TIDMNSF

RNS Number : 1400N

Non-Standard Finance PLC

28 September 2021

Non-Standard Finance plc

('Non-Standard Finance', 'NSF', the 'Company' or the

'Group')

Unaudited Half Year Results to 30 June 2021

28 September 2021

Key points

-- The Group is continuing its discussions with the FCA

regarding its redress programme for guarantor loans customers at an

estimated total cost of GBP16.9m that has already been provided for

in the Group's balance sheet

-- The independent regulatory reviews of both branch-based lending and home credit are ongoing

-- Plans for a substantial capital raise ('the Capital Raise')

remain subject to, inter alia, the satisfactory completion of the

independent regulatory reviews; the continued support of Alchemy

and other key shareholders as well as the Group's lenders

-- In the absence of the Capital Raise, the Group remains

balance sheet insolvent and the Group's ability to remain a going

concern is subject to material uncertainties, but the Directors

continue to believe there is a good prospect of resolving this

position

-- The Group's performance in the first half was better than

expected and current trading is also encouraging:

o Branch-based lending: normalised pre-tax profit of GBP2.1m

(2020: GBP0.9m) with promising levels of loans issued and

impairment at historically low levels;

o Home credit: normalised pre-tax profit of GBP1.0m (2020:

GBP2.2m) with steady growth in customer numbers and impairment at

record lows as the quality of our customer base has improved;

and

o Guarantor loans: reduced normalised pre-tax loss of GBP1.9m

(2020: loss of GBP9.2m) thanks to a collections performance that

exceeded expectations and a marked reduction in impairment

-- Normalised revenue(1) down 26% to GBP67.8m (2020: GBP92.2m);

reported revenue of GBP67.8m (2020: GBP91.2m)

-- Normalised operating profit(1) increased by 87% to GBP9.4m

(2020: GBP5.0m); reported operating profit of GBP7.4m (2020:

operating loss of GBP12.3m)

-- Normalised loss before tax(1) of GBP3.5m (2020: normalised loss before tax of GBP9.9m)

-- Exceptional charge of GBP4.0m (2020: GBP91.3m) includes a

small increased provision for redress in guarantor loans and costs

associated with the Capital Raise resulting in a much reduced

reported loss before tax(2) of GBP7.5m (2020: reported loss of

GBP102.7m)

-- No half year dividend per share is being declared (2020: 0.0p per share).

-- At 30 June 2021 the Group had cash balances of GBP103.7m

(2020: GBP75.7m), gross borrowing of GBP330.0m (2020:

GBP345.0m)

-- After careful consideration, and despite the presence of a

number of material uncertainties as detailed in note 1 to the

financial statements, the Board has concluded that it remains

appropriate to continue to adopt the going concern basis of

accounting. The Group has remained within its financial covenants

to date

-- Current trading and outlook: all three divisions are trading

ahead of budget and the Group remains confident of being able to

complete the Capital Raise that will fund customer redress,

strengthen the balance sheet and provide funding for future

growth

Financial summary

6 months to 30 June 2021 2020 % change

GBP'000 GBP'000

---------------------------------- -------- ---------- ---------

Normalised revenue(1) 67,842 92,223 -26%

Reported revenue 67,842 91,252 -26%

Normalised operating profit(1) 9,385 5,016 87%

Reported operating profit/(loss) 7,467 (12,307) -161%

Normalised (loss)/profit

before tax(1) (3,510) (9,896) 65%

Reported loss before tax(2) (7,535) (102,749) 93%

Normalised (loss) / earnings

per share(3) (1.12)p (2.55)p 56%

Reported loss per share (2.41)p (32.77)p 93%

Half year dividend per share Nil Nil n/a

=================================== ======== ========== =========

(1) Normalised figures are before fair value adjustments,

amortisation of acquired intangibles and exceptional items.

Operating profit/(loss) is before finance costs. See glossary of

alternative performance measures and key performance indicators in

the Appendix.

(2) After fair value adjustments, amortisation of acquired

intangible assets and exceptional costs.

(3) Normalised loss per share in 2021 is calculated as

normalised loss after tax of GBP3.510m divided by the weighted

average number of shares of 312,437,422. The normalised earnings

per share in 2020 is calculated as normalised profit after tax of

GBP7.952m, divided by the weighted average number of shares of

312,437,422.

Jono Gillespie, Group Chief Executive Officer, said

"The Group delivered a strong operational performance in the

first half and both branch-based lending and home credit enjoyed a

much improved financial result versus the prior year that was

severely impacted by the pandemic.

"When Non-Standard Finance was founded in 2015 it had one main

purpose and belief: that people on low incomes or with a poor

credit history deserve access to credit they can afford, provided

in a transparent, effective and efficient way that takes account of

their needs and individual circumstances. Since then, we have

provided credit to more than 428,000 customers, helping them to

manage the peaks and troughs in their expenditure, often when they

had few other places to turn to.

"Today there are more than 10 million people in Britain whose

financial circumstances mean that they are effectively excluded

from mainstream credit but whose financial needs - whether to

repair a car or buy a new washing machine - still need to be

addressed. It is also clear that in the past two years the

landscape has changed, prompting the exit of a number of leading

companies that have either quit the sector altogether or have

severely curtailed their activities, leaving many consumers with

even fewer options to access regulated credit.

"After a great deal of work over the past year and despite the

challenges presented by the pandemic and a complex regulatory

landscape, we are determined to continue to deliver on our original

purpose. We are progressing our discussions with the FCA and hope

to reach a conclusion soon. While this work is ongoing, the Group

has concluded that an additional exceptional provision of GBP1.9m

is required to cover expected costs of redress due to customers

that may have suffered harm. The methodology of this estimate

remains unchanged, but the amount has increased due to the

continued accrual of estimated penalty interest.

"As soon as we are able to resolve the Group's outstanding

regulatory issues, we are focused on executing a substantial

capital raise of around GBP80m that will be used to both fund the

payment of redress as well as strengthen significantly the Group's

balance sheet, underpinning our return to profitable growth."

The tables below provide an analysis of the normalised results

(excluding fair value adjustments, amortisation of acquired

intangibles and exceptional items) for the Group for the six month

period to 30 June 2021 and 30 June 2020 respectively.

6 months to 30 June Branch-based Guarantor Home credit Central NSF plc

2021 lending loans costs

Normalised(4)

GBP000 GBP000 GBP000 GBP000 GBP000

------------------------- ------------- ---------- ------------ --------- ----------

Revenue 39,443 10,380 18,019 - 67,842

Other operating income 237 1 607 8 853

Modification loss (1,306) (1,904) - - (3,210)

Derecognition (loss)

gain (1,621) 130 - - (1,491)

Impairments (4,041) (984) (1,419) - (6,444)

Admin expenses (23,200) (6,870) (15,752) (2,343) (48,165)

Operating profit (loss) 9,512 753 1,455 (2,335) 9,385

Net finance cost (7,367) (2,611) (486) (2,431) (12,895)

------------- ---------- ------------ --------- ----------

Profit (loss) before

tax 2,145 (1,858) 969 (4,766) (3,510)

------------- ---------- ------------ --------- ----------

6 months to 30 June Branch-based Guarantor Home credit Central NSF plc

2020 lending loans costs

Normalised(4)

GBP000 GBP000 GBP000 GBP000 GBP000

------------------------- ------------- ---------- ------------ --------- ----------

Revenue 47,914 17,032 27,277 - 92,223

Other operating income 888 - - - 888

Modification loss (638) (58) - - (696)

Derecognition gain 192 494 - - 686

Impairments (15,593) (15,727) (7,927) - (39,247)

Admin expenses (22,238) (7,114) (16,382) (3,104) (48,838)

Operating profit (loss) 10,525 (5,373) 2,968 (3,104) 5,016

Net finance cost (9,603) (3,871) (774) (664) (14,912)

------------- ---------- ------------ --------- ----------

Profit (loss) before

tax 922 (9,244) 2,194 (3,768) (9,896)

------------- ---------- ------------ --------- ----------

(4) Excludes fair value adjustments, amortisation of acquired

intangibles and exceptional items

Given the significant reduction in lending that took place

during 2020, combined with a healthy collections performance during

the second half of 2020 and into 2021, the combined net loan book

before fair value adjustments reduced by 23% versus 2020 as

summarised in the table below:

Reconciliation of 2021 2021 2021 2020 2020 2020

net loan book Normalised Fair value Reported Normalised Fair value Reported

adjustments adjustments

GBPm GBPm GBPm GBPm GBPm GBPm

---------------------- ------------ ------------- ---------- ------------ ------------- ----------

Branch-based lending 163.8 - 163.8 187.7 - 187.7

Guarantor loans 41.4 - 41.4 87.6 0.4 88.0

Home credit 24.3 - 24.3 24.3 - 24.3

------------ ------------- ---------- ------------ ------------- ----------

Total 229.5 - 229.5 299.6 0.4 300.0

====================== ============ ============= ========== ============ ============= ==========

Context for the results

The 2021 reported results include exceptional items whilst the

2020 reported results include fair value adjustments, amortisation

of acquired intangibles and exceptional items. Exceptional items in

2021 include an additional provision for customer redress of

GBP1.9m, advisory fees in connection with the Group's proposed

capital raise of GBP1.6m and restructuring costs of GBP0.5m.

Exceptional items in 2020 include the write down of certain

intangible assets and all goodwill assets and a provision for

customer redress of GBP15.8m.

Investor presentation and dial-in details

There will be an investor presentation at 1.00pm on 28 September

2021. The meeting will be broadcast via webcast and conference

call. To watch the live webcast, please register for access by

visiting the Group's website www.nsfgroupplc.com . For those unable

to access the web, details of a dial-in facility are given below. A

copy of the webcast and slide presentation given at the meeting

will be available on the Group's website later today.

Dial-in details to listen to the analyst presentation at 1.00

pm, 28 September 2021

12.50 pm Please call +44 (0)330 336 9125

Access code 1882529

1.00 pm Meeting starts

All times are British Summer Time.

For more information:

Non-Standard Finance plc

Jono Gillespie, Group Chief Executive Officer +44 (0) 20 3869

Peter Reynolds, Director, IR and Communications 9020

Maitland/AMO

Neil Bennett +44 (0) 20 7379

Finlay Donaldson 5151

The non-standard consumer finance market

The non-standard consumer finance market represents a

significant segment of the UK's retail financial services sector.

It provides credit to consumers that either fail to meet the

lending requirements of high street financial institutions or that

choose not to borrow from them. These consumers represent

approximately a third of the UK's adult population and include

those that have no credit history, low credit status or are credit

impaired. A well-regulated, trusted and sustainable credit sector

is imperative to these consumers, particularly in the current

economic climate. Between March and October 2020, the FCA found,

that due to the impact of the pandemic there are now over 14

million people in the UK with low financial resilience. Focused on

face-to-face lending through both branch-based lending and home

credit, NSF's businesses are focused on serving the needs of these

sub-prime borrowers for whom access to appropriate financial

services can be important in helping them manage the peaks and

troughs of their income and expenditure.

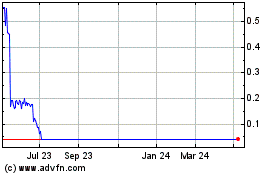

About Non-Standard Finance

Non-Standard Finance plc is listed on the main market of the

London Stock Exchange (ticker: NSF) and is a leading player in the

UK's non-standard finance market with leadership positions in

branch-based lending and home credit. The Group's evolution from a

cash shell back in 2015 has been achieved thanks to a period of

significant investment in all three divisions with a clear

differentiating feature being the Group's focus on face-to-face

lending. Our business is founded on building relationships with our

customers, many of whom have already been excluded by high-street

lenders and other mainstream providers. These relationships,

supported by significant physical and technological infrastructure,

represent the very heart of our business model that is focused on

addressing the credit needs of a growing proportion of the 10

million adults(4) that are either unable or unwilling to borrow

from mainstream banks and other lenders.

(4) UK Specialist Lending Market Trends and Outlook 2020.

Executive insights Volume XX, Issue 39 - L.E.K Consulting

Group Chief Executive's statement

Introduction

Against an uncertain but slowly improving macroeconomic backdrop

and despite a number of operational, regulatory and financial

challenges, the Group has performed ahead of management's

expectations with encouraging performances by the continuing

business divisions: branch-based lending and home credit. It was

announced on 30 June 2021 that the guarantor loans division was

being placed into a managed run-off due to the sub-scale nature of

the business and complex regulatory requirements, and would

ultimately be closed. As expressed at the time of the Group's 2020

full year results, whilst hugely disappointing, this was the only

logical conclusion and based on a detailed analysis, is expected to

deliver the best outcome for shareholders.

We are continuing to work with the FCA to resolve a number of

outstanding regulatory issues (see below) so that the Board can

move to complete a substantial capital raise of approximately

GBP80m (the 'Capital Raise') to fund customer redress, strengthen

the Group's balance sheet and underpin future loan book growth.

2021 half year results

The Group delivered a pleasing first half performance with both

branch-based lending and home credit ahead of budget and delivering

positive pre-tax profit before exceptional items. Despite not

having issued any loans in the period, the Guarantor Loans Division

also delivered an improved performance although remained

loss-making at the pre-tax level.

The significant reduction in the net loan books of all three

divisions versus the prior year meant that normalised revenue

before fair value adjustments reduced to GBP67.8m (2020: GBP92.2m).

However, this reduction was also accompanied by a marked reduction

in impairment due to the reduced levels of lending and a good

collections performance by all three divisions. This fed through

into a strong uplift in normalised operating profit to GBP9.4m in

the period (2020: GBP5.0m). A much reduced exceptional charge of

GBP4.0m (2020: GBP91.3m) meant that the reported loss before tax

was also significantly lower at GBP7.5m (2020: loss of GBP102.7m).

The exceptional charge included an additional provision for redress

of GBP1.9m, advisory fees associated with the Capital Raise of

GBP1.6m and restructuring costs in guarantor loans of GBP0.5m (see

Financial review below).

Branch-based lending

An uptick in both the number of leads and qualifying

applications to branch ('ATBs') more than justified the opening of

an additional branch in Leeds during the first half, taking the

total number of branches to 75. Whilst the sustained presence of

COVID-19 restrictions held back the pace of recovery during the

first four months of the year, both lead volume and ATBs increased

as these were gradually removed. While staff numbers had been

reduced during 2020, given the more gradual pace of recovery in

lending volumes there was still some surplus capacity in the

network during the first half although it is expected that this

will be removed by the usual seasonal increase in demand in the

autumn. Whilst the impact of lower lending volumes during 2020 and

2021 meant that revenues were down year-on-year, the impact on

profitability was mitigated by a strong collections performance

that also fed through into lower interest costs. The result was

that normalised profit before tax increased by 133% to GBP2.1m

(2020: GBP0.9m).

Since the end of June 2021, lending volumes have remained robust

and in-line with budget and the net loan book has continued to

recover. A reduction in the number of customers requiring

forbearance has helped to boost average yields and collections have

remained strong so that impairment remains at or below historic

norms. Whilst any return to COVID-19 restrictions or lockdowns

would hamper the pace of recovery, the current trading performance

is encouraging.

Home credit

As COVID-19 restrictions were gradually lifted, our agents were

able to return to making more face-to-face visits and overall

customer numbers began to increase. At the same time, the quality

of our customer base improved with an increase in the proportion

deemed to be 'quality customers' (i.e. those that have made 9 or

more payments out of the last 13 payments due) which is now back to

the levels seen in 2019. While the reduced levels of lending during

2020 and into 2021 meant that the net loan book declined

year-on-year, a step-up in lending volume in May and June drove a

return to month-on-month growth in the loan book. The collections

performance was particularly strong in the period with non-cash

payments remaining the most popular channel for customers. Whilst a

temporary spike in complaints in March meant that overall

administration costs were not down by as much as had previously

been expected, they were still down on last year and normalised

pre-tax profit was ahead of budget at GBP1.0m (2020: GBP2.2m).

Since the end of June, we have continued to grow the active

customer base as well as the number of quality customers on our

books which bodes well for future financial performance. Whilst the

summer months are traditionally a quieter lending period, with

lending volumes in July and August softer than expected, an

excellent collections performance meant that overall, the business

remains ahead of budget as we approach the important peak lending

period during the final quarter.

Guarantor loans

Following a detailed review of the Group's Guarantor Loans

Division, it was announced on 30 June 2021 that the division was to

be placed into a managed run-off and ultimately closed. Whilst

hugely disappointing, the Board determined that collecting out the

division's loan book was the only rational conclusion given the

combined impact of the pandemic, the sub-scale nature of the

business and complex regulatory requirements that would necessarily

impede any potential future recovery in profitability.

Having not written any new loans in the period, the loan book

declined by 53% and revenues were sharply down on the prior year.

However, collections were ahead of plan reflecting the dedication

and hard work of our staff, as well as a better than expected

payment performance by customers that had been affected by

COVID-19. This helped to reduce impairment significantly and the

delivery of a much reduced normalised pre-tax loss of GBP1.9m

(2020: pre-tax loss of GBP9.2m).

Since the end of June, the business has continued to deliver

strong collections performance alongside a carefully managed

reduction in the number of staff following the announcement that

the loan book was being placed into managed run-off.

Liquidity, funding and going concern

As at 30 June 2021 the Group had cash at bank of GBP103.7m (31

December 2020: GBP78.0m) and gross borrowings of GBP330.0m (31

December 2020: GBP330.0m). As at 31 August 2021 cash at bank was

GBP100.8m while the level of gross borrowings remained unchanged at

GBP330.0m.

The Group has a number of debt facilities including a GBP285m

term loan facility that matures in August 2023 and a GBP45m

revolving credit facility ('RCF') maturing in August 2022. Both

facilities remain fully drawn. The Group is in discussions with its

lenders regarding extensions to the term of its existing

facilities. Any such amendments to the existing facilities would be

conditional on the completion of the Capital Raise.

The Group also has a multi-year GBP200m securitisation facility

that remains undrawn. Whilst current cash balances mean that there

is no need for additional funding at the present time, the facility

remains in place. However, in the absence of the Capital Raise, it

is unlikely to be available for use owing to the associated

covenant requirements embedded within the facility agreement and

the need for permission from the lender prior to any drawdown. It

is hoped that following a successful capital raise the facility

will be available for future use, if required.

The Directors acknowledge the considerable challenges presented

over the last year and the material uncertainties which may cast

significant doubt on the ability of both the Group and the Company

to continue to adopt the going concern basis of accounting.

However, despite these challenges, it is the Directors' reasonable

expectation that the Group and Company will raise sufficient equity

in the timeframe required and will continue to operate and meet its

liabilities as they fall due for the next 12 months and beyond and

therefore it has concluded the business is viable.

Should the Capital Raise be unsuccessful or take longer than

expected to execute then it is expected that the Group would remain

in a net liability position from a balance sheet perspective, would

breach certain borrowing covenants during the next 12 months and as

a result would not be able to access further funding over the

period of breach and would require waivers from its lenders. In

such circumstance, the Group may fall under the control of its

lenders and there is a possibility of the Group going into

insolvency.

Refer to note 1 to the financial statements for further

detail.

Outstanding regulatory issues

Redress programme for guarantor loans customers

The Group announced on 5 August 2020 that, following its

multi-firm review of the guarantor loans sector, the FCA had raised

some concerns regarding certain processes and procedures at GLD and

a programme of redress would be required for those customers deemed

to have suffered harm as a result.

Having proposed a detailed redress methodology, the Group is

continuing to discuss this with the FCA with a view to commencing

the execution of the redress programme in 2021. In addition to the

exceptional provision of GBP15.4m that was included in the 2020

full year results to cover the total expected costs of the redress

programme, an additional exceptional provision of GBP1.9m has been

included in the 2021 half year results to reflect the continued

accrual of estimated penalty interest, as the scheme has taken

longer than expected to implement. The total estimated cost of the

programme, which remains subject to confirmation by the FCA,

includes: (i) the sum of all redress due to customers, including

penalty interest (the 'Gross Redress Amount') of GBP18.2m, offset

by existing impairment provisions of GBP1.9m; and (ii) the

associated operational costs of executing the programme amounting

to GBP0.6m, resulting in a net amount of GBP16.9m. It is possible

that the Gross Redress Amount may differ, perhaps materially from

the current estimate and that this could materially impact the

financial statements. This is because the Group and the FCA are

continuing to review the methodology as well as the risks and

inherent uncertainties surrounding the assumptions used in the

provision calculation.

Independent reviews of both branch-based lending and home

credit

In the light of its proposed redress methodology in guarantor

loans, the Group confirmed that it had commenced an independent

review of its lending processes and procedures in both branch-based

lending and home credit, taking account of recent decisions at the

Financial Ombudsman Service. These reviews are ongoing and we are

continuing to work closely with the FCA so that we can reach a

conclusion soon. The Directors recognise that whilst the

independent reviews at the branch-based lending and home credit

divisions remain ongoing there remains a risk that the final

outcome of these reviews may result in the identification of

customers who may require redress, and the cost of redress for the

Group could be materially higher than is currently provided for in

the financial statements.

Capital Raise

It is expected that the Capital Raise will involve a firm

placing and open offer and the Board has received indications of

support from the Group's major shareholder Alchemy, subject to the

outcome of the Group's engagement with its lenders, Alchemy's

analysis of the FCA and Group's regulatory reviews, and greater

levels of certainty around redress and claims.

Other regulatory developments

In addition to the matters outlined above, there have been a

number of other regulatory developments in late 2020 and in 2021

that have been particularly relevant to the Group's business and

these are summarised below:

-- Climate related disclosures - On 21 December 2020, the FCA

published a policy statement and final rule and guidance promoting

better climate-related financial disclosures for UK premium listed

commercial companies. They will be required to include a statement

in their annual financial report which sets out whether their

disclosures are consistent with the recommendations of the

Taskforce on Climate-related Financial Disclosures ('TCFD') and to

explain if they have not done so. The rule applies for accounting

periods beginning on or after 1 January 2021. The FCA has recently

consulted on proposals to: introduce climate-related financial

disclosure rules and guidance for asset managers, life insurers and

FCA-regulated pension providers; and extend climate-related

disclosure rules to standard listed issuers and we await the

outcome of this review. The FCA has also sought views on other

topical ESG issues in capital markets.

-- Woolard Review - On 2 February, the FCA published the

much-anticipated Woolard Review , a significant and wide-ranging

review of change and innovation in the unsecured credit market. The

report contains 26 recommendations for the FCA, government and

other bodies, including an urgent recommendation to bring all buy

now pay later products into the remit of FCA regulation.

-- Vulnerable customers - On 23 February 2021, the FCA published

its guidance for firms on the fair treatment of vulnerable

customers. The FCA wants to drive improvements in the way that

firms treat vulnerable customers and bring about a practical shift

in firms' actions and behaviour. It wants vulnerable customers to

experience outcomes that are as good as for other customers and to

receive consistently fair treatment.

-- Operational resilience - On 29 March 2021, the FCA published

its final rules and guidance on new requirements to strengthen

operational resilience in the financial services sector. They come

into force on 31 March 2022. By that date, affected firms must have

identified their important business services, set impact tolerances

for the maximum tolerable disruption and carried out mapping and

testing to a level of sophistication necessary to do so. Firms must

also have identified any vulnerabilities in their operational

resilience.

-- Consumer Duty - The FCA issued a consultation on a new

Consumer Duty that would seek to set clearer and higher

expectations for firms' standards of care towards consumers. It is

proposed that the Consumer Duty would be a package of measures,

comprised of a new Consumer Principle that provides an overarching

standard of conduct, supported by a set of cross-cutting rules and

four outcomes that set clear expectations for firms' cultures and

behaviours. Firms would be expected to monitor, test and (where

necessary) adapt their policies, practices and processes so they

can satisfy themselves, and demonstrate to the FCA where required,

that the outcomes for their customers are in line with the FCA's

expectations.

The FCA has sought views on two options for the wording of the

Consumer Principle: 'A firm must act to deliver good outcomes for

retail clients'; and 'A firm must act in the best interests of

retail clients'. The FCA is not consulting at this stage on the

drafting of the proposed remaining rules. A second consultation is

expected to follow by 31 December 2021 and any new rules will be

made by 31 July 2022.

We continue to monitor all regulatory developments closely so

that we can anticipate and, if necessary, engage with the relevant

authorities, either directly or through industry associations.

Dividend

As a result of the significant reported losses in 2020 and

during the first half of 2021, the Company does not have any

distributable reserves and is therefore not in a position to

declare a half year dividend (2020: GBPnil per share). As part of

any future capital raise, the Board is committed to completing a

process, subject to shareholder and Court approval, to create

sufficient distributable reserves so that the Company can resume

the payment of cash dividends to shareholders when it is

appropriate to do so.

Current trading and outlook

All three divisions remain ahead of budget with strong

collections and better than expected rates of impairment. While the

pace of recovery in lending volumes has been a little softer than

expected during the summer months, given the structural changes in

the home credit market and our pre-eminent position in branch-based

lending, subject to the successful execution of the Capital Raise,

we are well placed to achieve our financial objectives of

year-on-year loan book growth and an improving return on asset.

Jono Gillespie

Group Chief Executive Officer

28 September 2021

Financial review

Fair value adjustments and amortisation of acquired intangibles

in 2020 include amounts relating to the acquisition of George

Banco. There were no such adjustments in 2021.

6 months to 30 June 2021 2021 2021

Fair value

adjustments,

amortisation

of acquired

intangibles

and exceptional

Normalised(1) items Reported

GBP'000 GBP'000 GBP'000

-------------------------------------------- ---------------------------- ----------------- ----------------------

Revenue 67,842 - 67,842

Other operating income 853 - 853

Modification loss (3,210) - (3,210)

Derecognition gain (1,491) - (1,491)

Impairments (6,444) - (6,444)

Exceptional provision for customer redress - (1,918) (1,918)

Admin expenses (48,165) - (48,165)

---------------------------- ----------------- ----------------------

Operating profit (loss) 9,385 (1,918) 7,467

Exceptional items(2) - (2,107) (2,107)

---------------------------- ----------------- ----------------------

Profit (loss) before interest and tax 9,385 (4,025) 5,360

Finance cost (12,895) - (12,895)

---------------------------- ----------------- ----------------------

Loss before tax (3,510) (4,025) (7,535)

Taxation - - -

---------------------------- ----------------- ----------------------

Loss after tax (3,510) (4,025) (7,535)

============================ ================= ======================

Loss per share (1.12) (2.41)

Dividend per share - -

============================================ ============================ ================= ======================

6 months to 30 June 2020 2020 2020

Fair value

adjustments,

amortisation

of acquired

intangibles

and exceptional

Normalised(1) items Reported

GBP'000 GBP'000 GBP'000

-------------------------------------------- -------------- ----------------- ----------

Revenue 92,223 (971) 91,252

Other operating income 888 - 888

Modification loss (696) - (696)

Derecognition gain 686 - 686

Impairments (39,247) - (39,247)

Exceptional provision for customer redress - (15,753) (15,753)

Admin expenses (48,838) (599) (49,437)

-------------- ----------------- ----------

Operating profit (loss) 5,016 (17,323) (12,307)

Exceptional items(2) - (75,530) (75,530)

-------------- ----------------- ----------

Profit (loss) before interest and tax 5,016 (92,853) (87,837)

Finance cost (14,912) - (14,912)

-------------- ----------------- ----------

Loss before tax (9,896) (92,853) (102,749)

Taxation 1,944 (1,569) 375

-------------- ----------------- ----------

Loss after tax (7,952) (94,422) (102,374)

============== ================= ==========

Loss per share (2.55) (32.77)

Dividend per share - -

============================================ ============== ================= ==========

(1) Normalised figures, adjusted to exclude fair value

adjustments, amortisation of acquired intangibles and exceptional

items(2) . Refer to note 6 in the notes to the financial statements

for further detail

Whilst the UK economy bounced-back strongly during the first

half of 2021, the impact of the pandemic on the Group during 2020

together with sustained COVID-19 restrictions in certain sectors

continued to impact the Group's financial performance in the first

half of 2021. Normalised revenue was down 26% at GBP67.8m (2020:

GBP92.2m) reflecting the decline in the net loan books of all three

divisions following the significant reduction in lending and higher

impairment experienced in 2020. Whilst lending volumes at both

branch-based lending and home credit showed steady growth

month-on-month in 2021, there was no new lending at guarantor loans

and, as announced at the time of the Group's full year results in

June 2021, the loan book of that division is now in managed

run-off. Modification and derecognition losses increased in the

period following increased levels of forbearance offered to

customers affected by the pandemic, whilst better than expected

collections performance in all three divisions meant impairments

fell by 84% to GBP6.4m (2020: GBP39.2m).

Administration costs were 1% lower at GBP48.2m (2020: GBP48.8m)

with lower staff and marketing costs offset by an increase in

complaint handling costs following a temporary spike in complaints

during the first quarter. The spike was driven by certain claims

management companies ('CMCs') and has since reduced significantly.

Whilst still some way off from operating at full strength, the net

result was that normalised operating profit rose by 87% to GBP9.4m

(2020: GBP5.0m). Having repaid the securitisation facility that was

first drawn in April 2020, finance costs were some GBP2.0m lower at

GBP12.9m (2020: GBP14.9m) that led to a much reduced normalised

loss before tax of GBP3.5m (2020: loss before tax of GBP9.9m).

An exceptional charge totalling GBP4.0m (2020: GBP91.3m)

comprised an increased provision for customer redress together with

restructuring costs and fees associated with the Capital Raise. The

net result was a much reduced reported loss before tax of GBP7.5m

(2020: loss before tax of GBP102.7m) and normalised loss per share

was 1.12p (2020: loss per share of 2.55p) while exceptional items

meant that the Group's reported loss per share was 2.41p (2020:

loss per share of 32.77p).

Divisional review

Branch-based lending

Despite the continued presence of government restrictions, the

business remained fully operational throughout the period with all

branches open and delivered a better than expected performance in

the period. While remote channels remain popular in many areas of

the consumer credit market, we remain committed to face-to-face

lending which we continue to believe drives better outcomes for

customers, can deliver attractive shareholder returns and is at the

heart of our business model.

Financial results

6 months to 30 June 2021 2021 2021

Fair value adjustments

and exceptional

Normalised items Reported

GBP'000 GBP'000 GBP'000

------------------------------- ------------------------ ------------------------------------- --------------------

Revenue 39,443 - 39,443

Other operating income 237 - 237

Modification loss (1,306) - (1,306)

Derecognition loss (1,621) - (1,621)

Impairments (4,041) - (4,041)

------------------------ ------------------------------------- --------------------

Revenue less impairment 32,712 - 32,712

Admin expenses (23,200) - (23,200)

------------------------ ------------------------------------- --------------------

Operating profit 9,512 - 9,512

Exceptional items - - -

------------------------ ------------------------------------- --------------------

Profit before interest and tax 9,512 - 9,512

Finance cost (7,367) - (7,367)

------------------------ ------------------------------------- --------------------

Profit before tax 2,145 - 2,145

Taxation - - -

------------------------ ------------------------------------- --------------------

Profit after tax 2,145 - 2,145

======================== ===================================== ====================

6 months to 30 June 2020 2020 2020

Fair value adjustments

and exceptional

Normalised items Reported

GBP'000 GBP'000 GBP'000

------------------------- ----------- ----------------------- ----------

Revenue 47,914 - 47,914

Other operating

income 888 - 888

Modification loss (638) - (638)

Derecognition gain 192 - 192

Impairments (15,593) - (15,593)

----------- ----------------------- ----------

Revenue less impairment 32,763 - 32,763

Admin expenses (22,238) - (22,238)

----------- ----------------------- ----------

Operating profit 10,525 - 10,525

Exceptional items - - -

----------- ----------------------- ----------

Profit before interest

and tax 10,525 - 10,525

Finance cost (9,603) - (9,603)

----------- ----------------------- ----------

Profit before tax 922 - 922

Taxation (175) - (175)

----------- ----------------------- ----------

Profit after tax 747 - 747

=========== ======================= ==========

The business saw an increase in the volume of leads and

qualifying 'applications to branch' ('ATBs') during the first half

of 2021 versus the prior year although activity levels remained

below that in 2019. This increase, coupled with higher conversion

rates of new borrower ATBs drove an increase in the total number of

loans booked. Taken together these factors combined to have a

positive impact on monthly lending volumes and the total level of

new lending increased from GBP7.9m in January to GBP11.6m in June

2021, of which GBP10.0m was new cash. While the impact of the

pandemic on lending volumes in 2020 meant that the net loan book

declined year-on-year, the positive recovery in lending volumes

throughout 2021 meant that the net loan book returned to

month-on-month growth in June 2021 and ended the period at

GBP163.8m (2020: GBP187.7m).

Collections performance has been strong in the period and

although the absolute level of collections remains below 2019

levels, it has been an encouraging performance with the result that

both delinquency and impairment rates are at historic lows.

Contributing to this strong performance has been the significant

progress made on improving our lending processes, including the

assessment of creditworthiness, where we have made great strides

over the past nine months. The nature of IFRS 9 accounting means

that lower lending volumes also helps to reduce impairment charges

however, it is expected that impairment rates will gradually return

to historic norms as volumes recover. While the number of active

customers was down year-on-year at 65,500 in June 2021 (2020:

70,700), June delivered the first month-on-month increase in 2021

and this has been sustained into July and August.

IFRS 9 Key Performance Indicators(7) 2021 2020

Number of branches 75 73

Period end customer numbers (000) 65.5 70.7

Period end loan book (GBPm) 163.8 187.7

Average loan book (GBPm) 173.2 208.1

Revenue yield 47.0% 46.7%

Risk adjusted margin 35.7% 34.2%

Impairments/revenue 24.0% 26.7%

Impairment/average loan book 11.3% 12.4%

Cost to income ratio 51.8% 45.2%

Operating profit margin 15.2% 26.2%

Return on asset 7.2% 12.2%

====================================== ================ ======

(7) All definitions are as per glossary.

Despite an improvement in revenue yield, the decline in the net

loan book meant that revenue fell by 18% to GBP39.4m (2020:

GBP47.9m). Lower debt sales and government support in relation to

furloughed employees meant that other operating income was GBP0.2m

(2020: GBP0.9m). The increase in modification losses to GBP1.3m

(2020: GBP0.6m) and derecognition losses that increased to GBP1.6m

(2020: gain of GBP0.2m) reflected the increased level of deferred

and rescheduled loans that remain the division's primary

forbearance tools and that have been deployed extensively during

the pandemic. However, these higher costs were more than offset by

the strength of the collections performance that helped to drive a

significant reduction in the level of impairment. Impairment as a

percentage of revenue reduced to 24.0% on a rolling 12-month basis

(2020: 26.7%) and as a percentage of average net receivables it

fell from 12.4% to 11.3% which is only marginally higher than it

was in the six months to June 2020. Savings in staff and

marketing-related costs were offset by an increase in complaint

handling costs with the result that administrative expenses grew by

4% to GBP23.2m (2020: GBP22.2m). The net impact of these factors

was that normalised operating profit fell by 10% to GBP9.5m (2020:

GBP10.5m).

Strong cash generation and lower lending volumes meant that

finance costs fell by 23% to GBP7.4m (2020: GBP9.6m) which more

than offset the reduction in operating profit outlined above with

the result that the pre-tax profit more than doubled to GBP2.1m in

the first half (2020: GBP0.9m).

Despite the additional challenges presented by the pandemic, we

have continued to monitor a series of key value drivers (network

capacity, lead volumes and quality, productivity and delinquency

management) in order to manage the business and a description of

how these drivers changed during the first half of 2021 is set out

below.

Network capacity - Having suspended our previous branch opening

programme in 2020, given the steady increase in leads and ATBs, we

proceeded to open the planned new branch in Leeds during the first

half of 2021, taking the total number of open branches to 75. There

was however a net reduction of staff versus the prior year

following the decision to adjust our capacity after the first

lockdown in 2020. As a result, the total number of staff reduced to

436 as at the end of June 2021 (2020: 514). Whilst this still

resulted in some excess capacity during the first half, we were

focused on ensuring that we would be able to take full advantage of

the return to growth as the economy recovered and so accepted an

increase in the cost:income ratio during the period.

Lead volumes and quality - New borrower lead volumes and ATBs

were up strongly versus 2020 (10% and 21% respectively), although

this was still below the levels seen over the same period in 2019.

However, the trajectory was particularly encouraging and in the six

months to 30 June 2021, we received a total of 926,400 new borrower

applications (2020: 845,600) of which 188,400 (2020: 154,600)

passed our screening criteria and qualified as ATBs.

Productivity - Despite the strong increase in new borrower ATBs,

we still managed to increase conversion over the six month period

to 6.5% (2020: 6.2%), providing a further boost to the total number

of loans issued, which increased month-on-month throughout the

period to reach 17,577 (2020: 13,828), a 27% increase over the

prior year. We continued to invest in our technology with the

roll-out of an enhanced creditworthiness initiative, a more

effective telephony solution as well as an open banking pilot, all

of which are expected to drive better outcomes for customers and

increase productivity. New cash issued was up 36% to GBP48.3m

(2020: GBP35.5m).

Delinquency management - Whilst we remain extremely sensitive to

the challenges being faced by a number of customers at this

difficult time, the collections performance in the period was ahead

of expectations and reflects the effectiveness of both our

underwriting process as well as our forbearance tools and

collections procedures. The number of customers affected by

COVID-19 on 30 June 2021 had reduced to less than 800 versus over

8,600 at the end of June 2020 and rescheduled loans continued to

reduce as a percentage of the overall book while deferments had

also returned to normalised levels. The net result was that

delinquency levels overall were at historically low levels during

the first half of 2021 and this helped to drive lower rates of

impairment.

Other operational developments included the launch of an

independent review to ensure that there are no implications for the

division as a result of the multi-firm review into guarantor loans

or from recent decisions at the Financial Ombudsman Service. This

review is ongoing and there remains a risk that the final outcome

of the review may result in the identification of customers who may

require redress, and the cost of redress for the Group could be

materially higher than is currently provided for in the financial

statements.

Plans for the rest of 2021

We remain focused on rebuilding the loan book and returning the

branch network to full capacity whilst continuing to maintain a

tight grip on impairment. We remain committed to servicing the

needs of those consumers that may have been excluded from

mainstream lenders through the use of our face-to-face lending

model, one that is both popular with customers and capable of

generating attractive rates of return. Whilst more expensive to

operate than pure online lenders, we continue to believe that it

delivers better outcomes for customers and that our position in the

market offers scope for substantial growth.

Since the end of June 2021, whilst the summer months are

traditionally a softer trading period for the division, we have

continued to trade ahead of budget and lending volumes are in-line

with plan. Our collections performance is ahead of plan and while

we expect the historic low levels of impairment to return to more

normalised rates, we also expect that an improving yield will help

to sustain an attractive risk adjusted margin. We continue to

expect that the demand for our products and services will increase

as a result of the continued economic recovery as well as from some

of the structural changes in the market as a number of competitors

and product categories have been withdrawn. As a result, and whilst

we remain vigilant given the rapidly changing environment, based on

our performance to-date and the steps already taken, we plan to

return to our branch opening programme with a small number of

additional branches opening before the end of the year. Beyond

that, our medium-term vision remains to reach a network of over 100

branches and whilst this will first require the Group to complete

the Capital Raise as planned, once achieved, the business will be

well placed to realise that vision.

Home credit

As a face-to-face lender, the start of the pandemic in 2020

forced us to pivot, albeit temporarily, to an exclusively remote

lending and collections model. However, as soon as it was safe to

do so, we reverted to our face-to-face model. While a number of

customers have continued to use remote channels both to make

payments and also to borrow, our c.900 agencies are maintaining

their regular contact with customers, not just to make a physical

collection or to lend but importantly to ensure they know what is

happening in the household so that they are better placed to

anticipate future needs and/or can apply appropriate forbearance

should payment difficulties appear on the horizon. This insight

lies at the core of a successful home credit business and we

believe delivers a consistently better outcome for customers than

pure remote lending models where there is no face-to-face

contact.

2021 began with the UK in lockdown and this hampered the new

lending performance in home credit, especially during the early

months of the year. Whilst there is always a seasonal reduction in

loan volumes at the start of the calendar year following the

Christmas peak lending period, the demand for credit in the first

quarter of 2021 was a little softer than we might have expected,

with the result that the net loan book continued to decline until

April 2021 before returning to growth as COVID-19 restrictions came

to an end and as consumers began to feel more positive about the

macroeconomic outlook. This recovery in lending volumes continued

throughout the period rising from GBP1.4m in January and reaching

GBP5.9m in June 2021. Whilst this was still below 2019 volumes in

absolute terms (where the increase was from GBP3.5m in January to

GBP7.4m in June), the pace of recovery from May onwards was

encouraging.

Financial results

6 months to 30 June 2021 2021 2021

Normalised Exceptional items Reported

GBP'000 GBP'000 GBP'000

-------------------------------- -------------------------- ------------------ ----------

Revenue 18,019 - 18,019

Other income 607 607

Impairments (1,419) - (1,419)

-------------------------- ------------------ ----------

Revenue less impairments 17,207 - 17,207

Admin expenses (15,752) - (15,752)

-------------------------- ------------------ ----------

Operating profit 1,455 - 1,455

Exceptional items - - -

-------------------------- ------------------ ----------

Profit before interest and tax 1,455 - 1,455

Finance cost (486) - (486)

-------------------------- ------------------ ----------

Profit before tax 969 - 969

Taxation - -

-------------------------- ------------------ ----------

Profit after tax 969 - 969

6 months to 30 June 2020 2020 2020

Normalised Exceptional items Reported

GBP'000 GBP'000 GBP'000

-------------------------------- ----------- ------------------ ----------

Revenue 27,277 - 27,277

Impairments (7,927) - (7,927)

----------- ------------------ ----------

Revenue less impairments 19,350 - 19,350

Admin expenses (16,382) - (16,382)

Operating profit 2,968 - 2,968

Exceptional items - - -

----------- ------------------ ----------

Profit before interest and tax 2,968 - 2,968

Finance cost (774) - (774)

----------- ------------------ ----------

Profit before tax 2,194 - 2,194

Taxation (417) - (417)

----------- ------------------ ----------

Profit after tax 1,777 - 1,777

As the vast majority of the Group's customers tend to borrow

more than once, the size of the existing customer base is an

important key performance indicator for the business. With lower

lending volumes and a better than expected collections performance,

the number of active customers fell to 69,800 at the end of June

2021 (2020: 77,200) although this was above a low in the period of

68,500 in March 2021. Since then, lending volumes have continued to

increase and with it the number of active customers, of which an

increasing proportion are quality customers i.e. they have made at

least 9 out of the last 13 payments due. As at 30 June 2021, 55% of

the active customer base were quality customers, up from 40% in

June 2020 (in June 2019 the proportion of quality customers was

56%).

In 2021 the number of staff remained broadly steady at just over

300 throughout the period and so the business has continued to

deliver increasing levels of productivity as lending volumes

increased. However, the improvements would have been even greater

were it not for a significant spike in the number of customer

complaints received during the first quarter, following which there

was a marked increase in the number of staff (and contractors)

focused on reducing the volume of outstanding complaints. Most of

these staff were redeployed from other roles internally although

there was a need to also use third party contractors during the

period. Having already provided for this significant investment in

complaint handling in the 2020 full year results, the additional

manpower successfully reduced the backlog of outstanding complaints

and the numbers of complaints received has since reduced back down

to normalised levels. However, if the level of complaints were to

return to Q1 levels, this would have a material adverse impact on

the division.

The productivity improvements outlined above were in part thanks

to our persistent drive to improve and in particular our ongoing

investment in technology that in 2021 included the continued

evolution of our mobile lending app for agents that saw version 6

go live during the period. We also continued to develop our

customer portal that, among other things, allows customers to view

their balance, make a payment or request access to further credit -

approximately 9,200 customers or 11% of the total accessed the

portal during the first half of 2021, up from 7% in the first half

of 2020.

Despite lower lending volumes, the collections performance was

ahead of expectations, driven by our strong customer relationships

and underwriting approach. The result was that the rates of

impairment were also better than expected reaching unprecedented

low levels that are rarely seen in the home credit industry. Taken

together, the impact on the net loan book was that it ended the

period flat at GBP24.3m (2020: GBP24.3m).

Key Performance Indicators(8) 2021 2020

Period end agency numbers 896 887

Period end number of offices 64 65

Period end customer numbers (000) 69.8 77.2

Period end loan book (GBPm) 24.3 24.3

Average loan book (GBPm) 24.4 33.8

Revenue yield 141.9% 169.7%

Risk adjusted margin 125.5% 123.8%

Impairments/revenue 11.5% 27.1%

Impairment/average loan book 16.4% 45.9%

Cost to income ratio 101.9% 59.4%

Operating profit margin (11.6)% 13.5%

Return on asset (16.5)% 23.0%

===================================== ======== =======

(8) All definitions are as per glossary and above

Whilst there was a slight shift towards shorter-term loans in

2020, albeit with much lower lending volumes, the picture in 2021

returned to a more normalised mix, helped by the launch of a new

52-week product late in 2020 that is now our most popular product.

Around 34% of loans issued in the first six months of 2021 were for

34 weeks or less versus 36% in 2020. However, due to unprecedented

levels of forbearance offered in 2020, average yield dropped from

169.7% to 141.9% reflecting a marked increase in the number of

slow-paying loans that whilst continuing to be collected, reached

beyond their original term at which point, due to the fixed service

charge of the product, they no longer generate revenue. A lower net

loan book and reduced yield meant that overall revenue was 34%

lower at GBP18.0m (2020: GBP27.3m). As noted above, the collections

performance was better than expected and despite lower revenue, the

absolute level of impairment declined by 82% to GBP1.4m (2020:

GBP7.9m) and the rate of impairment as a percentage of revenue

declined from 27.1% in the prior year to 11.5% for the twelve month

period to 30 June 2021, an historic low for the business.

Solid cost savings in a number of areas including staff-related

costs, IT and travel, helped to reduce administration costs to

GBP15.8m (2020: GBP16.4m). However, given the reduction in revenue

for the reasons outlined above, the rolling 12-month cost:income

ratio increased to 101.9% (2020: 59.4%). This is clearly not

sustainable, but is a consequence of, among other things, the lower

net loan book due to COVID-19 and the accounting treatment of

slow-paying accounts. Assuming that the recent current trading

performance is sustained and the loan book continues to recover,

revenue will increase and the cost:income ratio will start to fall.

The net result was that normalised operating profit fell from

GBP3.0m to GBP1.5m and while strong cash generation meant that

finance costs fell to GBP0.5m (2020: GBP0.8m) pre-tax profit

reduced to GBP1.0m (2020: GBP2.2m).

Other operational developments included the launch of an

independent review to ensure that there are no implications for the

division as a result of the multi-firm review into guarantor loans

or from recent decisions at the Financial Ombudsman Service. This

review is ongoing and so there remains a risk that the final

outcome of the review may result in the identification of customers

who may require redress, and the cost of redress for the Group

could be materially higher than is currently provided for in the

financial statements.

Plans for the rest of 2021

The business is continuing to grow its customer base, that was

significantly reduced by the effects of the pandemic. The number of

quality customers is also continuing to increase which bodes well

for future levels of impairment and a recovery in the return on

assets. That said, we remain focused on maintaining our strong

collections performance and exploring how we can continue to

improve our lending approach, leveraging many of the in-house tools

that we have developed as well as through the deployment of new

tools such as open banking, taking into account any learnings from

the ongoing external reviews. Assuming the Capital Raise is

successful and given the structural changes in the market, the

Group believes that a significant opportunity exists to attract a

number of highly experienced competitor agents that could help to

accelerate the recovery in the division's loan book. The

encouraging current trading performance gives us a strong platform

as we look forward to the forthcoming peak lending period in

November and December.

Guarantor loans

The ongoing discussions with the FCA regarding the Group's

proposed redress methodology for certain of its guarantor loans

customers meant that the division didn't issue any new loans in the

period. However, the business continued to collect ahead of

management's expectations and whilst this was good for impairment

and cash flow, it also meant that the net loan book continued to

decline, reaching GBP41.4m at 30 June 2021 (2020: GBP87.6m). As

noted below, this impacted the financial performance of the

division and, as announced with the Group's 2020 full year results

on 30 June 2021, the Board concluded that shareholder interests

would be best served by placing the division into a managed run-off

and ultimately closing the business. Whilst hugely disappointing,

the Board determined that collecting out the loan book was the only

rational conclusion given the combined impact of the pandemic, the

sub-scale nature of the business and complex regulatory

requirements that would necessarily impede any potential recovery

in profitability in the future.

Financial results

The reduction in the net loan book meant that revenue declined

by 39% to GBP10.4m (2020: GBP17.0m). An increased number of

customers receiving forbearance drove up modification losses and

reduced derecognition gains while the smaller loan book and strong

collections performance meant the division saw a reduction in the

absolute value of impairment from GBP15.7m in 2020 to GBP1.0m. As a

percentage of both revenue and average net receivables, the rate of

impairment fell to 41.2% (2020: 61.6%) and 16.5% (2020: 19.9%)

respectively due to the reasons above. Whilst there was a

meaningful reduction in headcount versus the prior year, the full

benefit was partially offset by additional costs relating to the

proposed redress programme with the result that administration

costs fell by 3% to GBP6.9m (2020: GBP7.1m and the division

achieved a normalised operating profit of GBP0.8m which was a

marked improvement on the prior year (2020: operating loss of

GBP5.4m). Strong cashflow contributed to lower finance costs that

reduced the normalised loss before tax to GBP1.9m (2020: loss

before tax of GBP9.2m).

An additional exceptional provision for customer redress of

GBP1.9m (2020: GBP15.8m) reflected the impact of a delayed start to

the redress program which increased the penalty interest accrued

and also the amount to be returned to customers from more recent

collections. The total provision in the Group's balance sheet

represents the Directors' best estimate of the total costs of

redress based on the detailed methodology developed in conjunction

with the Group's advisers. As the redress review is still ongoing,

it is possible that the eventual outcome may differ materially from

the current estimate and that this could materially impact the

financial statements due to the risks and inherent uncertainties

surrounding the assumptions used in the provision calculation.

6 months to 30 June 2021 2021 2021

Fair value

Normalised(9) adjustments Reported

------------------------------------ -------------------------- ------------- ------------------

GBP'000 GBP'000 GBP'000

Revenue 10,380 - 10,380

Other income 1 - 1

Modification gain loss (1,904) - (1,904)

Derecognition gain loss 130 - 130

Impairments (984) - (984)

-------------------------- ------------- ------------------

Revenue less impairments 7,623 - 7,623

Exceptional provision for customer

redress - (1,918) (1,918)

Admin expenses (6,870) - (6,870)

-------------------------- ------------- ------------------

Operating profit (loss) 753 (1,918) (1,165)

Exceptional items - (527) (527)

Profit (loss) before interest and

tax 753 (2,445) (1,692)

Finance cost (2,611) - (2,611)

-------------------------- ------------- ------------------

Loss before tax (1,858) (2,445) (4,303)

Taxation - - -

-------------------------- ------------- ------------------

Loss after tax (1,858) (2,445) (4,303)

========================== ============= ==================

6 months to 30 June 2020 2020 2020

Fair value

Normalised(9) adjustments Reported

------------------------------------ -------------- ------------- ---------

GBP'000 GBP'000 GBP'000

Revenue 17,032 (971) 16,061

Other income - - -

Modification loss (58) - (58)

Derecognition gain 494 - 494

Impairments (15,727) - (15,727)

-------------- ------------- ---------

Revenue less impairment 1,741 (971) 770

Exceptional provision for customer

redress - (15,753) (15,753)

Admin expenses (7,114) - (7,114)

-------------- ------------- ---------

Operating loss (5,373) (16,724) (22,097)

Exceptional items - - -

Loss before interest and tax (5,373) (16,724) (22,097)

Finance cost (3,871) - (3,871)

-------------- ------------- ---------

Loss before tax (9,244) (16,724) (25,968)

Taxation 1,756 185 1,941

-------------- ------------- ---------

Loss after tax (7,488) (16,539) (24,027)

============== ============= =========

(9) Normalised figures, adjusted to exclude fair value

adjustments and amortisation of acquired intangibles

IFRS 9 Key Performance Indicators(10) 2021 2020

Period end customer numbers (000) 19.9 31.5

Period end loan book (GBPm) 41.4 87.6

Average loan book (GBPm) 60.7 102.1

Revenue yield 40.1% 32.3%

Risk adjusted margin 23.6% 12.4%

Impairment/revenue 41.2% 61.6%

Impairment/average loan book 16.5% 19.9%

Cost to income ratio 55.6% 41.8%

Operating profit margin (23.0)% (1.1)%

Return on asset (9.2)% (0.4)%

======================================= ======== =======

(10) All definitions are as per glossary.

Plans for the rest of 2021

The Group is focused on reaching a conclusion regarding its

proposed redress methodology which is a pre-requisite for the

execution of the Capital Raise and will also allow us to start to

execute the redress programme for those customers that may have

suffered harm. In the meantime, we are continuing to manage the

collect-out of the remaining loan book, a process that is currently

working well.

Central costs

6 months to 30 Jun e 2021 2021 2021

Normalised(11) Amortisation Reported

of acquired

intangibles

and exceptional

items

GBP000 GBP000 GBP000

------------------------------ -------------------------- -------------------------- --------------------------

Revenue - - -

Other income 8 8

Admin expenses (2,343) - (2,343)

-------------------------- -------------------------- --------------------------

Operating loss (2,335) - (2,335)

Exceptional items(14) - (1,580) (1,580)

Loss before interest and tax (2,335) (1,580) (3,915)

Net finance (cost)/income (2,431) - (2,431)

-------------------------- -------------------------- --------------------------

Loss before tax (4,766) (1,580) (6,346)

Taxation - - -

-------------------------- -------------------------- --------------------------

Loss after tax (4,766) (1,580) (6,346)

========================== ========================== ==========================

6 months to 30 Jun e 2020 2020 2020

Normalised(11) Amortisation Reported

of acquired

intangibles

and exceptional

items

GBP000 GBP000 GBP000

------------------------------ -------------------------- -------------------------- --------------------------

Revenue - - -

Admin expenses (3,104) (599) (3,703)

Operating loss (3,104) (599) (3,703)

Exceptional items - (75,530) (75,530)

-------------------------- -------------------------- --------------------------

Loss before interest and tax (3,104) (76,129) (79,233)

-------------------------- -------------------------- --------------------------

Net finance (cost)/income (664) - (664)

-------------------------- -------------------------- --------------------------

Loss before tax (3,768) (76,129) (79,897)

Taxation 780 (1,754) (974)

-------------------------- -------------------------- --------------------------

Loss after tax (2,988) (77,883) (80,871)

========================== ========================== ==========================

(11) Adjusted to exclude exceptional items (refer to notes to

the financial statements note 6), as well as the amortisation of

acquired intangibles related to the acquisition of George Banco

(14) Refer to note 6 in the notes to the financial statements

for further detail

Normalised administrative expenses fell by 25% to GBP2.3m (2020:

GBP3.1m) driven principally by lower staff and professional fees.

Finance fees increased as surplus cash was held at Group level,

rather than paying down any facilities due to the expectation of

the future cash requirements for loan book growth.

An exceptional charge of GBP1.6m related to professional fees

associated with the forthcoming Capital Raise (2020: GBPnil). The

exceptional charges of GBP75.5m in the prior year related to the

write-off of goodwill and intangible assets (see note 12).

Principal risks

The principal risks facing the Group are:

-- Going concern, solvency and liquidity - although as at 31

August 2021 the Group had GBP100.8m in cash, the Directors note

that material uncertainties exist regarding the successful

execution of a capital raise, current and future impacts of

COVID-19 and the impact of potential levels of redress and

complaints across the Group. The range of assumptions and the

likelihood of them all proving correct creates material uncertainty

and therefore the impact on liquidity and solvency under both the

base case and downside scenarios may cast significant doubt on both

the Group's and individual division's ability to continue as a

going concern. In such circumstance, the Group may fall under the

control of its lenders and there would be a possibility of the

Group going into insolvency;

-- Regulation - the Group faces significant operational and

financial risk through changes to regulations, changes to the

interpretation of regulations or a failure to comply with existing

rules and regulations. This risk may be impacted by the outcome of

the ongoing reviews of each of the Group's divisions. Following a

multi-firm review, the Group has developed a proposed methodology

for redress to certain guarantor loans customers and has made a

provision totalling GBP16.9m to cover the expected costs. Whilst

the provisions made represent the Directors' best estimate of the

total cost of redress across all divisions, based upon a detailed

methodology and analyses developed in conjunction with its

advisers, discussions with the FCA are ongoing and therefore,

although the Directors believe their best estimate represents a

reasonably possible outcome; there is a risk of a less favourable

outcome. The reviews into branch-based lending and home credit are

ongoing and there remains a risk that the final outcome of the

reviews may result in the identification of customers who may

require redress, and the cost of redress for the Group could be

materially higher than is currently provided for in the financial

statements. While the numbers of complaints received has declined

significantly from the peak seen earlier in the year, there remains

a risk of increasing levels of complaints and if the level of

complaints were to return to the levels seen during the first

quarter of 2021, this would have a material adverse impact on the

Group;

-- Conduct - risk of poor outcomes for our customers or other

key stakeholders as a result of the Group's actions;

-- Credit - risk of loss through poor underwriting or a

diminution in the credit quality of the Group's customers;

-- Business strategy - risk that the Group's strategy fails to

deliver the outcomes expected;

-- Business risks:

o operational - the Group's activities are large and complex and

so there are many areas of operational risk that include technology

failure, fraud, staff management and recruitment risks,

underperformance of key staff, the risk of human error, taxation,

increasing numbers of customer complaints, health and safety as

well as disaster recovery and business continuity risks;

o reputational - a failure to manage one or more of the Group's

principal risks may damage the reputation of the Group or any of

its subsidiaries which in turn may materially impact the future

operational and/or financial performance of the Group;

o cyber - increased connectivity in the workplace coupled with

the increasing importance of data and data analytics in operating

and managing consumer finance businesses means that this risk has

been identified separately from operational risk; and

o Pandemic - a large pandemic such as COVID-19, coupled with

restrictions on face-to-face contact by HM Government, may cause

significant disruption to the Group's operations and severely

impact the supply and level of demand for the Group's products. As

a result, any sustained period where such measures are in place

could result in the Group suffering significant financial loss.

On behalf of the Board of Directors

Jono Gillespie

Group Chief Executive Officer

28 September 2021

Statement of Directors' responsibilities

The Directors confirm that, to the best of their knowledge, the

unaudited condensed interim financial statements have been prepared

in accordance with IAS 34 as adopted by the European Union, and

that the interim report includes a fair review of the information

required by DTR 4.2.7R and DTR 4.2.8R, namely:

-- An indication of important events that have occurred during

the first six months of the financial year and their impact on the

unaudited condensed interim financial statements, and a description

of the principal risks and uncertainties for the remaining six

months of the financial year; and

-- Material related party transactions that have occurred in the

first six months of the financial year and any material changes in

the related party transactions described in the last annual report

and financial statements.

The current directors of Non-Standard Finance plc are listed in

the 2020 Annual Report & Financial Statements, with the

exception of John van Kuffeler who resigned from his role as Group

Chief Executive Officer and ceased to be a Director of the Company

with effect from 31 August 2021. A list of current directors is

also maintained on the Non-Standard Finance website:

www.nsfgroupplc.com .

The maintenance and integrity of the Non-Standard Finance