TIDMKWS

RNS Number : 7403U

Keywords Studios PLC

03 August 2022

3 August 2022

Keywords Studios plc ("Keywords Studios", "Keywords", the

"Group")

Half year trading update and notice of results

Strong organic revenue growth of 22%

Keywords Studios, the international technical and creative

services provider to the global video games industry, today

provides a trading update for the six months ended 30 June 2022,

ahead of half year results which will be announced on 21 September

2022.

Trading update

The Group has performed strongly during the first half, with the

Board expecting to report revenues of approximately EUR320m

representing a c.34% increase on the comparative period (H1 2021:

EUR238.7m). On an organic(1) basis, Group revenues are expected to

increase by approximately 22% (H1 2021: 22.9%) with robust demand

for all of the Group's services.

Adjusted profit before tax(2) is expected to be approximately

EUR54m, representing an increase of over 35% from EUR39.7m in the

comparative period in the prior year. This reflects a strong margin

of c.17% (H1 2021: 16.6%) which includes a 1% point benefit from

foreign exchange, particularly the strong US dollar during the

period as we invoice a proportion of our sales in US dollars.

We announced, at our Capital Markets Day in June, a more

simplified structure to support collaboration across the business,

meaning that for the half year ended 30 June 2022 onwards we will

report divisional results in three segments; Create (combining the

former Art Services and Game Development service lines); Globalize

(the former Audio Services, Localization and Functional and

Localization Testing service lines); and Engage (the former Player

Support and Marketing service lines).

The newly formed Create and Globalize services lines had very

strong performances, as the momentum from the renewed industry

focus on developing new content to keep gamers engaged in 2021

continued into 2022, and started to benefit our post production

services (Globalize) to a greater extent. Engage saw more modest

growth, with good growth from Player Support partially offset by

Marketing, due to the exceptionally strong performance in the first

half of last year (H1 2021 organic growth for Marketing of 50.6%),

and some delays in work with certain projects moving into H2 and

early next year.

As previously outlined, we are actively relocating some of our

people and existing work from our only business operating in

Russia, Sperasoft, to locations including Poland, Serbia, Armenia

and Malta. This has had a more limited impact on H1 performance

with the second half of the current financial year being the key

transition phase for this process. We are focussed on making this

as smooth a transition as possible for both our people and

international clients, with the benefit of our global footprint and

infrastructure.

Keywords Studios continues to deliver on its acquisition

strategy with the acquisition of the Game Development studio,

Forgotten Empires, having completed and the acquisition of Mighty

Games, as announced separately today. The Forgotten Empires

acquisition has extended the reach and scale of the Group's Create

service line. The acquisition of Mighty Games brings an innovative

and proprietary AI-based Testing technology platform, which will

allow us to do more for our clients and remain at the forefront of

our industry, in line with our strategy to develop more

technology-enabled solutions. We continue to actively review a

healthy pipeline of acquisition opportunities.

As at 30 June 2022, the Group had net cash of EUR121m (31

December 2021: EUR105.6m) after cash spend on prior year

acquisitions in the first half of the year amounting to EUR13.6m.

The Group's cash balance, strong cash generation and the EUR150m

available under its undrawn committed revolving credit facility,

leave the Group well placed to pursue it organic and acquisition

growth strategy.

Notification of Half Year Results

The Group expects to announce its half year results for the six

months ended 30 June 2022 on 21 September 2022. To register your

interest, please use the following link:

https://www.keywordsstudios.com/H1-2022-results/ , or contact

Keywords@mhpc.com .

Bertrand Bodson, CEO of Keywords Studios commented:

"Keywords has started the year very strongly, building on the

momentum achieved in 2021 as we continue to benefit from a renewed

focus on content creation post pandemic and the structural trends

towards outsourcing. We would like to thank all Keywordians for

their incredible dedication to serving our clients with passion and

commitment.

" Whilst we are mindful of a more uncertain macro-economic

environment and some volatility in the scheduling of certain

projects we continue to see strong demand for our services. Given

this and the Group's strong performance in H1, we are confident of

delivering a performance comfortably ahead of current market

expectations for the full year, albeit with organic growth rates

moderating and margins moving to historic levels of 15% as we

invest in the business, transition our people and work from Russia,

and as more costs return with the easing of COVID restrictions.

"We set out, in our Capital Markets Day in June, how we intend

to build on the Group's strong platform by developing strategic

customer partnerships, introducing new technologies, galvanising

the Group's culture of entrepreneurialism and collaboration,

establishing Keywords as the destination for talent and leveraging

the Group's capabilities into adjacent markets, all complemented by

our M&A strategy. Whilst it is early days, we are making good

progress with each of these areas of focus.

" We were pleased to have completed the acquisitions of

Forbidden Empires and Mighty Games and we continue to review a

healthy pipeline of acquisitions that extend the services Keywords

is able to offer its global video games clients, particularly as we

build our Create and Engage service lines.

"Our unrivalled, scale, reach and breadth of services position

Keywords well to continue to increase our share of our large

addressable market and our strong financial position will enable

further selective acquisitions as we cement our position as the 'go

to' services platform for the global video games industry and

beyond."

(1) Organic Revenue at constant exchange rates is calculated by

adjusting the prior year revenues, adding pre-acquisition revenues

for the corresponding period of ownership, and applying the prior

year foreign exchange rates to both years, when translating studio

results into the euro reporting currency.

(2) Adjusted profit before tax comprises Profit before taxation

as reported in the Consolidated statement of comprehensive income,

adjusted for share based payment expense, costs of acquisition and

integration, amortisation and impairment of intangible assets,

non-controlling interest, foreign exchange gains and losses, and

unwinding of discounted liabilities. In order to present the

measure consistently year-on-year, the impact of investment income

is also excluded.

For further information, please contact:

Keywords Studios ( www.keywordsstudios.com

)

B ertrand Bodson, Chief Executive Officer +353 190 22

Jon Hauck, Chief Financial Officer 730

Numis Securities

Stuart Skinner/Kevin Cruickshank/Will +44 20 7260

Baunton 1000

MHP Communications (Financial PR) +44 20 3128

Katie Hunt/Eleni Menikou/Charles Hirst 8193

keywords@mhpc.com

About Keywords Studios ( www.keywordsstudios.com )

Keywords Studios is an international technical services provider

to the global video games industry. Established in 1998, and now

with over 70 facilities in 24 countries strategically located in

Asia, Australia, the Americas and Europe, it provides integrated

art creation, marketing services, game development, testing,

localization, audio and player support services across more than 50

languages and 16 games platforms to a blue-chip client base of over

950 clients across the globe.

Keywords Studios has a strong market position, providing

services to 23 of the top 25 most prominent games companies. Across

the games and entertainment industry, clients include Activision

Blizzard, Bandai Namco, Bethesda, Electronic Arts, Epic Games,

Konami, Microsoft, Netflix, Riot Games, Square Enix, Supercell,

TakeTwo, Tencent and Ubisoft. Recent titles worked on include

Anthem, Star Wars Jedi: Fallen Order, Valorant, League of Legends,

Fortnite, Clash Royale and Doom Eternal. Keywords Studios is listed

on AIM, the London Stock Exchange regulated market (KWS.L).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFIFFETTIVIIF

(END) Dow Jones Newswires

August 03, 2022 02:01 ET (06:01 GMT)

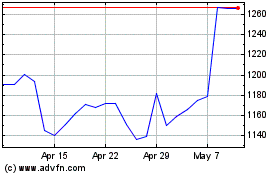

Keywords Studios (LSE:KWS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Keywords Studios (LSE:KWS)

Historical Stock Chart

From Apr 2023 to Apr 2024