TIDMGRP

RNS Number : 4478P

Greencoat Renewables PLC

19 October 2021

THIS ANNOUNCEMENT IS NOT FOR RELEASE, PUBLICATION OR

DISTRIBUTION IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, BY ANY

MEANS OR MEDIA, IN OR INTO OR FROM THE UNITED STATES (OR TO ANY US

PERSONS), CANADA, AUSTRALIA, NEW ZEALAND OR JAPAN, ANY MEMBER STATE

OF THE EUROPEAN ECONOMIC AREA (OTHER THAN IRELAND, THE NETHERLANDS,

OR SWEDEN (TOGETHER "ELIGIBLE MEMBER STATES), AND THEN, ONLY TO

PERSONS IN ELIGIBLE MEMBER STATES WHO ARE NOT RETAIL INVESTORS),

THE UNITED KINGDOM (OTHER THAN TO PERSONS IN THE UNITED KINGDOM WHO

ARE NOT RETAIL INVESTORS) OR ANY OTHER JURISDICTION IN WHICH

RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

ITSELF CONSTITUTE AN OFFER FOR SALE OR SUBSCRIPTION OF ANY

SECURITIES IN THE COMPANY.

19 October 2021

Greencoat Renewables PLC

Result of Initial Placing

Greencoat Renewables PLC raises gross proceeds of EUR 165

million in oversubscribed Initial Placing

19 October 2021 | Greencoat Renewables PLC ("Greencoat

Renewables" or the "Company"), the renewable infrastructure

company, invested in euro-denominated assets, is pleased to

announce the result of the Initial Placing launched on 4 October

2021.

Highlights of the Initial Placing:

- Gross proceeds of EUR 165 million in an oversubscribed placing;

- 148,648,649 Placing Shares will be issued (conditional on,

inter alia, shareholder approval at the EGM convened to be held on

28 October 2021), at the Placing Price of EUR1.11 per Placing

Share, increasing the total

issued share capital of the Company to 889,887,587 Ordinary Shares;

- The Placing Shares to be issued represent approximately 20 %

of the Company's existing issued Ordinary Share capital prior to

the Initial Placing;

- The Company has multiple attractive near-term investment

opportunities under consideration in both wind and solar assets in

Ireland and continental European markets with c.300MW under

exclusivity across a mix of operating and forward sale

opportunities located in Ireland, the Nordics and Spain, as well as

over 350MW of other pipeline opportunities; and

- Net proceeds will be used, in line with the Company's

strategy, to partly pay down the Company's Revolving Credit

Facility, which is currently drawn by EUR115 million, provide the

Company with the flexibility to execute on assets under

exclusivity, provide optionality around the assets at advanced

stages of negotiation, and meet obligations under committed forward

sale investments, all while maintaining gearing (currently 48 % and

falling to 37% on a pro forma basis fo llowing receipt of the net

proceeds of the I nitial P lacing ).

Rónán Murphy, Chairman of Greencoat Renewables, commented:

"I am pleased to announce another successful and oversubscribed

placing, and I thank shareholders for their ongoing strong support.

The company is well positioned in terms of pipeline, gearing and

headroom for acquisitions, and I am very optimistic about our

prospects for near and medium term growth across Europe."

The Initial Placing is conditional on, inter alia, shareholder

approval at the EGM to be held on 28 October 2021. The EGM will be

held at Davy House, 49 Dawson Street, Dublin 2, Ireland on 28

October 2021 at 10.00 a.m. Further details are set out in the

Circular which was posted to Shareholders on 4 October 2021 and is

available on the Company's website

http://www.greencoat-renewables.com/ .

The Company will apply to Euronext Dublin and to the London

Stock Exchange for the Placing Shares to be admitted to trading on

Euronext Growth and AIM respectively. It is expected that

settlement of the Placing Shares will occur, Admission will become

effective and that dealings will commence in the Placing Shares at

8.00 a.m. on 29 October 2021.

Rónán Murphy, who is a Director, has agreed to subscribe for

25,000 Placing Shares, so that following completion of the Initial

Placing, he will hold 217,694 Ordinary Shares representing c. 0.02

% of the enlarged issued Ordinary Share capital of the Company.

Kevin McNamara, who is a Director, has agreed to subscribe for

10,000 Placing Shares, so that following completion of the Initial

Placing, he will hold 78,327 Ordinary Shares, representing c. 0.01

% of the enlarged issued Ordinary Share capital of the Company.

Emer Gilvarry, who is a Director, has agreed to subscribe for

32,168 Placing Shares, so that following completion of the Initial

Placing, she will hold 100,000 Ordinary Shares, representing c.

0.01 % of the enlarged issued Ordinary Share capital of the

Company.

Capitalised terms not defined in this Announcement shall have

the meaning given to them in the announcement made by the Company

at 7 .00 a.m. on 4 October 2021 .

For further information on the Announcement, please contact:

Greencoat Renewables PLC: +44 20 7832 9400

Bertrand Gautier

Paul O'Donnell

Tom Rayner

Davy (Joint Bookrunner, Nomad and Euronext Growth Adviser) +353 1 679 6363

Ronan Veale

Barry Murphy

RBC (Joint Bookrunner) +44 20 7653 4000

Matthew Coakes

Duncan Smith

Elizabeth Evans

FTI Consulting (Media Enquiries) +353 1 765 0886

Jonathan Neilan

Melanie Farrell

AIFMD Disclosures

The Company is categorised as an externally managed alternative

investment fund for the purposes of the Alternative Investment Fund

Managers Directive (Directive 2011/61/EU) ("AIFMD"). The attention

of all Shareholders and any prospective investors in the Company,

through the Share Issuance Programme or otherwise, is drawn to

those disclosures required to be made under AIFMD from time to time

and which are available on the Company's website:

http://www.greencoat-renewables.com/investors/disclosures/aifmd

About Greencoat Renewables PLC

Greencoat Renewables PLC is an investor in euro-denominated

renewable energy infrastructure assets. Initially focused solely on

the acquisition and management of operating wind farms in Ireland,

the Company is now also investing in wind and solar assets in

certain other European countries with stable and robust renewable

energy frameworks. It is managed by Greencoat Capital LLP, an

experienced investment manager in the listed renewable energy

infrastructure sector.

For more information about Greencoat Renewables PLC, please

visit http://www.greencoat-renewables.com/

For more information about Greencoat Capital LLP, please visit

http://www.greencoat-capital.com

IMPORTANT NOTICE

This Announcement and the information contained herein is not

for release, publication or distribution, directly or indirectly,

in whole or in part, in or into or from the United States, Canada,

Australia, New Zealand, Japan or any other jurisdiction where to do

so might constitute a violation of the relevant laws or regulations

of such jurisdiction.

The Placing Shares have not been and will not be registered

under the Securities Act or under the securities laws of any state

or other jurisdiction of the United States and may not be offered,

sold, resold or delivered, directly or indirectly, in or into the

United States absent registration except pursuant to an exemption

from or in a transaction not subject to the registration

requirements of the Securities Act.

Persons (including, without limitation, nominees and trustees)

who have a contractual or other legal obligation to forward a copy

of this Announcement should seek appropriate advice before taking

any action.

This Announcement has been issued by and is the sole

responsibility of the Company. Neither the Joint Bookrunners, nor

any of their respective affiliates accept any responsibility

whatsoever for the contents of the information contained in this

Announcement or for any other statement made or purported to be

made by or on behalf of the Joint Bookrunners or any of their

respective affiliates in connection with the Company, the Placing

Shares or the Share Issuance Programme. The Joint Bookrunners and

each of their respective affiliates accordingly disclaim all and

any liability, whether arising in tort, contract or otherwise in

respect of any statements or other information contained in this

Announcement and no representation or warranty, express or implied,

is made by the Joint Bookrunners or any of their respective

affiliates as to the accuracy, completeness or sufficiency of the

information contained in this Announcement.

Certain statements in this Announcement are forward-looking

statements which are based on the Company's expectations,

intentions and projections regarding its future performance,

anticipated events or trends and other matters that are not

historical facts. These forward-looking statements, which may use

words such as "aim", "anticipate", "believe", "intend", "estimate",

"expect" and words of similar meaning, include all matters that are

not historical facts. These forward-looking statements involve

risks, assumptions and uncertainties that could cause the actual

results of operations, financial condition, liquidity and dividend

policy and the development of the industries in which the Company's

businesses operate to differ materially from the impression created

by the forward-looking statements. These statements are not

guarantees of future performance and are subject to known and

unknown risks, uncertainties and other factors that could cause

actual results to differ materially from those expressed or implied

by such forward-looking statements. Given those risks and

uncertainties, prospective investors are cautioned not to place

undue reliance on forward-looking statements. Forward-looking

statements speak only as of the date of such statements and, except

as required by Euronext Dublin, the London Stock Exchange or

applicable law, the Company undertakes no obligation to update or

revise publicly any forward-looking statements, whether as

a result of new information, future events or otherwise.

This Announcement does not identify or suggest, or purport to

identify or suggest, the risks (direct or indirect) that may be

associated with an investment in the Placing Shares. Any indication

in this Announcement of the price at which the ordinary shares of

the Company have been bought or sold in the past cannot be relied

upon as a guide to future performance. The contents of this

Announcement are not to be construed as legal, business, financial

or tax advice. Each investor or prospective investor should consult

their own independent legal adviser, business adviser, financial

adviser or tax advisor for legal, business, financial or tax

advice. No statement in this Announcement is intended to be a

profit forecast and no statement in this Announcement should be

interpreted to mean that earnings per share of the Company for the

current or future financial years would necessarily match or exceed

the historical published earnings per share of the Company.

Davy, which is regulated in Ireland by the Central Bank of

Ireland is acting as a Joint Bookrunner for the Company and no-one

else in connection with the Initial Placing and is not, and will

not be, responsible to anyone other than the Company for providing

the protections afforded to its clients nor for providing advice in

relation to the Initial Placing and/or any other matter referred to

in this Announcement.

RBC, which is authorised in the United Kingdom by the Prudential

Regulatory Authority and regulated by the FCA and the Prudential

Regulatory Authority, which is authorised and regulated in the

United Kingdom by the FCA is acting for the Company and for no one

else in connection with Initial Placing and is not, and will not

be, responsible to anyone other than the Company for providing the

protections afforded to its clients nor for providing advice in

relation to the Initial Placing and/or any other matter referred to

in this Announcement.

The Placing Shares to be issued pursuant to the Initial Placing

will not be admitted to trading on any stock exchange other than

AIM and Euronext Growth.

Neither the content of the Company's website (or any other

website) nor the content of any website accessible from hyperlinks

on the Company's website (or any other website) is incorporated

into, or forms part of, this Announcement.

Information to Distributors

Solely for the purposes of the product governance requirements

contained within: (a) EU Directive 2014/65/EU on markets in

financial instruments, as amended ("MiFID II"); (b) Articles 9 and

10 of Commission Delegated Directive (EU) 2017/593 supplementing

MiFID II; and (c) local implementing measures (together, the "MiFID

II Product Governance Requirements"), and the product governance

requirements contained within Chapter 3 of the FCA Handbook Product

Intervention and Product Governance Sourcebook (the "UK Product

Governance Requirements") and disclaiming all and any liability,

whether arising in tort, contract or otherwise, which any

"manufacturer" (for the purposes of the MiFID Product Governance

Requirements and UK Product Governance Requirements) may otherwise

have with respect thereto, the Placing Shares have been subject to

a product approval process, which has determined that the Placing

Shares are: (i) compatible with an end target market of investors

who meet the criteria of professional clients as defined in MiFID

II and Regulation (EU) NO 600/2014 as it forms part of United

Kingdom domestic law by virtue of the EUWA; (ii) eligible

counterparties, as defined in MiFID II and the FCA's Conduct of

Business Sourcebook ("COBS") and (iii) eligible for distribution

through all distribution channels as are permitted by MiFID II and

the UK Product Governance Requirements (the "Target Market

Assessment").

Notwithstanding the Target Market Assessment, Distributors

should note that: the price of the Placing Shares may decline and

investors could lose all or part of their investment; the Placing

Shares offer no guaranteed income and no capital protection; and an

investment in the Placing Shares is compatible only with investors

who do not need a guaranteed income or capital protection, who

(either alone or in conjunction with an appropriate financial or

other adviser) are capable of evaluating the merits and risks of

such an investment and who have sufficient resources to be able to

bear any losses that may result therefrom. The Target Market

Assessment is without prejudice to the requirements of any

contractual, legal or regulatory selling restrictions in relation

to the Initial Placing. Furthermore, it is noted that,

notwithstanding the Target Market Assessment, the Joint Bookrunners

will only procure investors who meet the criteria of professional

clients and eligible counterparties.

For the avoidance of doubt, the Target Market Assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of MiFID II or COBS; or (b) a recommendation to

any investor or group of investors to invest in, or purchase, or

take any other action whatsoever with respect to the Placing

Shares.

Each Distributor is responsible for undertaking its own target

market assessment in respect of the Placing Shares and determining

appropriate distribution channels.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROIVVLFFFBLLFBQ

(END) Dow Jones Newswires

October 19, 2021 02:00 ET (06:00 GMT)

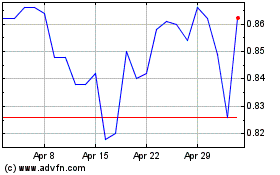

Greencoat Renewables (LSE:GRP)

Historical Stock Chart

From Mar 2024 to Apr 2024

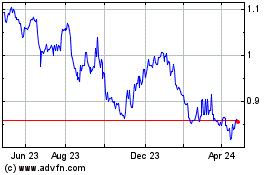

Greencoat Renewables (LSE:GRP)

Historical Stock Chart

From Apr 2023 to Apr 2024