Helios Underwriting Plc Capacity Value Update (4014S)

15 November 2021 - 10:27PM

UK Regulatory

TIDMHUW

RNS Number : 4014S

Helios Underwriting Plc

15 November 2021

15(th) November 2021

Helios Underwriting plc

("Helios" or the "Company")

Capacity Value Update

Helios, the unique investment vehicle which acquires and

consolidates underwriting capacity at Lloyd's announces an update

on the value of Company's capacity portfolio following the Capacity

Auctions at Lloyd's.

Nigel Hanbury, Chief Executive of Helios, commented:

"I am delighted that the value of the capacity portfolio will

increase to GBP60m with the revaluation of the existing portfolio

adding 9.6p to the Tangible Net Asset value per share - a 6.6%

increase."

Capacity Value

The value of the capacity fund as at 31 (st) December 202 1

using the weighted average prices of capacity from the 202 1

Lloyd's capacity auctions is expected to increase to GBP60.2 m ( 31

(st) December 2020: GBP30.8 m).

Capacity Value of

Capacity

GBPm GBPm

Capacity Value at 31 Dec

2020 110.3 30.8

Capacity expected to be acquired with

LLV's in 2021 35.4 18.0

Value of pre-emption capacity 6.3 2.3

Acquisition of capacity in the capacity

auction 23.8 2.6

Increase in portfolio value - 6.5

Capacity Value expected

at 31 Dec 2021 175.8 60.2

------------------------- ----------

Impact on Net Asset Value GBPm

Value of pre-emption

capacity 2.3

Increase in portfolio

value 6.5

8.8

Deferred Tax provision

- 25% (2.2)

Net Increase in Tangible Net Assets 6.6

=====================

Number of shares in Issue 69.0

Increase in Net Asset Value per

share 9.6p

A summary of the movements in capacity and its value are:

Helios is expecting to acquire 29 LLVs during 2021 with capacity

of GBP35.4m, which was valued at 2021 capacity prices at GBP18.0 m.

We have completed 19 acquisitions to date, acquiring GBP22.7m of

capacity and the remaining 10 acquisitions are expected to complete

shortly.

The syndicates supported by Helios offered free capacity of

GBP6.3m (2020 - GBP10.7m ) by way of pre-emptions to support the

improved underwriting market. The value of the pre-emptions taken

up have increased the value of the portfolio by GBP2.3m.

Helios continued to manage the capacity portfolio discarding

unwanted syndicates and taking positions on syndicat es, in

particular syndicate 510 and syndicate 2689, tak ing the total

additional capacity acquired at auction to GBP23.8 m for

consideration of GBP2.6m.

The average price per GBP of capacity with valu e after the 2021

auctions was 41p (2020 - 37 p) reflecting the increase in auction

prices .

This increase in the capacity portfolio value of GBP6.5m, net of

a provision for deferred tax, will increase the Tangible Net Asset

Value by 9.6p, an increase of 6.6% over the Tangible Net Asset

Value of at 30 (th) June 2021 of 146p.

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) NO 596/2014.

For further information, please contact:

Helios Underwriting plc

Nigel Hanbury - Chief Executive +44 (0)7787 530 404 / nigel.hanbury@huwplc.com

Arthur Manners - Chief Financial Officer +44 (0)7754 965 917

Shore Capital (Nomad and Broker)

Robert Finlay +44 (0)20 7601 6100

David Coaten

Willis Re Securities (Financial Adviser)

Alastair Rodger +44 (0)20 3124 6033

Buchanan (PR)

Helen Tarbet / Henry Wilson / George Beale +44 (0)7872 604 453

+44 (0)20 7466 5111

About Helios

Helios provides a limited liability direct investment into the

Lloyd's insurance market and is quoted on the London Stock

Exchange's AIM market (ticker: HUW). Helios trades within the

Lloyd's insurance market writing approximately GBP130m of capacity

for the 2021 account. The portfolio provides a good spread of

business being concentrated in property insurance and reinsurance.

For further information please visit www.huwplc.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDBABBTMTTBBJB

(END) Dow Jones Newswires

November 15, 2021 06:27 ET (11:27 GMT)

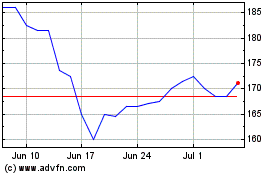

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Apr 2023 to Apr 2024