TIDMGRP

RNS Number : 4846L

Greencoat Renewables PLC

13 September 2021

Greencoat Renewables PLC

Interim Results to 30 June 2021

Dublin, London | 13 September 2021: Greencoat Renewables PLC

("Greencoat Renewables" or the "Company"), the renewable

infrastructure company invested in euro-dominated assets, is

pleased to announce its Interim Results for the six-month period

ended 30 June 2021.

Highlights

-- The Group's investments generated 745GWh of electricity, net

cash generation was EUR40 million (gross of SPV level debt

prepayment), resulting in gross dividend cover for the period of

1.8x.

-- Acquisition of Cordal and Glencarbry wind farms in Ireland

increased the portfolio to 23 wind farms, total installed capacity

to 685.6MW and GAV to EUR1,442 million as at 30 June 2021.

-- Successful entry into the Nordic wind market with the

commitment to acquire the 43MW Kokkoneva wind farm, once

operational in Q2 2022.

-- The Company declared total dividends of 3.03 cent per share

with respect to the period.

-- EUR693.3 million Aggregate Group Debt at 30 June 2021,

equivalent to 48.1 per cent of GAV.

-- Against a supportive backdrop with renewables remaining a

highly attractive asset class, the Group has identified significant

near and medium term growth opportunities in both Ireland and

Europe.

Commenting on today's results, Rónán Murphy, Non-Executive

Chairman of Greencoat Renewables, said:

"The past six months have been a successful period for Greencoat

Renewables, marked by a strong operational performance and

continued expansion into Europe, including our first investment

into the Nordic market.

The business continues to deliver enhanced value from the

existing portfolio and I am pleased with the progress made across a

number of strategic initiatives. These include a significant

corporate PPA at attractive terms, evidencing the maturing market

for contracted renewable power, and the construction of our first

co-located battery project.

The overall outlook for the company remains positive, with good

dividend cover, appropriate gearing, and the ability to pursue a

strong near and medium term pipeline of opportunities in both

Ireland and Europe."

Key Metrics as at 30 June 2021:

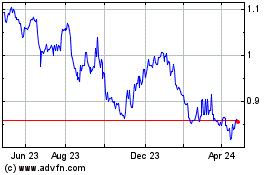

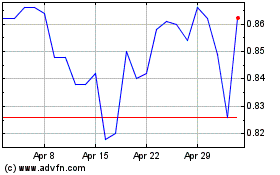

Market capitalisation EUR867.2 million

Share price 117.0 cent

Dividends with respect to the period EUR22.5 million

Dividends with respect to the period per share 3.03 cent

GAV EUR1,442.4 million

NAV EUR749.1 million

NAV per share 101.1 cent

Details of the conference call for analysts and investors:

A conference call for analysts and investors will be held at

10.00 am BST today, 13 September 2021. To register for the call

please contact FTI Consulting by email at

greencoat@fticonsulting.com .

Presentation materials will be posted on the Company's

website:

www.greencoat-renewables.com from 7.00 am.

---S ---

For further information on the Announcement, please contact:

Greencoat Renewables PLC: +44 20 7832 9400

-- Bertrand Gautier

-- Paul O'Donnell

-- Tom Rayner

Davy (Joint Broker, Nomad and

Euronext Growth Adviser) +353 1 6796363

-- Ronan Veale

-- Barry Murphy

RBC (Joint Broker) +44 20 7653 4000

-- Matthew Coakes

-- Duncan Smith

-- Elizabeth Evans

FTI Consulting (Media Enquiries) greencoat@fticonsulting.com

-- Jonathan Neilan

-- Melanie Farrell

About Greencoat Renewables PLC

Greencoat Renewables PLC is an investor in euro-denominated

renewable energy infrastructure assets. Initially focused solely on

the acquisition and management of operating wind farms in Ireland,

the Company is now also investing in wind and solar assets in

certain other Northern European countries with stable and robust

renewable energy frameworks. It is managed by Greencoat Capital

LLP, an experienced investment manager in the listed renewable

energy infrastructure sector.

Chairman's Statement

I am pleased to present the Interim Report of Greencoat

Renewables PLC for the six months ended 30 June 2021. The period

has seen the business continue to deliver sustainable returns to

shareholders, while capturing significant growth opportunities in

Ireland and continental Europe.

The Company has this year become the largest owner of

operational wind assets in Ireland, powering over 500,000 homes

while saving c.590,000 tonnes of carbon emissions otherwise emitted

by thermal generation. I am delighted that we have reached this

milestone whilst expanding into new geographies and maintaining the

robust dividend cover that our shareholders value.

Sustainability remains at the heart of everything the Company

does, and I am pleased with our increasing sophistication in terms

of ESG strategy and reporting. We will continue to drive this

agenda and will be communicating our full year results in line with

the relevant Task Force on Climate-Related Financial Disclosures,

Sustainable Finance Disclosure Regulation, and EU Taxonomy

recommendations.

In summary, this has been a successful period benefitting from

the hard-work and dedication required to ensure our best-in-class

operational standards have been maintained and extended. The

Company is in a strong position with a significant pipeline of

growth opportunities across the continent.

Performance

Overall, the portfolio generated 745GWh over the period, up from

688GWh in the corresponding period last year, which translated to

EUR40.2 million(1) of net cash generation. This resulted in a

dividend cash cover ratio for the period of 1.8x(1) .

(1) Net cash generation and dividend cover are gross of SPV

level debt repayment and were EUR31.9 million and 1.4x, net of SPV

level debt repayment.

Wind speeds fluctuated month on month causing production to be

down 11% overall. The impact of this was mitigated by the

portfolio's increased geographical diversification, and excellent

availability despite pandemic restrictions over the winter.

Our portfolio optimisation strategy continued with increased

revenues from system services, and a number of turbine enhancement

measures in Ireland and our new French portfolio which have been

implemented with our O&M partners.

It was pleasing to note the progress made in our fixed price PPA

strategy over the period, with the Company executing its first

medium-term PPA for assets outside of the REFIT period, as well as

a long-term fixed price PPA signed with Finland's state utility for

the Kokkoneva wind farm which is due to become operational in Q2,

2022

The asset management team, within the Investment Manager,

continue to work alongside our appointed operations managers to

monitor grid curtailment and constraint which remains above

pre-pandemic levels, while the Company has been actively involved

in the industry consultation on the EU Clean Energy Package with a

view to achieving compensation.

We have seen power price forecasts increase to above

pre-pandemic levels as a result of higher gas and carbon prices and

while our existing portfolio is predominately shielded from

near-term power price movements this provides a good opportunity as

we evaluate investment opportunities in Europe.

Dividend and Returns

We are pleased to advise that there has been no change in the

Company's annual dividend policy, with increases to be within the

range of zero to CPI. Despite CPI being negative in Ireland for

2020, we were pleased to hold our target dividend unchanged at 6.06

cent per share for 2021. This is supported by our continued cash

generation and proportionally high dividend cover.

The Company paid a quarterly dividend of 1.515 cents per share

with respect to Q4, 2020 on 26 February 2021 and another 1.515

cents per share on 1 June 2021, with future dividend payments

scheduled for August and November 2021.

NAV per share increased slightly in the period from 101.0 cents

per share on 31 December 2020 to 101.1 cents per share on 30 June

2021.

Acquisitions

The Investment Manager continues to identify a wide range of

opportunities and during the period an additional two investments

were made while maintaining our disciplined approach to investing.

Acquisitions in the period included:

-- The 89.6MW Cordal wind farm located in County Kerry, Ireland;

and

-- The 35. 6MW Glencarbry wind farm located in County Tipperary,

Ireland.

Both operational wind farms have contracted revenues under the

REFIT 2 scheme and provide a long-term guaranteed minimum floor

price for the electricity generated until 2032.

This brings total installed capacity to 686MW, up from 557MW as

at December 2020.

To complement the above, a forward sale agreement to acquire the

43.2 MW Kokkoneva wind farm in Siikalatva, Finland was entered into

in February 2021. The Finnish wind market is well-established and

characterised by high wind speeds, large capacity turbines

facilitated by high hub heights along with a correspondingly low

cost of electricity generation. The transaction will complete once

Kokkoneva is fully operational which is expected in Q2, 2022.

Diversification

The expansion into France last year and Finland this year is

indicative of the Company's intentions, seeing opportunities to

aggregate significant investments in diversified geographies, as we

have demonstrated in Ireland. In addition to geographic diversity,

the Company is expanding into other renewable technologies and has

considered a number of solar opportunities in the period,

benefitting from the leading expertise of the Investment Manager

and the extensive relationships that have been formed with solar

developers in the industry. This underpins our ability to acquire

on a pan-European basis, with access to the widest set of

transactions in the marketplace.

The Company has progressed the development and construction of a

battery storage facility co-located at Killala wind farm. The

facility is expected to be operational in H1, 2022, and will act as

a strategic pilot for the Company. Whilst battery storage as an

asset class is not yet sufficiently mature for the Company's

institutional approach, the DS3 system in Ireland provides a strong

investment case for co-located battery and wind with a short

payback period which is value accretive to the wind farm. We

continue to explore new opportunities to add further value to

existing and new assets.

Gearing

Acquisitions during the period were financed in first instance

by the 3-year Revolving Credit Facility ("RCF"). During the period,

an additional EUR75 million was refinanced following a step-up in

our 5-year tranche, which included the introduction of a new

lender. Total debt, including the Company and SPV's as at 30 June

2021 amounted to EUR693 million, which is 48 per cent of GAV. The

continued prudent use of low-cost debt (limited to 60% of GAV) has

further enhanced cash yield, with debt levels still well within the

maximum permitted under the Company's Investment Policy.

Principal Risks and Uncertainties

As detailed in the Company's Annual Report for the year ended 31

December 2020, the principal risks and uncertainties affecting the

Company are unchanged:

-- dependence on the Investment Manager;

-- regulatory risk;

-- financing risk; and

-- risk of investment returns becoming unattractive.

Also, as detailed in the Company's Annual Report for the year to

31 December 2020, the principal risks and uncertainties affecting

the investee companies are as follows:

-- changes in government policy on renewable energy;

-- a decline in the market price of electricity after the period of contracted subsidy;

-- risk of low wind resource;

-- lower than expected lifespan of the wind turbines;

-- risk of market structure change; and

-- health and safety and the environment.

The principal risks outlined above remain the most likely to

affect the Company and its investee companies in the second half of

the year.

Outlook

The Board continues to view Ireland as an attractive market for

further investment, and believes the Company is very well placed to

continue its aggregation strategy and deliver value for its

Shareholders. Following the successful partnership with Statkraft

to acquire assets under a "forward sale" structure, we expect the

Company to continue to target investments in REFIT and RESS assets,

across both wind and solar PV.

With our portfolio well established in our home market of

Ireland there is now additional focus on investment opportunities

in continental Europe, following our entry into France and Finland.

The Company is clearly benefiting from having access to the widest

opportunity set, and our core focus remains the acquisition of

contracted wind assets.

The scale of our Company and geographic reach is also allowing

us to access a wider range of opportunities whilst maintaining a

highly contracted overall portfolio.

We are seeing increased opportunities in offshore wind where the

Investment Manager's history of relationships and co-investment is

particularly valuable. In the Nordics, we continue to see

significant opportunities in large-scale unsubsidised assets in a

well-developed corporate PPA market. In Iberia, we are seeing the

emergence of an attractive pipeline, with similar characteristics

to the Nordics, given the regions' increasing ability to produce

very low-cost renewable energy.

Environmental, Social and Governance

Central to the Company's strategy is growing a successful

business that supports the transition to a net-zero carbon economy,

in a way that positively impacts the communities and local

environment in which we operate. This past year has been a

particularly challenging time with the ongoing effects of the

global pandemic on the economy and wider society. The Company's

swift response and implementation of COVID-19 related safe

practices to keep our asset management teams and wider stakeholders

safe, has been of the utmost importance to the Board. As the focus

on climate change challenges increases, fully engaging in global

decarbonisation initiatives is a priority for the Company and the

Board.

The Company continues to step up its participation in ESG

initiatives such as the Carbon Disclosure Project and supporting

the Task Force on Climate Related Financial Disclosures. Work is

ongoing to gather and analyse the potential impact, including risks

and opportunities, of climate change on the Company and its wider

portfolio in line with TCFD recommendations, which will be detailed

in the Company's 2021 Annual Report. We firmly believe that our

dedication to meeting our sustainability goals alongside a strong

governance framework will ensure the long-term success of our

business and protect the interests of all stakeholders.

The Company published our annual ESG Report for 2020 which

provides comprehensive information covering our dedication to ESG

initiatives. The highlights of this report include:

-- Supporting research into wind energy in Ireland;

-- Committing c. EUR1million towards local communities; and

-- Supporting the recommendations of the TCFD, which addresses

climate-related risks and opportunities.

The Board and Governance

The AGM took place on Thursday 29 April 2021, with the minimum

necessary quorum of two shareholders present and in accordance with

government guidance on social distancing, travel and other health

measures to help minimise the spread of COVID-19.

Conclusion

In conclusion, I am very pleased with the performance of the

Company while excited about the future direction as the Company

continues to expand geographically while considering other

renewable technologies. I would finally like to take this

opportunity to thank my fellow Board members, the Investment

Manager and Shareholders for their continued contribution and

support.

Rónán Murphy

Chairman

12 September 2021.

Information about Investment Manager

Greencoat Capital LLP, the Investment Manager, is responsible

for the day-to-day management of the Company's investment portfolio

in accordance with the Group's investment objective and policy,

subject to the overall supervision of the Board.

The Investment Manager is an experienced manager of renewable

infrastructure assets with over EUR7 billion of assets under

management, and investments in the UK, Europe and the United

States. The Investment Manager is authorised and regulated by the

Financial Conduct Authority and is a full scope UK AIFM.

Portfolio Performance

Portfolio generation for the six months ended 30 June 2021 was

11% below budget, producing 745GWh in the period. This was a result

of lower wind resource, with availability, constraint, and

curtailment in line with or above expectations.

Electricity demand increased over the period as Europe continued

to recover from the pandemic. Power prices in Ireland have

recovered strongly (with average power prices for Q2, 2021, being

EUR92/MWh) and the forecast for power prices is expected to track

close to the REFIT reference price for the next 12 months. The

Group's portfolio benefits from market price upside, where the

average capture power price is above the REFIT strike price. We

have also seen a more modest uplift in the medium-term power price

forecasts.

Ongoing Performance Improvement Plan

The Investment Manager continues to upgrade and optimise the

portfolio, working closely with turbine manufactures and suppliers

and leveraging its broad experience and relationships across 686MW

of operational wind generation assets.

During the period the Performance Improvement Plan included

specific upgrades to a number of wind farms:

-- Glanaruddery - Implementation of Vestas turbine upgrades

increasing generation by c.1%; forestry management in collaboration

with specialists, local landowners, and the Irish forestry board

expected to increase generation by 0.7% and reduce turbulence on

the turbines;

-- Gortahile - Identification and implantation of a Nordex

turbine start-up upgrade, expected to increase generation by 0.4%;

and

-- Knockacummer - continued execution of the forestry management

plan, expected to increase generation by 0.9%.

Across the portfolio we continue to identify opportunities to

enhance yield returns from active management.

DS3

The portfolio has increased its share of DS3 revenues and is now

EUR1.6 million for the period. This has been achieved by a range of

technology upgrades to our existing portfolio and we continue to

work closely with the wind turbine manufacturers to incentivise

them to develop software to allow DS3 services to be provided more

frequently.

Co-located battery project

With large-scale batteries maturing, we see the technology as an

increasingly investible opportunity and are deploying a 10MW

battery at our Killala wind farm, utilising the additional grid

capacity specific to the site. The project significantly enhances

DS3 contracted revenues and allows future upside in trading

revenues, improving the overall IRR at Killala. We expect the

battery storage facility to be operational by Q2, 2022.

In addition to the enhanced returns achieved at Killala, the

project provides an opportunity for the Investment Manager to

accurately assess investment opportunities for batteries across the

portfolio.

PPA activity

We are pleased to have successfully negotiated a five-year fixed

price PPA during the period with a local energy provider in

Ireland. The attractive price achieved is a clear illustration of

the PPA market maturing and demonstrates our ability to continue to

contract the portfolio's revenues post the REFIT life of the

assets. In addition, the Group will benefit from a long-term fixed

price PPA with Finland's state utility for the Kokkoneva wind farm,

due to become operational in Q2, 2022.

Health and safety

Health and safety are of paramount importance for both the Group

and the Investment Manager. The Investment Manager, reviews on a

monthly basis, comprehensive reports provided by operational site

managers, with information then reviewed by the Director's at each

of the scheduled Board meetings. Over the portfolio, there have

been in excess of 60 audits and site inspections carried out to

ensure best practises are being maintained.

The Investment Manager is pleased to report that there were no

major incidents in the period ended 30 June 2021 with plans in

place to ensure all sites receive an annual inspection and safety

audit during 2021.

Acquisitions

During the six-month period ending 30 June 2021, the Group

completed two material acquisitions as noted below:

-- Cordal wind farm, located in County Kerry, Ireland and

comprising 28 GE 3.2MW turbines with a combined capacity of 89.6MW.

The site has been operational since May 2018 and was developed by

Cubico Sustainable Investments. The wind farm benefits from a REFIT

2 contract, providing inflation protected revenue until 2032;

and

-- Glencarbry wind farm, located in County Tipperary, Ireland

and comprising 7 Nordex N100 3.3MW turbines and 5 Nordex N90 2.5MW

turbines with a combined capacity of 35.6MW. The site has been

operational since September 2017 and was developed by John Laing

Group PLC ("John Laing"). This followed the Group's acquisition

last year of the 51MW French portfolio also acquired from John

Laing (illustrating the strength of the Group's relationship with

pan-European developers). The wind farm benefits from a REFIT 2

contract, providing inflation protected revenue until 2032.

In addition, the Group successfully completed the 6(th) turbine

at Killala wind farm increasing the capacity of the wind farm to

20.4MW.

Forward sale and construction update

Over the period, the Group has committed to acquire a third wind

farm on a forward sale basis in addition to those announced in

December 2020. On an aggregate basis, there is 106.2MW of committed

forward sale investment. The agreement to acquire the Kokkenova

wind farm, once operational, was reached in February and is the

first asset the Company has agreed to acquire in the Nordics.

All of the projects under construction are proceeding as planned

with no material issues on the construction timetable.

-- Kokkoneva wind farm, Northern Ostrobothnia, Finland - 9

Nordex N149 4.8MW turbines with a combined capacity of 43.2MW.

Construction overseen by Abo Wind and is expected to reach

commercial operations in Q2, 2022;

-- Taghart wind farm, County Cavan, Ireland - 7 Vestas V117

3.6MW turbines with a combined capacity of 25.2MW. Construction

overseen by Statkraft and is expected to reach commercial

operations in Q4, 2022; and

-- Cloghan wind farm, County Offaly, Ireland - 9 Vestas V136

4.2MW turbines with a combined capacity of 37.8MW. Construction

overseen by Statkraft and is expected to reach commercial operation

in Q1, 2023.

Financial Performance

Dividend cover for the six months ended 30 June 2021 was 1.4x

net and 1.8x gross of project level debt repayment.

Cash balances, which include the Group and the SPV wind farms

was EUR49.2 million at 30 June 2021, being an increase of EUR7.8

million over the six months.

Group and wind farm SPV cash flows For the six months ended

30 June 2021

Net (1) Gross (1)

EUR 000 EUR 000

Net cash generation 31,923 40,239

Dividends paid (22,460) (22,460)

SPV Capex & PSO Cashflow (2) 3,531 3,531

SPV level debt repayment 0 (8,316)

Acquisitions (3) (273,959) (273,959)

Acquisition costs (2,590) (2,590)

Equity issuance 0 0

Equity issuance costs (70) (70)

Net drawdown under debt facilities 275,000 275,000

Upfront finance costs (1,160) (1,160)

Movement in cash (Group and wind farm SPVs) 10,215 10,215

Opening cash balance (Group and wind farm SPVs) 39,024 39,024

Ending cash balance (Group and wind farm SPVs) 49,239 49,239

Net cash generation (1) 31,923 40,239

Dividends (22,460) (22,460)

Dividend cover 1.4x 1.8x

(1) The dividend cover table shows two scenarios: the first

reflects cash generation net of the Group's share of project level

debt repayment (EUR8,316k) and the second is the net cash

generation gross of SPV level debt repayments. The following wind

farms contain project level debt: Cloosh Valley, Raheenleagh,

Sliabh Bawn, Saint Martin, Sommette and Pasilly.

(2) Cashflows reflect residual capital expenditure from acquired

SPVs, being (EUR1.7 million), less capital expenditure on the

Killala Battery project of (EUR2.1 million), plus REFIT PSO working

capital movements of EUR7.3 million relating to wind farm

SPV's.

(3) Acquisition consideration is net of the acquired SPV cash of

EUR20,123k.

The following two tables provide further detail in relation to

net generation figures of EUR40.2 million (gross) and EUR31.9

million (net).

For the six months ended

Net Cash Generation - Breakdown 30 June 2021

Net Gross

EUR'000 EUR'000

Revenue 72,984 72,984

Operating expenses (23,317) (23,317)

Tax / VAT (514) (514)

--------------------------------- ------------- ------------

Wind farm operating cashflow 49,153 49,153

SPV level debt interest (3,430) (3,430)

SPV level debt repayment (8,316) 0

--------------------------------- ------------- ------------

Wind farm cashflow 37,407 45,723

Management fee (3,521) (3,521)

Operating expenses (335) (335)

Ongoing finance costs (2,242) (2,242)

VAT 613 613

--------------------------------- ------------- ------------

Group cashflow (5,485) (5,485)

Net cash generation 31,923 40,239

--------------------------------- ------------- ------------

For the six months ended

Net Cash Generation - Reconciliation to Net Cash Flows from Operating Activities 30 June 2021

Net Gross

EUR'000 EUR'000

Net cash flows from operating activities (1) 5,631 5,631

Movement in cash balances of wind farm SPVs (2) 1,205 1,205

SPV capex and PSO cashflow (3) (3,168) (3,168)

Repayment of debt at SPV level (2) 0 8,316

Repayment of shareholder loan investment (1) 31,097 31,097

Finance costs (1) (1,682) (1,682)

Upfront finance costs (cash) (4) (1,160) (1,160)

---------------------------------------------------------------------------------- ------------- ------------

Net cash generation 31,923 40,239

---------------------------------------------------------------------------------- ------------- ------------

(1) Condensed Consolidated Statement of Cash Flows.

(2) Note 8 to the Financial Statements.

(3) EUR3,168k cashflows reflect residual capital expenditure

from acquired SPVs (covered by the vendor of the SPVs) of (EUR1.7

million), plus capital expenditure on the Killala Battery project

(EUR2.1 million) and plus EUR632k SPV working capital.

(4) EUR1,160k includes EUR719k facility arrangement fees plus

EUR441k professional fees (as per note 12 to the Financial

Statements).

During the period, the Group acquired two wind farms and

completed the construction of the 6th turbine as part of the

Killala wind farm for a total of EUR274.3 million. The investments

were predominately financed by an increase in the aggregate debt of

EUR265.4 million. The movement in aggregate debt included a EUR10

million repayment from the Group's excess cash reserves. This

prudent use of gearing further enhanced the portfolio returns with

an overall increase in the NAV over the period of EUR0.3 million

(or +0.1 cent on a per share basis).

The movement in the portfolio value of EUR14.6 million is in

line with the unwinding of the discount rate over the period, that

is off set by the net movement in cash held at both Group level and

within the SPV's.

The NAV increase per share remained broadly flat during the

period.

Dividends totally EUR22.5 million were paid in the period on 27

February and 3 June 2021.

The share price at 30 June 2021 was 117.0 cents, representing a

15.8 per cent. premium to NAV.

Cent per share

NAV at 31 December 2020 101.0

Less February 2021 dividend (1.5)

NAV at 31 December 2020 (ex-dividend) 99.5

NAV at 30 June 2021 101.1

Less August 2021 dividend (1.5)

NAV at 30 June 2021 (ex-dividend) 99.6

Movement in NAV (ex-dividend) 0.1

Reconciliation of Statutory Net Assets to Reported NAV

As at As at

30 June 2021 31 December 2020

EUR'000 EUR'000

DCF valuation 1,367,428 1,112,352

Other relevant assets (wind farm SPVs) 27,031 22,370

Cash (wind farm SPVs) 44,503 22,507

----------------------------------------- -------------- ------------------

Fair value of investments (1) 1,438,962 1,157,229

Cash (Group) 4,738 16,517

Other relevant (liabilities)/assets (2) (1,329) 2,944

----------------------------------------- -------------- ------------------

GAV 1,442,371 1,176,690

Aggregate Group Debt (3) (693,259) (427,877)

----------------------------------------- -------------- ------------------

NAV 749,112 748,813

Reconciling items - -

----------------------------------------- -------------- ------------------

Statutory net assets 749,112 748,813

Shares in issue 741,238,938 741,238,938

NAV per share (cent) 101.1 101.0

----------------------------------------- -------------- ------------------

(1) The fair value of investments are shown gross of EUR203.3

million debt and swap values held at wind farm SPV level that are

not included in the equivalent figure in the consolidated Statement

of Financial Position.

(2) Other relevant net assets at 30 June 2021 are gross of

EUR2.7 million of capitalised facility arrangement fees that are

netted off against loans and borrowings (consistent with Note 12)

to the financial statements).

(3) Aggregate Group debt reflects EUR215 million drawn under the

Group's revolving credit facility, (gross of EUR2.7 million of

capitalised facility arrangement fees) and consistent with Note 12

to the financial statements, plus EUR275 million of term debt and

EUR203.3 million of debt and swap fair values held at SPV wind farm

level.

Gearing

As at 30 June 2021, the aggregate Group debt was EUR693 million,

which equates to 48.1 per cent of GAV. This comprises EUR215

million drawn under the Group's Revolving Credit Facility (the

"RCF"), the Group's proportionate share of asset level, long-term

project finance debt of EUR203 million, and a five-year term loan

facility of EUR275 million, that included a EUR75 million increase

with the introduction of ING to the syndicate in April.

In addition, post the reporting period, the Investment Manager

arranged a new seven-year EUR150 million term facility with a long

term lender which will be used to refinance the RCF.

The group will continue to optimise the capital structure and

take advantage of favourable debt market conditions.

Environmental, Social and Governance

The Investment Manager recognises the role of ESG matters in

driving long-term value and resilience, as well as the importance

to all of the Group's stakeholders. During the period the Group

achieved the following:

-- Environmental - increased generation capacity, supporting

Ireland, France, and Finland's transition towards a net zero carbon

emissions economy; supporting for a four-year research project at

Trinity College Dublin aiming to improve the biodiversity benefits

of onshore wind farms; ongoing habitat management plans across the

portfolio;

-- Social - active engagement with, and support provided to,

local communities surrounding the areas in which the wind farms are

located, with particular concern for how they have been impacted by

the COVID-19 pandemic. In 2021, the Group expects to fund over EUR1

million of community initiatives; and

-- Governance - Supporting the recommendations of the TCFD,

which addresses climate related risks and opportunities, and

participation in other ESG initiatives such as the CDP.

Further details of the Group's ESG initiatives can be found in

the latest ESG report, available on the Company's website

www.greencoat-renewables.com.

Outlook

The outlook for the Group remains positive, with strong

operational performance from the existing portfolio coupled with a

healthy pipeline of attractive investment opportunities.

Continental Europe

We continue to see significant investment opportunities in

continental Europe and have an active pipeline across the continent

providing the Group with access to a wide range of assets. This

pipeline is largely comprised of sellers well known to the

Investment Manager, including European utilities and developers

with whom we have transacted previously.

We are currently seeing value in the renewable energy markets in

both the Iberian and Nordic regions, where subsidy-free renewable

infrastructure development continues to see strong growth, as well

as providing access to attractive Corporate PPA market. This well

complements our strategy of acquiring highly contracted

(tariff-based) assets in Ireland and Northern European markets.

In line with our strategy, growth in continental Europe gives us

access to the widest pool of assets, while allowing us to diversify

the business, in terms of weather patterns, power markets and

regulatory frameworks, and avoiding currency risk.

Ireland

2021 has continued to evidence the strong growth dynamics in the

Irish renewables market with the continued build-out of new

renewable assets under the RESS scheme, as well as the emergence of

a maturing corporate PPA market. We continue to see new

opportunities both in REFIT and RESS with over 4.0GW of onshore

wind capacity in operation or construction representing a c EUR8bn

market size.

Ireland's Department of the Environment, Climate and

Communications (DECC) published the framework for Ireland's

Offshore Electricity Transmission System in May, which included a

roadmap to facilitate significant growth in renewable energy, as

well as specific expansion of the offshore wind sector. The plan

includes 5GW of installed offshore wind generation by 2030

(increased from the original 3.5GW announced in 2020). This will be

supported by a new regulatory consenting regime for the offshore

renewable energy sector.

Greencoat is seeing a significant pipeline of late-stage

development opportunities for offshore wind on the east coast of

Ireland. These would represent a substantial power export

opportunity for the country, enabled by the announced plans for

significantly increased interconnector capacity between Ireland and

the UK, and Ireland and France. In addition, we are seeing an

early-stage pipeline of floating wind on the west coast which has

the potential to support an emerging large green hydrogen

production sector.

Condensed Consolidated Statement of Comprehensive Income

(unaudited)

For the six months ended 30 June 2021

For the six months ended For the six months ended

Note 30 June 2021 30 June 2020

EUR'000 EUR'000

Return on investments 3 32,991 21,756

Other income - 39

--------------------------------------------------------- ----- ------------------------- -------------------------

Total income and gains 32,991 21,795

Operating expenses 4 (4,605) (4,382)

Investment acquisition costs (2,309) (835)

--------------------------------------------------------- ----- ------------------------- -------------------------

Operating profit 26,077 16,578

Finance expense 12 (3,362) (3,257)

--------------------------------------------------------- ----- ------------------------- -------------------------

Profit for the period before tax 22,715 13,321

Taxation 5 - -

--------------------------------------------------------- ----- ------------------------- -------------------------

Profit for the period after tax 22,715 13,321

Profit and total comprehensive income attributable to:

Equity holders of the Company 22,715 13,321

Earnings per share

--------------------------------------------------------- ----- ------------------------- -------------------------

Basic and diluted earnings from continuing operations

during the period (cent) 6 3.06 2.11

--------------------------------------------------------- ----- ------------------------- -------------------------

The accompanying notes form an integral part of the condensed

consolidated interim financial statements.

Condensed Consolidated Statement of Financial Position

(unaudited)

As at 30 June 2021

Note 30 June 2021 31 December 2020

EUR'000 EUR'000

Non current assets

Investments at fair value through profit or loss 8 1,235,703 944,352

-------------------------------------------------- ----- ------------- -----------------

1,235,703 944,352

Current assets

Receivables 10 339 4,095

Cash and cash equivalents 4,738 16,517

-------------------------------------------------- ----- ------------- -----------------

5,077 20,612

Current liabilities

Payables 11 (5,897) (5,343)

Net current (liabilities)/assets (820) 15,269

Non current liabilities

Loans and borrowings 12 (485,771) (210,808)

-------------------------------------------------- ----- ------------- -----------------

Net assets 749,112 748,813

-------------------------------------------------- ----- ------------- -----------------

Capital and reserves

Called up share capital 14 7,412 7,412

Share premium account 14 507,520 507,476

Other distributable reserves 139,308 161,768

Retained earnings 94,872 72,157

-------------------------------------------------- ----- ------------- -----------------

Total shareholders' funds 749,112 748,813

-------------------------------------------------- ----- ------------- -----------------

Net assets per share (cent) 15 101.1 101.0

-------------------------------------------------- ----- ------------- -----------------

Authorised for issue by the Board on 12 September 2021 and

signed on its behalf by:

Rónán Murphy Kevin McNamara

Chairman Director

The accompanying notes form an integral part of the condensed

consolidated interim financial statements.

Condensed Consolidated Statement of Changes in Equity

(unaudited)

For the six months ended 30 June 2021

For the six Other

months distributable Retained

ended 30 June Share capital Share premium reserves earnings Total

2021 Note EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

Opening net

assets

attributable to

shareholders (1

January 2021) 7,412 507,476 161,768 72,157 748,813

Share issue costs - 44 - - 44

Interim dividends

paid in the

period 7 - - (22,460) - (22,460)

Profit and total

comprehensive

income for the

period - - - 22,715 22,715

------------------ ----- --------------- --------------- --------------- --------------- ---------

Closing net

assets

attributable to

shareholders 7,412 507,520 139,308 94,872 749,112

------------------ ----- --------------- --------------- --------------- --------------- ---------

After taking account of cumulative unrealised gains in fair

value of investments of EUR91,075,313, the total reserves

distributable by way of a dividend as at 30 June 2021 were

EUR143,104,623.

For the six months ended 30 June 2020

For the six Other

months distributable

ended 30 June Share capital Share premium deserves Retained earnings Total

2020 Note EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

Opening net assets

attributable to

shareholders (1 January

2020) 6,306 385,669 199,936 58,089 650,000

Interim dividends paid in

the period - - (19,060) - (19,060)

Profit and total

comprehensive income for

the period - - - 13,321 13,321

Closing net assets

attributable to

shareholders 6,306 385,669 180,876 71,410 644,261

--------------------------- -------------- -------------- ----------------------- ---------------- ---------

After taking account of cumulative unrealised gains in fair

value of investments of EUR75,300,316 the total reserves

distributable by way of a dividend as at 30 June 2020 were

EUR176,985,497.

The accompanying notes form an integral part of the condensed

consolidated interim financial statements.

Condensed Consolidated Statement of Cash Flows (unaudited)

For the six months ended 30 June 2021

For the six months ended 30 June For the six months ended 30 June

Note 2021 2020

EUR'000 EUR'000

Net cash flows from operating

activities 16 5,631 10,108

Cash flows from investing

activities

Acquisition of investments 8 (296,672) (66,478)

Investment acquisition costs (2,590) (835)

Repayment of shareholder loan

investments 8 31,097 18,704

------------------------------------ ----- ----------------------------------- ------------------------------------

Net cash flows from investing

activities (268,165) (48,609)

Cash flows from financing

activities

Payment of issue costs (103) (142)

Dividends paid 7 (22,460) (19,060)

Amounts drawn down on loan

facilities 12 360,000 306,000

Amounts repaid on loan facilities 12 (85,000) (240,000)

Finance costs (1,682) (5,854)

------------------------------------ ----- ----------------------------------- ------------------------------------

Net cash flows from financing

activities 250,755 40,944

Net (decrease)/increase in cash and

cash equivalents during the period (11,779) 2,443

Cash and cash equivalents at the

beginning of the period 16,517 6,020

Cash and cash equivalents at the

end of the period 4,738 8,463

------------------------------------ ----- ----------------------------------- ------------------------------------

The accompanying notes form an integral part of the condensed

consolidated interim financial statements.

Notes to the Unaudited Condensed Consolidated Financial Statements

For the six months ended 30 June 2021

1. Significant accounting policies

Basis of accounting

The condensed consolidated nancial statements included in this

Interim Report have been prepared in accordance with IAS 34

"Interim Financial Reporting".

The interim financial statements have been prepared in

accordance with IFRS to the extent that they have been adopted by

the EU and with those parts of the Companies Act 2014 (including

amendments by the Companies (Accounting) Act 2017) applicable to

companies reporting under IFRS. The financial statements have been

prepared on the historical cost basis, as modified for the

measurement of certain financial instruments at fair value through

profit or loss.

These condensed consolidated nancial statements are presented in

Euro ("EUR") which is the currency of the primary economic

environment in which the Group operates and are rounded to the

nearest thousand, unless otherwise stated.

These condensed nancial statements do not include all

information and disclosures required in the annual nancial

statements and should be read in conjunction with the Group's

consolidated annual nancial statements as of 31 December 2020. The

audited annual accounts for the year ended 31 December 2020 have

been delivered to the Companies Registration Office. The audit

report thereon was unmodi ed.

Review

The Interim Report has not been audited or formally reviewed by

the Company's Auditor in accordance with the International

Standards on Auditing (ISAs) (Ireland) or International Standards

on Review Engagements (ISREs).

Going concern

As at 30 June 2021, the Group had net assets of EUR749.1 million

(31 December 2020: EUR748.8 million) and cash balances of EUR4.7

million (31 December 2020: EUR16.5 million) which are sufficient to

meet current obligations as they fall due.

In the period since early 2020 and up to the date of this

report, the outbreak of COVID-19 has had a negative impact on the

global economy. The Directors and Investment Manager continue to

actively monitoring this and the effect on the Group and its SPVs.

In particular, they have considered the following specific key

impacts:

-- Unavailability of key personnel at the Investment Manager or

Administrator;

-- Disruptions to maintenance or repair at the investee company

level; and

-- Allowance for expected counterparty credit losses.

In considering the above key impacts of COVID-19 on the Group

and SPV operations, the Directors have assessed these with

reference to the mitigation measures in place. At the Group level,

the key personnel at the Investment Manager and Administrator have

successfully implemented business continuity plans to ensure

business disruption is minimised, including remote working, and all

staff are continuing to assume their day-today

responsibilities.

SPV revenues are derived from the sale of electricity and is

received through power purchase agreements in place with reputable

providers of electricity to the market and also through government

subsidies. Therefore, the Directors and the Investment Manager do

not expect a significant impact on revenue and cash flows of the

SPVs. The SPVs also have various risk mitigation plans in place to

ensure, as far as possible, electricity generation from the sites

are maintained. The SPVs have contractual operating and maintenance

agreements in place with large and reputable providers. Wind farm

availability has not been significantly affected: wind farms may be

accessed and operated remotely in some instances; otherwise, social

distancing has been possible in large part and personal protective

equipment has been used where not possible, for instance where

major component changes have been necessary. The Investment Manager

is confident that there are appropriate continuity plans in place

at each provider to ensure that the underlying wind farms are

maintained appropriately and that any faults would continue to be

addressed in a timely manner.

Based on the assessment outlined above, including the various

risk mitigation measures in place, the Directors do not consider

that the effects of COVID-19 have created a material uncertainty

over the assessment of the Group as a going concern.

The Directors have reviewed Group forecasts and projections

which cover a period of at least 12 months from the date of

approval of this report, taking into account foreseeable changes in

investment and trading performance, which show that the Group has

sufficient financial resources to continue in operation for at

least the next 12 months from the date of approval of this

report.

On the basis of this review, and after making due enquiries, the

Directors have a reasonable expectation that the Company and the

Group has adequate resources to continue in operational existence

for at least 12 months from the date of approval of this report.

Accordingly, they continue to adopt the going concern basis in

preparing the financial statements.

Segmental reporting

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision-maker.

The chief operating decision-maker, who is responsible for

allocating resources and assessing performance of the operating

segments, has been identified as the Board of Directors, as a

whole.

The key measure of performance used by the Board to assess the

Group's performance and to allocate resources is the total return

on the Group's net assets, as calculated under IFRS, and therefore

no reconciliation is required between the measure of profit or loss

used by the Board and that contained in the condensed consolidated

financial statements.

For management purposes, the Group is organised into one main

operating segment, which invests in wind farm assets.

The Group is engaged in a single segment of business, being

investment in renewable infrastructure to generate investment

returns while preserving capital. The Group presents the business

as a single segment comprising a homogeneous portfolio.

All of the Group's income is generated within Ireland and

France. All of the Group's non-current assets are located in

Ireland and France.

Seasonal and cyclical variations

The Group's results do not vary signi cantly during reporting

periods as a result of seasonal activity.

2. Investment management fees

Under the terms of the Investment Management Agreement, the

Investment Manager is entitled to a management fee from the

Company, which is calculated quarterly in arrears and remains at 1

per cent of NAV per annum on that part of NAV up to and including

EUR1 billion, as disclosed in the Company's Annual Report for the

year ended 31 December 2020.

Investment management fees paid or accrued in the period were as

follows:

For the six For the six

months ended months ended

30 June 2021 30 June 2020

EUR'000 EUR'000

Investment management fees 3,691 3,247

---------------------------- -------------- --------------

3,691 3,247

---------------------------- -------------- --------------

As at 30 June 2021, EUR1,855,028 was payable in relation to

investment management fees (31 December 2020: EUR1,685,383).

3. Return on investments

For the six For the six

months ended months ended

30 June 2021 30 June 2020

EUR'000 EUR'000

Dividends received (note 17) 1,498 8,551

Unrealised movement in fair value of investments (note 8) 25,776 7,226

Interest on shareholder loan investment 5,717 5,979

32,991 21,756

----------------------------------------------------------- -------------- --------------

4. Operating expenses

For the six For the six

months ended months ended

30 June 2021 30 June 2020

EUR'000 EUR'000

Investment management fees (note 2) 3,691 3,247

Other expenses 589 561

Group and SPV administration fees 126 401

Non-executive Directors' remuneration 159 129

Fees to the Company's Auditor:

for audit of the statutory financial statements 37 41

for other services 3 3

---------------------------------------------------- -------------- --------------

4,605 4,382

---------------------------------------------------- -------------- --------------

The fees to the Company's Auditor include EUR3,000 (2020:

EUR3,000) payable in relation to a limited review of these interim

financial statements, and estimated accruals apportioned across the

year for the audit of the statutory financial statements.

5. Taxation

Taxable income during the period was offset by management

expenses and the tax charge for the period ended 30 June 2021 is

EURnil (30 June 2020: EURnil). The Group is not expected to have

tax losses carried forward to offset against current and future

profits as at 30 June 2021 (30 June 2020: EUR399,458).

6. Earnings per share

For the six For the six

months ended months ended

30 June 2021 30 June 2020

Profit attributable to equity holders of the Company - EUR'000 22,715 13,321

Weighted average number of ordinary shares in issue 741,238,938 630,619,469

---------------------------------------------------------------------------- -------------- --------------

Basic and diluted earnings from continuing operations in the period (cent) 3.06 2.11

---------------------------------------------------------------------------- -------------- --------------

7. Dividends declared with respect to the period

Interim dividends paid during the period ended 30 June 2021 Dividend per Total

Share cent Dividend

With respect to the quarter ended 31 December 2020 1.5150 11,230

With respect to the quarter ended 31 March 2021 1.5150 11,230

------------------------------------------------------------- ------------- ----------

3.0300 22,460

------------------------------------------------------------- ------------- ----------

Interim dividends declared after 30 June 2021 and not accrued in the period Dividend per Total

Share cent Dividend

With respect to the quarter ended 30 June 2021 1.5150 11,230

----------------------------------------------------------------------------- ------------- ----------

1.5150 11,230

----------------------------------------------------------------------------- ------------- ----------

As disclosed in note 18, the Board approved a dividend of 1.515

cent per share on 27 August 2021 in relation to the quarter ended

30 June 2021, bringing total dividends declared with respect to the

period to 3.03 cent per share. The record date for the dividend was

30 July 2021 and the payment date was 27 August 2021.

8. Investments at fair value through profit or loss

For the period ended 30 June 2021 Loans Equity interest Total

EUR'000 EUR'000 EUR'000

Opening balance 505,552 438,800 944,352

Additions 256,189 40,483 296,672

Repayment of shareholder loan investments (31,097) - (31,097)

Unrealised movement in fair value of investments (note 3) 1,741 24,035 25,776

----------------------------------------------------------- --------- ---------------- ----------

732,385 503,318 1,235,703

----------------------------------------------------------- --------- ---------------- ----------

For the period ended 30 June 2020 Loans Equity interest Total

EUR'000 EUR'000 EUR'000

Opening balance 435,336 414,771 850,107

Additions 57,182 9,440 66,622

Shareholder loan interest capitalised 1,339 - 1,339

Repayment of shareholder loan investments (18,704) - (18,704)

Unrealised movement in fair value of investments (note 3) 2,160 7,226 9,386

----------------------------------------------------------- --------- ---------------- ---------

477,313 431,437 908,750

----------------------------------------------------------- --------- ---------------- ---------

The unrealised movement in fair value of investments of the

Group during the period was made up as follows:

For the six For the six

months ended months ended

30 June 2021 30 June 2020

EUR'000 EUR'000

Decrease in valuation of investments (18,457) (10,842)

Movement in swap fair values at

SPV level 1,025 129

Repayment of debt at SPV level 8,316 5,266

Loan interest capitalised - (1,339)

Repayment of shareholder loan investments

(note 17) 31,097 18,704

Movement in cash balances of SPVs 1,205 (3,367)

Acquisition costs 2,590 835

------------------------------------------- -------------- --------------

25,776 9,386

------------------------------------------- -------------- --------------

Fair value measurements

As disclosed in the Company's Annual Report for the year ended

31 December 2020, IFRS 13 "Fair Value Measurement" requires

disclosure of fair value measurement by level. The level of fair

value hierarchy within the financial assets or financial

liabilities ranges from level 1 to level 3 and is determined on the

basis of the lowest level input that is significant to the fair

value measurement.

The fair value of the Group's investments is ultimately

determined by the underlying fair values of the SPV investments.

Due to their nature, they are always expected to be classified as

level 3, as the investments are not traded and contain unobservable

inputs. There have been no transfers between levels during the six

months ended 30 June 2021. All other financial instruments are

classified as level 2.

Sensitivity analysis

The fair value of the Group's investments is EUR1,235,703,017

(31 December 2020: EUR944,352,444). The following analysis is

provided to illustrate the sensitivity of the fair value of

investments to a change in an individual input, while all other

variables remain constant. The Board considers these changes in

inputs to be within reasonable expected ranges. This is not

intended to imply the likelihood of change or that possible changes

in value would be restricted to this range.

Change in fair value of

Input Base case Change in input investments Change in NAV per share

EUR'000 cent

Discount rate 6 - 7 per cent + 0.25 per cent (22,718) (3.1)

- 0.25 per cent 23,500 3.2

Energy yield P50 10 year P90 (61,208) (8.3)

10 year P10 60,895 8.2

Forecast by leading

Power price consultant - 10 per cent (61,843) (8.3)

+ 10 per cent 62,664 8.5

Inflation rate 2.0 per cent - 0.5 per cent (44,036) (5.9)

+ 0.5 per cent 48,954 6.6

Asset Life 30 years - 5 years (95,911) (12.9)

+ 5 years 65,150 8.8

-------------------------------------------------------------- -------------------------- ------------------------

The sensitivities above are assumed to be independent of each

other. Combined sensitivities are not presented.

9. Unconsolidated subsidiaries, associates and joint

ventures

The following table shows subsidiaries of the Group acquired

during the period. As the Company is regarded as an investment

entity under IFRS, these subsidiaries have not been consolidated in

the preparation of the financial statements:

Ownership Interest as at

Investment Place of Business Registered Office 30 June 2021

Riverside One, Sir John

Cordal Ireland Rogerson's Quay, Dublin 2 100%

Riverside One, Sir John

Glencarbry Ireland Rogerson's Quay, Dublin 2 100%

There are no changes to unconsolidated subsidiaries of the Group

and there is no changes to associates and joint venture of the

group as disclosed in the Company's Annual Report for the year

ended 31 December 2020.

There have been no changes to security deposits or guarantees as

disclosed in the Company's Annual Report for the year ended 31

December 2020.

10. Receivables

30 June 2021 31 December 2020

EUR'000 EUR'000

Accrued income 233 3,774

Sundry receivables 22 218

VAT receivable 13 58

Prepayments 71 45

339 4,095

------------------------------------ ------------- -----------------

11. Payables

30 June 2021 31 December 2020

EUR'000 EUR'000

Investment management fees payable 1,855 1,685

Acquisition costs payable 1,151 1,389

Other payables 2,106 1,325

Loan interest payable 724 556

Commitment fee payable 61 224

Share issue costs payable - 157

Other finance costs payable - 7

5,897 5,343

------------------------------------ ------------- -----------------

12. Loans and borrowings

30 June 2021 31 December 2020

EUR'000 EUR'000

Opening balance 210,808 206,000

Revolving Credit Facility

Drawdowns 285,000 362,074

Repayments (85,000) (553,074)

Finance costs capitalised (246) (2,897)

Amortisation 725 725

Term debt facilities

Drawdowns 75,000 200,000

Finance costs capitalised (616) (2,120)

Amortisation 100 100

Closing balance 485,771 210,808

----------------------------- --------- -----------------

Non current liabilities 485,771 210,808

----------------------------- --------- -----------------

For the six For the six

months ended months ended

30 June 2021 30 June 2020

EUR'000 EUR'000

Loan interest 1,820 1,562

Professional fees 441 1,164

Commitment fees 382 293

Facility arrangement fees 719 238

--------------------------- -------------- --------------

Finance expense 3,362 3,257

--------------------------- -------------- --------------

As at 30 June 2021, the principal balance of the RCF was

EUR215,000,000 (31 December 2020: EUR15,000,000), accrued interest

was EUR13,294 (31 December 2020: EUR5,284) and the outstanding

commitment fee was EUR61,046 (31 December 2020: EUR223,662).

In April 2021, the Group increased the 5-year term debt

arrangements adding ING into the banking syndicate. Details of the

Group's term debt facilities and associated interest rate swaps are

set out in the below table:

Provider

CBA 7 October 2025 1.55 (0.399) 75,000 206

ING 7 October 2025 1.55 (0.300) 75,000 160

NAB 7 October 2025 1.55 (0.399) 75,000 206

Natwest 7 October 2025 1.55 (0.396) 50,000 138

========== ================ ===== ======== ======== ====

275,000 710

=========================== ===== ======== ======== ====

These loans contain swaps that are contractually linked.

Accordingly, they have been treated as single fixed rate loan

agreements, which effectively set interest payable at fixed

rates.

All borrowing ranks pari passu with a debenture over the assets

of Holdco 1 and Holdco 2 and a floating charge over Holdco 1 and

Holdco 2's bank accounts.

13. Contingencies & Commitments

At the time of acquisition, wind farms which had less than 12

months' operational data may have a wind energy true-up applied,

whereby the purchase price for these wind farms may be adjusted so

that it is typically based on a 2-year operational record, once

operational data has become available.

The following wind energy true-ups remain outstanding and the

maximum adjustments are as follows: Letteragh: EUR2,500,000.

In December 2020, the Group entered into an agreement to acquire

the Cloghan and Taghart wind farms for a headline consideration of

EUR123 million. The investment is scheduled to complete in late

2022 once the wind farms are fully operational.

In February 2021, the Group entered into an agreement to acquire

the Kokkoneva wind farm for headline consideration of EUR60

million. The investment is scheduled to complete in Q2, 2022 once

the wind farm is fully operational.

14. Share capital - ordinary shares

At 30 June 2021, the Company had authorised share capital of

2,000,000,000 ordinary shares of EUR0.01 each.

Date Issued and fully paid Number of shares issued Share capital Share premium Total

EUR'000 EUR'000 EUR'000

1 January 2021 Opening balance 741,238,938 7,412 507,476 514,888

Issues costs paid

during the period - - 44 44

30 June 2021 741,238,938 7,412 507,520 514,932

----------------------------------------- ------------------------ -------------- -------------- --------

Shareholders are entitled to all dividends paid by the Company

and, on a winding up, provided the Company has satisfied all of its

liabilities, the Shareholders are entitled to all of the residual

assets of the Company.

15. Net assets per share

30 June 2021 31 December 2020

Net assets - EUR'000 749,112 748,813

Number of ordinary shares issued 741,238,938 741,238,938

---------------------------------- ------------- -----------------

Total net assets - cent 101.1 101.0

---------------------------------- ------------- -----------------

16. Reconciliation of operating profit for the period to net

cash from operating activities

For the six months ended For the six months ended

30 June 2021 30 June 2020

EUR'000 EUR'000

Operating profit for the period 26,077 16,578

Adjustments for:

Unrealised movement in fair value of investments (note 8) (25,776) (7,226)

Investment acquisition costs 2,309 835

Loan interest capitalised - (1,339)

Finance costs capitalised (862) -

Amortisation of finance costs 825 -

Decrease in receivables 3,756 812

(Decrease)/Increase in payables (698) 448

----------------------------------------------------------- ------------------------- -------------------------

Net cash flows from operating activities 5,631 10,108

----------------------------------------------------------- ------------------------- -------------------------

17. Related party transactions

During the period, Holdco made repayments of EUR17,200,000 (30

June 2020: EUR18,150,000) . During the period, the Company also

received shareholder loan repayments from Knockacummer of

EUR4,155,069 (30 June 2020: EUR1,994,445) and Killhills of

EUR1,100,000 (30 June 2020: EUR573,187).

The below table shows the Group's dividend and management fee

income:

For the six months ending 30 June 2021 For the six months ending 30 June 2020

Management Management

Fee income Dividend Income Fee income Dividend Income

EUR000 EUR000 EUR000 EUR000

Cloosh Valley - - - 5,028

Ballybane - - 13 2,750

Beam Hill - - - 773

Knocknalour - 248 - -

Knockacummer - - 13 -

Killhills - - 13 -

Gortahile - 750 - -

Raheenleagh - 500 - -

- 1,498 39 8,551

--------------- ----------------- ---------------------- ----------------- ----------------------

The table below shows the Group's shareholder loans with the

wind farm investments

Loans Loans Loan Loan Loans Accrued Total 2021

at 1 advanced interest Repayments at 30 interest interest

January in the capitalised June 2021 at 30 on

2021(1) period in the June shareholder

period 2021 loan

investment

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

Knockacummer 116,502 - - (5,024) 111,478 528 112,006 1,206

Monaincha 65,274 - - (1,800) 63,474 219 63,693 503

Glanaruddery 48,033 - - (1,700) 46,333 158 46,491 365

Ballybane 39,108 - - (3,300) 35,808 123 35,931 287

Killala 26,706 - - (450) 26,256 126 26,382 359

Letteragh 25,350 - - (150) 25,200 341 25,541 316

Killhills 25,071 - - (2,100) 22,971 45 23,016 34

An Cnoc 17,547 - - (400) 17,147 59 19,060 135

Kostroma 16,577 1,854 - - 18,431 65 16,642 142

Gortahile 16,339 - - (699) 15,640 53 15,693 122

Tullynamoyle

II 14,511 - - (150) 14,361 49 14,410 111

Garranereagh 13,733 - - (500) 13,233 42 13,275 97

Carrickallen 13,498 - - (500) 12,998 89 13,087 205

Sommette 12,607 - - - 12,607 694 13,301 287

Lisdowney 10,623 - - (1,020) 9,603 49 9,652 116

Beam Hill

Extension 9,140 - - - 9,140 112 9,252 71

Pasilly 8,870 - - (150) 8,720 264 8,984 202

Cloosh Valley 7,015 - - (2,441) 4,574 - 4,574

Sliabh Bawn 6,879 - - (713) 6,166 55 6,221 21

Knocknalour 5,795 - - - 5,795 32 5,827 73

Saint Martin 3,543 - - - 3,543 178 3,721 74

Cordal - 179,501 - (10,000) 169,501 895 170,396 687

Glencarbry - 73,264 - - 73,264 374 73,638 287

Killala

Battery - 1,570 - - 1,570 22 1,592 17

502,721 256,189 - (31,097) 727,813 4,572 732,385 5,717

-------------- --------- ---------- ------------- ------------- ----------- ---------- --------- -------------

(1) Excludes accrued interest at 31 December 2020 of EUR2,831 .

18. Subsequent events

On 27 August 2021, the Board approved a dividend of

EUR11.2million, equivalent to 1.515 cent per share in relation to

the quarter ended 30 June 2021. The record date for the dividend

was 30 July 2021 and the payment date was 27 August 2021.

The Group entered into a new seven-year term facility with a

long-term institutional lender on favourable terms, which provides

the Group with an additional EUR150 million to be utilised in the

second half of 2021.

19. Board approval

The Group's Interim Report and Financial Statements were

approved by the Board of Directors on 12 September 2021.

Company Information

Directors (all non-executive) Registered Company Number

Rónán Murphy 598470

Emer Gilvarry

Kevin McNamara

Marco Graziano Registered Office

Riverside One

Investment Manager Sir John Rogerson's Quay

Greencoat Capital LLP Dublin 2

4(th) Floor The Peak

5 Wilton Road

London SW1V 1AN Registered Auditor

BDO

Beaux Lane House

Company Secretary Mercer Street Lower

Ocorian Administration (UK) Limited Dublin 2

(formerly Estera Administration (UK) Limited)

Unit 18 Innovation Centre

Northern Ireland Science Park Legal Advisers

Queens Road McCann Fitzgerald

Belfast BT3 9DT Riverside One

Sir John Rogerson's Quay

Administrator Dublin 2

Northern Trust International Fund

Administration Services (Ireland) Limited

54-62 Townsend Street Euronext Growth Advisor, NOMAD

Dublin 2 and Broker

J&E Davy

Davy House

Depositary 49 Dawson Street

Northern Trust International Fiduciary Dublin 2

Services (Ireland) Limited

Georges Court Account Banks

54-62 Townsend Street Allied Irish Banks plc.

Dublin 2 40/41 Westmoreland Street

Dublin 2

Registrar Northern Trust International Fiduciary

Computershare Investor Services Services (Ireland) Limited

(Ireland) Limited Georges Court

3100 Lake Drive 56-62 Townsend Street

Citywest Business Campus Dublin 2

Dublin 24

Defined Terms

Admission Document means the Admission Document of the Company

published on 31 December 2019

Aggregate Group Debt means the Group's proportionate share of

outstanding third party debt.

AIB means Allied Irish Bank plc

AIC means the Association of Investment Companies

AIC Code of Corporate Governance sets out a framework of best

practice in respect of the governance of investment companies. It

has been endorsed by the Financial Reporting Council as an

alternative means for our members to meet their obligations in

relation to the UK Corporate Governance Code

AIC Guide means the AIC's Corporate Governance Guide for

Investment Companies

AIF means Alternative Investment Funds (as defined in AIFMD)

AIFM means Alternative Investment Fund Manager (as defined in

AIFMD)

AIFMD means Alternative Investment Fund Managers Directive

AGM means Annual General Meeting of the Company

An Cnoc means Cnoc Windfarms Limited

Ballybane means Ballybane Windfarms Limited

BDO means the Company's Auditor as at the reporting date

Beam Hill means Beam Wind Limited

Beam Hill Extension means Meenaward Wind Farm Limited

Brexit mean the withdrawal of the United Kingdom from the

European Union

Board means the Directors of the Company

Carrickallen means Carrickallen Wind Farm

CBA means Commonwealth Bank of Australia

Cloosh Valley means Cloosh Valley Wind Farm Holdings DAC and

Cloosh Valley Wind Farm DAC

Company means Greencoat Renewables PLC

Cordal means Cordal Windfarm Holdings Limited, Oak Energy Supply

Limited and Cordal Windfarms Limited

CBI means the Central Bank of Ireland

CDP means Carbon Disclosure Project

CFD means Contract for Difference

CIBC means Canadian Imperial Bank of Commerce

CPI means Consumer Price Index

DCF means Discounted Cash Flow

DS3 means Delivering a Secure, Sustainable Electricity

System

EGM means Extraordinary General Meeting of the Company

ESG means the Environmental, Social and Governance

EU means the European Union

Euronext means the Euronext Dublin, formerly the Irish Stock

Exchange

EURIBOR means the Euro Interbank Offered Rate

Eurozone means the area comprising 19 of the 28 Member States

which have adopted the euro as their common currency and sole legal

tender

FCA means Financial Conduct Authority

FIT means Feed-In Tariff

FRC means Financial Reporting Council

GAV means Gross Asset Value as defined in the Admission

Document

Garranereagh means Sigatoka Limited

Glanaruddery means Glanaruddery Windfarms Limited and

Glanaruddery Energy Supply Limited

Glencarbry means Glencarbry Windfarm Limited

Gortahile means Gortahile Windfarm Limited

Group means Greencoat Renewables PLC, Holdco and, Holdco 2

Holdco means GR Wind Farms 1 Limited

Holdco 1 means Greencoat Renewables 1 Holdings Limited

Holdco 2 means Greencoat Renewables 2 Holdings Limited

IAS means International Accounting Standards

IFRS means International Financial Reporting Standards

ING means ING Bank N.V.

Investment Management Agreement means the agreement between the

Company and the Investment Manager

Investment Manager means Greencoat Capital LLP

IPEV means the International Private Equity and Venture Capital

Valuation Guidelines

IPO means Initial Public Offering

Irish Corporate Governance Annex is a corporate governance annex

addressed to companies with a primary equity listing on the Main

Securities Market of Euronext

IRR means internal rate of return

I-SEM means the Integrated Single Electricity Market, which is

the wholesale electricity market arrangement for Ireland and

Northern Ireland

Killala means Killala Community Wind Farm DAC

Killhills means Killhills Windfarm Limited

Knockacummer means Knockacummer Wind Farm Limited

Knocknalour means Knocknalour Wind Farm Holdings Limited and

Knocknalour Wind Farm Limited

Kostroma Holdings means Kostroma Holdings Limited

Letteragh means Seahound Wind Developments Limited

Lisdowney means Lisdowney Wind Farm Limited

Monaincha means Monaincha Wind Farm Limited

NAB means National Australia Bank

Natwest means National Westminster Bank

NAV means Net Asset Value as defined in the Admission

Document

NAV per Share means the Net Asset Value per Ordinary Share

NOMAD means a company that has been approved as a nominated

advisor for the Alternative Investment Market (AIM), by Euronext

Dublin and London Stock Exchange

O&M means operations and maintenance

Pasilly means Société d'Exploitation du Parc Eolien du

Tonnerois

PPA means Power Purchase Agreement entered into by the Group's

wind farms

PSO means Public Support Obligation

Raheenleagh means Raheenleagh Power DAC

RBC means Royal Bank of Canada

RCF means the Group's Revolving Credit Facility

REFIT means Renewable Energy Feed-In Tariff

RESS means Renewable Energy Support Scheme

Review Section means the front end review section of this report

(including but not limited to the Chairman's Statement and the

Investment Manager's Report)

Santander means Abbey National Treasury Services Plc (trading as

Santander Global Corporate Banking)

SEM means the Single Electricity Market, which is the wholesale

electricity market operating in the Republic of Ireland and

Northern Ireland

SFDR means Sustainable Finance Disclosure Regulation