TIDMOCI

RNS Number : 9517A

Oakley Capital Investments Limited

07 June 2021

07 June 2021

Oakley Capital Investments Limited

Oakley Capital Investments Limited(1) ("OCI") is pleased to

announce that Oakley Capital Origin Fund(2) ("Origin Fund") has

acquired controlling stakes in Afterbuy and DreamRobot, leading

providers of e-commerce software in the German-speaking region.

OCI's indirect contribution via Origin Fund will be GBP6

million.

Note that the above figure only relates to OCI's share of Origin

Fund's overall investment in Afterbuy and DreamRobot.

OCI's liquid resources available for future deployment

(including this transaction) are estimated to be GBP173

million.

Further details on the transaction can be found in the below

announcement from Oakley Capital(3) .

Investment in Afterbuy and DreamRobot, leading providers of

e-commerce software in the German-speaking region

Oakley Capital is pleased to announce that Oakley Capital Origin

Fund ("Origin Fund") has acquired controlling stakes in Afterbuy

and DreamRobot, two leading providers of e-commerce software in the

German-speaking region, which will be combined to become the newly

formed ECOMMERCE ONE Group (the "Group").

The two companies provide a comprehensive suite of Software as a

Service ("SaaS") solutions for small to mid-sized online merchants

selling their products through web shops and online marketplaces,

such as Amazon or eBay. The platform enables its users to manage

and automate difficult, manual and time-critical processes, such as

multi-channel product listing, data collection and stock

management. Together, more than EUR50 billion of Gross Merchandise

Volume has been processed across the businesses to date.

The two investments mark the beginning of a strategy aimed at

solidifying the Group's position as the market-leading provider for

small and medium-sized online merchants in the DACH region. Oakley

will support the growth of the businesses through its operational

experience and software buy-and-build expertise, drawing on its

track-record of successful investments in WebPros and Ekon.

The e-commerce software market is experiencing rapid growth,

underpinned by a structural shift as consumers increasingly

transact online and retailers launch and expand their online

offerings. Software tools such as Afterbuy and DreamRobot enable

merchants' e-commerce success by simplifying tasks and providing a

comprehensive overview and control centre for all sales and

transaction processes, which results in loyal customer bases and

recurring subscription revenues.

The deal was introduced to us by Valentin Schütt, who Oakley

partnered with on Oakley Capital Fund IV's investment in Wishcard

Technologies Group in 2019. The investment demonstrates the

importance of Oakley's entrepreneur network for both repeated

sourcing of proprietary deals and leveraging deep knowledge of

businesses and growth industries.

Peter Dubens, Managing Partner of Oakley Capital, commented:

"This is another example of Oakley's repeated partnering with

talented and trusted business founders, helping us to uncover

attractive opportunities that others may not be able to access. As

merchants continue to increase their online presence across

multiple channels, we see a significant opportunity to build the

go-to platform in e-commerce software alongside a talented

management team."

Daliah Salzmann, CEO of Afterbuy, commented:

"In partnering with Oakley, we look forward to building

Germany's leading e-commerce software provider. A combination of

this initial platform investment, a fragmented marketplace and

Oakley's expertise will result in ECOMMERCE ONE being the principal

supplier of software solutions to small and medium sized online

retailers."

- ends -

For further information please contact:

Oakley Capital Limited

+44 20 7766 6900

Steven Tredget, Investor Relations

Greenbrook Communications Limited

+44 20 7952 2000

Alex Jones / Michael Russell / Catriona Crellin

Liberum Capital Limited (Financial Adviser & Broker)

+44 20 3100 2000

Chris Clarke / Darren Vickers / Owen Matthews

Notes:

LEI Number: 213800KW6MZUK12CQ815

(1) About Oakley Capital Investments Limited ("OCI")

OCI is a Specialist Fund Segment ("SFS") traded investment

vehicle that aims to provide shareholders with consistent long-term

capital growth in excess of the FTSE All-Share Index by providing

liquid access to private equity returns through investment in the

Oakley Funds (2) .

A video introduction to OCI is available at

https://oakleycapitalinvestments.com/videos/

The contents of the OCI website are not incorporated into, and

do not form part of, this announcement.

(2) The Oakley Funds

Oakley Capital Private Equity L.P. and its successor funds,

Oakley Capital Private Equity II, Oakley Capital Private Equity

III, Oakley Capital IV and Oakley Capital Origin Fund are unlisted

lower-mid to mid-market private equity funds that aim to provide

investors with significant long-term capital appreciation. The

investment strategy of the Funds is to focus on buy-out

opportunities in industries with the potential for growth,

consolidation and performance improvement.

(3) Oakley Capital, the Investment Adviser

Founded in 2002, Oakley Capital Limited has demonstrated the

repeated ability to source attractive growth assets at attractive

prices. To do this it relies on its sector and regional expertise,

its ability to tackle transaction complexity and its deal

generating entrepreneur network.

Important information

Specialist Fund Segment securities are not admitted to the

Official List of the Financial Conduct Authority. Therefore, the

Company has not been required to satisfy the eligibility criteria

for admission to listing on the Official List and is not required

to comply with the Financial Conduct Authority's Listing Rules.

The Specialist Fund Segment is intended for institutional,

professional, professionally advised and knowledgeable investors

who understand, or who have been advised of, the potential risk

from investing in companies admitted to the Specialist Fund

Segment.

This announcement may include "forward-looking statements".

These forward-looking statements are statements regarding the

Company's objectives, intentions, beliefs or current expectations

with respect to, amongst other things, the Company's financial

position, business strategy, results of operations, liquidity,

prospects and growth. Forward-looking statements are subject to

risks and uncertainties because they relate to events and depend on

circumstances that may or may not occur in the future. Accordingly

the Company's actual future financial results, operational

performance and achievements may differ materially from those

expressed in, or implied by, the statements. Given these

uncertainties, prospective investors are cautioned not to place any

undue reliance on such forward-looking statements, which speak only

as at the date of this announcement. The Company expressly

disclaims any obligation or undertaking to update or revise any

forward-looking statements contained herein to reflect actual

results or any change in the Company's expectations with regard to

them or any change in events, conditions or circumstances on which

any such statements are based unless required to do so by the

Financial Services and Markets Act 2000, the Listing Rules or

Prospectus Regulation Rules of the Financial Conduct Authority or

other applicable laws, regulations or rules.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQBRGDLCBGDGBL

(END) Dow Jones Newswires

June 07, 2021 02:00 ET (06:00 GMT)

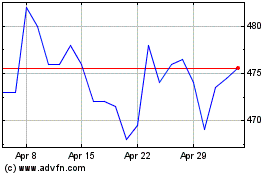

Oakley Capital Investments (LSE:OCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Oakley Capital Investments (LSE:OCI)

Historical Stock Chart

From Apr 2023 to Apr 2024