Melrose Industries PLC Trading Statement (9802N)

05 October 2021 - 5:00PM

UK Regulatory

TIDMMRO

RNS Number : 9802N

Melrose Industries PLC

05 October 2021

5 October 2021

MELROSE INDUSTRIES PLC

Trading Update

Melrose Industries PLC ("Melrose" or the "Group") publishes the

following trading update for the period 1 July 2021 to 30 September

2021 (the "Period"). All numbers are calculated at constant

currency.

Trading update

Melrose is seeing improvement in the Aerospace end markets with

revenue in the Period being 16%(1) higher than the same period last

year. The Aerospace business continues to improve its performance

through restructuring, and we expect the pace of this to further

pick up during the second half.

As previously discussed, there are well publicised supply

constraints in the automotive industry, and this naturally affects

the performance of the Automotive and Powder Metallurgy divisions.

At present the timing and duration of these constraints is

uncertain, but recently the consensus view is that they have

lengthened. There are a number of scenarios possible, but it is

likely these are below previous expectations.

The underlying demand from Automotive customers is strong, with

the near-term schedules from customers being above 2019

pre-COVID-19 levels. Those schedules are, however, then being

heavily constrained by the customers due to their supply chain

issues caused by the global shortage of semi-conductors. This is

best illustrated by 'in month cancellations' from customers rising

from a normal rate of c.1% each month experienced in Q1 this year

to a current rate of approximately 20% to 25%. A similar theme is

impacting Powder Metallurgy. These industry supply issues are very

difficult to plan for, or predict, and both businesses are working

with their customers to best manage this challenging situation.

The Automotive and Powder Metallurgy divisions would

nevertheless both still be able to deliver a full year margin of

approximately twice that achieved last year should the supply for

light vehicle production this year more closely resemble 2020

COVID-19 levels (i.e. approximately 76 million vehicles), as some

industry bodies now assume. This shows the clear benefit from the

restructuring projects being delivered especially as there is much

less governmental help for the industry this year compared to

last.

Melrose is confident that the scale of the impact on

profitability from any revenue adjustment is in line with previous

guidance given on margin drop-through, further underlining the good

progress being made with the restructuring of these businesses.

Both the Automotive and Powder Metallurgy businesses are fully on

track to achieve their margin targets once supply constraints are

resolved. As an inflationary environment returns, all of the

businesses are focussed on the recovery of their costs and will

take whatever actions are necessary to do so.

Cash generation in the year is expected to be managed well, with

all businesses showing positive cash flows, despite the supply

constraints in the automotive industry, and with continued

investment in new technology and restructuring. The disposal of

Nortek Control for $285 million has been successfully

completed.

As stated in the interim results, the Board will review a

capital return next March in the light of market conditions at the

time.

Simon Peckham, Chief Executive of Melrose Industries PLC,

said:

" All internal management actions are on track, and many are

ahead of plan. We are very pleased with the internal progress being

made. Tightened supply of semi-conductors to the automotive

industry are frustrating and difficult to plan for, but whilst they

affect current trading, they don't impact long-term value,

particularly as cash is well controlled and debt reduced. We have

made our businesses better, more flexible and resilient to deal

with near term headwinds, and all our businesses are on track to

achieve their margin targets assuming partial end market recoveries

.

1. Adjusted for the disposals of Fokker Services and Fokker

Techniek, completed in H1 2021

-ends-

Enquiries:

Montfort Communications: Nick Miles

+44 (0) 20 3514 0897

+44 (0) 7739 701 634

miles@montfort.london

Charlotte McMullen

+44 (0) 20 3514 0897

+44 (0) 7921 881 800

mcmullen@montfort.london

Melrose Investor Relations: Chris Dyett

+44 (0) 7974 974690

ir@melroseplc.net

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTKZLFBFBLBFBX

(END) Dow Jones Newswires

October 05, 2021 02:00 ET (06:00 GMT)

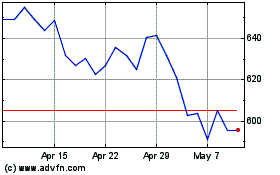

Melrose Industries (LSE:MRO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Melrose Industries (LSE:MRO)

Historical Stock Chart

From Apr 2023 to Apr 2024