TIDMMNRG

RNS Number : 0631A

MetalNRG PLC

31 January 2022

31 January 2022

MetalNRG plc

Commencement of legal proceedings against Brit Energy Holdings

LLP, Pierpoalo Rocco and BritNRG Limited

MetalNRG plc ("MNRG" or the "Company") announces that it has

filed and served civil legal proceedings in the English High Court

against BritENERGY Holdings LLP (the "LLP"), Pierpoalo Rocco ("Mr

Rocco") and BritNRG Limited (the "Joint Venture Company") (together

the "Defendants") for, inter alia, a declaration and the recovery

from the Defendants of monies paid to the LLP in 2021.

Following Mr Rocco's resignation as a director of the Company,

announced by the Company on 25 October 2021, the Company has also

terminated Mr Rocco's service agreement, as an employee, for cause,

following an open and robust disciplinary process which, despite

making written representations, Mr Rocco declined to attend. Mr

Rocco has subsequently appealed the decision.

Both MNRG and its shareholders have been impacted by information

circulated by Mr Rocco, the Joint Venture Company and the LLP on

social media, which is considered by the Company to be misleading

and factually incorrect. In particular, it has now been

acknowledged by the Joint Venture Company that the Company is one

of its shareholders despite recent social media claims to

contrary.

As the Company has now formally served proceedings on the

Defendants it is appropriate to provide a summary of the issues in

dispute.

As previously announced and disclosed in 2021 the Company

entered into an agreement to pay the LLP the sum of GBP475,000 to

acquire 190 ordinary shares in the capital of the Joint Venture

Company (the "SPA") and the LLP agreed to procure the transfer of

an additional 116 shares held by Mr Rocco to the Company upon the

Company's payment to the LLP of GBP475,000; the Company also

entered into an option agreement pursuant to which the LLP paid the

sum of GBP1 to the Company for an option to acquire up to 300

shares in the capital of the Joint Venture Company at the price of

GBP4,000 per share (the "LLP Option"; a further option agreement

was executed pursuant to which the Company paid the sum of

GBP545,000 to the LLP for an option to acquire 150 shares in the

Joint Venture Company at a price of GBP0.001 per share (the

"Company Option"); a share charge which purported to grant a

security interest in all convertible loan notes held by Company

(which convert into shares in the Joint Venture Company and

encompasses such acquired shares) in favour of the LLP to support

the payment obligations of the Company under the Company Option;

and a variation agreement between the Company, the LLP and the

Joint Venture Company purporting to vary the terms of the existing

shareholders agreement in respect of the Joint Venture Company

(together, the "April Transaction Documents").

The arrangements set out in the April Transaction Documents were

(and were understood and agreed by the parties at the time of the

entry into the same) to be an interconnected series of

arrangements, with the entry into each such document being

dependent upon the entry into the others. None of the arrangements

set out in the April Transaction Documents were intended to be of

legal effect in the event that all of the arrangements set out in

the April Transaction Documents were not entered into and such

arrangements were not legally effective.

The benefits to be acquired by the Company under the

arrangements set out in the April Transaction Documents (in

particular, under the SPA and the Company Option) was an

"arrangement" involving the acquisition of "non cash assets"

(within the meaning of section 190 of the Companies Act 2006) which

were, at the time of the entry into the arrangements set out in the

April Transaction Documents, "substantial" (within the meaning of

section 191 of the Companies Act 2006, in that they (in particular

the SPA and/or the Company Option) were said to be in respect of

arrangements worth in excess of GBP100,000).

In pursuance of the arrangements set out in the April

Transaction Documents, in a series of payments between 19 and 24

May 2021, the Company paid the sum of GBP1,019,999 to the LLP

(being the sums due under SPA and the Company Option less the GBP1

due under the LLP Option) (the "Company Payment").

It subsequently came to light that, following the Company having

not received share certificates for the shares in the Joint Venture

Company, at the time the parties entered into the April Transaction

Documents a private company limited by shares (incorporated on 23

September 2015 and with its registered office address at 18

Anderson Drive, Aberdeen, Scotland, AB15 4TY)known as Old Compton

Associates Limited ("OCAL") had an interest in the capital of the

LLP and by virtue of OCAL being owned by Mr Rocco's wife, Mr Rocco

and OCAL were connected persons for the purposes of sections 252 to

254 of the Companies Act 2006. In addition, it came to light that

Mr Rocco had an additional, potentially substantial, direct

interest in the LLP.

By reason of Mr Rocco's then status as a director of the

Company, the arrangements set out in the April Transaction

Documents, being a "substantial property transaction", required, in

accordance with section 190 of the Companies Act 2006, the approval

by a resolution of the members of the Company or to be conditional

upon such approval first having been obtained. The Directors have

at all times made it clear that they would have not entered into

the April Transaction Documents on behalf of the Company had they

been aware of the material interests of Mr Rocco in the LLP.

Accordingly, notwithstanding the requirements of section 190 of

the Companies Act 2006, the arrangements set out in the April

Transaction Documents were not approved by a resolution of the

members of the Company in a general meeting and were not

conditional upon such approval having been obtained, the Directors,

other than Mr Rocco, being unaware of the material nature of Mr

Rocco interests in the LLP.

As a result, the arrangements set out in the April Transaction

Documents and the Company Payment were each voidable at the

instance of the Company and by letter dated 22 September 2021, the

Company gave notice that the arrangements set out in the April

Transaction Documents were avoided and demanded repayment to the

Company of the principal amount of the Company Payment. The LLP and

Mr Rocco (by their joint solicitors) have sought to dispute the

validity of this notice and have, in any event, refused and/or

failed to pay to the Company the amount of the Company Payment.

The refusal by the LLP and Mr Rocco to accept that the

arrangements set out in the April Transaction Documents have been

avoided and/or to ensure the Company is repaid the principal amount

of the Company Payment is without credible foundation; the Company

has accordingly sought declaratory relief that it has avoided the

arrangements set out in the April Transaction Documents and the

Company Payment and an order for the immediate repayment of the

principal amount of the Company Payment. The Defendants have not

yet filed any defence.

In a separate action Mr Rocco has sought to recover his legal

and other costs relating to the Company's action described above

and in relation to his summary dismissal by the Company under the

terms of his service agreement in a case brought in the Courts of

Scotland. The Company disputes that the ability to recover legal

expenses under the contract was ever intended nor can be construed

to extend to actions by the Company itself against Mr Rocco for

breach of duty and/or misconduct against it, but is limited to the

reasonable costs of advice in relation to any personal claims by

third parties whilst discharging his duties to the Company. The

Company is accordingly vigorously defending these claims.

The Company will provide further updates on these issues and the

legal proceedings as appropriate.

END

Contact details:

MetalNRG PLC

Rolf Gerritsen

Christopher Latilla-Campbell +44 (0) 20 7796 9060

Corporate Broker

PETERHOUSE CAPITAL LIMITED

Lucy Williams/Duncan Vasey +44 (0) 20 7469 0930

----------------------

Corporate Broker

SI CAPITAL LIMITED

Nick Emerson +44 (0) 1483 413500

----------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCDGGDBISXDGDG

(END) Dow Jones Newswires

January 31, 2022 01:59 ET (06:59 GMT)

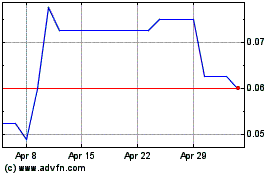

Metalnrg (LSE:MNRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Metalnrg (LSE:MNRG)

Historical Stock Chart

From Apr 2023 to Apr 2024