TIDMGSK

RNS Number : 5410A

GSK PLC

26 September 2022

Issued: 26 September 2022, London UK

Iain Mackay, Chief Financial Officer, to retire from GSK, Julie

Brown appointed as successor

GSK plc (LSE/NYSE: GSK) today announced that Iain Mackay, Chief

Financial Officer (CFO), has decided to retire from GSK. The Board

has agreed that he will step down as CFO and as an Executive

Director of the Board in May 2023.

The Board has selected Ms Julie Brown, currently Chief Operating

and Financial Officer, Burberry Group plc, as successor to Iain.

Julie is a highly respected CFO with extensive experience in the

biopharma and medtech sectors, having previously worked at

AstraZeneca plc and Smith & Nephew plc; and as a non-executive

director and Audit Chair of Roche Holding AG.

Julie will join GSK in April 2023 and will work with Iain to

transition responsibilities, taking responsibility as CFO and as an

Executive Director of GSK on 1 May 2023.

Emma Walmsley, Chief Executive Officer, GSK, said: "I want to

thank Iain for all he's done for GSK, and for his leadership and

support to our people. He has played a very significant role to

help deliver the reshaping of GSK and to improve our operating and

financial performance. I am absolutely delighted that Julie will be

joining the leadership team as his successor. Julie is a highly

experienced CFO with a tremendous understanding of the biopharma

sector. We also share a strong passion for people development,

diversity, inclusion and sustainability. I am looking forward to

working together to deliver progress for patients, shareholders and

our people."

Jonathan Symonds, Chair, GSK, said: "On behalf of the Board I

would like to thank Iain for his significant contribution at GSK.

He has been a highly valued member of the Board and has provided

strong support to Emma and the management team. We are delighted

that Julie will join the Board as Iain's successor. She is a CFO of

exceptional calibre and experience and I look forward to the

contribution she will make."

Notes to Editors

Biography

Julie serves as Chief Operating and Financial Officer, Burberry

Group plc and an Executive Director. She joined Burberry from Smith

& Nephew where she was the Group CFO from 2013-2017. Before

this, she was Interim Group CFO of AstraZeneca, having worked at

the company for 25 years in finance, commercial and strategic

roles.

Julie has also served as a Non-Executive Director and Audit

Chair of Roche Holding AG. She is also co-Chair of the Prince's

Accounting for Sustainability Project's CFO Leadership Network, a

member of the Prime Minister's Business Council, the Business

Advisory Board to the Mayor of London and Patron of Oxford

University Women in Business. Julie is a Fellow of the Institute of

Chartered Accountancy and the Institute of Tax and qualified with

KPMG International Limited.

Shareholding information and regulatory disclosure

Ms Brown holds 519 shares in GSK. The Company confirms that, in

respect of Listing Rule 9.6.13R(1), Ms Brown is currently an

Executive Director of Burberry Group plc and, prior to her

appointment to GSK, a Non-Executive Director of Roche Holding AG.

The Burberry directorship will cease before she commences her

employment with GSK and Ms Brown has resigned from the Roche Board.

There are no details to disclose in respect of Listing Rule

9.6.13R(2-6).

Appointment and selection process

Ms Brown's appointment was made by the Board on the

recommendation of the Nominations & Corporate Governance

Committee following an extensive search and selection process using

external search firms, each of which was a signatory of the

Voluntary Code of Conduct for Executive Search Firms. A diverse

list of candidates was compiled who were evaluated against an

agreed set of criteria, to identify the most suitable

candidate.

Remuneration

The Remuneration Committee considered the remuneration

arrangements that would be appropriate to enable the Company to

recruit and retain an experienced CFO to meet the criteria for the

role within the Company's current shareholder-approved remuneration

policy. Given Ms Brown's wealth of experience in the role and of

the industry it was agreed that her remuneration should be set in

line with the current CFO's remuneration, as follows.

Ms Brown's remuneration arrangements

GBP Notes

Base salary GBP915,335 The comparator group for pay for the CFO

remains the European cross-industry comparator

group set out in our Annual Report.

------------- ------------------------------------------------

Annual GBP915,335 The on-target bonus would be 100%, with

bonus a maximum of 300% for incremental exceptional

performance as for the existing CFO.

------------- ------------------------------------------------

Award of GBP1,830,670 This assumes an expected value of 50% of

Long Term an award of performance shares under the

Incentives Company's 2017 Performance Share Plan at

(LTIs) a 4x multiple of base salary as for the

existing CFO.

------------- ------------------------------------------------

Share Ownership 3x This is in line with GSK's shareholder

Requirement approved executive remuneration policy

(SOR) approved earlier in 2022.

------------- ------------------------------------------------

Pension Pension arrangements will be in line with

those of the wider UK workforce in line

with GSK's commitment from 1 January 2023.

------------- ------------------------------------------------

Benefits Benefits will be in line with GSK's policy

and arrangements for other executives based

in the UK to support them in undertaking

their role.

------------- ------------------------------------------------

Ms Brown's contract of employment will be available for

inspection at the Company's registered office and on GSK's website,

gsk.com, in due course.

The following Buyout Payments will be provided:

-- a sum ("the Bonus Buyout") equivalent to Ms Brown's on-target

Burberry bonus for the period from 1 April, 2022 to 31 March, 2023,

which she will forego on leaving Burberry,

-- a sum ("the LTI Buyout") equivalent to the aggregate value of

(i) her outstanding Burberry LTIs and SIP shares which will be lost

on leaving Burberry, at a price equivalent to the average price of

such shares for the one-month period ending on 7 September, 2022,

and (ii) the value of any dividend equivalents accruing on those

shares between their date of award and her departure from Burberry.

Given that the Burberry LTIs are not subject to a performance

measure, and only to a performance underpin, no discount will be

applied to the value of the shares so calculated.

The timing of these payments will be as follows. A cash amount

equivalent to:

-- the Bonus Buyout and one-third of 85% of the LTI Buyout will

be paid to her in the first payroll following the commencement of

her employment with GSK;

-- one-third of 85% of the LTI Buyout will be paid to her in the

first payroll following the first anniversary of the commencement

of her employment; and,

-- one-third of 85% of the LTI Buyout will be paid to her in the

first payroll following the second anniversary of the commencement

of her employment.

In addition, she will be paid an amount equivalent to 15% of the

LTI Buyout in the first payroll following the commencement of her

employment. Ms Brown has agreed that she will invest the net of tax

proceeds of this 15% tranche in GSK plc Ordinary Shares at the

first reasonably available opportunity having sought dealing

clearance and that she will then continue to hold those shares for

a period of at least two years. Ms Brown will be required to build

and maintain over time a holding of shares in GSK equivalent to a

value of three times' base salary.

Mr Mackay's remuneration

To support the succession and transition process, Mr Mackay will

continue to receive his base salary until he leaves GSK. He will be

eligible to receive bonuses which will be determined by the

Remuneration Committee based on a combination of business and

individual performance for his service during 2022 and 2023. He

will not be eligible to receive any further LTI awards. However, he

will retain all his existing long-term incentive awards. His

executive service contract will end on 31 December 2023. He will be

required to maintain his share ownership requirement in accordance

with the Company's shareholder approved remuneration policy for a

two year period.

Full details will be provided in the Remuneration Report.

About GSK

GSK is a global biopharma company with a purpose to unite

science, technology, and talent to get ahead of disease together.

Find out more at gsk.com/company

GSK enquiries

Media: Tim Foley +44 (0) 20 8047 (London)

5502

Madeleine Breckon +44 (0) 20 8047 (London)

5502

Kathleen Quinn +1 202 603 5003 (Washington DC)

Lyndsay Meyer +1 202 302 4595 (Washington DC)

Investor Relations: Nick Stone +44 (0) 7717 618834 (London)

James Dodwell +44 (0) 20 8047 (London)

2406

Mick Readey +44 (0) 7990 339653 (London)

Josh Williams +44 (0) 7385 415719 (London)

Jeff McLaughlin +1 215 751 7002 (Philadelphia)

Cautionary statement regarding forward-looking statements

GSK cautions investors that any forward-looking statements or

projections made by GSK, including those made in this announcement,

are subject to risks and uncertainties that may cause actual

results to differ materially from those projected. Such factors

include, but are not limited to, those described in the Company's

Annual Report on Form 20-F for 2021, GSK's Q2 Results for 2022 and

any impacts of the COVID-19 pandemic.

Registered in England & Wales:

No. 3888792

Registered Office:

980 Great West Road

Brentford, Middlesex

TW8 9GS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

BOAFELLLLKLXBBD

(END) Dow Jones Newswires

September 26, 2022 02:01 ET (06:01 GMT)

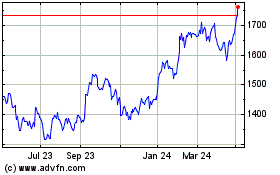

Gsk (LSE:GSK)

Historical Stock Chart

From Mar 2024 to Apr 2024

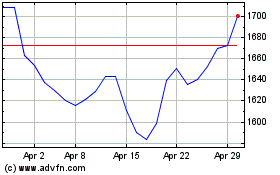

Gsk (LSE:GSK)

Historical Stock Chart

From Apr 2023 to Apr 2024