TIDMOCI

RNS Number : 7994T

Oakley Capital Investments Limited

26 July 2022

26 July 2022

Oakley Capital Investments Limited

Oakley Capital Investments Limited(1) ("OCI") is pleased to

announce that Oakley Capital Fund III(2) ("Fund III") has agreed

the strategic combination of Grupo Primavera, the leading business

software provider in Iberia, with Cegid, a leading provider of

cloud-based management solutions . As part of the transaction, Fund

III will increase its stake in Grupo Primavera and roll over its

equity into Cegid.

OCI's additional indirect contribution via Fund III is

anticipated to be c.GBP28 million.

Note that the above figure only relates to OCI's share of Fund

III's additional investment in Grupo Primavera.

Further details on the transaction can be found in the below

announcement from Oakley Capital(3) .

Oakley Capital agrees strategic combination of Grupo Primavera

with Cegid

Oakley Capital ("Oakley") is pleased to announce that Oakley

Capital Fund III ("Fund III") has agreed the strategic combination

of Grupo Primavera, the leading business software provider in

Iberia, with Cegid, a leading provider of cloud-based management

solutions. As part of the transaction, Fund III will increase its

stake in Grupo Primavera and roll over its equity into Cegid. The

all-share transaction values the combined company at approximately

EUR6.8 billion.

Oakley acquired Ekon as a standalone platform in 2019, and

assembled a group management team to lead an intensive buy and

build strategy. With that team Oakley acquired 11 further

companies, including the transformative acquisition of Primavera in

2021, to form the newly enlarged Grupo Primavera. Through

acquisitions as well as investment in product innovation and

talent, Grupo Primavera has performed well ahead of its business

plan, becoming Iberia's largest software platform in just three

years.

Today, Grupo Primavera has 800 employees based in five

countries, serves 165,000 paying customers, and delivered EUR76

million of revenue in 2021. The company offers a wide range of

cloud-based software solutions covering Invoicing, Accounting, and

Enterprise Resource Planning (ERP). These offerings serve small

businesses and mid-market segments across Spain, Portugal, and

Africa, with a particularly strong footprint among accounting

professionals. Together, Grupo Primavera and Cegid will have pro

forma revenue in the Iberia region of more than EUR150 million this

year.

Cegid is a global leading provider of cloud business management

solutions for finance (treasury, tax, ERP), human resources

(payroll, talent management), CPAs, retail and entrepreneurial

sectors. With 350,000 clients, the business is focused on large and

SMB customers, operating in 130 countries across the globe and its

installed base is already close to fully migrated to Cloud. Cegid

has a strong track record of double-digit organic growth with a

high proportion of recurring revenues, underpinned by the SaaS

transition of its customer base and new client acquisitions in the

Cloud, and investments in next-generation cloud products.

The combination of Cegid and Grupo Primavera underscores Cegid's

position as a leading provider of cloud-based management solutions.

The addition of Grupo Primavera firmly establishes Cegid's

leadership in Iberia and offers exciting expansion opportunities

for Grupo Primavera by leveraging Cegid's presence in Latin

America.

Upon close, Silver Lake will remain the majority shareholder of

the combined company. Oakley Capital will join KKR and AltaOne as

minority shareholders in the combined company. Together, these

shareholders will partner with Cegid CEO Pascal Houillon, Grupo

Primavera CEO Santiago Solanas, and the rest of the management team

in Cegid's next phase of growth.

Cegid CEO Pascal Houillon said: "Joining forces with Grupo

Primavera is an immense opportunity for both companies and our

respective clients. Like Cegid, Grupo Primavera offers useful and

innovative solutions to partners and customers in the cloud, and

has achieved impressive growth specifically across Spain, Portugal,

and Africa. We share an inspiring vision for the future driven by

continuous product and technology innovation, and Cegid is fully

committed to investing in the combined company's continued growth.

We look forward to working closely with Santiago and the talented

team at Grupo Primavera to bring value to a more global customer

base."

Grupo Primavera CEO Santiago Solanas said: "We are strongly

aligned with Cegid's vision and ambition and have long admired the

company. Like Cegid, we have an entrepreneurial and passionate

culture with a focus on product excellence, a commitment to

customers, and an exciting vision for growth. This is a powerful

partnership that will allow us to combine resources and expertise,

bringing customers new products and continued innovation, as well

as building on our proven track record to expand and integrate new

talent and approaches to market needs. Both Cegid and Grupo

Primavera share a mission to grow our ecosystem and to offer our

combined customers, channel partners, colleagues, and communities

renewed value."

Christian Lucas, Co-head of Silver Lake EMEA and Vice-Chairman

of the Board of Directors of Cegid, said: "Through our investment

and strategic development executed since 2016, Cegid has become a

pan European and global player with strong positions in multiple

geographies including France, Spain, and Portugal, with important

market presence in 12 other countries and selling in more than 130

countries. We are excited about the growth prospects of the

combined group and by the creation of the Iberian market leader in

the business software space, reinforcing Cegid's existing position

on a broader global scale. The market for digitisation solutions in

the European mid-market, namely through financial management

software, is large and growing meaningfully, and the combined

company will be uniquely positioned to capitalize on this

opportunity as it continues to expand."

Oakley Capital Managing Partner Peter Dubens, said "In

partnership with Oakley, Grupo Primavera has grown to become a

leading player in the Iberian market for business software. Now

under the stewardship of both highly experienced management teams

and committed shareholders, Cegid and Grupo Primavera are poised to

accelerate a global growth strategy with a focus on market

expansion and cross sell opportunities. We look forward to being a

part of this new chapter for both companies and the significant

potential that lies ahead."

Upon closing of the transaction, Mr. Solanas and his entire

management team will join Cegid, with Mr. Solanas reporting

directly to Mr. Houillon.

The transaction is expected to close in Q3 2022, and as is

customary, remains subject to the information and consultation

processes of the relevant employee representative bodies in

accordance with applicable laws.

- ends -

For further information please contact:

Oakley Capital Limited

+44 20 7766 6900

Steven Tredget

Greenbrook Communications Limited

+44 20 7952 2000

Rob White / Michael Russell

Liberum Capital Limited (Financial Adviser & Broker)

+44 20 3100 2000

Chris Clarke / Darren Vickers / Owen Matthews

Notes:

LEI Number: 213800KW6MZUK12CQ815

(1) About Oakley Capital Investments Limited ("OCI")

OCI is a Specialist Fund Segment ("SFS") traded investment

vehicle that aims to provide shareholders with consistent long-term

capital growth in excess of the FTSE All-Share Index by providing

liquid access to private equity returns through investment in the

Oakley Funds.

A video introduction to OCI is available at

https://oakleycapitalinvestments.com/videos/

The contents of the OCI website are not incorporated into, and

do not form part of, this announcement.

(2) The Oakley Funds

Oakley Capital Private Equity L.P. and its successor funds,

Oakley Capital Private Equity II, Oakley Capital Private Equity

III, Oakley Capital IV, Oakley Capital V and Oakley Capital Origin

Fund are unlisted lower-mid to mid-market private equity funds that

aim to provide investors with significant long-term capital

appreciation. The investment strategy of the Funds is to focus on

buy-out opportunities in industries with the potential for growth,

consolidation and performance improvement.

(3) Oakley Capital, the Investment Adviser

Founded in 2002, Oakley Capital Limited has demonstrated the

repeated ability to source attractive growth assets at attractive

prices. To do this it relies on its sector and regional expertise,

its ability to tackle transaction complexity and its deal

generating entrepreneur network.

Important information

Specialist Fund Segment securities are not admitted to the

Official List of the Financial Conduct Authority. Therefore, the

Company has not been required to satisfy the eligibility criteria

for admission to listing on the Official List and is not required

to comply with the Financial Conduct Authority's Listing Rules.

The Specialist Fund Segment is intended for institutional,

professional, professionally advised and knowledgeable investors

who understand, or who have been advised of, the potential risk

from investing in companies admitted to the Specialist Fund

Segment.

This announcement may include "forward-looking statements".

These forward-looking statements are statements regarding the

Company's objectives, intentions, beliefs or current expectations

with respect to, amongst other things, the Company's financial

position, business strategy, results of operations, liquidity,

prospects and growth. Forward-looking statements are subject to

risks and uncertainties because they relate to events and depend on

circumstances that may or may not occur in the future. Accordingly

the Company's actual future financial results, operational

performance and achievements may differ materially from those

expressed in, or implied by, the statements. Given these

uncertainties, prospective investors are cautioned not to place any

undue reliance on such forward-looking statements, which speak only

as at the date of this announcement. The Company expressly

disclaims any obligation or undertaking to update or revise any

forward-looking statements contained herein to reflect actual

results or any change in the Company's expectations with regard to

them or any change in events, conditions or circumstances on which

any such statements are based unless required to do so by the

Financial Services and Markets Act 2000, the Listing Rules or

Prospectus Regulation Rules of the Financial Conduct Authority or

other applicable laws, regulations or rules.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQSEIFEMEESEIW

(END) Dow Jones Newswires

July 26, 2022 09:00 ET (13:00 GMT)

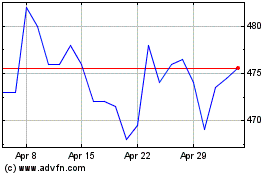

Oakley Capital Investments (LSE:OCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Oakley Capital Investments (LSE:OCI)

Historical Stock Chart

From Apr 2023 to Apr 2024