TIDMOCI

RNS Number : 6219C

Oakley Capital Investments Limited

22 June 2021

22 June 2021

Oakley Capital Investments Limited

Oakley Capital Investments Limited(1) ("OCI") is pleased to

announce that Oakley Capital Private Equity III(2) ("Fund III") has

agreed to invest in PRIMAVERA Business Software Solutions,

("PRIMAVERA" or the "Company"), the Portuguese leader in business

management software.

OCI's indirect contribution via Fund III will be GBP11

million.

Note that the above figure only relates to OCI's share of Fund

III's overall investment in PRIMAVERA.

OCI's liquid resources available for future deployment

(including this transaction) are estimated to be GBP162

million.

Further details on the transaction can be found in the

announcement below from Oakley Capital (3) .

Investment in PRIMAVERA establishes a leading Iberian business

software group

Oakley Capital is pleased to announce that Oakley Capital

Private Equity III ("Fund III") has agreed to acquire PRIMAVERA

Business Software Solutions ("PRIMAVERA" or the "Company"), the

Portuguese leader in business management software. The Company will

be combined with existing Oakley Capital portfolio company Ekon, a

Spanish provider of Enterprise Resource Planning ("ERP") software,

to create a new group under the name Grupo Primavera, which will be

the largest independent provider of business software in Iberia.

The transaction is subject to regulatory approval.

Founded in 1993, PRIMAVERA provides ERP and cloud business

software solutions to over 32,000 Small and Medium-sized

Enterprises ("SMEs") across Portugal and Portuguese-speaking

Africa. PRIMAVERA is widely recognised as a market leader, with a

strong brand and reputation, and is supported by a broad

distribution network of over 500 partners . The Company was

acquired from its founders, José Dionísio and Jorge Batista, who

will invest alongside Fund III in the merged entity and continue to

co-lead the PRIMAVERA business.

Grupo Primavera will comprise PRIMAVERA, Ekon, which was

acquired in 2019 as Fund III's initial investment in the space, and

five additional bolt-on acquisitions made over the last twelve

months (Tabulae, Contasimple, Billage, Diez Software and

Professional Software). The newly established group will be the

largest independent software platform serving SMEs in Iberia, with

over 55,000 customers, c.EUR60 million of revenues and double-digit

annual growth, driven by the rapid adoption of Software as a

Service ("SaaS") solutions. Grupo Primavera will be led by Santiago

Solanas, an industry veteran with over 30 years' experience in

global roles in the software industry, including leadership

positions at Cisco in France and Southern Europe, Sage Iberia, as

well as in Microsoft and Oracle.

The Iberian business software market continues to benefit from

long-term structural growth, as SMEs digitise and adopt cloud

technology. Portugal and Spain lag international benchmarks in

cloud adoption, at c.25% and c.30%, respectively, compared to over

60% in Northern Europe.

Grupo Primavera will accelerate its deployment of cloud

solutions organically through investment in product development and

go-to-market initiatives, as well as through further

acquisitions.

Peter Dubens, Managing Partner of Oakley Capital, commented:

"This is another example of Oakley's ability to invest in

founder-owned technology businesses and execute buy-and-build

strategies. With the adoption of cloud technology in Iberia being

behind the rest of Europe, we see significant value and further

potential in growing the largest independent business software

platform to service SMEs within the region."

José Dionísio and Jorge Batista, CEOs and Co-Founders of

PRIMAVERA, commented:

"We are very excited about the new path that we are taking by

creating an independent Iberian business software champion. This is

a project with great potential, bringing together companies with a

wide range of experience and leadership within the sector. We have

been approached by many potential partners over the years, but it

is with Oakley Capital and Santiago Solanas that we decided to take

this step due to the exciting project they presented to us."

- ends -

For further information please contact:

Oakley Capital Limited

+44 20 7766 6900

Steven Tredget, Investor Relations

Greenbrook Communications Limited

+44 20 7952 2000

Alex Jones / Michael Russell

Liberum Capital Limited (Financial Adviser & Broker)

+44 20 3100 2000

Chris Clarke / Darren Vickers / Owen Matthews

Notes:

LEI Number: 213800KW6MZUK12CQ815

(1) About Oakley Capital Investments Limited ("OCI")

OCI is a Specialist Fund Segment ("SFS") traded investment

vehicle that aims to provide shareholders with consistent long-term

capital growth in excess of the FTSE All-Share Index by providing

liquid access to private equity returns through investment in the

Oakley Funds (2) .

A video introduction to OCI is available at

https://oakleycapitalinvestments.com/videos/

The contents of the OCI website are not incorporated into, and

do not form part of, this announcement.

(2) The Oakley Funds

Oakley Capital Private Equity L.P. and its successor funds,

Oakley Capital Private Equity II, Oakley Capital Private Equity

III, Oakley Capital IV and Oakley Capital Origin Fund are unlisted

lower-mid to mid-market private equity funds that aim to provide

investors with significant long-term capital appreciation. The

investment strategy of the Funds is to focus on buy-out

opportunities in industries with the potential for growth,

consolidation and performance improvement.

(3) Oakley Capital, the Investment Adviser

Founded in 2002, Oakley Capital Limited has demonstrated the

repeated ability to source attractive growth assets at attractive

prices. To do this it relies on its sector and regional expertise,

its ability to tackle transaction complexity and its deal

generating entrepreneur network.

Important information

Specialist Fund Segment securities are not admitted to the

Official List of the Financial Conduct Authority. Therefore, the

Company has not been required to satisfy the eligibility criteria

for admission to listing on the Official List and is not required

to comply with the Financial Conduct Authority's Listing Rules.

The Specialist Fund Segment is intended for institutional,

professional, professionally advised and knowledgeable investors

who understand, or who have been advised of, the potential risk

from investing in companies admitted to the Specialist Fund

Segment.

This announcement may include "forward-looking statements".

These forward-looking statements are statements regarding the

Company's objectives, intentions, beliefs or current expectations

with respect to, amongst other things, the Company's financial

position, business strategy, results of operations, liquidity,

prospects and growth. Forward-looking statements are subject to

risks and uncertainties because they relate to events and depend on

circumstances that may or may not occur in the future. Accordingly

the Company's actual future financial results, operational

performance and achievements may differ materially from those

expressed in, or implied by, the statements. Given these

uncertainties, prospective investors are cautioned not to place any

undue reliance on such forward-looking statements, which speak only

as at the date of this announcement. The Company expressly

disclaims any obligation or undertaking to update or revise any

forward-looking statements contained herein to reflect actual

results or any change in the Company's expectations with regard to

them or any change in events, conditions or circumstances on which

any such statements are based unless required to do so by the

Financial Services and Markets Act 2000, the Listing Rules or

Prospectus Regulation Rules of the Financial Conduct Authority or

other applicable laws, regulations or rules.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQDKDBDBBKBAAB

(END) Dow Jones Newswires

June 22, 2021 02:00 ET (06:00 GMT)

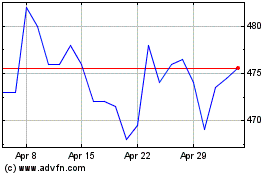

Oakley Capital Investments (LSE:OCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Oakley Capital Investments (LSE:OCI)

Historical Stock Chart

From Apr 2023 to Apr 2024