TIDMOCI

RNS Number : 0713O

Oakley Capital Investments Limited

08 June 2022

8 June 2022

Oakley Capital Investments Limited

Oakley Capital Investments Limited(1) ("OCI") is pleased to

announce that Oakley Capital Fund IV(2) ("Fund IV") has reached an

agreement to sell its stake in Contabo, a leading cloud hosting

platform used by SMEs.

OCI's share of proceeds will be c.GBP59 million and the sale

represents a c.105% premium to the 31 March 2022 carrying value, an

uplift of c.17 pence per share to the Company's NAV.

As part of the transaction, Oakley Capital Fund V ("Fund V")

will invest in Contabo alongside KKR. OCI's indirect contribution

via Fund V will be c.GBP37 million.

Note that the above figures only relate to OCI's share of

proceeds and its share of Fund V's overall investment in

Contabo.

OCI's liquid resources available for future deployment

(including this transaction) are estimated to be c.GBP178

million.

Further details on the transaction can be found in the below

announcement from Oakley Capital(3.)

Oakley Capital agrees sale of Contabo and follow-on

investment

Oakley Capital ("Oakley") is pleased to announce that Oakley

Capital Fund IV ("Fund IV") has reached an agreement to sell its

stake in Contabo, a leading cloud hosting platform offering

easy-to-use and cost-effective cloud services used by SMEs,

entrepreneurs and developers. The exit will generate a gross return

in excess of 10x MM and over 100% IRR to Fund IV. As part of the

transaction, Oakley Capital Fund V ("Fund V") will acquire a

minority stake in Contabo alongside majority investor KKR, to

benefit from the anticipated future growth of the business.

Fund IV first invested in Contabo in 2019 alongside proven

hosting entrepreneurs Thomas Strohe, Jochen Berger and Thomas

Vollrath who introduced the opportunity to Oakley. Under Oakley's

ownership, Contabo has generated strong revenue and EBITDA growth

to become a leading SME cloud hosting provider with 24 lean and

highly efficient data centres across four continents serving a

diversified mix of more than 250,000 customers. In 2020, Czech

hosting business VSHosting was acquired to expand Contabo's

international footprint, followed by GPORTAL in 2021, a rapidly

growing 'platform-as-a-service' provider in the gaming space.

The strategic partnership with KKR and fresh investment from

Oakley will support the next stage of Contabo's growth plan

including acquisitions, and enable Contabo to continue its

successful growth journey to become a global leader in SME cloud

hosting. The company is well positioned in a market that has shown

very strong and resilient growth in recent years, driven by

structural trends and market dynamics, including increasing data

traffic, the ongoing digitisation of small businesses as well as

the increasing use of cloud applications.

Contabo CEO, Thomas Noglik, commented:

"When we first invested in Contabo three years ago, the business

was very much a relatively unknown, subscale player in the domestic

German web-hosting market. In partnership with Oakley, we leveraged

our combined experience in cloud hosting and our track record in

successfully professionalising businesses to transform Contabo into

the market-leader it is today. We're pleased to be continuing our

collaboration with Oakley and now with KKR's support and sector

expertise as we proceed with the next stage of the company's growth

plan."

Jean-Pierre Saad, Partner and Head of Technology for Private

Equity in EMEA and Laura Schröder, Director at KKR, commented:

"The demand for cloud infrastructure and hosting services has

considerably accelerated over recent years, and is set to further

increase due to the ongoing digitalisation of small businesses and

secular growth of the developer community. With its differentiated

positioning in the market based on price-performance leadership and

strong customer satisfaction, Contabo benefits from these market

trends. We are excited by the opportunity to work with the

management team and Oakley to unlock the significant potential in

Contabo, drawing on our extensive expertise from investing in the

cloud and hosting industry globally."

Oakley Capital Managing Partner, Peter Dubens, commented:

"Over more than a decade, Oakley has built significant expertise

investing in the attractive web-hosting sector. We are pleased to

sustain our strong track record with Contabo, and look forward to

continuing our partnership with management to deliver on our

ambition for the company. We also welcome KKR as co-investors with

their deep experience in technology investing and the DACH

region."

- ends -

For further information please contact:

Oakley Capital Limited

+44 20 7766 6900

Steven Tredget

Greenbrook Communications Limited

+44 20 7952 2000

Rob White / Michael Russell

Liberum Capital Limited (Financial Adviser & Broker)

+44 20 3100 2000

Chris Clarke / Darren Vickers / Owen Matthews

Notes:

LEI Number: 213800KW6MZUK12CQ815

(1) About Oakley Capital Investments Limited ("OCI")

OCI is a Specialist Fund Segment ("SFS") traded investment

vehicle that aims to provide shareholders with consistent long-term

capital growth in excess of the FTSE All-Share Index by providing

liquid access to private equity returns through investment in the

Oakley Funds.

A video introduction to OCI is available at

https://oakleycapitalinvestments.com/videos/

The contents of the OCI website are not incorporated into, and

do not form part of, this announcement.

(2) The Oakley Funds

Oakley Capital Private Equity L.P. and its successor funds,

Oakley Capital Private Equity II, Oakley Capital Private Equity

III, Oakley Capital IV, Oakley Capital V and Oakley Capital Origin

Fund are unlisted lower-mid to mid-market private equity funds that

aim to provide investors with significant long-term capital

appreciation. The investment strategy of the Funds is to focus on

buy-out opportunities in industries with the potential for growth,

consolidation and performance improvement.

(3) Oakley Capital, the Investment Adviser

Founded in 2002, Oakley Capital Limited has demonstrated the

repeated ability to source attractive growth assets at attractive

prices. To do this it relies on its sector and regional expertise,

its ability to tackle transaction complexity and its deal

generating entrepreneur network.

Important information

Specialist Fund Segment securities are not admitted to the

Official List of the Financial Conduct Authority. Therefore, the

Company has not been required to satisfy the eligibility criteria

for admission to listing on the Official List and is not required

to comply with the Financial Conduct Authority's Listing Rules.

The Specialist Fund Segment is intended for institutional,

professional, professionally advised and knowledgeable investors

who understand, or who have been advised of, the potential risk

from investing in companies admitted to the Specialist Fund

Segment.

This announcement may include "forward-looking statements".

These forward-looking statements are statements regarding the

Company's objectives, intentions, beliefs or current expectations

with respect to, amongst other things, the Company's financial

position, business strategy, results of operations, liquidity,

prospects and growth. Forward-looking statements are subject to

risks and uncertainties because they relate to events and depend on

circumstances that may or may not occur in the future. Accordingly

the Company's actual future financial results, operational

performance and achievements may differ materially from those

expressed in, or implied by, the statements. Given these

uncertainties, prospective investors are cautioned not to place any

undue reliance on such forward-looking statements, which speak only

as at the date of this announcement. The Company expressly

disclaims any obligation or undertaking to update or revise any

forward-looking statements contained herein to reflect actual

results or any change in the Company's expectations with regard to

them or any change in events, conditions or circumstances on which

any such statements are based unless required to do so by the

Financial Services and Markets Act 2000, the Listing Rules or

Prospectus Regulation Rules of the Financial Conduct Authority or

other applicable laws, regulations or rules.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DISEAFKXEFDAEAA

(END) Dow Jones Newswires

June 08, 2022 02:01 ET (06:01 GMT)

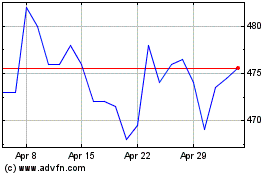

Oakley Capital Investments (LSE:OCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Oakley Capital Investments (LSE:OCI)

Historical Stock Chart

From Apr 2023 to Apr 2024