TIDMKP2

RNS Number : 0284Q

Kore Potash PLC

25 October 2021

25 October 2021

Kore Potash Plc

("Kore Potash" or "the Company")

Review of Operations for the Quarter ended 30 September 2021

Kore Potash, the potash development company with 97%-ownership

of the Kola and DX Potash Projects in the Sintoukola Basin, located

within the Republic of Congo ("RoC"), provides the following

quarterly update for the period ended 30 September 2021 (the

"Quarter").

Quarterly Highlights:

Kola Potash Project

-- The process to potentially finance the construction of the

Kola Potash Project (" Kola Project ") progressed in line with the

Memorandum of Understanding ("MoU") signed with the Summit

Consortium ("Consortium") in April 2021.

-- The Optimisation Study ("Study") on the Kola Project remains

on track for completion in Q1 2022.

-- The Company expects to receive an interim report on the Study within weeks.

-- Engineering, Procurement and Construction ("EPC") contract

terms are being discussed with the Consortium consistent with the

2017 2(nd) edition FIDIC Silver book.

-- The Consortium remains on track to present an EPC proposal

for the construction of Kola to the Company in Q2 of 2022.

-- The Consortium also continues to progress its debt and

royalty financing arrangements and is finalising its interest in

product offtake.

-- The Consortium advise that subject to completion of a

successful Study, they remain on track to provide the royalty and

debt financing proposal for the full construction cost of Kola to

the Company in Q2 of 2022.

-- Kore Potash management also continued to brief potential

offtake partners with the capability to procure all of the Kola

production and who have expressed interest in partnering with the

Company.

DX Potash Project

-- Work commenced developing an updated geological model for the

DX deposit which is expected to be completed in Q4 2021.

Corporate Highlights

-- Ms Amanda Farris was appointed as interim Chief Financial Officer on 15 July 2021.

-- Mr Ignacio Maijluf was appointed as a Non-Executive Director

on the Board as a nominee of S ociedad Química y Minera de Chile

S.A.

-- As of 30 September 2021, the Company held US$ 12.6 million in cash.

-- After the end of the Quarter, as a result of the COVID-19

pandemic, two long term Congolese consultants to the Company sadly

passed away. Kore Potash expresses its deepest sympathy to their

families, friends, and colleagues. The Company's Pointe Noire

office has been temporarily closed while risks to our employees and

additional mitigation measures are further assessed. This action is

not expected to have any material impact on the next Quarter's

activities.

Brad Sampson, Chief Executive Officer of Kore Potash,

commented:

"We are saddened by the recent COVID-19 impacts on our people

and their families in the Congo and continue to work with our

communities and the Government to further mitigate COVID-19 risks

to our people in the Congo."

" The Company is very pleased that the Optimisation Study and

the Consortium's financing process are progressing to schedule. We

are excited that the next key milestones for the Consortium are

imminent and look forward to receiving the interim study report and

being able to update shareholders further on the progress to

develop Kola."

Operational activities

Kola Potash Project

The financing process for the construction of the Kola Project

progressed in line with the MoU signed with the Consortium in April

2021.

Optimisation Study

The Consortium's first key milestone in the MoU is to complete

the Study on the Kola Project with key goals to improve the project

value, reduce the capital cost and shorten the construction

schedule. The Consortium set objectives at the start of the Study

to reduce the capital cost to US$ 1.65 billion and the construction

schedule to 40 months. The Study continues to progress as planned

and remains on track for completion in Q1 2022.

The completion of the Study has been the major focus of the

Company and the Consortium during the Quarter.

The Consortium has advised the Company that its key technical

partner with accountability for engineering design and

construction, SEPCO Electric Power Construction Corporation

("SEPCO"), is nearing completion of an interim report on the Study

and that the interim report will be delivered to the Company during

Q4 2021.

The Company intends to update shareholders further on the Study

progress following the completion of this interim report.

SEPCO and its subcontractor China ENFI Engineering Corporation

("ENFI") have had more than 80 personnel engaged full time on the

Study including a review of value opportunities identified in all

major areas of the Kola Definitive Feasibility Study ("DFS")

design.

During the Quarter, SEPCO appointed CCCC-FHDI Engineering

("FHDI") as marine consultants to bring additional marine

capability to the Study team. FHDI is a wholly-owned subsidiary of

the China Communications Construction Company Ltd founded in 1964

and was previously known as the Fourth Harbour Design Institute of

the Ministry of Transport.

The Study process includes weekly meetings between SEPCO, other

members of the Consortium, and Kore Potash management. These

meetings include discussion on capital cost and construction

schedule reduction initiatives being considered by SEPCO. Some of

the topics discussed during the Quarter included accommodation camp

design and construction methodology, possible relocation of the

processing plant closer to the mining area, improved mine shaft

design, improved shaft sinking methodology, optimum process plant

equipment design and a reduced cost approach to key component and

equipment sourcing.

Construction Contract Terms

In advance of completion of the Study and facilitating the

earliest possible receipt of a construction proposal from the

Consortium, the Company is engaging with SEPCO to agree EPC

contract terms consistent with the 2017 2(nd) edition FIDIC Silver

book and appropriate for the construction of Kola.

The Consortium has also advised it remains on track to present

an EPC proposal for the construction of Kola to the Company in Q2

2022 following completion of the Study.

Kola Financing

The Study and the EPC proposal are two key milestones committed

to by the Consortium in the MoU the Company signed with the

Consortium in April 2021. The Study will confirm the total quantum

of capital required to construct Kola and the construction

timeframe. This is important information the Consortium require to

be able to present the financing proposal to the Company.

Kore Potash management continued twice-weekly meetings with the

Consortium to remain briefed on the Consortium's progress towards

forming its debt and royalty financing proposal. The Consortium has

also continued to keep the Company informed on their level of

product offtake interest.

The Consortium advises that it remains on track, subject to the

completion of a successful Study, to provide the royalty and debt

financing proposal for the full construction cost of Kola to the

Company in Q2 2022.

Other Kola matters

Separate from the Consortium's activity, Kore Potash management

also continued to brief potential offtake partners with the

capability to procure all of the Kola production and who have

expressed interest in partnering with the Company.

During the Quarter, the Company requested the Government of the

RoC to extend the existing Kola land access agreement Decree

D'Utilité Publique ("DUP") to incorporate additional land areas to

allow flexibility for possible relocation of the Kola Processing

Plant following completion of the Study. Representatives of the

Ministry of Land Affairs visited the Kola Project site during

September to facilitate the Company's request. This request was

well received by the Government and the Ministry's staff are

working cooperatively with the Company to complete this as rapidly

as possible.

DX Potash Project

Following completion of the drilling at the DX Potash Project

("DX Project") by the Company earlier in 2021 as part of the first

phase of a DFS for the DX Project, all of the geological data for

the DX Project has now been provided to the geological consultants

to develop an updated geological model for the DX deposit.

This modelling work is expected to be completed late in Q4 2021

and presented to the Company for review.

This new model is expected to facilitate decision making on the

most appropriate next steps in the development of the DX Project.

The completion of this work may also result in a re-estimate of the

DX Mineral Resources.

Corporate

On 15 July 2021, Mr Jean-Michel Bour resigned from the Chief

Financial Officer role due to personal circumstances that prevented

his continued employment with the Company.

Ms Amanda Farris was subsequently appointed as Chief Financial

Officer on 15 July 2021. Ms Farris is a respected mining industry

accountant who has been working with the Company since May 2021 and

is familiar with the Company's systems, processes, and people.

On 24 August 2021, the Company announced its financial results

for the half year ended 30 June 2021.

On 2 September 2021, the Company announced the appointment of Mr

Ignacio Maijluf as a Non-Executive Director. Mr Majluf was

nominated by S ociedad Química y Minera de Chile S.A. ("SQM") to

replace Ms Trinidad Reyes, who has taken maternity leave from SQM

and resigned from the Board on 1 September 2021.

As at 30 September 2021, the Company held US$ 12.6 million

cash.

After the end of the Quarter, as a result of the COVID-19

pandemic, two long term Congolese consultants to the Company sadly

passed away. The Company expresses its deepest sympathy to their

families, friends, and colleagues. The Company has provided support

to the families in line with our normal practice in the Congo.

The Company's Pointe Noire office has been temporarily closed,

and the staff are working from home, while risks to our employees

and additional potential mitigating actions are further

assessed.

This action is not expected to have any material impact on the

next quarter's activities.

There were no mining production or construction activities

during the Quarter.

Planned Activity

During the quarter ending 31 December 2021, the Company aims

to:

Kola Potash Project

-- Receive the interim Study report from the Consortium.

-- Update shareholders on the Study progress following the

completion of this interim report by SEPCO.

-- Continue to work with SEPCO to evaluate the optimisation

initiatives for inclusion in the Final Optimisation Study

Report.

-- Finalise the granting of the revised DUP with the Minister of Land Affairs.

-- Continue discussing the financing proposal with the

Consortium for the royalty and debt financing for the full cost of

construction of the Kola Project.

DX Potash Project

-- Receive the completed updated geological model for the DX

Project incorporating the results of the 2021 drilling

campaign.

-- Commence review of this model and determination of the

appropriate next steps in developing the DX Project.

Quarterly cashflow report

In accordance with the ASX Listing Rules, the Company will also

lodge its cashflow report for the Quarter today. Included in those

cashflows are non-executive directors' fees and CEO salary of US$

198 thousand settled in cash. The Company settled outstanding

directors' fees for the Quarter ended 30 June 2021 through the

issue of 2,954,079 ordinary shares, as announced on 8 July

2021.

The Company invested US $681 thousand in exploration in the

Quarter, which comprised US$ 671 thousand related to the Kola Study

and US$ 10 thousand for the DX DFS Study. The Company ended the

Quarter with US$ 12.6 million in cash.

This announcement has been approved for release by the Board of

Kore Potash.

S

For further information, please visit www.korepotash.com or

contact:

Kore Potash Tel: +27 84 603 6238

Brad Sampson - CEO

Tavistock Communications Tel: +44 (0) 20 7920

Jos Simson 3150

Oliver Lamb

Canaccord Genuity - Nomad and Tel: +44 (0) 20 7523

Broker 4600

James Asensio

Henry Fitzgerald-O'Connor

Shore Capital - Joint Broker Tel: +44 (0) 20 7408

Jerry Keen 4050

Toby Gibbs

James Thomas

Questco Corporate Advisory - Tel: +27 (11) 011 9205

JSE Sponsor

Doné Hattingh

Tenement Details and Ownership

The Company is incorporated and registered in England and Wales

and wholly owns Kore Potash Limited of Australia. Kore Potash

Limited has a 97% holding in SPSA in the RoC. SPSA is the 100%

owner of Dougou Potash Mining S.A. which will hold the Dougou

Mining Lease upon the transfer from SPSA to Dougou Potash Mining

S.A. through the issue of a Presidential Decree. The Kola Deposit

is located within the Kola Mining Lease. The Dougou Mining lease

hosts the Dougou Deposit and the Dougou Extension Deposit.

Table 1: Schedule of mining tenements (Republic of Congo)

Project & Tenement Issued Company Interest Title Registered

Type to

Kola Decree 2013-412 100% Kola Potash Mining

Mining of 9 August potassium rights S.A.

2013 only

------------------ ------------------- -------------------

Dougou Decree 2017-139 100% Sintoukola Potash

Mining of 9 May 2017 potassium rights S.A.

only

------------------ ------------------- -------------------

Kore Potash Mineral Resources and Ore Reserves - Gross and

according to future 90% interest (10% by the RoC government)

KOLA SYLVINITE DEPOSIT

Gross Net Attributable (90% interest)

----------------------------------------------- --------------------------------------------

Mineral Resource Sylvinite Average Grade Contained Sylvinite Average Contained

Category Million Tonnes KCl % KCl million Million Tonnes Grade KCl KCl million

tonnes % tonnes

---------------- -------------- ------------- ---------------- ----------- -------------

Measured 216 34.9 75.4 194 34.9 67.8

---------------- -------------- ------------- ---------------- ----------- -------------

Indicated 292 35.7 104.3 263 35.7 93.9

---------------- -------------- ------------- ---------------- ----------- -------------

Sub-Total

Measured +

Indicated 508 35.4 179.7 457 35.4 161.7

---------------- -------------- ------------- ---------------- ----------- -------------

Inferred 340 34.0 115.7 306 34.0 104.1

---------------- -------------- ------------- ---------------- ----------- -------------

TOTAL 848 34.8 295.4 763 34.8 265.8

---------------- -------------- ------------- ---------------- ----------- -------------

Gross Net Attributable (90% interest)

Ore Reserve Sylvinite Average Grade Contained Sylvinite Average Contained

Category Million Tonnes KCl % KCl million Million Tonnes Grade KCl KCl million

tonnes % tonnes

---------------- -------------- ------------- ---------------- ----------- -------------

Proved 62 32.1 19.8 56 32.1 17.9

---------------- -------------- ------------- ---------------- ----------- -------------

Probable 91 32.8 29.7 82 32.8 26.7

---------------- -------------- ------------- ---------------- ----------- -------------

TOTAL 152 32.5 49.5 137 32.5 44.6

---------------- -------------- ------------- ---------------- ----------- -------------

Ore Reserves are not in addition to Mineral Resources but are derived from

them by the application of modifying factors

DOUGOU EXTENSION SYLVINITE DEPOSIT (HWSS and TSS)

Gross Net Attributable (90% interest)

----------------------------------------------- --------------------------------------------

Mineral Resource Sylvinite Average Grade Contained Sylvinite Average Contained

Category Million Tonnes KCl % KCl million Million Tonnes Grade KCl KCl million

tonnes % tonnes

---------------- -------------- ------------- ---------------- ----------- -------------

Measured - - - - - -

---------------- -------------- ------------- ---------------- ----------- -------------

Indicated 79 39.1 30.8 71 39.1 27.7

---------------- -------------- ------------- ---------------- ----------- -------------

Sub-Total

Measured +

Indicated 79 39.1 30.8 71 39.1 27.7

---------------- -------------- ------------- ---------------- ----------- -------------

Inferred 66 40.4 26.7 59 40.4 24.0

---------------- -------------- ------------- ---------------- ----------- -------------

TOTAL 145 39.7 57.5 130 39.7 51.8

---------------- -------------- ------------- ---------------- ----------- -------------

Gross Net Attributable (90% interest)

Ore Reserve Sylvinite Average Contained Sylvinite Average Contained

Category Million Grade KCl million Million Grade KCl KCl million

Tonnes KCl % tonnes Tonnes % tonnes

------------- ------------- ------------- ------------- ------------- -------------

Proved - - - - - -

------------- ------------- ------------- ------------- ------------- -------------

Probable 17.7 41.7 7.4 16 41.7 6.6

------------- ------------- ------------- ------------- ------------- -------------

TOTAL 17.7 41.7 7.4 16 41.7 6.6

------------- ------------- ------------- ------------- ------------- -------------

Ore Reserves are not in addition to Mineral Resources but are derived from

them by the application of modifying factors

DOUGOU CARNALLITE DEPOSIT

Gross Net Attributable (90% interest)

------------------------------------------- ---------------------------------------------

Mineral Million Average Contained Million Average Contained

Resource Tonnes Grade KCl KCl million Tonnes Grade KCl million

Category carnallite % tonnes carnallite KCl % tonnes

------------- ------------- ------------- ------------- ------------- ---------------

Measured 148 20.1 29.7 133 20.1 26.8

------------- ------------- ------------- ------------- ------------- ---------------

Indicated 920 20.7 190.4 828 20.7 171.4

------------- ------------- ------------- ------------- ------------- ---------------

Sub-Total

Measured +

Indicated 1,068 20.6 220.2 961 20.6 198.2

------------- ------------- ------------- ------------- ------------- ---------------

Inferred 1,988 20.8 413.5 1789 20.8 372.2

------------- ------------- ------------- ------------- ------------- ---------------

TOTAL 3,056 20.7 633.7 2750 20.7 570.3

------------- ------------- ------------- ------------- ------------- ---------------

KOLA CARNALLITE DEPOSIT

Gross Net Attributable (90% interest)

------------------------------------------- ---------------------------------------------

Mineral Million Average Contained Million Average Contained

Resource Tonnes Grade KCl KCl million Tonnes Grade KCl million

Category carnallite % tonnes carnallite KCl % tonnes

------------- ------------- ------------- ------------- ------------- ---------------

Measured 341 17.4 59.4 307 17.4 53.5

------------- ------------- ------------- ------------- ------------- ---------------

Indicated 441 18.7 82.6 397 18.7 74.4

------------- ------------- ------------- ------------- ------------- ---------------

Sub-Total

Measured +

Indicated 783 18.1 142.0 705 18.1 127.8

------------- ------------- ------------- ------------- ------------- ---------------

Inferred 1,266 18.7 236.4 1140 18.7 212.8

------------- ------------- ------------- ------------- ------------- ---------------

TOTAL 2,049 18.5 378.5 1844 18.5 340.6

------------- ------------- ------------- ------------- ------------- ---------------

Competent Persons Statements

All Mineral Resource and Ore Reserves are reported in accordance

with the JORC Code (2012 edition). Numbers are rounded to the

appropriate decimal place. Rounding 'errors' may be reflected in

the "totals". The Kola Mineral Resource Estimate was reported 6

July 2017 in an announcement titled 'Updated Mineral Resource for

the High -Grade Kola Deposit'. It was prepared by Competent Person

Mr. Garth Kirkham, P.Geo., of Met-Chem division of DRA Americas

Inc., a subsidiary of the DRA Group, and a member of the

Association of Professional Engineers and Geoscientists of British

Columbia. The Ore Reserve Estimate for sylvinite at Kola was first

reported 29 January 2019 in an announcement titled "Kola Definitive

Feasibility Study" and was prepared by Met-Chem; the Competent

Person for the estimate was Mr Mo Molavi, member of good standing

of Engineers and Geoscientists of British Columbia.

The Dougou carnallite Mineral Resource estimate was reported on

9 February 2015 in an announcement titled 'Elemental Minerals

Announces Large Mineral Resource Expansion and Upgrade for the

Dougou Potash Deposit'. It was prepared by Competent Persons Dr.

Sebastiaan van der Klauw and Ms. Jana Neubert, senior geologists

and employees of ERCOSPLAN Ingenieurgesellschaft Geotechnik und

Bergbau mbH and members of good standing of the European Federation

of Geologists.

The Dougou Extension sylvinite Mineral Resource Estimate and Ore

Reserve Estimate were reported in an announcement titled "Dougou

Extension (Dx) Project Pre-Feasibility Study" on 13 May 2020. Ms.

Vanessa Santos, P.Geo. of Agapito Associates Inc. was the Competent

Person, for the Exploration Results and Mineral Resources. Ms.

Santos is a licensed professional geologist in South Carolina

(Member 2403) and Georgia (Member 1664), USA, and is a registered

member (RM) of the Society of Mining, Metallurgy and Exploration,

Inc. (SME, Member 04058318). Dr. Michael Hardy was the Competent

Person for the Ore Reserves and he is a registered member in good

standing (Member #01328850) of Society for Mining, Metallurgy and

Exploration (SME) which is an RPO included in a list that is posted

on the ASX website from time to time

The Company confirms that, other than the activity currently

underway to develop an improved geological model for the DX deposit

which may in the future necessitate a change in the DX Mineral

Resources, that it is not aware of any new information or data that

materially affects the information included in the original market

announcements and, in the case of estimates of Mineral Resources or

Ore Reserves that all material assumptions and technical parameters

underpinning the estimates in the relevant market announcement

continue to apply and have not materially changed. The Company

confirms that the form and context in which the Competent Person's

findings are presented have not been materially modified from the

original market announcement.

Forward-Looking Statements

This release contains certain statements that are

"forward-looking" with respect to the financial condition, results

of operations, projects and business of the Company and certain

plans and objectives of the management of the Company.

Forward-looking statements include those containing words such as:

"anticipate", "believe", "expect," "forecast", "potential",

"intends," "estimate," "will", "plan", "could", "may", "project",

"target", "likely" and similar expressions identify forward-looking

statements. By their very nature forward-looking statements are

subject to known and unknown risks and uncertainties and other

factors which are subject to change without notice and may involve

significant elements of subjective judgement and assumptions as to

future events which may or may not be correct, which may cause the

Company's actual results, performance or achievements, to differ

materially from those expressed or implied in any of our

forward-looking statements, which are not guarantees of future

performance. Neither the Company, nor any other person, gives any

representation, warranty, assurance or guarantee that the

occurrence of the events expressed or implied in any

forward-looking statement will occur. Except as required by law,

and only to the extent so required, none of the Company, its

subsidiaries or its or their directors, officers, employees,

advisors or agents or any other person shall in any way be liable

to any person or body for any loss, claim, demand, damages, costs

or expenses of whatever nature arising in any way out of, or in

connection with, the information contained in this document.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDFZLLLFBLFFBL

(END) Dow Jones Newswires

October 25, 2021 02:00 ET (06:00 GMT)

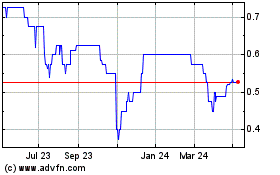

Kore Potash (LSE:KP2)

Historical Stock Chart

From Mar 2024 to Apr 2024

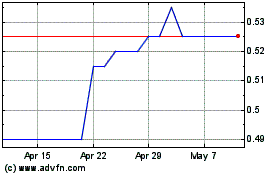

Kore Potash (LSE:KP2)

Historical Stock Chart

From Apr 2023 to Apr 2024