disclaims any obligation or

undertaking to release publicly any updates or revisions to any

forward-looking statements contained in this Announcement to

reflect any changes in the Company's expectations with regard

thereto or any changes in events, conditions or circumstances on

which any such statement is based.

This Announcement is for information purposes only and shall not

constitute an offer to buy, sell, issue, or subscribe for, or the

solicitation of an offer to buy, sell, issue, or subscribe for any

securities, nor shall there be any sale of securities in any

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification, or exemption,

under the securities laws of any such jurisdiction.

This Announcement has been issued by and is the sole

responsibility of the Company. No representation or warranty,

express or implied, is or will be made as to, or in relation to,

and no responsibility or liability is or will be accepted by SP

Angel or by any of their affiliates or agents as to, or in relation

to, the accuracy or completeness of this Announcement or any other

written or oral information made available to or publicly available

to any interested party or its advisers, and any liability

therefore is expressly disclaimed.

SP Angel is authorised and regulated by the FCA. SP Angel is

acting for the Company and for no-one else in connection with the

Placing, and will not be responsible to anyone other than the

Company for providing the protections afforded to its customers or

for providing advice to any other person in relation to the Placing

or any other matter referred to herein.

The distribution of this Announcement and the offering of the

Placing Shares in certain jurisdictions may be restricted by law.

No action has been taken by the Company or SP Angel that would

permit an offering of such shares or possession or distribution of

this Announcement or any other offering or publicity material

relating to such shares in any jurisdiction where action for that

purpose is required. Persons into whose possession this

Announcement comes are required by the Company and SP Angel to

inform themselves about, and to observe such restrictions.

Persons (including, without limitation, nominees and trustees)

who have a contractual or other legal obligation to forward a copy

of this Announcement should seek appropriate advice before taking

any action.

The Placing Shares to which this Announcement relates may be

illiquid and / or subject to restrictions on their resale.

Prospective purchasers of the Placing Shares should conduct their

own due diligence on the Placing Shares. If you do not understand

the contents of this Announcement you should consult an authorised

financial adviser.

Neither the content of the Company's website nor any website

accessible by hyperlinks on the Company's website is incorporated

in, or forms part of, this Announcement.

All times and dates in this Announcement may be subject to

amendment. SP Angel shall notify the Placees and any person acting

on behalf of the Placees of any changes.

Each distributor is responsible for undertaking its own target

market assessment in respect of the Placing Shares and determining

appropriate distribution channels.

Solely for the purposes of the product governance requirements

contained within the following, each as imported into the laws of

England and Wales by virtue of the European Union (Withdrawal) Act

2018 (as amended) and certain other enacting measures: (a) EU

Directive 2014/65/EU on markets in financial instruments, as

amended ("MiFID II"); (b) Articles 9 and 10 of Commission Delegated

Directive (EU) 2017/593 supplementing MiFID II; and (c) local

implementing measures (together, the "MiFID II Product Governance

Requirements"), and disclaiming all and any liability, whether

arising in tort, contract or otherwise, which any "manufacturer"

(for the purposes of the Product Governance Requirements) may

otherwise have with respect thereto, the Placing Shares have been

subject to a product approval process, which has determined that

the Placing Shares are: (i) compatible with an end target market of

(a) retail investors, (b) investors who meet the criteria of

professional clients and (c) eligible counterparties, each as

defined in MiFID II; and (ii) eligible for distribution through all

distribution channels as are permitted by MiFID II (the "Target

Market Assessment"). Notwithstanding the Target Market Assessment,

Distributors should note that: the price of the Placing Shares may

decline and investors could lose all or part of their investment;

the Placing Shares offer no guaranteed income and no capital

protection; and an investment in the Placing Shares is compatible

only with investors who do not need a guaranteed income or capital

protection, who (either alone or in conjunction with an appropriate

financial or other adviser) are capable of evaluating the merits

and risks of such an investment and who have sufficient resources

to be able to bear any losses that may result therefrom. The Target

Market Assessment is without prejudice to the requirements of any

contractual, legal or regulatory selling restrictions in relation

to an offer of securities such as the Placing Shares.

For the avoidance of doubt, the Target Market Assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of MiFID II; or (b) a recommendation to any

investor or group of investors to invest in, or purchase, or take

any other action whatsoever with respect to the Placing Shares.

Each distributor is responsible for undertaking its own target

market assessment in respect of the Placing Shares and determining

appropriate distribution channels.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEBMBBTMTTBTMB

(END) Dow Jones Newswires

November 11, 2021 02:00 ET (07:00 GMT)

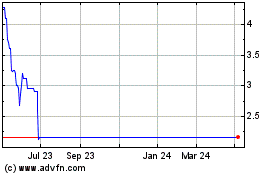

Goldstone Resources (LSE:GRL)

Historical Stock Chart

From Mar 2024 to Apr 2024

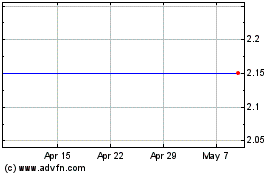

Goldstone Resources (LSE:GRL)

Historical Stock Chart

From Apr 2023 to Apr 2024