TIDMOCI

RNS Number : 6711G

Oakley Capital Investments Limited

28 July 2021

28 July 2021

Oakley Capital Investments Limited

Trading Update for the Six Months ended 30 June 2021

Portfolio strength drives 11% NAV uplift

Oakley Capital Investments Limited(1) ("OCI" or the "Company"),

a listed investment company providing investors access to the

Oakley Funds(2) , today announces a trading update for the six

months ended 30 June 2021.

Highlights for the period

-- Net Asset Value ("NAV") per share of 445 pence

-- Total NAV return per share of 11% since 31 December 2020

-- The Company invested GBP95 million and its share of proceeds

was GBP51 million

-- Cash of GBP172 million a t 30 June 2021

-- Outstanding Oakley Fund commitments of GBP438 million

NAV growth

The Company's unaudited NAV at 30 June 2021 was GBP804 million,

which represents a NAV per share of 445 pence, based on portfolio

company valuations at the half-year. The total NAV per share return

including dividends is 11% (+45 pence) since 31 December 2020 and

26% (+94 pence) since 30 June 2020.

Portfolio company performance

During the period, the Oakley Funds sustained their pattern of

solid performance and EBITDA growth. While the impact of the COVID

pandemic continues, the portfolio has continued to benefit from an

investment focus on technology-enabled businesses. Of the current

portfolio, 14 companies accounting for 52% of NAV* grew their

revenues at or above expectations in the period. Four companies

accounting for 14% of NAV* have seen a modest COVID impact on

financial performance. Meanwhile, three companies accounting for

29% of NAV* continue to be significantly impacted by ongoing,

Europe-wide COVID-related restrictions.

* Percentages shown are OCI's look-through exposure to the

portfolio companies via the Funds and direct investments.

Proceeds

The Company's share of proceeds from divestments, refinancings

and repayment of loans amounted to GBP51 million, consisting of the

refinancing of IU Group, the repayment of the Daisy loan and the

exit of Fund II's stake in the Digital Wholesale Solutions division

of portfolio company Daisy Group.

Investments

In the trading period, the Investment Adviser (3) continued to

originate proprietary opportunities for the Oakley Funds within its

focus sectors, namely Technology, Consumer and Education. During

the period, OCI made a total look-through investment of GBP95

million which, aside from some minor follow-on investments, was

attributable to the acquisition of four new platform investments:

idealista (Fund IV), Dexters (Fund IV), ICP Education (Fund IV) and

ECOMMERCE ONE (Origin Fund).

Cash & commitments

-- Balance sheet - O CI has no leverage and had cash on the

balance sheet of GBP172 million at 30 June 2021, comprising

21% of NAV

-- Recent commitments - OCI's total commitment to the Oakley

Capital Origin Fund, which closed in January 2021, was EUR129

(GBP111) million

-- Total outstanding commitments - outstanding Oakley Fund

commitments are GBP438 million

Post-balance sheet events

-- Exit and follow-on investment - Fund III sold its stake

in ACE Education ("ACE") to Groupe Amaury with its share

of proceeds being GBP16 million. As part of the transaction,

the Origin Fund invested in ACE alongside Groupe Amaury.

OCI's indirect contribution via the Origin Fund was GBP10

million

The Company expects to report its unaudited interim results for

2021 on Thursday 9 September 2021.

A live presentation of the trading update, delivered by Oakley

Capital Partner Steven Tredget, will be broadcast online on

Thursday 29 July 2021 at 12:00pm BST.

The interactive event will be available free via the Investor

Meet Company platform. Register to join the event

at: https://www.investormeetcompany.com/oakley-capital-investments-limited/register-investor

- ends -

For further information please contact:

Oakley Capital Limited

+44 20 7766 6900

Steven Tredget, Investor Relations

Greenbrook Communications Limited

+44 20 7952 2000

Alex Jones / Michael Russell

Liberum Capital Limited (Financial Adviser & Broker)

+44 20 3100 2000

Chris Clarke / Darren Vickers / Owen Matthews

Notes:

This announcement is deemed by the Company to constitute inside

information as stipulated under the Market Abuse Regulation (EU)

No. 596/2014 as amended by The Market Abuse (Amendment) (EU Exit)

Regulations 2019

LEI Number: 213800KW6MZUK12CQ815

(1) About Oakley Capital Investments Limited ("OCI")

OCI is a Specialist Fund Segment ("SFS") traded investment

vehicle that aims to provide shareholders with consistent long-term

capital growth in excess of the FTSE All-Share Index by providing

liquid access to private equity returns through investment in the

Oakley Funds(2) .

An introduction to OCI video is available at

https://oakleycapitalinvestments.com/videos/

(2) The Oakley Funds

Oakley Capital Private Equity L.P. and its successor funds,

Oakley Capital Private Equity II, Oakley Capital Private Equity

III, Oakley Capital IV and Oakley Capital Origin Fund are unlisted

lower-mid to mid-market private equity funds with the aim of

providing investors with significant long-term capital

appreciation. The investment strategy of the Funds is to focus on

buy-out opportunities in industries with the potential for growth,

consolidation and performance improvement.

(3) The Investment Adviser

Founded in 2002, Oakley Capital Limited has demonstrated the

repeated ability to source attractive growth assets at attractive

prices. To do this it relies on its sector and regional expertise,

its ability to tackle transaction complexity and its deal

generating entrepreneur network.

Important information

Specialist Fund Segment securities are not admitted to the

Official List of the Financial Conduct Authority. Therefore, the

Company has not been required to satisfy the eligibility criteria

for admission to listing on the Official List and is not required

to comply with the Financial Conduct Authority's Listing Rules.

The Specialist Fund Segment is intended for institutional,

professional, professionally advised and knowledgeable investors

who understand, or who have been advised of, the potential risk

from investing in companies admitted to the Specialist Fund

Segment.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTEAEXXASDFEAA

(END) Dow Jones Newswires

July 28, 2021 02:00 ET (06:00 GMT)

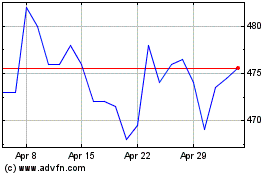

Oakley Capital Investments (LSE:OCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Oakley Capital Investments (LSE:OCI)

Historical Stock Chart

From Apr 2023 to Apr 2024