TIDMKIBO

RNS Number : 4498A

Kibo Energy PLC

23 September 2022

Kibo Energy PLC (Incorporated in Ireland)

(Registration Number: 451931)

(External registration number: 2011/007371/10)

Share code on the JSE: KBO

Share code on the AIM: KIBO

ISIN: IE00B97C0C31

("Kibo" or "the Group" or "the Company")

Unaudited Interim results for the six months ended 30 June

2022

Dated 23 September 2022

Kibo Energy PLC ('Kibo' or 'the Group' or 'the Company') (AIM:

KIBO; AltX: KBO), the renewable-energy-focused development company

, is pleased to announce its unaudited results for the six months

ended 30 June 2022. The interim results are also available on the

Company's website:

https://kibo.energy/wp-content/uploads/Kibo-Interim-Results-30-June-2022.pdf

Highlights

-- Continued focus on the Company's revised renewable energy

strategy in order to align with global requirements:

o Entered a 10-year take-or-pay conditional Power Purchase

Agreement ('PPA') to generate base-load electricity from a 2,7 MW

plastic-to-syngas power plant. The project is the first under

Sustineri Energy (Pty) Ltd ('Sustineri Energy' or 'Sustineri'), a

joint venture ('JV') in which Kibo holds 65%, with the balance of

35% held by Industrial Green Energy Solutions (Pty) Ltd

('IGES')

o Signed a rolling five-year Framework Agreement ('FA') with

Enerox GmbH ('CellCube') to develop and deploy Long Duration Energy

Storage ('LDES') solutions in selected target sectors in the

Southern African Development Community ('SADC') countries. The

agreement grants Kibo exclusive rights to the marketing, sales,

configuration and delivery of CellCube solutions, subject to

successful Proof of Concepts ('POCs'), within the target

sectors

o Acquired 51% of National Broadband Solutions ('NBS') to

jointly assess and develop a portfolio of LDES projects held

exclusively by NBS in South Africa, with an initial target of c.

36,320 MWh capacity

o Intention to dispose of original coal assets in accordance

with an approved disposal strategy that will realise value for

shareholders

o Proceeded with further test work to identify a suitable

clean/renewable energy fuel source, based on test results to date,

with the aim of converting the Company's existing energy projects

in Tanzania, Botswana and Mozambique to clean/renewable energy

projects

-- Appointed Mr Cobus van der Merwe as Group Chief Financial

Officer ('CFO') with effect from 1 June 2022

-- Confirmed the appointment of former Group CFO, Mr Pieter

Krügel as Chief Executive Officer ('CEO') of Kibo subsidiary, Mast

Energy Developments PLC ('MED'), with effect from 1 June 2022

-- As previously announced, Christian Schaffalitzky, the current

Chairman of the Board, will step down on conclusion of the

adjourned AGM

-- Appointed Shard Capital Partners LLP as a joint broker to the

Company with immediate effect, to act alongside the Company's

current broker Hybridan LLP and the Company's nominated advisor RFC

Ambrian Ltd

-- Settled outstanding fees owed to directors and management

through the issue of a convertible loan note ('CLN') instrument

-- Signed a bridging loan facility agreement with an

institutional investor for up to GBP3 million with a term of up to

36 months and an initial drawdown of GBP1 million available

immediately. Funds advanced under the facility will attract a fixed

coupon interest rate of 3,5%, repayable with accrued interest four

months after the drawdown

-- Post-reporting period:

o Successfully achieved the first CellCube FA target with a

commitment to purchase the first three POC projects

o Extended its conditional PPA of 10 years to 20 years for the

Company's first South African waste-to-energy ('WTE') project as

part of the Sustineri Energy JV with IGES

o Increased Kibo's interest in MED from 55,42% to 61,27%,

following the receipt of MED shares as partial settlement of

outstanding shareholder loan amount

o Initiated a process of Requests for Proposals ('RFPs') to

investigate the feasibility of replacing fossil fuel (coal) with

renewable biofuel, specifically regarding the operations and assets

wherein the Company determined to dispose all its coal assets while

retaining the associated energy (power) projects and

maintaining/adding value for shareholders

o Proceeded with a signed definitive agreement to acquire 100%

interest in a waste gasification and power plant in the United

Kingdom as part of its UK WTE portfolio

Chairman's Statement

Introduction

Following the announcement in last year's interim results for

the six months ended 30 June 2021, that Kibo Energy ('Kibo' or 'the

Company') had begun the process of pivoting its business to the

acquisition and development of a portfolio of sustainable,

renewable energy assets to capitalise on the global clean energy

revolution, I am pleased to report that the Company's continued

commitment to its renewed strategy in this regard has yielded

positive results. As part of Kibo's refocused strategy centred

around renewable energy development, the Company has acquired a

waste gasification and power plant in the United Kingdom as part of

its UK WTE portfolio. We believe this opportunity supports our

strategic intent to significantly advance and accelerate the

development of the Company's renewable energy portfolio in the

UK.

In South Africa, we are excited to have signed our first WTE

Power Purchase Agreement ('PPA') to generate base-load electricity

over 10 years from a 2,7 MW plastic-to-syngas power plant, which

aligns with our clean energy strategy. The project initiates a

pipeline of projects under the Company's South African WTE

portfolio with our partners, Industrial Green Energy Solutions

(Pty) Ltd ('IGES'). During the PPA process, the Company also

performed a large amount of work to procure funding for the project

and has received a higher-than-expected level of interest for the

provision of project and debt funding at very competitive

commercial terms from various institutions.

The growing energy market in the Southern African Development

Community ('SADC') countries, particularly the energy-starved South

Africa, makes the case for energy storage more viable. Further to

the Company's strategy to implement long-duration energy storage

('LDES') solutions we are delighted to have signed a five-year

Framework Agreement ('FA') with Enerox GmbH ('CellCube') to develop

and deploy LDES solutions in the SADC countries (RNS dated 17 May

2022) . The development of a large project pipeline ready for

immediate execution is the main pivot on which the FA hinges.

These smaller-scale renewable energy projects are focused on the

UK and Southern Africa as the market opportunities, government

support and technical innovation in these countries is slowly

evolving and at the ideal stage to position Kibo as an influential

innovator in the sector. This is most evident in Kibo's large

knowledge base of and experience in the renewable energy sector,

developed in recent years through its renewable energy and LDES

solutions for integration with and repositioning of its current

large utility fossil fuel-based projects.

The past few months have seen considerable progress across

Kibo's renewable and sustainable energy strategy. Following the RNS

dated 16 June 2021, in which Kibo announced an extensive review of

operations and assets, the Company decided to dispose of all its

coal assets while retaining the associated energy (power) projects

through its introduction of innovative biofuel technology to its

arsenal of solutions. By undertaking an evidence-based process of

test and evaluation on the biofuel technology, we believe, subject

to confirmatory test work, replacement of conventionally mined coal

with a 100% renewable energy source is possible. Work completed to

date indicates that our existing coal-fired power plant designs can

be adapted, with minor design changes, to accept the new renewable

fuel solution. All current and future projects across the Kibo

Energy portfolio as well as its investment holdings have been

extensively reviewed and realigned with the Company's renewed

strategy to focus on renewable, sustainable energy solutions while

retaining maximum value for Kibo and its shareholders as well as

remaining attractive for acquisition, funding and construction by

potential purchasers.

As progress continues on Kibo's portfolio of projects, the

Company has further invested in its management team with the

appointment of Mr Cobus van der Merwe as Chief Financial Officer

('CFO') as of 1 June 2022 (RNS dated 20 May 2022). Van der Merwe

brings a wealth of experience to the team as a registered Chartered

Accountant (South Africa) and having previously held managerial and

executive roles in the investment management and energy, utilities

and resource sectors. Most notably, he held a senior management

position at PricewaterhouseCoopers, servicing clients across the

United Kingdom, Ireland and Africa, as well as the position of

Partner and Chair of the Investment Committee at PSG Wealth, where

he managed bespoke investment portfolios for high net-worth

individuals. The Company also confirmed the appointment of Mr

Pieter Krügel to Chief Executive Officer ('CEO') of Mast Energy

Developments ('MED') as of 1 June 2022. Krügel previously held the

position of Group CFO at Kibo Energy for four years.

I firmly believe that these new appointments, as well as the

focus on the Company's renewable, sustainable energy strategy, will

play an integral role in delivering the Company's growth strategy

while placing Kibo Energy in an advantageous position within the

alternative energy sectors in the UK and sub-Saharan Africa, where

the majority of the Company's investments are held.

Conclusion

As we move forward into the second half of 2022, despite the

ongoing war in Ukraine, rising inflation and increased interest

rates adding to uncertainty across industries, I am pleased to

report that economic activity remains high, and this has yielded

positive results for Kibo in terms of the development of its

ongoing and new projects in the first half of 2022. The Company

intends to further streamline its operations with a primary focus

on the acquisition and development of its alternative and

renewable, sustainable energy solution projects, many on which we

have already made considerable progress while staying committed to

the disposal and conversion of our large-scale fossil fuel-based

utility projects.

Kibo's knowledge, experience and developments in this area are

at an advanced stage in comparison to the sectors in the regions

the Company operates. Therefore, as technologies within the

alternative and renewable energy sectors evolve to include

small-scale bespoke alternative and renewable energy solutions,

Kibo will remain at the forefront in providing an attractive

opportunity for potential investors.

Christian Schaffalitzky

Executive Chairman

Unaudited Interim Results for the six months ended 30 June

2022

Unaudited Condensed Consolidated Interim Statement of

Comprehensive Income

For the six months ended 30 June 2022

6 months 6 months 12 months

to to to

30 June 30 June 31 December

Note 2022 2021 2021

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

Revenue 15 305,384 - 3,245

Cost of sales (260,329) - (34,321)

------------ ------------ -------------

Gross profit/loss 45,055 - (31,076)

Administrative expenses (1,210,016) (1,052,448) (2,325,750)

Impairment of non-current

assets - - (20,705,209)

Project and exploration

expenditure (415,621) (432,678) (687,963)

Listing and capital

raising fees (185,070) (417,315) (321,365)

Operating Loss (1,765,652) (1,902,441) (24,071,363)

Other Income 8,593 56,565 1,017,937

Finance income - 11,945 -

Finance costs (86,914) (12,363) (46,372)

Share of loss from

associate (118,357) - (48,357)

------------ ------------ -------------

Loss before Tax (1,962,330) (1,846,294) (23,148,155)

Tax - - -

------------ ------------ -------------

Loss for the period (1,962,330) (1,846,294) (23,148,155)

Other comprehensive

income:

Exchange differences

on translating of

foreign operations,

net of taxes 60,869 579,500 (212,919)

Exchange differences

reclassified on disposal

of foreign operation - - 345,217

------------ ------------ -------------

Total Comprehensive

Loss for the Period (1,901,461) (1,266,794) (23,015,857)

------------ ------------ -------------

Loss for the period

attributable to (1,962,330) (1,846,294) (23,148,155)

------------ ------------ -------------

Owners of the parent (1,637,805) (1,011,565) (21,996,968)

Non-controlling interest (324,525) (834,729) (1,151,187)

------------ ------------ -------------

Total comprehensive

loss attributable

to (1,901,461) (1,266,794) (23,015,857)

------------ ------------ -------------

Owners of the parent (1,576,936) (432,065) (21,864,515)

Non-controlling interest (324,525) (834,729) (1,151,342)

------------ ------------ -------------

Basic loss per share 4 (0.0006) (0.0004) (0.009)

Dilutive loss per

share 4 (0.0006) (0.0004) (0.009)

Unaudited Condensed Consolidated Interim Statement of Financial

Position

As at 30 June 2022

Note 30 June 30 June 31 December

2022 2021 2021

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

Assets

Non-current assets

Property, plant, and equipment 7 2,931,097 297,910 2,899,759

Intangible assets 8 4,995,608 18,491,105 4,964,550

Goodwill 9 - 300,000 -

Investment in associates 10 3,972,524 9,696,351 4,092,403

Total non-current assets 11,899,229 28,785,366 11,956,712

------------- ------------- -------------

Current assets

Other financial assets 11 - - -

Other receivables 233,091 45,455 255,747

Cash and cash equivalents 1,163,297 4,882,121 2,082,906

------------- ------------- -------------

Total current assets 1,396,388 4,927,576 2,338,653

------------- ------------- -------------

Total assets 13,295,617 33,712,942 14,295,365

------------- ------------- -------------

Equity

Called up share capital 5 21,140,481 20,631,196 21,042,444

Share premium 5 45,516,081 44,960,112 45,429,328

Common control reserve - (18,329) -

Foreign currency translation

reserve (405,315) (19,137) (466,184)

Share based payment reserve 491,641 1,952,969 466,868

Retained deficit (58,265,194) (38,001,194) (56,627,389)

------------- ------------- -------------

Attributable to equity

holders of the parent 8,477,694 29,505,617 9,845,067

------------- ------------- -------------

Non-controlling interest 1,638,291 2,242,907 1,962,816

------------- ------------- -------------

Total Equity 10,115,985 31,748,524 11,807,883

------------- ------------- -------------

Liabilities

Non-current liabilities

Lease liability 13 287,721 296,435 289,045

------------- ------------- -------------

Total non-current liabilities 287,721 296,435 289,045

------------- ------------- -------------

Current liabilities

Trade and other payables 1,156,901 1,166,160 1,116,273

Borrowings 12 1,732,423 499,401 1,079,691

Lease liability 13 2,587 2,422 2,473

Total current liabilities 2,891,911 1,667,983 2,198,437

------------- ------------- -------------

Total liabilities 3,179,632 1,964,418 2,487,482

------------- ------------- -------------

Total equity and liabilities 13,295,617 33,712,942 14,295,365

------------- ------------- -------------

Unaudited Condensed Interim Consolidated Statement of Changes in

Equity

Share Share Share Control Foreign Retained Non-controlling Total

Capital Premium based Reserve currency deficit interest

payment translation

reserve reserve

GBP GBP GBP GBP GBP GBP GBP GBP

----------- ----------- ---------- --------- ------------ ------------- ---------------- -------------

Balance at 1

January 2022

(audited) 21,042,444 45,429,328 466,868 - (466,184) (56,627,389) 1,962,816 11,807,883

----------- ----------- ---------- --------- ------------ ------------- ---------------- -------------

Loss for the

year allocated

to equity

owners - - - - - (1,637,805) - (1,637,805)

----------- ----------- ---------- --------- ------------ ------------- ---------------- -------------

Loss for the

period

allocated to

non-controlling

interest (324,525) (324,525)

----------- ----------- ---------- --------- ------------ ------------- ---------------- -------------

Other

comprehensive

income-

translation of

foreign

operations - - - - 60,869 - - 60,869

----------- ----------- ---------- --------- ------------ ------------- ---------------- -------------

Issue of share

warrants - - 24,773 - - - - 24,773

----------- ----------- ---------- --------- ------------ ------------- ---------------- -------------

Issue of share

capital 98,037 86,753 - - - - - 184,790

----------- ----------- ---------- --------- ------------ ------------- ---------------- -------------

Balance as at 30

June 2022

(unaudited) 21,140,481 45,516,081 491,641 - (405,315) (58,265,194) 1,638,291 10,115,985

----------- ----------- ---------- --------- ------------ ------------- ---------------- -------------

Balance as at 31

December 2020

(audited) 20,411,493 44,312,371 1,728,487 (18,329) (598,637) (39,019,856) (256,841) 26,558,688

----------- ----------- ---------- --------- ------------ ------------- ---------------- -------------

Loss for the

year allocated

to equity

owners - - - - - (1,011,565) - (1,011,565)

----------- ----------- ---------- --------- ------------ ------------- ---------------- -------------

Loss for the

period

allocated to

non-controlling

interest - - - - - - (834,729) (834,729)

----------- ----------- ---------- --------- ------------ ------------- ---------------- -------------

Other

comprehensive

income-

translation of

foreign

operations - - - - 579,500 - - 579,500

----------- ----------- ---------- --------- ------------ ------------- ---------------- -------------

Issue of share

capital 219,703 647,741 - - - - - 867,444

----------- ----------- ---------- --------- ------------ ------------- ---------------- -------------

Acquisition of

the

Non-Controlling

Interest

without gaining

control - - - - - (300,029) 300,029 -

----------- ----------- ---------- --------- ------------ ------------- ---------------- -------------

Disposal of

equity to

Non-Controlling

Interest

without losing

control - - - - - (3,034,448) 3,034,448 -

----------- ----------- ---------- --------- ------------ ------------- ---------------- -------------

Changes in

ownership

interest in

subsidiaries

without a

change in

control - - - - - 5,354,486 - 5,354,486

----------- ----------- ---------- --------- ------------ ------------- ---------------- -------------

Warrants and

Share Options

issued by

Katoro Gold plc - - 234,700 - - - - 234,700

----------- ----------- ---------- --------- ------------ ------------- ---------------- -------------

Expirations of

share warrants - - (10,218) - - 10,218 - -

----------- ----------- ---------- --------- ------------ ------------- ---------------- -------------

Balance as at 30

June

2021(unaudited) 20,631,196 44,960,112 1,952,969 (18,329) (19,137) (38,001,194) 2,242,907 31,748,524

----------- ----------- ---------- --------- ------------ ------------- ---------------- -------------

Balance as at 31

December 2020

(audited) 20,411,493 44,312,371 1,728,487 (18,329) (598,637) (39,019,856) (256,841) 26,558,688

----------- ----------- ---------- --------- ------------ ------------- ---------------- -------------

Loss for the

year - - - - - (21,996,968) (1,151,187) (23,148,155)

----------- ----------- ---------- --------- ------------ ------------- ---------------- -------------

Other

comprehensive

income -

exchange

differences - - - - (212,764) - (155) (212,919)

----------- ----------- ---------- --------- ------------ ------------- ---------------- -------------

Shares issued 630,951 1,116,957 - - - - - 1,747,908

----------- ----------- ---------- --------- ------------ ------------- ---------------- -------------

Disposal of

non-controlling

interest

without losing

control - - - - - 3,259,232 3,201,014 6,460,246

----------- ----------- ---------- --------- ------------ ------------- ---------------- -------------

Acquisition of

non-controlling

interest - - - - - (308,030) 308,030 -

----------- ----------- ---------- --------- ------------ ------------- ---------------- -------------

Vesting of share

options -

Katoro Gold plc - - 146,249 - - - - 146,249

----------- ----------- ---------- --------- ------------ ------------- ---------------- -------------

Warrants issued

Kibo Energy plc - - 48,695 48,695

----------- ----------- ---------- --------- ------------ ------------- ---------------- -------------

Warrants issued

Kibo Energy plc

which expired

during the year - - (559,400) - - 559,400 - -

----------- ----------- ---------- --------- ------------ ------------- ---------------- -------------

Change of

shareholding

resulting is

loss of control - - (897,163) 18,329 345,217 878,833 (138,045) 207,171

----------- ----------- ---------- --------- ------------ ------------- ---------------- -------------

Balance as at 31

December 2021

(audited) 21,042,444 45,429,328 466,868 - (466,184) (56,627,389) 1,962,816 11,807,883

----------- ----------- ---------- --------- ------------ ------------- ---------------- -------------

Unaudited Condensed Consolidated Interim Statement of Cash

Flow

For the six months ended 30 June 2022

6 months 6 months 12 months

to to to

30 June 30 June 31 December

2022 2021 2021

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

Loss for the period before taxation (1,962,330) (1,846,294) (23,148,155)

Adjusted for:

Warrants and options issued 24,773 - 194,944

Exploration and development expenditure

JV - 83,532 91,179

Expenses settled through share issue 95,000 310,369 -

(Profit)/Loss from the disposal of

subsidiary - - (529,415)

Impairment of goodwill - - 300,000

Impairment of intangible assets - - 13,955,528

Impairment of associates - - 6,449,681

Impairment of financial asset receivable - - 43,722

Loss from equity accounting 118,357 - 48,357

Depreciation on property, plant,

and equipment 7,621 1,733 10,635

Interest accrued 52,198 - 21,632

Debt forgiven - (56,565) (355,659)

------------ ------------ -------------

Operating income before working

capital changes (1,664,381) (1,507,225) (2,917,551)

Decrease/(Increase) in trade and

other receivables 22,656 70,431 (145,525)

Increase/(Decrease) in trade and

other payables 40,630 (278,826) (240,957)

------------ ------------ -------------

Net cash outflows from operating

activities (1,601,095) (1,715,620) (3,304,033)

Cash flows from financing activities

Proceeds from borrowings 960,000 - 38,975

Repayment of borrowings (316,173) (25,000) (195,282)

Proceeds from issue of share capital - 6,449,513 1,527,576

Proceeds from disposal of shares

to non-controlling interest - - 6,099,500

Repayment of lease liabilities (1,210) - (2,275)

------------ ------------ -------------

Net cash proceeds from financing

activities 642,617 6,424,513 7,468,494

------------ ------------ -------------

Cash flows from investing activities

Cash received/(forfeited) on disposal

of subsidiary - - (272,075)

Cash advanced to Joint Venture - (83,532) (91,179)

Cash received on sale of plant and - - -

equipment

Property, plant, and equipment acquired (38,960) - (1,654,239)

Intangible assets acquired - - (150,273)

------------ ------------ -------------

Net cash used in investing activities (38,960) (83,532) (2,167,766)

Net movement in cash and cash equivalents (997,438) 4,625,361 1,996,695

Cash and cash equivalents at beginning

of period 2,082,906 256,760 256,760

Exchange movements 77,829 - (170,549)

------------ ------------ -------------

Cash and cash equivalents at end

of period 1,163,297 4,882,121 2,082,906

------------ ------------ -------------

Notes to the unaudited condensed consolidated interim financial

statements

For the six months ended 30 June 2022

1. General information

Kibo Energy PLC is a public company incorporated in Ireland. The

condensed consolidated interim financial results consolidate those

of the Company and its subsidiaries (together referred to as the

"Group"). The Company's shares are listed on the AIM Market ("AIM")

of the London Stock Exchange and the Alternative Exchange ("AltX")

of the Johannesburg Stock Exchange ("JSE") Limited. The principal

activities of the Company and its subsidiaries are related to the

development of renewable energy projects in Southern Africa and the

United Kingdom.

2. Statement of Compliance and Basis of Preparation

The unaudited condensed consolidated interim financial results

are for the six months ended 30 June 2022, and have been prepared

using the same accounting policies as those applied by the Group in

its December 2021 consolidated annual financial statements, which

are in accordance with the framework concepts and the recognition

and measurement criteria of the International Financial Reporting

Standards and Financial Reporting Pronouncements as issued by the

Financial Reporting Standards Council issued by the International

Accounting Standards Board ("IASB"), including the SAICA Financial

Reporting Guides as issued by the Accounting Practices Committee,

IAS 34 - Interim Financial Reporting, the Listings Requirements of

the JSE Limited, the AIM rules of the London Stock Exchange and the

Irish Companies Act 2014.

These condensed consolidated interim financial statements do not

include all the notes presented in a complete set of consolidated

annual financial statements, as only selected explanatory notes are

included to explain key events and transactions that are

significant to obtaining an understanding of the changes throughout

the financial period, accordingly the report must be read in

conjunction with the annual report for the year ended 31 December

2021.

The comparative amounts in the consolidated financial results

include extracts from the consolidated annual financial statements

for the period ended 31 December 2021.

These extracts do not constitute statutory accounts in

accordance with the Irish Companies Acts 2014. All monetary

information is presented in the presentation currency of the

Company being Pound Sterling. The Group's principal accounting

policies and assumptions have been applied consistently over the

current and prior comparative financial period.

3. Use of estimates and judgements

Preparing the condensed consolidated interim financial

statements requires management to make judgements, estimates and

assumptions that affect the application of accounting policies and

the reported amounts of assets and liabilities, income and

expenses. Actual results may differ from these estimates.

In preparing these condensed consolidated interim financial

statements, significant judgements made by management in applying

the Group's accounting policies and the key sources of estimation

uncertainty were the same as those applied to the consolidated

financial statements as at and for the year ended 31 December

2021.

4. Loss per share

Basic, dilutive and headline loss per share for the six months

ended 30 June 2022 are as follows:

6 months to 6 months 12 months

to to

30 June 30 June 31 December

2022 2021 2021

GBP GBP GBP

Loss for the year attributable

to equity holders of the parent (1,637,805) (1,011,565) (21,996,968)

Weighted average number of ordinary

shares for the purposes of basic

and dilutive loss per share 2,956,206,435 2,339,072,536 2,480,279,189

Basic loss per share (0.0006) (0.0004) (0.009)

Dilutive loss per share (0.0006) (0.0004) (0.009)

-------------- -------------- --------------

6 months 6 months 12 months

to to to

Reconciliation of Headline loss 30 June 30 June 31 December

per share

2022 2021 2021

GBP GBP GBP

Loss for the year attributable

to equity holders of the parent (1,637,805) (1,011,565) (21,996,968)

Adjusted for:

Profit on loss of control over

of subsidiaries - - (529,415)

Impairment of goodwill - - 300,000

Impairment of intangible assets - - 13,955,528

Impairment of associates - - 6,449,681

Headline loss per share (1,637,805) (1,011,565) (1,821,174)

Weighted average number of ordinary

shares for the purposes of headline

loss per share 2,956,206,435 2,339,072,536 2,480,279,189

Headline loss per share (0.0006) (0.0004) (0.0007)

-------------- -------------- --------------

Headline earnings per share (HEPS) is calculated using the

weighted average number of ordinary shares in issue during the

period and is based on the earnings attributable to ordinary

shareholders, after excluding those items as required by Circular

1/2021 issued by the South African Institute of Chartered

Accountants (SAICA).

5. Called up share capital and share premium

Authorised ordinary share capital of the company is

5,000,000,000 ordinary shares of EUR 0.001 each.

Authorised deferred shares of the company is 1,000,000,000 of

EUR 0.014 and 3,000,000,000 of EUR 0.009 respectively.

Detail of issued capital is as follows:

Number of Share Deferred Called Share Premium

Ordinary Capital Share Up Share

Shares Capital Capital

GBP GBP GBP GBP

Balance at 31 December

2020 2,221,640,835 1,205,611 19,205,882 20,411,493 44,312,371

Shares issued in period 253,707,902 219,703 - 219,703 -

-------------- ---------- ----------- ----------- --------------

Balance at 30 June

2021 2,475,348,737 1,425,314 19,205,882 20,631,196 44,312,371

Shares issued in period 455,308,700 411,248 - 411,248 1,116,957

-------------- ---------- ----------- ----------- --------------

Balance at 31 December

2021 2,930,657,437 1,836,562 19,205,882 21,042,444 45,429,328

-------------- ---------- ----------- ----------- --------------

Shares issued in period 108,540,021 98,037 - 98,037 86,753

-------------- ---------- ----------- ----------- --------------

Balance at 30 June

2022 3,039,197,458 1,934,599 19,205,882 21,140,481 45,516,081

-------------- ---------- ----------- ----------- --------------

The company issued the following ordinary shares during the

period, with regard to key transactions:

- 39,264,079 new Kibo Shares were issued on 16 February 2022 of

EUR 0.001 each at a deemed issue price of GBP0.0017828 per share to

an Institutional Investor ("Investor") in settlement of GBP70,000

of facility implementation fee pursuant to the Funding Facility

Agreement signed between the Investor and the Company in February

2022 ;

- 13,157,895 new Kibo Shares were issued on 16 February 2022 of

EUR 0.001 each at a deemed issue price of GBP0.0019 per share to

certain providers of financial and technical services in settlement

of GBP25,000 of outstanding invoices;

- 56,118,047 new Kibo Shares were issued on 20 May 2022 of EUR

0.001 each at a deemed issue price of GBP0.0016 per share to

Sanderson Capital Partners Limited in full and final settlement of

GBP89,788.88 of the total remaining outstanding amount owing

pursuant to the Forward Payment Facility; and

- 168,274,625 Company warrants to subscribe for 168,274,625 new

Kibo shares under the terms of warrants announced on the 16(th) of

February 2022.

6. Segment analysis

IFRS 8 requires an entity to report financial and descriptive

information about its reportable segments, which are operating

segments or aggregations of operating segments that meet specific

criteria. Operating segments are components of an entity about

which separate financial information is available that is evaluated

regularly by the chief operating decision-maker.

The Chief Executive Officer is the chief operating decision

maker of the Group.

Management currently identifies individual projects as operating

segments. These operating segments are monitored, and strategic

decisions are made based upon their individual nature, together

with other non-financial data collated from project and exploration

activities. Principal activities for these operating segments are

as follows:

30 June 2022

Mbeya Coal Bordersley Rochdale PyeBridge Sustinery Corporate 30 June 2022

PP Power Power Power Energy (GBP) Group

----------- ----------- --------- ---------- ---------- ------------ -------------

Revenue - - - 305,384 - - 305,384

Cost of sales - - - (260,329) - - (260,329)

Administrative

and other costs (590) (16,143) (3,420) (20,151) (220) (1,354,562) (1,395,086)

Loss from equity

accounted investment - - - - - (118,357) (118,357)

Project expenditure (25,908) (166,518) (39,284) (82,736) (50,985) (50,190) (415,621)

Finance cost - - - - - (86,914) (86,914)

Investment and

other income 5,686 - - - 141 2,766 8,593

----------- ----------- --------- ---------- ---------- ------------ -------------

Loss after tax (20,812) (182,661) (42,704) (57,832) (51,064) (1,607,257) (1,962,330)

----------- ----------- --------- ---------- ---------- ------------ -------------

30 June 2021

Mabesekwa Mbeya Coal Mast Energy Haneti Blyvoor Corporate 30 June 2021

Independent to Power Developments (GBP) Group

Power

------------- ----------- -------------- ---------- --------- ---------- -------------

Revenue - - - - - - -

Administrative

cost (806) (4,968) (275,445) (5,084) (4,228) (761,917) (1,052,448)

Exploration

expenditure - (33,254) (120,333) (119,802) (35,021) (124,268) (432,678)

Investment

and other income - 1,821 - - - 54,744 56,565

Capital raising

fees - - (260,878) - - (156,437) (417,315)

Loss from equity - - - - - - -

accounted investment

Finance income - - - - - 11,945 11,945

Finance costs - - (12,363) - - - (12,363)

------------- ----------- -------------- ---------- --------- ---------- -------------

Loss after

tax (806) (36,401) (669,019) (124,886) (39,249) (975,933) (1,846,294)

------------- ----------- -------------- ---------- --------- ---------- -------------

30 June 2022

Mbeya Coal Bordersley Rochdale PyeBridge Sustinery Corporate 30 June 2022

PP Power Power Power Energy Group (GBP) Group

----------- ------------ -------------- ------------- -------------- ------------ -------------

Segment assets 8,388 413,424 10,079 2,641,183 305,071 9,917,472 13,295,617

Segment

liabilities (21,650) (320,559) (26,682) (103,103) (33,493) (2,674,145) (3,179,632)

----------- ------------ -------------- ------------- -------------- ------------ -------------

30 June 2021

Mabesekwa Mbeya Coal Mast Energy Haneti Corporate 30 June 2021

Independent to Power Development Group (GBP) Group

Power

---------------- -------------------- ---------------- ------------------ ------------ ---------------

Segment assets - 9,822 4,590,930 5,536 29,104,836 33,712,942

Segment liabilities 8,464 98,090 686,205 90,527 1,079,633 1,964,418

---------------- -------------------- ---------------- ------------------ ------------ ---------------

7. Property, plant and

equipment

Right Furniture

of Use and Motor Office Computer Other

Land Asset Fittings Vehicles Equipment Equipment Equipment Total

Opening balance of Cost

at 1 January 2022 602,500 293,793 2,465 16,323 4,942 5,390 2,020,112 2,945,525

----------- ----------- ----------- ------------ -------------- ----------- ------------ -----------------

Additions - - - 36,012 36,012

Forex movement - - 268 1,779 452 3,325 923 6,747

----------- ----------- ----------- ------------ -------------- ----------- ------------ -----------------

Closing balance of Cost

at 30 June 2022 602,500 293,793 2,733 18,102 5,394 8,715 2,057,047 2,988,284

----------- ----------- ----------- ------------ -------------- ----------- ------------ -----------------

Opening balance of

Accumulated

Depreciation at 1 January

2022 - (9,793) (2,465) (16,322) (4,409) (4,074) (8,703) (45,766)

----------- ----------- ----------- ------------ -------------- ----------- ------------ -----------------

Depreciation - (7,042) - - (498) (81) - (7,621)

Forex movement - - (268) (1,779) 61 (865) (949) (3,800)

----------- ----------- ----------- ------------ -------------- ----------- ------------ -----------------

Closing balance of

Accumulated

Depreciation at 30 June

2022 - (16,835) (2,733) (18,101) (4,846) (5,020) (9,652) (57,187)

----------- ----------- ----------- ------------ -------------- ----------- ------------ -----------------

Carrying value at 30

June 2022 602,500 276,958 - 1 548 3,695 2,047,395 2,931,097

----------- ----------- ----------- ------------ -------------- ----------- ------------ -----------------

Right Furniture

of Use and Motor Office Computer Other

Land Asset Fittings Vehicles Equipment Equipment Equipment Total

Opening

balance of

Cost

at 1 January

2021 - - 2,436 16,131 4,970 4,989 8,601 37,127

------ --------- ------------- ----------- ------------ ------------ ------------ ---------

Additions - 297,593 - - - - - 297,593

Forex

movement - - - - - - - -

------- --------- ------------- ----------- ------------ ------------ ------------ ---------

Closing

balance of

Cost

at 30 June

2021 - 297,593 2,436 16,131 4,970 4,989 8,601 334,720

------ --------- ------------- ----------- ------------ ------------ ------------ ---------

Opening

balance of

Accumulated

Depreciation

at 1 January

2021 - - (2,436) (15,285) (4,398) (4,289) (8,601) (35,009)

------ --------- ------------- ----------- ------------ ------------ ------------ ---------

Depreciation - (1,733) - - - - - (1,733)

Forex movement - - (68) - - - (68)

--------- ------------- ----------- ------------ ------------ ------------ ---------

Closing

balance of

Accumulated

Depreciation

at 30 June

2021 - (1,733) (2,436) (15,353) (4,398) (4,289) (8,601) (36,810)

------ --------- ------------- ----------- ------------ ------------ ------------ ---------

Carrying

value at 30

June 2021 - 295,860 - 778 572 700 - 297,910

------ --------- ------------- ----------- ------------ ------------ ------------ ---------

Right Furniture

of Use and Motor Office Computer Other

Land Asset Fittings Vehicles Equipment Equipment Equipment Total

Opening

balance of

Cost

at 1 January

2021 - - 2,436 16,131 4,970 4,989 8,601 37,127

--------- --------- ----------- ----------- ----------- ------------ ----------- -----------

Additions 602,500 293,793 - - - 509 2,011,409 2,908,211

Forex movement - - 29 192 (28) (108) 102 187

--------- --------- ----------- ----------- ----------- ------------ ----------- -----------

Closing

balance of

Cost

at 31

December 2021 602,500 293,793 2,465 16,323 4,942 5,390 2,020,112 2,945,525

--------- --------- ----------- ----------- ----------- ------------ ----------- -----------

Opening

balance of

Accumulated

Depreciation

at 1 January

2021 - - (2,436) (15,285) (4,398) (4,289) (8,601) (35,009)

--------- --------- ----------- ----------- ----------- ------------ ----------- -----------

Depreciation - (9,793) - (842) - - - (10,635)

Forex movement - (29) (195) (11) 215 (102) (122)

--------- --------- ----------- ----------- ----------- ------------ ----------- -----------

Closing

balance of

Accumulated

Depreciation

at 31

December

2021 - (9,793) (2,465) (16,322) (4,409) (4,074) (8,703) (45,766)

--------- --------- ----------- ----------- ----------- ------------ ----------- -----------

Carrying

value at 31

December

2021 602,500 284,000 - 1 533 1,316 2,011,409 2,899,759

--------- --------- ----------- ----------- ----------- ------------ ----------- -----------

8. Intangible assets

Composition of Intangible assets 30 June 30 June 31 December

2022 2021 2021

GBP GBP GBP

Carrying value at 1 January 2022 4,964,550 18,491,105 18,491,105

---------- ----------- -------------

Foreign currency gain 31,058 - -

Acquisitions - - 428,973

Impairments - - (13,955,528)

---------- ----------- -------------

Carrying value at 30 June 2022 4,995,608 18,491,105 4,964,550

---------- ----------- -------------

Carrying value of intangible asset at

30 June 2022

Mbeya Coal to Power Project 1,947,500 15,896,105 1,940,577

Bordersley Power Project 2,595,000 2,595,000 2,595,000

Rochdale Power 150,273 - 150,273

Sustineri Energy 302,835 - 278,700

4,995,608 18,491,105 4,964,550

---------- ----------- -------------

Intangible assets are not amortised, due to the indefinite

useful life, which is attached to the underlying prospecting

rights, until such time that active mining operations commence,

which will result in the intangible asset being amortised over the

useful life of the relevant mining licences.

Intangible assets with an indefinite useful life are assessed

for impairment on an annual basis, against the prospective fair

value of the intangible asset. The valuation of intangible assets

with an indefinite useful life is reassessed on an annual basis

through valuation techniques applicable to the nature of the

intangible assets.

As at reporting period end, taking into account the various

applicable aspects, the Group concluded that none of the impairment

indicators had been met in relation to the Mbeya Coal to Power

Project, Bordersley Power Project, Rochdale Power or Sustineri

Energy.

9. Goodwill

30 June 30 June 31 December

2022 2021 2021

GBP GBP GBP

Goodwill - 300,000 -

-------- -------- ------------

- 300,000 -

-------- -------- ------------

MAST Energy Projects Limited - 2020

During the 30 June 2021 period, the Group acquired a 60% equity

interest in MAST Energy Project Limited, previously known as MAST

Energy Development Limited, for GBP300,000, settled through the

issue of 5,714,286 ordinary shares in Kibo Energy plc effective on

19 October 2018. The acquisition of MAST Energy Projects Limited

falls within the ambit of IFRS 3: Business Combinations.

The net assets acquired were valued at Nil, with the resultant

purchase price being allocated to Goodwill on date of acquisition.

Goodwill is assessed for impairment on an annual basis, against the

recoverable amount of underlying Cash Generating Unit ("CGU"). The

recoverable amount of the CGU is the higher of its fair value less

cost to sell and its value in use.

Because the underlying projects previously held by Mast Energy

Projects Limited have now been restructured into separate SPV's,

controlled directly by the intermediary holding company Sloane

Developments Limited, there was no prospective benefit from

continued operations of Mast Energy Projects Limited therefore the

goodwill was impaired. The Company will cease operations in the

foreseeable future.

10. Investment in associates

30 June 30 June 31 December

2022 2021 2021

GBP GBP GBP

Mabesekwa Coal Independent Power Plant 3,563,639 9,696,351 3,563,639

Katoro Gold plc 528,764 - 577,121

Share of loss for the period (118,357) - (48,357)

Foreign exchange loss (1,522)

---------- ---------- ------------

3,972,524 9,696,351 4,092,403

---------- ---------- ------------

The value of the equity interest in Kibo Energy Botswana (Pty)

Ltd was determined based on the fair value of the proportionate

equity interest retained in the enlarged resource following the

restructuring in the prior period.

As at reporting period end, taking into account the various

applicable aspects, the Group concluded that none of the impairment

indicators had been met in relation to the Mabesekwa Coal

Independent Power Plant project.

11. Other financial assets

30 June 30 June 31 December

2022 2021 2021

GBP GBP GBP

-------- ------------ ------------

Other financial assets consist of:

Financial assets recognised at amortised - 1,880,556 -

cost

-------- ------------ ------------

Lake Victoria Gold - 657,061 -

Blyvoor Joint Venture - 1,223,495 -

Impairment of financial assets recognised - (1,880,556) -

at amortised cost

-------- ------------ ------------

Impairment - (1,880,556) -

-------- ------------ ------------

Carrying value at reporting period end - - -

-------- ------------ ------------

12. Borrowings

Amounts falling due within one year 30 June 30 June 31 December

2022 2021 2021

GBP GBP GBP

Short-term borrowings 1,732,423 499,401 1,079,691

---------- -------- ---------------

1,732,423 499,401 1,079,691

---------- -------- ---------------

Short-term borrowings consist of:

Apex Capital 661,911 - 960,686

Institutional Investor 1,070,512 - -

Sanderson Capital - 144,004 119,005

St Anderton on Vaal Ltd - 355,397 -

---------- -------- ------------

1,732,423 499,401 1,079,691

---------- -------- ------------

The borrowings relate to the following loan facilities:

Institutional Investor

The Institutional Investor borrowing is a bridge loan facility

agreement for up to GBP3m with a term of up to 36 months. Funds

advanced under the Facility will attract a fixed coupon interest

rate of 3.5% and will be repayable with accrued interest on 23 July

2022.

Sanderson Capital Partners Limited

Short term loans relate to the unsecured interest free loan

facility from Sanderson Capital Partners Limited in the amount of

GBPNIL (31 December: GBP119,005, 31 December: GBP144,004) which is

was repaid through the issue of ordinary shares by the Company.

Deferred vendor liability - Apex Capital

The amount due to vendors represents the balance of the purchase

consideration owing in respect of the acquisition of Pyebridge

Power Limited. The liability will be settled in cash as

follows:

-- GBP500,000 payable within 8 months after the signing of the

SPA represents: and

-- GBP500,000 payable within 12 months after the signing of the

SPA represents.

The fair value of the deferred vendor liability is based on the

anticipated purchase consideration payable, at the fair value

thereof on the date of the transaction. The carrying value of

current other financial liability equals their fair value due

mainly to the short-term nature of these payables.

St Anderton on Vaal Limited

The amount due to St Anderton on Vaal Limited represented the

balance of amounts owed by MAST Energy Projects Limited for

consulting services rendered. The amount due as at 30 June 2021 of

GBP355,397 was written off by St Anderton on Vaal Limited during

the previous financial period and resulted in other income of

GBP355,397 during the financial period 1 July 2021 to 31 December

2021.

13. Right of use asset and Lease liability

The Group has one lease contract for land it shall utilise to construction

a 5MW gas-fuelled power generation plant. The land is located at Bordesley,

Liverpool Street, Birmingham. The lease of the land has a lease term

of 20 years, with an option to extend for 10 years which the Group has

opted to include due to the highly likely nature of extension as at

the time of the original assessment. The Group's obligations under its

leases are secured by the lessor's title to the leased assets. The Group's

incremental borrowing rate implicit to the lease is 8.44%. Refer to

note 7 for the right of use asset.

30 June 30 June 31

Lease 2022(GBP) 2021(GBP) December

liability 2021(GBP)

--------------------- --------------------- ---------------------

Carrying amounts of

lease liabilities:

Opening 291,518 - -

balance

--------------------- --------------------- ---------------------

Additions - 297,594 293,793

Interest 12,290 12,363 24,725

Payments (13,500) (11,100) (27,000)

--------------------- --------------------- ---------------------

Closing

balance 290,308 298,857 291,518

--------------------- --------------------- ---------------------

Spilt of

lease

liability

between

current

and

non-current

portions

Current 2,587 2,422 2,473

Non-current 287,721 296,435 289,045

--------------------- --------------------- ---------------------

290,308 298,857 291,518

--------------------- --------------------- ---------------------

14. Financial instruments

30 June 30 June 31 December

2022 2021 2021

GBP GBP GBP

Financial assets - carrying amount

Loans and receivables held at amortised

cost

Trade and other receivables 233,091 45,455 255,747

Cash and cash equivalents 1,163,297 4,882,121 2,082,906

---------- ---------- ------------

1,396,388 4,927,576 2,338,653

---------- ---------- ------------

Financial liabilities - carrying amount

Financial liabilities held at amortised

cost

Trade and other payables 1,156,901 1,166,160 1,116,273

Borrowings 1,732,423 499,401 1,079,691

---------- ---------- ------------

2,889,324 1,665,561 2,195,964

---------- ---------- ------------

The Board of Directors considers that the fair values of

financial assets and liabilities approximate their carrying values

at each reporting date due to the short-term nature thereof, and

market related interest rate applied.

15. Revenue

30 June 30 June 31 December

2022 2021 2021

GBP GBP GBP

Electricity sales 305,384 - 3,245

-------- -------- ------------

305,384 - 3,245

-------- -------- ------------

Revenue is comprised of electricity sales from renewable energy

operations of MAST Energy Developments plc in the United

Kingdom.

16. Unaudited results

These condensed consolidated interim financial results have not

been audited or reviewed by the Group's auditors.

17. Dividends

No dividends were declared during the interim period.

18. Board of Directors

There were no changes to the board of directors during the

interim period, or any other committee's composition.

19. Subsequent events

The following subsequent events have been noted:

-- MAST appointed Mr. Pieter Krügel as a director with effect

from 1 June 2022 and announced on the Company's RNS on 13 July

2022. Mr. Krügel was appointed as Chief Executive Officer of the

Company and announced on the Company's RNS of the 20 May 2022 with

effect from 1 June 2022 and this completes his appointment to the

board.

-- KIBO has successfully achieved its first major Framework

Agreement ('FA') target, by placing the first commitment, to

purchase the first two proof of concept ('POC') projects, as

announced in the Company's RNS dated 17 May 2022. These projects

relate to its signed strategic five-year FA with CellCube to deploy

long-duration energy storage in Southern Africa. The FA envisages

the deployment of c.1 Gigawatt of Long Duration Energy Storage in

Southern Africa over the next five years. Kibo placed the

commitment to purchase via its 51%-owned subsidiary National

Broadband Solutions ('NBS'), for two (2) CellCube FB 250 - 1000

Vanadium Redox Flow Batteries as part of its initial stage of the

FA.

-- KIBO has extended to 20 years its conditional 10-year

take-or-pay Power Purchase Agreement ('PPA'), first announced in

the Company's RNS dated 14 February 2022. The PPA outlines the

construction, commissioning and operation of a 2.7 MW

plastic-to-syngas power plant to generate baseload electricity for

an industrial business park developer (the 'Client') in Gauteng,

South Africa (the 'Project'). The Project is the Company's first

under its joint venture, Sustineri Energy, in which Kibo Energy PLC

holds 65% and Industrial Green Energy Solutions Pty Ltd ('IGES')

holds the balance of 35%. The extended term period to 20 years will

improve the already compelling Project highlights, including:

-- Strong financials: An increase in the projected EBITDA from

c. ZAR 388 million to c. ZAR 953 million, of which an amount of c.

ZAR 619 million is attributable to the Company;

-- Improved Internal Rate of Return ('IRR'): An increased

projected IRR of 15-18%, up from 11-14%; and

-- Commencement of construction and commissioning: The

Construction Phase is scheduled to commence during Q1 2023 with

project commissioning 11 to 14 months thereafter.

-- MAST has issued 28,735,632 new MED Shares of GBP0.001 each

("the Settlement Shares") at a deemed issue price of GBP0.0348 per

share ("Settlement Share Price") to its majority shareholder, Kibo

Energy PLC ("Kibo") in partial settlement of GBP1m (the "Partial

Settlement") of the total remaining outstanding amount owing to

Kibo Mining Cyprus Ltd, a wholly owned subsidiary of Kibo, pursuant

to the shareholder loan account ("the Loan"), as disclosed in the

Company's IPO admission document and most recently its latest

audited annual report and accounts. Following the Partial

Settlement, the Loan's remaining outstanding amount owing to Kibo

is c. GBP1.27m. The Settlement Share Price is the 5-day VWAP for

the period up to the closing price of the Company shares on the

London Stock Exchange on 26 July 2022, plus a 20% premium and has

effectively increase Kibo's shareholding in MED to 61.27%. This was

announced on the Company's RNS on 29 July 2022.

-- KIBO has initiated a process for Requests for Proposals

('RFPs') to investigate the feasibility of replacing fossil-fuel

(coal) with renewable biofuel, as mentioned in the Company's RNS

dated 27 May 2022. This follows an extensive review of the

Company's operations and assets wherein it determined to dispose of

all its coal assets (RNS dated 16 June 2021) while retaining the

associated energy (power) projects through its introduction of

innovative biofuel technology, on which the Company has been doing

extensive work in recent months. Through the RFP process, Kibo

intends to appoint an experienced international biomass and biofuel

consultant to determine the economic and technical viability of

utilising the specific biomass (or bio-coal) technology, referred

to above and in previous RNS's, as a feasible fuel source at

industrial scale, to fuel the Company's existing and already

developed utility scale power projects. The feasibility studies

will investigate whether sufficient biomass can be sustainably

(NOTE: sustainable = economically, environmentally and socially

viable) produced and supplied as fuel for a 300 MW power plant over

a 20 to 25-year power purchase agreement ('PPA') period. The

biofuel technology, which will be the subject of the above referred

investigation, has already been subjected to extensive bench

testing and has thus far delivered positive results in all tests

performed.

-- Kibo has signed a definitive Share Purchase Agreement (the

'SPA') to acquire a 100% interest in a waste reception, Anaerobic

Digestor and CHP power plant ('Southport' or 'the Project') at

Merseyside, United Kingdom. The acquisition is in line with the

Company's refocused strategy to acquire and develop an energy

portfolio centred around sustainable renewable / clean energy

solutions and opportunities, as detailed in a Company RNS dated 19

April 2021. This includes the addition of a 12MW waste-to-energy

project in the UK (see RNS dated 27 May 2022).

20. Going concern

The Group currently generated revenue of GBP305,384 and had net

assets of GBP10,115,985 as at 30 June 2022 (31 December 2021: net

assets of GBP11,807,883; 30 June 2021: GBP31,748,524).

In performing the going concern assessment, the Board considered

various factors, including the availability of cash and cash

equivalents; data relating to working capital requirements for the

foreseeable future; cash-flows from operational commencement,

available information about the future, the possible outcomes of

planned events, changes in future conditions, the current global

economic situation due to the Covid-19 pandemic and Ukraine

conflict and the responses to such events and conditions that would

be available to the Board.

Furthermore, the group has incurred losses in the current

financial period and previous periods. These losses coupled with

the net current liability position the Group finds itself in as at

June 2022, indicate that a material uncertainty exists which may

cast significant doubt on the Group's ability to continue as a

going concern.

This is largely attributable to the short-term liquidity

position the Group finds itself in as a result of the significant

capital required to develop projects that exceeds cash contributed

to the group by the capital contributors.

The Directors have evaluated the Groups liquidity requirements

to confirm whether the Group has adequate cash resources to

continue as a going concern for the foreseeable future, taking into

account the net current liability position, and consequently

prepared a cash flow forecast covering a period of 12 months from

the date of these interim financial statements, concluding that the

Group would be able to continue its operations as a going

concern.

The interim financial statements have accordingly been prepared

on the going concern basis which contemplates the continuity of

normal business activities and the realisation of assets and the

settlement of liabilities in the normal course of business.

21. Commitments and contingencies

There are no material commitments, contingent assets or

contingent liabilities as at 30 June 2022 nor any of the

comparative periods.

22. Seasonality of operations

The company's operations are not considered to be seasonal or

cyclical. These interim results were therefore not impacted by

seasonality or cyclicality.

23 September 2022

**S**

This announcement contains inside information as stipulated

under the Market Abuse Regulations (EU) no. 596/2014 ("MAR").

For further information please visit www.kibo.energy or

contact:

Louis Coetzee info@kibo.energy Kibo Energy Chief Executive Officer

PLC

Andreas Lianos +357 99 53 1107 River Group JSE Corporate and Designated

Adviser

------------------- ----------------------------

Claire Noyce +44 (0) 20 3764 Hybridan LLP Joint Broker

2341

--------------------------------- ------------------- ----------------------------

Damon Heath +44 207 186 9952 Shard Capital Joint Broker

Partners LLP

--------------------------------- ------------------- ----------------------------

Bhavesh Patel +44 20 3440 6800 RFC Ambrian NOMAD on AIM

/ Stephen Allen Ltd

--------------------------------- ------------------- ----------------------------

Zainab Slemang zainab@lifacommunications.co.za Lifa Communications Investor and Media Relations

van Rijmenant Consultant

--------------------------------- ------------------- ----------------------------

Notes

Kibo Energy PLC is a renewable energy focused development

company with its primary focus to advance its business as a

significant diversified energy developer of sustainable power

solutions that integrate existing and emerging Renewable Generation

technology, Waste-to-Energy technology and Energy Storage

technology in southern and eastern Africa, and the United

Kingdom.

Additionally, the Company has a 61.27% interest in MAST Energy

Developments Limited ('MED'), a private UK registered company

targeting the development and operation of flexible power plants to

service the UK Reserve Power generation market.

Johannesburg

23 September 2022

Corporate and Designated Adviser River Group

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BKNBDFBKKOCB

(END) Dow Jones Newswires

September 23, 2022 04:30 ET (08:30 GMT)

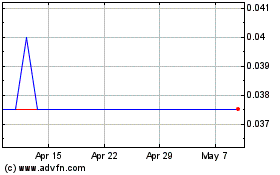

Kibo Energy (LSE:KIBO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kibo Energy (LSE:KIBO)

Historical Stock Chart

From Apr 2023 to Apr 2024