TIDMORM

RNS Number : 6873M

Ormonde Mining PLC

23 September 2021

23 September 2021

Ormonde Mi n i ng p lc

("Or m onde" or "the C o m pany ")

Interim Results for the six months ended 30 June 2021

The Board of Ormonde (the "Board") announces the Company's

unaudited interim results for the six months ended 30 June 2021,

details of which are provided below.

During the interim period, progress in relation to the

identification and evaluation of new opportunities slowed, and

ultimately stalled, for reasons including the absence of agreement

with the largest shareholder in relation to proposals the Board

believed to be transformative for the Company and its shareholders.

This culminated in the removal of shareholder authority which

previously had allowed Ormonde to utilise shares as full or part

consideration for a transaction, greatly reducing the

attractiveness of Ormonde as a counterparty and therefore the

number of potential transactions available to the Company. Until

such matters are resolved, it will be very difficult for the

Company to conclude any material transaction.

Spanish projects

-- Salamanca and Zamora Gold Projects (Ormonde interest at 30

June 2021: 50.2% Salamanca, 45.5% Zamora): The three investigation

permits that make up these promising gold exploration projects came

up for renewal during July and September 2021. Applications to

extend each permit for a further three years have been submitted to

the mining authorities where they are currently being processed. No

field activities will be carried out while the applications are

pending. This process can take some time to be completed with no

guarantee in relation to the renewal of the permits.

-- La Zarza: The Company continues to hold discussions with

interested parties with a view to disposing of its data and land

assets relating to the La Zarza copper-gold project in the Iberian

Pyrite Belt. These assets are held for sale on the Company's

balance sheet at a value of EUR2.4 million.

Financial results

-- The Company reports a loss after tax for the six months ended

30 June 2021 of EUR630,000 (2020: EUR1.16 million profit). In 2020

the reported profit included a gain of EUR1,600,000 relating to

accounting for the completion of the Barruecopardo Mine disposal in

February 2020.

-- As at 30 June 2021, the Company held EUR4.3 million of cash

(EUR5.6 million at 30 June 2020).

Adjourned Annual General Meeting ("AGM")

On 6 September 2021, the Company announced the reconvening of

its AGM on Thursday, 30 September 2021 at 11 a.m. IST/BST, at the

Carlton Hotel Blanchardstown, Dublin 15, Ireland. A Letter from the

Executive Chair, Jonathan Henry (the "Chair's Letter"), Notice of

AGM and Form of Proxy were posted to shareholders on 6 September

2021, along with a letter from Mr. Thomas Anderson, a shareholder

of the Company, which are available for review on the Company's

website www.ormondemining.com . The Chair's Letter, which explains

the resolutions to be proposed at the AGM and the Board's

recommendations thereon, was also provided in an announcement on

the same day.

Shareholders are urged to read the note section of the Notice of

AGM for important information pertaining to voting and attending

the meeting, including associated Covid-19 safety measures which

may apply at the time of the meeting.

Enqu iries t o:

Ormonde Mining plc

Jonathan Henry, Executive Chair

Paul Carroll, Chief Financial Officer

Fraser Gardiner, Chief Operating Officer

Tel: +353 (0)1 8014184

Media enquiries - Buchanan

Bobby Morse / Ariadna Peretz / James Husband

Tel: +44 (0)20 7466 5000

Email: ormonde@buchanan.uk.com

Davy (Nomad, Euronext Growth Advisor and Joint Broker)

John Frain / Barry Murphy

Tel: +353 (0)1 679 6363

SP Angel Corporate Finance LLP (Joint Broker)

Ewan Leggat

Te l: +44 (0)20 3 470 0470

Company website: www.ormondemining.com

Ormonde Mining plc

Consolidated Statement of Comprehensive Income

Six months ended 30 June 2021

unaudited unaudited audited

6 Months ended 6 Months ended Year ended

30-Jun-21 30-Jun-20 31-Dec-20

EUR000s EUR000s EUR000s

Turnover - - -

Administration expenses (617) (436) (1,119)

______ ______ ______

Loss on ordinary activities (617) (436) (1,119)

Finance costs (13) (4) (17)

______ ______ ______

Loss for the period from continuing

activities (630) (440) (1,136)

Tax expense - - -

______ ______ ______

Loss for the period after tax (630) (440) (1,136)

Profit from discontinued operations - 1,600 1,600

______ ______ ______

Profit/(loss) for the period (630) 1,160 464

Other comprehensive income

less: Reclassification of foreign

currency gain on disposal of

foreign operation - (1,600) (1,600)

______ ______ ______

Total comprehensive (loss) for

the period (630) (440) (1,136)

(Loss) per share

from continuing operations

Basic & diluted (loss) per share

(in cent) (0.13) (0.09) (0.24)

Total earnings per share

Basic & diluted gain (loss) per

share (in cent) (0.13) 0.25 0.10

Ormonde Mining plc

Consolidated Statement of Financial Position

As at 30 June 2021

unaudited unaudited audited

30-Jun-21 30-Jun-20 31-Dec-20

EUR000s EUR000s EUR000s

Assets

Non-current assets

Intangible assets 305 295 295

_______ _______ _______

Total non-current assets 305 295 295

Current assets

Trade & other receivables 31 36 59

Cash & cash equivalents 4,315 5,591 4,965

Asset classified as held for

sale 2,400 2,400 2,400

_______ _______ _______

Total current assets 6,746 8,027 7,423

_______ _______ _______

Total assets 7,051 8,322 7,718

_______ _______ _______

Equity & liabilities

Equity

Issued share capital 4,725 13,485 4,725

Share premium account 29,932 29,932 29,932

Share based payment reserve 283 837 283

Capital conversion reserve

fund 29 29 29

Capital redemption reserve

fund 7 7 7

Retained losses (28,099) (36,105) (27,469)

_______ _______ _______

Total equity - attributable

to the owners of the Company 6,877 8,185 7,507

Current liabilities

Trade & other payables 174 137 211

_______ _______ _______

Total current liabilities 174 137 211

_______ _______ _______

Total equity & liabilities 7,051 8,322 7,718

_______ _______ _______

Ormonde Mining plc

Consolidated Statement of Cashflows

Six months ended 30 June 2021

unaudited unaudited audited

6 Months ended 6 Months ended Year ended

30-Jun-21 30-Jun-20 31-Dec-20

EUR000s EUR000s EUR000s

Cashflows from operating activities

(Loss) / profit for period before

taxation

Continuing operations (630) (440) (1,136)

Discontinued operations - 1,600 1,600

________ ________ ________

(630) 1,160 464

Adjustments for:

Reclassification of foreign exchange

gain - (1,600) (1,600)

Non cash item: Share option cost - - 19

________ ________ ________

(630) (440) (1,117)

Movement in working capital

Movement in receivables 27 343 320

Movement in liabilities (37) (432) (358)

________ ________ ________

Net cash used in operations (640) (529) (1,155)

Investing activities

Expenditure on intangible assets (10) (10) (10)

Proceeds from disposal of associate - 6,000 6,000

________ ________ ________

Net cash (used in) / generated

by investing activities (10) 5,990 5,990

Net (decrease) / increase in

cash and cash equivalents (650) 5,461 4,835

Cash and cash equivalents at

beginning of period 4,965 130 130

______ ______ ______

Cash and cash equivalents at

end of period 4,315 5,591 4,965

_______ _______ _______

Ormonde Mining plc

Consolidated Statement of Changes in Equity

Six months ended 30 June 2021

Share

based

payment

reserve

Share Share Other Retained Total

Capital Premium Reserves Losses

EUR000s EUR000s EUR000s EUR000s EUR000s EUR000s

At 1 January 2020 13,485 29,932 837 1,636 (37,265) 8,625

Loss for the period - - - - (440) (440)

Other comprehensive income

Reclassification of Foreign

exchange gain on disposal

of overseas associate - - - (1,600) 1,600 -

______ ______ ______ ______ ______ ______

Total comprehensive income

for the period 0 0 0 (1,600) 1,160 (440)

______ ______ ______ ______ ______ ______

At 30 June 2020 13,485 29,932 837 36 (36,105) 8,185

Loss for the period - - - - (696) (696)

______ ______ ______ ______ ______ ______

Total comprehensive income

for the period 0 0 0 0 (696) (696)

Release relating to expired

share options - - (572) - 572 -

Employee share-based compensation - - 18 - 18

Cancellation of shares (8,760) - - - 8,760 -

______ ______ ______ ______ ______ ______

At 31 December 2020 4,725 29,932 283 36 (27,469) 7,507

Loss for the period - - - - (630) (630)

______ ______ ______ ______ ______ ______

Total comprehensive income

for the period 0 0 0 0 (630) (630)

______ ______ ______ ______ ______ ______

At 30 June 2021 4,725 29,932 283 36 (28,099) 6,877

______ ______ ______ ______ ______ ______

Notes to the Interim Consolidated Financial Statements

1. Accounting policies and basis of preparation

Ormonde Mining plc is a company domiciled in the Republic of

Ireland. The Unaudited Consolidated Interim Financial Statements

("the Interim Consolidated Financial Statements") of the Company,

as at and for the six months ended 30 June 2021, comprise the

Company and its subsidiaries (together referred to as the

"Group").

The comparative information provided in the Interim Consolidated

Financial Statements relating to the year ended 31 December 2020

does not comprise statutory financial statements. The audit opinion

on the statutory financial statements for the year ended 31

December 2020 was unqualified. However, the auditors drew attention

by way of an emphasis of matter paragraph to the material

uncertainty relating to the carrying value of the La Zarza

exploration and evaluation assets, which are classified as assets

held for sale.

The Interim Consolidated Financial Statements do not include all

of the information required for full annual financial statements

and should be read in conjunction with the audited consolidated

financial statements of the Group as at and for the year ended 31

December 2020, which are available on the Company's website,

www.ormondemining.com. The Interim Consolidated Financial

Statements for the six months ended 30 June 2021 are unaudited but

have been reviewed by the Company's auditors.

The interim consolidated financial information in this report

has been prepared using accounting policies consistent with

International Financial Reporting Standards (" IFRS") as adopted by

the European Union. IFRS is subject to amendment and interpretation

by the International Accounting Standards Board ("IASB") and the

IFRS Interpretations Committee and there is an ongoing process of

review and endorsement by the European Commission. These policies

are consistent with those to be adopted in the Group's consolidated

financial statements for the year ending 31 December 2021. The

accounting policies applied by the Group in the Interim

Consolidated Financial Statements are the same as those applied by

the Group in the consolidated financial statements for the year

ended 31 December 2020.

The principal risks and uncertainties of the Group have not

changed since the last annual consolidated financial statements for

the year ended 31 December 2020.

The Board of Directors has carefully considered the impact of

Covid-19, noting the widespread disruption to normal activities and

the uncertainty over the duration of this disruption. The Group is

currently seeking new investment opportunities and has been

impacted by Covid-19, particularly in relation to management's

ability to conduct technical due diligence in overseas

jurisdictions.

Three previously issued Investigation Permits in Spain, which

have a book value of EUR305,000, have renewal dates between July

and September 2021. It is possible that applications for license

renewal may be declined by the relevant authorities, which would

result in the licenses becoming impaired.

The Company has, for some time, been advancing a disposal

process in relation to certain land and data assets associated with

the La Zarza Project, located in south-west Spain. Based on the

information available at the time of signing these interim

consolidated financial statements, the Directors have estimated a

fair value for these assets of EUR2.4m, with the assets represented

in the financial statements as "assets held for sale". While the

Directors believe this estimation to be reasonable, there is no

binding agreement presently in place relating to this disposal

process and as a result there remains a material uncertainty as to

whether such a disposal will take place and/or the final price at

which any such disposal will complete. Were a disposal not to

materialise the assets held for sale could become impaired in

value.

The Board of Directors is satisfied that the Group has

sufficient resources to continue in operation for the foreseeable

future, being a period of not less than 12 months from the date of

the Interim Consolidated Financial Statements. Accordingly, it

continues to adopt the going concern basis in preparing the

financial information.

The unaudited Interim Consolidated Financial Statements were

approved by the Board of Directors on 22 September 2021.

Notes to the Interim Consolidated Financial Statements

2. Segmental analysis

An analysis by geographical segments is presented below. The

Group has geographical segments in Ireland and Spain.

The segment results for the period ended 30 June 2021 are as

follows:

Ireland Spain Total

Total comprehensive loss for 6 months

to 30 June 2021 EUR000s EUR000s EUR000s

Segment (loss) for period (532) (97) (630)

______ ______ ______

(532) (97) (630)

______ ______ ______

Total comprehensive loss for year

to 31 December 2020 EUR000s EUR000s EUR000s

Segment (loss) / profit for period (737) 1,201 464

Less: Reclassification of foreign

exchange gain on disposal of foreign

operation - (1,600) (1,600)

______ ______ ______

(737) (399) (1,136)

______ ______ ______

Total comprehensive loss for 6 months

to 30 June 2020 EUR000s EUR000s EUR000s

Segment (loss) / profit for period (394) 1,554 1,160

Less: Reclassification of foreign

exchange gain on disposal of foreign

operation - (1,600) (1,600)

______ ______ ______

(394) (46) (440)

______ ______ ______

Notes to the Interim Consolidated Financial Statements

(continued)

3. Basic earnings per share

The basic and weighted average number of ordinary shares used in

the calculation of basic earnings per share are as follows:

Earnings per share 30-Jun-21 30-Jun-20 31-Dec-20

EUR000s EUR000s EUR000s

(Loss) / profit for the period attributable

to equity holders of the parent:

From continuing business (630) (440) (1,136)

From discontinuing business 0 1,600 1,600

______ ______ ______

Total (loss) / profit for period (630) 1,160 464

Weighted average number of ordinary

shares

for the purpose of basic earnings per

share 472,507,482 472,507,482 472,507,482

______ ______ ______

Basic loss per ordinary shares (in

cent) from continuing operations (0.13) (0.09) (0.24)

Basic profit per ordinary shares (in

cent) from discontinuing operations 0.00 0.34 0.34

______ ______ ______

Total basic (loss) / profit per ordinary

shares (in cent) (0.13) 0.25 0.10

______ ______ ______

Diluted earnings per share

For the six months to 30 June 2021, the share options are

anti-dilutive and therefore diluted earnings per share is the same

as the basic earnings per share.

For the six months to 30 June 2020 and the year ended 31

December 2020 the basic and diluted earnings per share are the

same.

Notes to the Interim Consolidated Financial Statements

(continued)

4. Share capital

30-Jun-21 30-Jun-20 31-Dec-20

EUR000s EUR000s EUR000s

Authorised Equity

650,000,000 ordinary shares of EUR0.01

each 6,500 6,500 6,500

650,000,000 A deferred shares of EUR0.015 - 9,750 -

each

100,000,000 deferred shares of EUR0.038092

each - 3,809 -

______ ______ ______

6,500 20,059 6,500

______ ______ ______

Issued Capital

Share Capital 4,725 13,485 4,725

Share Premium 29,932 29,932 29,932

______ ______ ______

34,657 43,417 34,657

______ ______ ______

Issued Capital comprises

472,507,482 ordinary shares of EUR0.01

each 4,725 4,725 4,725

Nil (Jun 2020: 472,507,482) A deferred - 7,087 -

shares of EUR0.015 each

Nil (Jun 20: 43,917,841) deferred shares - 1,673 -

of EUR0.038092 each

______ ______ ______

4,725 13,485 4,725

______ ______ ______

5. Dividends

No dividends were paid or proposed in respect of the six months

ended 30 June 2021.

6. Post balance sheet event

There are no post balance sheet events.

Independent Review Report to Ormonde Mining plc

Introduction

We have been engaged by Ormonde Mining plc ("the Company") to

review t he Unaudited Consolidated Interim Financial Statements

("the Interim Consolidated Financial Statements") in the half

yearly report of the Company as at and for the six months ended 30

June 2021 comprising the Consolidated Statement of Comprehensive

Income, the Consolidated Statement of Financial Position, the

Consolidated Statement of Cashflows, the Consolidated Changes in

Equity and the related explanatory notes. We have read the other

information contained in the half-yearly report and considered

whether it contains any apparent misstatements or material

inconsistencies with the information in the Interim Consolidated

Financial Statements .

Directors' responsibilities

The Interim Consolidated Financial Statements are the

responsibility of, and have been approved by, the Board of

Directors. The directors are responsible for preparing the Interim

Consolidated Financial Statements in accordance with AIM Rule 18

and Euronext Growth Rule 14.

As disclosed in note 1, the annual financial statements of the

Group are prepared in accordance with International Financial

Reporting Standards ("IFRSs") as adopted by the European Union

("EU"). It is the responsibility of the Board of Directors to

ensure that the Interim Consolidated Financial Statements included

in this half-yearly report have been prepared on a basis consistent

with that which will be adopted in the Group's annual financial

statements.

Our responsibility

Our responsibility is to express to the Company a conclusion on

the Interim Consolidated Financial Statements in the half-yearly

report based on our review.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410 "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity", issued by the Financial Reporting Council. A review

of interim financial information consists of making enquiries,

primarily of persons responsible for financial and accounting

matters, and applying analytical and other review procedures. A

review is substantially less in scope than an audit conducted in

accordance with International Standards on Auditing (Ireland) and

consequently does not enable us to obtain assurance that we would

become aware of all significant matters that might be identified in

an audit. Accordingly, we do not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the Interim Consolidated Financial

Statements in the half-yearly report for the six months ended 30

June 2021 are not prepared, in all material respects, in accordance

with AIM Rule 18 and Euronext Growth Rule 14.

Emphasis of matter - carrying value of the intangible assets and

the assets held for sale

We draw attention to Note 1 Accounting policies and basis of

preparation which describes the material uncertainties relating to

the anticipated disposal of the La Zarza assets which are

classified as held for sale, and the possible risks of impairment

of these assets. Our conclusion is not modified in respect of this

matter.

Use of our report

This report is made solely to the Company in accordance with the

terms of our engagement to assist the Company in meeting the

requirements of AIM Rule 18 and Euronext Growth Rule 14. Our review

has been undertaken so that we might state to the Company those

matters we are required to state to it in this report and for no

other purpose. To the fullest extent permitted by law, we do not

accept or assume responsibility to anyone other than the Company

for our review work, for this report or for the conclusions we have

reached.

Nexia Smith and Williamson (Ireland) Limited

Chartered Accountants, Statutory Audit Firm

Paramount Court

Corrig Road

Sandyford Business Park

Dublin 18

22 September 2021

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FFFILATIFFIL

(END) Dow Jones Newswires

September 23, 2021 02:00 ET (06:00 GMT)

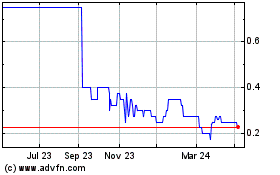

Ormonde Mining (AQSE:ORM)

Historical Stock Chart

From Mar 2024 to Apr 2024

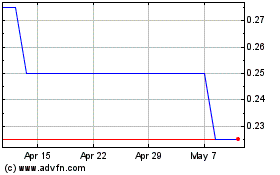

Ormonde Mining (AQSE:ORM)

Historical Stock Chart

From Apr 2023 to Apr 2024