TIDMGSF

RNS Number : 3106G

Gore Street Energy Storage Fund PLC

29 March 2022

THIS ANNOUNCEMENT, AND THE INFORMATION CONTAINED IN IT, IS NOT

FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART,

DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES, AUSTRALIA,

CANADA, JAPAN, SOUTH AFRICA OR ANY OTHER JURISDICTION IN WHICH THE

SAME WOULD BE UNLAWFUL OR RESTRICTED BY LAW.

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED TO

CONSTITUTE INSIDE INFORMATION AS STIPULATED UNDER THE UK'S MARKET

ABUSE REGULATION. UPON THE PUBLICATION OF THIS ANNOUNCEMENT, THIS

INSIDE INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC

DOMAIN.

This announcement is an advertisement for the purposes of the

Prospectus Regulation Rules of the UK Financial Conduct Authority

("FCA") and does not constitute a prospectus. Investors must

subscribe for or purchase any shares referred to in this

announcement only on the basis of information contained in the

prospectus to be published by Gore Street Energy Storage Fund plc

(the "Prospectus") and not in reliance on this announcement. A copy

of the Prospectus, once published, will be available on the

Company's website ( www.gsenergystoragefund.com ). No information

set out in this announcement is intended to form the basis of any

contract of sale, investment decision or any decision to purchase

shares in the Company. Approval of the Prospectus by the FCA should

not be understood as an endorsement of the securities that are the

subject of the Prospectus. Potential investors are recommended to

read the Prospectus before making an investment decision in order

to fully understand the potential risks and rewards associated with

a decision to invest in the Company's securities. This announcement

does not constitute, and may not be construed as, an offer to sell

or an invitation or recommendation to purchase, sell or subscribe

for any securities or investments of any description, or a

recommendation regarding the issue or the provision of investment

advice by any party .

29 March 2022

Gore Street Energy Storage Fund plc

(the "Company" or "Gore Street")

Proposed Placing, Offer for Subscription and Intermediaries

Offer

Gearing Policy Clarification

Gore Street, London's first listed energy storage fund

supporting the transition to low carbon power, is pleased to

announce that further to its announcement on 22 March 2022, the

Company is proposing to raise GBP75 million, via the issue of

68,181,818 new Ordinary Shares , at a price of 110 pence per

Ordinary Share (the "Issue Price"), by way of an Initial Placing,

Initial Offer for Subscription and Initial Intermediaries Offer

(the "Initial Issue"). The Initial Issue could be upscaled subject

to demand and Board discretion.

Any capitalised terms used but not otherwise defined in this

announcement have the meaning set out in the Prospectus.

Initial Issue highlights

-- The Issue Price represents:

o a discount of approximately 5.98% to the closing share price

of 117 pence per Ordinary Share on Monday 21 March 2022 (prior to

announcement of the Initial Issue and Share Issuance

Programme),

o a discount of approximately 4.35% to the closing share price

of 115 pence per Ordinary Share on Monday 28 March 2022, and

o a premium of approximately 5.87% to the last reported NAV of

103.9 pence per Ordinary Share as at 31 December 2021.

-- The net proceeds of the Initial Issue will be used to acquire

and construct new projects in the Company's pipeline. The

Investment Manager has identified a pipeline of investments with a

total project size of over 1.3 GW in the UK and internationally,

offering additional geographical portfolio diversification.

-- Investors in the Initial Issue are expected to benefit from

an attractive level of dividend income and the prospects of capital

appreciation over the long term, expected to be delivered with low

volatility and uncorrelated to other asset classes.

-- The Initial Issue includes an intermediaries offer to enable

retail investor participation. Details on how to invest and the

participating intermediaries are outlined on the Company's website:

www.gsenergystoragefund.com

-- The Initial Issue will be managed and conducted by the

Company's Joint Corporate Brokers and Joint Bookrunners Shore

Capital and J.P. Morgan Securities plc (which conducts its UK

investment banking business as J.P. Morgan Cazenove) .

Prospectus publication and Share Issuance Programme

Following the Initial Issue, the Directors intend to implement a

programme of subsequent issues of up to 750 million Ordinary Shares

and/or C Shares (less the number of Ordinary Shares issued pursuant

to the Initial Issue) to raise capital for further investment (the

"Share Issuance Programme", each a "Subsequent Issue").

The prospectus (the "Prospectus") relating to the Initial Issue

and the Share Issuance Programme is expected to be published

shortly.

The Directors have reserved the right, in conjunction with the

Joint Bookrunners, to increase the size of the Initial Issue to a

maximum of 136,363,636 Ordinary Shares if overall demand exceeds

68,181,818 Ordinary Shares, with any increase being announced

through a Regulatory Information Service.

The Initial Issue is conditional on, amongst other things, the

approval of the Company's shareholders ("Shareholders") at a

general meeting to be held at 11am BST on 11 April 2022 (the

"General Meeting"), details of which were set out in the circular

published by the Company on 22 March 2022.

Expected Timetable of Initial Issue

Initial Issue opens 29 March 2022

Latest time and date for receipt of 3.00 p.m. on 11 April

completed applications from Intermediaries 2022

in respect of the Initial Intermediaries

Offer

Latest time and date for receipt of 11.00 a.m. on 12 April

completed Application Forms in respect 2022

of the Initial Offer for Subscription

Latest time and date for commitments 11.00 a.m. on 12 April

under the Initial Placing 2022

Publication of results of the Initial 12 April 2022

Issue

Initial Admission and dealings in Ordinary 8.00 a.m. on 14 April

Shares commence 2022

CREST accounts credited with uncertificated 14 April 2022

Ordinary Shares

Where applicable, definitive share certificates Within ten Business

despatched by post* Days of Initial Admission

Other Dates 2022

General Meeting 11.00 a.m. on 11 April

*The dates and times specified above are references to London

times and are subject to change, in which event details of the new

times and dates will be notified, as required, through an RIS.

Dealing Codes

The dealing codes for the Ordinary Shares are as follows:

ISIN GB00BG0P0V73

SEDOL BG0P0V7

Ticker GSF

Alex O'Cinneide, CEO of Gore Street Capital, the Company's

Investment Manager, commented:

"As predicted since Gore Street's IPO in 2018, the demand for

energy storage has continued to grow exponentially in the UK,

Ireland and internationally. The importance of energy security and

the need to rapidly de-carbonise global economies is more important

than ever before. Reflecting these trends, we are screening and

executing ever larger transactions and have now built a portfolio

with an aggregated capacity of over 700 MW.

Having closely analysed markets in North America and Western

Europe over a number of years, we are delighted to have recently

made our first investments in Germany and Texas, a transformative

milestone for the growth and diversification of the Company's

portfolio. These more nascent markets offer significant potential

for growth opportunities but also provide complementary revenue

streams to those received from our assets in the UK and Ireland.

These assets, along with the rest of Gore Street's portfolio, also

deliver an essential energy infrastructure service in those

geographies and help them to reach their climate goals.

Meanwhile, the UK and Ireland continue to also offer significant

potential opportunities for investment where Gore Street Capital

has established itself as a pre-eminent investor. The proposed

fundraise would enable us to execute on our ambitions for growth

with the potential for investment in new acquisitions, while

continuing our solid track record of capital discipline for the

benefit of our shareholders."

Gearing policy clarification

The recently published Circular to shareholders (dated 22 March

2022) stated that, "The Board and the Investment Manager have

undertaken a review of the Company's gearing policy to ensure that

it is appropriate in light of the energy storage market's maturity

and to allow for the ability to utilise debt, where appropriate and

subject to the prior approval of the Board, to expand the size and

scale of operations, support the development of an expanding

portfolio, and ultimately to seek to enhance profitability. The

Directors intend that the Company will maintain a conservative

level of borrowings but that the maximum aggregate borrowings be

increased from 15 per cent. to 50 per cent. of Gross Asset Value

(calculated at the time of drawdown of the relevant

borrowings)."

The Directors wish to clarify for Shareholders that,

notwithstanding the above flexibility, the Board's gearing policy

will firmly limit borrowings to no more than 30 per cent. of gross

assets at any time. If in the future the Directors views on this

policy were to change, they will revert to Shareholders for further

approval.

Background to the Initial Issue

The Company was launched as a closed-ended investment company in

May 2018 with the investment objective of providing Shareholders

with an attractive level of income over the long term by investing

in a diversified portfolio of utility scale energy storage

projects. The Company has raised in excess of GBP330 million to

date, which has been invested or committed for investment in

accordance with the Company's investment objectives and policy,

including the Company's first recently announced acquisitions in

Germany and the United States.

Dividend

Investors in the Initial Issue will be entitled to receive the

next quarterly dividend for the period end 31 March 2022. The

Company will target dividends in respect of the Ordinary Shares in

each nancial year based on a 7 per cent. yield on the average Net

Asset Value per Ordinary Share during that nancial year, subject to

a minimum target of 7 pence per Ordinary Share in each nancial

year. The annual target dividend will increase by 0.5 pence

increments per Ordinary Share based on a certain progression of the

average Net Asset Value per Ordinary Share in any nancial year

above 100 pence.

Market Opportunity

Utility scale energy storage is an increasing international

priority as investment in intermittent renewable generation

continues to grow. Recent geopolitical events have further

underlined the importance of energy security, particularly in

Europe and the critical services to the grid that Gore Street's

assets provide. An ongoing significant renewable infrastructure

investment alongside the move away from traditional baseload

generation sources provide a compelling backdrop for energy storage

investment opportunities to enable countries to reach their climate

targets.

Pipeline

In addition to the Company's signi cant UK investment pipeline,

the opportunities outside the UK have continued to grow

considerably and there are potentially attractive opportunities

available. As at the date of this announcement, the Investment

Manager has identi ed a pipeline of over 1.3 GW. The pipeline

includes a significant number of potential projects comprising 900

MW in GB, 375 MW in North America and 100 MW in Europe. The

Investment Manager continues to work with several sources of

potential pipeline projects, such as strategic partners, developers

and EPC contractors.

The assets which form part of the Company's pipeline are exible

in terms of services and availability, and therefore present

multiple and increasing revenue opportunities. The Investment

Manager believes these additional revenue streams will become

increasingly important as a means of diversi cation. Initially,

projects were focused on: (a) frequency response services; (b)

Triad avoidance services; and (c) capacity market services. Today,

the Investment Manager is currently analysing projects that

include: (i) balancing mechanisms; (ii) wholesale trading; (iii)

distribution network cost saving; (iv) voltage control; (v) black

start; and (vi) DS3 services in Ireland.

The Company intends to hold a diversi ed portfolio of energy

storage projects with target unleveraged IRRs from its portfolio of

projects of 10-12 per cent. (before fees and expenses of the

Company) through multiple revenue streams which may be stacked on a

single battery. The majority of the Group's revenues are currently

derived from grid balancing services and/or wholesale trading.

High yield

The Company will target dividends in respect of the Ordinary

Shares in each nancial year based on a 7 per cent. yield on the

average Net Asset Value per Ordinary Share during that nancial

year, subject to a minimum target of 7 pence per Ordinary Share in

each nancial year. The annual target dividend will increase by 0.5

pence increments per Ordinary Share based on a certain progression

of the average Net Asset Value per Ordinary Share in any nancial

year above 100 pence (subject to rounding). For illustrative

purposes only: if the average Net Asset Value per Ordinary Share

during a nancial year is 107 pence per Ordinary Share or greater

(but less than 114 pence) the target dividend for that nancial year

will be 7.5 pence per Ordinary Share; if the average Net Asset

Value per Ordinary Share during a nancial year is 114 pence per

Ordinary Share or greater (but less than 121 pence) the target

dividend for that nancial year will be 8.0 pence per Ordinary

Share; and if the average Net Asset Value per Ordinary Share during

a nancial year is 121 pence per Ordinary Share or greater (but less

than 128 pence) the target dividend for that nancial year will be

8.5 pence per Ordinary Share. Dividends are paid quarterly and the

Company will target a dividend of 2.0 pence per Ordinary Share for

the rst three interim dividends in each nancial year and the amount

of the nal dividend will depend on the overall annual dividend

target for that nancial year.

Investors should note that the target dividend and target return

are targets only and are not a profit forecast. There may be a

number of factors that adversely affect the Company's ability to

achieve its target dividend yield and/or target return and there

can be no assurance that they will be met. The target dividend and

target return should not be seen as an indication of the Company's

expected or actual results or returns. Accordingly, investors

should not rely on these targets in deciding whether to invest in

the Shares or assume that the Company will make any distributions

at all.

Addressable Market

Energy storage is a market which is undergoing continued and

transformative growth in the UK and globally. The fundamental

growth driver is the steady increase in intermittent renewable

energy capacity combined with a need for grid stability and

electricity price stability. Storage projects are well positioned

to address these issues. As a result, energy storage is a key part

of government energy policy, helping to deliver the low-carbon

electricity sector that is the stated goal of the UK, the US, the

EU and many other jurisdictions. The growth in energy storage

assets is therefore anticipated to increase in these markets as the

levers that drive their growth further develop. The Board, having

been advised by the Investment Manager, considers that the Company

remains ideally positioned to capitalise on this anticipated

increase in demand for energy storage assets.

Growth potential in grid flexibility from decarbonising

environment

During the Conference of the Parties (COP) 26 held in Glasgow in

2021, countries stressed the urgency of action required to reduce

carbon dioxide emissions by 45 per cent. in order to achieve net

zero around the mid-century. Countries were called to present

stronger national action plans next year, instead of in 2025, the

original timeline. Countries have also ultimately agreed to a

provision for phasing-down coal power and phasing-out inef cient

fossil fuel subsidies, therefore moving away from fossil fuels.

The increase of wind and solar renewable energy, which are

intermittent sources of electricity, together with the closure of

coal and nuclear power plants, is expected to create difficulties

in balancing demand/supply of electricity in the system which

creates tight capacity margins and which could, therefore, lead to

blackout risks during peak demand. The Investment Manager expects

that energy storage will increasingly be required to play an

important role in managing critical balancing and frequency

management services to stabilise the system and provide flexibility

to the electricity market. Therefore, Shareholders will have early

exposure to what the Investment Manager believes will be a dominant

theme in energy investment over the coming years.

Further information

Shore Capital and J.P. Morgan Cazenove are acting as Joint

Bookrunners to the Company in connection with the Initial Issue and

the Share Issuance Programme. The Joint Bookrunners will today

commence a bookbuild process in respect of the Initial Issue at the

Issue Price. The Initial Issue will be non-pre-emptive pursuant to

the terms set out in the Prospectus and is expected to close no

later than 11.00 a.m. on 12 April 2022 but may be closed earlier or

later at the absolute discretion of the Joint Bookrunners. Details

of the number of Ordinary Shares to be issued pursuant to the

Initial Issue will be determined by the Board (following

consultation with Joint Bookrunners and the Investment Manager) and

will be announced as soon as practicable after the close of the

Initial Issue.

In the event that commitments received under the Initial Issue

exceed the maximum number of Ordinary Shares available,

applications under the Initial Placing, the Initial Offer for

Subscription and the Initial Intermediaries Offer will be scaled

back at the Joint Bookrunners' discretion (in consultation with the

Company and the Investment Manager).

Application will be made for the Ordinary Shares to be admitted

to trading on the premium segment of the London Stock Exchange's

main market ("Admission"). Admission is expected to occur and

dealings in the Ordinary Shares to commence at 8.00 a.m. on 14

April 2022. The Initial Issue is conditional on the requisite

shareholder resolutions being passed at the General Meeting on 11

April 2022 and on Admission.

The Ordinary Shares issued pursuant to the Initial Issue will

rank pari passu in all respects with the existing Ordinary Shares,

including the right to receive all dividends and other

distributions declared, made or paid after the date of Admission.

For the avoidance of doubt, investors participating in the Initial

Issue will be entitled to receive the next quarterly dividend

declared by the Company relating to the quarter ending 31 March

2022.

By choosing to participate in the Initial Issue and by making an

oral and legally binding offer to subscribe for Ordinary Shares,

investors will be deemed to have read and understood this

announcement and the Prospectus in their entirety and to be making

such offer on the terms and subject to the conditions in the

Prospectus, and to be providing the representations, warranties and

acknowledgements contained therein.

A copy of the Prospectus, when published, will be submitted to

the National Storage Mechanism and will shortly thereafter be

available for inspection at: on the Company's website at (

www.gsenergystoragefund.com ) or via the National Storage Mechanism

( https://data.fca.org.uk/#/nsm/nationalstoragemechanism ). Full

details of the Terms and Conditions of the Initial Placing, the

Initial Offer for Subscription and the Initial Intermediaries Offer

will be made available in the Prospectus.

The Legal Entity Identifier of the Company is

213800GPUNVGG81G4O21.

For further information:

Gore Street Capital Limited

Alex O'Cinneide / Paula Travesso / Maria Vaggione Tel: +44 (0) 20 3826 0290

Shore Capital (Joint Corporate Broker and Joint Bookrunner)

Anita Ghanekar / Rose Ramsden / Iain Sexton (Corporate Advisory) Tel: +44 (0) 20 7408 4090

Fiona Conroy (Corporate Broking)

J. P. Morgan Cazenove (Joint Corporate Broker

and Joint Bookrunner)

William Simmonds / Jérémie Birnbaum Tel: +44 (0) 20 7742

(Corporate Finance) 4000

Buchanan (Media enquiries)

Charles Ryland / Henry Wilson / George Beale Tel: +44 (0) 20 7466 5000

Email: Gorestreet@buchanan.uk.com

JTC (UK) Limited, Company Secretary Tel: +44 (0) 20 7409 0181

Disclaimer

This announcement has been issued by, and is the sole

responsibility of, Gore Street Energy Storage Fund plc (the

"Company"). The content of this announcement has been approved by

Gore Street Capital Limited solely for the purposes of section

21(2)(b) of the Financial Services and Markets Act 2000 (as

amended).

This announcement is for information purposes only and is not

intended to and does not constitute or form part of any offer or

invitation to purchase or subscribe for, or any solicitation to

purchase or subscribe for shares, in or into any jurisdiction in

which such an offer or solicitation is unlawful. No information set

out in this announcement is intended to form the basis of any

contract of sale, investment decision or any decision to purchase

shares in the Company. Approval of the Prospectus by the FCA should

not be understood as an endorsement of the securities that are the

subject of the Prospectus. Potential investors are recommended to

read the Prospectus before making an investment decision in order

to fully understand the potential risks and rewards associated with

a decision to invest in the Company's securities.

This announcement is an advertisement and does not constitute a

prospectus relating to the Company and does not constitute, or form

part of, any offer or invitation to sell or issue, or any

solicitation of any offer to subscribe for, any shares in the

Company in any jurisdiction nor shall it, or any part of it, or the

fact of its distribution, form the basis of, or be relied on in

connection with or act as any inducement to enter into, any

contract therefor.

This announcement does not constitute, or form part of, an offer

to sell or the solicitation of an offer to purchase or subscribe

for any Company securities, directly or indirectly, in or into any

of Australia, Canada, the Republic of South Africa, Japan or the

United States. The Shares have not been and will not be registered

under the US Securities Act of 1933, as amended (the "US Securities

Act"), or with any securities regulatory authority of any state or

other jurisdiction of the United States, and may not be offered,

sold, resold, pledged, delivered, distributed or otherwise

transferred, directly or indirectly, into or within the United

States, except pursuant to an exemption from the registration

requirements of the US Securities Act and in compliance with any

applicable securities laws of any state or other jurisdiction of

the United States. Outside the United States, the Shares may be

sold to persons who are not "US Persons", as defined in and

pursuant to Regulation S under the US Securities Act. No public

offering of Shares is being made in the United States.

In addition the Company has not been and will not be registered

under the US Investment Company Act of 1940, as amended.

The distribution of this announcement into jurisdictions other

than the United Kingdom may be restricted by law, and, therefore,

persons into whose possession this announcement comes should inform

themselves about and observe any such restrictions. Any failure to

comply with any such restrictions may constitute a violation of the

securities laws of such jurisdiction. In particular, subject to

certain exceptions, this announcement and the Prospectus, when

published, should not be distributed, forwarded to or transmitted

in any of Australia, Canada, the Republic of South Africa, Japan or

the United States.

The merits or suitability of any securities must be

independently determined by the recipient on the basis of its own

investigation and evaluation of the Company. Any such determination

should involve, among other things, an assessment of the legal,

tax, accounting, regulatory, financial, credit and other related

aspects of the securities.

This announcement may not be used in making any investment

decision in isolation. This announcement on its own does not

contain sufficient information to support an investment decision

and investors should ensure that they obtain all available relevant

information before making any investment. This announcement does

not constitute a recommendation concerning the Initial Issue, the

Share Issuance Programme or any Subsequent Issue. The price and

value of securities can go down as well as up. Past performance is

not a guide to future performance. The contents of this

announcement are not to be construed as legal, business, financial

or tax advice. Each Shareholder or prospective investor should

consult his, her or its own legal adviser, business adviser,

financial adviser or tax adviser for legal, financial, business or

tax advice. No reliance may be placed for any purposes whatsoever

on this announcement or its completeness.

The information and opinions contained in this announcement are

provided as at the date of the announcement and are subject to

change without notice and no representation or warranty, express or

implied, is or will be made in relation to the accuracy or

completeness of the information contained herein and no

responsibility, obligation or liability or duty (whether direct or

indirect, in contract, tort or otherwise) is or will be accepted by

the Company, the Investment Manager, Shore Capital, J.P. Morgan

Cazenove or any of their affiliates or by any of their respective

officers, employees or agents to update or revise publicly any of

the statements contained herein. No reliance may be placed for any

purpose whatsoever on the information or opinions contained in this

announcement or on its completeness, accuracy or fairness. The

document has not been approved by any competent regulatory or

supervisory authority.

Potential investors should be aware that any investment in the

Company is speculative, involves a high degree of risk, and could

result in the loss of all or substantially all of their investment.

Results can be positively or negatively affected by market

conditions beyond the control of the Company or any other person.

Any data on past performance contained herein is no indication as

to future performance and there can be no assurance that any

targeted or projected returns will be achieved or that the Company

will be able to implement its investment strategy or achieve its

investment objectives. Any target returns published by the Company

are targets only. There is no guarantee that any such returns can

be achieved or can be continued if achieved, nor that the Company

will make any distributions whatsoever. There may be other

additional risks, uncertainties and factors that could cause the

returns generated by the Company to be materially lower than the

target returns of the Company.

The information in this announcement may include forward-looking

statements, which are based on the current expectations, intentions

and projections about future events and trends or other matters

that are not historical facts and in certain cases can be

identified by the use of terms such as "may", "will", "should",

"expect", "anticipate", "project", "estimate", "intend",

"continue", "target", "believe" (or the negatives thereof) or other

variations thereof or comparable terminology. These forward-looking

statements, as well as those included in any related materials, are

not guarantees of future performance and are subject to known and

unknown risks, uncertainties, assumptions about the Company and

other factors, including, among other things, the development of

its business, trends in its industry, and future capital

expenditures and acquisitions. In light of these risks,

uncertainties and assumptions, the events in the forward-looking

statements may not occur and actual results may differ materially

from those expressed or implied by such forward looking statements.

Given these risks and uncertainties, prospective investors are

cautioned not to place undue reliance on forward-looking

statements.

Each of Shore Capital and Corporate Limited and Shore Capital

Stockbrokers Limited (together "Shore Capital"), which is

authorised and regulated in the United Kingdom by the Financial

Conduct Authority, and J.P. Morgan Securities plc, which conducts

its UK investment banking activities as J.P. Morgan Cazenove ("J.P.

Morgan Cazenove") and which is authorised by the Prudential

Regulation Authority and regulated by the Prudential Regulation

Authority and the FCA, is acting exclusively for the Company and

for no-one else in relation to the Initial Issue, the Share

Issuance Programme or any Admission and the other arrangements

referred to in this announcement. Neither Shore Capital nor J.P.

Morgan Cazenove will regard any other person (whether or not a

recipient of this announcement) as its client in relation to the

Initial Issue, the Share Issuance Programme or any Admission and

will not be responsible to anyone other than the Company for

providing the protections afforded to its clients or for providing

any advice in relation to the Initial Issue, the Share Issuance

Programme or any Admission, the contents of this announcement or

any transaction or arrangement referred to herein. Apart from the

responsibilities and liabilities, if any, which may be imposed on

Shore Capital or J.P. Morgan Cazenove by the FSMA or the regulatory

regime established thereunder, neither Shore Capital nor J.P.

Morgan Cazenove makes any representation express or implied in

relation to, nor accepts any responsibility whatsoever for, the

contents of this announcement or any other statement made or

purported to be made by it or on its behalf in connection with the

Company, the Shares, the Initial Issue, the Share Issuance

Programme or any Admission. Each of Shore Capital and J.P. Morgan

Cazenove accordingly, to the fullest extent permissible by law,

disclaims all and any responsibility or liability whether arising

in tort, contract or otherwise which it might have in respect of

this announcement or any other statement.

Solely for the purposes of the product governance requirements

contained within: (a) the UK's implementation of EU Directive

2014/65/EU on markets in financial instruments, as amended ("UK

MiFID II"); (b) the UK's implementation of Articles 9 and 10 of

Commission Delegated Directive (EU) 2017/593 supplementing UK MiFID

II, and in particular Chapter 3 of the Product Intervention and

Product Governance Sourcebook of the FCA (together, the "MiFID II

Product Governance Requirements"), and disclaiming all and any

liability, whether arising in tort, contract or otherwise, which

any "manufacturer" (for the purposes of the MiFID II Product

Governance Requirements) may otherwise have with respect thereto,

the Shares have been subject to a product approval process, which

has determined that the Shares are: (i) compatible with an end

target market of retail investors and investors who meet the

criteria of professional clients and eligible counterparties, each

as defined in UK MiFID II; and (ii) eligible for distribution

through all distribution channels as are permitted by UK MiFID II

(the "Target Market Assessment").

Notwithstanding the Target Market Assessment, distributors (such

term to have the same meaning as in the MiFID II Product Governance

Requirements) should note that: the market price of the Shares may

decline and investors could lose all or part of their investment;

the Shares offer no guaranteed income and no capital protection;

and an investment in the Shares is compatible only with investors

who do not need a guaranteed income or capital protection, who

(either alone or in conjunction with an appropriate financial or

other adviser) are capable of evaluating the merits and risks of

such an investment and who have sufficient resources to be able to

bear any losses that may result therefrom. The Target Market

Assessment is without prejudice to the requirements of any

contractual, legal or regulatory selling restrictions in relation

to the Issues. Furthermore, it is noted that, notwithstanding the

Target Market Assessment, Shore Capital and J.P. Morgan Cazenove

will, pursuant to the Initial Placing and each Subsequent Placing,

only procure Placees who meet the criteria of professional clients

and eligible counterparties.

For the avoidance of doubt, the Target Market Assessment does

not constitute: (a) an assessment of

suitability or appropriateness for the purposes of UK MiFID II;

or (b) a recommendation to any investor or group of investors to

invest in, or purchase, or take any other action whatsoever with

respect to the Shares.

Each distributor is responsible for undertaking its own target

market assessment in respect of the Shares a nd determining

appropriate distribution channels.

In accordance with the UK PRIIPs Regulation, a key information

document in respect of the Ordinary Shares has been prepared and is

available to investors at www.gsenergystoragefund.com . If you are

distributing the Ordinary Shares, it is your responsibility to

ensure that the key information document is provided to any clients

that are "retail clients".

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEJPMMTMTMTTBT

(END) Dow Jones Newswires

March 29, 2022 02:01 ET (06:01 GMT)

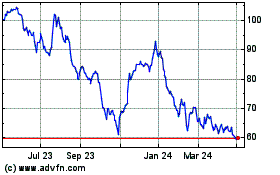

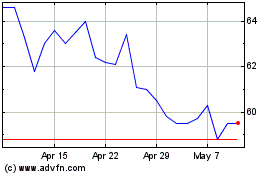

Gore Street Energy Storage (LSE:GSF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gore Street Energy Storage (LSE:GSF)

Historical Stock Chart

From Apr 2023 to Apr 2024