TIDMHTG

RNS Number : 5926R

Hunting PLC

02 March 2023

For Immediate Release 2 March 2023

Hunting PLC

("Hunting" or "the Company" or "the Group")

Results for the year ended 31 December 2022

Strong performance in 2022 and well positioned for 2023 with

demand

continuing to improve for all segments

Hunting PLC (LSE:HTG), the international energy services group,

today announces its results for the year ended 31 December

2022.

Financial Highlights

* Order book increased by 124% to $473.0m.

* Revenue increased by 39% to $725.8m.

* Gross margin improved to 24% from 12%.

* Return to profitability with EBITDA of $52.0m and

adjusted profit from operations of $14.6m.

* Total dividends declared in the year of 9.0 cents per

share.

Financial Summary

Financial Performance measures as defined by the Group*

2022 2021 Variance

Revenue $725.8m $521.6m +39%

EBITDA** $52.0m $3.1m +$48.9m

Adjusted profit (loss) from operations** $14.6m $(35.1)m +$49.7m

Net assets $846.2m $871.3m -$25.1m

Total cash and bank** $24.5m $114.2m -$89.7m

Adjusted diluted earnings per share** 4.7 cents (27.1) cents +31.8 cents

Final dividend proposed*** 4.5 cents 4.0 cents +0.5 cents

Financial Performance measures as derived from IFRS

2022 2021 Variance

Profit (loss) from operations $2.0m $(79.7)m +$81.7m

Diluted earnings per share (2.8) cents (53.2) cents +50.4 cents

* Adjusted results exclude adjusting items agreed by the Audit

Committee and Board.

** Non-GAAP measure ("NGM"). Please see the 2022 Annual Report

and Accounts pages 240 to 246.

*** Payable on 12 May 2023 to shareholders on the register on 21

April 2023, subject to approval at the Company's AGM.

Commenting on the results Jim Johnson, Chief Executive,

said:

"I am pleased with the Group's performance this year, delivering

good results in a period of commodity price volatility and

macro-economic uncertainty. Whilst certain challenges remain, we

are confident that we will deliver a strong performance in the year

ahead, with Hunting exceptionally well positioned to benefit from

increased investment in energy security and higher demand for

energy as China continues to re-open post COVID.

"Whilst our commitment to our growth plans in oilfield services

remains rock solid, I am delighted to be launching our Hunting 2030

Strategy today that includes increased investment to enhance our

growth in other complementary markets, including the energy

transition."

Operational and Corporate Highlights

Strong increases in activity across all operating segments as

higher commodity prices support new global drilling projects.

* External sales order book increased 124% during the

year to $473.0m (2021 - $211.5m).

* Revenue visibility increased due to level of order

book, which now extends into 2025.

139% increase in sales order book within the Subsea Technologies

division to $105.1m.

* The Subsea Spring business unit has grown materially

during the year, following new orders for steel and

titanium stress joints for the Gulf of Mexico and

South America.

* Record $48m order received in October 2022 to apply

stress joints to FPSO units.

Record OCTG contract awarded by CNOOC for Premium Connections

and Accessories.

* In August 2022, the Group's Asia Pacific operating

segment was awarded a contract for OCTG that

management estimates to be worth up to $86m for

Hunting's proprietary SEAL-LOCK XD(TM) premium

connection.

* Vast majority of order to be delivered in 2023.

Strong development of non-oil and gas sales order book within

the Advanced Manufacturing group.

* The Dearborn business now has a sales order book of

$71.3m, which comprises c.68% of non-oil and gas

sales.

* The Electronics business now has a sales order book

of $49.8m, which comprises c.14% of non-oil and gas

sales.

Construction of a new threading facility in India commenced

with Jindal SAW to support domestic activity.

* Facility to be operational during Q2 2023 with three

premium connection threading lines.

* 162,000 sqft facility is located in Nashik Province,

adjacent to Jindal's steel mill.

* Hiring of employees and QA training underway.

Formation of global Energy Transition group to build sales in

geothermal and carbon capture market sub-sectors.

* Hunting is pursuing a broad range of sales

opportunities in these growing low carbon sub-sectors,

leveraging its position in OCTG and accessories,

valves and couplings and subsea products to drive

growth.

* The Board has set a revenue target of $100m of sales

within this area by the end of the decade.

$150m Asset Based Lending facility agreed in February 2022 .

* Borrowing base secured against certain North American

freehold property, inventories and trade receivables.

* Facility agreed with four-year tenor.

* The facility provides an appropriate funding base to

pursue growth opportunities.

Outlook Statement

The outlook for energy continues to be highly robust, given the

demand projections for the year ahead, which continue to indicate a

daily requirement of c.102m barrels of crude oil per day - or an

increase of c.1.5m to 2.0m barrels per day over what was seen in

2022. The outlook for natural gas remains strong, as customers of

Russia-origin natural gas move to other global LNG suppliers.

Despite some macro-economic concerns, the re-opening of China

and material under investment in new oil and gas production since

2019 will likely lead to continued growth for all industry

participants.

Commentators continue to project an average oil price for the

year ahead of between $75 to $100 per barrel, which is a range that

will support new activity in all basins globally. Overall, the

short to medium term market outlook remains strongly positive given

the economic fundamentals driving the global demand for oil and

gas.

For Hunting, all the Group's businesses are seeing improving

demand as onshore and offshore projects increase.

Across North America, investment in drilling is projected to

grow further, following a strong performance in 2022. This will

lead to a steady growth in the demand for our perforating systems,

OCTG and accessories businesses.

Our newly formed Subsea Technologies operating segment has

delivered strong growth in its revenue profile and sales order book

over the past two years. This has been predominantly driven by the

Subsea Spring business unit, but with strong market projections for

subsea trees and SURF products, Hunting is well placed to capture

strong growth in all of our deep water orientated technologies.

These opportunities also extend to Hunting's OCTG and accessories

businesses, which supply many offshore clients with critical

components.

The Advanced Manufacturing group has built a robust sales order

book during 2022, which reflects our pursuit of non-oil and gas

sales as well as our existing energy-focused product lines.

With the newly formed Energy Transition sales group, Hunting is

also well placed to drive a further diversification in our revenue

profile, with a primary focus on geothermal and carbon capture

projects, as announced separately today.

The EMEA and Asia Pacific operating segments continue to see

strong increases in enquiries. There is likely to be good progress

in the Middle East, as drilling investment increases, which will

drive a return to profitability in the year ahead for these

segments.

In summary, Hunting remains in a good position to invest in the

market upturn to grow revenue and profitability in the year ahead.

Management is targeting further EBITDA margin expansion as price

increases, improved facility utilisation and production

efficiencies continue to be pursued.

Overall, Hunting has demonstrated its resilience during the

industry challenges associated with the effect of COVID-19, which

is due to Hunting's committed and skilled workforce, underpinned by

a world class HSE performance.

I would like to thank all of our employees for helping to guide

Hunting through a particularly challenging period, but now look

forward to a new growth phase in our chosen industry and our

Company.

Group Results Narrative

For access to narrative on the Group's results (incorporating

the Chairman's and Chief Executive's Statements, Outlook, Market

Analysis, Group Review and Segmental Review) for the year ended 31

December 2022 please click on the following link.

http://www.rns-pdf.londonstockexchange.com/rns/5926R_1-2023-3-1.pdf

Financial Statements and Notes to the Accounts

For access to the Financial Statements and Notes to the Accounts

for the year ended 31 December 2022 please click on the following

link.

http://www.rns-pdf.londonstockexchange.com/rns/5926R_2-2023-3-1.pdf

Listing Rules / Disclosure Guidance and Transparency Rules

Information

For access to Hunting's Key Performance Indicators, Business

Model and Strategy, ESG, Risk Management (including Principal

Risks), and the Statement of the Directors' Responsibilities for

the year ended 31 December 2022, please click on the following

link.

http://www.rns-pdf.londonstockexchange.com/rns/5926R_3-2023-3-1.pdf

Page number references refer to the full Annual Report when

available.

The linked documents provide access to all major financial and

operational disclosures contained in the Group's 2022 Annual Report

and Accounts. The complete 2022 Annual Report and Accounts will be

published on 16 March 2023 and can then be accessed at

www.huntingplc.com .

The financial information set out in the above links does not

constitute the Company's statutory accounts for the years ended 31

December 2022 or 31 December 2021, but is extracted from those

accounts. Statutory accounts for 2021 have been delivered to the

Registrar of Companies and those for 2022 will be delivered in due

course. The auditor has reported on those accounts; their reports

were unqualified, did not draw attention to any matter by way of

emphasis without qualifying their report and did not contain

statements under s498(2) or (3) of the Companies Act 2006. Whilst

the financial information included in this preliminary announcement

has been computed in accordance with International Financial

Reporting Standards, this announcement does not itself contain

sufficient information to comply with IFRS.

Analyst Briefing and Webcast

Hunting PLC will host an analyst briefing and webcast at the

offices of Buchanan (107 Cheapside, London, EC2V 6DN) on 2 March

2023 commencing at 9:30a.m. GMT.

The live webcast can be accessed via the following link:

https://webcasting.buchanan.uk.com/broadcast/63bd5edbdd6e71503201641c

Analysts and investors wishing to participate in a Q&A

session can do so by submitting questions via the chat function of

the webcast and these will be addressed by management during the

live webcast. If you have any queries relating to this then please

email hunting@buchanan.uk.com .

For further information please contact:

Hunting PLC Tel: +44 (0) 20 7321 0123

Jim Johnson, Chief Executive

Bruce Ferguson, Finance Director

lon.ir@hunting-intl.com

Buchanan Tel: +44 (0) 20 7466 5000

Ben Romney

Jon Krinks

Notes to Editors:

About Hunting PLC

Hunting PLC is an international energy services provider to the

world's leading upstream oil and gas companies. Established in

1874, it is a premium listed public company traded on the London

Stock Exchange. The Company maintains a corporate office in Houston

and is headquartered in London. As well as the United Kingdom, the

Company has principal operations in Canada, China, Indonesia,

Mexico, Netherlands, Singapore, United Arab Emirates and the United

States of America.

For the year ended 31 December 2022, the Group reports across

four segments: Hunting Titan, North America, Europe, Middle East

and Africa ("EMEA") and Asia Pacific.

From 1 January 2023, the Group is reporting across five

segments: Hunting Titan, North America, Subsea Technologies,

Europe, Middle East and Africa ("EMEA") and Asia Pacific.

Hunting PLC's Legal Entity Identifier is

2138008S5FL78ITZRN66.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR FFFFIVDILIIV

(END) Dow Jones Newswires

March 02, 2023 02:00 ET (07:00 GMT)

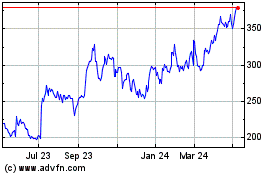

Hunting (LSE:HTG)

Historical Stock Chart

From Mar 2024 to Apr 2024

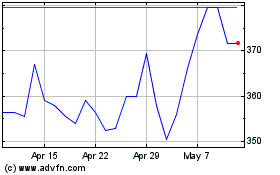

Hunting (LSE:HTG)

Historical Stock Chart

From Apr 2023 to Apr 2024