TIDMOCI

RNS Number : 8350T

Oakley Capital Investments Limited

27 July 2022

27 July 2022

Oakley Capital Investments Limited

Oakley Capital Investments Limited(1) ("OCI") is pleased to

announce that Oakley Capital Origin Fund(2) ("Origin") has reached

an agreement to sell part of its stake in Seedtag to private equity

investor Advent International ("Advent").

OCI's look-through share of proceeds is expected to be c.GBP13

million, representing an increase of 4 pence per share to the

Company's NAV as at 30 June 2022.

Further details on the transaction can be found in the below

announcement from Oakley Capital(3) .

Oakley Capital agrees partial exit from Seedtag

Oakley Capital ("Oakley") is pleased to announce that Oakley

Capital Origin Fund ("Origin") has reached an agreement to sell

part of its stake in Seedtag to private equity investor Advent

International ("Advent").

Founded by Jorge Poyatos and Albert Nieto in Madrid in 2014,

Seedtag is the leader in contextual advertising in EMEA and LATAM.

The Company helps brands and agencies deliver digital advertising

that is directly relevant to the content that readers are

consuming, meeting growing market demand for cookie-less solutions

that protect brands and prioritise consumer privacy.

Oakley leveraged its deep media expertise and strong track

record growing digital businesses to invest in Seedtag in 2021,

attracted by its proprietary AI technology and entrepreneurial

team, and in order to support the company's international

expansion. Since 2021, Oakley has supported Seedtag's launch into

North America as well as the strategic acquisition of KMTX

(previously Keymantics), a leading French company specialised in

building AI models to optimise and automate performance marketing

campaigns. During Oakley's ownership, Seedtag has grown revenues

and earnings significantly ahead of forecast.

Partnering with Advent will enable Seedtag to leverage its

significant expertise in marketing and data, accelerate its

expansion into the US, the world's largest advertising market, as

well as provide additional firepower for additional M&A and

investment in the company's contextual product suite.

Jorge Poyatos and Albert Nieto will continue to lead Seedtag

from both its Spanish and US headquarters.

Seedtag co-Founders & co-CEOs Jorge Poyatos and Albert Nieto

said: "In partnership with Oakley, we have made strong progress in

our business plan, driving top-line growth, pursuing strategic

acquisitions and further professionalising the business. We see

tremendous opportunity to grow Seedtag further as profound changes

in the advertising industry drive demand for our contextual

advertising services that enhance both brand awareness and

security. We look forward to partnering with Advent and Oakley to

take full advantage of these opportunities."

Oakley Capital Managing Partner Peter Dubens said: "What first

attracted us to invest behind Seedtag were two highly ambitious,

ex-Google entrepreneurs with a vision to create a leader in

advertising technology, and a market-leading product that addressed

the increasing focus on consumer privacy. This is a terrific

combination that has delivered strong outcomes. We are pleased to

continue our partnership with Jorge and Albert, and welcome Advent

as together we position the company for the next stage of its

growth plan. Seedtag remains Oakley's third platform investment in

Iberia, a cornerstone region for the firm, alongside market-leading

property portal idealista and business software provider Grupo

Primavera.

Gonzalo Santos, Managing Director at Advent International and

Head of Spain, said : "Seedtag has established itself as a leading

player in Europe and Latin America in the very dynamic contextual

advertising sector. We are delighted to partner with Jorge and

Albert as they continue to build on this momentum. With our

international presence and deep sector expertise, Advent will work

with the Seedtag management team to further expand the business

internationally. We look forward to supporting this hugely exciting

business to grow and scale-up and to taking it to the next

level."

- ends -

For further information please contact:

Oakley Capital Limited

+44 20 7766 6900

Steven Tredget

Greenbrook Communications Limited

+44 20 7952 2000

Rob White / Michael Russell

Liberum Capital Limited (Financial Adviser & Broker)

+44 20 3100 2000

Chris Clarke / Darren Vickers / Owen Matthews

Notes:

LEI Number: 213800KW6MZUK12CQ815

(1) About Oakley Capital Investments Limited ("OCI")

OCI is a Specialist Fund Segment ("SFS") traded investment

vehicle that aims to provide shareholders with consistent long-term

capital growth in excess of the FTSE All-Share Index by providing

liquid access to private equity returns through investment in the

Oakley Funds.

A video introduction to OCI is available at

https://oakleycapitalinvestments.com/videos/

The contents of the OCI website are not incorporated into, and

do not form part of, this announcement.

(2) The Oakley Funds

Oakley Capital Private Equity L.P. and its successor funds,

Oakley Capital Private Equity II, Oakley Capital Private Equity

III, Oakley Capital IV, Oakley Capital V and Oakley Capital Origin

Fund are unlisted lower-mid to mid-market private equity funds that

aim to provide investors with significant long-term capital

appreciation. The investment strategy of the Funds is to focus on

buy-out opportunities in industries with the potential for growth,

consolidation and performance improvement.

(3) Oakley Capital, the Investment Adviser

Founded in 2002, Oakley Capital Limited has demonstrated the

repeated ability to source attractive growth assets at attractive

prices. To do this it relies on its sector and regional expertise,

its ability to tackle transaction complexity and its deal

generating entrepreneur network.

Important information

Specialist Fund Segment securities are not admitted to the

Official List of the Financial Conduct Authority. Therefore, the

Company has not been required to satisfy the eligibility criteria

for admission to listing on the Official List and is not required

to comply with the Financial Conduct Authority's Listing Rules.

The Specialist Fund Segment is intended for institutional,

professional, professionally advised and knowledgeable investors

who understand, or who have been advised of, the potential risk

from investing in companies admitted to the Specialist Fund

Segment.

This announcement may include "forward-looking statements".

These forward-looking statements are statements regarding the

Company's objectives, intentions, beliefs or current expectations

with respect to, amongst other things, the Company's financial

position, business strategy, results of operations, liquidity,

prospects and growth. Forward-looking statements are subject to

risks and uncertainties because they relate to events and depend on

circumstances that may or may not occur in the future. Accordingly

the Company's actual future financial results, operational

performance and achievements may differ materially from those

expressed in, or implied by, the statements. Given these

uncertainties, prospective investors are cautioned not to place any

undue reliance on such forward-looking statements, which speak only

as at the date of this announcement. The Company expressly

disclaims any obligation or undertaking to update or revise any

forward-looking statements contained herein to reflect actual

results or any change in the Company's expectations with regard to

them or any change in events, conditions or circumstances on which

any such statements are based unless required to do so by the

Financial Services and Markets Act 2000, the Listing Rules or

Prospectus Regulation Rules of the Financial Conduct Authority or

other applicable laws, regulations or rules.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DISDBGDRRXDDGDL

(END) Dow Jones Newswires

July 27, 2022 05:00 ET (09:00 GMT)

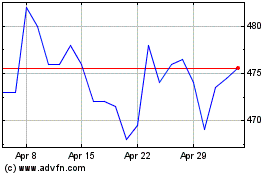

Oakley Capital Investments (LSE:OCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Oakley Capital Investments (LSE:OCI)

Historical Stock Chart

From Apr 2023 to Apr 2024