TIDMGWMO

RNS Number : 6025J

Great Western Mining Corp. plc

28 April 2022

GREAT WESTERN MINING CORPORATION PLC

("Great Western" or the "Company")

FINAL RESULTS FOR THE YEARED 31 DECEMBER 2021

Great Western Mining Corporation PLC (AIM - GWMO, Euronext

Growth - 8GW), which is exploring and developing multiple

early-stage gold, silver and copper targets in Nevada, USA,

announces its results for the year ended 31 December 2021. The

Company is in the exploration, appraisal and development phase and

currently has no revenues.

Financial Highlights:

-- Loss for year EUR535,960 (2020: loss of EUR852,042)

-- Basic and diluted loss per share 0.001 (cent): (2020: 0.001 cent)

-- Net assets at year-end: EUR8.9 million (2020: EUR7.9 million)

-- Cash at 31 December 2021: EUR2.0 million (2020: EUR2.3 million)

Operational Highlights

-- Successful first drilling for gold and silver at Olympic Gold and Rock House

o Best recorded gold grade of over 8 grams/ton

-- Metallurgical testing proved commercial potential of multiple spoil heaps results

-- Analysis and augering of OMCO Mine tailings indicated

commercial potential for recovery of gold

o High grades exist throughout the tailings volume

o The tailings were found to be thicker than expected.

-- Successful Pilot Gravity and Bottle Roll testing on Mineral

Jackpot Spoil and OMCO Tailings

-- Ground magnetometer surveys conducted at Mineral Jackpot

-- Copper potential enhanced at Eastside Mine by IP survey

-- Reconnaissance mapping carried out at Huntoon

-- Appointment of Exploration Manager

Post Period End

-- Completed road upgrade to Mineral Jackpot now provides access

for drill rig and spoil heap recovery

o Enabling 20-ton trucks to carry spoil material and for

drilling units to explore and appraise the area

-- Further augering samples on OMCO tailings currently being assayed

-- Mineral Jackpot sampling results indicated broad distribution of mineralised material

o Positioned for next phase of commercialising this significant

asset

-- Magnetometry and orthophoto drone surveys at Mineral Jackpot,

Huntoon, Jack Springs and Tun

-- Orthophoto drone survey over the OMCO tailings for better volume calculations

Brian Hall, Executive Chairman, commented: "In 2021 we launched

our first drilling campaign expressly for gold and silver with

highly encouraging results at both the Rock House Group, never

previously drilled or exploited, and the Olympic Gold Project, over

which we acquired a purchase option in 2020. This was a very busy

period for the Company, during which we made significant progress

across our portfolio. Importantly, in addition to enhancing the

prospectivity of the region, we made significant strides in proving

our ability to move towards a production-led model. During 2022 we

are continuing our drill programme - and expect to make strong

progress on our project for secondary recovery of gold and silver

from mine tailings and ancient spoil heaps."

Great Western Mining Corporation PLC

Brian Hall, Chairman +44 207 933 8780

Max Williams, Finance Director +44 207 933 8780

Davy (NOMAD, Euronext Growth Adviser

& Joint Broker)

John Frain +353 1 679 6363

Novum Securities (Joint Broker)

Jon Belliss +44 207 399 9400

Walbrook PR (PR advisers)

Nick Rome +44 207 933 8783

Executive Chairman's Statement

For the year ended 31 December 2021

Dear Shareholder,

Great Western Mining Corporation PLC ("Great Western" or "the

Company") explores for, appraises and develops mineral resources on

its claims in the state of Nevada, USA but currently has no

revenues from its operations. Accordingly it is reporting a loss of

EUR535,960 for the year ended 31 December 2021 (2020 EUR852,042).

At the end of the year Great Western's net assets were EUR8,945,631

(2020: EUR7,919,625) with no debt apart from trade creditors in the

normal course of business.

Your Company made strong progress in 2021, launching its first

ever drilling campaign aimed specifically at gold and silver. A

maiden reverse circulation (RC) drill programme of six holes in the

Southern Alteration Zone at the Rock House Group (RH) yielded good

grades of gold, the best recording over 8 grams/ton. In 2020 Great

Western secured an option to purchase the 800 acre Olympic Gold

Project in Mineral County, about 50 miles east of the existing

claim groups. Olympic Gold historically hosted the OMCO Mine which

produced gold at grades of around 25 grams/ton until the 1940s and

includes several other prospects which have only been lightly

drilled in the past. In 2021 Great Western drilled six holes on the

Trafalgar Hill prospect at Olympic Gold, yielding encouraging

grades of gold of 8 grams/ton in one of them and mineralisation in

all of them. Five further holes were drilled at Olympic Gold,

primarily in and around the productive veins of the former OMCO

Mine and to the east of a bounding north-south fault which was the

limit of historic mining operations, with good evidence of

mineralisation.

Mineral Jackpot (MJ) is the core property in Great Western's

original portfolio of gold and silver claims, in the Black Mountain

Group, and was the reason for forming the Company in the first

place. Drilling by the Company in the Black Mountain Group at M2

has already established a substantial inferred and indicated copper

resource for which joint venture partners are being sought to take

it to the next stage. The Mineral Jackpot group itself comprises

five old gold and silver mines which were worked and then abandoned

more than a century ago. These mines are Ming Toy, Silver Moon,

Silver Bell, Cabin Rock and the Bass Mine. Geophysical surveys and

physical sampling by the Company have established firstly the

potential for further recovery of precious metals from around the

existing mine workings, secondly connectivity between the five mine

sites and thirdly the indications of a southeasterly extension to

the original productive veins, together effectively doubling the

likely area of mineralisation. In addition, over 50 spoil heaps

have been identified which lend themselves to secondary recovery of

gold and silver and for which a commercial project is currently

being worked up to provide early revenues for the Company.

Great Western considers the potential value of Mineral Jackpot

to be very high, both for future mining operations and for the

recovery potential from spoil material. However, this is a steep

mountainous area with deep gullies which can be difficult to

access, particularly when compared to Olympic Gold and Rock House

which are both relatively more straightforward. Difficulty of

access is undoubtedly the reason that the mines have not been

further developed since the days of old, when miners using mules

for transport worked the area by hand, driving deep adits into the

mountainside. Great Western has recently completed an aerial

magnetometer survey with specialist drone units to map parts of the

claims which are not easily accessible on foot. Significantly,

since the end of the reporting year, the Company has successfully

upgraded a 14km mountain access road from its base in the valley at

Marietta to the mine sites at Mineral Jackpot, which will open up

the area for 20-ton trucks to carry spoil material and for drilling

units to explore and appraise the area.

At the very end of 2020, the Company fulfilled a promise to

produce a small doré bar of gold and silver from Mineral jackpot

spoil material, proving the viability of a small scale secondary

recovery operation to generate revenues from the MJ spoil heaps. In

2021, laboratory analysis and a variety of tests were conducted on

the spoil material, a consultant metallurgist was brought on to the

team and plans drawn up for a simple, gravity-processing operation.

However, during the year while drilling at Olympic Gold, we became

aware of substantial tailings heaps dating from the abandoned OMCO

gold mine which clearly offer commercial possibilities well in

excess of the spoil heaps at Mineral Jackpot alone. At the time of

writing, analysis and precise quantification of these tailings is

still ongoing but there is a clear message that the overall project

for generating revenues from pre-mined material is now likely to be

on a much larger scale than previously envisaged. Your Board

believes that an expanded operation to include Olympic Gold, and

probably other spoil material from other properties in the

Company's portfolio, offers a much more exciting and profitable

short-term revenue-generating future for the Company than could be

achieved by simply processing the MJ spoil material. This is a

constantly expanding venture which is being given high

priority.

During the year, Gemma Cryan, a highly-experienced mineral

geologist, was elected a non-executive director and has been making

a strong contribution to the Company's affairs. The Board now has a

mix of three executive and three non-executive directors and uses

best efforts to pursue good corporate governance, fulfilling its

environmental and social obligations as well as directing the

Company's business affairs. Late in the year, Dr. James Blight

joined Great Western as Exploration Manager, has quickly

assimilated the Company's projects and is now fully engaged in

managing the 2022 exploration programme.

Despite the travel and other severe restrictions imposed by the

Covid pandemic in 2021, Great Western had a busy, productive and

successful year. Looking ahead, we will commence our firm 2022

drill programme in the coming weeks, details of which have already

been set out in an announcement, covering follow-up drilling at

Rock House, Olympic Gold and Mineral Jackpot. The newly upgraded

road to Mineral Jackpot will open up this exciting area and enable

us both to exploit pre-mined material and to explore untapped

leads. We are actively working on finding a partner or partners

with sufficient resources to help develop the high copper potential

of our acreage and take it to the next stage. In the near term we

will finalise our plans for recovery of gold and silver from

pre-mined material and will share these plans with shareholders. We

will also continue to carry out early stage exploration on the many

prospects we have under licence which have so far not been fully

evaluated. Great Western is funded for its approved 2022 programme

and we will keep shareholders informed as we make progress.

The mining industry can be a long game but we are making really

good progress and all the members of our small and well-integrated

team are ever mindful of the need to deliver results. Continuing

shareholder support is greatly appreciated and we will as ever

provide progress reports when appropriate.

Yours sincerely,

Brian Hall

Executive Chairman

Operations Report

For the year ended 31 December 2021

Principal activities, strategy and business model

The principal activity of Great Western is to explore for and

develop gold, silver, copper and other minerals. The Board aims to

increase shareholder value by the systematic evaluation and

exploitation of its existing assets in Mineral County, Nevada, USA

and elsewhere as may become applicable.

Great Western's near-term objective is to develop small scale,

short lead-time gold and silver projects which can potentially be

brought into production under the control of the Group. These

projects include both in situ mineralisation and waste reprocessing

opportunities.

The Group is also focused on progressing the copper projects

which it has already identified and enhanced through extensive

drilling. Such projects have potential for the discovery of large

mineralised systems which can be monetised over the longer term,

possibly through joint ventures with third parties.

Business development and performance

During the twelve months ended 31 December 2021, Great Western

carried out exploration across all but two of its portfolio of

seven claim groups (six of which are 100% owned, one of which is

held under an option agreement) in Nevada.

In September 2021 as part of the annual claim renewal procedure,

the Group renewed all its claims including the 12 new claims staked

earlier in 2021 to the east of the OMCO Mine. Following renewal,

the land position held by Great Western in Mineral County consists

of 741 full and fractional unpatented claims, covering a total land

area of approximately 61km(2).

Review by Claim Group

Olympic

In 2020, the Company acquired an option to purchase the Olympic

Gold Project, a group of 48 claims, located approximately 50 miles

from Great Western's original concessions but still within Mineral

County. The purchase consideration of $150,000 is spread over four

years during which time Great Western has full rights to all data

and to conduct exploration and appraisal work. Great Western may

elect to bring forward the closing of the purchase by early-paying

the schedule in full or it may exit the project at any time without

penalty and without completing the payment schedule. Work is in

progress on several potential prospects over this 800-acre

site.

The Olympic Gold Project lies on the northern flanks of the

Cedar Mountain Range, on the eastern edge of Mineral County. It

lies within the Walker Lane Fault Belt, at the intersection of two

major mineral trends - the Rawhide-Paradise Peak trend and the

Aurora-Round Mountain Trend. The mineral deposit type at Olympic is

of low sulphidation epithermal banded quartz-gold vein style.

Historic production from the former Olympic Gold Mine totalled

approximately 35,000 tonnes, at a grade of 25 g/t gold and 30 g/t

silver, in the interwar period of 1918 to 1939. Based on its review

of the historical data, Great Western believes that faulted offsets

of the high-grade Olympic Vein remain to be discovered in the area

and this forms one of the numerous target zones on the

prospect.

During 2021 several targets at Olympic were addressed with RC

drilling. Six holes were drilled at Trafalgar Hill, a satellite

prospect lying in the western parts of the claim group. All these

holes contained anomalous values for gold and silver and two

intersected grades of economic interest (1.5m at 8.9 g/t Au and

1.5m @ 1.04 g/t Au): these have been modelled together to suggest

an easterly dipping mineralised structure lying southeast of

Trafalgar Hill. Four holes were drilled southeast of the main OMCO

mine site to investigate the potential continuation of the main

vein in that area, particularly to the east of the major East Fault

structure, where a previous magnetometer survey had identified an

anomaly. These holes did not intersect mineralisation comparable

with the OMCO vein's grade but each contained considerable

intersects of low-grade gold enrichment, suggesting that fluid

circulation and mineralisation were at work in this volume.

Finally, one hole was drilled at West Ridge without encountering

the mineralised structure.

In addition to the in-situ targets, a substantial waste pad of

tailings from workings on the OMCO vein remains at surface and is a

prime candidate for reprocessing. Surface samples from this

material, though likely over-enriched due to weathering processes,

indicated the presence of appreciable gold grades and led to an

augering programme towards the end of the year, consisting of 12

holes in the tailings material. These holes resulted in 67

individual assays with an average grade of 1.25 g/t, in a range of

0.17 g/t - 3.76 g/t, being highly encouraging results and showing

that high grades exist throughout the tailings volume. The tailings

were also found to be thicker than expected.

Rock House

The M7 gold-silver prospect lies within the Rock House (RH)

group of claims. This area is accessible and lends itself to mining

operations but was never mined in the past, its potential having

only recently been identified through satellite imagery. It is a

circular structure associated with a magnetic low, adjacent to the

prolific Golconda thrust fault. The area is characterised by

intense argillic and sericitic alteration, along with

silicification and oxidation, within basement siltstones and

slates. Unlike many of Great Western's other prospects, the RH

targets were virgin territory until drilled by the Company in 2021.

They are previously unworked. While workings represent an important

guide for exploration, a lack of any previous workings does not

rule out any mineralisation. Indeed, any discovery made in such

ground will have the benefit of being entirely intact as its

highest-grade and nearest-surface portions will not have been

removed by previous mining operations.

A significant breakthrough occurred at RH in 2021, during

drilling at the Southern Alteration Zone ("SAZ"), on a programme

designed to target anomalies detected in the earlier soil and

trenching programmes. Six holes were drilled at this prospect, with

best intercepts of 1.52m at 8.02 g/t Au from 97.53m (RHRC006) and

1.52m at 2.29 g/t Au from 28.95m (RHRC007). These two drillholes

are in profile with one another and these intercepts are open to

the west and down dip, potentially to the east, depending on the

trend of the mineralisation. The highest-grade intercept also

occurred 1.5m from the end of hole RHR006. This hole effectively

ended in mineralisation and further potential therefore exists

across-strike to the north in this area.

Black Mountain

The Black Mountain Group ("BM") lies on a southwest trending

spur ridge of the Excelsior Range of mountains and comprises 249

full and fractional claims covering approximately 20.7km(2). The BM

group contains both Great Western's copper resource at M2 and the

Mineral Jackpot prospect, where outcropping veins, vein workings

and spoil heaps contain high-grade gold and silver.

Results were received from Grinding Solutions in the UK on the

MJ sample collected in 2020. These results covered gravity

concentration and leaching, including bottle roll and column leach

tests. The results of these tests were favourable, indicating that

a gravity concentration plant to treat this material would be

potentially viable. Leaching tests resulted in higher recoveries,

but the viability of a leaching project, which would have higher

set up costs and more regulatory burden, depends on what additional

feed may be brought into the plant from elsewhere.

An extensively experienced consulting metallurgist was engaged

who has written a preliminary report on a potential concentrator

plant layout and costings and continues to work with Great

Western.

All 51 identified spoil heaps at Mineral Jackpot were sampled,

with one sample representing vein material and one of altered vein

wall-rock obtained from each heap. The proportions of each, and of

unmineralised material were visually estimated for each heap, as an

internal guide to the potential gold content. Further sampling is

required before any firm statement on tonnage or grade can be

made.

The ground magnetometry survey was extended during the year,

from the 1,150m2 of coverage in 2,020 to 4,500m2 total coverage.

The focus of this work was the core of the soil anomalies and

historic workings near the Bass Mine, where the additional survey

coverage led to the interpretation of a host of new structures.

Huntoon

A total of 107 full and 12 fractional claims surround the

workings of the historic underground Huntoon gold mine and are

prospective for gold, silver and copper mineralisation. The claims

are located on the northwest side of the Huntoon Valley, covering

approximately 10km2. Due to the pandemic little work took place at

Huntoon during 2021, beyond a short reconnaissance visit. During

this visit multiple metre-thick quartz and copper oxide-bearing

carbonate veins were identified, trending into Great Western's

claim area, with an observed strike of 500m. These structures

appear to line up with the copper breccia intersected at M4 on the

southeast side of the Huntoon Valley. More work will take place in

2022 at Huntoon, with a drone magnetometer survey planned early in

the year and follow up soil and grab sampling planned later in the

summer.

Jack Springs

The M5 gold prospect lies within the JS Group in altered

siliceous host rock, exposed beneath Tertiary volcaniclastics for

1km. Gold, arsenic and antimony were all anomalous in samples taken

along a northeasterly crest of the central ridge at M5 and the

coincidence of anomalous pathfinder geochemistry and altered

sediments strongly suggests the presence of sediment hosted

disseminated gold mineralisation.

The M4 Copper-Gold project also lies within the JS Group. The M4

copper target was identified through geophysical surveys, soil

sampling and mapping of mineralised structures on surface. Great

Western believes that the breccia vein intercepted in hole M4_05,

along with other veins mapped at surface, could be offshoot

structures in the roof of a buried sulphide orebody. In 2019 the

Group received a drill permit to follow up on the exciting

discovery in hole M4_05 and which remains current. The abundance of

highly prospective targets in the Company's portfolio, combined

with rig availability issues, led to the JS projects being deferred

during 2021.

Eastside Mine

The M8 copper prospect lies within the Eastside Mine (EM) claim

group, named for the historic Eastside Mine where high-grade

copper-oxide ore was mined from shallow underground workings during

the First World War. Conoco investigated Eastside as a copper

porphyry prospect in the early 1970's, identifying mineralisation

consisting of substantial copper and molybdenum values, within a

northeast trending graben structure. Drilling by Conoco at the

southern end of this structure identified thick successions of

alteration together with copper enrichment. Conoco did not follow

up on these results. The Company regards the northerly continuation

of this structure to be a strong target for buried copper

mineralisation, which remains untested.

During 2021 an induced polarization (IP) survey was performed at

EM Group and the results were highly encouraging. The key findings

of this work were:

-- Identification of two main faulted graben structures.

-- Fault zones accompanied by high resistivity and chargeability

features, correlating with observed surface stockwork veining,

silicification, copper mineralisation and copper soil halos.

-- Interpretation points towards graben faults as loci of sulphide mineralisation and wall rock silicification, perhaps representing shallow indicators of a deeper porphyry system.

The Tun Group of Claims

The M6 gold-silver prospect lies within the Tun Group. The M6

prospect is a parallel system of multiple, oxide and sulphide,

gold-silver veins and veinlet stockworks. Supergene, high-grade

ores have been mined in the past at M6 and the potential remains

for deposits of shallow, oxidised stockworks in the immediate

vicinity of the historic workings.

Due to the competing pressures of other highly prospective

projects, no work took place at Tun group during 2021, but

magnetometry and field reconnaissance are planned for 2022.

Summary of 2021 Work Programme

-- Drilling at Olympic and Rock House

-- Metallurgical Test results from Grinding Solutions on MJ sample

-- Secured the involvement of a highly experienced metallurgist

-- Pilot Gravity and Bottle roll testing on MJ Spoil and OMCO Tails

-- MJ spoil heap and OMCO tails sampling and measuring

-- MJ ground mag survey

-- IP/Res survey at EM Group performed by Zonge

-- Reconnaissance mapping at Huntoon

-- Mapping of North Olympic

-- OMCO tails augering

Forward to 2022

2022 is scheduled to be a busy and exciting year for Great

Western with the prospect of fresh drilling, surveys and fieldwork

following on from our successes in 2021, running in parallel with

several important steps in the reprocessing project.

Drilling

Drilling is scheduled at Rock House and Trafalgar Hill following

up on high grades intersected in 2021 and at various targets around

the OMCO mine site, investigating potential continuations of the

main mineralised structure there, with the possibility of residual

unmined wall rock mineralisation around the main workings. With the

access road upgrade complete, drilling is also planned at Mineral

Jackpot.

Surveys

New drone magnetometry surveys will be flown over Huntoon, Jack

Springs and Tun claim groups and over the Mineral Jackpot area

within the Black Mountain claim group.

Fieldwork

Once the initial drill programme is complete, field time will be

spent at various prospects, extending mapping and soil sampling

coverage and ground truthing magnetometry survey results.

Reprocessing

A detailed plan for the reprocessing operations is in the

process of being formulated:

-- The OMCO tailings have undergone a second phase of auger sampling.

-- The new sample material is being assayed and sent for ore

characterisation and bottle roll tests.

-- The surface of the tailings, and of the Mineral Jackpot spoil heaps, are being surveyed with orthophotography to obtain a high-resolution 3D model.

-- The Mineral Jackpot spoil heaps which have the best

combination of grade, volume and accessibility are being further

sampled.

-- New information gleaned from the work detailed above will be

used to produce resource reports and scoping studies in

collaboration with independent external experts.

-- The scoping studies will be used to support the permitting

steps required for reprocessing operations.

-- A financial model and project plan is being developed,

setting out the steps and a timetable for start-up of gold and

silver production.

Consolidated Income Statement

For the year ended 31 December 2021

Notes 2021 2020

EUR EUR

Continuing operations

Administrative expenses 4 (536,178) (852,270)

Finance income 5 218 228

------------------ ------------------

Loss for the year before tax (535,960) (852,042)

Income tax expense 7 - -

------------------ ------------------

Loss for the financial year (535,960) (852,042)

Loss attributable to:

Equity holders of the Company (535,960) (852,042)

================== ==================

Loss per share from continuing

operations

Basic and diluted loss per share

(cent) (0.001) (0.002)

================== ==================

Consolidated Statement of Other Comprehensive Income

For the year ended 31 December 2021

Notes 2021 2020

EUR EUR

Loss for the financial year (535,960) (852,042)

Other comprehensive income

Items that are or may be reclassified

to profit or loss:

Currency translation differences 498,070 (512,730)

----------- ---------------

498,070 (512,730)

Total comprehensive expense

for the financial year

attributable to equity holders

of the Company (37,890) (1,364,772)

=========== ===============

Consolidated Statement of Financial Position

For the year ended 31 December 2021

Notes 2021 2020

Assets EUR EUR

Non-current assets

Property, plant and equipment 10 72,170 66,612

Intangible assets 11 7,086,254 5,898,940

--------------- ----------------

Total non-current assets 7,158,424 5,965,552

Current assets

Trade and other receivables 13 110,940 99,904

Cash and cash equivalents 14 2,042,547 2,287,172

--------------- ----------------

Total current assets 2,153,487 2,387,076

Total assets 9,311,911 8,352,628

=============== ================

Equity

Capital and reserves

Share capital 18 357,751 307,071

Share premium 18 13,572,027 12,543,606

Share based payment reserve 19 318,621 559,420

Foreign currency translation

reserve 519,243 21,173

Retained earnings (5,822,011) (5,511,645)

--------------- ----------------

Attributable to owners of the

Company 8,945,631 7,919,625

Total equity 8,945,631 7,919,625

Liabilities

Current liabilities

Trade and other payables 15 146,642 102,062

Decommissioning provision 16 123,344 75,287

Share warrant provision 17 96,294 255,654

--------------- ----------------

Total current liabilities 366,280 433,003

Total liabilities 366,280 433,003

Total equity and liabilities 9,311,911 8,352,628

=============== ================

Consolidated Statement of Changes in Equity

For the year ended 31 December 2021

Share Foreign

based currency

Share Share payment translation Retained

capital premium reserve reserve earnings Total

EUR EUR EUR EUR EUR EUR

Balance at 1

January

2020 112,205 9,687,151 435,962 533,903 (4,535,134) 6,234,087

Total

comprehensive

income

Loss for the

year - - - - (852,042) (852,042)

Currency

translation

differences - - - (512,730) - (512,730)

----------------- ----------------- ----------------- ----------------- ----------------- -------------

Total

comprehensive

income for

the year - - - (512,730) (852,042) (1,364,772)

Transactions

with

owners,

recorded

directly in

equity

Shares issued 153,591 1,964,204 - - (140,490) 1,977,305

Share warrants

granted

on issue of

shares - - 25,521 - (25,521) -

Share warrants

exercised 41,275 892,251 (11,815) - - 921,711

Share warrants

terminated - - (41,542) - 41,542 -

Share options

charge - - 151,294 - - 151,294

----------------- ----------------- ----------------- ----------------- ----------------- -------------

Total

transactions

with owners,

recorded

directly in

equity 194,866 2,856,455 123,458 - (124,469) 3,050,310

----------------- ----------------- ----------------- ----------------- ----------------- -------------

Balance at 31

December

2020 307,071 12,543,606 559,420 21,173 (5,511,645) 7,919,625

Total

comprehensive

income

Loss for the

year - - - - (535,960) (535,960)

Currency

translation

differences - - - 498,070 - 498,070

----------------- ----------------- ----------------- ----------------- ----------------- -------------

Total

comprehensive

income for

the year - - - 498,070 (535,960) (37,890)

Transactions

with

owners,

recorded

directly in

equity

Shares issued 45,455 916,610 - - (69,206) 892,859

Share warrants

granted

on issue of

shares - - 20,709 - (20,709) -

Share warrants

exercised 4,625 106,220 - - - 110,845

Share warrants

terminated - - (13,865) - 13,865 -

Share options

exercised 600 5,591 (4,777) - 4,777 6,191

Share options

terminated - - (296,867) - 296,867 -

Share options

charge - - 54,001 - - 54,001

----------------- ----------------- ----------------- ----------------- ----------------- -------------

Total

transactions

with owners,

recorded

directly in

equity 50,680 1,028,421 (240,799) - 225,594 1,063,896

----------------- ----------------- ----------------- ----------------- ----------------- -------------

Balance at 31

December

2021 357,751 13,572,027 318,621 519,243 (5,822,011) 8,945,631

================= ================= ================= ================= ================= =============

Consolidated Statement of Cash Flows

For the year ended 31 December 2021

Notes 2021 2020

EUR EUR

Cash flows from operating activities

Loss for the year (535,960) (852,042)

Adjustments for:

Depreciation 10 - 3,733

Interest receivable and similar

income 4 (218) (228)

Increase in trade and other

receivables (11,036) (4,961)

Increase/(Decrease) in trade

and other payables 13,055 (72,067)

Gain on revaluation of share

warrants (330,708) -

Equity settled share-based payment 19 54,001 151,294

---------- -----------------

Net cash flows from operating

activities (810,866) (774,271)

Cash flow from investing activities

Expenditure on intangible assets 11 (657,727) (196,982)

Interest received 4 218 228

---------- -----------------

Net cash from investing activities (657,509) (196,754)

Cash flow from financing activities

Proceeds from the issue of new

shares 18 1,059,085 3,130,705

Share warrants granted 17 191,364 -

Commission paid from the issue

of new shares 18 (69,206) (140,490)

---------- -----------------

Net cash from financing activities 1,181,243 2,990,215

Decrease in cash and cash equivalents (287,132) 2,019,190

Exchange rate adjustment on

cash and cash

equivalents 42,507 (38,693)

Cash and cash equivalents at

beginning of the year 14 2,287,172 306,675

---------- -----------------

Cash and cash equivalents at

end of the year 14 2,042,547 2,287,172

========== =================

Notes to the Financial Statements PDF link:

http://www.rns-pdf.londonstockexchange.com/rns/6025J_1-2022-4-27.pdf

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR SEIFMWEESEIL

(END) Dow Jones Newswires

April 28, 2022 02:00 ET (06:00 GMT)

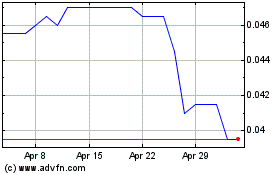

Great Western Mining (LSE:GWMO)

Historical Stock Chart

From Mar 2024 to Apr 2024

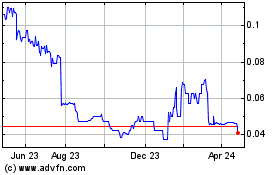

Great Western Mining (LSE:GWMO)

Historical Stock Chart

From Apr 2023 to Apr 2024