TIDMKWG

RNS Number : 1948T

Kingswood Holdings Limited

23 November 2021

23rd November 2021

Acquisition of Metnor Holdings Limited

Kingswood Holdings Limited ("Kingswood") announces it has agreed

to acquire Metnor Holdings Limited ("Metnor") and its subsidiaries,

IBOSS Asset Management Limited ("IBOSS") and Novus Financial

Services Limited ("Novus") (Metnor, IBOSS and Novus together, "the

IBOSS Group").

Bringing together the IBOSS Group and Kingswood Investment

Management creates a leading UK discretionary fund manager (DFM)

business with an enviable long-term investment track record, an

award-winning service proposition, open market distribution, and a

broad range of complementary investment solutions for our

clients.

The transaction boosts Kingswood's UK assets under management

("AuM") to GBP3 billion with a growth aspiration to more than

double this figure over the next three years. The transaction also

supports Kingswood's broader ambition to be a top 10 UK investment

management firm.

In addition to recently announced deals, the acquisition of the

IBOSS Group increases Kingswood's client facing advisory team to 80

people, UK funds under advice/management to GBP6.3 billion, and the

number of active clients to over 15,900.

Kingswood Group assets under administration ("AuA") will total

over GBP7.9 billion from a combination of both global retail and

institutional clients matching our ambition to grow globally as an

international integrated full service wealth and investment

manager

This transaction also provides an attractive exit opportunity

for the IBOSS Group's firms to be acquired by Kingswood without

changing their client investment choices.

Kingswood Holdings Limited (AIM: KWG), the international, fully

integrated wealth and investment management group, is pleased to

announce it has agreed to acquire, subject to regulatory approval,

Metnor Holdings Limited ("Metnor"). Metnor is based in Harrogate

and is the holding company for IBOSS Asset Management Limited

("IBOSS") and Novus Financial Services Limited ("Novus") (Metnor,

IBOSS and Novus together, "the IBOSS Group").

IBOSS is a leading provider of Managed Portfolio Services

("MPS") and other investment solutions on both an advisory and

discretionary basis to UK independent financial advisers ("IFAs")

under the leadership of Investment and Managing Director, Chris

Metcalfe. IBOSS has developed a leading service proposition, as

recognised by a five star rating in the FT Adviser service awards

and an enviable, long term track record of high performance with

low volatility. Novus is a reputable regional IFA meeting the needs

of clients based largely in the North of England.

On an underlying basis for the 12 month period to 31 October

2021, the IBOSS Group generated revenue of GBP3.3 million and

EBITDA of GBP1.3 million. The IBOSS Group currently employs 29

people and has over 6,000 clients with over GBP1.4 billion of

AUA/M. At 31 December 2020, the IBOSS Group had net assets of

GBP3.1 million.

David Lawrence, UK CEO at Kingswood, commented:

"My ambition when taking the reins of Kingswood's UK business

was, and remains, to create a leading financial advisory and

investment management business and this transaction is a big step

towards that goal.

"In the IBOSS Group, Chris Metcalfe has built a fantastic brand

with a superb Investment track record. From our first meeting, we

knew that blending the IBOSS Group with Kingswood would create

something special in the sector, harnessing the IBOSS Group's

investment record, product range and open market IFA distribution

with Kingswood's existing discretionary investment expertise and

rapidly growing financial planning businesses.

"The IBOSS brand and expertise will be retained, with Chris

Metcalfe and his investment team remaining at the helm of the

investment strategy, implementation and servicing. With Kingswood's

resources we aim to accelerate growth and create greater reach into

the IFA sector. The transaction also allows Kingswood to leverage

its successful track record in buying and integrating financial

planning businesses by providing the capital to purchase financial

planning businesses using IBOSS that wish to exit but don't wish to

risk the investment solution provided to their clients.

"Kingswood's tailored Personal Portfolio Service (PPS) will

strongly complement the Portfolio Management Services (PMS) and

Managed Portfolio Services (MPS) products provided by IBOSS, with

Kingswood also benefiting from IBOSS' OEIC products, as together we

develop a full range of investment solutions for clients.

"We remain committed to our growth strategy within the UK and

internationally. This is our fourth acquisition of 2021, and we

have a strong pipeline of high-quality UK opportunities under

negotiation, four of which are in the exclusive due diligence

stage."

Chris Metcalfe Investment and Managing Director at Metnor

commented:

"The synergy of Kingswood and IBOSS gives both parties an

exceptional opportunity to enhance their client propositions and

range of services. We had several potential suitors, but none

realised the intrinsic value of how we manage money and the

attraction for advisers that comes with our industry-leading

service standards and client communications.

"As part of the Kingswood Group, we will offer our new and

existing IBOSS users an exit strategy that will be one of the most

attractive in the industry, something that adviser firms have been

asking us to facilitate for some years now. We are pleased to be

able to deliver precisely what advisers have asked for. For many

adviser firms, continuing the investment proposition and not

disturbing the client is extremely important.

"As we increase our range of investment services, we realised we

would need to keep bolstering our team, especially in light of the

Sustainable range, which is particularly research-heavy. Kingswood

will offer us the ability to build up our investment team with no

affect on to the strategy and methodology."

Consideration and Funding

Upon receipt of regulatory approval, the consideration payable

to the shareholders of Metnor is:

- Initial cash consideration of GBP9.6 million, paid on closing;

- A maximum of GBP6.4 million of deferred consideration, payable

over a two year period, some of which is subject to the achievement

of pre-agreed performance targets; and

- A performance based earn out linked to the three year EBITDA

growth for IBOSS Asset Management Limited.

Each part of the Consideration may be paid in cash or, if a

selling shareholder of Metnor so elects and Kingswood agrees, in

ordinary shares of Kingswood. If the consideration is to be settled

in cash, it will be funded from the issue of convertible preference

shares, under the terms of its Convertible Preference Share

subscription agreement with HSQ INVESTMENT LIMITED, a wholly owned

indirect subsidiary of funds managed and/or advised by Pollen

Street Capital Limited ("Pollen Street"). Kingswood's partnership

with Pollen Street grows in strength, and to date has provided

growth equity of GBP44.8 million to support existing and future

acquisitions.

Grant Thornton and Eversheds Sutherland have supported Kingswood

on both due diligence, accounting and legal work, with Simpson Wood

Chartered Accountants and Pannone Corporate acting for Metnor.

For further details, please contact:

Kingswood Holdings Limited +44 (0)20 7293 0730

David Lawrence www.kingswood-group.com

finnCap Ltd (Nomad & Broker) +44 (0)20 7220 0500

Stuart Andrews / Simon Hicks / Abigail

Kelly

GreenTarget (for Kingswood media) +44 (0)20 7324 5498

Jamie Brownlee / Alice Gasson / Jamie.Brownlee@greentarget.co.uk

Ellie Basle

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the company's obligations under Article 17 of MAR.

About Kingswood

Kingswood Holdings Limited (trading as Kingswood) is an

AIM-listed (AIM: KWG) international fully integrated wealth

management group with circa GBP7.8 billion of Assets under Advice

and Management. It services circa 8600 clients from a growing

network of offices in the UK including Abingdon, Beverley,

Darlington, Derby, Grimsby, Harrogate, Hull, Lincoln, London,

Maidstone, Newcastle, Sheffield (2), Worcester and York with

overseas offices in Johannesburg, South Africa and Atlanta, New

York and San Diego in US.

Kingswood offers a range of trusted investment solutions to its

clients, which range from private individuals to some of the UK's

largest universities and institutions, including investment advice

and management, personal and company pensions and wealth planning.

Kingswood is focused on becoming a leading player in the wealth and

investment management market through targeted acquisitions in the

UK and US, creating a global business through strategic

partnerships.

About Pollen Street

Pollen Street Capital is an independent alternative asset

investment management company focused on the financial and business

services sectors across both private equity and credit strategies.

The private equity strategy is focused on investing middle market

firms which have the capacity to become leaders in their field

across Europe. Pollen Street have deployed over GBP1.2 billion

capital into this strategy over the last 14 years delivering strong

returns for its investors that include leading pension funds, asset

managers, banks and family offices from around the world. Pollen

Street Capital has a team of 70+ professionals with offices in

London and New York.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQDGBDBBUDDGBD

(END) Dow Jones Newswires

November 23, 2021 02:00 ET (07:00 GMT)

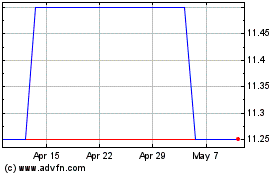

Kingswood (LSE:KWG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kingswood (LSE:KWG)

Historical Stock Chart

From Apr 2023 to Apr 2024