GSTechnologies Ltd Placing and Subscription to raise GBP1.33 million (9982X)

11 January 2022 - 6:00PM

UK Regulatory

TIDMGST

RNS Number : 9982X

GSTechnologies Ltd

11 January 2022

NOT FOR RELEASE, DISTRIBUTION OR PUBLICATION, DIRECTLY OR

INDIRECTLY, IN OR TO THE UNITED STATES, CANADA, AUSTRALIA, THE

REPUBLIC OF SOUTH AFRICA, JAPAN OR ANY MEMBER STATE OF THE EUROPEAN

ECONOMIC AREA ("EEA") (OTHER THAN ANY MEMBER STATE OF THE EEA WHERE

SECURITIES MAY BE LAWFULLY MARKETED) OR ANY OTHER JURISDICTION

WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS ANNOUNCEMENT. THE

INFORMATION CONTAINED HEREIN DOES NOT CONSTITUTE OR FORM PART OF

ANY OFFER TO ISSUE OR SELL, OR ANY SOLICITATION OF ANY OFFER TO

SUBSCRIBE OR PURCHASE, ANY INVESTMENTS IN ANY JURISDICTION.

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014 which forms part of UK

law by virtue of the European Union (Withdrawal) Act 2018

("MAR").

11 January 2022

GSTechnologies Limited

("GST" or the "Company" or the "Group")

Placing and Subscription to raise GBP1.33 million

Appointment of Broker

GSTechnologies Limited (LSE: GST), the fintech and information

technology solutions company, is pleased to announce that the

Company has raised gross proceeds of GBP1,335,100 through a placing

(the "Placing") of 40,476,190 shares and a subscription for

23,100,000 shares (the "Subscription") of no par value in the

Company ("Fundraising Shares") at a price of 2.10 pence per

share.

The issue of the Fundraising Shares is within the Company's

existing allotment authorities. The Fund Raising Shares equate to

approximately 4.3% of the Company's currently issued share capital.

In addition, participants in the Placing and the Subscription have

been issued with one warrant for every five Fundraising Shares

exercisable at 2.10 pence per share at any time up to one year from

Admission, as defined below.

The funds raised from the Placing and the Subscription will be

principally used to accelerate the implementation of the Group's

strategy, in particular covering planned sales and marketing costs,

and the costs of further development and implementation of the Wise

MPay technology, including in relation to the acquisition of Angra

Limited, which remains subject to FCA approval.

Further announcements will be made by the Company as

appropriate.

Appointment of Broker

The Company is pleased to announce the appointment of Monecor

(London) Ltd, trading as ETX Capital, as the Company's Broker with

immediate effect. The Placing was arranged by ETX Capital.

Tone Goh, Chairman of GST, commented : "I am pleased that we are

able to announce this successful fundraising, again at a higher

price than our previous raise, to provide further funds for our

development. I look forward to providing further updates in due

course, including in relation to the FCA approval of the Angra

acquisition, as we seek to rapidly build a blockchain enabled

neobanking business."

Admission and Total Voting Rights

The Placing and the Subscription have been conducted utilising

the Company's existing share authorities. The Fundraising Shares

will rank pari passu in all respects with the existing shares. The

Placing is conditional, inter alia, on there being no breach of the

obligations under the Placing Agreement entered into between

Monecor (London) Ltd (trading as ETX Capital) and the Company prior

to Admission, and admission of the Fundraising Shares to trading on

the Main Market of the London Stock Exchange ("Admission") becoming

effective. Application will be made to the London Stock Exchange

for the Fundraising Shares to be admitted to trading on the Main

Market of the London Stock Exchange and the Standard Segment of the

FCA Official List. It is expected that Admission will become

effective and that dealings in the Fundraising Shares on the Main

Market of the London Stock Exchange will commence on or around 17

January 2022.

On Admission, the Company will have 1,548,558,192 shares in

issue, each with one voting right. There are no shares held in

treasury. Therefore, the Company's total number of shares and

voting rights will be 1,548,558,192 and this figure may be used by

shareholders from Admission as the denominator for the calculations

by which they will determine if they are required to notify their

interest in, or a change to their interest in, the Company under

the FCA's Disclosure Guidance and Transparency Rules.

Enquiries:

The Company

Tone Goh, Executive Chairman +65 6444 2988

F inancial Adviser

+44 (0)20 3005

VSA Capital Limited 5000

Simon Barton / Pascal Wiese

Broker

+44 (0)20 7392

ETX Capital 1400

Tom Curran / Thomas Smith

Financial PR & Investor Relations

IFC Advisory Limited

Tim Metcalfe / Graham Herring / Florence +44 20 (0) 3934

Chandler 6630

For more information please see:

https://gstechnologies.co.uk/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEFBLLFLFLZBBB

(END) Dow Jones Newswires

January 11, 2022 02:00 ET (07:00 GMT)

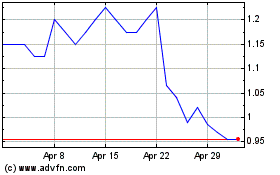

Gstechnologies (LSE:GST)

Historical Stock Chart

From Mar 2024 to Apr 2024

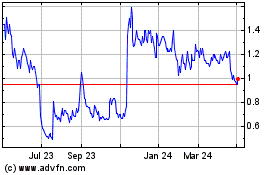

Gstechnologies (LSE:GST)

Historical Stock Chart

From Apr 2023 to Apr 2024