TIDMKRS

RNS Number : 9220C

Keras Resources PLC

24 June 2021

24 June 2021

Keras Resources plc ('Keras' or the 'Company')

Interim Results

Keras Resources plc (AIM: KRS) announces its interim results for

the six months ended 31 March 2021.

Highlights

Utah - Diamond Creek Phosphate Mine ("Diamond Creek") - one of

the highest grade organic phosphate mines in the US, a fully

integrated mine to market asset

-- Diamond Creek milling plant currently being commissioned will

produce premium organic phosphate products for sale into the North

American organic fertiliser market

-- Milling plant enables in-house production which will reduce operating costs

-- 2020 mining season completed during October 2020 exceeding

management's targets for stockpiling of feed material for the new

milling plant

-- 2021 mining season to begin during July 2021

-- Marketing campaign will now be expanded to take into account

additional sized products and increased capacity from the new

processing plant - sales targets remain achievable and further

guidance to be provided on 2021/2 schedule

-- Granulator plant being shipped to the Spanish Fork processing

site will further bolster our in-house beneficiation capacity and

product range to include sized granulated organic fertiliser

products

-- 51% controlling interest secured in Diamond Creek with

payment of the final tranche of the agreed US$2.5m loan to Falcon

Isle Resources in December 2020

Togo - Nay éga Manganese Project, production ready on receipt of

the exploitation permit

-- Appointment of Mr Blaise Gozan as Country Manager who brings

a range of international project management experience to bolster

Keras's in-country presence

-- Continuing to engage with Togolese authorities regarding the

permitting of the Nayéga manganese project

Financial

-- Successfully raised GBP550,000 and GBP1,000,000 (before

expenses) in December 2020 and January 2021 respectively through

new and existing investors - both placings were subscribed to and

supported by the Directors

Russell Lamming, Keras Resources CEO commented, "Considerable

progress has been made at our integrated Diamond Creek phosphate

operation during the period. With the new milling plant constructed

and commissioning underway we are now in a position to ramp up the

marketing campaign for our premium organic phosphate products for

sale into the North American fertiliser market. Having our own

plant allows us to increase the amount of saleable product due to

increased plant capacity and better control on the product split.

This will be further accentuated with the construction of a

downstream granulator plant which has been delayed due to the

ongoing worldwide shipping container imbalance.

"We have one of the highest-grade organic phosphate mines in the

US producing six different fully certified organic products. Our

job now, in addition to mining and processing, is to create and

cultivate our place in the burgeoning US organic phosphate industry

and build our market share turning our initial customers into

long-term sales partners. We can adapt our premium, higher-grade

phosphate resources to deliver customised products for the specific

needs of local soil, climate, and crops with the ultimate aim of

generating higher crop yields for our customers.

"As noted, we are making significant in-roads in this respect,

with 21 customers already on our books, however unlike selling

direct into an established bulk commodity marketplace, building

market share in the organic phosphate/fertiliser arena will take

time. That said with our premium product already gaining traction

we remain confident that this will be achieved.

"In Togo, we are delighted to welcome Blaise Gozan as Togo

Country Manager. Blaise joins from Rio Tinto and will play a

pivotal role in the progression of our manganese project in the

country. As previously noted, we look forward to updating

shareholders on the progress of the Exploitation Permit approval

process.

"Finally, despite the many challenges experienced during the

period, due to the ongoing Covid pandemic, travel restrictions and

the knock-on effects this has had, when I look at our portfolio of

assets, I remain more excited than ever for the future of Keras and

would like to thank the team for their commitment and dedicated

work, and our shareholders for their continued support."

The information contained within this Announcement is deemed by

the Company to constitute inside information as stipulated under

Article 7 of the Market Abuse Regulation (EU) No. 596/2014 (as

amended) as it forms part of the domestic law of the United Kingdom

by virtue of the European Union (Withdrawal) Act 2018 (as amended).

Upon the publication of this Announcement via the Regulatory

Information Service, this inside information is now considered to

be in the public domain.

For further information please visit www.kerasplc.com , follow

us on Twitter @kerasplc or contact the following:

Russell Lamming Keras Resources plc annabel @kerasplc.com

Annabel Redford

Nominated Adviser & Joint SP Angel Corporate Finance

Broker LLP

Ewan Leggat / Charlie Bouverat +44 (0) 20 3470 0470

Joint Broker Shard Capital Partners

Damon Heath / Erik Woolgar LLP +44 (0) 207 186 9900

CHAIRMAN'S REVIEW

FOR THE SIX MONTHSED 31 MARCH 2021

I am pleased to report on our activities over the past six

months. The team in Utah has worked very hard on the installation

of the milling plant for the Diamond Creek mine. This had its

challenges but it is great to see the plant being commissioned. We

now have the in-house capacity to produce a range of high quality

products that we can tailor for customers and will now process the

remainder of the run-of-mine ore from our 2020 mining season. The

plant will also reduce our operating costs as no third-party

tolling will be required going forward. Work will now focus on

ensuring full road access and maintenance is complete so that we

can commence our 2021 mining schedule. Production from our mining

season is expected to commence in July and will run through to

October.

Management has also continued to engage with the Togolese

Authorities on the final permitting for the Nay é ga manganese

project in Togo and we are very pleased to welcome Blaise Gozan,

previously employed by Rio Tinto in Canada, as Country Manager who

further bolsters our presence and expertise in country and will

continue to progress discussions on our behalf.

Diamond Creek Phosphate Mine (Diamond Creek) - Utah, US

Diamond Creek is a fully permitted, high grade organic phosphate

mine and Keras now holds a 51% controlling interest having paid the

final tranche of a US$2.5m loan to Falcon Isle Resources, the owner

of the Diamond Creek mine, at the end of December 2020. Work

throughout the period at Diamond Creek focussed on the installation

of the milling plant at Spanish Fork, Utah, which is being

commissioned during June 2021, and provides the in-house capacity

to beneficiate products on site and sell a range of premium organic

phosphates directly into the high demand US fertiliser markets.

This capacity will be further enhanced once the granulator plant is

brought online. Delivery had been delayed due to shipping container

constraints but this is now en route to site and will be

commissioned later this year . The 2020 mining campaign - when we

can carry out our physical mining activities and produce our target

run-of-mine tonnages for the year - was completed in October 2020

with a total of 7,620 ore tons extracted. As previously announced,

we plan to mine 10,000 tons during the 2021 mining season

commencing during July 2021 - to ensure that sufficient material is

available for planned sales, while maintaining the phased increase

to the Year 5 target of 48,000 tons of commercial production.

Sales from the 2020 mining campaign up to 31 March 2021 were

1,297 tons, and the year-to-date total sales are 2,483 tons, at an

average sales price of $267 per ton, representing approximately 50%

of forecast sales to 31 December 2021. To date we have sold six

different products in both 1 ton and 50lb bags to 21 different

customers with several repeat orders, all produced through toll

treating agreements. The majority of the orders have been for

testwork to benchmark our products against their current producers

and with the recent commissioning of our milling plant in Spanish

Fork we can now not only guarantee high grade products in North

America but can also guarantee tonnages.

Falcon Isle Resources only became a Keras subsidiary on 31

December 2020, as such only the Q1 2021 sales (241 tons) are

reported as Revenue in the Income Statement.

With the milling plant now in production, sales of our #100 and

#350 mesh product will be our key focus as we increase our

production and are now able to deliver products on demand. We

expect our granulated products to be available for sale in the

first quarter of 2022 to meet the new season's demand. Further

improvements to the plant are envisaged in order to widen our

product range, and the Company has ample funds in hand to finance

its 51% share of the cost.

Nay é ga Manganese Project - Togo

Management remains in close communication with the Togolese

Ministry of Mines & Energy on the Exploitation Permit for the

Nay é ga Manganese Project and whilst this remains pending, we are

very pleased to announce the appointment of Blaise Gozan as Togo

Country Manager for Keras Resources Plc. Blaise is a Togolese

national, and he joins the Company from Rio Tinto in Canada

bringing a wealth of experience in mining and project management to

this role. We look forward to updating shareholders on the

Exploitation Permit when we have additional information to

share.

Financial Review

The current financial period for Keras has been extended to 15

months and will end on 31 December 2021, enabling the accounts of

all subsidiaries to terminate on the same date. As a result, Keras

will publish a second interim statement for the six months ending

30 September 2021.

The loss for the six months to 31 March 2021 was GBP506,000

compared with GBP809,000 for the comparable period in 2020. As

explained above there was no material revenue in the period, but

increasing sales are expected to be reflected in the next interim

statement to 30 September 2021.

Management was very pleased to complete two placings during the

period through to the end of March 2021. These funds have in part

been utilised to fund Falcon Isle Resources working capital

requirements, and to finance our 51% of the plant expansion in

Utah. In addition, they have allowed us to bolster our management

team and to provide additional working capital. Our Directors all

supported these placings, and we welcomed a number of new holders

to our register.

Focus on Sustainability

We are aware of our responsibility as an employer and a mining

company and we are committed to upholding best practice across our

business. We care about all our stakeholders and are focused on

looking to create value and benefits for all whilst seeking to

manage and mitigate the potential impacts that our operations may

have. Our assets are diverse in commodity and location but have

important similarities - mining essential resources that can

contribute to a more sustainable future, running simple operations

with minimal processing requirements and looking to maintain a low

carbon footprint. We are focused on meeting our commitments across

the ESG space and will continue to be proactive in this area as we

look to develop and sustain a positive legacy.

Looking Forward

There was a range of challenges experienced during the period,

notably the ongoing travel and quarantine restrictions due to the

Covid pandemic which limited interactions between the business

units and stopped key consultants and original equipment

manufacturers from travelling and the knock-on effects resulting in

the global imbalance of shipping containers, but we look forward to

the coming months. Mining will be underway in Utah soon and we will

continue to process and sell premium organic phosphate from Diamond

Creek whilst we also pursue the Exploitation Permit in Togo. Whilst

securing the final grant has continued to take time, we remain

confident in the process and continue to work hard to look to

unlock this.

Finally, I would like to take this opportunity to thank the rest

of the board and management for their ongoing hard work and

shareholders for their continuing support.

Brian Moritz

Chairman

23 June 2021

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 31 MARCH 2021

31-Mar-21 31-Mar-20 30-Sep-20

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Continuing operations

Revenue 31 - -

Cost of production (74) - -

Gross loss (43) - -

Administrative and exploration

expenses (517) (810) (1,235)

Loss from operating activities (560) (810) (1,235)

Finance income - 1 -

Finance

costs - - (3)

Net finance costs - 1 (3)

Share of net loss of associate

accounted for using the

equity method - (4)

Loss before taxation (560) (809) (1,242)

Taxation - - -

------------- ------------- ------------

Loss for the period (560) (809) (1,242)

------------- ------------- ------------

Other comprehensive income - items that

may be subsequently reclassified to profit

or loss

Exchange translation on foreign operations (47) (3) (15)

Change in fair value of available for - - -

sale financial assets

Items that will not be reclassified to

profit or loss

Change in fair value of equity investments

at fair value through other comprehensive - - -

income

------------- ------------- ------------

Total comprehensive (loss) for

the period (607) (812) (1,257)

============= ============= ============

(Loss)/profit attributable

to:

Owners of the Company (497) (753) (1,181)

Non-controlling interests (63) (56) (61)

------------- ------------- ------------

(Loss)/profit for the period (560) (809) (1,242)

============= ============= ============

Total comprehensive income/(loss)

attributable to:

Owners of the Company (556) (756) (1,194)

Non-controlling interests (51) (56) (63)

------------- ------------- ------------

Total comprehensive loss

for the period (607) (812) (1,257)

============= ============= ============

Earnings per share - continuing operations

Basic and diluted (loss)/earnings

per share (pence) (0.017) (0.029) (0.040)

============= ============= ============

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT 31

MARCH 2021

31-Mar-21 31-Mar-20 30-Sep-20

(unaudited) (unaudited) (audited)

Notes GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Intangible assets 7 3,637 1,066 1,069

Property, plant and equipment 8 493 274 263

Investments accounted for

using the equity method 9 - - 1,622

4,130 1,340 2,954

------------- ------------- -----------

Current assets

Inventory 10 135 - -

Other investments 11 - - -

Trade and other receivables 12 391 36 83

Cash and cash equivalents 886 87 438

------------- ------------- -----------

1,412 123 521

------------- ------------- -----------

Total assets 5,542 1,463 3,475

============= ============= ===========

Equity

Equity attributable to owners of

the Company

Share capital 13 629 279 487

Share premium 13 4,027 419 2,637

Other reserves 68 - 16

Retained deficit (590) 428 8

------------- ------------- -----------

4,134 1,126 3,148

Non-controlling interests 934 (132) (140)

------------- ------------- -----------

Total equity 5,068 994 3,008

------------- ------------- -----------

Liabilities

Current liabilities

Trade and other payables 14 474 469 467

474 469 467

------------- ------------- -----------

Total liabilities 474 469 467

------------- ------------- -----------

Total equity and liabilities 5,542 1,463 3,475

============= ============= ===========

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 31 MARCH 2020

Total attributable to owners of the Company

Share

option/ Financial Retained Non-controlling

Share Share warrant Exchange assets earnings/ interests Total

capital premium reserve reserve at FVOCI (deficit) Total GBP'000 equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

October 2019

(audited) 7,266 10,938 - (33) 3,459 (10,310) 11,320 (76) 11,244

Loss for the

period - - - - - (753) (753) (56) (809)

Other

comprehensive

income - - - 3 - (6) (3) - (3)

--------- --------- -------- ---------- ----------- ----------- ---------- ----------------- ---------

Total

comprehensive

loss

for the period - - 3 - (759) (756) (56) (812)

Capital

reduction (7,023) (10,938) - - (3,459) 11,497 (9,923) - (9,923)

Issue of

ordinary

shares 36 429 - - - - 465 - 465

Issue costs - (10) - - - - (10) - (10)

Share based

payment

transactions - - 30 - - - 30 - 30

(6,987) (10,519) 30 - (3,459) 11,497 (9,438) - (9,438)

Balance at 31

March 2020

(unaudited) 279 419 30 (30) - 428 1,126 (132) 994

========= ========= ======== ========== =========== =========== ========== ================= =========

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

(CONTINUED) FOR THE SIX MONTHSED 30 SEPTEMBER

2020

Total attributable to owners of

the

Company

Share

option/ Financial Non-controlling

Share Share warrant Exchange assets Retained interests Total

capital premium reserve reserve at FVOCI earnings Total GBP'000 equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

April 2020

(unaudited) 279 419 30 (30) - 428 1,126 (132) 994

Loss for the

period - - - - - (428) (428) (5) (433)

Other

comprehensive

income - - - (19) - 10 (9) (3) (12)

--------- --------- -------- ----------- ----------- ---------- ---------- ----------------- ---------

Total

comprehensive

income for the

period - - - (19) - (418) (437) (8) (445)

Issue of

ordinary

shares 208 2,289 - - - - 2,497 - 2,497

Share based

payment

transactions - - 33 - - - 33 - 33

Issue costs - (71) - - - - (71) (71)

Transfer - - - 2 - (2) - - -

--------- --------- -------- ----------- ----------- ---------- ---------- ----------------- ---------

208 2,218 33 2 - (2) 2,459 - 2,459

Balance at 30

September

2020 (audited) 487 2,637 63 (47) - 8 3,148 (140) 3,008

========= ========= ======== =========== =========== ========== ========== ================= =========

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

(CONTINUED) FOR THE SIX MONTHSED 31 MARCH 2021

Total attributable to owners of the

Company

Share

option/ Financial Non-

Share Share warrant Exchange assets Retained controlling Total

capital premium reserve reserve at FVOCI earnings Total interests equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 October

2020 (audited) 487 2,637 63 (47) - 8 3,148 (140) 3,008

Loss for the period - - - - - (497) (497) (63) (560)

Total other comprehensive

income - - - 42 - (101) (59) 12 (47)

--------- --------- -------- ---------- ----------- ------- ------ --------- ---------

Total comprehensive

loss for the period - - - 42 - (598) (556) (51) (607)

Issue of ordinary shares 142 1,463 - - - - 1,605 - 1,605

Issue costs - (73) - - - - (73) - (73)

Non-controlling interest

on acquisition of

subsidiary - - - - - - - 1,125 1,125

Share based payment

transactions - - 10 - - - 10 10

142 1,390 10 - - - 1,542 1,125 2,667

Balance at 31 March

2021 629 4,027 73 (5) - (590) 4,134 934 5,068

(unaudited)

========= ========= ======== ========== =========== ======= ====== ========= =========

CONDENSED CONSOLIDATED STATEMENT OF CASH

FLOWS FOR THE SIX MONTHSED 31 MARCH

2021

31-Mar-21 31-Mar-20 30-Sep-20

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Cash flows from operating

activities

Loss from operating activities (560) (809) (1,242)

Adjustments for:

Depreciation and amortisation 18 57 76

Share of loss of equity accounted

associate 71 - 4

Loss on disposal of property, plant - - -

and equipment

Foreign exchange differences 117 (2) (39)

Compensation on cancellation of

SARS scheme - 119 120

Equity-settled share-based payment

transactions 10 30 63

-------------- -------------- ------------

(344) (605) (1,018)

Changes in:

- inventories 7 - -

- trade and other receivables (186) (1) 2

- trade and other payables 45 188 278

-------------- -------------- ------------

Cash used in operating activities (478) (418) (738)

Finance costs - - -

Net cash used in operating

activities (478) (418) (738)

-------------- -------------- ------------

Cash flows from investing

activities

Acquisition of property, plant and (93) - -

equipment

Proceeds from sale of property, - - -

plant and equipment

Exploration and licence expenditure (161) (16) (1)

Investment in associate to date

of control (455) - (938)

Net cash used in investing

activities (709) (16) (939)

-------------- -------------- ------------

Cash flows from financing

activities

Net proceeds from issue of

share capital 1,477 337 1,931

Proceeds from short term - - -

borrowings

Net cash flows from financing

activities 1,477 337 1,931

-------------- -------------- ------------

Net (decrease)/increase in cash

and cash equivalents 290 (97) 254

Cash and cash equivalents at beginning

of period 438 184 184

Cash acquired with subsidiary 158 - -

Effect of foreign exchange - - -

rate changes

-------------- -------------- ------------

Cash and cash equivalents at end

of period 886 87 438

============== ============== ============

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

FOR THE SIX MONTHSED 31 MARCH 2021

1. Reporting entity

Keras Resources plc (the "Company") is a company domiciled in

England and Wales. The condensed consolidated interim financial

statements of the Company as at and for the six months ended 31

March 2021 comprise the Company and its subsidiaries (together

referred to as the "Group") and the Group's interests in associates

and jointly controlled entities. The Group currently operates as an

explorer and developer.

2. Basis of preparation

(a) Statement of compliance

This condensed consolidated interim financial report has been

prepared in accordance with IAS 34 Interim Financial Reporting.

Selected explanatory notes are included to explain events and

transactions that are significant to an understanding of the

changes in financial performance and position of the Group since

the last annual consolidated financial statements as at and for the

year ended 30 September 2020. This condensed consolidated interim

financial report does not include all the information required for

full annual financial statements prepared in accordance with

International Financial Reporting Standards.

This condensed consolidated interim financial report was

approved by the Board of Directors on 23 June 2021.

(b) Judgements and estimates

Preparing the interim financial report requires Management to

make judgements, estimates and assumptions that affect the

application of accounting policies and the reported amounts of

assets and liabilities, income and expense. Actual results may

differ from these estimates.

In preparing this condensed consolidated interim financial

report, significant judgements made by Management in applying the

Group's accounting policies and key sources of estimation

uncertainty were the same as those that applied to the consolidated

financial statements as at and for the year ended 30 September

2020.

3. Significant accounting policies

The accounting policies applied by the Group in this condensed

consolidated interim financial report are the same as those applied

by the Group in its consolidated financial statements as at and for

the year ended 30 September 2020.

4. Financial instruments

Financial risk management

The Group's financial risk management objectives and policies

are consistent with those disclosed in the consolidated financial

statements as at and for the year ended 30 September 2020.

5. Segment information

The Group considers that it operates in two distinct business

areas, manganese mining in West Africa and phosphate mining in

Utah, USA. These business areas form the basis of the Group's

operating segments. For each segment, the Group's Managing Director

(the chief operating decision maker) reviews internal management

reports on at least a quarterly basis.

Other operations relate to the group's administrative functions

conducted at its head office and by its intermediate holding

company together with consolidation adjustments.

Information regarding the results of each reportable segment is

included below. Performance is measured based on segment profit

before tax, as included in the internal management reports that are

reviewed by the Group's Managing Director. Segment results are used

to measure performance as Management believes such information is

the most relevant in evaluating the performance of certain segments

relative to other entities that operate within the exploration

industry.

For the six months ended 31 March 2021 (unaudited)

Other

Manganese Phosphate operationsGBP'000 Total

GBP'000 GBP'000

External revenue - 31 - 31

============== ============ =================== ==========

Loss before tax (60) (110) (390) (560)

============== ============ =================== ==========

Segment assets 1,082 2,958 1,502 5,542

============== ============ =================== ==========

For the six months ended 31 March 2020 (unaudited)

Other

Manganese Phosphate operations Total

GBP'000 GBP'000 GBP'000 GBP'000

External revenue - - - -

============== ============ =================== ==========

Loss before tax (373) - (436) (809)

============== ============ =================== ==========

Segment assets 993 - 470 1,463

============== ============ =================== ==========

For the twelve months ended 30 September 2020 (audited)

Other

Manganese Phosphate operations Total

GBP'000 GBP'000 GBP'000 GBP'000

External revenue - - - -

============== ============ =================== ==========

Profit/(loss) before

tax (405) (4) (833) (1,242)

============== ============ =================== ==========

Segment assets 1,011 1,622 842 3,475

============== ============ =================== ==========

Information about geographical segments:

For the six months ended 31 March 2021 (unaudited)

West US Other Total

Africa operationsGBP'000

GBP'000 GBP'000 GBP'000

External revenue - 31 - 31

========= ========= =================== =========

Loss before tax (60) (110) (390) (560)

========= ========= =================== =========

Segment assets 1,082 2,958 1,502 5,542

========= ========= =================== =========

For the six months ended 31 March 2020 (unaudited)

West US Other Total

Africa operations

GBP'000 GBP'000 GBP'000 GBP'000

External revenue - - - -

========= ========= =================== =========

Loss before tax (373) - (436) (809)

========= ========= =================== =========

Segment assets 993 - 470 1,463

========= ========= =================== =========

For the twelve months ended 30 September 2020 (audited)

West US Other Total

Africa operations

GBP'000 GBP'000 GBP'000 GBP'000

External revenue - - - -

========= ========= =================== =========

Profit/(loss) before

tax (405) (4) (833) (1,242)

========= ========= =================== =========

Segment assets 1,011 1,622 842 3,475

========= ========= =================== =========

6. Seasonality of operations

The Group is not considered to be subject to seasonal

fluctuations.

7. Intangible assets

6 months 6 months 12 months

31 Mar 31 Mar 30 Sep

21 20 (unaudited) 20

(unaudited) GBP'000 (audited)

GBP'000 GBP'000

Cost

Balance at beginning of period 1,227 1,206 1,206

Additions 2,629 16 1

Disposals (158) - -

Effect of movement in exchange rates (61) (1) 20

------------- ---------------- -----------

Balance at end of period 3,637 1,221 1,227

============= ================ ===========

Impairment losses

Balance at beginning of period 158 155 155

Impairment - - -

Amortisation - - -

Disposals (158) - -

Effect of movement in exchange rates - - 3

------------- ---------------- -----------

Balance at end of period - 155 158

============= ================ ===========

Carrying amounts

Balance at end of period 3,637 1,066 1,069

====== ====== ======

Balance at beginning of period 1,069 1,051 1,051

====== ====== ======

Intangible assets comprise the fair value of prospecting and

exploration rights.

8. Property, plant and equipment

Acquisitions and disposals

During the six months ended 31 March 2021 the Group acquired

assets with a cost of GBP263,000 (six months ended 31 March 2020:

GBPnil, twelve months ended 30 September 2020: GBPnil).

Assets with a carrying amount of GBPnil were disposed of during

the six months ended 31 March 2021 (six months ended 31 March 2019:

GBPnil; twelve months ended 30 September 2020: GBPnil), resulting

in a loss on disposal of GBPnil (six months ended 31 March 2019:

GBPnil; twelve months ended 30 September 2020: GBPnil), which is

included in 'administrative expenses' in the condensed consolidated

statement of comprehensive income.

9. Investments

The interest in Falcon Isle was acquired for nominal

consideration under a binding heads of terms dated 28 July 2020.

Under this agreement the Company agreed to provide US$2.5m in loans

to Falcon Isle payable in agreed tranches. Falcon Isle is the 100%

owner of the Diamond Creek phosphate mine located in in Utah (USA)

which is a fully permitted, high grade direct shipping ore organic

phosphate operating mine.

At 30 September 2020 the Company had advanced US$1.9m to Falcon

Isle, resulting in an equity interest of 40% and bringing the cost

of the investment in the associate to GBP1,626,000.

On 31 December 2020 the Company advanced the balance of $0.6m

and its equity interest has increased to 51%.

The initial acquisitions were accounted for under the equity

method of accounting but upon achieving control on 31 December

2020, the acquisition method of accounting has been applied.

The details of the business combination are as follows:

Fair value

GBP'000

Intangibles 2,170

Fixed assets 172

Inventory 142

Receivables 122

Bank balances and cash 158

Trade and other payables (17)

Loans (3,164)

(417)

Adjust: Non controlling

interest 204

Adjust: goodwill 298

Adjust: Equity accounted losses to date

of control 76

---------------

161

===============

GBP'000

Satisfied by:

Acquisition related costs 161

161

=============

10. Inventories

31-Mar-21 31-Mar-20 30-Sep-20

(unaudited)

(unaudited) (audited)

GBP'000 GBP'000 GBP'000

Phosphate 135 - -

135 - -

============= ============= ===========

11. Other investments

31-Mar-21 31-Mar-20 30-Sep-20

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Equity securities - available for sale

Brought forward - 9,923 9,923

Disposal via demerger - (9,923) (9,923)

- - -

==================== ============= ===========

Equity securities represented ordinary and performance shares in

Calidus Resources Limited ("Calidus"), a company listed on the

Australian Securities Exchange ("ASX").

These equity securities were demerged on 19 November 2019 by way

of a capital reduction scheme.

12. Trade and other receivables

31-Mar-21 31-Mar-20 30-Sep-20

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Other receivables 352 36 71

Prepayments 39 - 12

391 36 83

============= ============= ===========

Trade receivables and other receivables are stated at their

nominal values less allowances for non recoverability.

13. Share capital and reserves

Issue of ordinary shares

On 18 December 2020, 400,000,000 ordinary shares were issued for

cash at GBP0.0011 per share.

On 18 December 2020 B Moritz and D Reeves, conditionally agreed

to subscribe for 36,363,636 and 63,636,364 shares each at GBP0.0011

per share, these were issued on 18 January 2021 following a General

Meeting to grant increased authority to issue shares.

On 18 January 2021, 869,565,217 ordinary shares were agreed to

be issued at GBP0.00115 per share, of these, B Moritz conditionally

agreed to subscribe for 17,391,304 shares and R Lamming

conditionally agreed to subscribe for 26,086,957 shares in lieu of

part of his salary. Of these shares, 600,000,000 were issued on 18

January 2021 and the balance of 269,565,217 were issued on 15

February 2021 following a General Meeting to grant increased

authority to issue shares.

13. Share capital and reserves (continued)

On 18 January 2021, the company conditionally agreed to issue

48,000,000 ordinary shares at GBP0.00115 per share in settlement of

amounts owing to advisors. These were issued on 15 February 2021

following a General Meeting to grant increased authority to issue

shares.

Dividends

No dividends were declared or paid in the six months ended 31

March 2021 (six months ended 31 March 2020: GBPnil, twelve months

ended 30 September 2020: GBPnil).

14. Trade and other payables

31-Mar-21 31-Mar-20 30-Sep-20

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Trade payables 146 220 104

Accruals 230 187 228

Other payables 98 62 135

------------- ------------- -----------

474 469 467

============= ============= ===========

There is no material difference between the fair value of trade

and other payables and their book value.

15. Related parties

The total amount due to D Reeves at the period end was GBP43,000

in respect of unpaid remuneration (six months ended 31 March 2020:

GBP19,000, twelve months ended 30 September 2020: GBP31,000). The

total amount due to B Moritz at the period end was GBPnil in

respect of unpaid remuneration (six months ended 31 March 2019:

GBP27,000, twelve months ended 30 September 2020: GBPnil). The

total amount due to Parallel Resources Limited, a company owned and

controlled by R Lamming in respect of unpaid fees at the period end

was GBPnil (six months ended 31 March 2020: GBP28,500, twelve

months ended 30 September 2020: GBPnil).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FFFVLRRIVFIL

(END) Dow Jones Newswires

June 24, 2021 02:00 ET (06:00 GMT)

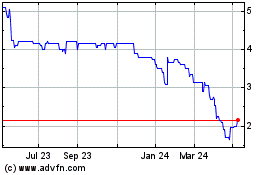

Keras Resources (LSE:KRS)

Historical Stock Chart

From Mar 2024 to Apr 2024

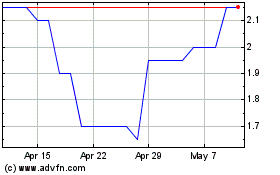

Keras Resources (LSE:KRS)

Historical Stock Chart

From Apr 2023 to Apr 2024