TIDMMNRG

RNS Number : 3006N

MetalNRG PLC

29 September 2021

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF REGULATION 2014/596/EU WHICH IS PART OF DOMESTIC UK

LAW PURSUANT TO THE MARKET ABUSE (AMMENT) (EU EXIT) REGULATIONS (SI

2019/310) ("UK MAR"). UPON THE PUBLICATION OF THIS ANNOUNCEMENT,

THIS INSIDE INFORMATION (AS DEFINED IN UK MAR) IS NOW CONSIDERED TO

BE IN THE PUBLIC DOMAIN.

29(th) September 2021

METALNRG plc

("MetalNRG" or the "Company")

Unaudited Interim Results to 30 June 2021

Operational Highlights

Key operational milestones achieved during the period:

The Company has and continues to assess a number of projects

that meet its investment criteria.

At the beginning of the financial year, we considered an

acquisition of Lake Victoria Gold Ltd ("LVG"), however the Board

decided not to proceed as certain conditions on the properties in

Tanzania were not as reported by LVG. We spent significant time and

effort on the due diligence, and we supported LVG financially which

has been converted into equity in LVG.

MetalNRG completed a transaction for a distressed UK onshore Oil

& Gas company with operating and exploration licenses. A

Special Purpose Vehicle, BritNRG, was set up to complete the

transaction. Operational work on site has progressed and 100-day

operational plan implemented, setting the company up on a more

secure operational footing.

Work at our Goldridge gold project in Arizona has also

progressed well. In the early part of the year SRK Consulting

completed a Competent Person's Report update on the asset. The CPR

was an input document to the prospectus the Company completed in

May. In the report SRK pointed out that in addition to the old

waste dumps and pillars left behind by previous operators, there

appears to be an opportunity to explore in more detail the

connectivity between the previously producing gold mines to get a

detailed understanding of the geological structure on the property.

Work has progressed in this direction and the initial findings are

encouraging.

During the first part of the year, MetalNRG announced a

partnership agreement with EQTEC plc, an AIM listed world leading

gasification technology solutions company focused on waste to

sustainable energy projects. The purpose of the partnership as

announced to market is to seek "shovel ready" green sustainable

waste to energy projects that offer financial upside.

In partnership with EQTEC plc, MetalNRG announced its

participation in the acquisition and planned recommissioning of a

1MW waste-to-energy plant in Italy. Originally commissioned in

2015, the plant was built around EQTEC's proprietary and patented

Advanced Gasification Technology.

MetalNRG joined a consortium led by EQTEC to repower, own and

operate the biomass-to- energy p lant (the "Plant") in Castiglione

d'Orcia, Tuscany, Italy. Once operational, it is intended that the

plant will transform straw and forestry wood waste from local farms

and forests into green electricity and heat for use in the local

community.

The Company continues to support IMC which has a Uranium project

in Kyrgyzstan which is currently on hold due to that Government's

current ban on the exploitation of uranium in the country.

Corporate Development

The Company will continue to seek additional projects that meet

its set investment criteria. The intention is specifically to seek

opportunities where we can deliver early positive cash flows from

an asset and, where the cash generated from the operations allows

us, explore and develop each particular project further. We expect

announcements in the very near future on further developments.

Financial Review

MetalNRG reported an unaudited operating loss for the six months

period ended 30 June 2021 of GBP890,354 (six months period to 30

June 2020: an unaudited operating loss of GBP386,304). Basic and

diluted loss per share for the period was 0.14p and 0.08p

respectively (six months period to 30 June 2020: Basic loss per

share was 0.11p and diluted loss per share was 0.08p).

Outlook

A number of projects have been evaluated and good progress has

been made to date. We expect further announcements will be made to

update the market on any concrete achievements.

Responsibility Statement

We confirm that to the best of our knowledge:

-- The interim financial statements have been prepared in

accordance with International Accounting Standard 34, Interim

Financial Reporting, as adopted by the EU;

-- The interim financial statements give a true and fair view of

the assets, liabilities, financial position and loss of the

Group;

-- The interim report includes a fair review of the information

required by DTR 4.2.7R of the Disclosure and Transparency Rules,

being an indication of important events that have occurred during

the first six months of the financial year and their impact on the

interim financial information, and a description of the principal

risks and uncertainties for the remaining six months of the year;

and

-- The interim financial information includes a fair review of

the information required by DTR 4.2.8R of the Disclosure and

Transparency Rules, being the information required on related party

transactions.

Consolidated Income Statement

6 months 6 months Year ended

to to 31 December

30 June 30 June 2020

2021 2020

Unaudited Unaudited Audited

GBP GBP GBP

Revenue 38,422 - -

Cost of sales (29,320) - -

---------- ---------- ---------------

Gross profit 9,102 - -

Administrative expenses (642,837) (405,647) (829,267)

Other operating income 381 19,343 19,134

IPO expenses (257,000) - -

Operating loss (890,354) (386,304) (810,133)

Finance income - - -

Loss on ordinary activities

before taxation (890,354) (386,304) (810,133)

Tax on loss on ordinary - - -

activities

---------- ---------- ---------------

Loss for the financial

period attributable

to equity holders (890,354) (386,304) (810,133)

========== ========== ===============

Attributable to:

Equity holders of

the parent (867,870) (386,304) (810,133)

Non-controlling interests (22,484) - -

---------- ---------- ---------------

(890,354) (386,304) (810,133)

========== ========== ===============

Earnings per share

- see note 3 (0.14) (0.11) (0.22) pence

Basic pence pence (0.18) pence

Diluted (0.08) (0.08)

pence pence

Consolidated Statement of Comprehensive Income

6 months 6 months Year ended

to to 31 December

30 June 30 June 2020

2021 2020

Unaudited Unaudited Audited

GBP GBP GBP

Loss after tax (890,354) (386,304) (810,133)

Items that may subsequently

be reclassified to

profit or loss:

* Foreign exchange movements 923 (3,675) (418)

Total comprehensive

loss (889,431) (389,979) (810,551)

========== ========== =============

Attributable to:

Equity holders of

the parent (866,947) (389,979) (810,551)

Non-controlling interests (22,484) - -

---------- ---------- -------------

(889,431) (389,979) (810,551)

========== ========== =============

Consolidated Statement of Financial Position

6 months 6 months Year ended

to 30 June to 31 December

2021 30 June 2020

2020

Unaudited Unaudited Audited

GBP GBP GBP

Assets

Non-current assets

Intangible fixed

assets 2,580,009 669,198 668,937

Tangible fixed assets 5,891 - -

Investments 467,033 166,808 466,652

Investments in associates 687,198 - -

Available for sale

assets 391,062 - -

--------------- --------------- --------------

Total assets 4,131,193 836,006 1,135,589

--------------- ---------------

Current assets

Trade and other

receivables 964,667 63,122 29,736

Cash and cash equivalents 99,798 111,699 63,611

--------------- --------------- --------------

Total current assets 1,064,465 174,821 93,347

--------------- --------------- --------------

Current liabilities

Trade and other

payables (2,069,773) (480,065) (1,049,772)

--------------- --------------- --------------

Total current liabilities (2,069,773) (480,065) (1,049,772)

--------------- --------------- --------------

Non-current liabilities

Other non-current

liabilities (377,875) - (28,975)

--------------- --------------- --------------

Total non-current

liabilities (377,875) - (28,975)

--------------- --------------- --------------

Net assets 2,748,010 530,762 150,189

=============== =============== ==============

Equity

Share capital 332,116 273,301 273,968

Share premium 5,911,719 2,443,784 2,483,117

Retained losses (3,473,406) (2,181,708) (2,605,538)

Foreign currency

reserve (435) (4,615) (1,358)

--------------- --------------- --------------

Equity attributable

to equity holders

of the parent 2,769,994 530,762 150,189

Non-controlling (21,984) - -

interests

Total equity 2,748,010 530,762 150,189

==================== =============== ==============

Consolidated Statement of Cash Flows

6 months 6 months Year ended

to to 31 December

30 June 30 June 2020

2021 2020

Unaudited Unaudited Audited

GBP GBP GBP

Cash flow from operating

activities

Operating loss (890,354) (386,304) (810,133)

(profit)/loss on sale

of investment - (19,134) (19,134)

Fees settled in shares 11,750 - -

Impairment of investments 108,939 - -

Foreign exchange 923 - (418)

Finance costs 12,600 - 32,436

Increase in payables 1,178,902 160,186 50,931

(Increase)/decrease

in receivables (934,931) 22,167 55,554

Net cash outflow from

operations (512,171) (223,085) (690,764)

------------ ----------- -------------

Cash flows from investing

activities

Payments for intangible (1,911,071) - -

assets

Payments for tangible (5,891) - -

fixed assets

Proceeds from sale of

investment - 102,467 102,467

Purchase of investments (1,187,580) (38,047) (337,631)

------------ ----------- -------------

Net cash flows from

investing activities (3,104,542) 64,420 (235,164)

------------ ----------- -------------

Cash flows from financing

activities

Proceeds from issue

of shares and warrants 3,614,000 30,000 70,000

Cost of shares issued (151,100) - -

Proceeds from Convertible

Loan Notes - 105,000 370,000

Bridging and other loan

financing 190,000 - 410,500

Net cash flows from

financing activities 3,652,900 135,000 850,500

------------ ----------- -------------

Net increase/(decrease)

in cash and cash equivalents

Cash and cash equivalents 36,187 (23,665) (75,428)

at the beginning of

period 63,611 139,039 139,039

Effect of exchange rate - (3,675) -

changes on cash and

cash equivalents

------------ ----------- -------------

Cash and cash equivalents

at end of period 99,798 111,699 63,611

============ =========== =============

Consolidated Statement of Changes in Equity

Share Share Retained Foreign Non-controlling Total

capital premium earnings currency interest

reserve

GBP GBP GBP GBP GBP GBP

As at 31 August

2019 266,847 2,167,311 (1,470,778) (2,700) - 960,680

========= ========== ============ ========== ================ ==========

Loss for the

period - - (324,627) - - (324,627)

Translation

differences - - - 1,760 - 1,760

--------- ---------- ------------ ---------- ---------------- ----------

Total comprehensive

income - - (324,627) 1,760 - (322,867)

Share capital

issued 5,954 246,973 - - - 252,927

--------- ---------- ------------ ---------- ---------------- ----------

Total contributions

by and distributions

to owners of

the Company 5,954 246,973 - - - 252,927

--------- ---------- ------------ ---------- ---------------- ----------

As at 31 December

2019 272,801 2,414,284 (1,795,405) (940) - 890,740

========= ========== ============ ========== ================ ==========

Loss for the

period - - (386,304) - - (386,304)

Translation

differences - - - (3,675) - (3,675)

Total comprehensive

income - - (386,304) (3,675) - (389,979)

Share capital

issued 500 29,500 - - - 30,000

--------- ---------- ------------ ---------- ---------------- ----------

Total contributions

by and distributions

to owners of

the Company 500 29,500 - - - 30,000

--------- ---------- ------------ ---------- ---------------- ----------

As at 30 June

2020 273,301 2,443,784 (2,181,708) (4,615) - 530,762

========= ========== ============ ========== ================ ==========

Loss for the

period - - (423,830) - - (423,830)

Translation

differences - - - 3,257 - 3,257

--------- ---------- ------------ ---------- ---------------- ----------

Total comprehensive

income - - (423,830) 3,257 - (420,573)

Share capital

issued 667 39,333 - - - 40,000

--------- ---------- ------------ ---------- ---------------- ----------

Total contributions

by and distributions

to owners of

the Company 667 39,333 - - - 40,000

--------- ---------- ------------ ---------- ---------------- ----------

As at 31 December

2020 273,968 2,483,117 (2,605,538) (1,358) - 150,189

========= ========== ============ ========== ================ ==========

Loss for the

period - - (867,870) - (22,484) (890,354)

Translation

differences - - - 923 - 923

--------- ---------- ------------ ---------- ---------------- ----------

Total comprehensive

income - - (867,870) 923 (22,484) (889,431)

Share capital

issued 58,149 3,428,601 - - 500 3,487,250

--------- ---------- ------------ ---------- ---------------- ----------

Total contributions

by and distributions

to owners of

the Company 58,149 3,428,601 - - 500 3,487,250

--------- ---------- ------------ ---------- ---------------- ----------

As at 30 June

2021 332,116 5,911,719 (3,473,406) (435) (21,984) 2,748,010

========= ========== ============ ========== ================ ==========

Half-yearly report notes

1. Half-yearly report

This interim report was approved by the Board of Directors on 28

September 2021.

The information relating to the six months periods to 30 June

2021 and 30 June 2020 are unaudited.

The information relating to the year ended 31 December 2020 is

extracted from the audited financial statements of the Company

which have been filed at Companies House and on which the auditors

issued an unqualified audit report. The condensed interim financial

statements have been reviewed by the Company's auditor.

2. Basis of accounting

The interim financial statements have been prepared using

accounting policies and practices that are consistent with those

adopted in the statutory financial statements for the year ended 31

December 2020, although the information does not constitute

statutory financial statements within the meaning of the Companies

Act 2006. The interim financial statements have been prepared under

the historical cost convention.

These interim financial statements are prepared in accordance

with IAS 34 Interim Financial Reporting as adopted by the European

Union and the Disclosure and Transparency Rules of the UK Financial

Conduct Authority.

This interim report does not include all the notes of the type

normally included in an annual financial report. Accordingly, this

interim report should be read in conjunction with the annual report

for the year ended 31 December 2020, which have been prepared in

accordance with International Financial Reporting Standards (IFRS)

as adopted by the European Union.

The Company will report again for the full year to 31 December

2021.

Going concern

The Company's day-to-day financing is from its available cash

resources.

The Company is confident of raising funds to enable it to

continue to develop its targeted investments and exploration

campaigns across its key projects over the next 12-18 months and

the Directors are confident that adequate funding can be raised as

required to meet the Company's current and future liabilities.

For the reasons outlined above, the Directors are satisfied that

the Company will be able to meet its current and future

liabilities, and continue trading, for the foreseeable future and,

in any event, for a period of not less than twelve months from the

date of approving this interim report. The preparation of these

interim financial statements on a going concern basis is therefore

considered to remain appropriate.

Critical accounting estimates

The preparation of condensed interim financial statements

requires management to make estimates and assumptions that affect

the reported amounts of assets and liabilities at the end of the

reporting period. Significant items subject to such estimates are

set out in the Company's 2020 Annual Report and Financial

Statements. The nature and amounts of such estimates have not

changed significantly during the interim period.

Intangible assets

Exploration and development costs

All costs associated with mineral exploration and investments

are capitalised on a project-by-project basis, pending

determination of the feasibility of the project. Costs incurred

include appropriate technical and administrative expenses but not

general overheads. If an exploration project is successful, the

related expenditures will be transferred to mining assets and

amortised over the estimated life of economically recoverable

reserves on a unit of production basis.

Intangible assets

Exploration and development costs

Where a licence is relinquished or a project abandoned, the

related costs are written off in the period in which the event

occurs. Where the Group maintains an interest in a project, but the

value of the project is considered to be impaired, a provision

against the relevant capitalised costs will be raised.

The recoverability of all exploration and development costs is

dependent upon the discovery of economically recoverable reserves,

the ability of the Group to obtain necessary financing to complete

the development of reserves and future profitable production or

proceeds from the disposition thereof.

3. Earnings per share

6 months 6 months Year ended

to to 31 December

30 June 30 June 2020

2021 2020

Unaudited Unaudited Audited

GBP GBP GBP

These have been calculated

on a loss of: (890,354) (386,604) (810,133)

---------------- -------------- --------------

The basic weighted

average number of

shares used was:

623,214,765 359,990,020 363,554,242

The diluted weighted

average number of

shares used was: 1,044,548,093 466,523,346 453,720,902

---------------- -------------- --------------

Basic loss per share: (0.14) pence (0.11) (0.22)

pence pence

Diluted loss per (0.08) pence (0.08) (0.18)

share: pence pence

4. Events after the reporting period

There were no reportable events after the reporting period other

than those highlighted in the 'Financial Review'.

The Condensed interim financial statements were approved by the

Board of Directors on 28 September 2021.

By order of the Board

Rolf Gerritsen

Director

For the purposes of UK MAR, the person responsible for arranging

for the release of this announcement on behalf of the Company is

Rolf Gerritsen, Chief Executive Officer.

Contact details:

MetalNRG PLC

Rolf Gerritsen

Christopher Latilla-Campbell +44 (0) 20 7796 9060

Corporate Adviser

PETERHOUSE CAPITAL LIMITED

Lucy Williams/Duncan Vasey +44 (0) 20 7469 0930

----------------------

Corporate Broker

SI CAPITAL LIMITED

Nick Emerson +44 (0) 1483 413500

----------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPUGPBUPGPPR

(END) Dow Jones Newswires

September 29, 2021 02:00 ET (06:00 GMT)

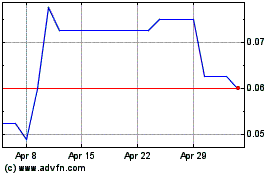

Metalnrg (LSE:MNRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Metalnrg (LSE:MNRG)

Historical Stock Chart

From Apr 2023 to Apr 2024