TIDMOCN

RNS Number : 3601I

Ocean Wilsons Holdings Ltd

12 August 2021

Interim Statement

Highlights

-- Solid first half performance for both Ocean Wilsons Investments Limited

("OWIL" or "investment portfolio") and Wilson Sons Limited. OWIL's net

return for the six months ended 30 June 2021 was 9.0%, outperforming

the benchmark by 3.3%. Operational indicators from Wilson Sons are on

a positive trajectory as the Brazilian market starts its rebound from

the impact of Covid-19 on imports and exports.

-- Operating profit for the period was 83.0% higher than the comparable

period at US$50.7 million (2020: US$27.7 million).

-- OWIL returned US$29.5 million for the period (2020: US$13.8 million

loss); assets and cash under management was US$25.0 million higher at

US$335.9 million compared to 31 December 2020 (US$310.9 million).

-- Net profit after tax for the period was US$51.8 million (2020: US$18.4

million loss).

-- Net cash inflow from operating activities for the period of US$41.6

million (2020: US$68.5 million).

-- Dividends paid to shareholders in the period of US$24.8 million (2020:

US$10.6 million).

About Ocean Wilsons Holdings Limited

Ocean Wilsons Holdings Limited ("Ocean Wilsons" or the

"Company") is a Bermuda investment holding company which, through

its subsidiaries, operates a maritime services company in Brazil

and holds a portfolio of international investments. The Company is

listed on both the London Stock Exchange and the Bermuda Stock

Exchange. It has two principal subsidiaries: Wilson Sons Limited

("Wilson Sons") and Ocean Wilsons (Investments) Limited (together

with the Company and their subsidiaries, the "Group").

At 30 June 2021 Ocean Wilsons holds a 57% interest in Wilson

Sons which is fully consolidated in the Group accounts with a 43%

non-controlling interest. Wilson Sons is one of the largest

providers of maritime services in Brazil with over three thousand

employees and activities including towage, container terminals,

offshore oil and gas support services, small vessel construction,

logistics and ship agency.

Objective

Ocean Wilsons focuses on long-term performance and value

creation. This approach applies to both OWIL and our investment in

Wilson Sons. The long-term strategy, managed by the Board, enables

Wilson Sons' investments to grow and develop sustainable results

with less pressure to produce short-term performance at the expense

of longer-term value creation. This same view allows the Investment

Manager of OWIL to make investment decisions to achieve long-term

capital growth.

Chairman's Statement

The Group has delivered a strong financial performance with its

returns on the investment portfolio and has demonstrated both

operational and financial resilience with its direct investment in

Wilson Sons. Against the backdrop of continuing challenges and the

recovery from the impacts of Covid-19 on our investments, the Board

is pleased with the Investment Manager's performance and with the

Management team of Wilson Sons continued focus on growth and

innovation and their commitment to ensuring the welfare of our

employees and on continuity of services to our customers

We continue to drive strategies that we consider will improve

the current trading discount of our stock and improve market

valuations of our investment in Wilson Sons to match its industry

peers in Brazil. As such, in May of this year, we announced that

Wilson Sons would undertake a corporate restructuring that includes

the reverse merger of the Bermuda-registered Wilson Sons , into its

Brazilian subsidiary, Wilson Sons Holdings Brasil (WS S/A), and the

listing of its shares on the Novo Mercado, with former shareholders

and holders of Wilson Sons BDRs receiving shares of WS S/A on a 1:1

basis . Since Wilson Sons' announcement of this restructuring,

Wilson Sons' share price has increased 25% as at 31 July 2021

COVID-19

Wilson Sons provides port and maritime logistics services which

is classified as essential activities by the Brazilian government

limiting the negative effects of COVID-19 on the company's results

up to this time. The company does not predict any material impact

on its long-term performance as the global economy is expected to

gradually recover in the coming years.

Regarding the progress of vaccination, government authorities

prioritized the vaccination of port workers throughout the country.

As such, we expect to have more than 90% of employees vaccinated by

September 2021.

Environmental, Social and Governance Practices ("ESG")

The Group continues to evolve and seek improvements in its ESG

practices. In 2021 Wilson Sons is participating in the S&P ESG

Corporate Sustainability Assessment with results to be disclosed at

year end.

In response to the Covid-19 pandemic, Wilson Sons has developed

a detailed set of working practices and protocols to ensure (i) the

health, safety and well-being of our employees, clients and other

stakeholders and (ii) the continuity of all our operations safely,

in line with best practice, as well as health authority rules and

guidance.

Workplace safety improvement reflects our relentless commitment

to safety, with a reduction of 83% in lost-time injuries per one

million man-hours worked between 2011 and the first half of

2021.

Wilson Sons continues to monitor its performance through various

environmental and other social responsibility indicators with a

number of actions and results disclosed in the Integrated Annual

Report and the Bloomberg ESG Survey published on the company's

investor relations website ( wilsonsons.com.br/ir ).

OWIL Report

Market backdrop

The past six months proved to be another positive one for stock

markets. Risk assets generally continued their upward march with

world equities rising by 12.3% in US dollar terms. Confounding many

commentators who had expected 2021 to be less good for US equities

given the market's bias towards technology and growth stocks, the

US market continued to outperform and returned just under 15% for

the first half of the year. Elsewhere, Europe returned 11.8%

year-to-date and emerging markets a more modest 7.4% albeit with

significant variation at the country level with China barely

positive for the year (+1.8%) compared to +10% and +19.7% for

Brazil and Russia respectively.

Bonds had a more difficult period with global treasuries down

4.6%, investment grade bonds down 1.7% while high yield bonds were

up 2.1%. Similarly, US treasuries declined by 2.6% and emerging

market bonds were down 1% in USD terms. Rounding-off the picture

commodities delivered mixed returns with energy continuing its

strong run (up 28.7% year-to-date) and industrial metals lagged

although was positive while gold declined 6.8% in the first half of

the year.

Portfolio commentary

While most economies started the period in lockdown, equity

markets chose to look through this predicting a wave of activity as

economies reopened and vaccination rates crept up. This was

initially expressed by a swing towards more cyclical names further

boosted by higher oil prices. However, towards the end of the

period the uncertainty, and delay in some cases, of the reopening

process gave markets the jitters leading to a move back to higher

quality, growth stocks which led to strong performance for our

active managers later in the period. The investment portfolio was

up 9.5% in the first half of the year, whilst its benchmark, the US

CPI Urban Consumers NSA + 3%, returned 5.7% over the same period.

The MSCI ACWI gained 12.3% while the Bloomberg Barclays Global

Treasury index fell by 4.5%.

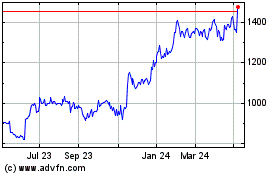

Cumulative Portfolio Returns

3 Years 5 Years

Performance (Time-weighted) YTD p.a. p.a.

---------------------------- ----- ------- -------

OWIL (net) 9.0% 8.8% 9.1%

Performance Benchmark* 5.7% 5.5% 5.4%

MSCI ACWI + FM 12.3% 14.5% 14.6%

MSCI Emerging Markets 7.4% 11.3% 13.9%

---------------------------- ----- ------- -------

*Notes:

The OWIL Performance Benchmark which came into effect on 1

January 2015 is US CPI Urban Consumers NSA +3% p.a. This has been

combined with the old benchmark (USD 12 Month LIBOR +2%) for

periods prior to the adoption of the new benchmark.

Investment Portfolio at 30 June 2021

Market Value

US$000 % Primary Focus

-------------------------------------- ------------ ----- -------------------------------------

Findlay Park American Fund 35,390 10.5 US Equities - Long Only

Adelphi European Select Equity Fund 18,216 5.4 Europe Equities - Long Only

BlackRock European Hedge Fund 15,887 4.7 Europe Equities - Hedge

GAM Star Fund PLC - Disruptive Growth 15,843 4.7 Technology Equities - Long Only

Egerton Long - Short Fund Limited 15,522 4.6 Europe/US Equities - Hedge

Select Equity Offshore, Ltd 13,251 3.9 US Equities - Long Only

Vulcan Value Equity Fund 13,197 3.9 US Equities - Long Only

Schroder ISF Asian Total Return Fund 10,202 3.0 Asia ex-Japan Equities - Long Only

Greenspring Global Partners VI, LP 7,987 2.4 Private Assets - US Venture Capital

Goodhart Partners: Hanjo Fund 7,924 2.4 Japan Equities - Long Only

Top 10 Holdings 153,419 45.7

-------------------------------------- ------------ ----- -------------------------------------

NG Capital Partners II, LP 7,027 2.1 Private Assets - Latin America

NTAsian Discovery Fund 6,923 2.1 Asia ex-Japan Equities - Long Only

Pangaea II, LP 6,405 1.9 Private Assets - GEM

Hudson Bay International Fund Ltd 6,159 1.8 Market Neutral - Multi-Strategy

Pershing Square Holdings Ltd 6,055 1.8 US Equities - Long Only

Silver Lake Partners IV, LP 5,479 1.6 Private Assets - Global Technology

Impax Environmental Markets Fund 5,448 1.6 Environmental Equities - Long Only

Prince Street Opportunities Fund 5,357 1.6 Emerging Markets Equities - Long Only

Indus Japan Long Only Fund 5,345 1.6 Japan Equities - Long Only

KKR Americas XII, LP 5,326 1.6 Private Assets - North America

Top 20 Holdings 212,943 63.4

-------------------------------------- ------------ ----- -------------------------------------

Remaining Holdings 121,300 36.1

-------------------------------------- ------------ ----- -------------------------------------

Cash 1,670 0.5

-------------------------------------- ------------ ----- -------------------------------------

TOTAL 335,913 100.0

-------------------------------------- ------------ ----- -------------------------------------

Wilson Sons Report

The Wilson Sons second quarter 2021 earnings report released on

12 August 2021 is available on the Wilson Sons website:

www.wilsonsons.com.br

In the report, Fernando Salek, CEO of Operations in Brazil

said:

"Wilson Sons 2Q21 EBITDA of US$41.1 million increased 11.4%

against 2Q20 (US$36.9 million) with strong operating results. In

BRL terms EBITDA grew 9.8%.

Robust container terminal results were driven by import and

transshipment volumes in 2Q21 with a growing domestic economic

activity in the quarter, although the lack of availability of empty

containers and logistic bottlenecks continues to be a challenge for

export volumes. The Salvador terminal had an all-time record first

half, handling 184,000 TEUs. The Rio Grande terminal total volumes

grew 10.8% against 2Q20 with an emphasis on the largest

simultaneous transshipment operation in terminal history, with

13,580 TEUs and two 300 metre long vessels.

Towage results continued solidly driven by commodity volumes

with chemicals and oil performing well. Oil and gas services demand

remains challenging, with oversupply for offshore supply

vessels.

Despite the complications of the Covid-19 pandemic in Brazil,

the company delivered robust growth in the quarter driven by the

container terminals and towage volumes. Health and safety continue

to be fundamental for our business in these difficult times and we

are closely monitoring the evolution of the pandemic in the

country."

Group Results

Revenue

Revenue increased by 8.4% compared to the first half of the

prior year to US$188.9 million (2020: US$174.2 million). In

Brazilian Real ("BRL") terms, revenues rose 19.1%. Revenues were up

for all lines of business compared to the first half of the prior

year, save for offshore support bases. Container terminals had

increased import volumes and higher storage revenue with a 2.8%

increase in revenues to US$69.3 million (2020: US$67.4 million).

Logistics revenues increased 8.4% as airport imports increased

correlating with the increases experienced at shipping ports.

Towage revenues for the first half of the year were US$92.9

million, an increase of 12.9% (2020: US$82.3 million) as a result

of both increased volumes and improving revenue per manoeuvre.

Shipping agency and shipyard services both improved with the

increased activity across the business lines. Offshore support

bases continue to struggle with a market backdrop of the pressured

oil and gas sectors.

Operating volumes (to 30 June) 2021 2020 % Change

-------------------------------------------------------- ------ ------ --------

Container Terminals (container movements in TEU '000s)* 538.6 484.0 11.3%

Towage (number of harbour manoeuvres performed) 29,957 25,175 7.1%

Offshore Vessels (days in operation) 2,573 2,553 0.8%

-------------------------------------------------------- ------ ------ --------

* TEUs stands for "twenty-foot equivalent units".

Operating profit

Operating profit was US$23.0 million better than the comparative

period at US$50.7 million (2020: US$27.7 million). This favourable

result is primarily driven by higher revenues and a stronger

USD/BRL exchange rate for the period. Raw materials and consumables

increased US$2.1 million over the prior period as economic activity

is climbing to pre-pandemic levels. Employee costs decreased US$3.5

million over the prior period; however, these costs continue to

climb quarterly as the workforce resumes activity with increased

overtime costs as we continue to take measures to protect our

employees during the pandemic by managing work crew scheduling.

Other operating expenses increased 17.6% during the first half of

the year as Wilson Sons had to rent tugs to manage demand while

their own vessels were dry-docked for repairs and maintenance.

Additionally, based on the performance of OWIL in the first half of

the year, operating expenses include a US$1.2 million performance

fee accrual. The depreciation and amortisation expense at US$25.3

million was US$0.5 million lower than the comparative period (2020:

US$25.8million). Foreign currency exchange gains were US$2.3

million, a US$14.0 million improvement on the prior period loss

(2020: US$11.7 million loss), arose from the Group's foreign

currency monetary items and reflect the movement of the BRL against

the USD during the period.

Share of results of joint ventures

The share of results of joint ventures is Wilson Sons' 50% share

of the net results for the period from our offshore support vessel

joint venture. The net loss attributable to Wilson Sons for the

period was US$0.8 million (2020: US$5.2 million loss) principally

due to improved foreign exchange gains and tax credits associate

with previous losses.

Returns on the investment portfolio at fair value through profit

and loss

The gain for the period on the investment portfolio of US$29.5

million (2020: US$13.8 million loss) comprises unrealised gains on

financial assets at fair value through profit and loss of US$23.4

million (2020: US$18.3 million loss), investment income of US$1.2

million (2020: US$1.5 million) and realised profits on the disposal

of financial assets at fair value through profit and loss of US$5.0

million (2020: US$3.0 million).

Finance costs

Finance costs for the period were US$3.2 million more than the

comparative period at US$14.6 million (2020: US$11.4 million) which

was driven by interest on bank loans and overdrafts which were

US$3.2 million higher than the prior year at US$7.8 million (2020:

US$4.6 million).

Exchange rates

The Group reports in USD and has revenue, costs, assets and

liabilities in both BRL and USD. Therefore, movements in the

USD/BRL exchange rate can impact the Group both positively and

negatively from period to period. In the six months to 30 June 2021

the BRL depreciated 3.8% against the USD from R$5.00 at 1 January

2020 to R$5.20 at the period end. In the comparative period in 2020

the BRL depreciated 26.5% against the USD from R$4.03 to

R$5.48.

The principal effects from the movement of the BRL against the

USD on the income statement are:

2021 2020

US$ million US$ million

------------------------------------------------- ----------- -----------

Exchange gain/(loss) on monetary items(1) 2.3 (11.7)

Deferred tax on retranslation of fixed assets(2) 6.6 (21.2)

Deferred tax on exchange variance on loans(3) (3.7) 19.6

------------------------------------------------- ----------- -----------

Total 5.2 (13.3)

------------------------------------------------- ----------- -----------

1. This arises from the translation of BRL denominated monetary items in

USD functional currency entities.

2. The Group's fixed assets are located in Brazil and therefore future

tax deductions from depreciation used in the Group's tax calculations

are denominated in BRL. When the BRL depreciates against the US Dollar

the future tax deduction in BRL terms remain unchanged but are reduced

in US Dollar terms and vice versa.

3. Deferred tax credit arising from the exchange losses on USD denominated

borrowings in Brazil.

The average USD/BRL exchange rate in the period at R$5.39 was

9.6% higher (2020: R$4.92) than the comparative period in 2020. A

higher average exchange rate negatively impacts BRL denominated

revenues and benefits BRL denominated costs when converted into our

reporting currency.

Profit/(Loss) before tax

Profit before tax increased US$68.0 million to US$66.2 million

compared with prior year (2020: US$1.8 million loss) with this

sharp increase mainly attributable to the improvement in operating

profit of US$23.0 million and the results of improved stock market

conditions as the investment portfolio produced returns of US$29.5

million. Additionally, losses from the share of results of joint

ventures were US$0.8 million (2020: US$5.2 million loss) which was

offset by increased finance costs of US$3.2 million at US$14.6

million (2020: US$11.4 million).

Taxation

The corporate tax rate prevailing in Brazil is 34%. The Group

recorded an income tax expense for the period of US$14.4 million

(2020:US$16.6 million). The principal net expenses not included in

determining taxable profit in Brazil are foreign exchange losses on

monetary items, share of results of joint ventures and deferred tax

items. These are mainly deferred tax credits arising on the

retranslation of BRL denominated fixed assets in Brazil and the

deferred tax charge on the exchange losses on USD denominated

borrowings.

Profit/(Loss) for the period

After deducting the profit attributable to non-controlling

interests of US$12.3 million (2020: US$0.6 million loss), the

profit attributable to equity holders of the Company is US$39.5

million (2020: US$17.8 million loss). The earnings per share for

the period was US 111.7 cents (2020: US 50.2 cents loss per

share).

Investment portfolio performance

As markets continue to improve while the global economy

navigates its way through the pandemic recovery, the investment

portfolio and cash under management was US$25.0 million higher at

US$335.9 million as at 30 June 2021 (31 December 2020: US$310.9

million), after paying dividends of US$2.5 million to the parent

company, deducting management and other fees of US$1.4 million and

accruing US$1.2 million in performance fees year based on current

performance.

Cash flow and debt

Net cash inflow from operating activities for the period was

US$41.6 million (2020: US$68.5 million). Dividends of US$24.8

million were paid to shareholders in the period (2020: US$10.6

million) with a further US$14.9 million paid to non-controlling

interests in our subsidiaries (2020: US$6.4 million). At 30 June

2021, the Group had cash and cash equivalents of US$55.6 million

(31 December 2020: US$63.3 million). Group borrowings including

lease liabilities at the period end were US$518.8 million (31

December 2020: US$500.6 million). New loans were raised in the

period of US$8.0 million (2020: US$47.2 million) while capital

repayments on existing loans in the period of US$41.1 million

(2020: US$20.5 million) were made. The Group's reported borrowings

do not include the Company's 50% share of our offshore vessel joint

venture's debt being US$209.9 million.

Balance sheet

Equity attributable to shareholders at the balance sheet date

was US$20.5 million higher at US$576.3 million compared with

US$555.8 million at 31 December 2020. The main movements in equity

for the half year was the profit for the period of US$39.5 million,

dividends paid of US$24.8 million and a positive currency

translation adjustment of US$2.7 million. The currency translation

adjustment arises from exchange differences on the translation of

operations with a functional currency other than USD.

Other matters

Principal risks

The Board reported on the principal risks and uncertainties

faced by the Company in the Annual Report and Financial Statements

for the year ended 31 December 2020. A detailed explanation can be

found in the Report of Directors on pages 30 to 33 of the Annual

Report and Financial Statements which are available on the website

at www. oceanwilsons.bm.

Related party transactions

Related party transactions during the period are set out in note

19.

Going concern

The Group closely monitors and manages its liquidity risk. The

Group has considerable financial resources including US$55.6

million in cash and cash equivalents and the majority of the

Group's borrowings have a long maturity profile. The Group's

business activities together with the factors likely to affect its

future development and performance are set out in the Chairman's

statement and Investment Manager's report. The financial position,

cash flows and borrowings of the Group are also set out in the

Chairman's statement. Details of the Group's borrowings are set out

in note 15 to the accounts. Based on the Group's cash forecasts and

sensitivities run, the Directors have a reasonable expectation that

the Company and the Group have adequate resources to continue in

operation for the foreseeable future.

The Group manages its liquidity risk and does so in a manner

that reflects its structure and two distinct businesses, being the

parent company along with OWIL and Wilson Sons.

OWIL

The parent company and OWIL have combined cash and cash

equivalents of US$2.1 million. They have no debts but have made

commitments in respect of investment subscriptions amounting to

US$38.0 million, details are provided in note 18. The timing of the

investment commitments may be accelerated or delayed in comparison

with those indicated in note 18.

However, highly liquid investments held are significantly in

excess of the commitments. Neither Ocean Wilsons nor OWIL have made

any commitments or have obligations towards Wilsons Sons and its

subsidiaries and their creditors or lenders. Therefore, in the

unlikely circumstance that Wilsons Sons was to encounter financial

difficulty, the parent company and its subsidiary have no

obligations to provide support and have sufficient cash and other

liquid resources to continue as a going concern on a standalone

basis.

Wilson Sons

Wilson Sons has cash and cash equivalents of US$53.5 million.

All of the debt, as set out in note 15, and all of the lease

liabilities, as set out in note 11, relate to Wilson Sons, and

generally have a long maturity profile. The debt held by Wilson

Sons is subject to covenant compliance tests as summarised in note

15, which were in compliance with at 30 June 2021.

Wilson Sons has adequate cash, other liquid resources and

undrawn credit facilities to enable it to meet its obligations as

they fall due in order to continue its operations.

Based on the Board's review of Wilson Sons' going concern

assessment and the liquidity and cash flow reviews of the Company

and its subsidiary OWIL, the Directors have a reasonable

expectation that the Company and the Group have adequate resources

to continue in operational existence for the foreseeable future.

Accordingly, the Directors continue to adopt the going concern

basis in preparing the Interim report and accounts.

Responsibility statement

The Directors confirm that this condensed interim financial

information has been prepared in accordance with IAS 34 and that

the interim management report includes a fair review of the

information required by DTR 4.2.7 and DTR 4.2.8, namely:

-- an indication of important events that have occurred during the first

six months and their impact on the condensed set of financial statements

and a description of the principal risks and uncertainties for the remaining

six months of the financial year; and

-- material related party transactions in the first six months and any

material changes in the related party transactions described in the

last Annual Report.

J F Gouvêa Vieira

Chairman

11 August 2021

Condensed Consolidated Interim Statement of Profit or Loss and

Other Comprehensive Income

for the six months ended 30 June 2021

Unaudited Unaudited

six months to six months to

30 June 30 June

2021 2020

Notes US$'000 US$'000

--------------------------------------------------------------------------------- ----- ------------- -------------

Revenue 3 188,877 174,211

Raw materials and consumables used (11,216) (9,163)

Employee benefits expense 5 (53,369) (56,868)

Depreciation and amortisation expense (25,270) (25,842)

Amortisation of right-of-use assets (5,982) (5,312)

Other operating expenses (44,677) (37,982)

Gain on disposal of property, plant and equipment 2 295

Foreign exchange gains/(losses) on monetary items 2,315 (11,657)

--------------------------------------------------------------------------------- ----- ------------- -------------

Operating profit 50,680 27,682

Share of results of joint ventures 16 (749) (5,212)

Returns on investment portfolio at fair value through profit and loss 6 29,548 (13,761)

Other investment income 1,307 923

Finance costs 7 (14,584) (11,413)

Profit/(loss) before tax 66,202 (1,781)

Income tax expense 8 (14,424) (16,572)

--------------------------------------------------------------------------------- ----- ------------- -------------

Profit/(loss) for the period 51,778 (18,353)

--------------------------------------------------------------------------------- ----- ------------- -------------

Other comprehensive income: items that may be reclassified subsequently to profit

and loss

Exchange differences arising on translation of foreign operations 4,804 (59,471)

Effective portion of changes in fair value of derivatives 106 (156)

--------------------------------------------------------------------------------- ----- ------------- -------------

Other comprehensive income/(loss) for the period 4,910 (59,627)

Total comprehensive income/(loss) for the period 56,688 (77,980)

--------------------------------------------------------------------------------- ----- ------------- -------------

Profit/(loss) for the period attributable to:

Equity holders of the Company 39,516 (17,766)

Non-controlling interests 12,262 (587)

--------------------------------------------------------------------------------- ----- ------------- -------------

51,778 (18,353)

--------------------------------------------------------------------------------- ----- ------------- -------------

Total comprehensive income/(loss) for the period attributable to:

Equity holders of the Company 42,284 (52,173)

Non-controlling interests 14,404 (25,807)

--------------------------------------------------------------------------------- ----- ------------- -------------

56,688 (77,980)

--------------------------------------------------------------------------------- ----- ------------- -------------

Earnings per share

Basic and diluted 10 111.7c (50.2c)

--------------------------------------------------------------------------------- ----- ------------- -------------

Condensed Consolidated Interim Statement of Financial

Position

as at 30 June 2021

Unaudited Audited

as at as at

30 June 31 December

2021 2020

Notes US$'000 US$'000

------------------------------------------------------- ----- --------- -----------

Non-current assets

Goodwill 13,518 13,429

Right-of-use assets 11 192,922 149,278

Other intangible assets 16,190 16,967

Property, plant and equipment 12 579,229 579,138

Deferred tax assets 23,366 29,716

Investment in joint ventures 16 25,774 26,185

Related party loans 30,634 30,460

Recoverable taxes 6,170 11,006

Other non-current assets 4,749 4,905

Other trade receivables 14 11,278 9

------------------------------------------------------- ----- --------- -----------

903,830 861,093

------------------------------------------------------- ----- --------- -----------

Current assets

Inventories 12,658 11,764

Financial assets at fair value through profit and loss 13 334,243 347,464

Trade and other receivables 14 61,793 47,807

Recoverable taxes 27,036 22,479

Cash and cash equivalents 55,616 63,255

------------------------------------------------------- ----- --------- -----------

491,346 492,769

------------------------------------------------------- ----- --------- -----------

Total assets 1,395,176 1,353,862

------------------------------------------------------- ----- --------- -----------

Current liabilities

Trade and other payables (52,823) (47,298)

Tax liabilities (878) (114)

Lease liabilities 11 (23,725) (18,192)

Bank overdrafts and loans 15 (44,514) (58,672)

------------------------------------------------------- ----- --------- -----------

(121,940) (124,276)

------------------------------------------------------- ----- --------- -----------

Net current assets 369,406 368,493

------------------------------------------------------- ----- --------- -----------

Non-current liabilities

Bank loans 15 (269,387) (283,989)

Post-employment benefits (1,739) (1,641)

Deferred tax liabilities (43,761) (50,987)

Provisions for tax, labour and civil cases (9,508) (9,560)

Lease liabilities 11 (181,150) (139,702)

------------------------------------------------------- ----- --------- -----------

(505,545) (485,879)

------------------------------------------------------- ----- --------- -----------

Total liabilities (627,485) (610,155)

------------------------------------------------------- ----- --------- -----------

Net assets 767,691 743,707

------------------------------------------------------- ----- --------- -----------

Capital and reserves

Share capital 11,390 11,390

Retained earnings 621,783 603,996

Capital reserves 31,991 31,991

Translation and hedging reserve (88,827) (91,595)

------------------------------------------------------- ----- --------- -----------

Equity attributable to equity holders of the Company 576,337 555,782

Non-controlling interests 191,354 187,925

------------------------------------------------------- ----- --------- -----------

Total equity 767,691 743,707

------------------------------------------------------- ----- --------- -----------

Condensed Consolidated Statement of Changes in Equity

as at 30 June 2021

Hedging Attributable

and to equity Non-

Share Retained Capital Translation holders of controlling Total

For the six months ended 30 June 2020

(unaudited) capital earnings reserves reserve the Company interests equity

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

--------------------------------------- ------- -------- -------- ----------- ------------ ----------- --------

Balance at 1 January 2020 11,390 588,160 31,991 (61,748) 569,793 216,067 785,860

--------------------------------------- ------- -------- -------- ----------- ------------ ----------- --------

Currency translation adjustment - - - (34,317) (34,317) (25,154) (59,471)

Effective portion of changes in fair

value of derivatives - - - (90) (90) (66) (156)

Loss for the period - (17,766) - - (17,766) (587) (18,353)

--------------------------------------- ------- -------- -------- ----------- ------------ ----------- --------

Total comprehensive loss for the period - (17,766) - (34,407) (52,173) (25,807) (77,980)

Dividends (note 9) - (10,609) - - (10,609) (6,418) (17,027)

Share options exercised in subsidiary - 1,272 - - 1,272 1,032 2,304

Share based expense (note 5) - - - - - 105 105

--------------------------------------- ------- -------- -------- ----------- ------------ ----------- --------

Balance at 30 June 2020 11,390 561,057 31,991 (96,155) 508,283 184,979 693,262

--------------------------------------- ------- -------- -------- ----------- ------------ ----------- --------

For the six months ended 30 June 2021

(unaudited)

Balance at 1 January 2021 11,390 603,996 31,991 (91,595) 555,782 187,925 743,707

--------------------------------------- ------- -------- -------- ----------- ------------ ----------- --------

Currency translation adjustment - - - 2,708 2,708 2,096 4,804

Effective portion of changes in fair

value of derivatives - - - 60 60 46 106

Profit for the period - 39,516 - - 39,516 12,262 51,778

--------------------------------------- ------- -------- -------- ----------- ------------ ----------- --------

Total comprehensive income for the

period - 39,516 - 2,768 42,284 14,404 56,688

Dividends (note 9) - (24,754) - - (24,754) (14,948) (39,702)

Share options exercised in subsidiary - 3,025 - - 3,025 3,860 6,885

Share based expense (note 5) - - - - - 113 113

--------------------------------------- ------- -------- -------- ----------- ------------ ----------- --------

Balance at 30 June 2021 11,390 621,783 31,991 (88,827) 576,337 191,354 767,691

--------------------------------------- ------- -------- -------- ----------- ------------ ----------- --------

Share capital

The Group has one class of ordinary share which carries no right

to fixed income.

Capital reserves

The capital reserves arise principally from transfers from

revenue to capital reserves made in the Brazilian subsidiaries

arising in the following circumstances:

(a) profits of the Brazilian subsidiaries and Brazilian holding company

which in prior periods were required by law to be transferred to capital

reserves and other profits not available for distribution; and

(b) Wilson Sons' byelaws require the company to credit an amount equal to

5% of the company's net profit to a retained earnings account to be

called legal reserve until such amount equals 20% of the Wilson Sons

share capital.

Hedging and translation reserve

The hedging and translation reserve arises from exchange

differences on the translation of operations with a functional

currency other than US Dollars and effective movements on

designated hedging relationships.

Amounts in the statement of changes in equity are stated net of

tax where applicable.

Condensed Consolidated Interim Statement of Cash Flows

for the six months ended 30 June 2021

Unaudited Unaudited

six months to six months to

30 June 30 June

2021 2020

Notes US$'000 US$'000

--------------------------------------------------------------------------------- ----- ------------- -------------

Net cash inflow from operating activities 17 41,582 68,500

--------------------------------------------------------------------------------- ----- ------------- -------------

Investing activities

Interest received 861 945

Income received from underlying investment vehicles 1,162 1,513

Proceeds on disposal of financial assets at fair value through profit and loss 13 56,036 32,980

Proceeds on disposal of intangible assets 4 -

Proceeds on disposal of property, plant and equipment 49 156

Purchase of property, plant and equipment (16,585) (40,968)

Purchase of intangible asset (405) (502)

Purchase of financial assets at fair value through profit and loss 13 (14,429) (13,407)

Advance for future capital increase in joint ventures 16 (9,985) -

Net cash provided by/(used in) investing activities 16,708 (19,283)

--------------------------------------------------------------------------------- ----- ------------- -------------

Financing activities

Dividends paid 9 (24,754) (10,609)

Dividends paid to non-controlling interests in subsidiary (14,948) (6,418)

Repayments of borrowings (41,059) (20,468)

Payments of lease liabilities (4,376) (3,240)

New bank loans drawn down 7,978 47,167

Net cash inflow arising from issue of new shares in subsidiary under employee

stock option

scheme 6,885 2,304

--------------------------------------------------------------------------------- ----- ------------- -------------

Net cash (used in)/provided by financing activities (70,274) 8,736

--------------------------------------------------------------------------------- ----- ------------- -------------

Net (decrease)/increase in cash and cash equivalents (11,984) 57,953

--------------------------------------------------------------------------------- ----- ------------- -------------

Cash and cash equivalents at beginning of period 63,255 68,979

--------------------------------------------------------------------------------- ----- ------------- -------------

Effect of foreign exchange rate changes 4,345 (26,517)

--------------------------------------------------------------------------------- ----- ------------- -------------

Cash and cash equivalents at end of period 55,616 100,415

--------------------------------------------------------------------------------- ----- ------------- -------------

Notes to Condensed Consolidated Interim Financial

Information

for the six months ended 30 June 2021

1. General Information

The condensed consolidated interim financial information is not

the Company's statutory accounts. The auditors of the Company have

not made any report thereon under section 90(2) of the Bermuda

Companies Act.

Ocean Wilsons Holdings Limited ("Ocean Wilsons" or the

"Company") is a Bermuda investment holding company which, through

its subsidiaries, operates a maritime services company in Brazil

and holds a portfolio of international investments. The Company is

listed on both the London Stock Exchange and the Bermuda Stock

Exchange. It has two principal subsidiaries: Wilson Sons Limited

("Wilson Sons") and Ocean Wilsons (Investments) Limited ("OWIL")

(together with the Company and their subsidiaries, the

"Group").

Ocean Wilsons Holdings Limited is a company incorporated in

Bermuda under the Companies Act 1981 and the Ocean Wilsons Holdings

Limited Act, 1991. The condensed consolidated interim financial

information is presented in US Dollars, the currency of the primary

economic environment in which the Group operates.

2. Accounting policies

The condensed consolidated interim financial information of the

Company for the six months ended 30 June 2021 comprises the Company

and its subsidiaries (together referred to as the "Group") and the

Group's interests in associates and jointly controlled

entities.

The condensed set of financial statements has been prepared

using accounting policies consistent with International Financial

Reporting Standards ("IFRS") and in accordance with IAS 34 -

Interim Financial Reporting. For these purposes, IFRS comprise the

standards issued by the International Accounting Standards Board

("IASB") and interpretations issued by the International Financial

Reporting Interpretations Committee ("IFRIC").

The condensed consolidated interim financial information has

been prepared on the basis of accounting policies consistent with

those applied to the consolidated financial statements for the year

ended 31 December 2020.

3. Revenue

An analysis of the Group's revenue is as follows:

Unaudited Unaudited

six months to six months to

30 June 30 June

2021 2020

US$'000 US$'000

---------------------------------------------------- ------------- -------------

Sales of services (note 3.1) 188,877 174,211

Income from underlying investment vehicles (note 6) 1,162 1,513

Other investment income 1,307 923

---------------------------------------------------- ------------- -------------

191,346 176,647

---------------------------------------------------- ------------- -------------

3.1 Disaggregated revenue information

The following is an analysis of the Group's revenue from sales

of services for the period:

Unaudited Unaudited

six months to six months to

30 June 30 June

2021 2020

US$'000 US$'000

-------------------------------------- ------------- -------------

Harbour manoeuvres 83,776 73,873

Special operations 9,156 8,433

Ship agency 4,247 4,006

-------------------------------------- ------------- -------------

Total Towage and ship agency services 97,179 86,312

-------------------------------------- ------------- -------------

Container handling 36,453 35,636

Warehousing 16,426 15,429

Ancillary services 10,622 8,960

Oil and Gas support base 3,183 4,535

Other services 5,830 7,371

-------------------------------------- ------------- -------------

Total Port terminals 72,514 71,931

-------------------------------------- ------------- -------------

Logistics 16,012 14,768

-------------------------------------- ------------- -------------

Total Logistics 16,012 14,768

-------------------------------------- ------------- -------------

Shipyard 3,172 1,200

-------------------------------------- ------------- -------------

Total Shipyard 3,172 1,200

-------------------------------------- ------------- -------------

Total 188,877 174,211

-------------------------------------- ------------- -------------

Unaudited Unaudited

six months to six months to

30 June 30 June

2021 2020

US$'000 US$'000

------------------------------ ------------- -------------

Timing of revenue recognition

At a point of time 185,705 173,011

Over time 3,172 1,200

------------------------------ ------------- -------------

188,877 174,211

------------------------------ ------------- -------------

3.2 Contract balance

Trade receivables are generally received within 30 days of the

invoice date. The carrying amount of operational trade receivables

at the end of reporting period was US$49.6 million (31 December

2020: US$40.6 million). These amounts included US$12.7 million (31

December 2020: US$10.4 million) of contract assets (unbilled

accounts receivables).

There were no contract liabilities as at 30 June 2021 (31

December 2020: nil).

4. Business and geographical segments

Business segments

Ocean Wilsons Holdings Limited has two reportable segments:

maritime services and investments. These segments report their

financial and operational data separately to the Board. The Board

considers these segments separately when making business and

investment decisions. The maritime services segment provides towage

and ship agency, port terminals, offshore, logistics and shipyard

services in Brazil through Wilson Sons. The investment segment

holds a portfolio of international investments.

Segment information relating to these businesses is presented

below:

Maritime

services Investment Unallocated Consolidated

US$'000 US$'000 US$'000 US$'000

-------------------------------------------------------------------- --------- ---------- ----------- ------------

Result - six months to 30 June 2021 (unaudited)

Revenue 188,877 - - 188,877

Segment result 53,459 (2,953) (2,141) 48,365

Share of results of joint venture (749) - - (749)

Returns on investment portfolio at fair value through profit and

loss - 29,548 - 29,548

Other investment income 1,307 - - 1,307

Finance costs (14,584) - - (14,584)

Foreign exchange gains/(losses) on monetary items 2,416 3 (104) 2,315

-------------------------------------------------------------------- --------- ---------- ----------- ------------

Profit/(loss) before tax 41,849 26,598 (2,245) 66,202

Tax (14,424) - - (14,424)

-------------------------------------------------------------------- --------- ---------- ----------- ------------

Profit/(loss) after tax 27,425 26,598 (2,245) 51,778

-------------------------------------------------------------------- --------- ---------- ----------- ------------

Other information - six months to 30 June 2021 (unaudited)

Capital additions 16,990 - - 16,990

Depreciation and amortisation (25,270) - - (25,270)

Amortisation of right-of-use assets (5,982) - - (5,982)

Balance Sheet - as at June 30 2021 (unaudited)

Segment assets 1,054,889 335,913 4,374 1,395,176

Segment liabilities (625,147) (1,554) (784) (627,485)

Net Assets 429,742 334,359 3,590 767,691

-------------------------------------------------------------------- --------- ---------- ----------- ------------

Maritime

services Investment Unallocated Consolidated

six months to six months to six months to six months to

30 June 30 June 30 June 30 June

2020 2020 2020 2020

US$'000 US$'000 US$'000 US$'000

---------------------------------------------------------- ------------- ------------- ------------- -------------

Result - six months to 30 June 2020 (unaudited)

Revenue 174,211 - - 174,211

Segment result 41,906 (1,420) (1,147) 39,339

Share of results of joint venture (5,212) - - (5,212)

Returns on investment portfolio at fair value through

profit and loss - (13,761) - (13,761)

Other investment income 923 - - 923

Finance costs (11,413) - - (11,413)

Foreign exchange (losses)/gains on monetary items (11,653) (12) 8 (11,657)

---------------------------------------------------------- ------------- ------------- ------------- -------------

Profit/(loss) before tax 14,551 (15,193) (1,139) (1,781)

Tax (16,572) - - (16,572)

---------------------------------------------------------- ------------- ------------- ------------- -------------

Loss after tax (2,021) (15,193) (1,139) (18,353)

---------------------------------------------------------- ------------- ------------- ------------- -------------

Other information - six months to 30 June 2020 (unaudited)

Capital additions 43,173 - - 43,173

Depreciation and amortisation (25,842) - - (25,842)

Amortisation of right-of-use assets (5,312) - - (5,312)

Balance Sheet - as at December 31 2020

Segment assets 1,039,374 310,882 3,606 1,353,862

Segment liabilities (609,104) (621) (430) (610,155)

Net Assets 430,270 310,261 3,176 743,707

---------------------------------------------------------- ------------- ------------- ------------- -------------

Finance costs and associated liabilities have been allocated to

reporting segments where interest costs arise from loans used to

finance the construction of fixed assets in that segment.

Geographical Segments

The Group's operations are located in Bermuda and Brazil. The

Group, through its participation in an offshore vessel joint

venture in Panama, earns income in that country and in Uruguay. All

the Group's sales are derived in Brazil.

The following is an analysis of the carrying amount of segment

assets and additions to property, plant and equipment and

intangible assets, analysed by the geographical area in which the

assets are located.

Carrying amount of Additions to property, plant and

segment assets equipment and intangible assets

---------------------- ----------------------------------

Unaudited Unaudited

Unaudited Audited six months to six months to

30 June 31 December 30 June 30 June

2021 2020 2021 2020

US$'000 US$'000 US$'000 US$'000

-------- --------- ----------- ---------------- ----------------

Brazil 1,054,889 994,826 16,990 43,173

Bermuda 340,287 359,036 - -

-------- --------- ----------- ---------------- ----------------

1,395,176 1,353,862 16,990 43,173

-------- --------- ----------- ---------------- ----------------

5. Employee benefits expense

Unaudited Unaudited

six months to six months to

30 June 30 June

2021 2020

US$'000 US$'000

---------------------------------- ------------- -------------

Aggregate remuneration comprised:

Wages and salaries 43,199 45,209

Share based expense 113 105

Social security costs 9,675 11,261

Other pension costs 382 293

---------------------------------- ------------- -------------

53,369 56,868

---------------------------------- ------------- -------------

6. Returns on investment portfolio at fair value through profit and loss

Unaudited Unaudited

six months to six months to

30 June 30 June

2021 2020

US$'000 US$'000

------------------------------------------------------------------------------------ ------------- -------------

Unrealized gains/(losses) on financial assets at fair value through profit and loss 23,398 (18,301)

Income from underlying investment vehicles 1,162 1,513

Profit on disposal of financial assets at fair value through profit and loss 4,988 3,027

------------------------------------------------------------------------------------ ------------- -------------

29,548 (13,761)

------------------------------------------------------------------------------------ ------------- -------------

7. Finance costs

Unaudited Unaudited

six months to six months to

30 June 30 June

2021 2020

US$'000 US$'000

-------------------------------------- ------------- -------------

Interest on lease liabilities 6,790 6,839

Interest on bank overdrafts and loans 7,755 4,552

Other interest 39 22

-------------------------------------- ------------- -------------

14,584 11,413

-------------------------------------- ------------- -------------

8. Taxation

Unaudited Unaudited

six months to six months to

30 June 30 June

2021 2020

US$'000 US$'000

-------------------------------------------------------------- ------------- -------------

Current

Brazilian taxation:

Corporation tax 10,549 10,989

Social contribution 4,035 4,056

-------------------------------------------------------------- ------------- -------------

Total current tax 14,584 15,045

-------------------------------------------------------------- ------------- -------------

Deferred tax - origination and reversal of timing differences (160) 1,527

-------------------------------------------------------------- ------------- -------------

Total taxation 14,424 16,572

-------------------------------------------------------------- ------------- -------------

Brazilian corporation tax is calculated at 25% (2020: 25%) of

the assessable profit for the year.

Brazilian social contribution tax is calculated at 9% (2020: 9%)

of the assessable profit for the year.

At the present time, no income, profit, capital or capital gains

taxes are levied in Bermuda and accordingly, no provision for such

taxes has been recorded by the Company. In the event that such

taxes are levied, the Company has received an undertaking from the

Bermuda Government exempting it from all such taxes until 31 March

2035. The Group is monitoring the ongoing development of the G20

initiative to implement a global minimum tax rate as it relates to

its corporate structure.

9. Dividends

Unaudited Unaudited

six months to six months to

30 June 30 June

2021 2020

US$'000 US$'000

---------------------------------------------------------------------------------------- ------------- -------------

Dividend declared and paid to equity holders in the current period of 70 cents (2020: 30

cents)

per share 24,754 10,609

10. Earnings per share

The calculation of the basic and diluted earnings per share is

based on the following data:

Unaudited Unaudited

six months to six months to

30 June 30 June

2021 2020

US$'000 US$'000

---------------------------------------------------------------------------------------- ------------- -------------

Earnings:

Earnings for the purposes of basic earnings per share being net profit/(loss)

attributable

to equity holders of the Company 39,516 (17,766)

Number of shares:

Weighted average number of ordinary shares for the purposes of basic and diluted

earnings

per share 35,363,040 35,363,040

---------------------------------------------------------------------------------------- ------------- -------------

11. Lease arrangements

11.1 Right-of-use assets

Operational Vehicles, plant

facilities Floating craft Buildings and equipment Total

US$'000 US$'000 US$'000 US$'000 US$'000

------------------------------------------------ ----------- -------------- --------- --------------- --------

Cost or valuation

At 1 January 2020 186,026 4,481 6,449 12,703 209,659

Transfers from property, plant and equipment - - - 495 495

Contractual amendments 9,376 52 201 83 9,712

Additions 1,553 3,504 19 124 5,200

Exchange differences (42,245) (759) (772) (1,745) (45,521)

Terminated contracts - - (200) (1,911) (2,111)

------------------------------------------------ ----------- -------------- --------- --------------- --------

At 31 December 2020 154,710 7,278 5,697 9,749 177,434

Contractual amendments 34,780 110 10 3 34,903

Additions - 7,353 16 145 7,514

Exchange differences 8,255 797 (259) 182 8,975

Terminated contracts - - (109) (399) (508)

------------------------------------------------ ----------- -------------- --------- --------------- --------

At 30 June 2021 197,745 15,538 5,355 9,680 228,318

------------------------------------------------ ----------- -------------- --------- --------------- --------

Accumulated amortisation

At 1 January 2020 8,269 2,276 1,469 8,634 20,648

Transfers from property, plant and equipment - - - 471 471

Charge for the year 7,280 2,995 1,099 1,062 12,436

Exchange differences (1,810) (521) (77) (1,060) (3,468)

Terminated contracts - - (70) (1,861) (1,931)

------------------------------------------------ ----------- -------------- --------- --------------- --------

At 31 December 2020 13,739 4,750 2,421 7,246 28,156

Charge for the year 3,639 2,042 503 424 6,608

Exchange differences 755 204 (218) 176 917

Terminated contracts - - (62) (223) (285)

------------------------------------------------ ----------- -------------- --------- --------------- --------

At 30 June 2021 18,133 6,996 2,644 7,623 35,396

------------------------------------------------ ----------- -------------- --------- --------------- --------

Carrying Amount

------------------------------------------------ ----------- -------------- --------- --------------- --------

At 30 June 2021 (unaudited) 179,612 8,542 2,711 2,057 192,922

------------------------------------------------ ----------- -------------- --------- --------------- --------

At 31 December 2020 (audited) 140,971 2,528 3,276 2,503 149,278

------------------------------------------------ ----------- -------------- --------- --------------- --------

Operational facilities

The main lease commitments included as operational facilities

are described below:

Tecon Rio Grande

The Tecon Rio Grande lease was signed on 3 February 1997 for a

period of 25 years renewable for a further 25 years. Tecon Rio

Grande was granted the right to renew the lease as set out in the

contract amendment signed on 7 March 2006 due to compliance with

the contractual requirements to make additional investments in

expanding the terminal by constructing a third berth and achieving

the minimum annual container volume handled.

Tecon Salvador

Tecon Salvador S.A. has the right to lease and operate the

container terminal and heavy cargo terminal in the Port of Salvador

for 25 years renewed in 2016 for a further 25 years. The total

lease term of 50 years, until March 2050, is provided in the second

addendum to the rental agreement. This addendum requires the Group

to make a minimum specified investment in expanding the leased

terminal area.

Wilson Sons shipyard

Lease commitments mainly refer to a 60-year right to lease from

June 2008 and operate an area located adjacent to our shipyard in

Guarujá, São Paulo state. The initial lease of 30 years is

renewable for a further period of 30 years at the option of the

Group. The area has been used to expand and develop the Wilson Sons

shipyard. Management's intention is to exercise the renewal

option.

Brasco

The Brasco lease commitments mainly refers to a 30-year lease

expiring in 2043 to operate a port area in Caju, Rio de Janeiro,

with convenient access to service the Campos and Santos oil

producing basins.

Logistics

Lease commitments mainly refer to the bonded terminals and

distribution centres located in Santo André, São Paulo state and

Suape, Pernambuco state with terms ranging between 18 and 24

years.

Floating craft

Variable chartering of vessels for maritime transport between

port terminals. Payments made relating to the number of vessel

trips were not included in the measurement of lease liabilities

because they relate to variable payments.

Buildings

The Group has lease commitments for its Brazilian business

headquarters, branches and commercial offices in several Brazilian

cities.

Vehicles, plant and equipment

Rental contracts mainly for forklifts, vehicles for operational,

commercial and administrative activities and other operating

equipment.

11.2 Lease liabilities

Unaudited Audited

30 June 31 December

2021 2020

Discount rate US$'000 US$'000

------------------------------------ -------------- --------- -----------

Lease liabilities by class of asset

Operational facilities 5.17% - 9.33% 191,680 150,513

Buildings 4.41% - 12.9% 2,555 2,932

Vehicles, plant and equipment 4.87% - 12.9% 1,615 1,690

Floating craft 7.75% - 8.54% 9,025 2,759

Total 204,875 157,894

---------------------------------------------------- --------- -----------

Total current 23,725 18,192

---------------------------------------------------- --------- -----------

Total non-current 181,150 139,702

---------------------------------------------------- --------- -----------

The breakdown of lease liabilities by maturity is as

follows:

Unaudited Audited

30 June 31 December

2021 2020

US$'000 US$'000

-------------------------------------------------------- --------- -----------

Maturity analysis - contractual undiscounted cash flows

Within one year 24,940 19,153

In the second year 22,807 17,365

In the third to fifth years inclusive 64,721 49,353

After five years 373,099 292,766

-------------------------------------------------------- --------- -----------

Total cash flows 485,567 378,637

-------------------------------------------------------- --------- -----------

Adjustment to present value (280,692) (220,743)

-------------------------------------------------------- --------- -----------

Total lease liabilities 204,875 157,894

-------------------------------------------------------- --------- -----------

Inflation adjustment of the lease liabilities

The table below presents the lease liabilities balance

considering the projected future inflation rate in the discounted

payment flows. For the purposes of this calculation, all other

assumptions were maintained.

Unaudited Audited

30 June 31 December

2021 2020

US$'000 US$'000

------------------ --------- -----------

Actual flow 485,567 378,637

Embedded interest (280,692) (220,743)

------------------ --------- -----------

Lease liabilities 204,875 157,894

------------------ --------- -----------

11.3 Amounts recognised in profit and loss

Unaudited Unaudited

six months to six months to

30 June 30 June

2021 2020

US$'000 US$'000

---------------------------------------------------------------------------------- ------------- -------------

Amortisation of right-of-use assets (6,608) (6,486)

Amortisation of PIS and COFINS(1) 626 1,174

---------------------------------------------------------------------------------- ------------- -------------

Net Amortisation of right-of-use assets (5,982) (5,312)

---------------------------------------------------------------------------------- ------------- -------------

Interest on lease liabilities (7,237) (7,790)

Interest of PIS and COFINS 447 951

Variable lease payments not included in the measurement of lease liabilities (2,) (1,117) (968)

Expenses relating to short-term leases (13,325) (8,953)

Expenses relating to low-value assets (311) (568)

---------------------------------------------------------------------------------- ------------- -------------

Total (27,525) (22,640)

---------------------------------------------------------------------------------- ------------- -------------

1. The PIS (Program of Social Integration) and COFINS

(Contribution for the Financing of Social Security) are federal

taxes based on the turnover of companies

2. The amounts refer to payments, which exceeded the minimum

forecast volumes of Tecon Rio Grande and Tecon Salvador.

The Group is not able to estimate the future cash outflows

related to variable lease payments due to operational, economic and

foreign exchange uncertainties.

11.4 Amounts recognised in the statement of cash flows

Unaudited Unaudited

six months to six months to

30 June 30 June

2021 2020

US$'000 US$'000

-------------------------------- ------------- -------------

Payment of lease liability (4,376) (3,237)

Interest paid - lease liability (7,237) (7,805)

Short-term leases paid (13,325) (8,953)

Variable lease payments (1,117) (968)

Low-value leases paid (311) (568)

-------------------------------- ------------- -------------

Total (26,366) (21,531)

-------------------------------- ------------- -------------

12. Property, plant and equipment

Land and Vehicles, plant Assets under

buildings Floating Craft and equipment construction Total

US$'000 US$'000 US$'000 US$'000 US$'000

---------------------------------------- --------- -------------- --------------- ------------ ---------

Cost or valuation

At 1 January 2020 313,432 516,361 231,226 292 1,061,311

Additions 25,901 10,216 25,284 - 61,401

Transfers 148 (124) (24) - -

Transfers to right-of-use assets - - (495) - (495)

Transfers to intangible assets - - (99) - (99)

Exchange differences (56,443) - (42,819) - (99,262)

Disposals (3,725) (969) (4,039) - (8,733)

---------------------------------------- --------- -------------- --------------- ------------ ---------

At 1 January 2021 279,313 525,484 209,034 292 1,014,123

Additions 3,711 9,736 2,318 820 16,585

Transfers (22) - 22 - -

Transfers to intangible assets (1) - - - (1)

Exchange differences 6,717 - 6,572 - 13,289

Disposals 38 (114) (552) - (628)

---------------------------------------- --------- -------------- --------------- ------------ ---------

At 30 June 2021 289,756 535,106 217,394 1,112 1,043,368

---------------------------------------- --------- -------------- --------------- ------------ ---------

Accumulated depreciation and impairment

At 1 January 2020 91,945 217,369 124,948 - 434,262

Charge for the year 6,774 29,030 11,989 - 47,793

Elimination on construction contracts - 13 - - 13

Transfers to right-of-use assets - - (471) - (471)

Exchange differences (16,691) - (22,764) - (39,455)

Disposals (2,400) (829) (3,928) - (7,157)

---------------------------------------- --------- -------------- --------------- ------------ ---------

At 1 January 2021 79,628 245,583 109,774 - 434,985

Charge for the period 3,957 13,382 6,557 - 23,896

Elimination on construction contracts - 25 - - 25

Exchange differences 2,234 - 3,580 - 5,814

Disposals - (113) (468) - (581)

---------------------------------------- --------- -------------- --------------- ------------ ---------

At 30 June 2021 85,819 258,877 119,443 - 464,139

---------------------------------------- --------- -------------- --------------- ------------ ---------

Carrying Amount

---------------------------------------- --------- -------------- --------------- ------------ ---------

At 30 June 2021 (unaudited) 203,937 276,229 97,951 1,112 579,229

---------------------------------------- --------- -------------- --------------- ------------ ---------

At 31 December 2020 (audited) 199,685 279,901 99,260 292 579,138

---------------------------------------- --------- -------------- --------------- ------------ ---------

The Group has pledged assets with a carrying amount of

approximately US$252.5 million (31 December 2020: US$253.6 million)

to secure loans granted to the Group.

There were no capitalised borrowing costs in 2021 (2020: US$3.0

million, at an average interest rate of 2.49%).

13. Financial assets at fair value through profit and loss

Unaudited Audited

six months to 31 December

30 June 2021 2020

US$'000 US$'000

Financial assets at fair value through profit and loss

At 1 January 347,464 298,839

Additions, at cost 14,429 63,723

Disposals, at market value (56,036) (45,154)

Increase/(decrease) in fair value of financial assets at fair value through profit and

loss 23,398 (29,055)

Profit on disposal of financial assets at fair value through profit and loss 4,988 1,001

------------------------------------------------------------------------------------------ ------------- -----------

At period end 334,243 347,464

------------------------------------------------------------------------------------------ ------------- -----------

OWIL 334,243 307,874

Wilson Sons - 39,590

------------------------------------------------------------------------------------------ ------------- -----------

Financial assets at fair value through profit and loss held at period end 334,243 347,464

------------------------------------------------------------------------------------------ ------------- -----------

Wilson Sons

The Wilson Sons investments are held and managed separately from

the OWIL portfolio and consist of US Dollar denominated depository

notes.

OWIL portfolio

The Group has not designated any financial assets that are not

classified as trading investments as financial assets at fair value

through profit and loss.

Financial assets at fair value through profit and loss above

represent investments in listed equity securities, funds and

unquoted equities that present the Group with opportunity for

return through dividend income and capital appreciation.

Included in financial assets at fair value through profit and

loss are open ended funds whose shares may not be listed on a

recognised stock exchange but are redeemable for cash at the

current net asset value at the option of the Group. They have no

fixed maturity or coupon rate. The fair values of these securities

are based on quoted market prices where available. Where quoted

market prices are not available, fair values are determined by

third parties using various valuation techniques that include

inputs for the asset or liability that are not based on observable

market data (unobservable inputs).

14. Trade and other receivables

Unaudited Audited

30 June 31 December

2021 2020

US$'000 US$'000

------------------------------------------- --------- -----------

Trade and other receivables

Other trade receivables 11,278 9

------------------------------------------- --------- -----------

Total other non-current trade receivables 11,278 9

------------------------------------------- --------- -----------

Amount receivable for the sale of services 49,973 41,152

Allowance for bad debts (390) (554)

------------------------------------------- --------- -----------

Total current trade receivables 49,583 40,598

------------------------------------------- --------- -----------

Prepayments 5,796 4,252

Insurance claim receivable 750 995

Other receivables 5,664 1,953

------------------------------------------- --------- -----------

Total other current trade receivables 12,210 7,200

------------------------------------------- --------- -----------

Total current trade and other receivables 61,793 47,807

------------------------------------------- --------- -----------

Unaudited Audited

30 June 31 December

2021 2020

Ageing of trade receivables US$'000 US$'000

---------------------------- --------- -----------

Current 43,504 34,561

From 0 - 30 days 4,170 4,800

From 31 - 90 days 1,033 852

From 91 - 180 days 786 197

More than 180 days 480 742

---------------------------- --------- -----------

Total 49,973 41,152

---------------------------- --------- -----------

Due to the Covid-19 pandemic, the Company has reviewed the

variables that make up the methodology of measurement of estimated

losses. There has been no increase in customer default rate due to

the outbreak. Additionally, the Company created a credit committee

to monitor and, if necessary, propose payment terms to those

customers with credit risk.

The Board considers that the carrying amount of trade and other

receivables approximates their fair value.

15. Bank loans and overdrafts

Unaudited Audited

Annual 30 June 31 December

interest rate 2021 2020

% US$'000 US$'000

--------------------------------------------- ---------------- --------- ------------

Secured borrowings

BNDES - FMM linked to US Dollar(1) 2.07% to 5.00% 146,021 146,446

BNDES - Real 6.64% to 13.23% 57,087 55,177

BNDES - FMM Real(1) 8.59% 774 805

Total BNDES 203,882 202,428

--------------------------------------------- ---------------- --------- ------------

Banco do Brasil - FMM linked to US Dollar(1) 2.00% - 4.00% 74,791 75,795

Bradesco - NCE - Real(2) 5.08% - 5.45% 35,228 38,660

Itaú - NCE - Real(2) 3.38% - 4,056

Santander - Real 6.44% - 8,056

China Construction Bank - Real 5.65% - 13,666

Total others 110,019 140,233

--------------------------------------------- ---------------- --------- ------------

Total 313,901 342,661

--------------------------------------------- ---------------- --------- ------------

1. As an agent of Fundo da Marinha Mercante's ("FMM"), Banco Nacional de

Desenvolvimento Econômico e Social ("BNDES") and Banco do Brasil

("BB") finances the construction of tugboats and shipyard facilities.

2. NCE is an export credit note.

The breakdown of bank overdrafts and loans by maturity is as

follows:

Unaudited Audited

30 June 31 December

2021 2020

US$'000 US$'000

-------------------------------------------- --------- ------------

Within one year 44,514 58,672

In the second year 38,712 44,707

In the third to fifth years (inclusive) 95,464 96,250

After five years 135,211 143,032

-------------------------------------------- --------- ------------

Total 313,901 342,661

-------------------------------------------- --------- ------------

Amounts due for settlement within 12 months 44,514 58,672

-------------------------------------------- --------- ------------

Amounts due for settlement after 12 months 269,387 283,989

-------------------------------------------- --------- ------------

The analysis of borrowings by currency is as follows:

BRL

linked to

BRL US Dollars US Dollars Total

US$'000 US$'000 US$'000 US$'000

--------------------------- ------- ---------- ---------- -------

30 June 2021 (unaudited)

Bank loans 93,090 220,811 - 313,901

--------------------------- ------- ---------- ---------- -------

Total 93,090 220,811 - 313,901

--------------------------- ------- ---------- ---------- -------

31 December 2020 (audited)

Bank loans 120,420 222,241 - 342,661

--------------------------- ------- ---------- ---------- -------

Total 120,420 222,241 - 342,661

--------------------------- ------- ---------- ---------- -------

Loan agreement for civil works

In December 2018, the subsidiary Tecon Salvador S.A. signed a

US$67.9 million financing agreement with the BNDES to be used for

civil works during the terminal's expansion. The civil works for

this expansion were completed in October 2020.

Guarantees

Loans with the BNDES and Banco do Brasil rely on corporate

guarantees from Wilson Sons de Administração e Comércio Ltda. For

some contracts, the corporate guarantee is in addition to a pledge

of the respective financed tugboat or a lien over the logistics and

port operations equipment financed.

The loan agreement for Tecon Rio Grande from Banco Santander for

the purchase of equipment relies on a corporate guarantee from

Wilson, Sons de Administração e Comércio Ltda.

The loan agreement for Tecon Rio Grande from Banco Itaú for the

purchase of equipment relies on a corporate guarantee from Wilport

Operadores Portuários Ltda.

The loan agreement for Tecon Salvador from Banco Bradesco for

the purchase of equipment relies on a corporate guarantee from

Wilport Operadores Portuários Ltda.