TIDMAG99 TIDMGSK

RNS Number : 5044G

GlaxoSmithKline Capital PLC

15 November 2022

THIS ANNOUNCEMENT RELATES TO THE DISCLOSURE OF INFORMATION THAT

QUALIFIES OR MAY QUALIFY AS INSIDE INFORMATION WITHIN THE MEANING

OF ARTICLE 7 OF THE MARKET ABUSE REGULATION (EU) 596/2014 AS IT

FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION

(WITHDRAWAL) ACT 2018 (EUWA).

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN OR INTO OR TO

ANY PERSON LOCATED OR RESIDENT IN, OR AT ANY ADDRESS IN, THE UNITED

STATES OF AMERICA, ITS TERRITORIES AND POSSESSIONS (INCLUDING

PUERTO RICO, THE U.S. VIRGIN ISLANDS, GUAM, AMERICAN SAMOA, WAKE

ISLAND AND THE NORTHERN MARIANA ISLANDS), ANY STATE OF THE UNITED

STATES OF AMERICA OR THE DISTRICT OF COLUMBIA (THE UNITED STATES)

OR TO ANY U.S. PERSON OR IN OR INTO ANY OTHER JURISDICTION WHERE IT

IS UNLAWFUL TO RELEASE, PUBLISH OR DISTRIBUTE THIS ANNOUNCEMENT

GlaxoSmithKline Capital plc announces results of tender offers

for its outstanding Notes ( the Notes and each a Series) listed in

the table below, in each case guaranteed by GSK plc (GSK)

15 November 2022.

GlaxoSmithKline Capital plc (the Offeror) announces today the

results of its invitation to holders of its outstanding Notes to

tender their Notes for purchase by the Offeror for cash (each, an

Offer and together, the Offers). The Offeror announced the

indicative results of the Offers earlier today.

The Offers were announced on 8 November 2022 and were made on

terms and subject to the conditions contained in the tender offer

memorandum dated 8 November 2022 (the Tender Offer Memorandum).

Capitalised terms used in this announcement but not defined have

the meanings given to them in the Tender Offer Memorandum.

Results of the Offers

The Offeror announces that it will accept for purchase in cash

an aggregate nominal amount of the Notes validly tendered pursuant

to the Offers equal to GBP1,593,679,000. The final results of the

Offers are as follows:

Notes Description of ISIN / Common Aggregate Series Scaling Purchase Purchase Accrued

the Notes Code nominal amount Acceptance Factor Yield (per Price (per Interest

of Notes Amount (per cent.) cent.) Payment (per

tendered cent.) GBP1,000)

------- ------------------ -------------- ---------------- ---------------- ----------- ----------- ----------- ---------------

GBP600,000,000

3.375 per cent.

2027 Notes due 20 XS0866588527 Not

Notes December 2027 / 086658852 GBP292,230,000 GBP292,230,000 Applicable 4.388 95.460 GBP30.70

GBP1,000,000,000

5.250 per cent.

2033 Notes due 19 XS0140516864

Notes December 2033 / 014051686 GBP734,199,000 GBP350,051,000 47.700 4.238 108.875 GBP21.66

2039 GBP700,000,000 XS0350820931 GBP409,561,000 GBP0 0.000 Not Not Not Applicable

Notes 6.375 per cent. / 035082093 Applicable Applicable

Notes due 9 March

2039

GBP1,000,000,000

5.250 per cent.

2042 Notes due 10 XS0294624373 Not

Notes April 2042 / 029462437 GBP522,184,000 GBP522,184,000 Applicable 4.495 109.604 GBP31.79

GBP800,000,000

4.250 per cent.

2045 Notes due 18 XS0866596975 Not

Notes December 2045 / 086659697 GBP429,214,000 GBP429,214,000 Applicable 4.415 97.639 GBP38.89

General

The Settlement Date in respect of the Notes accepted for

purchase pursuant to the Offers is expected to be 17 November

2022.

Following the Settlement Date, GBP307,770,000 in aggregate

nominal amount of the 2027 Notes will remain outstanding,

GBP649,949,000 in aggregate nominal amount of the 2033 Notes will

remain outstanding, GBP700,000,000 in aggregate nominal amount of

the 2039 Notes will remain outstanding, GBP477,816,000 in aggregate

nominal amount of the 2042 Notes will remain outstanding and

GBP370,786,000 in aggregate nominal amount of the 2045 Notes will

remain outstanding.

The Dealer Managers (in respect of the Offers as made to

Relevant Noteholders)

BNP Paribas

16, boulevard des Italiens

75009 Paris

France

Telephone: +33 1 55 77 78 94

Attention: Liability Management Group

Email: liability.management@bnpparibas.com

J.P. Morgan Securities plc

25 Bank Street

Canary Wharf

London E14 5JP

United Kingdom

Telephone: +44 207 134 2468

Attention: EMEA Liability Management Group

Email: liability_management_EMEA@jpmorgan.com

The Offeror

GlaxoSmithKline Capital plc

980 Great West Road

Brentford

Middlesex TW8 9GS

United Kingdom

Email: company.secretary@gsk.com

The Tender Agent

Kroll Issuer Services Limited

The Shard

32 London Bridge Street

London SE1 9SG

United Kingdom

Telephone: +44 20 7704 0880

Attention: David Shilson

Email: gsk@is.kroll.com

Website: https://deals.is.kroll.com/gsk

This announcement contains information that qualifies or may

qualify as inside information. The person responsible for arranging

the release of this announcement on behalf of GlaxoSmithKline

Capital plc is Victoria Whyte, Company Secretary.

DISCLAIMER This announcement must be read in conjunction with

the Tender Offer Memorandum. No offer or invitation to acquire any

securities is being made pursuant to this announcement. The

distribution of this announcement and the Tender Offer Memorandum

in certain jurisdictions may be restricted by law. Persons into

whose possession this announcement and/or the Tender Offer

Memorandum comes are required by each of the Offeror, GSK, the

Dealer Managers and the Tender Agent to inform themselves about,

and to observe, any such restrictions.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TENKZMMMKKZGZZM

(END) Dow Jones Newswires

November 15, 2022 10:53 ET (15:53 GMT)

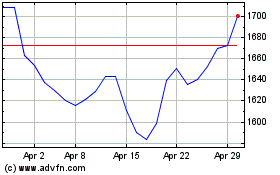

Gsk (LSE:GSK)

Historical Stock Chart

From Mar 2024 to Apr 2024

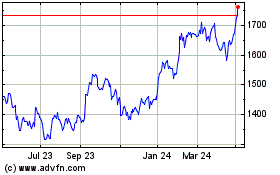

Gsk (LSE:GSK)

Historical Stock Chart

From Apr 2023 to Apr 2024