TIDMKAT

RNS Number : 3220L

Katoro Gold PLC

10 September 2021

10 September 2021

Katoro Gold plc ("Katoro" or "the Company")

Unaudited Interim results for the six months ended 30 June

2021

Katoro Gold plc ('Katoro' or the 'Company') (AIM: KAT), the AIM

listed gold and nickel exploration and development company, is

pleased to announce its unaudited results for the six months ended

30 June 2021. The interim results will also shortly be available on

the Company's website: https://www.katorogold.com/ .

Overview

-- Drilling results from the RAB drill programme carried out at

the Haneti project, confirmed the results from previous exploration

work done, which was the primary objective. The latest results

provided the confirmation desired, therefore s ubsequently refined

planning and budgeting of the diamond drilling programme as well as

the selection and engagement process for a suitable drilling

contractor has been submitted for review and approval.

-- Raised GBP960,000 (gross) through a placing and subscription

of 48,000,000 new ordinary shares of 1.00p each in the capital of

the Company at 2.00p per share.

-- Katoro is currently in the processes of compiling a

comprehensive funding package in accordance with the Blyvoor Joint

Venture ("the JV") that will allow the construction, commissioning

and operation of a mining and processing facility capable of

processing 500,000 tonnes of tailings material per month, at an

average Life of Mine ("LoM") gold grade of 0.29 g/t and confirmed

recovery of 51%, before incorporating recovery gains from the

latest metallurgical optimization tests.

-- Furthermore, the JV's total project resource size of

1,410,000 oz gold consist of 500,000 oz gold in the measured

category (35.5%), 368,000 oz gold in the indicated category

(26.1%), and 542,000 oz gold in the inferred category (38.4%).

-- Post period end:

o A period of limited political unrest in South Africa

temporarily delayed the funding process when some of the

short-listed parties requested additional time to re-assess the

country risk profile as a result of the unrest. However, the

Company is pleased to announce that discussions with these

potential funders have since resumed, and the joint venture

partners hope to conclude a final funding arrangement for Blyvoor

during the latter part of 2021.

This announcement contains inside information as stipulated

under the Market Abuse Regulations (EU) no. 596/2014.

****

For further information please visit www.katorogold.com or

contact:

Louis Coetzee Katoro Gold plc Executive Chairman louisc@katorogold.com

Bhavesh Patel

Andrew Thomson RFC Ambrian Ltd Nominated Adviser +44 20 3440 6800

-------------------- -------------------- ----------------------------

Nick Emerson +44 (0) 1483 413

Sam Lomanto SI Capital Ltd Broker 500

-------------------- -------------------- ----------------------------

Isabel de Salis St Brides Partners Investor & Media info@stbridespartners.co.uk

Oonagh Reidy Ltd Relations Adviser

-------------------- -------------------- ----------------------------

Chairman's Statement

Introduction

Despite the ongoing challenges around the COVID-19 pandemic, the

Company has continued to make significant progress across its

project portfolio. As Chairman I would like to thank Katoro's

Directors and our management team for their continued perseverance

and hard work, and in particular our shareholders, for their

patience during this difficult time. We are looking forward to

accelerating on all fronts, despite ongoing and varying lockdown

conditions in the second half of 2021.

Company successfully completed a maiden Rotary Air Blast Drill

("RAB") programme targeting the discovery of nickel and platinum

group metals at the Haneti Joint Venture Project in Tanzania ('

Haneti JV Project'), despite substantial challenges presented by

COVID-19 and the extreme rainy conditions. Furthermore, the Company

announced the results of a comprehensive Competent Person's Report

("CPR") on the results and findings technical and financial work

that was conducted on the Blyvoor Gold Tailings Project, South

Africa.

Haneti Nickel PGM Project

The Haneti JV Project is a large-scale Polymetallic project

covering a vast prospective area in central Tanzania, where the

principal target zone is an 80km long ultra-mafic belt with grades

from surface sampling of up to 13.6% nickel and 2.33g/t combined

Platinum Group Metals (PGM's). Katoro holds a 65% ownership

interest in Haneti with 35% held by Power Metal Resources plc

(LON:POW).

During the reporting period, Katoro completed a 50 hole, 1,965

metres, maiden RAB drill programme at Mihanza Hill and Mwaka Hill

and collected 1,965 samples. Following analysis of the assay

results, an earlier decision to progress to a diamond core drilling

programme in order to test for nickel sulphide mineralisation at

depth, was confirmed. Subsequent refined planning and budgeting of

the diamond drilling programme, as well as the selection and

engagement process for a suitable drilling contractor has been

submitted for review and approval.

Blyvoor Joint Venture Project

In early 2020 the Company entered into a strategic gold

production opportunity in South Africa, focused on the reprocessing

of an existing Australasian Code for Reporting of Exploration

Results, Mineral Resources and Ore Reserves (JORC) compliant

1.34-million-ounce gold tailings resource. Katoro entered into a

binding conditional agreement to form a 50/50 incorporated joint

venture to advance the project to near term production.

During the reporting period, Katoro and its joint venture

partners announced the results of a comprehensive CPR on the gold

resource, based on the results and findings of advanced technical

and financial work conducted on the Project.

The CPR comprised an advanced Pre-Feasibility level study, a

South African Code for Reporting Exploration Results, Mineral

Resources and Ore Reserves (SAMREC) compliant reserve and resource

statement, and a South African Mineral Asset Valuation ("SAMVAL")

report for Blyvoor TSF 1, 6 and 7 and Doornfontein TSF 1, 2 and 3

gold tailings storage facilities.

The findings of the CPR were subjected to the results of

confirmatory, optimization metallurgical test work. Following

receipt of all the outstanding metallurgical test results, the

findings of the CPR was validated, and the Company could proceed to

further engage with prospective funders to a juncture where several

parties recently submitted initial funding offers / proposals that

were within the broad funding requirements and expectations of the

Company.

Post reporting period, the Company has continued to make

significant progress on all aspects of the business. A period of

limited political unrest in South Africa temporarily delayed the

funding process when some of the short-listed parties requested

additional time to re-assess the country risk profile as a result

of the unrest. However, the Company is pleased to announce that

discussions with these potential funders have since resumed and the

joint venture partners hope to conclude a final funding arrangement

for Blyvoor during the latter part of 2021. Finalization of future

Engineering, Procurement and Construction (EPC), mining contractor

and operator appointment will follow on conclusion of the

funding.

In conclusion, I am optimistic about Katoro and its prospects

and look forward to a productive and exciting second half of FY

2021.

Louis Coetzee

Executive Chairman

Unaudited Interim Results for the six months ended 30 June

2021

Unaudited condensed consolidated interim Statement of

Comprehensive Income

For the six months ended 30 June 2021

6 months to 6 months to 12 months to

Note 30 June 30 June 31 December

2021 2020 2020

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

Revenue - - -

Cost of sales - - -

------------ ------------ -------------

Gross Profit - - -

------------ ------------ -------------

Administrative expenses (341,987) (432,928) (894,872)

Profit from disposal of subsidiary 13 - 815,691 -

Foreign exchanges gain/(loss) 69 (293) (76,889)

Share based payment transactions 7 (162,700) - (225,778)

Exploration expenditure (279,092) (26) (1,394,715)

Finance costs - (17,701) (22,303)

------------ ------------ -------------

Operating profit/loss (783,710) 364,743 (2,614,557)

------------ ------------ -------------

Other Income 13 - 815,691 43,873

Finance Income 11,919 - 9,570

------------ ------------ -------------

Profit/(loss) before Tax (771,791) 364,743 (2,561,114)

------------ ------------ -------------

Tax - - -

------------ ------------ -------------

Profit/(loss) for the period (771,791) 364,743 (2,561,114)

------------ ------------ -------------

Other comprehensive Income/(loss):

Items that may be classified subsequently to profit or

loss:

Exchange differences on translating of foreign operations (16,456) (7,789) (9,266)

Gain/loss reclassified to P&L on disposal of foreign

operation - - 121,670

------------ ------------ -------------

Total Comprehensive Income/(loss) (788,247) 356,954 (2,448,710)

Profit/(loss) for the period (771,791) 364,743 (2,561,114)

Attributable to owners of the parent (770,161) 364,743 (2,437,234)

Attributable to non-controlling interest (1,630) - (123,880)

------------ ------------ -------------

Total comprehensive Income/(loss) (788,247) 356,954 (2,692,050)

Attributable to owners of the parent (786,617) 356,954 (2,324,830)

Attributable to non-controlling interest (1,630) - (123,880)

------------ ------------ -------------

Earnings/(loss) Profit per share

Basic and diluted Earnings/(loss) per share (pence) 4 (0.21) 0.17 (0.91)

Unaudited condensed consolidated interim Statement of Financial

Position

As at 30 June 2021

6 months to 6 months to 12 months to

30 June 30 June 31 December

Note 2021 2020 2020

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

Assets

Non-current assets

Intangible assets 8 209,500 209,500 209,500

Other financial assets 13 - 405,700 -

Investments - 37,661 -

------------ ------------ -------------

209,500 652,861 209,500

------------ ------------ -------------

Current assets

Cash and cash equivalents 420,860 61,769 97,777

Other receivables 23,104 13,020 46,405

Other financial assets 13 - 1,159,200 -

Total current assets 443,964 1,233,989 144,182

------------ ------------ -------------

Total Assets 653,464 1,886,850 353,682

------------ ------------ -------------

Equity

Called up share capital 6 3,789,125 2,503,650 3,286,982

Share premium 2,823,382 2,505,634 2,472,725

Capital contribution reserve 10,528 10,528 10,528

Translation reserve (355,300) (459,039) (338,844)

Merger reserve 1,271,715 1,271,715 1,271,715

Warrant and share-based payment reserve 7 985,612 141,055 750,912

Retained deficit (8,032,868) (4,439,559) (7,262,707)

------------ ------------ -------------

Reserves attributable to owners 492,194 1,533,984 191,311

Minority interest (71,065) 33,272 (69,435)

------------ ------------ -------------

Total Equity 421,129 1,567,256 121,876

------------ ------------ -------------

Liabilities

Current liabilities

Trade and other payables 3 232,335 236,704 214,806

Other financial liabilities - 82,890 17,000

------------ ------------ -------------

Total current liabilities 232,335 319,594 231,806

------------ ------------ -------------

Total Equity and Liabilities 653,464 1,886,850 353,682

------------ ------------ -------------

Unaudited Condensed Consolidated Statement of Changes in

Equity

Share Share Warrant Merger Capital Foreign currency Retained Minority Total

Capital Premium reserve Reserve Contribution translation deficit interest

and Reserve reserve

share

based

payment

reserve

GBP GBP GBP GBP GBP GBP GBP GBP

Balance at 31 December 2020

(audited) 3,286,982 2,472,725 750,912 1,271,715 10,528 (338,844) (7,262,707) (69,435) 121,876

---------------------------- ---------- ---------- -------- ---------- ------------- ------------------ ------------ ---------- ---------------

Loss for the period - - - - - - (770,161) (1,630) (771,791)

Other comprehensive loss -

exchange differences - - - - - (16,456) - - (16,456)

---------------------------- ---------- ---------- -------- ---------- ------------- ------------------ ------------ ---------- ---------------

Proceeds of share issue of

share capital 502,143 350,657 - - - - - - 852,800

Issue of share options and

share warrants - - 234,700 - - - - - 234,700

Balance as at 30 June 2021 3,789,125 2,823,382 985,612 1,271,715 10,528 (355,300) (8,032,868) (71,065) 421,129

(unaudited)

---------------------------- ---------- ---------- -------- ---------- ------------- ------------------ ------------ ---------- ---------------

Balance at 1 January 2020

(audited) 1,795,555 2,216,729 105,467 1,271,715 10,528 (451,250) (4,804,302) 33,272 177,714

---------------------------- ---------- ---------- -------- ---------- ------------- ------------------ ------------ ---------- ---------------

Loss for the period - - - - - - 364,743 - 364,743

Other comprehensive income

- exchange differences - - - - - (7,789) - - (7,789)

---------------------------- ---------- ---------- -------- ---------- ------------- ------------------ ------------ ---------- ---------------

Proceeds of share issue of

share capital 708,095 288,905 - - - - - - 997,000

Issue of share options and

share warrants - - 35,588 - - - - - 35,588

Balance at 30 June 2020

(unaudited) 2,503,650 2,505,634 141,055 1,271,715 10,528 (459,039) (4,439,559) 33,272 1,567,256

---------------------------- ---------- ---------- -------- ---------- ------------- ------------------ ------------ ---------- ---------------

Balance at 1 January 2020

(audited) 1,795,555 2,216,729 105,467 1,271,715 10,528 (451,250) (4,804,302) 33,272 177,714

---------------------------- ---------- ---------- -------- ---------- ------------- ------------------ ------------ ---------- ---------------

Loss for the period - - - - - - (2,437,232) (123,880) (2,561,112)

Other comprehensive loss - - - - - (9,264) - - (9,264)

Issue of share capital 1,491,427 255,996 - - - - - - 1,747,423

Issue of share warrants and

options - - 645,445 - - - - - 645,445

---------------------------- ---------- ---------- -------- ---------- ------------- ------------------ ------------ ---------- ---------------

Disposal of interest in

subsidiary without losing

control - - - - 121,670 (21,173) 21,173 121,670

---------------------------- ---------- ---------- -------- ---------- ------------- ------------------ ------------ ---------- ---------------

Balance at 31 December 2020

(audited) 3,286,982 2,472,725 750,912 1,271,715 10,528 (338,844) (7,262,707) (69,435) 121,876

---------------------------- ---------- ---------- -------- ---------- ------------- ------------------ ------------ ---------- ---------------

Unaudited condensed consolidated interim statement of cash

flow

For the six months ended 30 June 2021

6 months 6 months 12 months

to to to

30 June 30 June 31 December

2021 2020 2020

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

Profit/(loss) for the period before

taxation (771,791) 364,743 (2,561,114)

Adjusted for:

Foreign exchange (gain)/ loss (69) (7,789) 99,828

Share based payment transactions 162,700 - 225,778

Directors shares issued as part

of capital placing - - 50,090

Warrants issued for facilitation - 35,588 -

fees

Profit on disposal of subsidiaries - (815,691) (43,873)

Impairments of other financial

assets 83,532 - 1,160,337

Non trade expenses not settled - - (4,200)

Operating income before working

capital changes (525,628) (423,149) (1,073,154)

Decrease/ (Increase) in trade

and other receivables 23,301 85 (33,387)

(Decrease)/ Increase in trade

and other payables 17,529 130,561 67,506

Net cash outflows from operating

activities (484,798) (292,503) (1,039,035)

Cash flows from investing activities

Cash and cash equivalents disposed

of due to sale of Subsidiary - (6,966) (6,966)

Advances of other financial assets (83,532) (753,500) (1,122,676)

Proceed received from sale of

Subsidiary - - 76,717

Advances to subsidiaries (9,597) - -

Advances to Reef Miners (6,790) - -

Proceeds from sale of subsidiary

without loss of control - - 25,000

Net cash outflow from investing

activities (99,919) (760,466) (1,027,925)

Cash flows from financing activities

Issue of shares (net of share

issue costs) 907,800 287,000 1,337,000

Proceeds from convertible loan

note - 792,800 792,800

--------------------- ------------ ------------

Net cash proceeds from financing

activities 907,800 1,079,800 2,129,800

Net increase in cash and cash

equivalents 323,083 26,831 62,839

Cash and cash equivalents at beginning

of period 97,777 34,938 34,938

--------------------- ------------ ------------

Cash and Cash equivalents at End

of Period 420,860 61,769 97,777

--------------------- ------------ ------------

Notes to the unaudited condensed consolidated interim financial

statements

For the six months ended 30 June 2021

Note 1 General information

Katoro Gold plc ("Katoro" or the "Company") is incorporated in

England & Wales as a public Ltd company. The Company's

registered office is located at 60 Gracechurch Street, London EC3V

OHR.

The principal activity of Katoro, through its subsidiaries

(together the 'Group'), is to carry out evaluation and exploration

studies within a licenced portfolio area with a view to generating

commercially viable Mineral Resources, namely gold and nickel

mines. In Haneti, the Group has one nickel mining project, which

has mineral exploration licences currently held by Eagle

Exploration Ltd. In addition, in South Africa the Group has entered

into binding conditional agreement to form a 50/50 unincorporated

joint venture pertaining to gold tailing project.

The condensed interim consolidated financial statements do not

represent statutory accounts within the meaning of section 435 of

the Companies Act 2016.

The condensed interim financial information is unaudited and has

been prepared on the basis of the accounting policies as set out in

the audited financial statements for the period ended 31 December

2020.

Accounting policies applied are consistent with those of the

previous financial period.

The seasonality or cyclicality of operations does not impact on

the interim financial statements.

Note 2 Going concern

The Company currently generates no revenue and had net assets of

GBP 421,129 as at 30 June 2021.

Following the recent successful placing and subscription of new

ordinary shares, where the Group raised in cash the amount of GBP

892,800 , the Group has adequate cash and cash equivalents

(financial resources) to ensure the Group is able to continue as a

going concern for the foreseeable future.

Furthermore, after reviewing the Group's financial projections,

the directors of the Company (the "Directors") have a reasonable

expectation that the Group will have adequate resources to continue

in operational existence for the foreseeable future.

For this reason, they adopted the going concern basis in

preparing the Group Financial Information.

The effective implementation of COVID-19 vaccination protocol

within the key areas the Group operations has led to an increase in

operational activity for the Group. As at the time of preparing

these results, the Group does not anticipate any further

significant foreseeable disruption from the COVID-19 pandemic, and

expects operational activities to normalise in the coming

months.

Post period end there has been a period of limited political

unrest in South Africa, however the impact on the groups operations

have been temporary and limited in this regard.

Note 3 Trade and other payables

30 June 2021 30 June 2020 31 Dec 2020

GBP GBP GBP

------------- ------------- ------------

Trade payables 122,897 123,424 62,892

Cash received on unlisted

placing - 45,000 -

Accruals 109,438 68,280 151,914

------------- ------------- ------------

232,335 236,704 214,806

------------- ------------- ------------

Note 4 Earnings per share

The calculation of loss per share is based on the following loss

and number of shares:

30 June 2021 30 June 2020 31 Dec 2020

GBP GBP GBP

------------- ------------- ------------

Profit/(loss) for

the period from

continuing operations (770,161) 364,743 (2,437,234)

------------- ------------- ------------

Weighted Average

basic and diluted

number of shares 373,931,716 214,713,873 268 475 455

------------- ------------- ------------

Basic and diluted

Earnings/(loss)

per share (pence) (0.21) 0.17 (0.91)

The Group presents basic and diluted EPS data on the basis that

the current structure has always been in place. Therefore the

number of Katoro shares in issue as at the period end has been used

in the calculation. Basic Earnings/loss per share is calculated by

dividing the Profit/loss for the period from continuing operations

of the Group by the weighted average number of shares in issue

during the period.

The Company had in issue warrants and options at 30 June 2021,

the inclusion of such warrants and options in the weighted average

number of shares in issue would be anti-dilutive and therefore they

have not been included for the purpose of calculating the loss per

share.

Note 5 Unaudited results

These condensed consolidated interim financial results have not

been audited or reviewed by the Group's auditors.

Note 6 Share Capital

The called-up and fully paid share capital of the Company is as

follows:

30 June 2021 30 June 2020 31 Dec 2020

GBP GBP GBP

------------- ------------- ------------

Allotted, called-up and

fully paid: 3,789,125 2,503,650 3,286,982

------------- ------------- ------------

A reconciliation of share capital is set out below:

Allotted,

called-up

and fully

Number of paid

shares GBP

------------ -----------

At 1 January 2021 328,698,305 3,286,982

Shares issued on cash placing 48,000,000 480,000

Conversion of convertible loans 1,214,285 12,143

Warrants exercised 1,000,000 10,000

At 30 June 2021 378,912,590 3,789,125

------------ -----------

Note 7 Warrant and Share based payment reserve

Warrants

The following reconciliation serves to summarise the composition

of the warrant reserve as at period end:

30 June 30 June 31 December

2021 2020 2020

GBP GBP GBP

Opening balance of warrant reserve 494,597 74,930 74,930

Issue of warrants 72,000 35,588 419,667

Exercise of warrants - - -

566,597 110,518 494,597

-------- -------- ------------

Reconciliation of the quantity of warrants in issue:

30 June 30 June 31 December

2021 2020 2020

------------ ------------ ------------

Opening balance 70,274,999 21,208,333 21,208,333

Warrants exercised (1,000,000) (4,800,000) (4,800,000)

Warrants issued 48,000,000 17,200,000 53,866,666

------------ ------------ ------------

117,274,999 33,608,333 70,274,999

------------ ------------ ------------

During the current year the following warrants have been issued

over the Company's Ordinary Shares :

48,000,000 warrants to various funders in respect of placing and

subscription of 48,000,000 ordinary shares of 1.0p each issued on

15 January 2021. Each Financing Share has an attaching warrant to

subscribe for a further new Ordinary Share at a price of 3p, with a

life to expiry of 3 years from the Financing Shares admission to

trading on AIM ('Admission'), creating 48,000,000 new warrants.

Share Options

The following reconciliation serves to summarise the composition

of the share based payment reserve as at period end:

30 June 30 June 31 December

2021 2020 2020

GBP GBP GBP

Opening balance of share based

payment reserve 256,315 30,537 30,537

Vesting of share options 162,700 - 225,778

419,015 30,537 256,315

-------- -------- ------------

Reconciliation of the quantity of Share options in issue:

30 June 30 June 31 December

2021 2020 2020

----------- ----------- ------------

Opening balance 32,244,781 14,944,783 14,944,783

Share options issued - - 17,300,000

----------- ----------- ------------

32,244,781 14,944,783 32,244,781

----------- ----------- ------------

During the current year the remaining 50% of the share options

issued in August 2020 has vested.

Note 8 Exploration and evaluation assets

Exploration and evaluation assets consist solely of separately

identifiable prospecting assets held by Kibo Nickel and its

subsidiaries.

The following reconciliation serves to summarise the composition

of intangible prospecting assets as at period end:

Reconciliation of exploration and evaluation

assets

Carrying value as at 1 January 2020 209,500

--------

Acquisition of prospecting licences -

Impairment of licences -

Carrying value as at 30 June 2020 209,500

--------

Acquisition of prospecting licences -

Impairment of licences -

Carrying value as at 31 December 2020 209,500

--------

Acquisition of prospecting licences -

--------

Impairment of licences

--------

Carrying value as at 30 June 2021 209,500

--------

Haneti comprises tenements (prospecting licences, offers and

applications) prospective for nickel, platinum-group-elements and

gold. It covers an area of approximately 5,000 sq. km in central

Tanzania and forms a near contiguous project block. The project

area straddles the Dodoma, Kondoa and Manyoni districts all within

the Dodoma (Administrative) Region. The main prospective belt of

rocks within the project, the Haneti-Itiso Ultramafic Complex

(HIUC), is centred on the small town of Haneti, located 88

kilometres north of Tanzania's capital city Dodoma. The HIUC

sporadically crops out over a strike length of 80 kilometres with

most outcrop exposure occurring 15 kilometres east of Haneti

village where artisanal mining of the semi-precious mineral

chrysoprase (nickel stained chalcedonic quartz) is being carried

out at a few localities.

Note 9 Board of Directors

There were no changes to the board of directors during the

interim period, or any other committee's composition.

Note 10 Subsequent events

Blyvoor Joint Venture Project

A period of limited political unrest in South Africa temporarily

delayed the funding process when some of the short-listed parties

requested additional time to re-assess the country risk profile as

a result of the unrest. However, the Company is pleased to announce

that discussions with these potential funders have since resumed

and the joint venture partners hope to conclude a final funding

arrangement for Blyvoor during the latter part of 2021.

Note 11 Commitments and contingencies

There are no material contingent assets or liabilities as at 30

June 2021.

Note 12 Segment report

Segmental disclosure per category

Mining Corporate Total

GBP GBP GBP

30 June 2020

Loss after tax (516) 365,259 364,743

Segmental assets 211,768 1,675,082 1,886,650

Segmental liabilities 10,051 309,543 319,594

30 June 2021

Loss after tax (369,842) (401,949) (771,791)

Segmental assets 217,519 435,945 653,464

Segmental liabilities 113,169 119,166 232,335

Segmental disclosure per geographical location

Tanzania Cyprus UK South Africa Total

GBP GBP GBP GBP GBP

30 June 2020

Loss after

tax (516) (138,339) 503,598 - 364,743

Segmental

assets 211,768 1,495 1,673,587 - 1,886,650

Segmental

liabilities 10,051 85,776 223,767 - 319,594

30 June 2021

Loss after

tax (120,438) (131,894) (401,949) (117,509) (771,791)

Segmental

assets 214,705 996 435,945 1,818 653,464

Segmental

liabilities 9,553 102,117 119,166 1,499 232,335

Notable changes from the prior interim report has been the

addition of a new geographical location in which the Group

prospecting operation has been initiated which is South Africa

where the Group has entered into binding conditional agreement to

form a 50/50 unincorporated joint venture pertaining to gold

tailing project.

Note 13 Other financial assets

30 June 30 June 31 December

2021 2020 2020

GBP GBP GBP

Other financial assets consists

of:

Lake Victoria Gold - 811,400 640,821

Impairment - - (640,821)

- 811,400 -

======= ======= ===========

On 30 June 2020, the last condition precedent related to the

disposal of Reef Miners Ltd ("Reef") as per the SPA, comprising the

Imweru gold project and the Lubando gold project in northern

Tanzania, was met resulting in the effective disposal of the

subsidiary to Lake Victoria Gold Ltd ("LVG").

The following profit on disposal of the subsidiary was

recognised in the audited annual report at 31 December 2020:

Group (GBP)

Cash and cash equivalents (336)

Trade and other payables 9,136

Net liability value disposed of at 31 December

2020 8,800

Foreign currency translation reserve reclassified

through profit or loss (121,670)

Proceeds from disposal 797,564

---------------

Profit on disposal for group 684,694

---------------

Impairment (640,821)

---------------

Net profit on disposal for group at 31 December

2020 43,873

---------------

The amount receivable from Lake Victoria Gold will be due and

payable on the following dates:

1. US$100,000 upon the satisfaction of the Condition Precedent;

2. US$100,000 upon registration of Reef in the name of LVG;

3. US$100,000 four months from the date of the SPA;

4. US$200,000 nine months from the date of the SPA; and

5. US$500,000 upon the earlier of the commissioning of the first

producing mine of LVG in the Tanzania or the date 24 months from

the date of the SPA.

As at 31 December 2020, funds of $100,000 have been received

from Lake Victoria Gold in respect of the sale of Reef Miners Ltd

("Reef")

The receivable in Lake Victoria Gold has been fully impaired at

31 December 2020 due to the significant increase in credit risk,

which is as a result of payments 1, 3 and 4 not being received as

they become due and is still outstanding at the date of this

interim report.

Blyvoor Joint Venture

On 30 January 2020, the Group entered into a Joint Venture

Agreement with Blyvoor Gold Mines (Pty) Ltd, whereby Katoro Gold

plc and Blyvoor Gold Mines (Pty) Ltd would become 50/50

participants in an unincorporated Joint Venture.

In accordance with the requirements of the Joint Venture

Agreement, the Katoro Group was to provide a ZAR15.0 million loan

(approximately GBP790,000) to the JV ('the Katoro Loan Facility'),

which will fund ongoing development work on the Project.

As at 31 December 2020, the Group has advanced funding in the

amount of GBP1,201,767 of which 100% relate to expenditure

allocated to the Joint Venture operations, carried by the Katoro

Gold plc Group.

Furthermore, the Group has continued to advance funding in the

amount of GBP97,207 of which 100% relate to expenditure allocated

to the Joint Venture operations, carried out by the Katoro Gold plc

Group.

The Katoro Loan Facility shall form part of the development

capital project financing that Katoro shall procure in accordance

with its obligations contained in the Agreement, as detailed below,

provided that:

-- the balance of the Katoro Loan Facility then outstanding

shall be subordinated to third party creditors participating in the

development capital project financing;

-- the Katoro Loan Facility will bear interest at the 12-month

London Inter Bank Offered Rate, or its successor; and

-- the Katoro Loan Facility will be repayable within 12 months

after:

- the last third-party creditor participating in the project

financing shall have been paid; or

- any earlier date on which the Parties may agree.

Note 14 Related parties

Relationships

Name Relationship

Kibo Energy plc Significant shareholder and controlling

parent

Power Metal Resources plc Common shareholding

Related party balances trade receivables/(trade 30 June 30 June 31 December

payables) 2021 2020 2020

GBP GBP GBP

Kibo Energy plc - - 23,024

Power Metal Resources plc (77,080) - (41,155)

--------- -------- ------------

(77,080) - (18,131)

========= ======== ============

Related parties of the Group comprise subsidiaries, significant

shareholders, and the Directors.

Transactions between the Company and its subsidiaries, which are

related parties, have been eliminated on consolidation.

Transactions with related parties are effected on a commercial

basis and related party debts are repayable on a commercial

basis.

The transactions during the period between the Company and its

subsidiaries included the settlement of expenditure to/from

subsidiaries, working capital funding, and settlement of the

Company's liabilities through the issue of equity in subsidiaries.

The loans to/from Group companies do not have fixed repayment terms

and are unsecured.

Note 15 Principal risks

The principal risks and uncertainties identified in the last

Annual Report of Katoro Gold plc, issued in May 2021, have not

materially changed/altered in the interim period.

Note 16 Use of Estimates and Judgements

The preparation of these condensed interim consolidated

financial statements in conformity with IFRS requires management to

make judgements, estimates and assumptions that affect the

application of accounting policies and the reported amounts of

assets, liabilities, income and expenses.

The estimates and associated assumptions are based on historical

experience and various other factors that are believed to be

reasonable under the circumstances, the results of which form the

basis of making judgements about carrying values of assets and

liabilities that are not readily apparent from other sources.

In particular, there are significant areas of estimation,

uncertainty and critical judgements in applying accounting policies

that have the most significant effect on the amounts recognised in

the financial statements.

-- Valuation of share options and warrants;

-- Credit loss allowance for other financial assets; and

-- Valuation of mining licence in Kibo Nickel Ltd.

Note 17 Financial instruments - Fair value and Risk Management

The carrying amount of all financial assets and liabilities

approximates the fair value. Directors consider the carrying value

of financial instruments of a short-term nature, that mature in 12

months or less, to approximate the fair value of such assets or

liability classes.

The carrying values of longer-term assets are considered to

approximate their fair value as these instruments bear interest at

interest rates appropriate to the risk profile of the asset or

liability class.

The Group does carry any unlisted financial instruments measured

in the statement of financial position at fair value at 30 June

2021.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UKAVRABUKRAR

(END) Dow Jones Newswires

September 10, 2021 02:00 ET (06:00 GMT)

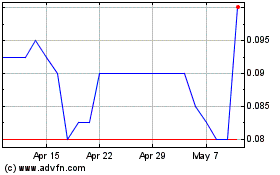

Katoro Gold (LSE:KAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Katoro Gold (LSE:KAT)

Historical Stock Chart

From Apr 2023 to Apr 2024