TIDMGTC

RNS Number : 9108A

GETECH Group plc

28 September 2022

28 September 2022

Getech Group plc

("Getech" or the "Company")

Interim report for the six months ended 30 June 2022

Getech (AIM: GTC), the geoenergy and green hydrogen company,

announces its unaudited interim results and report for the six

months to 30 June 2022 ("H1 2022" or the "Period").

Financial highlights

-- Demand for Getech products and services continues to

accelerate and diversify - revenue up 11% year-on-year to GBP2.7

million (H1 2021: GBP2.4 million).

-- Record orderbook value of GBP4.8 million, a 118% increase

year-on-year (30 June 2021: GBP2.2 million) and 45% increase since

the end of 2021 (31 December 2021: GBP3.3 million).

-- Strong visibility in revenue generation, with GBP1.5 million

of the orderbook expected to convert in H2 20 22, and a further

GBP1.6 million due i n FY 2023.

-- Gross profit margin of 63% (H1 2021: 59%) driven by increased product revenue.

-- Robust cash position of GBP4.3 million at 30 June 2022 (31

December 2021: GBP5.9 million), plus GBP2.4 million of receivables

invoiced post Period-end for payment in H2.

Corporate and operational highlights

-- Continued implementation of 'locate, develop, operate'

business model, using foundation products and services to grow

revenue and unlock transformational asset investment

opportunities.

-- Investment to grow products and services rewarded with

multi-million-pound contracts and diversification across

transitional petroleum, critical minerals, geothermal, carbon

storage.

-- Green hydrogen developments advancing at pace - with

expansion in tangibility, scale and scope:

-- Completion of engineering and commercial feasibility studies

for both Shoreham and Inverness, resulting in extension of the

Shoreham Green Energy Port exclusivity for five years (through to

first production and beyond), groundworks at Inverness SGN

gasholder site, and progress towards concluding terms on a

multi-hub Joint Venture Agreement with The Highland Council.

-- Phase 1 hydrogen production design capacity of Shoreham and

Inverness increased to 2.5 tonnes/day (6 MW) in response to strong

indicators of initial hydrogen demand - with c.5 tonnes/day of

potential identified and targeted for production start-ups in

2025.

-- Owned and operated wind and solar generation assets added to

the development plan of the Shoreham and Inverness green energy

hubs, expanding the revenue generation potential and reducing the

cost of hydrogen production.

-- The hydrogen project pipeline now totals c.240 MW of production capacity.

Current trading and outlook

-- The macro-economic environment continues to drive robust

demand for Getech's products and services, demonstrated by further

revenue and orderbook momentum into H2 2022 , with additional Globe

contracts closed.

-- Asset development pipeline is expanding into the geothermal and critical minerals sectors.

Dr Jonathan Copus, Getech CEO commented:

"With global energy investment forecast to rise to $2.4 trillion

[1] in 2022, driven mainly by the accelerating need for clean and

secure energy, Getech continues to see escalating and widening

demand for our industry-leading geoscience data and proprietary

geospatial software. This is evidenced by sustained increases in

revenue and rapid orderbook growth - both of which have continued

to grow post Period end. Inclusive of investment to extend the

reach of our foundation products and services, they generated an H1

2022 cash profit. This underscores the strength of our foundation

business, which also benefits from US dollar strength.

Against a backdrop of increasing global investment in green

hydrogen and recognition of its critical role in energy security,

we are making strong progress with our development projects at

Shoreham and Inverness. When in operation, Inverness will be the

first regional green hydrogen network in the UK and Shoreham a

vital local green economic hub in the South of England. Both

projects have the potential to demonstrate the suitability of green

hydrogen as a decarbonisation solution and provide a framework for

future scalability and repeatability across the UK and

internationally.

With a clear business model of locating, developing and

operating geoenergy and green hydrogen projects, a unique

foundation offering and a strong team, Getech is well positioned to

drive growth through the acceleration in energy investment."

Investor Meet Company presentation

The Company will hold an investor call on Wednesday 5 October at

11.00am BST to discuss the interim results. Investors can sign up

to Investor Meet Company for free and add to meet Getech via:

https://www.investormeetcompany.com/investor/company/getech-group-plc.

Investors who already follow Getech on the Investor Meet Company

platform will automatically be invited. Questions can be submitted

pre-event via your Investor Meet Company dashboard up until 9am the

day before the meeting or at any time during the live

presentation.

For further information, please contact:

Getech Group plc Tel: 0113 322 2200

Dr Jonathan Copus, Chief Executive

Cenkos Securities plc

Neil McDonald / Pete Lynch (Corporate Finance)

Michael Johnson / Dale Bellis (Sales) Tel: 0207 397 8900

Camarco Tel: 020 3781 8331

James Crothers / Toby Strong / Charles Dingwall

Notes to editors:

Getech Group plc (AIM: GTC) applies its world-leading geoscience

data and unique geospatial software products to accelerate the

energy transition by locating, developing and operating geoenergy

and green hydrogen projects.

For further information, please visit www.getech.com .

Chairman and CEO review

The global energy transition offers new business opportunities

that are reliant on a diverse range of solutions. These are often

'local' in nature and the success of their deployment requires

technical, spatial and economic analysis of energy sources,

customer needs and infrastructure options. Therefore, Getech is

well positioned to address these requirements.

In H1 2022 our customers used our market-leading data, software

and services to locate and develop new sources of energy, new

deposits of critical minerals, and sites for the secure storage of

CO(2) . As a result of our unique industry position with

involvement across energy sectors, Getech can collaborate with

companies and governments at each step of their energy transition

journey to bring diversified yet integrated, low-carbon

solutions.

Employing Getech's 'locate, develop, operate' business model, we

are also establishing our own scalable portfolio of low carbon

assets to transform the Company's value proposition.

Unique technology, data and expertise to accelerate the energy

transition

Unprecedented energy market volatility, the cost of climate

change and threats to energy security highlight the need for a

sustainable, secure, and accelerated path to decarbonisation. A

diversified and resilient energy system is required to deliver this

and in 2022 governments have announced bold policy action alongside

significant infrastructure and innovation investment

programmes.

Getech set out a plan in H1 2021 to target the rapidly expanding

market for energy transition solutions. By investing to extend the

application of our geoscience and geospatial petroleum products and

services into the critical minerals, geothermal, green hydrogen and

carbon storage sectors we have since grown our orderbook to a

record high, and H1 2022 revenue increased by 11% year-on-year.

Getech products and services are routinely used to locate and

develop natural resource assets of very significant value. This

allows us to demonstrate our expertise and build new strategic

partnerships. Through these partnerships we are successfully

accessing low carbon asset participation opportunities. These

opportunities further transform the value proposition of our

business model, having the potential to deliver a step-change in

Getech's value creation and revenue generation. Our ambition is to

establish at least 500MW of new geoenergy and green hydrogen assets

by 2030.

Developing assets to achieve scale

Our asset development strategy is based on employing Getech data

and analytics to identify and value operational locations where

there is a clear and compelling decarbonisation pathway. By

combining spatial analytics with our data, economic and technical

expertise, we can rapidly assess the cost competitiveness and

commercial viability of a site versus other locations.

Having identified potential, we mature opportunities using a

rigorous phase-gate processes. We have redeployed this from the

petroleum industry, and we are applying it to clean energy

solutions using our decades of energy industry experience.

The process strengthens our resource allocation decisions and is

familiar to strategic and financial investment partners. This aids

their understanding of Getech projects and accelerates

engagement.

Green hydrogen

Our first asset developments are in green hydrogen and our aim

is to provide this clean energy source to customers at an

acceptable price, in the location, volume and at the time they need

it. We are working to establish networks of hubs, where green

hydrogen (which uses renewable energy to separate oxygen and

hydrogen atoms from water) is produced, stored, and supplied.

Where practical, we intend to develop renewable energy

generation assets alongside our hydrogen production. The associated

increase in capital scale is offset by the diversification of

low-carbon revenue streams (spilling surplus power to the grid)

whilst lowering the principal operational expense of hydrogen

production and reducing merchant power price volatility. This

produces an overall more robust, larger scale investment

opportunity with improved returns and reduced risk.

In H1 2022 our green hydrogen hub projects at Shoreham and

Inverness reached an important stage in their development, passing

fundamental commercial and operational milestones that confirm

feasibility and a robust foundation of hydrogen demand (covered in

the operational review below). Given the scale of potential demand

we are seeing, the site capacities have both been increased to a

Phase 1 target production capacity of 2.5 tonnes/day (6 MW) and

peak site capacities of 10 tonnes/day (25 MW each).

This is against a backdrop of intensifying government energy

investment and policy actions in 2021, including the $369 billion

US Clean Energy Bill and coordinated cross-border initiatives such

as REPowerEU ([2]) . The European Commission has also just

announced a EUR3 billion investment fund to help build the hydrogen

economy.

Outlook

With a clear business model, a unique foundation offering and a

strong team, Getech is well positioned to drive growth at this

unique time when governments and companies are working to transform

global primary energy sources and delivery systems.

In support of this, we continue to invest in our team, with key

recent appointments demonstrating the exciting potential we see in

hydrogen and geothermal. Our broader investment in technical

disciplines, business development, marketing, communications and

sales, focus on both maintaining innovation and accelerating our

growth profile. The success of these investments is demonstrated by

the record strength of our orderbook and the progress across our

asset developments.

In our 'locate' operations, revenue and orderbook momentum has

continued into H2 2022, with further Globe contracts closed. In our

'development' operations, we see potential to rapidly expand our

participation activities across our focus sectors - building an

asset portfolio of transformational scale.

With the world focused on the delivery of a sustainable and

secure transition to a low carbon future, we believe Getech's

products, services and expertise to be uniquely positioned to meet

accelerating demand. As we continue to invest in our products and

services, we target sustained profitability and growth in our

foundation business. In parallel, we continue to invest in our

asset developments, which we expect to present a step-change in

revenue generation and profitability from 2025. We are excited by

the opportunities ahead to deliver transformational shareholder

value.

Operating review

Locate

Widening applicability of our industry-leading geoscience data

and unique geospatial software

We continue to update our products and services to meet demand

and provide solutions with a wide range of benefits for our

customers by accelerating growth, increasing returns, making

operations safer and improving efficiency. This supports our

customers in navigating decarbonisation, which involves both

low-carbon solutions, but also the transitional role of petroleum

in providing affordable, reliable and efficient energy needed for a

responsible and resilient transition.

Transitional petroleum and carbon storage

Driven by a resurgence of focus on transitional petroleum's role

in maintaining energy security and the path to net zero, Getech's

work in opportunity identification, development optimisation and

operational spatial management has been particularly strong. We

have added new customers for our Globe platform, which included a

$1.1 million multi-year contract with a major international energy

company post-Period end, as well as notable new software customers.

Globe 2022 was recently released with new content and functionality

to deliver even more value for customers and application to

transitional uses.

Progress on carbon storage, is demonstrated by the UK

Government's North Sea Transition Authority (NSTA) contracting

Getech to deploy our proprietary geospatial software and subsurface

expertise to support its first carbon storage licensing round.

Using Getech's Exploration Analyst software, we are working with

the NSTA to create strategic maps that define optimal areas for

CO(2) storage. The opportunity to scale our participation in carbon

storage is large. In 2021, c.130 new commercial-scale CO(2) capture

and storage projects were announced, and the International Energy

Agency forecasts that carbon storage capital spending could exceed

US$40bn by 2024 (from US$1.8bn in 2021). The world however must

locate and develop a further 700 carbon storage projects at this

scale by 2030 to stay on track for the IEA's 2050 Net Zero Emission

Scenario.

Critical minerals

Activities in the critical minerals sector are growing thanks to

Getech's unique product offerings and proprietary data, which

enable customers to locate and define economic concentrations of

resources. The value these bring is demonstrated by new contracts

with leading mining companies in H1 2022 to explore for sedimentary

copper in Australia, iron oxide-copper-gold deposits in South

America, and other minerals in North America. With copper demand

forecast to total 25.5 million tonnes per year by 2030 versus

current annual supply of 19.1 million tonnes, this shortfall must

be met with new exploration discoveries. Our new sediment-hosted

copper solutions provide an innovative path to bridge this gap. In

addition, with c.60% of world's cobalt (required in many green

technologies) mined from sedimentary hosted deposits, there is

potential for Getech to unlock a much broader front of value across

a range of critical mineral needs. Illustrative of this, in June,

Getech signed a $0.9 million multi-product sale with a global

diversified minerals company. This is Getech's largest critical

minerals contract to date.

Geothermal

Getech is ramping up its work in the geothermal sector,

undertaking work in Europe and North America that ranges from

regional evaluation to site-specific studies for power generation

and heat distribution projects. Alongside this client-led work, we

are maturing a portfolio of potential asset investment

opportunities that leverage our proprietary Heat Seeker solution.

Heat Seeker integrates below-ground energy opportunities with

above-ground demand and offtake potential to find optimal locations

for geothermal projects. With global geothermal capacity growing at

c.250MW per year, the sector is expected to expand into a $50

billion market by 2027. We are also working to integrate our

geothermal and critical minerals activities to unlock direct

lithium extraction from geothermal brines. There is potential for

Getech to make geothermal licence applications which we can use our

data and expertise to target in the most favourable areas for heat

and lithium resources.

Develop and Operate

Hydrogen will play a critical role in the decarbonisation of

commercial transport and sectors that are difficult to electrify.

In H1 2022 the scale of national and international government

support for hydrogen continued to expand, with the UK doubling and

the EU quadrupling their respective supply targets. The UK's

ambition, upgraded to 10 GW of installed capacity by 2030 [3] , is

supported by various funding programmes and incentives, for which

our projects are eligible. The EU's demand is even greater,

targeting 40 GW in 2030 with 10 million tonnes of renewable

hydrogen production [4] . In response to this escalating demand and

strengthening support of green hydrogen as a crucial element of

decarbonisation, Getech accelerated its planned expansion onto the

continent by hiring of senior business development personnel in

Germany.

Developing scalable green hydrogen networks to facilitate the

energy transition

Since acquiring H2 Green in 2021, Getech has secured exclusive

development rights for green hydrogen hubs at Shoreham Port (West

Sussex) and in Inverness (Scotland). Onsite production facilities

at both locations can be expanded to 25 MW of offtake capacity (10

tonnes per day of hydrogen production). In parallel, we have grown

our hydrogen opportunity pipeline to c. 240 MW, which we are

working to advance into new exclusive development

opportunities.

Shoreham Green Energy Hub

The Shoreham Green Energy Hub will integrate onsite renewable

energy generation with hydrogen production, storage and dispensing.

There is also potential to significantly expand the hub's scale via

the import of green ammonia. Shoreham Port is a testbed example of

a back-to-base hydrogen hub, with over 830 heavy goods vehicle

(HGV) movements in and out per day supported by large on-site

fleets of large diesel-powered forklift trucks. Assessing the

opportunity using geospatial economics, we have been able to

optimise the facility design for optimum return on investment

(ROI).

Following successful engineering and commercial outcomes in H1

2022, Getech agreed an extended exclusivity with the Port of

Shoreham through to Q3 2027. Importantly, this now secures

hydrogen, renewable energy and ammonia development rights for

Getech through to first production.

Inverness Hydrogen Hub

The Inverness Hydrogen Hub will be the cornerstone of our

Highlands Hydrogen Network of production, storage, and dispensing

facilities. Our bold, unique vision of a network attracted the

support of The Highland Council, resulting in a Memorandum of

Understanding with the council to accelerate the regional

deployment.

As a large, rural, and mountainous region, with a relatively

cold climate, the Highlands is proving less suitable to battery

electrification for transport and more likely to adopt hydrogen

electric in a wholesale fashion. This has encouraged us to upgrade

our view on market potential to include a greater percentage of

Light Goods Vehicles (LGVs) and passenger vehicles in our offtake

assumptions.

Under continued exclusivity, Getech and The Highland Council are

working toward concluding terms of a Joint Venture Agreement. This

will define how the parties collaborate to deliver a regional

hydrogen network and a conclusion to discussions is targeted in Q4

2022.

Robust feasibility successfully completed at both hubs

Both Shoreham and Inverness will be developed in multiple phases

of expansion that will be scaled in alignment with demand growth.

In H1 2022, both projects advanced through a robust feasibility

process, passing critical commercial and operational milestones

that have built tangibility, scope and scale. Details of these

steps are given below.

-- Engineering - feasibility studies have been completed at both

locations. These integrate a broad range of hydrogen production,

storage and supply configurations with various on-site grid, wind

and solar energy supply systems. Following a rigorous assessment

process and applying an industry standard 50% contingency to all

'feasibility' capital cost estimates, this work confirmed

operational and commercial viability, with hydrogen priced at or

near diesel parity.

-- Renewables - At Shoreham, Getech holds exclusivity for wind

and solar developments at the port. H1 2022 engineering has

confirmed the site's capacity to support 13.8 MW of onshore wind

and 1.6 MW of rooftop solar. We also confirmed grid connectivity

for import and future export of renewable power. These

confirmations deliver significant value as renewable power will

protect the development from electricity price volatility and it

simplifies access to high value Renewable Transport Fuel Credits.

Shoreham benefits from the best wind speeds and hours of sunshine

in the UK, and existing wind and solar assets onsite provide

demonstrable generational data to predict future generational

capacity.

Having built a wealth of renewables knowledge at Shoreham, we

now intend to explore the development of wind assets at Inverness,

where wind speeds mean renewable energy potential is strong. If

executed this will expand the land requirement at Inverness, but

this will also allow development of the SGN site to be optimised

for high-volume rail customers. At this location, SGN expects to

soon conclude the removal of a redundant gas holder, readying the

site for development.

-- Demand development expands Phase 1 scale - We have received

strong indicators of green hydrogen demand from potential customers

at both Shoreham and Inverness. Pledges, Letters of Intent,

Expressions of Interest and Memorandums of Understanding have been

collected over both locations totalling 3 tonnes of hydrogen

equivalent per day in 2025 growing to 5.5 tonnes per day in 2030. A

further 2 tonnes of qualified near-term demand potential has been

identified across Shoreham and Inverness. The sum of Pledges,

Letters of Intent, Expressions of Interest and Memorandums of

Understanding and qualified demand across the two hubs already

exceeds the Phase 1 design capacity, three years ahead of project

start-up.

Whilst we do not expect all identified volumes to convert to

offtake contracts, the strong market pull received at this

early-stage drives confidence in demand exceeding production

capacity in the early stages of the project life. The focus now

lies on ensuring the project phasing can scale quickly enough to

capitalise on early market growth. This has led to expansion of

Phase 1 design capacity from 800 kg/day to 2.5 tonnes per day (c. 6

MW of electrolyser capacity), with three subsequent phases to

deliver a peak production capacity of 10 tonnes/day (25 MW). At

these scales, both projects also qualify for UK Government Net Zero

Hydrogen Fund capital expenditure support.

-- Tangibility and funding - By building Shoreham and

Inverness's tangibility, the pace of engagement with strategic and

investment counterparties has accelerated. In parallel, we have

also entered several grant funding rounds. The Shoreham Port Green

Energy Hub has achieved early success, with the Port securing

GBP100k from the Regional Projects Business Case Development Fund -

Coast to Capital to help fund third party costs.

Next development steps

Both projects are now moving into Front End Engineering and

Design (FEED) to mature the engineering design to support Final

Investment Decision (FID). In support of this, Getech will soon

appoint specialist third parties to further advance our

engineering, commercial and planning workstreams.

With FID expected to be made in H2 2023/H1 2024, first gas is

anticipated in 2025. When in production, Getech will assume the

role of asset operator in return for a management fee. In

preparation for this role, we embarked on extending our ISO

certifications to H2 Green in H1 2022. This underscores our

commitment to robust quality, safety and environmental

practices.

Financial review

Revenue and sales

H1 2022 revenue totalled GBP2.7 million (H1 2021: GBP2.4

million), representing a 11% increase.

Significant new contract wins in multiple sectors during H1 2022

resulted in a record orderbook value of GBP4.8 million (December

2021: GBP3.3 million), representing a 45% increase over six months

and an 118% increase over 12 months. Encompassing products

subscriptions and specialist services, our diverse orderbook

comprises customers across transitional petroleum, critical

minerals, geothermal and carbon storage markets. GBP1.5 million is

expected to convert to revenue before year end, with a further

GBP1.6 million due in FY 2023.

Annualised Recurring Revenue from subscriptions and service

contracts continues to be healthy at GBP2.1m (31 December 2021:

GBP2.1m). In July this increased to GBP2.4m through new contract

wins.

By delivering product innovations around key energy transition

themes, Getech is meeting increasing and broadening market demand,

demonstrated for example by our work with the NSTA to define

optimal carbon storage areas.

The strong USD in H1 has been favourable for the sale of

products and services in US markets, which represented a

significant portion of our H1 revenue.

Cost management

In April 2021, Getech completed an equity raise to fund the

diversification of the business. Since then, Getech has used the

proceeds of this fundraise, and free cash flow from our

transitional petroleum operations, to invest in our products,

services, business development, marketing, communications and sales

teams to maintain innovation and accelerate our growth profile.

The Group has developed new products and services, with enhanced

applicability to decarbonisation, as well as acquiring H2 Green in

2021. In 2022, a wealth of project management and engineering

experience has been added to the hydrogen team to drive development

in this sector.

The cost of these activities is included in administrative

expenses.

12 months

6 months 6 months ended 31

ended 30 ended 30 December

June 2022 June 2021 2021

(unaudited) (unaudited) (audited)

Variance

from

prior

6 months GBP'000 GBP'000 GBP'000

------------------------------- ---------- -------------- -------------- ------------

Cost of sales 1,006 992 2,315

Development costs capitalised 459 417 847

Administrative expenses 2,895 2,032 5,033

Payment of lease liabilities - 6 -

Depreciation and amortisation

charges (580) (583) (1,525)

Movement in provisions - - (88)

RDEC adjustments - (46) (127)

Exchange adjustments (31) (89) -

Cost base 37% 3,749 2,729 6,455

------------------------------- ---------- -------------- -------------- ------------

Profitability

Getech's H1 2022 gross profit margin is 63% (H1 2021: 59%). This

is due to increased revenues against a largely fixed cost base and

a change in sales mix, with lower royalty payments in H1 2022

compared to H1 2021.

As a result of increased administrative expenses, detailed

above, Getech reports a post-tax loss of GBP0.9 million (H1 2021:

GBP0.5 million).

Operating cash flow

Net cash outflow from operations totalled GBP0.96 million (H1

2021: GBP0.6 million). This includes net working capital outflows

of GBP0.7 million (H1 2021: GBP0.4 million outflow), which relates

to the timing of invoicing and trading activities during the

Period.

Operating cash flows also include c.GBP1.1 million of costs

relating to Getech's hydrogen and geothermal asset development

activities. Excluding these asset-related costs, the operating cash

inflow from Getech's foundation business was GBP0.9m, before

working capital adjustments. After funding development costs

capitalised (GBP0.5m) and property, plant and equipment (PPE)

purchases (GBP0.1m), the foundation business generated GBP0.3m of

free cash flow.

Liquidity

During H1 2021 there was overall net cash outflow of GBP1.6

million (H1 2021: GBP4.6 million inflow, inclusive of GBP6.25

million fundraise). Getech's cash balance at 30 June 2022 was

GBP4.3m (GBP5.9 million at 31 December 2021).

Getech's sales invoicing cycle is weighted to H2, and a large

proportion of the Group's subscription-based customers have July

renewals. This has a significant impact on half-year working

capital movements. In July and August, Getech issued c.GBP2.4

million in invoices, in addition to base monthly invoicing, with

cash inflow expected during H2 2022.

Dividends

The Board, as part of the recent equity fundraise, has set a

clear investment path that is focused on growth through energy

transition diversification. Getech's Board has therefore decided

that it is not appropriate to pay a dividend at this time.

Group Statement of Comprehensive Income

for the six months ended 30 June 2022

6 months 12 months

ended 6 months ended 31

30 June ended 30 December

2022 June 2021 2021

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

---------------------------------- ------------ ------------ ----------

Revenue 2,697 2,421 4,280

Cost of sales (1,006) (992) (2,315)

----------------------------------- ------------ ------------ ----------

Gross profit 1,691 1,429 1,965

Other operating income - - 176

Administrative expenses (2,895) (2,032) (4,733)

Operating loss before exceptional

items (1,204) (603) (2,592)

Exceptional items - - (300)

----------------------------------- ------------ ------------ ----------

Operating loss (1,204) (603) (2,892)

Finance income 1 3 -

Finance costs (23) (34) (55)

Other gains and losses - - 60

----------------------------------- ------------ ------------ ----------

Loss before tax (1,226) (634) (2,887)

Income tax 253 102 938

----------------------------------- ------------ ------------ ----------

Loss for the period (973) (532) (1,949)

Other comprehensive income

Currency translation differences 66 88 24

----------------------------------- ------------ ------------ ----------

Total comprehensive loss for the

period (907) (444) (1,925)

----------------------------------- ------------ ------------ ----------

Earnings per ordinary share

Basic (pence/share) (1.45) (1.01) (3.27)

Diluted (pence/share) (1.45) (1.01) (3.27)

----------------------------------- ------------ ------------ ----------

Group Statement of Financial Position

as at 30 June 2022

30 June 30 June 31 December

2022 2021 2021

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

------------------------------ --- ------------- ------------- ------------

Non-current assets

Goodwill 631 1,293 631

Intangible assets 3,409 3,557 3,431

Property, plant and equipment 2,368 2,483 2,355

Investment property 122 - 174

Deferred tax assets 218 404 214

----------------------------------- ------------- ------------- ------------

6,748 7,737 6,805

---------------------------------- ------------- ------------- ------------

Current assets

Trade and other receivables 2,104 2,264 1,591

Current tax recoverable 716 448 793

Cash and cash equivalents 4,262 6,769 5,864

----------------------------------- ------------- ------------- ------------

7,082 9,481 8,248

---------------------------------- ------------- ------------- ------------

Total assets 13,830 17,218 15,053

----------------------------------- ------------- ------------- ------------

Current liabilities

Trade and other payables 1,913 1,949 2,127

Borrowings 113 113 110

2,026 2,062 2,237

---------------------------------- ------------- ------------- ------------

Net current assets 5,056 7,419 6,011

----------------------------------- ------------- ------------- ------------

Non-current liabilities

Borrowings 611 699 659

Trade and other payables 15 747 102

Deferred tax liabilities - 200 -

Long-term provisions 25 - 25

----------------------------------- ------------- ------------- ------------

651 1,646 786

---------------------------------- ------------- ------------- ------------

Net assets 11,153 13,510 12,030

----------------------------------- ------------- ------------- ------------

Equity

Called up share capital 167 167 167

Share premium account 8,685 8,685 8,685

Merger reserve 2,601 2,601 2,601

Share based payment reserve 206 257 258

Currency translation reserve 64 62 (2)

Retained earnings (570) 1,738 321

----------------------------------- ------------- ------------- ------------

Total equity 11,153 13,510 12,030

----------------------------------- ------------- ------------- ------------

Group Statement of Changes in Equity

for the six months ended 30 June 2022

Currency

Share Share Merger SBP translation Retained Total

capital premium reserve reserve reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------- -------- -------- -------- -------- ------------ --------- --------

1 January 2022 167 8,685 2,601 258 (2) 321 12,030

Loss for the year - - - - - (973) (973)

Other comprehensive

income - - - - 66 - 66

------------------------- -------- -------- -------- -------- ------------ --------- --------

Total comprehensive

income - - - - 66 (973) (907)

Transactions with owners

of the company

Share-based payment

charge - - - 30 - - 30

Transfer of reserves - - - (82) - 82 -

------------------------- -------- -------- -------- -------- ------------ --------- --------

30 June 2022 (unaudited) 167 8,685 2,601 206 64 (570) 11,153

------------------------- -------- -------- -------- -------- ------------ --------- --------

For the six months ended 30 June 2021

Currency

Share Share Merger SBP translation Retained Total

capital premium reserve reserve reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------- -------- -------- -------- -------- ------------ --------- --------

1 January 2021 94 3,053 2,407 251 (26) 2,270 8,049

Loss for the year - - - - - (532) (532)

Other comprehensive

income - - - - 88 - 88

------------------------- -------- -------- -------- -------- ------------ --------- --------

Total comprehensive

income - - - - 88 (532) (444)

Transactions with owners

of the Company

Share-based payment

charge - - - 6 - - 6

Issue of share capital 73 5,632 194 - - - 5,899

------------------------- -------- -------- -------- -------- ------------ --------- --------

30 June 2021 (unaudited) 167 8,685 2,601 257 62 1,738 13,510

------------------------- -------- -------- -------- -------- ------------ --------- --------

For the year ended 31 December 2021

Currency

Share Share Merger SBP translation Retained Total

capital premium reserve reserve reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------- -------- -------- -------- -------- ------------ --------- --------

1 January 2021 94 3,053 2,407 251 (26) 2,270 8,049

Loss for the year - - - - - (1,949) (1,949)

Other comprehensive

income - - - - 24 - 24

----------------------- -------- -------- -------- -------- ------------ --------- --------

Total comprehensive

income - - - - 24 (1,949) (1,925)

Transactions with owners

of the Company

Issue of share capital 73 6,179 194 - - - 6,446

Share-based payment

charge - - - 7 - - 7

Costs of share issue

deducted from share

premium - (547) - - - - (547)

----------------------- -------- -------- -------- -------- ------------ --------- --------

31 December 2021

(audited) 167 8,685 2,601 258 (2) 321 12,030

----------------------- -------- -------- -------- -------- ------------ --------- --------

Consolidated Statement of Cash Flows

for the six months ended 30 June 2022

12 months ended 31 December

6 months ended 30 June 2022 6 months ended 30 June 2021 2021

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

----------------------------- --------------------------- --------------------------- -----------------------------

Operating activities

Loss before tax (1,226) (634) (2,887)

Adjust for non-cash items:

Fair value gains and losses - (86) (60)

Depreciation charge 101 82 299

Amortisation of intangible

assets 479 501 1,226

Expected credit loss

provisions - (70) -

Share-based payment charge 30 6 7

Finance income (1) (3) -

Finance costs 23 34 55

RDEC adjustments within

administrative expenses - (46) (127)

Foreign exchange adjustments 31 89 -

----------------------------- --------------------------- --------------------------- -----------------------------

(563) (127) (1,487)

(Increase)/decrease in trade

and other receivables (513) (880) (245)

Increase/(decrease) in trade

and other payables (208) 455 710

----------------------------- --------------------------- --------------------------- -----------------------------

Cash generated from

operations (1,284) (552) (1,022)

Income tax refunded 327 (37) 223

----------------------------- --------------------------- --------------------------- -----------------------------

Net cash outflow from

operations (957) (589) (799)

Investing activities

Business combinations (net of

cash received) - (54) (54)

Development costs capitalised (459) (417) (847)

Purchase of property, plant

and equipment (115) (4) (29)

Interest received 1 3 -

----------------------------- --------------------------- --------------------------- -----------------------------

Net cash used in investing

activities (573) (472) (930)

----------------------------- --------------------------- --------------------------- -----------------------------

Financing activities

Proceeds from issue of shares - 6,250 6,250

Share issue costs - (546) (547)

Repayment of bank loans (44) (23) (66)

Payment of lease liabilities (41) (6) (199)

Interest paid (23) (34) (44)

----------------------------- --------------------------- --------------------------- -----------------------------

Net cash generated from/(used

in) financing activities (108) 5,641 5,394

----------------------------- --------------------------- --------------------------- -----------------------------

Net increase/(decrease) in

cash and cash equivalents (1,638) 4,580 3,665

Cash and cash equivalents at

the beginning of the period 5,863 2,192 2,192

Effect of foreign exchange

rates 37 (3) 7

----------------------------- --------------------------- --------------------------- -----------------------------

Cash and cash equivalents at

the end of the period 4,262 6,769 5,864

----------------------------- --------------------------- --------------------------- -----------------------------

Notes to the Interim Report

for the six months ended 30 June 2022

Corporate information

Getech Group plc ("the Company" and ultimate Parent of "the

Group") is a public limited company domiciled and incorporated in

England and Wales. The Company's registered office and principal

place of business is Kitson House, Elmete Lane, Leeds LS8 2LJ.

The principal activity of the Group is to provide data,

knowledge, software and analytical products and services to help

governments and investors locate and manage new energy and mineral

resources and to optimise their development.

Basis of preparation

The interim results are for the six months ended 30 June 2022.

They have been prepared using the recognition and measurement

principals of international accounting standards in conformity with

the requirements of the Companies Act 2006. As permitted, this

interim report has been prepared in accordance with the AIM rules

and not in accordance with IAS 34 'interim financial reporting' and

therefore the interim information is not in full compliance with

international accounting standards.

This interim report does not constitute full statutory financial

statements within the meaning of section 434(5) of the Companies

Act 2006 and the financial statements are unaudited. The unaudited

interim financial statements were approved for issue by the board

on 27 September 2022.

The financial statements are prepared on a going concern basis

under the historical cost convention, with the exception of certain

items measured at fair value, and are presented to the nearest

thousand pounds (GBP'000), except as otherwise stated. They have

been prepared in accordance with the accounting policies adopted in

the last annual financial statements for the year ended 31 December

2021. A copy of the audited financial statements for the period

ended 31 December 2021 has been delivered to the Registrar of

Companies. The Auditor's opinion on those financial statements was

unqualified, did not draw attention to any matters by way of an

emphasis of matter paragraph, and it contained no statement under

section 498(2) or section 498(3) of the Companies Act 2006.

In making the going concern assessment, the Board has considered

the Group budgets and detailed cash flow forecasts for at least the

next 12 months. The Board has considered the sensitivity of these

forecasts with regards to different assumptions about future income

and costs. These cash flow projections, when considered in

conjunction with the Group's existing cash balances demonstrate

that the Group has sufficient working capital for the foreseeable

future. Consequently, the Directors are fully satisfied that the

Group is a going concern.

Earnings per share

Basic Earnings Per Share is calculated by dividing the profit

attributable to equity holders of the Group by the weighted average

number of the Ordinary Shares in issue in the period.

12 months

6 months 6 months ended 31

ended 30 ended 30 December

June 2022 June 2021 2021

(unaudited) (unaudited) (audited)

----------------------------------------- ------------- ------------- -----------

Loss attributable to the equity holders

of the Group (GBP'000) (973) (532) (1,949)

Weighted average number of Ordinary

Shares in issue 67,208,417 52,400,161 59,612,590

Basic and diluted earnings (pence/share) (1.45)p (1.01)p (3.27)p

----------------------------------------- ------------- ------------- -----------

Basic EPS is calculated by dividing the profit attributable to

equity holders of the parent by the weighted average number of

ordinary shares outstanding during the period.

Diluted EPS is calculated by dividing the profit attributable to

equity holders of the parent by the weighted average number of

ordinary shares outstanding plus the weighted average number of

shares that would be issued on conversion of all the dilutive share

options into ordinary shares. In the current and comparative

period, the Group has incurred losses and as such has not presented

any dilution of earnings per share in accordance with IAS 33

'Earnings per share'. However, these dilutive shares would dilute

the earnings per share should the Group become profitable.

About us

Getech (AIM; GTC) applies its world-leading geoscience data and

unique geospatial software products to accelerate the energy

transition by locating, developing and operating geoenergy and

green hydrogen projects.

For further information, please visit www.getech.com.

Directors, officers and advisors

Directors and officers

Richard Bennett Non-executive Chairman

Dr Jonathan Copus Chief Executive Officer

Michael Covington Non-executive Director

Andrew Darbyshire Chief Financial Officer

Chris Jepps Chief Operating Officer

Emma Parker Non-executive Director

Dr Stuart Paton Non-executive Director

Company number

Registered in England and Wales, company number 02891368

Registered office

Kitson House

Elmete Lane

Leeds LS8 2LJ

Nominated advisor and broker

Cenkos Securities plc

6 7 8 Tokenhouse Yard

London EC2R 7AS

Financial PR and IR

Capital Market Communications Ltd

3rd Floor, Cannongate House

62-64 Cannon Street

London EC4N 6AE

Auditor

Grant Thornton UK LLP

No 1 Whitehall Riverside

Leeds LS1 4BN

Solicitors

Womble Bond Dickinson LLP

No 1 Whitehall Riverside

Leeds LS1 4BN

Principal bankers

National Westminster Bank plc

PO box 183, 8 Park Row

Leeds LS1 5HD

Registrars

Link Group Ltd

Northern House

Woodsome Park

Fenay Bridge

Huddersfield HD8 0GA

[1] Source: IEA, 22 June 2022

[2] The European Commission's programme to rapidly reduce

dependence on Russian fossil fuels and fast forward the green

transition well before 2030 -

https://ec.europa.eu/commission/presscorner/detail/en/IP_22_3131.

[3]

https://www.gov.uk/government/news/government-unveils-investment-for-energy-technologies-of-the-future

[4]

https://www.europarl.europa.eu/RegData/etudes/BRIE/2021/689332/EPRS_BRI(2021)689332_EN.pdf

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UBUWRUWUKUAR

(END) Dow Jones Newswires

September 28, 2022 02:02 ET (06:02 GMT)

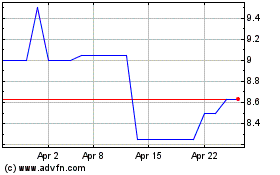

Getech (LSE:GTC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Getech (LSE:GTC)

Historical Stock Chart

From Apr 2023 to Apr 2024