TIDMMSMN

RNS Number : 5700X

Mosman Oil and Gas Limited

26 April 2023

26 April 2023

Mosman Oil and Gas Limited

("Mosman" or the "Company")

93% Increase in Quarterly Net Production

Mosman Oil and Gas Limited (AIM: MSMN) the oil exploration,

development, and production company, announces its Q3 production

update for the three months ended 31 March 2023 ("Q3" or "March

Quarter") delivering a 93% increase in net production compared to

the prior December Quarter.

US Production (Various interests)

Mosman made significant progress in growing the production

portfolio as a result of the Cinnabar-1 well (Mosman 75% working

interest) coming on production. Improved production at Stanley and

Winters contributed to the growth in the quarter in which Mosman

achieved net production of 11,960 boe (circa 133 boepd) versus

6,212 boe (c. 67 boepd) in the prior December Quarter.

March Quarter Production Summary

3 Months to 3 Months to

31 March 2023 31 December 2022

boe boe

=============================== ===============================

Gross Project Net Production Gross Project Net Production

Production to Mosman Production to Mosman

============== =============== ============== ===============

Gross boe Net boe Gross boe Net boe

============== =============== ============== ===============

Cinnabar 6,690 5,017 - -

============== =============== ============== ===============

Stanley 13,753 5,028 12,943 4,897

============== =============== ============== ===============

Winters 6,324 1,476 3,431 800

============== =============== ============== ===============

Livingston 535 107 1,238 248

============== =============== ============== ===============

Arkoma 1330 332 1,070 267

============== =============== ============== ===============

Total boe 28,632 11,960 18,682 6,212

============== =============== ============== ===============

Net Production of 11,960 boe comprised of 9,908 barrels of oil

and 11,902 MMBtu of gas. The average sale prices achieved during

the period was US$73.46 per barrel for oil and US$3.49 per MMBtu

for gas (December quarter was US$82.02 and US$5.69 respectively,

and in each case after transport and processing costs but before

royalties).

Production numbers in the Quarter are based on the current best

available data (including field data if necessary) and are subject

to adjustment upon receipt of final sales invoices from the

purchasers of products.

Major Project Updates

Cinnabar (75% Working Interest)

The Cinnabar-1 well was put on production at the end of December

2022 and produced throughout the March Quarter.

Gas infrastructure has been upgraded and a connection to the

sales gas pipeline is under way that will enable gas to be sold.

Current production numbers do not include gas.

During the period, formation water influx increased and this

caused a decrease in oil production to c50 bopd during April.

Wireline logs indicated that the oil and gas production was coming

from the 1st Wilcox and water was coming from one 2nd Wilcox sand

that had also been perforated. A workover was successfully

completed on 25 April setting a plug to seal off the 2(nd) Wilcox

zone. Production from the 1st Wilcox is expected to be restarted

during 26 April and updated flow rates will be reported in due

course. At some time in the future, the 2(nd) Wilcox will be

squeeze cemented to seal off the source of the water and

re-perforated in a different 2(nd) Wilcox sands to produce the

significant Reserves identified in the 2(nd) Wilcox. In addition,

in due course artificial lift may be used to increase flow

rates.

At G-2, a workover was performed to enable gas injection. Gas

from Cinnabar-1 was injected and this led to the well flowing,

demonstrating proof of concept. The next step is to inject gas at a

high enough pressure to initiate gas lift. This will require the

acquisition and installation of a gas compressor.

Technical work is being undertaken in order to prepare a

Development Plan for the Cinnabar lease. This work will include

updates of the 3D seismic interpretation on the lease and the

geological model and result in the identification of drilling

targets and locations. The Development Plan is expected to take

several months to complete.

Stanley (34.85% to 38.5% Working Interest)

Stanley benefitted from the completion of gas infrastructure and

workovers to optimise production. The gas lift on Stanley 4 and 5

was successful, with several days producing approximately 300 bopd.

However, due to decline in available gas the decision was made to

change to fluid injection and install jet pumps in these wells. The

recent aggregate daily gross production rate across Stanley is 154

bopd (averaged over the last 5 days of available data).

In addition to production optimisation work, a technical report

was also completed that detailed significant remaining production

potential in the Stanley leases.

Winters (23% Winters-2 Working Interest)

Winters-2 continues to produce at rates exhibiting natural

decline.

Cash position

As at 31 March 2023, Mosman had cash at bank of circa AU$682k,

which does not include the additional GBP300,000 raised per the

announcement on 6 April 2023.

John W Barr, Chairman, said: "We are pleased to report on the

progress we have made as a result of the development work enabling

us to deliver a significant quarter on quarter increase in

production."

Market Abuse Regulation (MAR) Disclosure

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ('MAR') which has

been incorporated into UK law by the European Union (Withdrawal)

Act 2018. Upon the publication of this announcement via Regulatory

Information Service ('RIS'), this information is now considered to

be in the public domain.

Enquiries:

Mosman Oil & Gas Limited NOMAD and Broker

John W Barr, Executive Chairman SP Angel Corporate Finance LLP

Andy Carroll, Technical Director Stuart Gledhill / Richard Hail /

jwbarr@mosmanoilandgas.com Adam Cowl

acarroll@mosmanoilandgas.com +44 (0) 20 3470 0470

Alma PR

Justine James

+44 (0) 20 3405 0205

+44 (0) 7525 324431

mosman@almapr.co.uk

Updates on the Company's activities are regularly posted on its

website:

www.mosmanoilandgas.com

Notes to editors

Mosman (AIM: MSMN) is an oil exploration, development, and

production company with projects in the US and Australia. Mosman's

strategic objectives remain consistent: to identify opportunities

which will provide operating cash flow and have development upside,

in conjunction with progressing exploration of existing exploration

permits. The Company has several projects in the US, in addition to

exploration projects in the Amadeus Basin in Central Australia.

Glossary

boe Barrels of oil equivalent based on calorific value as

opposed to dollar value

boepd Barrels of oil per day of oil equivalent based on calorific

value as opposed to dollar value

--------------------------------------------------------------

bo Barrels of oil

--------------------------------------------------------------

bopd Barrels of oil per day

--------------------------------------------------------------

Gross Project Means the production of boe at a total project level

Production (100% basis) before royalties (where Mosman is the Operator)

and where Mosman is not the operator the total gross

production for the project

--------------------------------------------------------------

Mcf Thousand cubic feet

--------------------------------------------------------------

Mcfpd Thousand cubic feet per day

--------------------------------------------------------------

MBtu One thousand British Thermal Units

--------------------------------------------------------------

MBtupd One thousand British Thermal Units per day

--------------------------------------------------------------

MMBtu One million British Thermal Units

--------------------------------------------------------------

MMBtupd One million British Thermal Units per day

--------------------------------------------------------------

Net Production Net to Mosman's Working Interest; Net Production attributable

to Mosman means net to Mosman's Working Interest before

royalties

--------------------------------------------------------------

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCDZGZDMVMGFZM

(END) Dow Jones Newswires

April 26, 2023 07:44 ET (11:44 GMT)

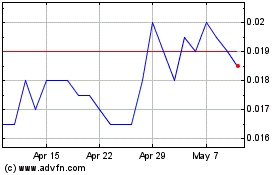

Mosman Oil And Gas (LSE:MSMN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mosman Oil And Gas (LSE:MSMN)

Historical Stock Chart

From Apr 2023 to Apr 2024