TIDMKRPZ

RNS Number : 2642N

Kropz PLC

29 September 2021

The information contained within this announcement is deemed to

constitute inside information as stipulated under the retained EU

law version of the Market Abuse Regulation (EU) No. 596/2014 (the

"UK MAR") which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018. The information is disclosed in accordance

with the Company's obligations under Article 17 of the UK MAR. Upon

the publication of this announcement, this inside information is

now considered to be in the public domain.

29 September 2021

Kropz Plc

("Kropz" or the "Company")

New Convertible Facility Agreement

and

General Meeting Notice

Kropz Plc (AIM: KRPZ), an emerging African phosphate explorer

and developer, announces it has entered into a new conditional

convertible equity facility of up to ZAR 200 million ("New ZAR

Equity Facility"), with ARC Fund ("ARC"), the Company's major

shareholder, in order to deliver the Company's Elandsfontein

phosphate project to first revenue.

The New ZAR Equity Facility is in addition to the US$ 5 million

facility which ARC and the Company entered into in February 2021

("Existing US$ 5 million Equity Facility"). US$ 600,000 remains

undrawn on the Existing US$ 5 million Equity Facility.

As previously announced, a funding shortfall of approximately

US$ 8.5 million (approximately ZAR 127 million) was expected in

respect of the commissioning and ramp-up of Elandsfontein in Q4

2021 and Q1 2022, before first revenue from the sales of

Elandsfontein rock is expected in mid-Q1 2022. Kropz had secured a

convertible loan facility of up to US$ 40 million (not exceeding a

maximum of ZAR 680 million) from ARC ("Original Equity Facility")

in June 2020, to be used exclusively for the development of

Elandsfontein. At the time of concluding the Original Equity

Facility, the exchange rate was well above ZAR 17 / US$ and budgets

and cashflows were calculated based on that ZAR exchange rate. Due

to the strengthening of the ZAR to the US$ since mid-2020, ZAR

drawdown receipts in South Africa were well below the ZAR 680

million anticipated at the time of concluding the Original Equity

Facility. In addition, interest receipts on surplus cash invested

generated less than expected interest receipts due to lower

interest rates as a result of the COVID-19 pandemic and factoring

in delays to commissioning in late Q4 2021 and to subsequent first

ore sales, have led to the anticipated shortfall.

New ZAR Equity Facility Highlights

-- The New ZAR Equity Facility comprises a total commitment of

up to ZAR 200 million provided by ARC, which can be drawn down at

the discretion of Kropz, as follows:

o ZAR 127 million from the date that all the conditions to the

New ZAR Equity Facility have been met (the "Effective Date") and up

to 30 April 2022; and

o ZAR 73 million from the date as determined by ARC, and at its

discretion, but no earlier than the Effective Date and until a

further date as determined by ARC;

-- At any time during the term of the New ZAR Equity Facility,

repayment of the New ZAR Equity Facility capital amount will, at

the election of ARC, either be:

o In the form of the conversion into ordinary shares of 0.1

pence ea ch ("Ordinary Shares") in the Company and issued to ARC,

at a conversion price of 4.5058 pence per Ordinary Share each,

representing the 30-day Volume Weighted Average Price ("VWAP") on

21 September 2021, and at fixed exchange rate of GBP 1 = ZAR 20.24

("Conversion") ; or

o Payable in cash by the Company;

-- The first drawdown is expected on 25 October 2021;

-- Following a Conversion, the Company will apply for the newly

issued Ordinary Shares in the capital of the Company to be admitted

to trading on AIM;

-- The New ZAR Equity Facility will bear interest at 14 per

cent. per annum and will be compounded monthly ("Interest").

Interest will be payable in cash to ARC by the Company;

-- The term of the New ZAR Equity Facility will be from the Effective Date, to the earlier of:

o 5 years from the Effective Date; or

o One year after the term loan facility provided by BNP Paribas

to Kropz Elandsfontein (Pty) Ltd (in the amount not exceeding US$

30 million), has been repaid;

-- The New ZAR Equity Facility will be secured by the shares

which Kropz holds in Cominco Resources Ltd ("Share Charge"). The

New ZAR Equity Facility is conditional on entering into the Share

Charge, which will be entered into before the General Meeting;

and

-- The New ZAR Equity Facility will be conditional on:

o approval from the South African Reserve Bank ("SARB"). The

SARB application was lodged on 27 September 2021 and the approval,

once received, will be announced via the Regulatory News Service

("RNS"); and

o shareholder approval .

Notice of General Meeting and Irrevocable Undertakings

The New Equity Facility is above the authorisation limits given

at the last Annual General Meeting in June 2021 and is conditional

on shareholder approval which is being sought from the Company's

shareholders at a General Meeting to be held in London at 11:30 on

15 October 2021 at the offices of Memery Crystal, 165 Fleet Street,

London, EC4A 2DY ("General Meeting") .

The Company is proposing at the General Meeting, resolutions to

give the Company's directors authority to issue and allot, on a

non-pre-emptive basis, shares in the Company to meet the full

demand under the New ZAR Equity Facility (these are in addition to

the authorities granted at the previous Annual General

Meeting).

Shareholders may attend the General Meeting to vote, or they may

appoint a proxy or vote online by following the instructions set

out in the Notice of General Meeting attached to this announcement.

Proxy votes must be received no later than 11:30 on 13 October

2021.

A copy of the Notice of General Meeting and this announcement is

being posted to shareholders today and will shortly be available

for the purposes of AIM Rule 26 on the Company's website at

www.kropz.com/investors/publications.

The Company has received irrevocable undertakings from the

directors in respect of their holdings of 0.05 per cent. of the

Company's issued share capital and from shareholders holding 83.53

per cent. of the Company's issued share capital to vote in favour

of the resolutions proposed.

Related Party Transaction

The New ZAR Equity Facility is a related party transaction

("Transaction") pursuant to Rule 13 of the AIM Rules. Machiel

Reyneke is a director of the Company and the representative of ARC.

Further, as noted below, ARC and Kropz International are treated as

acting in concert for the purposes of the City Code on Takeovers

and Mergers (the "Code") and have individual and aggregate

interests in the Ordinary Shares as set out above. Mike Nunn, a

director of the Company, is the beneficial owner of Kropz

International. Accordingly, Mr Reyneke and Mr Nunn have not been

involved in the approval of the Transaction by the Company's

board.

The directors of the Company who are considered independent for

the purposes of the Transaction (being the directors excluding Mr

Reyneke and Mr Nunn), having consulted with the Company's Nominated

Adviser, consider the terms of the Transaction to be fair and

reasonable insofar as the Company's shareholders are concerned.

Draw Down

As noted above, the Company will be making the first draw down

request under the New ZAR Equity Facility on or around 25 October

2021.

The next draw down under the Existing US$ 5 million Equity

Facility is expected to be made on or about 10 December 2021.

Further details of these drawdowns will be made in separate

announcements in due course.

Concert Parties and Impact on Shareholdings

As noted in the Company's AIM admission document, ARC and Kropz

International are treated as acting in concert for the purposes of

the Code and have individual and aggregate interests in the

Ordinary Shares as set out in the table below. It is noted that,

both before and after the closing of the Existing US$ 5 million and

the New Equity Facilities, on an aggregate basis, ARC and Kropz

International hold and will continue to hold more than 50 per cent.

of the Ordinary Shares and voting rights in the Company. On a

standalone basis ARC, through its option with Kropz International,

currently has a fully diluted interest of 86.6 per cent. of the

Company (see footnote 3 below).

Maximum Interests in Ordinary Shares (1)

Maximum no.

of further

shares to

be issued Maximum shareholdings

pursuant to following

Existing US$ Existing US$

5 million 5 million

Existing and New ZAR and New ZAR

ordinary Equity Facilities Equity Facilities

shares (1) (1)

No. % No. No. %

--------------------- ------------ ---- ------------------- ---------------------- ----

ARC (2) 753,944,010 83.5 229,728,125 983,672,135 86.9

Kropz International

S.a.r.l (2)(3) 54,933,474 6.1 0 54,933,474 4.8

Concert Party 808,877,484 89.6 229,728,125 1,038,605,609 91.7

(1) Assumes for illustrative purposes that the Existing US$ 5

million Equity Facility and New ZAR Equity Facility is fully drawn

and that all capital under the New ZAR Equity Facility is converted

into equity.

(2) ARC and Kropz International are deemed to be acting in

concert as defined in the Code.

(3) Kropz International and ARC have entered into an arrangement

pursuant to which Kropz International has granted to ARC a call

option over 50 per cent. of its shareholding. The call option over

Kropz International's Ordinary Shares can be exercised by ARC if

the value of ARC's shareholding on the third anniversary of

Admission is 20 per cent. lower than its value on IPO on 30

November 2018. The call option has an alternative settlement of

cash or assets, if the transfer of the Ordinary Shares would

require the transferee to make a Rule 9 offer for the Company

pursuant to the City Code.

(4) Mike Nunn, a director of Kropz, holds his beneficial

interest in Kropz through Kropz International.

(5) Exchange rates used are fixed at GBP 1 = ZAR20.24 for the

New ZAR Equity Facility and US$ 1 = GBP 0.73 for the Existing US$ 5

million Equity Facility.

For further information visit www.kropz.com or contact:

Kropz Plc

+27 (0) 79

Mark Summers (CEO) 744 8708

Grant Thornton UK LLP Nominated Adviser

Samantha Harrison

Harrison Clarke +44 (0) 20

George Grainger 7383 5100

Hannam & Partners Broker

Andrew Chubb +44 (0) 20

Ernest Bell 7907 8500

Tavistock Financial PR

& IR (UK)

Nick Elwes +44 (0) 207

Jos Simson 920 3150

Oliver Lamb kropz@tavistock.co.uk

R&A Strategic Communications PR (South Africa)

James Duncan +27 (0) 11

880 3924

james@rasc.co.za

About Kropz Plc

Kropz is an emerging African explorer and developer of plant

nutrient feed minerals with phosphate projects in South Africa and

in the Republic of Congo. The vision of the Group is to become a

leading independent phosphate rock producer and to develop into an

integrated, mine-to-market plant nutrient company focusing on

sub-Saharan Africa.

-ENDS-

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCGZGZLDRDGMZM

(END) Dow Jones Newswires

September 29, 2021 02:00 ET (06:00 GMT)

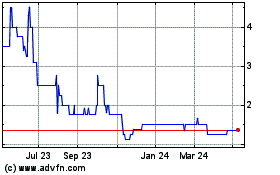

Kropz (LSE:KRPZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

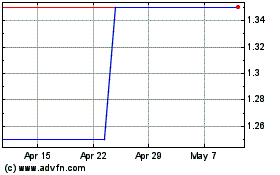

Kropz (LSE:KRPZ)

Historical Stock Chart

From Apr 2023 to Apr 2024