TIDMOSI

RNS Number : 1354N

Osirium Technologies PLC

28 September 2021

28 September 2021

Osirium Technologies plc

("Osirium", "the Group" or "the Company")

Interim Results

Osirium Technologies plc (AIM: OSI), a leading vendor of

cloud-based cybersecurity software, announces its unaudited interim

results for the six months ended 30 June 2021.

Financial highlights

-- Total recognised revenue up 5% to GBP0.74 million (1H 2020:

GBP0.70 million)

-- Total bookings increased 19% to GBP0.91 million (1H 2020:

GBP0.77 million)

-- Deferred revenue increased by 17% to GBP1.68 million (1H

2020: GBP1.43 million), providing continued visibility

over future revenues

-- Operating loss lower at GBP1.52 million (1H 2020: GBP1.57

million), reflecting reduced overheads while increasing

investment in headcount, particularly in R&D and engineering,

positioning the Company well for future growth prospects

-- Cash balances at 30 June 2021 of GBP1.74 million (1H 2020:

GBP2.13 million), increasing to GBP2.03 million as at 31

July 2021 following receipt of a GBP0.59 million R&D tax

credit post-period end

Operational highlights

-- Resilient H1 trading, showing strong rebound in bookings

as temporary delay in buying decisions from COVID pandemic

start to unwind

-- Significant new customer wins with 31 customers added (FY20:

16), particularly within the NHS segment, demonstrating

strong competitive positioning of tailored solutions

-- 99% customer retention demonstrating value customers attribute

to solution set and providing good foundations for "land

and expand" strategy

-- "Land and expand" strategy continuing to add licences to

existing customers

-- Further product development with enhanced automation capabilities

to complement security offering

-- Expanded and more proactive partner network driving new

business in core UK market as well as internationally

-- Successful fundraise of GBP2.17 million in period enabling

the Group to scale further through investment in headcount

and increased marketing activities

-- Strong trading momentum into second half of the year with

continued new business wins

David Guyatt, CEO of Osirium, commented:

"We made good progress against our stated strategy in the

period, built around our commitment to innovation, customer focus

and market expansion. Despite persistent uncertainty in our end

markets as a result of the impact of COVID-19, we achieved

significant new business wins, particularly within the NHS segment

and have continued to see the benefits of our "land and expand"

approach supported by high customer retention levels.

As the benefits of PAM and IT Process Automation solutions

become more mainstream, our sales pipeline steadily builds. We are

encouraged by the continued trading momentum as we enter the second

half, with further new business wins resulting in Osirium's passing

the significant 100(th) customer milestone post-period.

Moving forwards, we remain focused on delivering our strategic

objectives. We will continue to strengthen our relationships with

customers, particularly with our partners in the healthcare sector.

I would also like to thank everyone on our team for their continued

enthusiasm and drive as we remain focused on fulfilling our growth

ambitions and cementing our position as a leading provider of

Privileged Access Security."

Contacts

Osirium Technologies plc Tel: +44 (0)11 8324 2444

David Guyatt, CEO

Rupert Hutton, CFO

Stifel Nicolaus Europe Limited Tel: +44 (0)20 7710 7600

Fred Walsh

Richard Short

Alma PR (financial PR adviser) Tel: +44 (0)20 3405 0205

Hilary Buchanan osirium@almapr.co.uk

Kieran Breheny

Faye Calow

About Osirium

Osirium Technologies plc (AIM: OSI) operates in one of the

fastest growing parts of the cybersecurity market and is a leading

vendor of Privileged Access Security solutions. Osirium's

cloud-based products protect critical IT assets, infrastructure and

devices by preventing targeted cyber-attacks from directly

accessing Privileged Accounts, removing unnecessary access and

powers of Privileged Account users, deterring legitimate Privileged

Account users from abusing their roles and containing the effects

of a breach if one does happen.

Osirium has defined and delivered what the Directors view as the

next generation Privileged Access Management (PAM) solution.

Osirium's award-winning Privileged Task Management module further

strengthens Privileged Account Security by minimising the

cyber-attack surface and delivering an impressive return on

investment benefits for customers. Building on Osirium's Privileged

Task Management module, in May 2019 Osirium launched Privileged

Process Automation, providing a highly-flexible platform for

automating essential IT processes to set a new benchmark in IT

Process Automation. This was followed by the launch of Privileged

Endpoint Manager in December 2019, bringing the total portfolio to

three complementary solutions.

Founded in 2008 and with its headquarters in Reading, UK, the

Group was admitted to AIM in April 2016.

www.osirum.com

Chief Executive Officer's Review

I am pleased to report on a period of sustained growth in what

has been a challenging macro-environment as a result of the ongoing

COVID-19 pandemic. We have made good progress against all elements

of our core strategy and strengthened the Group's foundations for

future growth, including further investment in R&D and

engineering staff and a robust balance sheet. Despite some degree

of persistent uncertainty among our end markets during the period

and with the transition of our sales functions operating largely

remotely, we have grown our customer base in the half alongside

maintaining our 99% customer retention rate.

Bookings, a key metric for the Group, increased 19% for the

period reflecting both the normalisation of trading activity and a

growing awareness of the Group's offering. Our customer numbers

grew significantly in reflection of the growing demand for

Privileged Security, with 31 new customers added to our roster in

the period (FY20 customers added: 16).

In April 2021, we raised approximately GBP2.17m by way of a

placing and subscription. These funds will help pave the way for

the next phase of Osirium's growth by enabling the scaling of our

business in Privileged Access Management ("PAM") and digital

process automation, two rapidly growing markets, further developing

our Group's partner channel network, and accelerating the Group's

recruitment across sales, engineering and research and

development.

Moving into the second half and beyond, we expect the growing

awareness of privileged security, in tandem with our 'land and

expand' strategy, to produce further customer growth and bookings.

We have continued to win new business in the early part of H2,

resulting in the Group surpassing the milestone of signing its

100(th) customer.

Market

The global lockdown as a result of the COVID-19 pandemic has

accelerated a shift to the online environment for many

organisations across industries, and with that the threat of

cybercrime is more present than ever. Our solutions are

increasingly recognised as a critical service for organisations of

all sizes. PAM remains one of the fastest growing areas of

cybersecurity and risk management software solutions across the UK

and overseas. KuppingerCole estimate the global market to be worth

around $2.20bn per annum, predicted to grow to $5.40bn by 2025.

Similarly, the digital automation market, served by our PPA

product, presents an exciting growth opportunity. The Directors

consider both the PAM and digital automation market to remain

predominantly greenfield with an estimated aggregated market size

of over $20 billion by 2026.

The PAM market experienced a degree of consolidations activity

in the half, including further interest from private equity

participants. This underlines the increasing importance and growing

awareness of this type of security among organisations. In contrast

to other more mature cybersecurity market sub-sectors, often

characterised by the wide availability of comparable offerings, the

Group is finding the vast majority of qualified new prospect leads

to be 'greenfield' opportunities.

While we have seen growing awareness of Privileged Access

Security across the spectrum, we experienced a substantial number

of bookings in the healthcare market in large part as a result of

the funding for trusts via NHS Digital for PAM projects. The

success in servicing this core market segment provides the Group

with powerful customer use cases and references to target further

new customer acquisition within the NHS.

In addition to healthcare, the Group is encouraged by the

increased activity and pipeline of opportunities from financial

services and education, where it has focused its targeted sales and

marketing programmes. All of these targeted market segments are

characterised by complex operating landscapes with many

stakeholders and high levels of regulation. Whilst there continues

to be uncertainty amongst our end target market as we move to a

post-lockdown environment, the overall trend towards better

security, coupled with IT process Automation, remains an

irreversible direction of travel.

Product development

As part of our growth strategy, we have made a number of

developments to our product suite in order to both enhance user

experience and provide further security guarantees to our

customers.

Our product suite is set apart by its simplicity of deployment

and unrivalled "time to protection" - available for use within 1

day for our customers, and able to be deployed by our resellers. To

further ensure that our product suite addresses our customers'

needs, we have invested in the development of secure automation

capabilities to complement our core PAM, PPA and PEM products.

As market interest in PAM increases, we have seen a

proportionate increase in customers looking beyond traditional PAM

by adding endpoint protection and automation that both increase

security and provide productivity gains. As such, Osirium has

focused on creating innovative packages of products, tailor-made to

address our customers' requirements, making the entry onto the

platform an easy and uncomplicated process. These packages can be

deployed quickly and with minimal complications, one of the key

differentiators of our product suite.

As the market understanding of the importance of PAM continues

to increase, we have sought to further optimise our offering in

this space. Improvements in the half year include: the introduction

of SAML Single Sign On capability, which allows us to integrate our

solutions with identity providers, and the creation of a new

desktop client tool which combines the latest features from our

web-based interface.

Improvements to PPA, our highly flexible platform for automating

essential IT processes, have been a key focus for the half, as

demonstrated by the introduction of authentication tools such as

Kerberos authentication with Windows devices, increased management

integration, future task scheduling capability and a simplified

process for on-boarding users. We have launched sales and

on-boarding initiatives, including the bundling of PPA products

alongside PAM solutions, to increase penetration levels within our

existing customers, evidencing how cross-selling opportunities

advance our "land and expand" strategy.

PEM, our Privileged Endpoint Manager, allows customers to remove

local administrator rights from end-users, while enabling them to

have escalated privileges only for specific processes and

executables. This product allows customers to increase productivity

while simultaneously increasing security.

We have seen more and more customers looking at a broader view

of Privileged Access; they are adopting PAM to protect their

critical shared IT infrastructure, PEM to remove risky local admin

accounts as the first line of defence against ransomware and other

malware attacks, and PPA to securely automate complex IT processes

as a comprehensive Privileged Access Security solution. The

popularity of this combined approach demonstrates the increasing

demand for automation and productivity products that work

complementarily to our Privileged Security products.

Partner and reseller network expansion

The Group's partner and reseller network forms a core element of

our strategy, allowing Osirium to scale further by approaching a

greater addressable market.

During the period, the Group made significant progress via these

sales functions with the quality and proactive engagement from this

channel driving new business. A number of new partners have signed

with us, and the Group is pleased to be working with a new UK

distributor. Directing existing customers to recommend Osirium's

products via this channel has been a particular focus, resulting in

an increase in new customers most notably within the NHS.

Although the UK remains Osirium's key market, the partner

network has been instrumental in enabling the Group to extend its

presence internationally, with new contract wins in APAC, Turkey,

and continental Europe in the half year across both public and

private sector organisations.

Elsewhere, we continue to make good progress in forming

strategic technology alliances, strengthening our market position

by expanding the range of complementary technologies with which we

integrate, opening up new market opportunities, and embedding our

technology more tightly in customer environments.

Financial summary

New customer acquisition for the period adding a record 31 new

customers. Bookings for the half were GBP0.91 million, a 19%

increase on GBP0.77m in the corresponding period in the previous

half year.

Revenue was GBP0.74 million, a 5% increase from GBP0.70 million

in the corresponding period last year due to the timing of bookings

and a mix of contract lengths. Deferred revenue as at 30 June 2021

was GBP1.68 million, a 17% increase from GBP1.43 million as at 30

June 2020, providing continued and steadily rising visibility over

future revenues.

Osirium's operating loss was flat at GBP1.58 million versus

GBP1.57 million in the first half of the previous financial year,

reflecting the tight cost control measures, increasing revenues and

increasing headcount in core areas continuing our investment in

R&D, sales and marketing teams as the cornerstones of our

growth strategy. Loss before tax for the period was also flat at

GBP1.68 million versus GBP1.68m million in the first half of the

previous financial year.

Cash balances were GBP1.74 million at the end of the period

under review (H1 2020: GBP2.13 million). Post period, the Group

received R&D tax credit of GBP0.59 million, resulting in a

GBP2.03 million cash balance as of 31 July 2021.

Product development expenditure capitalised in the period was

GBP0.90 million (H1 2020: 0.78 million). All of this expenditure

was associated with new products and features for our suite of

three products.

Current trading and outlook

Trading momentum has continued through to the second half of the

year. We have continued to build on the progress made in the period

against our stated strategy, centred on a commitment to innovation,

customer focus and market expansion, and market trends remain in

our favour as sales activity increases and interest in PAM and

digital process automation solutions becomes more mainstream.

With momentum in new customer wins building, combined with high

customer retention levels, our comprehensive and complementary

suite of products stands us in good stead to address the market

opportunity and further grow our pipeline. We will continue to

focus on strengthening our relationships with partners,

particularly in the healthcare sector, identifying opportunities to

cross sell to our existing customers and increasing the scope of

our reach through the partner network.

Whilst we remain mindful of the ongoing implications of the

COVID-19 environment, the long-term outlook remains unchanged as we

continue to execute against our strategic objectives. With a

best-in-class service offering, expanded sales function and clear

strategy in place, we remain focused on maintaining our position as

one of the leading providers of Privileged Access Security.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

6 months 6 months Year to

to to

30-Jun-21 30-Jun-20 31-Dec-20

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

CONTINUING OPERATIONS

Revenue 736,711 702,649 1,434,875

Other operating income 13 700 700

Administrative expenses (2,256,279) (2,271,996) (4,307,952)

------------ ------------ ------------

OPERATING LOSS (1,519,555) (1,568,647) (2,872,377)

Finance costs (91,863) (110,875) (222,322)

Finance income - - -

------------ ------------ ------------

LOSS BEFORE

TAX (1,611,418) (1,679,522) (3,094,699)

Income tax credit 292,326 260,654 590,223

------------ ------------ ------------

LOSS FOR THE PERIOD ATTRIBUTABLE

TO

THE OWNERS OF OSIRIUM TECHNOLOGIES

PLC (1,319,092) (1,418,868) (2,504,476)

============ ============ ============

Loss per share from continuing

operations: 5p 8p 13p

Basic and diluted loss per

share

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

30-Jun-21 30-Jun-20 31-Dec-20

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

ASSETS

NON-CURRENT ASSETS

Intangible

assets 3,521,842 3,101,660 3,335,455

Property, plant &

equipment 81,284 76,027 90,530

Right-of-use

asset 36,798 85,861 61,329

------------- ------------- -------------

3,639,924 3,263,548 3,487,314

CURRENT ASSETS

Trade and other receivables 1,155,804 1,194,099 818,445

Cash and cash equivalents 1,737,223 2,128,347 1,482,376

------------- ------------- -------------

2,893,027 3,322,446 2,300,821

------------- ------------- -------------

TOTAL ASSETS 6,532,951 6,585,994 5,788,135

============= ============= =============

LIABILITIES

CURRENT LIABILITIES

Trade and other payables 2,153,854 1,836,258 2,088,722

Lease liability 40,276 33,916 54,958

------------- ------------- -------------

2,194,130 1,870,174 2,143,680

============= ============= =============

NON-CURRENT LIABILITIES

Lease liability - 68,578 15,765

Convertible loan

notes 2,599,431 2,449,815 2,502,883

------------- ------------- -------------

2,599,431 2,518,393 2,518,648

------------- ------------- -------------

TOTAL LIABILITIES 4,793,561 4,388,567 4,662,328

============= ============= =============

EQUITY

SHAREHOLDERS EQUITY

Called up share capital 293,820 194,956 194,956

Share premium 12,462,317 10,635,500 10,635,500

Share option reserve 358,541 337,559 351,547

Convertible note

reserve 394,830 394,830 394,830

Merger reserve 4,008,592 4,008,592 4,008,592

Retained earnings (15,778,710) (13,374,010) (14,459,618)

------------- ------------- -------------

TOTAL EQUITY ATTRIBUTABLE

TO THE

OWNERS OF OSRIRIUM TECHNOLOGIES

PLC 1,739,390 2,197,427 1,125,807

------------- ------------- -------------

TOTAL EQUITY AND LIABILITIES 6,532,951 6,585,994 5,788,135

============= ============= =============

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Called up Share Convertible

share Retained Share Merger option note Total

capital earnings premium reserve reserve reserve equity

GBP GBP GBP GBP GBP GBP GBP

Balance at 1

January 2020 194,956 (11,955,142) 10,635,500 4,008,592 337,559 394,830 3,616,295

Changes in

equity

Total

comprehensive

loss - (1,418,868) - - - - (1,418,868)

---------- ------------- ----------- ---------- -------- ------------ ------------

Balance at 30

June 2020

(unaudited) 194,956 (13,374,010) 10,635,500 4,008,592 337,559 - 2,197,427

========== ============= =========== ========== ======== ============ ============

Balance at 1

January 2020 194,956 (11,955,142) 10,635,500 4,008,592 337,559 394,830 3,616,295

Changes in

equity

Total

comprehensive

loss - (2,504,476) - - - - (2,504,476)

Share option

charge - - - - 13,988 - 13,988

---------- ------------- ----------- ---------- -------- ------------ ------------

Balance at 31

December 2020

(audited) 194,956 (14,459,618) 10,635,500 4,008,592 351,547 394,830 1,125,807

========== ============= =========== ========== ======== ============ ============

Balance at 1

January 2021 194,956 (14,459,618) 10,635,500 4,008,592 351,547 394,830 1,125,807

Changes in

equity

Total

comprehensive

loss - (1,319,092) - - - - (1,319,092)

Share option

charge - - - - 6,994 - 6,994

Issue of share

capital 98,864 - 2,076,133 - - - 2,174,997

Issue costs - - (249,316) - - - (249,316)

---------- ------------- ----------- ---------- -------- ------------ ------------

Balance at 30

June 2021

(unaudited) 293,820 (15,778,710) 12,462,317 4,008,592 358,541 394,830 1,739,390

========== ============= =========== ========== ======== ============ ============

CONSOLIDATED STATEMENT OF CASHFLOW

6 months 6 months Year

ended ended ended

30-Jun-21 30-Jun-20 31-Dec-20

(unaudited) (unaudited) (audited)

GBP GBP GBP

Cashflows from operating activities

Cash used in operations (728,996) (905,478) (967,180)

Tax received - - 557,251

------------ ------------ ------------

Net cash used in operating

activities (728,996) (905,478) (409,929)

------------ ------------ ------------

Cash flows from investing

activities

Purchase of intangible fixed

assets (904,088) (781,570) (1,806,146)

Purchase of tangible

fixed assets (12,155) (25,152) (68,994)

Sale of tangible fixed

assets 167 - 17,537

Net cash used in investing

activities (916,076) (806,722) (1,857,603)

------------ ------------ ------------

Cashflows from financing

activities

Share issue 2,174,996 - -

Share issue

costs (249,316) - -

Allocation of loan note

interest 7,374 - (56,530)

Lease payment (33,135) (14,375) (48,484)

------------ ------------ ------------

Net cash from financing

activities 1,899,919 (14,375) (105,014)

------------ ------------ ------------

Increase/(decrease) in cash and cash

equivalents 254,847 (1,726,575) (2,372,546)

Cash and cash equivalents at beginning

of period 1,482,376 3,854,922 3,854,922

------------ ------------ ------------

Cash and cash equivalents

at end of period 1,737,223 2,128,347 1,482,376

============ ============ ============

GENERAL INFORMATION

Osirium Technologies PLC was incorporated on 3 November 2015,

and registered and domiciled in England and Wales with its

registered office located at One Central Square, Cardiff CF10

1FS.

The principal activity of the Group in the periods under review

was that of the development, sale and licensing of security

software.

BASIS OF PREPARATION AND SIGNIFICANT ACCOUNTING POLICIES

Basis of preparation

The Group financial information is presented in pounds sterling

which is the Group's presentational currency and all values are

rounded to the nearest whole pound.

The financial information does not comprise statutory accounts

within the meaning of section 435 of the Companies Act 2006. The

financial information together with the comparative information for

the six months ended 30 June 2020 are unaudited with the audited

information included for the 12 month period ended 31 December

2020. The audited information received an audit report which was

unqualified and did not include a statement under section 498(2) or

section 498(3) of the Companies Act 2006, but did contain a

material uncertainty paragraph on going concern.

The financial information was approved by the Board of Directors

on 27 September 2021 and authorised for issue on 28 September

2021.

Accounting Policies

The accounting policies used in the preparation of the financial

information for the six months ended 30 June 2021 are in accordance

with the recognition and measurement criteria of UK-adopted

international accounting standards and are consistent with those

which will be adopted in the annual financial statements for year

ended 31 December 2020.

These Interim Financial Statements have been prepared in

accordance with the accounting policies, methods of computation and

presentation adopted in the financial statements for the year ended

31 December 2020. As permitted, the Group has chosen not to adopt

IAS 34 'Interim Financial Reporting' in preparing these Interim

Financial Statements.

The Directors have considered all new, revised or amended

standards and interpretations which are mandatory for the first

time for the financial year ending 31 December 2021, and concluded

that none have had any significant impact on these interim

financial statements. New, revised or amended standards and

interpretations that are not yet effective have not been adopted

early.

Intangible assets

An internally-generated, development intangible asset arising

from Osirium's product development is recognised if, and only if,

Osirium can demonstrate all of the following:

- The technical feasibility of completing the intangible asset

so that is will be available for use of sale.

- Its intention to complete the intangible asset and use or sell it.

- Its ability to use or sell the intangible asset.

- How the intangible asset will generate probable future economic benefits.

- The availability of adequate technical, financial and other

resources to complete the development and to use or sell the

intangible asset.

- Its ability to measure reliably the expenditure attributable

to the intangible asset during its development.

Internally-generated development intangible assets are amortised

on a straight-line basis over their useful lives. Amortisation

commences in the financial year of capitalisation. Where no

internally-generated intangible asset can be recognised,

development expenditure is recognised as an expense in the period

in which it is incurred.

Development costs 20% per annum, straight line.

Share based payments

Osirium issues equity-settled share-based payments to certain

employees and others under which Osirium receives services as

consideration for equity instruments (options) in Osirium.

Equity-settled share-based payments are measured at fair value at

the date of grant by reference to the fair value of the equity

instruments granted. The fair value determined at the grant date of

equity-settled share-based payments is recognised as an expense in

Osirium's Statement of Comprehensive Income over the vesting period

on a straight-line basis, based on Osirium's estimate of the number

of instruments that will eventually vest with a corresponding

adjustment to equity. The expected life used in the valuation is

adjusted, based on management's best estimate, for the effect of

non-transferability, exercise restrictions, and behavioural

considerations.

Non-vesting and market vesting conditions are taken into account

when estimating the fair value of the options at grant date.

Service and non-market vesting conditions are taken into account by

adjusting the number of options expected to vest at each reporting

date. When the options are exercised Osirium issues new shares. The

proceeds received net of any directly attributable transaction

costs are credited to share capital (nominal value) and share

premium.

INTANGIBLE FIXED ASSETS

Development

Costs

GBP

Cost

At 1 January

2020 7,692,829

Additions to 30 June

2020 781,570

------------

Cost c/f as at 30

June 2020 8,474,399

============

At 1 January

2020 7,692,829

Additions to 31 December

2020 1,806,146

------------

Cost c/f as at 31 December

2020 9,498,975

============

At 1 January

2021 9,498,975

Additions to 30 June

2021 904,088

------------

Cost c/f as at 30

June 2021 10,403,063

============

Amortisation

At 1 January

2020 4,756,356

Charge to 30 June

2020 616,383

------------

Amortisation c/f as at 30

June 2020 5,372,739

============

At 1 January

2020 4,756,356

Charge to 31 December

2020 1,407,164

------------

Amortisation c/f as at 31

December 2020 6,163,520

============

At January

2021 6,163,520

Charge to 30 June

2021 717,701

------------

Amortisation as at 30 June

2021 6,881,221

============

Carrying Amount:

At 30 June 2020 (unaudited) 3,101,660

============

At 31 December 2020 (audited) 3,335,455

============

At 30 June 2021 (unaudited) 3,521,842

============

All development costs are amortised over their estimated useful

lives, which is on average 5 years. Amortisation is charged in full

in the financial year of capitalisation.

All amortisation has been charged to administrative expenses in

the statement of comprehensive income.

RIGHT OF USE ASSETS

Leases

& Buildings

GBP

Cost

At 31 December

2019 159,455

Additions -

-------------

At 31 December

2020 159,455

Additions -

At 30 June 2021 159,455

Depreciation

At 31 December

2019 49,063

Charge for year 49,063

-------------

At 31 December

2020 98,126

Charge for year 24,532

At 30 June 2021 122,658

Net Book Value

At 31 December

2020 61,329

=============

At 30 June 2021 36,798

=============

Additions to the right-of-use assets during the period were

GBPnil (year to 31 December 2020: GBPnil).

The group leases land and buildings for its office under an

agreement for 4 years running from 2018 to 2022.

LEASE LIABILITIES

Group

As at As at As at

30-Jun-21 30-Jun-20 31-Dec-20

GBP GBP

Current

Lease liability 40,276 33,916 54,958

========== ========== ==========

Non- current

Lease liability - 68,578 15,765

========== ========== ==========

RECONCILIATION OF LOSS BEFORE ANY INCOME TAX TO CASH GENERATED

FROM OPERATIONS

6 months 6 months Year

ended ended ended

30-Jun-21 30-Jun-20 31-Dec-20

(unaudited) (unaudited) (audited)

GBP GBP GBP

Loss before income

tax (1,611,418) (1,679,522) (3,094,699)

Depreciation charges 45,982 51,190 101,713

Amortisation charges 717,701 616,383 1,407,164

Share option

charge 6,994 - 13,988

Profit on disposal of fixed

assets (167) - (14,189)

Finance costs 91,863 110,875 222,322

Finance income - - -

------------- ------------- ------------

(749,045) (901,074) (1,363,701)

(Increase)/decrease in trade and

other receivables (45,032) 50,138 196,895

Increase /(decrease) in trade

and other payables 65,081 (54,542) 199,626

------------- ------------- ------------

Cash used in operations (728,996) (905,478) (967,180)

============= ============= ============

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR VDLFLFKLFBBX

(END) Dow Jones Newswires

September 28, 2021 02:00 ET (06:00 GMT)

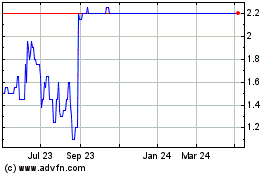

Osirium Technologies (LSE:OSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Osirium Technologies (LSE:OSI)

Historical Stock Chart

From Apr 2023 to Apr 2024