TIDMKRM

RNS Number : 3073K

KRM22 PLC

01 September 2021

RNS

01 September 2021

KRM22 plc

("KRM22", the "Group" or the "Company")

UNAUDITED INTERIM RESULTS FOR THE SIX MONTHSED 30 JUNE 2021

KRM22 plc (AIM: KRM.L), the technology and software investment

company, with a particular focus on risk management in capital

markets, announces its unaudited interim results for the six months

ended 30 June 2021 ("H1 2021" or the "Period").

Highlights

Financial

-- Annualised Recurring Revenue* ("ARR") of GBP3.7m at 30 June 2020 (H1 2020: GBP4.0m)

-- Total revenue recognised of GBP2.2m (H1 2020: GBP2.3m)

-- Adjusted EBITDA loss** of GBP0.3m (H1 2020: loss of GBP0.3m)

-- Loss before tax of GBP1.7m (H1 2020: GBP1.2m)

-- Cash and cash equivalents at 30 June 2021 of GBP1.4m (FY 2020: GBP2.0m)

Operational

-- Two new Market Surveillance customers

-- An existing Pre-Trade Risk customer adding the Market

Surveillance product to their Global Risk Platform

-- A five-year renewal with a major European Bank for the Market

Surveillance product, with increased ARR on an annual basis over

the term of the contract

-- Launch of People and Culture Risk offering in February 2021

-- New partnerships signed with Waymark, to provide compliance

scanning of regulatory changes, and Lexis Nexis, to provide

Exchange Data News Service to the Global Risk Platform

-- Soc 2 accreditation approved in March 2021

Post-Period Events

-- Signed a three-year contract extension with to an existing

tier one customer, with ARR of GBP0.4m per year, an increase in

existing ARR of GBP0.15m per year

-- Growth in ARR to GBP3.9m

* Annualised Recurring Revenue (ARR) is the value of contracted

Software-as-a-Service (SaaS) revenue normalised to a one year

period and excludes one time fees

** Adjusted EBITDA is the reported profit/(loss), adjusted for

depreciation, amortisation, share-based payment charges and

unrealised foreign currency gains/losses and non-recurring

exceptional costs including impairment charges, reorganisation

costs, gain on extinguishment of debt and acquisition and funding

costs, gain/loss on disposal of property, plant and equipment

Commenting on the results, Executive Chairman and CEO of KRM22,

Keith Todd CBE, said:

"We have made good progress in the year expanding our offering

and improving the quality of our recurring revenue while

maintaining a tight handle on costs. Delays in signing some larger

orders is frustrating but larger customers will lay the bedrock for

further shareholder value creation in the future."

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014

For further information please contact:

KRM22 plc

InvestorRelations@krm22.com

Keith Todd CBE, Executive Chairman and CEO

Kim Suter, CFO

finnCap Ltd (Nominated Adviser and Sole Broker) +44 (0)20 7220

0500

Carl Holmes / Kate Bannatyne / James Balicki

Alice Lane / Sunila de Silva (ECM)

About KRM22 plc

KRM22 is a closed-ended investment company which listed on AIM

on 30 April 2018. The Company has been established with the

objective of creating value for its investors through the

investment in, and subsequent growth and development of, target

companies in the technology and software sector, with a focus on

risk management in capital markets.

Through its investments and the Global Risk Platform, KRM22

helps capital market companies reduce the cost and complexity of

risk management. The Global Risk Platform provides applications to

help address firms' market, compliance, operations and technology

risk challenges and to manage their entire enterprise risk

profile.

Capital markets companies' partner with KRM22 to optimise risk

management systems and processes, improving profitability and

expanding opportunities to increase portfolio returns by leveraging

risk as alpha.

KRM22 plc is listed on AIM and the Group is headquartered in

London, with offices in several of the world's major financial

centres.

See more about KRM22 at www.krm22.com

CHAIRMAN'S REPORT

The Company has made progress in the first half of 2021, with

new Annual Recurring Revenue ("ARR") derived from new customers,

sales of new products to existing customers and existing customer

contract renewals with extended contract terms and increases in ARR

over the new contract term, all of which has further strengthened

the quality of the Company's ARR.

Annual recurring revenue

As of the date of this report, the Company has total ARR of

GBP3.9m. In addition to the new ARR signed in the year to date of

GBP0.4m, the pipeline of sales opportunities remains strong with

GBP0.5m of ARR with agreed contracts awaiting signature plus a

further GBP0.2m in final discussion ahead of contract negotiation.

We are also seeing strong engagement with new high-quality

prospects. The delay in signing these contracts is frustrating but

unfortunately not uncommon when dealing with global banks.

As previously announced in the update on 22 July 2021, the

Company did see two customer losses worth an aggregate of GBP0.5m

ARR, one as it transitioned legacy business to its current business

model of delivering Software as a Service and a second due to the

impact of a customer non-payment of invoices and therefore

non-renewal.

Our new business since the start of the year includes two new

Market Surveillance customers, an existing Pre-Trade Risk customer

adding the Market Surveillance product to their Global Risk

Platform, a five-year renewal with a major European Bank for the

Market Surveillance product with increased ARR on an annual basis

over the contract term and a three-year contract extension with a

tier one customer for use of the Enterprise Risk Cockpit,

increasing ARR by GBP0.1m to GBP0.4m per year, with the contract

including an option to increase ARR further by up to GBP0.2m from

March 2022.

Since KRM22 was set up in 2018, new business wins have increased

from GBP0.2m in FY 2018, GBP0.7m in FY 2019, GBP0.8m in FY 2020 and

GBP0.4m in the year to date in 2021. The Company also has further

opportunities across its product suite and is anticipating

increased ARR contract signings in the second half of the year.

We are working on several initiatives to reduce the time to

convert opportunities to contracts including:

-- Transition of our historic ARR contracts to a Master Services

Agreement ("MSA") under longer-term contracts which reduces

significantly the time to contact for additional sales. These,

together with new business wins that are also contracted under an

MSA, now represent 58% of total ARR;

-- Achieving SOC2 Type 1 accreditation in March 2021 and working

towards SOC2 Type 2 accreditation. This globally recognised

security certification should speed up the Tier one Bank internal

sign off process related to cyber security as the accreditation

provides customers with confidence that their information is

protected and secure; and

-- Looking to expand our distribution partnerships in particular

working with top tier capital markets technology suppliers to add

our product offering to their own offering. These firms are already

approved suppliers to tier one banks and therefore it should reduce

the on boarding time to close new deals.

Our Market

The market we serve is adapting to the new norm and we

anticipate an increase in new projects and opportunities

particularly as we enter our customers and prospects new budgets

for 2022. Most of the European and North American markets are

replacements opportunities that play well with our proposition to

reduce the cost and complexity of risk systems. The cryptocurrency

market is an exception where there is increasing focus on

professionalising the marketplace as it moves more mainstream and

is seeing larger financial institutions investigating it. The Asia

market still has new opportunities in addition to cryptocurrency as

Chinese capital markets firms expand outside of mainland China.

Products

We have continued to invest in our products with over thirty

functional and operational enhancements delivered in the year to

date. This includes functionality for the first customer deployment

of our new Pre Trade product that provides risk limit management

integrated into the firm's electronic execution platforms though

predefined authorisation workflow with full audit trail and will go

live in the third quarter. We also announced partnerships with

Waymark, to provide compliance horizon scanning of key regulatory

changes from more than 2,500 global data sources, Kintail

Consulting, to develop a People and Culture Risk Cockpit, and Lexis

Nexis, to add an Exchange Data News Service to the Global Risk

Platform.

Additional product features and launches for the remainder of

2021 include the release of the enhanced Risk Cockpit which will

provide enriched functionality and the ability for a customer to

'self-set-up' thus allowing for "Low Touch" sales of the product.

We are working with a partner company to deliver AI as a service

across our suite of products, initially focusing on Market

Surveillance and Operational Risk, and we will shortly be

announcing our first technology and cyber risk offering delivered

through the Risk Cockpit.

Selling

We have expanded the number of active prospects so that we can

increase the ability to convert the sales pipeline. Actions include

expanding our opportunities through distributor networks and

launching new sales campaigns that leverage our Global Risk

Platform capability such as the redefining of Compliance Risk with

a Holistic Surveillance offering that includes four of our existing

product offerings integrated into one package. In September, and in

conjunction with our partner, Acuiti, the first report on the KRM22

risk sentiment will be released which will provide an initial view

of the critical risk factors as seen by the community we

address.

Vision and mission

Our vision 'A world in which organisations operate at their

optimal threshold of risk to drive increased returns' and mission

'To bring increased visibility and lower cost risk management to

capital market organisations' has not changed since our

inception.

Our ability to offer integrated functionality as a technology

service significantly reduces the cost and complexity of managing

risk for our customers. We are already seeing existing customers

adding new KRM22 products to their existing suite of risk products

and new customers buying a suite of KRM22 risk products through the

Global Risk Platform, thus eliminating the requirement for multiple

distinct applications that demand separate infrastructure and data

sources

Strategy

Our strategy has not changed. The core of which is to drive

organic growth from our suite of products and our partners products

delivered through the Global Risk Platform. We will also be looking

again at acquisitions and investments to further drive our growth

and scale. Our business is built on a highly scalable

administrative and operational platform which will ensure that our

growth delivers high margins.

Outlook

We have a compelling set of product offerings and broad base of

prospects within our 2021 and 2022 sales pipeline which underpins

our confidence in delivering the market expectations.

Keith Todd CBE

Executive Chairman and CEO

31 August 2021

FINANCIAL REVIEW

Income statement

Total revenue

Total revenue reported in the period was GBP2.2m (H1 2020:

GBP2.3m) and 94% (H1 2020: 94%) was generated from recurring

customer contracts.

Recurring revenue

Recurring revenue recognised for the period was GBP2.0m (H1

2020: GBP2.2m). As at 30 June 2021, the Group had contracted ARR of

GBP3.7m and as at the date of this report, contracted ARR had

increased to GBP3.9m.

Gross profit

Gross profit for the period was GBP1.8m (H1 2020: GBP2.1m) and

the reduction in gross profit margin to 84% (H1 2020: 91%) was due

to an increase in recurring revenue related to partner products and

services.

Loss for the period

The operating loss for the period was GBP1.6m (H1 2020: loss of

GBP1.0m).

Adjusted EBITDA

Adjusted EBITDA is a key metric to consider in order to

understand the cash-profitability of the business due in particular

to the non-cash items that impact the Income Statement under IFRS

accounting, such as non-cash share-based costs.

Adjusted EBITDA for the period was a loss of GBP0.3m (H1 2020:

loss of GBP0.3m) and a reconciliation of adjusted EBITDA loss to

operating loss is provided as follows:

H1 2021 H1 2020

GBP'm GBP'm

Adjusted EBITDA loss (0.3) (0.3)

Depreciation and amortisation (0.8) (0.9)

Impairment of intangible assets - (0.1)

Acquisition and debt expenses - (0.1)

Unrealised foreign exchange (loss)/gain (0.2) 0.4

Gain on extinguishment of debt - 0.8

Group restructuring costs - (0.4)

Share-based payment expense (0.3) (0.4)

Operating loss (1.6) (1.0)

-------- --------

Total comprehensive loss

KRM22 reported a total comprehensive loss for the period of

GBP1.7m (H1 2020: loss of GBP1.2m).

Financial position

Cash

As of 30 June 2021, KRM22 held GBP1.4m in cash (31 December

2020: GBP2.0m).

Liabilities

As at 30 June 2021, our principal liabilities were:

-- GBP3.0m Convertible Loan owed to Kestrel Partners LLP. The

interest rate payable on the loan is 9.5% payable in cash quarterly

in arears. The loan can be converted into new Ordinary Shares in

the Company at any time at a conversion price of 38p and the

conversion can be requested by Kestrel Partners at any time. The

Company has the right to request conversion eighteen months

following the date of the agreement, 15 September 2020, subject to

certain conditions regarding the Company's share price at that

time.

-- GBP0.2m (US$0.3m) Payback Protection Program ("PPP") loan, a

US government backed loan, owed to the Group's US banker, Silicon

Valley Bank ("SVB"). The proceeds of the PPP loan are to be used to

cover specific US based payroll costs under the rules of the

scheme. The PPP forgivable loan is deemed to be an income-related

government grant, as the Company is reasonably assured that it will

comply with the loan forgiveness conditions associated with the PPP

loan. The PPP loan was initially recognised as a deferred income

liability on the statement of financial position and will remain as

such until the loan is forgiven by the Small Business

Administration in the United States. Grant income related to the

payroll costs is being recognised as other income of GBP0.1m.

-- GBP0.8m (US$1.1m) discounted (GBP1.1m (US$1.6m) undiscounted)

contingent consideration for earn out payments for the acquisition

of Object+. The contingent consideration can be satisfied in either

cash or Company ordinary shares at the Company's discretion.

-- GBP0.9m for the right of use assets relating to all future

payments of leased-office rentals under IFRS16 'Leases', of which

GBP0.4m will be paid within twelve months with the balance for

periods greater than one year.

-- GBP1.3m of deferred revenue; contracted and paid services

that will be released within one year.

Principal risks and uncertainties

The principal risks and uncertainties facing the Group remain

broadly consistent with the Principal Risks and Uncertainties

reported in the Group's 31 December 2020 Annual Report. Since the

2020 Annual Report, the impact of the COVID-19 pandemic on the

business continues to be monitored by the Board.

Kim Suter

CFO

31 August 2021

Interim consolidated statement of comprehensive loss

for the six months ended 30 June 2021

Note 6 months 6 months

to to

30 June 30 June

2021 2020

(unaudited) (unaudited)

GBP'000 GBP'000

Revenue 4 2,153 2,324

Cost of sales (334) (211)

Gross profit 1,819 2,113

Other income 112 -

Administrative expenses (3,488) (3,155)

------------- -------------

Operating loss before interest, taxation,

depreciation, amortisation, share based

payment and exceptional items ("Adjusted

EBITDA") (325) (319)

Depreciation and amortisation (823) (896)

Impairment of intangible assets - (74)

Profit on disposal of tangible assets 8 -

Acquisition and debt expenses - (115)

Unrealised foreign exchange (loss)/gain (147) 413

Gain on extinguishment of debt - 745

Group restructuring costs (2) (422)

Share-based payment expense (268) (374)

------------- -------------

Operating loss (1,557) (1,042)

------------------------------------------------- ----- --- ------------- --- -------------

Net finance charge (171) (152)

Loss before taxation (1,728) (1,194)

Taxation credit/(charge) 47 (31)

Loss for the period (1,681) (1,225)

Other comprehensive income

Exchange (loss)/gain on translating

foreign operations (40) 54

------------- -------------

Total comprehensive loss for the period (1,721) (1,171)

============= =============

Loss for the period attributable to:

Owners of the parent (1,681) (1,311)

Non-controlling interest - 86

------------- -------------

(1,681) (1,225)

============= =============

Total comprehensive loss for the period

attributable to:

Owners of the parent (1,721) (1,257)

Non-controlling interest - 86

------------- -------------

(1,721) (1,171)

============= =============

Earnings per share for loss for the

period attributable to the owners of

the parent during the period

Basic and diluted earnings per share

(pence) 5 (0.06) (0.06)

All amounts relate to continuing activities.

Interim consolidated statement of financial position

at 30 June 2021

30 June 31 December

2021 2020

(unaudited) (audited)

GBP'000 GBP'000

Assets

Non-current assets

Goodwill 4,821 4,937

Other intangible assets 2,851 3,065

Property, plant and equipment 93 136

Right of use assets 829 1,041

------------- ------------

8,594 9,179

Current assets

Trade and other receivables 717 1,434

Cash and cash equivalents 1,376 1,974

------------- ------------

2,093 3.408

Total assets 10,687 12,587

Current liabilities

Trade and other payables 2,260 2,539

Lease liabilities 396 456

Loans and borrowings 97 97

Derivative financial liability 45 45

------------- ------------

2,798 3,137

------------- ------------

Net current (liabilities)/assets (705) 271

Non-current liabilities

Trade and other payables 837 882

Lease liabilities 454 549

Loans and borrowings 2,664 2,664

Deferred tax liability 348 405

------------- ------------

4,303 4,500

Total liabilities 7,101 7,637

Net Assets 3,586 4,950

============= ============

Equity

Share capital 2,675 2,672

Share premium reserve 16,682 16,676

Merger reserve (190) (190)

Convertible debt reserve 224 224

Foreign exchange reserve 148 108

Share-based payment reserve 2,831 2,563

Retained losses (18,784) (17,103)

--------- ---------

Total equity 3,586 4,950

========= =========

Interim consolidated statement of cash flows

for the six months ended 30 June 2021

6 months 6 months

to to

30 June 2021 30 June 2020

(unaudited) (unaudited)

GBP'000 GBP'000

Cash flows from operating activities

Loss for the period (1,681) (1,225)

Adjustments for:

Deferred tax charge/(credit) (47) 31

Net finance charge 171 152

Depreciation and amortisation 823 896

Impairment - 74

Profit on disposal of tangible assets (8) -

Gain on extinguishment of debt - (745)

Unrealised foreign exchange loss 147 -

Share-based payment expense 268 374

Bad debt provision 146 -

Grant income related to COVID-19* (76) -

-------------- --------------

(257) (443)

Decrease/(increase) in trade and

other receivables 717 (215)

(Decrease)/increase in trade and

other payables (569) 59

-------------- --------------

148 (156)

Net cash outflows from operating

activities (109) (599)

============== ==============

Cash flows from investing activities

Purchases of intangible assets (402) (511)

Purchases of property, plant and (6) -

equipment

-------------- --------------

Net cash used in investing activities (408) (511)

============== ==============

Financing activities

Proceeds from issue of shares (net) 9 1,280

Lease payments principal (109) (264)

Lease payments interest (25) (47)

Loans and borrowings receipts* 186 -

Loans and borrowings repayments (142) (153)

-------------- --------------

Net cash (used in)/from financing

activities (81) 816

============== ==============

Net cash decrease in cash and cash

equivalents (598) (294)

Cash and cash equivalent at beginning

of the period 1,974 1,076

Cash and cash equivalent at end of

the period 1,376 782

============== ==============

* PPP US funding

Notes to the interim financial information

1. General information

KRM22 Plc (the "Company") is a public limited company

incorporated in England and Wales on 2 March 2018 under

registration number 11231735. The address of its registered office

is 5 Ireland Yard, London, EC4V 5EH. The Company listed on the

London Stock Exchange on 30 April 2018.

The principal activity the Company and together with its

subsidiaries (the "Group") is to develop and invest in leading risk

tools to support regulatory, market, technology and operational

risks.

The Board of Directors approved this interim report on 31 August

2021.

2. Basis of preparation and consolidation

These interim consolidated financial statements have been

prepared using accounting policies based on International Financial

Reporting Standards (IFRS and IFRIC Interpretations) issued by the

International Accounting Standards Board ("IASB") in conformity

with the requirements of the Companies Act 2006. They do not

include all disclosures that would otherwise be required in a

complete set of financial statements and should be read in

conjunction with the 31 December 2020 Annual Report. The financial

information for the half years ended 30 June 2021 and 30 June 2020

does not constitute statutory accounts within the meaning of

Section 434 (3) of the Companies Act 2006 and both periods are

unaudited.

The annual financial statements of KRM 22 Plc (the "Group") are

prepared in accordance with IFRS. The statutory Annual Report and

Financial Statements for 2020 have been filed with the Registrar of

Companies. The Independent Auditors' Report on the Annual Report

and Financial Statements for the year ended 31 December 2020 was

unqualified, did draw attention to a matter by way of emphasis,

being going concern and did not contain a statement under 498(2) or

498(3) of the Companies Act 2006.

The Group has applied the same accounting policies and methods

of computation in its interim consolidated financial statements as

in its 31 December 2020 annual financial statements, except for

those that relate to new standards and interpretations effective

for the first time for periods beginning on (or after) 1 January

2021 and will be adopted in the 2021 financial statements. There

are deemed to be no new and amended standards and/or

interpretations that will apply for the first time in the next

annual financial statements that are expected to have a material

impact on the Group.

3. Going concern

In carrying out the going concern assessment, the Directors have

considered a range of scenarios in relation to revenue and cash

forecasts for the next twelve months including, but not limited to,

existing customer churn at different churn rates, no new contracted

sales revenue, delayed sales, cost reductions and a combination of

these different scenarios.

Having assessed the sensitivity analysis on cashflows, the key

risks to KRM22 remaining a going concern without implementing

extensive cost reduction measures is, existing customers paying on

payment terms and within 45 days of invoice, customer churn of up

to 10%, conversion of some of the sales opportunities that are

currently at contract negotiation stage and maintaining control of

the cost base.

If the forecasts are achieved, KRM22 will be able to operate

within its existing facilities. However, the time to close new

customers and the value of each customer, which are deemed

individually as high value and low volume, is key. As such, there

is a risk that Group's working capital may prove insufficient to

cover both operating activities and the repayment of its debt

facility. In such circumstances, KRM22 would be obliged to seek

additional funding, through a placement of shares or other source

of funding. There is no certainty that such funds could be raised.

In addition, delayed sales and/or increased existing customer churn

could result in the Company failing to comply with financial

covenants associated with the Convertible Loan and in this

circumstance KRM22 would be obliged to seek resolution with Kestrel

Partners on these financial covenants.

The Directors have concluded that the circumstances set forth

above represent a material uncertainty, which may cast significant

doubt about the Group's ability to continue as a going concern.

However the Directors expect to be able to raise funds through a

placement of shares or other source of funding and believe that

taken as a whole, the factors described above enable the Group to

continue as a going concern for the foreseeable future. The interim

financial statements do not include the adjustments that would be

required if the Group were unable to continue as a going

concern.

4. Revenue (and segmental reporting)

The Board of Directors, as the chief operating decision maker in

accordance with IFRS 8 Operating Segments, has determined that

KRM22 has identified five risk domains as operating segments,

however for reporting purposes into a single global business

segment, as the nature of services delivered are common.

The Directors consider that the business has five risk domains:

Enterprise, Compliance, Market, Operations and Technology. Within

these five risk domains, there are three revenue streams with

different characteristics, which are generated from the same assets

and cost base.

6 months 6 months

to to

30 June 2021 30 June

2020

(unaudited) (unaudited)

GBP'000 GBP'000

Recurring 2,029 2,186

Non-recurring revenue 124 113

Other revenue - 25

-------------- --------------

Total 2,153 2,324

============== ==============

KRM22's revenue from external customers by geography and risk

domain is detailed below:

6 months 6 months

to to

30 June 2021 30 June

2020

(unaudited) (unaudited)

GBP'000 GBP'000

UK 583 246

Europe 445 404

USA 937 1,383

Rest of world 188 291

-------------- --------------

Total 2,153 2,324

============== ==============

6 months 6 months

to to

30 June 2021 30 June

2020

(unaudited) (unaudited)

GBP'000 GBP'000

Enterprise 190 201

Compliance 1,023 850

Market 940 1,220

Other - 53

-------------- --------------

Total 2,153 2,324

============== ==============

5. Loss per share

Basic earnings per share is calculated by dividing the loss

attributable to the equity holders of KRM22 by the weighted average

number of shares in issue during the period.

KRM22 has dilutive ordinary shares, this being warrants and

options granted to employees. As KRM22 has incurred a loss in both

periods, the diluted loss per share is the same as the basic

earnings per share as the loss has an anti-dilutive effect.

6 months 6 months

to to

30 June 2021 30 June

2020

(unaudited) (unaudited)

GBP'000 GBP'000

Loss for the period attributable to equity

shareholders of the parent (1,681) (1,311)

Basic weighted average number of shares in

issue 26,731,309 22,083,693

Diluted weighted average number of shares

in issue 37,313,776 30,237,213

Basic and diluted loss per share (pence) (0.06) (0.06)

6. Intangibles

The Group capitalised GBP0.4m of costs (H1 2020: GBP0.5m, FY

2020: GBP1.0m) representing the development of KRM22's products

during the period, resulting in a net book value of GBP1.3m (H1

2020: GBP1.1m, FY 2020: GBP1.3m) after an amortisation and

impairment charge of GBP0.3m (H1 2020: GBP0.2m, FY 2020:

GBP0.5m).

7. Cautionary statement

This document contains certain forward-looking statements

relating to KRM22 plc (the "Group"). The Group considers any

statements that are not historical facts as "forward-looking

statements". They relate to events and trends that are subject to

risk and uncertainty that may cause actual results and the

financial performance of the Group to differ materially from those

contained in any forward-looking statement. These statements are

made by the Directors in good faith based on information available

to them and such statements should be treated with caution due to

the inherent uncertainties, including both economic and business

risk factors, underlying any such forward-looking information.

Copies of this report and all other announcements made by KRM22

plc are available on the Company's website at

https://www.krm22.com/investor-relations/home

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR LFLLXFVLBBBQ

(END) Dow Jones Newswires

September 01, 2021 02:00 ET (06:00 GMT)

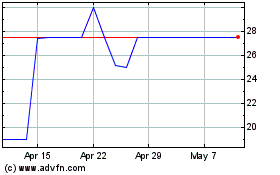

Krm22 (LSE:KRM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Krm22 (LSE:KRM)

Historical Stock Chart

From Apr 2023 to Apr 2024