TIDMMNRG

RNS Number : 2531B

MetalNRG PLC

30 September 2022

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF REGULATION 2014/596/EU WHICH IS PART OF DOMESTIC UK

LAW PURSUANT TO THE MARKET ABUSE (AMMENT) (EU EXIT) REGULATIONS (SI

2019/310) ("UK MAR"). UPON THE PUBLICATION OF THIS ANNOUNCEMENT,

THIS INSIDE INFORMATION (AS DEFINED IN UK MAR) IS NOW CONSIDERED TO

BE IN THE PUBLIC DOMAIN.

MetalNRG plc

("MetalNRG" or "the Company")

Interim Results to 30 June 2022

Operational Highlights

Key operational milestones achieved during the period:

The Company has and continues to assess a number of projects

that meet its investment criteria.

During the first half of last year, MetalNRG plc ("the Company)

announced a partnership agreement with EQTEC plc ("EQTEC"), an AIM

listed world leading gasification technology solutions company

focused on waste-to- sustainable energy projects. The purpose of

the partnership as announced to market is to seek "shovel ready"

green sustainable waste-to-energy projects that offer financial

upside.

In partnership with EQTEC, the Company announced its

participation in the acquisition and planned recommissioning of a

1MW waste-to-energy plant in Italy. Originally commissioned in

2015, the plant was built around EQTEC's proprietary and patented

Advanced Gasification Technology. The Company joined a consortium

led by EQTEC to repower, own and operate the biomass-to- energy p

lant (the "Plant") in Castiglione d'Orcia, Tuscany, Italy. Once

operational, the plant will transform straw and forestry wood waste

from local farms and forests into green electricity and heat for

use in the local community. We are now working towards the

commissioning of the plant in the next few months. More importantly

the Company has worked closely with EQTEC to identify a number of

additional projects and create a short list of investable projects

that meet the Company's investment criteria.

During the year we worked with Advircorp, a boutique corporate

advisory firm based in London to identify debt providers who would

re finance the Italian project once it has been commissioned and

revenues and profitability has stabilized. The Company expects

further developments to be announced once the plant is fully

operational.

Work at our Goldridge gold project in Arizona has also

progressed well. As previously announced SRK Consulting completed a

Competent Person's Report on the asset. In the report SRK pointed

out that in addition to the old waste dumps and pillars left behind

by previous operators, there appears to be an opportunity to

explore in more detail the connectivity between the previously

producing gold mines to get a detailed understanding of the

geological structure on the property. Work has progressed in this

direction and the initial findings are encouraging. During the

first half of the year we completed a detailed geo sampling of the

asset, the results indicate that our initial assumption appears to

be validated and that further exploration work should be conducted

leading to an even greater understanding of the overall opportunity

that Goldridge offers.

The Company has continued to support IMC's Uranium project in

Kyrgyzstan which is currently on hold due to that Government's

current ban on the exploitation of uranium in the country. IMC is

seeking to unlock the current situation via a number of actions

which we will report on as they develop.

BritNRG Limited

Our investment in BritNRG Limited, has not turned out as

planned. In September last year we rescinded the transaction

entered into referred to as the April transaction and requested the

amount invested in the April transaction be returned, while

maintaining a minority interest in the firm.

In its continuing civil legal proceedings in the English High

Court against Brit Energy Holdings LLP (the "LLP"); Mr Pierpoalo

Rocco and BritNRG Limited (the "Joint Venture Company"), the

Company's application for summary judgment against the LLP and the

Joint Venture Company for, inter alia; (1) summary judgment on the

Company's claim against and/or the striking out of the defences

filed by the LLP and the Joint Venture Company; (2) a declaration

that the series of agreements entered into in April 2021 were

effectively rescinded in September 2021; and (3) the recovery from

those defendants of monies paid to the LLP totalling GBP1,019,999,

plus interest and costs (such amount to be determined) was granted

on 28 September 2022. An application by the LLP and the Joint

Venture Company for permission to appeal and an application by Mr

Rocco, the LLP and the Joint Venture Company for a stay of

enforcement were also dismissed at the same hearing.

Further information about the decision will follow when the

formal order is made.

Mr Rocco brought action against the Company, in Scotland, but

the case was dismissed and the Company was awarded costs in

addition to a favourable verdict on all counts. Mr Rocco has

appealed, and a further hearing is still to be scheduled.

Mr Rocco also lodged a claim with the Employment Tribunal which

will be heard in the early part of 2023.

Corporate Development

The Company will continue to seek additional projects that meet

its set investment criteria. The specific intention is to seek

opportunities where we can deliver early positive cash flows from

an asset and, where the cash generated from the operations allows

us to explore and develop those projects further. With the work

carried out with EQTEC we will focus on waste-to-energy projects

which are similar in nature to the project we have invested in in

Italy.

Financial Review

MetalNRG reported an unaudited operating loss for the six months

period ended 30 June 2022 of GBP999,949 which includes GBP629,811

in legal and professional fees relating to the BritNRG Ltd et al

claims (six months period to 30 June 2021: an unaudited operating

loss of GBP890,354). Basic and diluted loss per share for the

period was 0.09p and 0.06p respectively (six months period to 30

June 2021: Basic loss per share was 0.14p and diluted loss per

share was 0.08p).

Outlook

A number of projects have been evaluated and good progress has

been made to date. We expect further announcements will be made to

update the market on any concrete achievements.

Responsibility Statement

We confirm that to the best of our knowledge:

-- The interim financial statements have been prepared in

accordance with International Accounting Standard 34, Interim

Financial Reporting, as adopted by the EU;

-- The interim financial statements give a true and fair view of

the assets, liabilities, financial position and loss of the

Group;

-- The interim report includes a fair review of the information

required by DTR 4.2.7R of the Disclosure and Transparency Rules,

being an indication of important events that have occurred during

the first six months of the financial year and their impact on the

interim financial information, and a description of the principal

risks and uncertainties for the remaining six months of the year;

and

-- The interim financial information includes a fair review of

the information required by DTR 4.2.8R of the Disclosure and

Transparency Rules, being the information required on related party

transactions.

Consolidated Statement of Profit or Loss

6 months 6 months Year ended

to to 31 December

30 June 30 June 2021

2022 2021

Unaudited Unaudited Audited

GBP GBP GBP

Revenue - 38,422 -

Cost of sales - (29,320) -

---------- ---------- ---------------

Gross profit - 9,102 -

Administrative expenses (999,949) (642,837) (1,631,640)

Other operating income - 381 24,361

IPO expenses - (257,000) (257,000)

Operating loss before

tax (999,949) (890,354) (1,864,279)

Taxation - - -

---------- ---------- ---------------

Loss for the period (999,949) (890,354) (1,864,279)

========== ========== ===============

Attributable to:

Equity holders of

the parent (999,949) (867,870) (1,864,279)

Non-controlling interests - (22,484) -

---------- ---------- ---------------

(999,949) (890,354) (1,864,279)

========== ========== ===============

Earnings per share

- see note 3 (0.09) (0.14) (0.22) pence

Basic pence pence (0.14) pence

Diluted (0.06) (0.08)

pence pence

Consolidated Statement of Comprehensive Income

6 months 6 months Year ended

to to 31 December

30 June 30 June 2021

2022 2021

Unaudited Unaudited Audited

GBP GBP GBP

Loss after tax (999,949) (890,354) (1,864,279)

Items that may subsequently

be reclassified to

profit or loss:

* Foreign exchange movements (452) 923 (12,439)

Total comprehensive

loss (1,000,401) (889,431) (1,876,718)

============ ========== =============

Attributable to:

Equity holders of

the parent (1,000,401) (866,947) (1,876,718)

Non-controlling interests - (22,484) -

------------ ---------- -------------

(1,000,401) (889,431) (1,876,718)

============ ========== =============

Consolidated Statement of Financial Position

6 months 6 months Year ended

to 30 June to 31 December

2022 30 June 2021

2021

Unaudited Unaudited Audited

GBP GBP GBP

Non-current assets

Intangible fixed

assets 575,077 2,580,009 575,077

Tangible fixed assets - 5,891 -

Investments 1,293,053 467,033 1,265,749

Investments in associates - 687,198 -

Available for sale

assets - 391,062 -

--------------- --------------- --------------

Total non-current

assets 1,868,130 4,131,193 1,840,826

--------------- ---------------

Current assets

Trade and other

receivables 1,057,037 964,667 1,089,026

Cash and cash equivalents 12,073 99,798 49,316

--------------- --------------- --------------

Total current assets 1,069,110 1,064,465 1,138,342

--------------- --------------- --------------

Current liabilities

Trade and other

payables (1,601,239) (2,069,773) (649,135)

--------------- --------------- --------------

Total current liabilities (1,601,239) (2,069,773) (649,135)

--------------- --------------- --------------

Non-current liabilities

Other non-current

liabilities (19,861) (377,875) (23,263)

--------------- --------------- --------------

Total non-current

liabilities (19,861) (377,875) (23,263)

--------------- --------------- --------------

Net assets 1,316,140 2,748,010 2,306,770

=============== =============== ==============

Equity

Share capital 350,349 332,116 350,349

Share premium 6,422,036 5,911,719 6,422,036

Share based payment

reserve 27,770 17,999

Retained losses (5,469,766) (3,473,406) (4,469,817)

Foreign currency

reserve (14,249) (435) (13,797)

--------------- --------------- --------------

Equity attributable

to equity holders

of the parent 1,316,140 2,769,994 2,306,770

Non-controlling - (21,984) -

interests

Total equity 1,316,140 2,748,010 2,306,770

==================== =============== ==============

Consolidated Statement of Cash Flows

6 months 6 months Year ended

to to 31 December

30 June 30 June 2021

2022 2021

Unaudited Unaudited Audited

GBP GBP GBP

Cash flow from operating

activities

Operating loss (999,949) (890,354) (1,864,279)

Loss on sale of investment - - 149,545

Impairment of investments - 108,939 -

Foreign exchange (452) 923 (12,439)

Finance costs 8,872 12,600 14,774

Bonus shares issued - 11,750 16,250

Share option charge 9,771 - 17,999

Increase in creditors 679,829 1,178,902 25,850

Decrease/(increase)

in debtors 31,989 (934,931) (1,059,291)

Net cash used in operating

activities (269,940) (512,171) (2,711,591)

----------- ------------ -------------

Cash flows from investing

activities

Payments for intangible - (1,911,071) -

assets

Payments for tangible - (5,891) -

fixed assets

Proceeds from sale of

investment - - 350,455

Purchase of investments (27,303) (1,187,580) (1,205,237)

----------- ------------ -------------

Net cash used in investing

activities (27,303) (3,104,542) (854,782)

----------- ------------ -------------

Cash flows from financing

activities

Proceeds from issue

of shares and warrants - 3,614,000 4,017,900

Cost of shares issued - (151,100) (288,850)

Convertible loan note

repayment - - (105,835)

Bridging loan repayment - - (271,137)

Bridging and other loan

financing 260,000 190,000 200,000

Net cash generated

from financing activities 260,000 3,652,900 3,552,078

----------- ------------ -------------

Net increase/(decrease)

in cash and cash equivalents

Cash and cash equivalents (37,243) 36,187 (14,295)

at the beginning of

period 49,316 63,611 63,611

Cash and cash equivalents

at end of period 12,073 99,798 49,316

=========== ============ =============

Consolidated Statement of Changes in Equity

Share Share Share Retained Foreign Non-controlling Total

capital premium based earnings currency interest

payment reserve

reserve

GBP GBP GBP GBP GBP GBP GBP

As at 30 June

2020 273,301 2,443,784 - (2,181,708) (4,615) - 530,762

========= ========== ========= ============ ========== ================ ============

Loss for the

period - - - (423,830) - - (423,830)

Translation

differences - - - - 3,257 - 3,257

--------- ---------- --------- ------------ ---------- ---------------- ------------

Total comprehensive

income - - - (423,830) 3,257 - (420,573)

Share capital

issued 667 39,333 - - - - 40,000

--------- ---------- --------- ------------ ---------- ---------------- ------------

Total contributions

by and

distributions

to owners of

the Company 667 39,333 - - - - 40,000

--------- ---------- --------- ------------ ---------- ---------------- ------------

As at 31 December

2020 273,968 2,483,117 - (2,605,538) (1,358) - 150,189

========= ========== ========= ============ ========== ================ ============

Loss for the

period - - - (867,868) - (22,484) (890,354)

Translation

differences - - - - 923 - 923

Total comprehensive

income - - - (867,868) 923 (22,484) (889,431)

Shares issued 58,148 3,611,202 - - - 500 3,669,850

Share issue

costs - (182,600) - - - - (182,600)

--------- ---------- --------- ------------ ---------- ---------------- ------------

Total contributions

by and

distributions

to owners of

the Company 58,148 3,428,602 - - - 500 3,487,250

--------- ---------- --------- ------------ ---------- ---------------- ------------

As at 30 June

2021 332,116 5,911,719 - (3,473,406) (435) (21,984) 2,748,010

========= ========== ========= ============ ========== ================ ============

Loss for the

period - - - (996,411) - 22,484 (973,927)

Translation

differences - - - - (13,362) - (13,362)

--------- ---------- --------- ------------ ---------- ---------------- ------------

Total comprehensive

income - - - (996,411) (13,362) 22,484 (987,289)

Share option

charge - - 17,999 - - - 17,999

Shares issued 18,233 616,567 - - - (500) 634,300

Share issue

costs - (106,250) - - - - (106,250)

--------- ---------- --------- ------------ ---------- ---------------- ------------

Total contributions

by and

distributions

to owners of

the Company 18,233 510,317 17,999 - - (500) 546,049

--------- ---------- --------- ------------ ---------- ---------------- ------------

As at 31 December

2021 350,349 6,422,036 17,999 (4,469,817) (13,797) - 2,306,770

========= ========== ========= ============ ========== ================ ============

Loss for the

period - - - (999,949) - - (999,949)

Translation

differences - - - - (452) - (452)

--------- ---------- --------- ------------ ---------- ---------------- ------------

Total comprehensive

income - - - (999,949) (452) - (1,000,401)

Share option

charge - - 9,771 - - - 9,771

Shares issued - - - - - - -

Total contributions

by and

distributions

to owners of

the Company - - 9,771 - - - 9,771

--------- ---------- --------- ------------ ---------- ---------------- ------------

As at 30 June

2022 350,349 6,422,036 27,770 (5,469,766) (14,249) - 1,316,140

========= ========== ========= ============ ========== ================ ============

Half-yearly report notes

1. Half-yearly report

This interim report was approved by the Board of Directors on 29

September 2022.

The information relating to the six months periods to 30 June

2022 and 30 June 2021 are unaudited.

The information relating to the year ended 31 December 2021 is

extracted from the audited financial statements of the Company

which have been filed at Companies House and on which the auditors

issued an unqualified audit report. The condensed interim financial

statements have been reviewed by the Company's auditor.

2. Basis of accounting

The interim financial statements have been prepared using

accounting policies and practices that are consistent with those

adopted in the statutory financial statements for the year ended 31

December 2021, although the information does not constitute

statutory financial statements within the meaning of the Companies

Act 2006. The interim financial statements have been prepared under

the historical cost convention.

These interim financial statements are prepared in accordance

with IAS 34 Interim Financial Reporting as adopted by the European

Union and the Disclosure and Transparency Rules of the UK Financial

Conduct Authority.

This interim report does not include all the notes of the type

normally included in an annual financial report. Accordingly, this

interim report should be read in conjunction with the annual report

for the year ended 31 December 2021, which have been prepared in

accordance with International Financial Reporting Standards (IFRS)

as adopted by the European Union.

The Company will report again for the full year to 31 December

2022.

Going concern

The Company's day to day financing is from its available cash

resources.

The Company is confident of raising funds to enable it to

continue to develop its targeted investments and exploration

campaigns across its key projects over the next 12-18 months and

the Directors are confident that adequate funding can be raised as

required to meet the Company's current and future liabilities.

For the reasons outlined above, the Directors are satisfied that

the Company will be able to meet its current and future

liabilities, and continue trading, for the foreseeable future and,

in any event, for a period of not less than twelve months from the

date of approving this interim report. The preparation of these

interim financial statements on a going concern basis is therefore

considered to remain appropriate.

Critical accounting estimates

The preparation of condensed interim financial statements

requires management to make estimates and assumptions that affect

the reported amounts of assets and liabilities at the end of the

reporting period. Significant items subject to such estimates are

set out in the Company's 2020 Annual Report and Financial

Statements. The nature and amounts of such estimates have not

changed significantly during the interim period.

Intangible assets

Exploration and development costs

All costs associated with mineral exploration and investments

are capitalised on a project-by-project basis, pending

determination of the feasibility of the project. Costs incurred

include appropriate technical and administrative expenses but not

general overheads. If an exploration project is successful, the

related expenditures will be transferred to mining assets and

amortised over the estimated life of economically recoverable

reserves on a unit of production basis.

Intangible assets

Exploration and development costs

Where a licence is relinquished or a project abandoned, the

related costs are written off in the period in which the event

occurs. Where the Group maintains an interest in a project, but the

value of the project is considered to be impaired, a provision

against the relevant capitalised costs will be raised.

The recoverability of all exploration and development costs is

dependent upon the discovery of economically recoverable reserves,

the ability of the Group to obtain necessary financing to complete

the development of reserves and future profitable production or

proceeds from the disposition thereof.

3. Earnings per share

6 months 6 months Year ended

to to 31 December

30 June 30 June 2021

2022 2021

Unaudited Unaudited Audited

GBP GBP GBP

These have been calculated

on a loss of: (999,949) (890,354) (1,864,279)

---------------- ---------------- ----------------

The basic weighted

average number of

shares used was:

1,135,219,460 623,214,765 849,236,645

The diluted weighted

average number of

shares used was: 1,608,853,296 1,044,548,093 1,322,870,481

---------------- ---------------- ----------------

Basic loss per share: (0.09) pence (0.14) (0.22) pence

pence

Diluted loss per (0.06) pence (0.08) (0.14) pence

share: pence

4. Events after the reporting period

There were no reportable events after the reporting period other

than those highlighted in the 'Financial Review'.

The Condensed interim financial statements were approved by the

Board of Directors on 29 September 2022.

For the purposes of UK MAR, the person responsible for arranging

for the release of this announcement on behalf of the Company is

Rolf Gerritsen, Chief Executive Officer.

Contact details:

MetalNRG PLC

Rolf Gerritsen

Christopher Latilla-Campbell +44 (0) 20 7796 9060

Corporate Adviser

PETERHOUSE CAPITAL LIMITED

Lucy Williams/Duncan Vasey +44 (0) 20 7469 0930

----------------------

Corporate Broker

SI CAPITAL LIMITED

Nick Emerson +44 (0) 1483 413500

----------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPUUUBUPPGBB

(END) Dow Jones Newswires

September 30, 2022 02:00 ET (06:00 GMT)

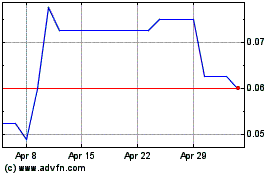

Metalnrg (LSE:MNRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Metalnrg (LSE:MNRG)

Historical Stock Chart

From Apr 2023 to Apr 2024