TIDMKIBO

RNS Number : 8799M

Kibo Energy PLC

24 September 2021

Kibo Energy plc (Incorporated in Ireland)

(Registration Number: 451931)

(External registration number: 2011/007371/10)

Share code on the JSE: KBO

Share code on the AIM: KIBO

ISIN: IE00B97C0C31

("Kibo" or "the Group" or "the Company")

Unaudited Interim results for the six months ended 30 June

2021

Dated 24 September 2021

Kibo Energy plc, the multi-asset, Africa focused, Energy Company

, is pleased to announce its unaudited interim results for the 6

month period ended 30 June 2021.

Highlights

-- Refocused strategy centred around renewable energy

opportunities and capitalising on the global clean energy

revolution.

-- Proceeding with the agreement to jointly develop a portfolio

of Waste to Energy projects in South Africa with Industrial Green

Energy Solutions (Pty) Ltd , which will initially develop a phased

c. 8MW project for an industrial client, to be followed by six

other projects at different sites, to a total generation of up to

50MW. This aims to address the country's insecure energy supply

environment as well as the renewable energy portfolio in the UK,

currently the subject of a due diligence investigation.

-- Intention to dispose of coal assets in accordance with a

disposal strategy that will realise value for shareholders.

-- Successful technical and business workshop with Mozambique

Utility Electricidade De Moçambique("EDM") to negotiate and agree

next steps in the process towards the agreement and finalization of

a PPA for the Benga Power Project, and a formal submission of an

advanced technical and commercial information pack to EDM, as part

of the ongoing development workstreams provided for under the

existing MoU with EDM and emanating from the Definitive Feasibility

Study previously submitted to EDM.

-- Successful listing in April 2021 of Mast Energy Developments

which raised GBP5.54 million to support the company's aggressive

expansion plans following the listing.

-- Moreover, the market value of Kibo's 55.42% interest in MAST

is valued at c. GBP12 million as of 23 September 2021, which is

approximately twice the current valuation of Kibo.

-- Post reporting period:

o All conditions have been satisfied and the agreement completed

with South Africa-based Industrial Green Energy Solutions (Pty) Ltd

to jointly develop a portfolio of Waste to Energy projects in South

Africa. Kibo and IGES have entered into an amendment (the

"Amendment") to fast track the implementation of the first project.

Completion of the agreement and Amendment follows the positive

findings of an extensive due diligence process.

o Completed a Heads of Terms (the "Agreement") with EQTEC plc

(AIM: EQT) ("EQTEC"), a world-leading gasification solutions

company, to acquire a 54.54% interest in the proposed 25 MWe

Billingham waste gasification and power plant (the "Project") at

Haverton Hill, Teesside, UK. The Project is at advanced stages of

development with a concept design for the full plant produced,

planning permission approved, grid connection offer secured.

Furthermore, the Project is expected to annually process 200,000

metric tonnes of non-recyclable everyday Municipal Solid Waste into

25 Mwe of green electricity, enough to power 50,000 homes.

Chairman's Statement

Following a shift in international climate policies we recently

announced a significant pivot in our strategy. We have decided to

focus on the acquisition and development of a portfolio of

sustainable, renewable energy assets and dispose of, or reposition,

our fossil fuel utility projects. Set against this, and in

following our adjusted strategy, we are currently undertaking due

diligence on a portfolio comprising mostly of waste to energy

projects in the UK and have signed an agreement with Industrial

Green Energy Solutions (Pty) Ltd ("IGES") to jointly develop a

portfolio of waste-to-energy projects in South Africa.

It has become increasingly apparent that the development and

funding of large-scale coal - fired utility projects such as our

MCPP, Benga and Mabesekwa Projects, is becoming increasingly

challenging and especially for small companies like Kibo. This does

not change our view that our focus should remain on the development

of sustainable energy opportunities. It is in this context that

Kibo has decided to refocus on smaller scale renewable energy

projects, initially in countries such as the UK and South Africa,

where the market opportunities, government support and technical

innovation are rapidly evolving.

Kibo has developed much experience in the renewable energy

sector in recent years primarily through its work in developing

renewable energy and storage solutions for integration with its

large utility coal projects in Africa. The Company was also a key

driver behind Mast Energy Developments plc (Kibo holds a 55% equity

stake) which has an ambitious reserve energy site portfolio and

recently completed a successful IPO on the London Stock Exchange.

While Mast's focus is on the niche reserve energy/peaking power

site development in the UK, Kibo's will rather concentrate on

Renewable Energy and Waste to Energy Opportunities.

I would also like to remind shareholders that we have developed

significant inherent value in our large-scale utility projects over

the last few years supported by our ownership interests in two

large coal deposits (MCPP and Mabesekwa). We are committed to

structuring our disposal plans for these projects to ensure that

our shareholders retain the benefit of any future upside potential

from the development of these projects. Advisers have been engaged

in order to retain maximum value in the projects for Kibo whilst

making them attractive for acquisition, funding and construction by

potential purchasers.

Operations

Industrial Green Energy Solutions (IGES) Projects

The agreement in May 2021 with IGES for the joint development of

a portfolio of waste to energy projects in South Africa (with an

initial aggregate target of 50 MW generating capacity) is our first

investment as part of the new strategy. Though subject to the

completion of certain conditions, it will give Kibo a 65% interest

(IGES will hold the balance) in a South African company holding

seven projects at different sites. The intention is to convert

specified grades of non-recyclable waste plastic to syngas for the

generation of electricity and heat for industrial clients. Kibo's

initial investment in the project will comprise R11.1 million (c.

GBP0.55m) as an equity loan.

One of these sites, based South of Pretoria, will have a phased

generation capacity of up to 8 MW, with the first stage of

development of 4 MW expected to be completed within 14 months.

I believe the IGES business opportunity is timely as it

coincides with intensified legal restrictions pertaining to

disposal of plastics and increased demand for private electricity

generation in South Africa where the state utility ESKOM are

finding it difficult to meet this demand.

UK Energy Portfolio

Earlier this year we announced that an extensive due diligence

process by an independent specialist was in progress on a portfolio

of several attractive standalone waste-to-energy projects in the

UK. Based on exclusivity, and subject to the findings, successful

acquisition(s) from this portfolio will further enhance Kibo's new

strategy adjustment, and in the process support the UK's Renewable

Energy Strategy.

Other Projects

Our large-scale coal utility projects, Benga, MCIPP and

Mabesekwa remain in good standing, and we will determine how these

can be disposed of while realising a significant portion of their

value.

Investment Holdings

Mast Energy Development Projects ("MED")

During the current year to date, Kibo had diluted its equity

interest in MAST Energy Developments plc, previously a wholly owned

subsidiary, as MAST raised in excess of GBP5m through Clear Capital

Markets Ltd from its IPO on the Official List of the London Stock

Exchange plc by way of a Standard Listing. On the date of listing

the market capitalisation for MAST Energy Developments plc was c.

GBP23 million.

Furthermore, initially Kibo's equity holding measured at cost

pre-IPO in MAST was GBP2,615,929 which increased substantially to

GBP6,580,050 post-IPO when calculated as a portion of the net

assets of MAST. Moreover, the current market value of Kibo's 55.42%

interest in MAST is valued at c. GBP12 million, which is

approximately twice the current valuation of Kibo.

In addition, the recent IPO has enabled MED to expedite the

addition of further reserve power sites to its portfolio to

increase its generating capacity while preparing its first site for

production. MED's target is to assemble a portfolio of well-located

flexible power sites in the UK, commencing with c. 50 MW in the

first year and building up to a portfolio of up to 300 MW of

flexible power generating capacity.

Katoro Gold plc ("Katoro")

Our commitment to supporting our 25.37% investment in Katoro

Gold plc (AIM: KAT) remains strong as Katoro actively progresses

its projects in Tanzania (nickel sulphides & battery metals)

and gold development in South Africa. The Katoro board is currently

receiving and evaluating comprehensive funding proposals from

several interested parties for the construction and commissioning

of the Blyvoor Gold Tailings Project. A drilling programme at the

Nickel-PGM Haneti project in Tanzania has also been designed and

will be implemented before the end of 2021.

Corporate

During the period, we continued exploring funding options for

the Company and benefited from warrant exercises resulting in the

issue of 188,431,556 new shares at prices ranging from 0.2p to 0.4p

yielding total proceeds of GBP697,726. We also settled the total

outstanding amount of GBP339,437 pursuant to the Forward Payment

Facility signed between Sanderson Capital Partners Ltd and the

Company in December 2016 in cash and shares. The share component

comprised GBP169,718 (50% of the total) for which we issued

65,276,346 new shares at a deemed value of 0.26p per share.

At an EGM held on 22 February 2021 the shareholders of Kibo

approved resolutions to permit the migration of the Company's

dematerialised shares held through CREST to Euroclear Nominees Ltd

(the "Eurobank Migration") The Eurobank Migration was required to

allow shareholders to continue to hold the Company shares in

dematerialised form following the UK's exit from the EU and this

successfully completed on the 12 March 2021.

Conclusion

I am pleased to report that the Covid-19 pandemic has not unduly

impacted our business operations so far this year and would like to

place on record my sincere thanks to all our employees and

shareholders.

We are now well positioned to focus primarily on the acquisition

and development of sustainable renewable energy projects, on which

we have made significant progress while concurrently exploring the

optimum disposal route for our large-scale utility projects.

The pace at which renewable energy technologies are evolving and

the fragmentation of the electricity generation and supply markets

including the increasing popularity of small bespoke renewable

energy solutions for industry provides an attractive opportunity

for Kibo to participate in these evolving energy markets.

Christian Schaffalitzky

Chairman

Unaudited Interim Results for the six months ended 30 June

2021

Unaudited Condensed Consolidated Interim Statement of

Comprehensive Income

For the six months ended 30 June 2021

6 months 6 months 12 months to

to to

30 June 30 June 31 December

Note 2021 2020 2020

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

Revenue - - -

Administrative expenses (1,052,448) (1,136,966) (3,393,687)

Exploration Expenditure (432,678) (181,283) (2,052,202)

Capital raising fees (417,315) - (1,027,658)

Operating Loss (1,902,441) (1,318,249) (6,473,547)

Other Income 56,565 62,621 78,945

Loss from equity accounted

investment - (336) (332)

Finance income 11,945 - -

Finance costs (12,363) - (22,303)

------------ ------------ --------------

Loss before Tax (1,846,294) (1,255,964) (6,417,237)

Tax - - -

------------ ------------ --------------

Loss for the period (1,846,294) (1,255,964) (6,417,237)

Other comprehensive

income:

Exchange differences

on translating of

foreign operations,

net of taxes 579,500 673,457 152,635

Exchange differences

reclassified on disposal

of foreign operation - - 121,670

Total Comprehensive

Loss for the Period (1,266,794) (582,507) (6,142,932)

------------ ------------ --------------

Loss for the period

attributable to (1,846,294) (1,255,964) (6,417,237)

------------ ------------ --------------

Owners of the parent (1,011,565) (1,426,128) (4,726,286)

Non-controlling interest (834,729) 170,164 (1,690,951)

------------ ------------ --------------

Total comprehensive

loss attributable

to (1,266,794) (582,507) (6,142,932)

------------ ------------ --------------

Owners of the parent (432,065) (752,671) (4,451,981)

Non-controlling interest (834,729) 170,164 (1,690,951)

------------ ------------ --------------

Basic loss per share 4 (0.0004) (0.001) (0.003)

Diluted loss per share 4 (0.0004) (0.001) (0.003)

Unaudited Condensed Consolidated Interim Statement of Financial

Position

As at 30 June 2021

Note 30 June 30 June 31 December

2021 2020 2020

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

Assets

Non-current assets

Property, plant and equipment 2,050 10,103 2,118

Intangible assets 7 18,491,105 18,491,105 18,491,105

Investment in associates 8 9,696,351 9,696,347 9,696,351

Other financial assets 9 - 443,362 -

Goodwill 300,000 300,000 300,000

Right of use asset 11 295,860 - -

Total non-current assets 28,785,366 28,940,917 28,489,574

------------- ------------- -------------

Current assets

Other financial assets 9 - 1,159,200 -

Other receivables 45,455 237,371 115,886

Cash and cash equivalents 4,882,121 68,612 256,760

------------- ------------- -------------

Total current assets 4,927,576 1,465,183 372,646

------------- ------------- -------------

Total assets 33,712,942 30,406,100 28,862,220

------------- ------------- -------------

Equity

Called up share capital 5 20,631,196 19,564,383 20,411,493

Share premium 5 44,960,112 43,214,322 44,312,371

Common control reserve (18,329) (18,329) (18,329)

Translation reserve (19,137) (199,485) (598,637)

Share based payment reserve 1,952,969 1,118,630 1,728,487

Retained deficit (38,001,194) (36,052,082) (39,019,856)

------------- ------------- -------------

Attributable to equity

holders of the parent 29,505,617 27,627,439 26,815,529

------------- ------------- -------------

Non-controlling interest 2,242,907 441,173 (256,841)

Total Equity 31,748,524 28,068,612 26,558,688

Liabilities

Non-current liabilities

Lease liability 11 296,435 - -

------------- ------------- -------------

Total non-current liabilities 296,435 - -

------------- ------------- -------------

Current liabilities

Trade and other payables 1,166,160 1,730,873 1,444,986

Borrowings 10 499,401 606,615 858,546

Lease liability 11 2,422 - -

Total current liabilities 1,667,983 2,337,488 2,303,532

------------- ------------- -------------

Total liabilities 1,964,418 2,337,488 2,303,532

------------- ------------- -------------

Total equity and liabilities 33,712,942 30,406,100 28,862,220

------------- ------------- -------------

Unaudited Condensed Interim Consolidated Statement of Changes in

Equity

Share Share Share Control Foreign Retained Non-controlling Total

Capital Premium based Reserve currency deficit interest

payment translation

reserve reserve

GBP GBP GBP GBP GBP GBP GBP

----------- ----------- ---------- --------- ------------ ------------- ---------------- ------------

Balance at 31

December 2020

(audited) 20,411,493 44,312,371 1,728,487 (18,329) (598,637) (39,019,856) (256,841) 26,558,688

----------- ----------- ---------- --------- ------------ ------------- ---------------- ------------

Loss for the

year allocated

to equity

owners - - - - - (1,011,565) - (1,011,565)

----------- ----------- ---------- --------- ------------ ------------- ---------------- ------------

Loss for the

period

allocated to

non-controlling

interest - - - - - - (834,729) (834,729)

----------- ----------- ---------- --------- ------------ ------------- ---------------- ------------

Other

comprehensive

income-

translation of

foreign

operations - - - - 579,500 - - 579,500

----------- ----------- ---------- --------- ------------ ------------- ---------------- ------------

Issue of share

capital 219,703 647,741 - - - - - 867,444

----------- ----------- ---------- --------- ------------ ------------- ---------------- ------------

Acquisition of

the

Non-Controlling

Interest

without gaining

control - - - - - (300,029) 300,029 -

----------- ----------- ---------- --------- ------------ ------------- ---------------- ------------

Disposal of

equity to

Non-Controlling

Interest

without losing

control - - - - - (3,034,448) 3,034,448 -

----------- ----------- ---------- --------- ------------ ------------- ---------------- ------------

Changes in

ownership

interest in

subsidiaries

without a

change in

control - - - - - 5,354,486 - 5,354,486

----------- ----------- ---------- --------- ------------ ------------- ---------------- ------------

Warrants and

Share Options

issued by

Katoro Gold plc - - 234,700 - - - - 234,700

----------- ----------- ---------- --------- ------------ ------------- ---------------- ------------

Expirations of

share warrants - - (10,218) - - 10,218 - -

----------- ----------- ---------- --------- ------------ ------------- ---------------- ------------

Balance as at 30

June

2021(unaudited) 20,631,196 44,960,112 1,952,969 (18,329) (19,137) (38,001,194) 2,242,907 31,748,524

----------- ----------- ---------- --------- ------------ ------------- ---------------- ------------

Balance at 1

January 2020

(audited) 19,532,350 42,750,436 1,504,513 (18,329) (872,942) (34,625,954) 27,073 28,297,147

----------- ----------- ---------- --------- ------------ ------------- ---------------- ------------

Loss for the

year - - - - - (1,426,128) 170,164 (1,255,964)

----------- ----------- ---------- --------- ------------ ------------- ---------------- ------------

Other

comprehensive

income-

translation of

foreign

operations - - - - 673,457 - - 673,457

----------- ----------- ---------- --------- ------------ ------------- ---------------- ------------

Issue of share

capital 32,033 463,886 (421,471) - - - - 74,448

----------- ----------- ---------- --------- ------------ ------------- ---------------- ------------

Equity

contribution of

minorities - - - - - - 243,936 243,936

----------- ----------- ---------- --------- ------------ ------------- ---------------- ------------

Issue of share

options or

share warrants - - 35,588 - - - - 35,588

----------- ----------- ---------- --------- ------------ ------------- ---------------- ------------

Balance at 30

June 2020 19,564,383 43,214,322 1,118,630 (18,329) (199,485) (36,052,082) 441,173 28,068,612

----------- ----------- ---------- --------- ------------ ------------- ---------------- ------------

Balance at 1

January 2020

(audited) 19,532,350 42,750,436 1,504,513 (18,329) (872,942) (34,625,954) 27,073 28,297,147

----------- ----------- ---------- --------- ------------ ------------- ---------------- ------------

Loss for the

year - - - - - (4,726,286) (1,690,951) (6,417,237)

----------- ----------- ---------- --------- ------------ ------------- ---------------- ------------

Other

comprehensive

income -

exchange

differences - - - - 152,635 - - 152,635

----------- ----------- ---------- --------- ------------ ------------- ---------------- ------------

Shares issued 871,984 1,149,095 - - - - - 2,021,079

----------- ----------- ---------- --------- ------------ ------------- ---------------- ------------

Shares issued to

pay deferred

vendor

liability 7,159 412,840 (421,471) - - - - (1,472)

----------- ----------- ---------- --------- ------------ ------------- ---------------- ------------

Warrants issued

by Katoro Gold

plc - - 419,667 - - - - 419,667

----------- ----------- ---------- --------- ------------ ------------- ---------------- ------------

Share Options

issued by

Katoro Gold plc - - 225,778 - - - - 225,778

----------- ----------- ---------- --------- ------------ ------------- ---------------- ------------

Change in

shareholding

without a loss

of control - - - - - 332,384 1,407,037 1,739,421

----------- ----------- ---------- --------- ------------ ------------- ---------------- ------------

Disposal of

subsidiary - - - - 121,670 - - 121,670

----------- ----------- ---------- --------- ------------ ------------- ---------------- ------------

Balance at 31

December 2020

(audited) 20,411,493 44,312,371 1,728,487 (18,329) (598,637) (39,019,856) (256,841) 26,558,688

----------- ----------- ---------- --------- ------------ ------------- ---------------- ------------

Unaudited Condensed Consolidated Interim Statement of Cash

Flow

For the six months ended 30 June 2021

6 months 6 months 12 months

to to to

30 June 30 June 31 December

2021 2020 2020

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

Loss for the period before taxation (1,846,294) (1,255,964) (6,417,237)

Adjusted for:

Other income (56,565) - -

Warrants and options issued - 35,588 697,006

Exploration and development expenditure

on a Joint Operation 83,532 - 1,122,676

Expenses settled through share issues 310,369 - 436,076

Profit on sale of property, plant

and equipment - - (53,574)

(Profit)/Loss from the disposal

of subsidiary - (28,400) 102,414

Impairment of other financial asset - - 640,821

Loss from equity accounting - 336 332

Depreciation on property, plant

and equipment 1,733 - 5,686

Operating income before working

capital changes (1,507,225) (1,248,440) (3,465,800)

Decrease in trade and other receivables 70,431 143,322 108,872

Increase/(Decrease) in trade and

other payables (278,826) 706,747 982,244

Net cash outflows from operating

activities (1,715,620) (398,371) (2,374,684)

Cash flows from financing activities

Proceeds from borrowings - 792,800 1,370,000

Repayment of borrowings (25,000) - -

Proceeds from issue of share capital 6,449,513 243,936 2,277,000

------------ ------------ ------------

Net cash proceeds from financing

activities 6,424,513 1,036,736 3,647,000

------------ ------------ ------------

Cash flows from investing activities

Cash received/(forfeited) on disposal

of subsidiary - (23,022) 76,716

Cash advanced to Joint Venture (83,532) (753,500) (1,122,676)

Cash received on sale of plant and

equipment - 54,303 58,628

Net cash used in(out) from investing

activities (83,532) (722,219) (987,332)

Net movement in cash and cash equivalents 4,625,361 (83,854) 284,984

Cash and cash equivalents at beginning

of period 256,760 91,634 91,634

Exchange movements - (60,832) (119,858)

------------ ------------ ------------

Cash and cash equivalents at end

of period 4,882,121 68,612 256,760

------------ ------------ ------------

Notes to the unaudited condensed consolidated interim financial

statements

For the six months ended 30 June 2021

1. General information

Kibo Energy plc is a public company incorporated in Ireland. The

condensed consolidated interim financial results consolidate those

of the Company and its subsidiaries (together referred to as the

"Group"). The Company's shares are listed on the AIM Market ("AIM")

of the London Stock Exchange and the Alternative Exchange ("AltX")

of the Johannesburg Stock Exchange ("JSE") Ltd. The principal

activities of the Company and its subsidiaries are related to the

development of energy projects in Mozambique, Botswana, Tanzania,

South Africa and the United Kingdom.

2. Statement of Compliance and Basis of Preparation

The unaudited condensed consolidated interim financial results

are for the six months ended 30 June 2021, and have been prepared

using the same accounting policies as those applied by the Group in

its December 2020 consolidated annual financial statements, which

are in accordance with the framework concepts and the recognition

and measurement criteria of the International Financial Reporting

Standards and Financial Reporting Pronouncements as issued by the

Financial Reporting Standards Council issued by the International

Accounting Standards Board ("IASB"), including the SAICA Financial

Reporting Guides as issued by the Accounting Practices Committee,

IAS 34 - Interim Financial Reporting, the Listings Requirements of

the JSE Ltd, the AIM rules of the London Stock Exchange and the

Irish Companies Act 2014.

These condensed consolidated interim financial statements do not

include all the notes presented in a complete set of consolidated

annual financial statements, as only selected explanatory notes are

included to explain key events and transactions that are

significant to obtaining an understanding of the changes throughout

the financial period, accordingly the report must be read in

conjunction with the annual report for the year ended 31 December

2020.

The comparative amounts in the consolidated financial results

include extracts from the consolidated annual financial statements

for the period ended 31 December 2020.

These extracts do not constitute statutory accounts in

accordance with the Irish Companies Act 2014. All monetary

information is presented in the presentation currency of the

Company being Pound Sterling. The Group's principal accounting

policies and assumptions have been applied consistently over the

current and prior comparative financial period.

3. Use of estimates and judgements

Preparing the condensed consolidated interim financial

statements requires management to make judgements, estimates and

assumptions that affect the application of accounting policies and

the reported amounts of assets and liabilities, income and

expenses. Actual results may differ from these estimates.

In preparing these condensed consolidated interim financial

statements, significant judgements made by management in applying

the Group's accounting policies and the key sources of estimation

uncertainty were the same as those applied to the consolidated

financial statements as at and for the year ended 31 December

2020.

4. Loss per share

Basic, dilutive and headline loss per share for the six months

ended 30 June 2021 are as follows:

6 months to 6 months 12 months

to to

30 June 30 June 31 December

2021 2020 2020

GBP GBP GBP

Loss for the year attributable

to equity holders of the parent (1,011,565) (1,426,128) (4,726,286)

Weighted average number of ordinary

shares for the purposes of basic

and dilutive loss per share 2,339,072,536 1,261,786,374 1,546,853,959

Basic loss per share (0.0004) (0.001) (0.003)

Dilutive loss per share (0.0004) (0.001) (0.003)

6 months 6 months to 12 months

to to

Reconciliation of Headline loss 30 June 30 June 31 December

per share

2021 2020 2020

GBP GBP GBP

Loss for the year attributable

to equity holders of the parent (1,011,565) (1,426,128) (4,726,286)

Adjusted for:

(Profit)/Loss on disposal of subsidiaries - 28,400 102,414

Profit on disposal of motor vehicle - - (53,574)

Headline loss per share (1,011,565) (1,397,728) (4,677,446)

-------------- -------------- --------------

Weighted average number of ordinary

shares for the purposes of headline

loss per share 2,339,072,536 1,261,786,374 1,546,853,959

Headline loss per share (0.0004) (0.001) (0.003)

Headline earnings per share (HEPS) is calculated using the

weighted average number of ordinary shares in issue during the

period and is based on the earnings attributable to ordinary

shareholders, after excluding those items as required by Circular

1/2021 issued by the South African Institute of Chartered

Accountants (SAICA).

5. Called up share capital and share premium

Ordinary share capital of the company is 5,000,000,000 ordinary

shares of EUR0.001 each.

Deferred shares of the company is 1,000,000,000 of EUR0.014 and

3,000,000,000 of EUR0.009 respectively.

Authorised share capital of the company is 9,000,000 shares.

Details of issued share capital is as follows:

Number of

Ordinary Share Deferred Share

Share

shares Capital Capital Premium

GBP GBP GBP

Balance at 31 December

2019 1,257,276,078 326,468 19,205,882 42,750,436

Shares issued in period

(net of expensed for cash) 964,364,757 879,143 - 1,561,935

Balance at 31 December

2020 2,221,640,835 1,205,611 19,205,882 44,312,371

-------------- ---------- ----------- -----------

Warrants exercised 188,431,556 163,278 - 534,447

Shares issued to convert

debt 65,276,346 56,425 - 113,294

-------------- ---------- ----------- -----------

Balance at 30 June 2021 2,475,348,737 1,425,314 19,205,882 44,960,112

-------------- ---------- ----------- -----------

The company issued the following ordinary shares during the

period, with regard to key transactions:

- 65,276,346 new Kibo Shares were issued on 27 May 2021 of

EUR0.001 each at a deemed issue price of GBP0.0026 per share to

Sanderson Capital Partners Ltd ("Sanderson") in settlement of

GBP169,718.50 of the total outstanding amount of GBP339,437

pursuant to the Forward Payment Facility signed between Sanderson

and the Company in December 2016 ;

- 74,569,556 Company warrants to subscribe for 74,569,556 new

Kibo shares under the terms of warrants announced on the 17

September 2020 were exercised on 3 March 2021 at a price of GBP

0.004 (0.4p) per warrant; and

- 50,000,889 Company warrants to subscribe for 50,000,889 new

Kibo shares under the terms of warrants announced on the 17

September 2020 were exercised on 4 May 2021 at a price of GBP 0.004

(0.4p) per warrant.

- 24,000,000 and 7,500,000 Company warrants to subscribe for an

aggregate 31,500,000 new Kibo shares under the terms of warrants

announced on the 17 September 2020 were exercised on 19 February

2021 at a price of GBP 0.0025 (0.25p) and GBP 0.004 (0.4p) per

warrant respectively.

As the remainder of the shares issued were in relation to

smaller equity tranches these have not been disclosed.

6. Segment analysis

IFRS 8 requires an entity to report financial and descriptive

information about its reportable segments, which are operating

segments or aggregations of operating segments that meet specific

criteria. Operating segments are components of an entity about

which separate financial information is available that is evaluated

regularly by the chief operating decision-maker.

The Chief Executive Officer is the chief operating decision

maker of the Group.

Management currently identifies two divisions as operating

segments - mining and corporate. These operating segments are

monitored, and strategic decisions are made based upon them

together with other non-financial data collated from exploration

activities. Principal activities for these operating segments are

as follows:

30 June 2021

Benga Mabesekwa Mbeya Mast Energy Haneti Blyvoor Corporate 30 June

Power Independent Coal (GBP) 2021

Power to Power Development (GBP) Group

Revenue - - - - - - - -

Administrative

cost - (806) (4,968) (275,445) (5,084) (4,228) (761,917) (1,052,448)

Exploration

expenditure - - (33,254) (120,333) (119,802) (35,021) (124,268) (432,678)

Investment

and other

income - - 1,821 - - - 54,744 56,565

Capital raising

fees - - - (260,878) - - (156,437) (417,315)

Loss from - - - - - - - -

equity

accounted

investment

Finance income - - - - - - 11,945 11,945

Finance costs - - - (12,363) - - - (12,363)

Loss after

tax - (806) (36,401) (669,019) (124,886) (39,249) (975,933) (1,846,294)

----------- ------------ ---------- ------------ ---------- --------- ---------- ------------

30 June 2020

Benga Power Mabesekwa Mbeya Coal Mast Energy Haneti Lake Corporate 30 June

Independent to Power Development Victoria 2020

Power Gold (GBP) Group

Revenue - - - - - - - -

Administrative

cost - (223,177) - (15,687) (292) - (897,810) (1,136,966)

Exploration

expenditure - - - (123,000) (26) - (58,257) (181,283)

Investment

and other

income - 54 - - - - 62,567 62,621

Capital raising - - - - - - - -

fees

Loss from

equity

accounted

investment - - - - - - (336) (336)

Finance costs - - - - - - - -

------------ ------------ ----------- ------------ ------- ---------- ---------- ------------

Loss after

tax - (223,123) - (138,687) (318) - (893,836 (1,255,964)

------------ ------------ ----------- ------------ ------- ---------- ---------- ------------

30 June 2021

Mabesekwa Mbeya

Benga Independent Coal Mast Energy Corporate 30 June

Power Power to Power Development Haneti Blyvoor Group 2021

(GBP)

Group

-------- ------------ --------- ------------- ---------- --------- ----------- -----------

Assets

Segment assets - - 9,822 4,590,930 5,536 1,818 29,104,836 33,712,942

Liabilities

Segment liabilities - 8,464 98,090 686,205 90,527 1,499 1,079,633 1,964,418

Depreciation - - - (1,733) - - - -

30 June 2020

Mabesekwa Mbeya Lake

Benga Independent Coal Mast Energy Victoria Corporate 30 June

Power Power to Power Development Haneti Gold Group 2020 (GBP)

Group

--------- ------------- ---------- ------------- --------- ---------- ----------- -------------

Assets

Segment

assets - 218,912 - - 2,244 - 30,184,944 30,406,100

Liabilities

Segment

liabilities 2,150 622,301 69,876 372,694 6,223 - 1,264,244 2,337,488

Depreciation - - - - - - - -

7. Intangible assets

Composition of Intangible assets 30 June 30 June 31 December

2021 2020 2020

GBP GBP GBP

Mbeya Coal to Power Project 15,896,105 15,896,105 15,896,105

Mabesekwa Coal Independent Power Project - - -

Bordersley Power Project 2,595,000 2,595,000 2,595,000

18,491,105 18,491,105 18,491,105

----------- ----------- ------------

Intangible assets are not amortised, due to the indefinite

useful life which is attached to the underlying prospecting rights,

until such time that active mining operations commence, which will

result in the intangible asset being amortised over the useful life

of the relevant mining licences.

Intangible assets with an indefinite useful life are assessed

for impairment on an annual basis, against the prospective fair

value of the intangible asset. The valuation of intangible assets

with an indefinite useful life is reassessed on an annual basis

through valuation techniques applicable to the nature of the

intangible assets.

As at reporting period end, taking into account the various

applicable aspects, the Group concluded that none of the impairment

indicators had been met in relation to the Mbeya Coal to Power

Project or the Bordersley Power Project.

8. Investment in associate

30 June 30 June 31 December

2021 2020 2020

GBP GBP GBP

Mabesekwa Coal Independent Power Plant 9,696,351 9,696,347 9,696,683

Share of loss for the year - - (332)

9,696,351 9,696,347 9,696,351

---------- ---------- ------------

The value of the equity interest in Kibo Energy Botswana (Pty)

Ltd was determined based on the fair value of the proportionate

equity interest retained in the in the enlarged resource following

the restructuring in 2019.

As at reporting period end, taking into account the various

applicable aspects, the Group concluded that none of the impairment

indicators had been met in relation to the Mabesekwa Coal

Independent Power Plant project.

9. Other financial assets

30 June 30 June 31 December

2021 2020 2020

GBP GBP GBP

Other financial assets consists of:

At Amortised Cost:

Lake Victoria Gold Ltd - 811,400 640,821

Blyvoor Joint Venture - Loans Advanced - 753,501 -

At Fair value through profit or loss - -

Lake Victoria Gold Ltd - 37,661 -

Impairment - - (640,821)

- 1,602,562 -

======= ========= ===========

Spilt of other financial assets between current

and non-current portions

Current - 443,362 -

Non-current - 1,159,200 -

------------- --------------------- -------------

- 1,602,562 -

============= ===================== =============

On 30 June 2020, the last condition precedent related to the

disposal of Reef Miners Ltd ("Reef") as per the SPA, comprising the

Imweru gold project and the Lubando gold project in northern

Tanzania, was met resulting in the effective disposal of the

subsidiary to Lake Victoria Gold Ltd ("LVG").

The following profit on disposal of the subsidiary was

recognised in the audited annual report at 31 December 2020:

Group (GBP)

Intangible assets 787,108

Cash and cash equivalents (336)

Trade and other payables 9,136

Net liability value disposed of at 31 December

2020 (778,308)

Foreign currency translation reserve reclassified

through profit or loss (121,670)

Proceeds from disposal 797,564

---------------

Profit on disposal for group 102,414

---------------

Impairment (640,821)

---------------

Net loss on disposal for group at 31 December

2020 743,235

---------------

The amount receivable from Lake Victoria Gold will be due and

payable on the following dates:

1. US$100,000 upon the satisfaction of the Condition Precedent;

2. US$100,000 upon registration of Reef in the name of LVG;

3. US$100,000 four months from the date of the SPA;

4. US$200,000 nine months from the date of the SPA; and

5. US$500,000 upon the earlier of the commissioning of the first

producing mine of LVG in the Tanzania or the date 24 months from

the date of the SPA.

As at 31 December 2020, funds of $100,000 have been received

from Lake Victoria Gold in respect of the sale of Reef Miners Ltd

("Reef")

The receivable in Lake Victoria Gold has been fully impaired at

31 December 2020 due to the significant increase in credit risk,

which is as a result of payments 1, 3 and 4 not being received as

they became due and are still outstanding at the date of this

interim report.

Blyvoor Joint Venture

On 30 January 2020, the Group entered into a Joint Venture

Agreement with Blyvoor Gold Mines (Pty) Ltd, whereby Katoro Gold

plc and Blyvoor Gold Mines (Pty) Ltd would become 50/50

participants in an unincorporated Joint Venture.

In accordance with the requirements of the Joint Venture

Agreement, the Katoro Group was to provide a ZAR15.0 million loan

(approximately GBP790,000) to the JV ("the Katoro Loan Facility"),

which will fund ongoing development work on the Project.

As at 31 December 2020, the Group has advanced funding in the

amount of GBP1,122,676 of which 100% relate to expenditure

allocated to the Joint Venture operations, carried by the Katoro

Gold plc Group.

Furthermore, the Group has continued to advance funding in the

amount of GBP83,532 of which 100% relate to expenditure allocated

to the Joint Venture operations, carried out by the Katoro Gold plc

Group.

The Katoro Loan Facility shall form part of the development

capital project financing that Katoro shall procure in accordance

with its obligations contained in the Agreement, as detailed below,

provided that:

-- the balance of the Katoro Loan Facility then outstanding

shall be subordinated to third party creditors participating in the

development capital project financing;

-- the Katoro Loan Facility will bear interest at the 12-month

London Inter Bank Offered Rate, or its successor; and

-- the Katoro Loan Facility will be repayable within 12 months after:

- the last third-party creditor participating in the project

financing shall have been paid; or

- any earlier date on which the Parties may agree.

10. Borrowings

Amounts falling due within one year 30 June 30 June 31 December

2021 2020 2020

GBP GBP GBP

Short term borrowings 499,401 606,615 858,546

499,401 606,615 858,546

-------- -------- ------------

The borrowings relate to the unsecured interest free loan

facility from Sanderson Capital Partners Ltd ("Sanderson") and St

Anderton on the Vaal ("St Anderton") which is repayable either

through the issue of cash or ordinary shares in the Company.

Furthermore, the Sanderson loan balance has been partially settled

in the current year through the issue of shares and a cash

payment.

11. Right of use asset and Lease liability

The Group has one lease contract for land it shall utilise to construct

a 5MW gas-fuelled power generation plant. The land is located at Bordersley,

Liverpool Street, Birmingham. The lease of the land has a lease term

of 20 years, with an option to extend for 10 years which the Group has

opted to include due to the highly likely nature of extension as at

the time of the original assessment. The Group's obligations under its

leases are secured by the lessor's title to the leased assets. The Group's

incremental borrowing rate implicit to the lease is 8.44%.

Right of use 31

asset 30 June 30 June December

2021(GBP) 2020(GBP) 2020(GBP)

Set out

below are

the carrying

amounts

of

right-of-use

assets

recognised

and

the

movements

during the

period:

Opening - - -

balance

Additions 297,593 - -

Depreciation (1,733) - -

Closing 295,860 - -

balance

--------------------- --------------------- ---------------------

31

Lease 30 June 30 June December

liability 2021(GBP) 2020(GBP) 2020(GBP)

Set out below are the

carrying amounts

of lease liabilities

and the movements

during the period:

Opening - - -

balance

Additions 297,594 - -

Interest 12,363 - -

Payments (11,100) - -

--------------------- --------------------- ---------------------

Closing 298,857 - -

balance

--------------------- --------------------- ---------------------

Spilt of

lease

liability

between

current

and

non-current

portions

Current 2,422 - -

Non-current 296,435 - -

--------------------- --------------------- ---------------------

298,857 - -

--------------------- --------------------- ---------------------

12. Financial instruments

30 June 30 June 31 December

2021 2020 2020

GBP GBP GBP

Financial assets - carrying amount

At fair value through other comprehensive

income

Other financial assets - 37,661 -

Loans and receivables held at amortised

cost

Other financial assets - 1,564,901 -

Trade and other receivables 45,455 237,371 86,719

Cash and cash equivalents 4,882,121 68,612 256,760

---------- ---------- ------------

4,927,576 1,908,545 343,479

---------- ---------- ------------

Financial liabilities - carrying amount

Financial liabilities held at amortised

cost

Trade and other payables 1,166,160 1,730,873 1,444,986

Borrowings 499,401 606,615 858,546

1,665,561 2,337,488 2,303,532

---------- ---------- ------------

The Board of Directors considers that the fair values of

financial assets and liabilities approximate their carrying values

at each reporting date due to the short-term nature thereof, and

market related interest rate applied.

13. Corporate transactions

During the current year to date, Kibo had diluted its equity

interest in MAST Energy Developments plc, previously a wholly owned

subsidiary, as MAST raised in excess of GBP5m through Clear Capital

Markets Ltd from its IPO on the Official List of the London Stock

Exchange plc by way of a Standard Listing. On the date of listing

the market capitalisation for MAST Energy Developments plc was c.

GBP23 million .

Furthermore, initially Kibo's equity holding measured at cost

pre-IPO in MAST was GBP2,615,929 which increased substantially to

GBP6,580,050 post-IPO when calculated as a portion of the net

assets of MAST. Moreover, the current market value of Kibo's 55.42%

interest in MAST is valued at c. GBP12 million, which is

approximately twice the current valuation of Kibo.

14. Unaudited results

These condensed consolidated interim financial results have not

been audited or reviewed by the Group's auditors.

15. Dividends

No dividends were declared during the interim period.

16. Board of Directors

There were no changes to the board of directors during the

interim period, or any other committee's composition.

17. Subsequent events

The following subsequent events have been noted:

-- MAST entered into a Sale and Purchase Agreement to acquire

Pyebridge Power Ltd, a Special Purpose Vehicle comprising an

installed and commissioned synchronous gas-powered standby

generation facility with 9 MW export capacity.

-- MAST entered into a definitive Sale and Purchase Agreement to

acquire a 100% interest in Rochdale Power Ltd, a Special Purpose

Vehicle from Balance Power Projects Ltd, for the installation of a

4.4 MW flexible gas power project.

-- A period of limited political unrest in South Africa

temporarily delayed the funding process for the Blyvoor Joint

Venture Project when some of the short-listed parties requested

additional time to re-assess the country risk profile as a result

of the unrest. However, the Company is pleased to announce that

discussions with these potential funders have since resumed and the

joint venture partners hope to conclude a final funding arrangement

for Blyvoor during the latter part of 2021.

-- All conditions have been satisfied and an agreement completed

with South Africa-based Industrial Green Energy Solutions (Pty) Ltd

to jointly develop a portfolio of Waste to Energy projects in South

Africa. Kibo and IGES have entered into an amendment (the

"Amendment") to fast track the implementation of the first project.

Completion of the Agreement and Amendment follows the positive

findings of an extensive due diligence process.

-- Completed a Heads of Terms (the "Agreement") with EQTEC plc

(AIM: EQT) ("EQTEC"), a world-leading gasification solutions

company, to acquire a 54.54% interest in the proposed 25 MWe

Billingham waste gasification and power plant (the "Project") at

Haverton Hill, Teesside, UK. The Project is at advanced stages of

development with a concept design for the full plant produced,

planning permission approved, grid connection offer secured.

18. Going concern

The Group currently generates no revenue and had net assets of

GBP31,748,524 as at 30 June 2021 (31 December 2020: net assets of

GBP26,558,688).

Following multiple warrant exercising and successful cash

placings for the subscription of new ordinary shares, where the

Group raised in cash an aggregate amount of GBP6,449,513 , the

Group has adequate cash and cash equivalents (financial resources)

to ensure the Group is able to continue as a going concern for the

foreseeable future.

Furthermore, after reviewing the Group's financial projections,

the directors of the Company (the "Directors") have a reasonable

expectation that the Group will have adequate resources to continue

in operational existence for the foreseeable future.

For this reason, they adopted the going concern basis in

preparing the Group Financial Information.

The effective implementation of COVID-19 vaccination protocol

within the key areas the Group operations has led to an increase in

operational activity for the Group. As at the time of preparing

these results, the Group does not anticipate any further

significant foreseeable disruption from the COVID-19 pandemic and

expects operational activities to normalise in the coming

months.

Post period end there has been a period of limited political

unrest in South Africa, however the impact on the Group's

operations have been temporary and limited in this regard.

19. Commitments and contingencies

There are no material commitments, contingent assets or

contingent liabilities as at 30 June 2021.

20. Seasonality of operations

The company's operations are not considered to be seasonal or

cyclical. These interim results were therefore not impacted by

seasonality or cyclicality.

24 September 2021

**ENDS**

This announcement contains inside information as stipulated

under the Market Abuse Regulations (EU) no. 596/2014 ("MAR").

For further information please visit www.kibo.energy or

contact:

Louis Coetzee info@kibo.energy Kibo Energy Chief Executive

plc Officer

Andreas Lianos +27 (0) 83 4408365 River Group Corporate and Designated

Adviser on JSE

------------------ ------------------------

Claire Noyce +44 (0) 20 3764 Hybridan LLP AIM Broker

2341

-------------------- ------------------ ------------------------

Bhavesh Patel +44 20 3440 6800 RFC Ambrian NOMAD on AIM

/ Ltd

Stephen Allen

-------------------- ------------------ ------------------------

Isabel de Salis +44 (0) 20 7236 St Brides Partners Investor and Media

/ 1177 Ltd Relations Adviser

Beth Melluish

-------------------- ------------------ ------------------------

Notes

Kibo Energy plc is a multi-asset, Africa and UK focused, energy

company positioned to address the acute power deficit, which is one

of the primary impediments to economic development in Sub-Saharan

Africa. To this end, it is the Company's objective to become a

leading independent power producer in the region.

Kibo is simultaneously developing three similar coal-fuelled

power projects: the Mbeya Coal to Power Project ("MCPP") in

Tanzania; the Mabesekwa Coal Independent Power Project ("MCIPP") in

Botswana; and the Benga Independent Power Project ("BIPP") in

Mozambique. By developing these projects in parallel, the Company

intends to leverage considerable economies of scale and timing in

respect of strategic partnerships, procurement, equipment, human

capital, execution capability / capacity and project finance.

Additionally, the Company has a 55% interest in MAST Energy

Developments Limited ("MED"), a private UK registered company

targeting the development and operation of flexible power plants to

service the UK Reserve Power generation market.

Johannesburg

24 September 2021

Corporate and Designated Adviser River Group

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR USVSRAOUKURR

(END) Dow Jones Newswires

September 24, 2021 02:59 ET (06:59 GMT)

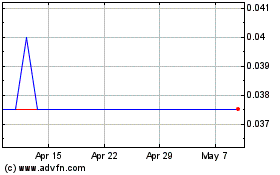

Kibo Energy (LSE:KIBO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kibo Energy (LSE:KIBO)

Historical Stock Chart

From Apr 2023 to Apr 2024