TIDMGST

RNS Number : 2585W

GSTechnologies Ltd

21 December 2021

21 December 2021

GSTechnologies Limited

("GST" or the "Company" or the "Group")

Interim Results

GSTechnologies Limited (LSE: GST), the fintech and information

technology solutions company, announces the Company's interim

results for the six months ended 30 September 2021.

Period Highlights

-- Collaboration agreement signed with Wise MPay, the

Singaporean blockchain payment solution provider, to provide the

Company with software and services to facilitate the Company's

blockchain related fintech plans.

-- Placing to raise GBP1.4 million at 1.0 pence per ordinary

share and publication of a prospectus on 6 September 2021.

-- Resumption of EMS operations following the relaxation of

government measures against Covid-19 controls resulted in an

increase in revenue for H1 2021 to US$2,261,000 (H1 2020:

US$769,000).

-- Net loss for the period of US$1,094,000 (H1 2020: US$561,000 loss).

-- As of 30 September 2021, the Company had US$2,749,000 in cash

and cash equivalents (30 September 2020: US$1,789,000).

Post Period Highlights

-- Appointment of Jack Bai as Chief Executive Officer and Shayne Tan as Chief Operating Officer.

-- Conditional acquisition of Angra Limited.

-- Placing to raise gross proceeds of GBP1.0 million at 2.0

pence per ordinary share on 19 November 2021.

-- Launch of the GS Money protocol on the Coalculus platform.

-- Receipt of 100 million COAL tokens as part of the ongoing collaboration with Wise MPay.

Chairman's Statement

Despite the backdrop of the continuing pandemic the period has

been one of significant progress for the Group. The Group's revenue

continues to be provided by our subsidiary, EMS Wiring Systems Pte

Ltd ("EMS"), whilst the GS Fintech companies are currently

pre-revenue.

Although the world has had to shut and open its doors repeatedly

and often shifted into a lower gear, our EMS corporate customers

still needed IT support and new services, whilst navigating the

uncertainty and challenges of the global pandemic.

EMS remains a predominantly Singapore focused business and

Singapore's GDP showed positive growth in the first half of 2021,

even though the growth was from the lower base in 2020. For 2021,

Singapore's GDP expanded by 1.5% in the first quarter, followed by

14.7% in the second. Likewise, the construction sector grew

sharply, up by 106.2% on a year-on-year basis in the second quarter

of 2021, compared to the same period last year when construction

activities ground to a halt during Singapore's circuit breaker

measures. While the Ministry of Trade and Industry, upgraded

Singapore's official growth forecast for 2021 to between 6% and 7%,

labour shortages arising from restrictions on the entry of migrant

workers, are weighing on the recovery of the construction sector.

Against this background we are pleased with the performance of EMS

during the period and anticipate that the business will recover

further in the second half.

However, the primary focus for the future of the Group has been

on the new 'GS Fintech' subsidiaries in the UK and Singapore and

the Company's planned expansion into blockchain related

technologies, specifically its plans to launch a borderless

neobanking platform providing next-generation digital money

solutions.

During the period we significantly progressed these activities

with the signing of a collaboration agreement with Wise MPay, the

Singaporean blockchain payment solution provider, on 28 May 2021,

with a view to Wise MPay providing the Company with software and

services to facilitate the Company plans. The collaboration is

progressing according to plan and post period end we announced a

number of developments which are described below.

Fund Raising

On 6 September 2021 the Company raised gross proceeds of

GBP1.415 million through a placing of 141,500,000 ordinary shares

at a price of 1p per share. This was followed, post period end, on

19 November 2021, with a placing of 50,000,000 ordinary shares at a

price of 2p per share raising gross proceeds of GBP1.0 million.

The funds raised from the two placing are being principally used

to accelerate the implementation of the Group's strategy, in

particular covering the planned sales and marketing costs, and the

costs of further development and implementation of the Wise MPay

technology.

Management Changes

Post period end we were delighted that Mr Bai GuoJin ("Jack

Bai"), an existing Executive Director, was appointed as the

Company's new Chief Executive Officer on 12 October 2021. Jack Bai,

who joined the GST board in January 2021, has over 30 years'

experience in software development for the financial and

telecommunication industries. He is a successful technology

entrepreneur, who has successfully built and exited multiple

companies, including in fintech and payment solutions. He is a

co-founder of Wise MPay, the Company's collaboration partner, and

leads the development of the Coalculus blockchain technology. He is

leading the Group's blockchain technology activities and its plans

to launch a borderless neobanking platform providing

next-generation digital money solutions.

On 20 October 2021, additionally Mr. Tan Guan Han, Shayne

("Shayne Tan"), an existing Executive Director, was appointed as

the Company's new Chief Operating Officer. Shayne Tan, who joined

the GST board in January 2021, holds a Bachelor of Business

Management Degree from Singapore Management University and has more

than five years of sales, operations, and management experience in

growth-stage companies operating exclusively within the blockchain

and cryptocurrency sector. He is, alongside Jack Bai, a co-founder

of the Coalculus blockchain platform.

Post Period End Developments

On 5 October 2021 the Company announced that it had entered into

a conditional agreement to acquire the whole of the issued share

capital of Angra Limited ("Angra"), a UK-based foreign exchange and

payment services company. Angra, which operates under the AngraFX

brand name, is a Financial Conduct Authority ("FCA") approved

Authorised Payment Institution ("API"), conducting fast, secure and

low-cost foreign exchange business and payment services

internationally.

The acquisition of Angra is now only subject to FCA approval for

the change of control. If approved Angra will provide the Company

with an operating business in the UK and an API licence in order to

be able to connect to traditional banking payment systems and agent

networks, operate a remittance business in the UK and grow revenues

from the stablecoin network and applications that are being

developed.

On 30 November we reported that we had successfully tested all

four of the enterprise chains provided by Wise MPay (representing

four digital currencies pegged to the US Dollar, the Pound, the

Euro, and the Yuan), together with implementing a mainnet upgrade

on the Coalculus platform, provided by Wise MPay. This marked the

launch of the GS Money protocol. This was followed on 17 December

2021 by GST receiving 100 million COAL tokens from Wise MPay and

the enabling of the COAL token staking capability on four full

nodes managed by the Company. The value of the COAL tokens provided

by Wise MPay, as one of their deliverables under the collaboration

agreement, was approximately GBP475,000 at the current COAL token

trading price.

The four digital currencies are strictly pegged to the US

Dollar, the Pound, the Euro and the Yuan which will allow GST to

carry out transactions immediately through blockchain ledgers,

which can be used in place of wire transfers that generally take

several days to complete. The four enterprise chains work alongside

one another to form a decentralised and highly efficient

multicurrency cross border payment system for digital transactions

that utilise the Coalculus blockchain ledger technology.

Additionally, each enterprise chain's total supply will allow GST

to issue up to 10 billion digital currency units.

With the launch of the GS Money protocol, this blockchain

technology is now available to GST and its future clients. The

Company intends to deploy GS Money early in 2022 in limited

cross-border payment trials, and then gradually roll out GS Money

for commercial operations in the coming months.

The future roll-out of GS Money is intended to be focused on

three initial use-cases:

International Money Transfers: GS Money will initially be used

in restricted cross-border payment testing before being gradually

expanded to include commercial activities.

Borderless accounts: GS Money will be integrated into a GST

borderless account payment service. This borderless account will

allow customers to retain many digital currencies, but the biggest

advantage is that they may be converted at the prevailing exchange

rate and in any currency, with minimal, transparent fees.

Private Stablecoin: Ultimately it is intended that GS Money will

also be focussed on private stablecoin. The objective is to

establish public trust, maintain stability, and enable claims

backed by reserves. By establishing a private stablecoin ecosystem,

GST intends to encourage market players to allow transactions to

settle in GS Money digital currencies, as well as be integrated

into various other payment services.

Summary

The period under review was one of significant achievement as we

progressed our blockchain based financial services ambitions.

Given the ongoing pandemic situation, forecasting the future is

especially difficult. We expect uncertain worldwide economic

conditions to continue, depending on how the pandemic evolves,

particularly with the emergence of new Covid 19 variants. However,

this is likely to have a much more significant impact on our EMS

business, but with anticipated improvement in future construction

demand we are optimistic for the future of this business.

However, our primary focus is on progressing our plans to launch

a borderless neobanking platform providing next-generation digital

money solutions, based on blockchain technology, which has been

significantly less impacted by the pandemic.

In doing so we will continue to practice prudent financial

management, and working capital management, to ensure the Group

maintains appropriate liquidity, while being mindful of operational

expenditure. Operationally, we are constantly striving to improve

our work methods, and the skills and capabilities of our people. We

continue to advance GST's digital capabilities, developing

innovative technological solutions to improve our project

productivity and efficiency.

I would also like to extend my appreciation to GST's

shareholders for their continued support, and to my fellow board

members and staff for their support and hard work during the

period. Whilst we still have a lot to do, GST has come a long way

in a short period of time. I look forward to the future with

confidence and reporting on our further progress in the coming

months.

Tone Kay Kim GOH

Chairman

Financial Highlights

-- Resumption of operations following the relaxation of

government measures against Covid-19 controls resulted in an

increase in revenue for H1 2021 to US$2,261,000 (H1 2020:

US$769,000).

-- As of 30 September 2021, the Company had US$2,749,000 in cash

and cash equivalents (30 September 2020: US$1,789,000). In the

interim period, the debt/equity structure has shifted to lesser

dependence on debt financing to support its operating activities.

Post period end, on 19 November 2021 the Company raised a further

GBP1m (gross) through a placing of ordinary shares.

-- Net loss for the period is US$1,094,000 (H1 2020: US$561,000

loss). Major contributing factors for the increased net loss for

the period are due to the decrease of US$203,000 in government

grants being received and the increase of US$112,000 in foreign

worker levy paid arising from the cessation of the government

assistance incentive on the foreign worker levy waiver. Costs

incurred in relation to share placement and the preparation of a

prospectus amounted to US$479,000.

Enquiries:

The Company

Tone Goh, Executive Chairman +65 6444 2988

Financial Adviser

+44 (0)20 3005

VSA Capital Limited 5000

Simon Barton / Pascal Wiese

Financial PR & Investor Relations

IFC Advisory Limited

Tim Metcalfe / Graham Herring / Florence +44 20 (0) 3934

Chandler 6630

For more information please see:

https://gstechnologies.co.uk/

CONSOLIDATED INTERIM STATEMENT OF COMPREHENSIVE INCOME

For the period 1 April 2021 to 30 September 2021

6 months ended 30 September

2021 2020

Notes US$'000 US$'000

(Unaudited) (Unaudited)

Net operating income

Sales 2,261 769

Other income 92 295

------------------------------ -----------------------------

2,353 1,063

Net operating expense

Continuing Operations 6 (3,447) (1,624)

Net loss for the period (1,094) (561)

------------------------------ -----------------------------

Other comprehensive loss

Movement in foreign exchange

reserve (58) 148

------------------------------ -----------------------------

Total comprehensive loss

for the period (1,152) (412)

Net Loss for the year attributable

to:

Equity holders for the parent (1,094) (561)

Non-controlling interest - -

------------------------------ -----------------------------

Total comprehensive loss for the year attributable

to:

Equity holders for the parent (1,152) (412)

Non-controlling interest 20 - -

------------------------------ -----------------------------

(Loss)/Earnings per share attributable

to members

of the Parent

Basic (loss) per share 9 (0.00090) (0.00056)

Diluted (loss) per share 9 (0.00090) (0.00056)

CONSOLIDATED INTERIM STATEMENT OF FINANCIAL POSITION

As at 30 September 2021

6 months ended 30 September

2021 2020

Notes US$'000 US$'000

(Unaudited) (Unaudited)

ASSETS

Current assets

Cash and cash equivalents 11 2,749 1,789

Trade and other receivables 12 2,638 1,480

Work in progress 15 272 186

Inventories 13 307 316

Total current assets 5,966 3,771

---------------------------- ----------------------------

Non-current assets

Property, plant and equipment 14 192 286

Intangible Assets 16 6 6

Total non-current assets 198 292

---------------------------- ----------------------------

TOTAL ASSETS 6,164 4,063

---------------------------- ----------------------------

EQUITY

Share Capital 19 5,331 1,804

Reserves (768) (718)

Retained Earnings (637) 387

Total Equity 3,926 1,473

---------------------------- ----------------------------

Equity attributable to owners

of the parent 3,926 1,473

Non-controlling equity interest 20 - -

3,926 1,473

---------------------------- ----------------------------

LIABILITIES

Current liabilities

Trade and other payables 21 818 748

Loans payable - current 22 222 213

Total current liabilities 1,040 961

---------------------------- ----------------------------

Non-current liabilities

Loans payable 22 1,198 1,629

Total current liabilities 1,198 1,629

---------------------------- ----------------------------

Total Liabilities 2,238 2,590

---------------------------- ----------------------------

TOTAL EQUITY & LIABILITIES 6,164 4,063

---------------------------- ----------------------------

CONSOLIDATED INTERIM STATEMENT OF CASH FLOWS

For the period 1 April 2021 to 30 September 2021

6 months ended 30 September

2021 2020

Notes US$'000 US$'000

(Unaudited) (Unaudited)

CASH FLOWS FROM OPERATING ACTIVITIES

Loss before taxation from operations (1,094) (561)

Adjustments:

Depreciation of property, plant

and equipment 81 22

Exchange loss 2 -

Operating loss before working

capital changes (1,011) (538)

Decrease/(Increase) in inventories 10 (4)

Decrease/(Increase) in trade and other

receivables 790 (218)

(Decrease)/Increase in trade

and other payables (317) 12

Decrease in capital work in progress (79) -

Net cash flow used in operating

activities (607) (749)

CASH FLOWS FROM INVESTING ACTIVITIES

Addition property, plant and

equipment - (13)

Proceeds from disposal of property, - -

plant and equipment

-------------------------- ---------------------------

Net cash flow from investing

activities - (13)

CASH FLOWS FROM FINANCING ACTIVITIES

Issuance of new shares 1,907 -

Increase in loans payable (235) 1,842

Forex reserves (58) 148

-------------------------- ---------------------------

Net cash flow from financing

activities 1,614 1,991

Net increase/(decrease) in cash and

cash equivalents 1,007 1,229

-------------------------- ---------------------------

Cash and cash equivalents at beginning

of the year 1,742 561

-------------------------- ---------------------------

Cash and cash equivalents at

end of the year 11 2,749 1,789

-------------------------- ---------------------------

CONSOLIDATED INTERIM STATEMENT OF CHANGES IN EQUITY

For the period 1 April 2021 to 30 September 2021

Shareholder FX Reserve Retained Total

Capital Earnings

(Unaudited) (Unaudited) (Unaudited) (Unaudited)

2021 CONSOLIDATED US$'000 US$'000 US$'000 US$'000

---------------------------- ----------------- ------------------ ----------------- ------------------

Balance as at 1 April

2021 2,077 (710) 457 1,824

Comprehensive Income

Loss for the year - - (1,094) (1,094)

Other comprehensive loss

for the year - (58) - (58)

----------------- ------------------ ----------------- ------------------

Total comprehensive loss

for the period - (58) (1,094) (1,152)

Transactions with owners

in their

capacity as owners:

Shares issued during the

period 3,254 - - 3,254

----------------- ------------------ ----------------- ------------------

3,254 - - 3,254

Balance as at 30 September

2021 5,331 (768) (637) 3,926

----------------- ------------------ ----------------- ------------------

Notes to the Financial Statements

1. General Information

1.1 Corporate information

The consolidated financial statements of GSTechnologies Ltd (the

"Company") and its subsidiaries (collectively referred to as the

"Group" for the financial period from 1 April 2021 to 30 September

2021 were authorised for issue in accordance with a resolution of

the Directors on 20 December 2021.

The registered office of GSTechnologies Ltd, the ultimate parent

of the Group, is Ritter House, Wickhams Cay II, Tortola, BVI

VG1110.

The principal activity of the Company comprises of fintech

services through the use of blockchain technology; and the

provision of data infrastructure, storage and technology services

by its subsidiaries.

2. Basis of preparation

The consolidated financial statements of the Group have been

prepared in accordance with International Financial Reporting

Standards (IFRS) as issued by the International Accounting

Standards Board (IASB) and adopted by the European Union (EU) as

they apply to the financial statements of the Group for the period

from 1 April 2021 to 30 September 2021.

The consolidated financial statements have been prepared on a

historical cost convention basis, except for certain financial

instruments that have been measured at fair value. The consolidated

financial statements are presented in US dollars and all values are

rounded to the nearest thousand except when otherwise

indicated.

2.1 Consolidation

The consolidated financial statements comprise the financial

statements of the Group as of 30 September 2021, and for the period

then ended.

Subsidiaries are fully consolidated from the date of

acquisition, being the date on which the Group obtains control, and

continue to be consolidated until the date when such control

ceases.

The financial statements of the subsidiaries are prepared for

the same reporting period as the GSTechnologies Ltd (parent

company), using consistent accounting.

All intra-group balances, transactions, unrealised gains and

losses resulting from intra-group transactions and dividends are

eliminated in full.

Total comprehensive income within a subsidiary is attributed to

the non-controlling interest even if it results in a deficit

balance. A change ownership interest of a subsidiary, without a

loss of control, is accounted for as an equity transaction.

Business Combinations

Business combinations occur where an acquirer obtains control

over one or more businesses. A business combination is accounted

for by applying the acquisition method, unless it is a combination

involving entities or businesses under common control. The business

combination will be accounted for from the date that control is

attained, whereby the fair value of the identifiable assets

acquired and liabilities (including contingent liabilities) assumed

is recognised (subject to certain limited exceptions).

When measuring the consideration transferred in the business

combination, any asset or liability resulting from a contingent

consideration arrangement is also included. Subsequent to initial

recognition, contingent consideration classified as equity is not

re-measured and its subsequent settlement is accounted for within

equity. Contingent consideration classified as an asset or

liability is re-measured in each reporting period to fair value,

recognising any change to fair value in profit or loss, unless the

change in value can be identified as existing at acquisition

date.

All transaction costs incurred in relation to business

combinations are expensed to the statement of comprehensive income.

The acquisition of a business may result in the recognition of

goodwill or a gain from a bargain purchase.

3. Significant accounting judgements, estimates and assumptions

The preparation of the Group's consolidated financial statements

requires management to make judgements, estimates and assumptions

that affect the reported amounts of assets and liabilities and the

disclosure of contingent liabilities at the date of the

consolidated financial statements, and the reported amounts of

revenues and expenses during the reporting period. Estimates and

assumptions are continuously evaluated and are based on

management's experience and other factors, including expectations

of future events that are believed to be reasonable under the

circumstances. However, actual outcomes would differ from these

estimates if different assumptions were used and different

conditions existed.

In particular, the Group has identified the following areas

where significant judgements, estimates and assumptions are

required, and where actual results were to differ, may materially

affect the financial position or financial results reported in

future periods. Further information on these and how they impact

the various accounting policies is in the relevant notes to the

consolidated financial statements.

Going concern

This report has been prepared on the going concern basis, which

contemplates the continuation of normal business activity and the

realisation of assets and the settlement of liabilities in the

normal course of business.

At 30 September 2021, the Group held cash reserves of

US$2,749,000 (2020:US$1,789,000).

The Directors are confident the Group will generate revenue from

data and technology services which will contribute to cash flow in

the next 6-month period.

On this basis, the Directors believe that there are sufficient

funds to meet the Group's working capital requirements.

The Group recorded a loss of US$1,094,000 for the six months

ended 30 September 2021 and had net assets of US$3,926,000 as of 30

September 2021 (2020: loss of US$561,000 and net assets of

($1,473,000).

Accruals

Management has used judgement and prudence when estimating

certain accruals for contractor claims. The accruals recognised are

based on work performed but are before settlement.

Contingencies

By their nature, contingencies will only be resolved when one or

more uncertain future events occur or fail to occur. The assessment

of the existence, and potential quantum, of contingencies

inherently involves the exercise of significant judgement and the

use of estimates regarding the outcome of future events. Please

refer to Note 22 for further details.

The preparation of the Company's financial statements requires

management to make judgements, estimates and assumptions that

affect the reported amounts of revenues, expenses, assets and

liabilities, and the disclosure of contingent liabilities at the

end of each reporting period. Uncertainty about these assumptions

and estimates could result in outcomes that require a material

adjustment to the carrying amount of the asset or liability

affected in the future periods.

Judgements made in applying accounting policies

Management is of the opinion that there are no significant

judgements made in applying accounting estimates and policies that

have a significant risk of causing a material adjustment to the

carrying amounts of assets and liabilities within the next

financial year.

Key sources of estimation uncertainty

The key assumptions concerning the future and other key sources

of estimation uncertainty at the end of the reporting period are

discussed below. The Company based its assumptions and estimates on

parameters available when the financial statements were prepared.

Existing circumstances and assumptions about future developments,

however, may change due to market changes or circumstances arising

beyond the control of the Company. Such changes are reflected in

the assumptions when they occur.

Provision for expected credit losses (ECL) on trade receivables

and contract assets

ECLs are unbiased probability-weighted estimates of credit

losses which are determined by evaluating a range of possible

outcomes and taking into account past events, current conditions

and assessment of future economic conditions.

The Company uses a provision matrix to calculate ECLs for trade

receivables and contract assets. The provision rates are based on

days past due for groupings of various customer segments that have

similar loss patterns. The provision matrix is initially based on

the Company's historical observed default rates. The Company will

calibrate the matrix to adjust historical credit loss experience

with forward-looking information. At every reporting date,

historical default rates are updated and changes in the forward-

looking estimates are analysed.

The assessment of the correlation between historical observed

default rates, forecast economic conditions and ECLs is a

significant estimate. The amount of ECLs is sensitive to changes in

circumstances and of forecast economic conditions. The Company's

historical credit loss experience and forecast of economic

conditions may also not be representative of customer's actual

default in the future.

The carrying amount of the Company's trade receivables at the

end of the reporting period is disclosed in Note 12 to the

financial statements.

Revenue recognition

The Company uses the percentage-of-completion method to account

for its contract revenue. The stage of completion is measured in

accordance with the accounting policy stated in Note 5. Significant

assumptions are required in determining the stage of completion,

the extent of the contract cost incurred, the estimated total

contract cost and the recoverability of the contracts. In making

these assumptions, management has relied on past experience and the

work of specialists.

Significant judgement is also required to assess allowance made

for foreseeable losses, if any, where the contract cost incurred

for any job exceeds its contract sum. The carrying amounts of

contract balances at the reporting date are disclosed in Note 15 to

the financial statements.

Allowance for inventory obsolescence

The Company reviews the ageing analysis of inventories at each

reporting date, and makes provision for obsolete and slow moving

inventory items identified that are no longer suitable for sale.

The net realisable value for such inventories are estimated based

on the most reliable evidence available at the reporting date.

These estimates take into consideration market demand, competition,

selling price and cost directly relating to events occurring after

the end of the financial year to the extent that such events

confirm conditions existing at the end of the financial year.

Possible changes in these estimates could result in revisions to

the valuation of inventories. The carrying amounts of the Company's

inventories at the reporting date are disclosed in Note 13 to the

financial statements .

4. New standards and amendments and interpretations adopted by the Group

There are several new accounting standards and interpretations

issued by the IASB that are not yet mandatorily applicable to the

Group and have not been applied in preparing these consolidated

financial statements. The Group does not plan to adopt these

standards early.

These standards are not expected to have a material impact on

the Group in the current or future reporting periods.

5. Summary of significant accounting policies

Property, plant and equipment

Plant and equipment are shown at cost less accumulated

depreciation and impairment losses. The initial cost of an asset

comprises its purchase price or construction cost, any costs

directly attributable to bringing the asset into operation, any

incidental cost of purchase, and associated borrowing costs. The

purchase price or construction cost is the aggregate amount paid

and the fair value of any other consideration given to acquire the

asset. Directly attributable costs include employee benefits,

professional fees and costs of testing whether the asset is

functioning properly. Capitalised borrowing costs include those

that are directly attributable to the construction of mining and

infrastructure assets.

Property, plant and equipment relate to plant, machinery,

fixtures and fittings and are shown at historical cost less

accumulated depreciation and impairment losses.

The depreciation rates applied to each type of asset are as

follows:

Plant and machinery 2 to 10 years

Motor Vehicles 2 to 10 years

Fixtures and fittings 3 years

Lease Improvements 5 years

Subsequent expenditure is capitalised when it is probable that

future economic benefits from the use of the asset will be

increased. All other subsequent expenditure is recognised as an

expense in the period in which it is incurred. Assets that are

replaced and have no future economic benefit are derecognised and

expensed through profit or loss. Repairs and maintenance which

neither materially add to the value of assets nor appreciably

prolong their useful lives are charged against income. Gains/

losses on the disposal of fixed assets are credited/charged to

income. The gain or loss is the difference between the net disposal

proceeds and the carrying amount of the asset.

The asset's residual values, useful lives and methods of

depreciation are reviewed at each reporting period and adjusted

prospectively if appropriate.

Inventories

Inventories are valued at the lower of cost and net realisable

value.

Financial instruments

(a) Financial assets

(i) Classification, initial recognition and measurement

The Company classifies its financial assets into the following

measurement categories:

amortised cost; fair value through other comprehensive income

(FVOCI); and fair value through profit or loss (FVPL).

Financial assets are recognised when, and only when the entity

becomes party to the contractual provisions of the instruments.

At initial recognition, the Company measures a financial asset

at its fair value plus, in the case of a financial asset not at

FVPL, transaction costs that are directly attributable to the

acquisition of the financial assets. Transaction costs of financial

assets carried at FVPL are expensed in profit or loss.

Trade receivables are measured at the amount of consideration to

which the Company expects to be entitled in exchange for

transferring promised goods or services to a customer, excluding

amounts collected on behalf of third party, if the trade

receivables do not contain a significant financing component at

initial recognition.

(ii)Subsequent measurement

Debt instruments

Subsequent measurement of debt instruments depends on the

Company's business model for managing the asset and the contractual

cash flow characteristics of the asset. The Company only has debt

instruments at amortised cost.

Financial assets that are held for the collection of contractual

cash flows where those cash flows represent solely payments of

principal and interest are measured at amortised cost. Financial

assets are measured at amortised cost using the effective interest

method, less impairment. Gains and losses are recognised in profit

or loss when the assets are derecognised or impaired, and through

the amortisation process.

Debt instruments of the Company comprise cash and cash

equivalents and trade and other receivables.

Equity instruments

On initial recognition of an investment in equity instrument

that is not held for trading, the Company may irrevocably elect to

present subsequent changes in fair value in other comprehensive

income which will not be reclassified subsequently to profit or

loss. Dividends from such investments are to be recognised in

profit or loss when the Company's right to receive payments is

established. For investments in equity instruments which the

Company has not elected to present subsequent changes in fair value

in other comprehensive income, changes in fair value are recognised

in profit or loss.

(iii)Derecognition

A financial asset is derecognised where the contractual right to

receive cash flows from the asset has expired. On derecognition of

a financial asset in its entirety, the difference between the

carrying amount and the sum of the consideration received and any

cumulative gain or loss that had been recognised in other

comprehensive income for debt instruments is recognised in profit

or loss.

(b) Financial liabilities

(i) Initial recognition and measurement

Financial liabilities are recognised when, and only when, the

Company becomes a party to the contractual provisions of the

financial instrument. The Company determines the classification of

its financial liabilities at initial recognition.

All financial liabilities are recognised initially at fair value

plus in the case of financial liabilities not at FVPL, directly

attributable transaction costs.

(ii) Subsequent measurement

After initial recognition, financial liabilities that are not

carried at FVPL are subsequently measured at amortised cost using

the effective interest method. Gains and losses are recognised in

profit or loss when the liabilities are derecognised, and through

the amortisation process.

Financial liabilities measured at amortised cost comprise trade

and other payables.

(iii) Derecognition

A financial liability is derecognised when the obligation under

the liability is discharged or

cancelled or expires. On derecognition, the difference between

the carrying amounts and the consideration paid is recognised in

profit or loss.

Offsetting

Financial assets and liabilities are offset and the net amount

presented in the statement of financial position when, and only

when, the Company has a legal right to offset the amounts and

intends either to settle on a net basis or to realise the asset and

settle the liability simultaneously

Cash and cash equivalents

Cash and cash equivalents are measured at fair value, based on

the relevant exchange rates at balance sheet date. Cash and cash

equivalents comprise cash balances and short-term deposit that are

readily convertible to known amount of cash and that are subject to

an insignificant risk of changes in their fair value and are used

by the Company in the management of its short-term commitments. For

the purpose of the consolidated statement of cash flows, cash and

cash equivalents consist of cash and cash equivalents as defined

above, net of outstanding bank overdrafts.

Impairment

Financial Assets

The Company recognises an allowance for expected credit losses

(ECLs) for all debt instruments not held at FVPL and contract

assets. ECLs are based on the difference between the contractual

cash flows due in accordance with the contract and all the cash

flows that the Company expects to receive, discounted at an

approximation of the original effective interest rate. The expected

cash flows will include cash flows from the sale of collateral held

or other credit enhancements that are integral to the contractual

terms.

ECLs are recognised in two stages. For credit exposures for

which there has not been a significant increase in credit risk

since initial recognition, ECLs are provided for credit losses that

result from default events that are possible within the next

12-months (a 12-month ECL). For those credit exposures for which

there has been a significant increase in credit risk since initial

recognition, a loss allowance is recognised for credit losses

expected over the remaining life of the exposure, irrespective of

timing of the default (a lifetime ECL).

For trade receivables and contract assets, the Company applies a

simplified approach in calculating ECLs. Therefore, the Company

does not track changes in credit risk, but instead recognises a

loss allowance based on lifetime ECLs at each reporting date. The

Company has established a provision matrix that is based on its

historical credit loss experience, adjusted for forward-looking

factors specific to the debtors and the economic environment which

could affect debtors' ability to pay.

The Company considers a financial asset in default when

contractual payments are past due for more than 90 days. However,

in certain cases, the Company may also consider a financial asset

to be in default when internal or external information indicates

that the Company is unlikely to receive the outstanding contractual

amounts in full before taking into account any credit enhancements

held by the Company. A financial asset is written off when there is

no reasonable expectation of recovering the contractual cash

flows.

Non-financial assets

The carrying amounts of the Company's non-financial assets,

other than inventories, are reviewed at each reporting date to

determine whether there is any indication of impairment. If any

such indication exists, then the asset's recoverable amount is

estimated. An impairment loss is recognised if the carrying amount

of an asset or its related cash-generating unit (CGU) exceeds its

estimated recoverable amount.

The recoverable amount of an asset or CGU is the greater of its

value in use and its fair value less costs to sell. For the purpose

of impairment testing, the recoverable amount is determined on an

individual asset basis unless the asset does not generate cash

inflows that are largely independent of those from other assets. If

this is the case, the recoverable amount is determined for the CGU

to which the asset belongs. If the recoverable amount of the asset

(or CGU) is estimated to be less than its carrying amount, the

carrying amount of the asset (or CGU) is reduced to its recoverable

amount.

The difference between the carrying amount and recoverable

amount is recognised as an impairment loss in profit or loss.

An impairment loss for an asset other than goodwill is reversed

only if, there has been a change in the estimates used to determine

the asset's recoverable amount since the last impairment loss was

recognised. The carrying amount of this asset is increased to its

revised recoverable amount, provided that this amount does not

exceed the carrying amount that would have been determined (net of

any accumulated amortisation or depreciation) had no impairment

loss been recognised for the asset in prior years.

A reversal of impairment loss for an asset other than goodwill

is recognised in profit or loss

Trade and other payables

Trade and other payables are non-derivative financial

liabilities that are not quoted in an active market. It represents

liabilities for goods and services provided to the Group prior to

the year end and which are unpaid. These amounts are unsecured and

have 7-30 day payment terms. Trade and other payables are presented

as current liabilities unless payment is not during within 12

months from the reporting date. They are recognised initially at

their fair value and subsequently measured at amortised cost using

the effective interest method.

Interest-bearing loans and borrowings

Interest-bearing loans and borrowings are recognised initially

at fair value, net of transaction costs incurred. Borrowings are

subsequently carried at amortised cost using the effective interest

(EIR) method. The fair value implies the rate of return on the debt

component of the facility. This rate of return reflects the

significant risks attaching to the facility from the lenders'

perspective.

Determination of Fair Values

A number of the Company's accounting policies and disclosures

require the determination of fair value, for both financial and

non-financial assets and liabilities. Fair values have been

determined for measurement and/or disclosure purposes based on the

following methods. When applicable, further information about the

assumptions made in determining fair values is disclosed in the

notes specific to that asset or liability.

Trade and other receivables

The fair values of trade and other receivables are estimated as

the present value of future cash flows, discounted at the market

rate of interest at the measurement date. Current receivables with

no stated interest rate are measured at the original invoice amount

if the effect of discounting is immaterial. Fair value is

determined at initial recognition and, for disclosure purposes, at

each annual reporting date.

Non-derivative financial liabilities

Non-derivative financial liabilities are measured at fair value

at initial recognition and for disclosure purposes, at each annual

reporting date. Fair value is calculated based on the present value

of future principal and interest cash flows, discounted at the

market rate of interest at the measurement date.

Other financial assets and liabilities

The carrying amount of financial assets and liabilities with a

maturity of less than one year is assumed to approximate their fair

values.

Provisions

Provisions are measured at the present value of management's

best estimate of the expenditure required to settle the present

obligation at the end of the reporting period. The discount rate

used to determine the present value is a pre-tax amount that

reflects current market assessments of the time value of money, and

the risks specific to the liability. The increase in the provision

due to the passage of time is recognised as interest expense.

Finance income

Interest income is made up of interest received on cash and cash

equivalents.

Deferred taxation

Deferred income tax is provided using the balance sheet method

on temporary differences at the reporting date between the tax

bases of assets and liabilities and their carrying amounts for

financial reporting purposes.

Deferred income tax liabilities are recognised for all taxable

temporary differences.

Deferred income tax assets are recognised for all deductible

temporary differences, carry forward of unused tax credits and

unused tax losses, to the extent that it is probable that taxable

profit will be available against which the deductible temporary

differences, and the carry forward of unused tax credits and unused

tax losses, can be utilised, except:

In respect of deductible temporary differences associated with

investments in subsidiaries, deferred income tax assets are

recognised only to the extent that it is probable that the

temporary differences will reverse in the foreseeable future and

taxable profit will be available against which the temporary

differences can be utilised.

The carrying amount of deferred income tax assets is reviewed at

the end of each reporting period and reduced to the extent that it

is no longer probable that sufficient taxable profit will be

available to allow all or part of the deferred income tax asset to

be utilised. Unrecognised deferred income tax assets are reassessed

at the end of each reporting period and are recognised to the

extent that it has become probable that future taxable profit will

be available to allow the deferred tax asset to be recovered.

Deferred income tax assets and liabilities are measured at the

tax rates that are expected to apply to the year when the asset is

realised or the liability is settled, based on tax rates (and tax

laws) that have been enacted or substantively enacted by the end of

the reporting period.

Deferred income tax assets and deferred income tax liabilities

are offset if a legally enforceable right exists to set off current

tax assets against current income tax liabilities and the deferred

income taxes relate to the same taxable entity and the same

taxation authority.

Foreign currencies

i) Functional and presentation currency

The consolidated financial statements are presented in US

dollars, which is the Group's presentation currency.

ii) Transaction and Balances

Transactions in foreign currencies are initially recorded in the

functional currency at the respective functional currency rates

prevailing at the date of the transaction. Monetary assets and

liabilities denominated in foreign currencies are retranslated at

the spot rate of exchange ruling at the reporting dates. All

differences are taken to the profit or loss, should specific

criteria be met.

Non-monetary items that are measured in terms of historical cost

in a foreign currency are translated using the exchange rate as at

the date of the initial transaction. Non-monetary items measured at

fair value in a foreign currency are translated using the exchange

rates at the date when the fair value was determined.

iii) Group Companies

The results and financial position of foreign operations (none

of which has the currency of a hyperinflationary economy) that have

a functional currency different from the presentation currency are

translated into the presentation currency as follows:

-- Assets and liabilities for each statement of financial

position presented as translated at

the closing rate at the date of the statement of financial

position.

-- Income and expenses for each income statement and statement of profit or loss and other comprehensive income are translated at average exchange rates (unless this is not a reasonable approximation of the cumulative effect of the rates prevailing on the transactions dates, in which case income and expenses are translated at the dates of the transactions), and

-- All resulting exchange differences are recognised in other comprehensive income

Revenue Recognition

Revenue is measured based on the consideration to which the

Company expects to be entitled in exchange for transferring

promised goods or services to a customer, excluding amounts

collected on behalf of third parties.

Revenue is recognised when the Company satisfies a performance

obligation by transferring a promised good or service to the

customer, which is when the customer obtains control of the good or

service. A performance obligation may be satisfied at a point in

time or over time. The amount of revenue recognised is the amount

allocated to the satisfied performance obligation.

Rendering of services

Revenue from rendering of services is recognised as performance

obligations are satisfied. Payments are due from customers based on

the agreed billing milestone stipulated in the contracts or based

on the amounts certified by the customers.

Where performance obligations are satisfied over time as work

progresses, revenue is recognised progressively based on the

percentage of completion method. The stage of completion is

assessed by reference to the cost incurred relative to total

estimated costs (input method). The related costs are recognised in

profit or loss when they are incurred, unless they relate to future

performance obligations.

If the value of services rendered for the contract exceeds

payments received from the customer, a contract asset is recognised

and presented separately on the balance sheet. The contract assets

are transferred to receivables when the entitlement to payment

becomes unconditional. If the amounts invoiced to the customer

exceeds the value of services rendered, a contract liability is

recognised and separately presented in the statement of financial

position.

Interest Income

Interest income is recognised using the effective interest

method. When a receivable is impaired, the Group reduces the

carrying amount to its recoverable amount, being the estimated

future cash flow discounted at the original effective interest rate

of the instrument, and continues unwinding the discount as interest

income.

Contract assets and liabilities

Contract assets primarily relate to the Company's rights to

consideration for work completed but not billed at the reporting

date on project work. Contract assets are transferred to trade

receivables when the rights become unconditional. This usually

occurs when the Company invoices the customer.

Contract liabilities primarily relate to advance consideration

received from customers and progress billings issued in excess of

the Company's rights to the consideration.

6. Net Operating Expenses

6 months ended 30 September

2021 2020

US$'000 US$'000

(Unaudited) (Unaudited)

Continuing Operations

Costs of goods sold 1,217 913

Employee Cost 1,151 318

Travel Expenses 3 1

Admin Expense 839 283

Lease Expenses 1 57

Distribution, Advertising

and promotion 4 4

General Expenses 105 17

Depreciation of property plant

and equipment 81 22

Interest on lease expenses 3 -

Occupancy costs 43 9

3,447 1,624

------------------------------ ------------------------------

7. Key Management Personnel

6 months ended 30 September

2021 2020

US$'000 US$'000

(Unaudited) (Unaudited)

Directors' emoluments 229 181

8. Employee costs

6 months ended 30 September

2021 2020

US$'000 US$'000

(Unaudited) (Unaudited)

Wages and salaries 91 70

Wages and salaries - Cost

of sales 722 528

Other employee costs 109 68

Total 922 666

----------------------------- -----------------------------

9. Earnings per share

6 months ended 30 September

2021 2020

US$'000 US$'000

(Unaudited) (Unaudited)

Loss for the period attributable

to members of the parent (1,152) (412)

Basic loss per share is calculated by dividing

the loss attributable

to owners of the Parent by the weighted average

number of ordinary

share in issue during the

period.

Basic weighted average number

of ordinary shares in issue 1,215,794,502 995,482,002

Basic loss per share-cents (0.00090) (0.00056)

Diluted loss per share-cents (0.00090) (0.00056)

10. Segment Reporting

The consolidated entity's operating segments have been

determined with reference to the monthly management accounts used

by the chief operating decision maker to make decisions regarding

the consolidated entity's operations and allocation of working

capital.

Due to the size and nature of the consolidated entity, the Board

has been determined as the chief operating decision maker.

The consolidated entity operates in one business segment, being

information data technology and infrastructure.

The revenues and results are those of the consolidated entity as

a whole and are set out in the statement of profit and loss and

other comprehensive income. The segment assets and liabilities of

this segment are those of the consolidated entity and are set out

in the Statement of Financial Position.

11. Cash and Cash Equivalents

6 months ended 30 September

2021 2020

US$'000 US$'000

(Unaudited) (Unaudited)

Cash at Bank 2,749 1,789*

*Cash at bank includes US$78,000 pledged to the bank as security

for banker guarantee given to customer.

12. Trade and Other Receivables

6 months ended 30 September

2021 2020

US$'000 US$'000

(Unaudited) (Unaudited)

Trade Receivables 1,228 1,407

Prepayments 62 73

Other Receivables 1,347 -

2,638 1,480

----------------------------- -----------------------------

13. Inventories

6 months ended 30 September

2021 2020

US$'000 US$'000

(Unaudited) (Unaudited)

Inventories 307 316

14. Property, Plant and Equipment

Right-of-Use Building Furniture Vehicle Total

Assets and improvts & Office

Equipment

US$'000 US$'000 US$'000 US$'000 US$'000

Cost

As at 1 Apr 2020 169 46 502 148 865

Impact of IFRS

16 (Note 4) 124 - - - 124

Additions /

Transfer

in - - 7 - 7

Disposal / - - - - -

Write-off

Adjustments/Forex

translation 10 7 20 (8) 29

----------------- ----------------- ----------------- ----------------- -----------------

At 31 March 2021 303 53 529 140 1,025

Impact of IFRS

16 (Note 4) - - - - 0

Additions /

Transfer

in - - 0 - 0

Disposal / - - - - -

Write-off

Adjustments/Forex

translation (3) (1) (7) (1) (12)

----------------- ----------------- ----------------- ----------------- -----------------

At 30 September

2021 300 52 522 139 1,013

Accumulated depreciation

As at 1 Apr 2020 55 39 401 75 570

Charge for the

year 120 3 34 13 170

Disposal/Write-off - - - - -

Adjustments/Forex

translation 3 8 13 (14) 10

----------------- ----------------- ----------------- ----------------- -----------------

At 31 March 2021 178 50 448 74 750

Charge for the

year 60 1 15 5 81

Disposal/Write-off - - - - -

Adjustments/Forex

translation (2) (1) (6) (1) (10)

----------------- ----------------- ----------------- ----------------- -----------------

At 30 September

2021 236 50 457 78 821

Net book value

At 31 March 2021 125 3 81 66 275

================= ================= ================= ================= =================

At 30 September

2021 64 2 65 61 192

================= ================= ================= ================= =================

15. Work in Progress

6 months ended 30 September

2021 2020

US$'000 US$'000

(Unaudited) (Unaudited)

Contract assets 272 186

Contract assets primarily relate to the Company's right to

consideration for work completed but not billed at the reporting

date. If the value of services rendered exceeds payments received

from the customer, a contract asset is recognised and presented

separately. The contract assets is transferred to receivables when

the entitlement to payment becomes unconditional.

16. Intangible Assets

US$'000

Opening net book value 1

April 2021 6

Addition -

Amortisation charge -

-----------------------------

Closing net book value 30

September 2021 6

There was no impairment during the period.

17. Subsidiaries

Details of the Company's subsidiaries as of 30 September 2021

are as follows:

Name of Subsidiary Place of Incorporation Proportion Proportion

of of Voting

Ownership Power

Interest

Golden Saint Technologies

(Australia) Pty Ltd Australia 100 100

EMS Wiring Systems Pte.

Ltd Singapore 100 100

GS Fintech Ltd UK 100 100

GS Fintech Pte Ltd Singapore 100 100

18. Taxation

Unrecognised tax losses

Where the realisation of deferred tax assets is dependent on

future taxable profits, losses carried forward are recognised only

to the extent that business forecasts predict that such profits

will be available to the companies in which losses arose.

The parent, GSTechnologies Ltd, is not liable to corporation tax

in BVI, so it has no provision for deferred tax. However, Golden

Saint Technologies (Australia) Pty Ltd is liable to tax in

Australia and EMS is liable for tax in Singapore.

19. Share Capital and Reserves

The share capital of the Company is denominated in UK Pounds

Sterling. Each allotment during the period was then translated into

the Group's functional currency, US Dollars at the spot rate on the

date of issue.

Authorised Number of Shares US$'000

Ordinary Shares

As at 1 April 2020 995,482,002 1,804

Issues during the period

1 Apr 2020 - 31 Mar 2021 198,000,000 273

------------------------ ----------------------------

As at 31 March 2021 1,193,482,002 2,077

Issues during the period

1 Apr 2021 - 30 Sep 2021 241,500,000 3,254

As at 30 September 2021 1,434,982,002 5,331

------------------------ ----------------------------

20. Non-Controlling Equity Interest

All entities within the group are currently 100% owned and

accordingly a non-controlling interest does not arise.

21. Trade and Other Payables

6 months ended 30 September

2021 2020

US$'000 US$'000

(Unaudited) (Unaudited)

Trade Payables 223 399

Accruals 485 325

Other Payables 43 24

Lease liabilities 67 -

818 748

----------------------------- -----------------------------

Trade payables are non-interest bearing and are normally settled

on 60-day terms.

22. Loans Payable

30-Sep-21 30-Sep-20

-------------------------- ------------------------- -------------------------- -------------------------

Term Current Non-current Current Non-current

US$'000 US$'000 US$'000 US$'000

(Unaudited) (Unaudited) (Unaudited) (Unaudited)

Loan 5

1 years 136 975 132 1,238

Loan 3

2 years 86 223 82 391

-------------------------- ------------------------- -------------------------- -------------------------

222 1,198 213 1,629

23. Commitments and Contingencies

The Group is subject to no material commitments or contingent

liabilities.

24. Subsequent Events

As announced, on 25 November 2021, subscription of 50,000,000

ordinary share has been placed at GBP0.02 per ordinary share.

25. Financial risk management objectives and policies

The Group's activities expose it to a variety of financial

risks. The Group's Board provides certain specific guidance in

managing such risks, particularly as relates to credit and

liquidity risk. Any form of borrowings requires approval from the

Board and the Group does not currently use any derivative financial

instruments to manage its financial risks. The key financial risks

and the Group's major exposures are as follows:

Credit risk

The maximum exposure to credit risk is represented by the

carrying amount of the financial assets. In relation to cash and

cash equivalents, the Group limits its credit risk with regards to

bank deposits by only dealing with reputable banks. In relation to

sales receivables, the Group's credit risk is managed by credit

checks for credit customers and approval of letters of credit by

the Group's advising bank.

Foreign Currency Risk

Currency risk is the risk that the value of a financial

instrument will fluctuate due to changes in foreign exchange rates.

The table below indicates the currencies to which the Group had

significant exposure at 30 September 2019 on its monetary assets

and liabilities. The analysis calculates the effect of a reasonably

possible movement of the currency rate against the US dollar, with

all other variables held constant on the statement of comprehensive

income (due to the fair value of currency sensitive non- trading

monetary assets and liabilities). A positive amount in the table

reflects a potential net increase in the consolidated statement of

comprehensive income.

26. Liquidity risk

Liquidity risk is the risk that the Group will not be able to

meet its financial obligations as they fall due.

The Group monitors its risk to a shortage of funds using a

combination of cash flow forecasts, budgeting and monitoring of

operational performance.

27. Capital management

Capital includes equity attributable to the equity holders of

the parent. Refer to the statement of changes in equity for

quantitative information regarding equity.

The Group's primary objectives when managing capital are to

safeguard its ability to continue as a going concern in order to

provide returns for shareholders. For details of the capital

managed by the Group as of 30 September 2021, please see Note

19.

The Group is not subject to any externally imposed capital

requirements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FEWFMSEFSEIE

(END) Dow Jones Newswires

December 21, 2021 01:59 ET (06:59 GMT)

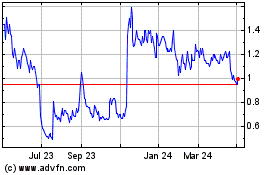

Gstechnologies (LSE:GST)

Historical Stock Chart

From Mar 2024 to Apr 2024

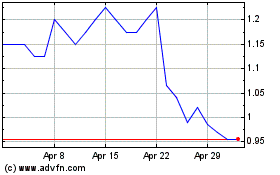

Gstechnologies (LSE:GST)

Historical Stock Chart

From Apr 2023 to Apr 2024