TIDMOTMP

RNS Number : 7115O

OnTheMarket plc

12 October 2021

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

12 October 2021

ONTHEMARKET PLC

("OnTheMarket", "OTM", the "Group" or the "Company")

INTERIM RESULTS FOR THE SIX MONTHSED 31 JULY 2021

STRONG GROWTH AND STRATEGIC PROGRESS DRIVING PERFORMANCE AHEAD

OF EXPECTATIONS

OnTheMarket plc (AIM: OTMP), the majority agent-owned company

which operates the OnTheMarket.com property portal, today announces

its unaudited interim results for the six months ended 31 July 2021

("H1 21/22").

Highlights

Period ended 31 July 2021 2020 Change

Group revenue GBP14.9m GBP10.2m 46%

Adjusted operating profit(1) GBP2.1m GBP0.8m 163%

Operating profit GBP0.0m GBP0.7m n/a

Profit after tax GBP0.5m GBP0.7m (29)%

Period-end net cash GBP9.9m GBP10.7m(2) (7)%

ARPA(3) GBP188 GBP124 52%

Average monthly advertisers(4)

listed 12,972 13,592 (5)%

Period-end advertisers 13,362 12,687(5) 5%

Period-end agency branches 11,198 10,645(5) 5%

Period-end new homes developments 2,164 2,042(5) 6%

Traffic/visits(6) 159m 117m 36%

Average monthly leads per advertiser 132 105 26%

-- Revenue and ARPA up 46% and 52% respectively. Adjusting for

COVID-19 H1 20/21 related customer support discounts of GBP1.8m,

revenue and ARPA growth still strong at 24% and 28%

respectively.

-- Adjusted operating profit increased 163% to GBP2.1m, despite

increases of 105% in marketing expenditure, to GBP4.5m, and 28% in

staff costs, to GBP4.7m.

-- Profit after tax of GBP0.5m, reduced by non-recurring costs

arising from the Glanty acquisition, the repayment of government

grants and an increase in non-cash share-based agent recruitment

charges.

-- Strong balance sheet retained with cash generated from

operating activities of GBP2.6m after repaying CJRS loans of

GBP0.4m (H1 20/21: GBP2.9m, after receiving CJRS loans of GBP0.3m).

Period-end net cash was GBP9.9m, with no borrowings (31 January

2021: GBP10.7m before deferred creditor payments of GBP0.4m).

-- Average monthly advertisers listed were down 5% period on

period, reflecting a reduction in H2 20/21 as agents on long-term

free of charge contracts were asked to migrate to paying contracts.

Since 31 January 2021, agency branches listing have risen 5% and

new homes developments listed by 6%.

-- Increased branches listed under paying contracts, up 3% since

31 January 2021 to 10,190 at 31 July 2021.

-- Continued strong operational performance, with traffic and

average monthly leads per advertiser up versus both H1 and H2

20/21.

-- Significant progress in strategy to build a differentiated,

technology-enabled property business, with the acquisition of

Glanty, new commercial partnerships and new website functionality

and lead types.

Outlook:

-- After a positive first 6 months, the Board now anticipates

revenues to be slightly ahead of expectations and adjusted

operating profit to be substantially ahead of expectations for the

full year to 31 January 2022.

-- Demand for residential properties in the UK has remained at

very high levels, however sales and lettings instructions remain

subdued.

-- Rollout of refreshed brand and website planned for H2 21/22

release, designed to further encourage consumer engagement and

provide increasing support and competitive advantage to our

customers .

-- Agents using OnTheMarket.com as their only property listings

portal now represent 968 branches, demonstrating our ability to

help customers secure instructions and complete transactions,

without them needing any other portal subscriptions.

-- Encouraging pipeline of new commercial arrangements to

further differentiate and add value to our offering.

-- Strong balance sheet to support our strategic vision to

create a tech-enabled property business across the broader property

ecosystem and drive long-term profitable growth.

The Company will be hosting a live presentation open to all

existing and potential shareholders via the Investor Meet Company

platform at 6:00pm BST on 19 October 2021. Full details of this

session will be included in a separate announcement to be released

shortly after these interim results are published.

Jason Tebb, Chief Executive Officer of OnTheMarket,

commented:

"I am delighted to report that the first half of our year has

seen a strong financial performance, operational growth and real

progress with our strategic objective of building a differentiated,

tech-enabled property business.

Since joining OnTheMarket I have been focussed on engaging with

our customers to understand how we can better serve them. Having

spoken with hundreds of agents, I am encouraged that they are not

only pleased we are listening, but also that the changes we have

made to our proposition have been well received.

The first stage of our transition is complete and we see this as

the start of a mutually beneficial journey. We will continue to

innovate and are actively exploring further new customer product

and service offerings. As part of the next stage of our development

we are undertaking a review of our branding and proposition to

clearly articulate our USPs to serious property seekers and at the

same time provide more tools for our agents and housebuilders,

continuing to add value to customers and consumers alike.

None of this would be possible without the hard work and

enthusiasm of my colleagues. I thank all of them and look forward

to working with them to deliver value to all of our

stakeholders.

With a growing and loyal customer base, strong engagement with

serious and active property-seekers, progress against our strategic

roadmap and a balance sheet and cash generation to support the

Group's current strategy, the Board looks to the future with

confidence."

Footnotes

1) Adjusted operating profit is defined as operating profit

before share based payments (including charges relating to shares

issued for agent recruitment), specific professional fees and

non-recurring items. This is an alternative performance measure and

should not be considered an alternative to IFRS measures, such as

revenue or operating profit. Please see the Financial Review and

Key Performance Indicators section below for a reconciliation of

operating profit to adjusted operating profit.

2) Period-end net cash in the 2020 column is net cash at 31

January 2021. Net cash at 31 July 2020 was GBP9.8m.

3) Average revenue per property advertiser, being revenues due

from property advertisers for a period divided by the number of

property advertisers for that period. ARPA presented herein is the

average of the monthly ARPAs for the period unless otherwise

stated. A property advertiser is a listed agency branch or a new

home development advertising on OnTheMarket.com.

4) Advertisers are either estate and lettings agent branches or new home developments listed at OnTheMarket.com.

5) Period-end figures in the 2020 column are at 31 January 2021.

Advertisers, agency branches and new home developments as at 31

July 2020 were 13,757, 12,245 and 1,512 respectively.

6) Visits comprise individual sessions on OnTheMarket's web

based portal or mobile applications by users for the period

indicated as measured by Google Analytics.

7) Unless otherwise stated, all figures refer to the six months

ended 31 July 2021 and comparative figures are for the six months

ended 31 July 2020 ("H1 20/21").

For further information, please contact:

OnTheMarket

Jason Tebb, Chief Executive Officer

Clive Beattie, Chief Financial Officer 0207 353 4200

Tulchan Communications (Financial PR 0207 353 4200

Adviser) onthemarket@tulchangroup.com

Giles Kernick

Oliver Norgate

Zeus Capital (Nominated Adviser/Joint

Broker)

Jamie Peel, Martin Green, Daniel Harris

(Corporate Finance) 0203 829 5000

Benjamin Robertson (Broking)

Shore Capital (Joint Broker)

Daniel Bush, John More (Corporate Finance)

Fiona Conroy (Corporate Broking) 0207 408 4090

Background on OnTheMarket:

OnTheMarket plc, the majority agent-owned company which operates

the OnTheMarket.com property portal, is a leading UK residential

property portal provider.

Its objective is to create value for shareholders and property

advertiser customers by delivering an agent-backed,

technology-enabled portal - offering a first-class service to

agents and new homes developers at sustainably fair prices and

becoming the go-to portal for serious property-seekers.

OnTheMarket provides a unique opportunity for agents to

participate in the equity value of their own portal. Agent backing

and support enable OnTheMarket to display "New & Exclusive"

properties to serious property-seekers 24 hours or more before

agents release these properties to other portals.

This announcement contains forward-looking statements that are

based on current expectations or beliefs, as well as assumptions

about future events. These forward-looking statements can be

identified by the fact that they do not relate only to historical

or current facts. Forward-looking statements often use words such

as anticipate, target, expect, estimate, intend, plan, goal,

believe, will, may, should, would, could, is confident, or other

words of similar meaning. Undue reliance should not be placed on

any such statements because they speak only as at the date of this

document and, by their very nature, they are subject to known and

unknown risks and uncertainties and can be affected by other

factors that could cause actual results, plans and objectives to

differ materially from those expressed or implied in the

forward-looking statements. There are a number of factors which

could cause actual results to differ materially from those

expressed or implied in forward-looking statements. The Group

undertakes no obligation to revise or update any forward-looking

statement contained within this announcement, regardless of whether

those statements are affected as a result of new information,

future events or otherwise, save as required by law and

regulations.

Chief Executive Officer's Report

The period to 31 July 2021 saw us build on the progress made in

the year to 31 January 2021. Our encouraging financial and

operational performance sat alongside positive momentum in

delivering our vision to create a tech-enabled property business

across the broader property ecosystem, structured around four

strategic pillars, with the following highlights:

1. Property portal - further growth in paying customers and

revenues and increased consumer traffic and leads, alongside the

introduction of new lead types.

2. Software solutions - acquisition of the remaining 80% of

Glanty and a commercial partnership with Canopy.

3. Data and market intelligence - agreement with Sprift to power

'best in class' market appraisal guides to support new instructions

for our customers and the launch of the OnTheMarket Property

Sentiment Index.

4. Communications and marketing - commercial partnership with

Reach plc, the UK's largest commercial news publisher.

These achievements are all the more impressive as they were

delivered within just a few short months against a backdrop of the

ongoing COVID-19 pandemic. Stakeholder safety remains our upmost

priority. Our staff continue to work from home, save where they

choose to attend the office, and these arrangements will remain in

place at least to the end of 2021. Meetings with other stakeholders

have been predominantly virtual, in line with their preferences. We

continue to have the interests of our stakeholders and communities

at the heart of our decision making.

Summary of the half-year period

Revenues and ARPA both grew strongly, up 46% and 52%

respectively. Adjusting the prior period revenues to add back

COVID-19 related customer support discounts of GBP1.8m, revenue and

ARPA growth remained strong at 24% and 28% respectively. This

followed the conversion activity undertaken in the second half of

the year to 31 January 2021, whereby agents on long-term free of

charge contracts were asked to migrate to paying contracts in order

to continue listing at OnTheMarket.com. The Group also benefited

from an accelerated roll out of agency products, specifically the

Group's Automated Valuation Model.

Whilst the conversion activity led to a reduction in agency

branches listing during H2 20/21, we continue to positively engage

with those agents who chose not to migrate to paying contracts at

that time, as well as those agents who have yet to list with us. We

believe the development of our offering and our continued growth in

engagement with serious property-seekers make the value agents

receive through listing at OnTheMarket.com increasingly

compelling.

This has led to an increase in agency branches listing in the

current period, up 5% since 31 January 2021 to 11,198. Whilst this

increase benefits from one element of our customer acquisition

strategy, which is to offer targeted, short-term free of charge

listing periods for certain new customers considering listing at

OnTheMarket.com, we still enjoyed an increase in total branches

listed under paying contracts, up 3% to 10,190 at 31 July 2021. The

greater number of agency branches under paying contracts in the

period gave rise to strong agency ARPA growth.

New homes advertiser numbers also continued to grow during the

period, with 2,164 developments listed at 31 July 2021, up 6% from

2,042 at 31 January 2021 and up 43% on the number listed at 31 July

2020. New homes monthly ARPA increased by 23% to GBP92 (H1 20/21:

GBP75), notwithstanding a reduction in the need for new homes

developers to advertise properties amidst the exceptional demand

from buyers in the UK residential market during the period.

Attracting serious property-seekers to visit the portal and then

to engage with our customers remains a fundamental part of our

offering. We enjoyed strong growth in both traffic and average

monthly leads per advertiser, up 36% and 26% respectively, with

159m visits and 132 leads per advertiser per month. Whilst H1 20/21

was impacted by the effective suspension of the property market as

a result of the coronavirus pandemic, both of these metrics also

represent growth on H2 20/21, a period of intense activity as

consumers sought to move as lockdown ended. The ratio of leads to

visits suggests our marketing, which is targeted to engage serious

property-seekers, has continued to be effective.

We offer consumers engaging with OnTheMarket.com real

advantages, perhaps particularly in the current market environment

where properties are often going under offer very shortly after

listing. Each month we have thousands of properties listed as "New

& exclusive", properties that are available to view at

OnTheMarket.com 24 hours or more before they appear on Rightmove or

Zoopla.

We also enjoy the support and confidence of agents with 968

branches who list their properties at OnTheMarket.com and no other

property portal, up from 700 in March 2021. We believe this is

strong evidence of our ability to offer value-for-money property

listing services that help these customers secure instructions and

complete transactions, by introducing serious and active

property-seekers to them. "New & exclusive" properties and

properties of agents listing exclusively with OnTheMarket help

attract motivated property-seekers, who in turn deliver value to

our advertiser customers through the provision of high-quality

leads.

The Group achieved an adjusted operating profit of GBP2.1m (H1

20/21: GBP0.8m) and a profit after tax of GBP0.5m (H1 20/21:

GBP0.7m). A strong balance sheet was maintained. Cash generated

from operating activities was GBP2.6m after repaying CJRS loans of

GBP0.4m (H1 20/21: GBP2.9m after receiving GBP0.3m of CJRS loans).

After costs, consideration and loan repayments totalling GBP1.8m

connected with the acquisition of Glanty, period-end net cash was

GBP9.9m, with no borrowings (31 January 2021: GBP10.7m before

deferred creditor payments of GBP0.4m).

Strategic developments - the "4 pillars"

1. Property portal

We introduced two new lead types to the site, Ask the Agent and

Reserve Buyers List. Both are designed to encourage consumer

interaction with estate agents in a different way to the

conventional lead generation methods. We are combining 'good old

fashioned' agency principles with modern technological solutions,

solving real world problems for agents in a tangible way. Although

only recently launched, both products are generating leads to

agents that we believe are incremental to those arising from

standard portal listings services.

On 8 October 2021 we signed an exclusive agreement with

Autoenhance.ai Limited to provide our customers with its photo

enhancement software services in respect of advertised properties.

The image enhancements are designed to display properties so as to

generate greater consumer engagement and therefore more high

quality leads to our customers.

2. Software solutions

In May 2021 we completed the acquisition of the remaining 80% of

Glanty Limited that we did not already own. Although it is still

very early days, the business has performed in line with our

expectations and our focus is on developing software products and

platforms to drive engagement between our customers and consumers,

as well as generate revenues for the Group. Further details on the

acquisition are set out in Note 11.

We entered into a commercial agreement to provide our agency

customers with the opportunity for free tenant referencing checks

through the Canopy platform, another opportunity to deliver more

value and more leads to our customers.

We also launched an automated call service partnership with

Callwell to provide agents real time connections to potential

clients who use our automated valuation model or request a

valuation through our instant valuation tool. These potential

vendors represent very high quality leads and the ability to

connect immediately by phone a competitive advantage to agents in

securing instructions.

3. Data and market intelligence

In May 2021 we signed an exclusive commercial partnership with

Sprift Technologies, the award-winning property data specialist.

The relationship enables OnTheMarket to provide its customers with

free Market Appraisal Guides which are powered by the Sprift

platform via OTM Expert. The guides provide enhanced data and

market intelligence on residential properties, supporting our agent

customers in providing expert valuations and winning new

instructions, increasing the value they receive from listing with

OnTheMarket.

In July 2021 we also released our inaugural OnTheMarket Property

Sentiment Index, which will be published monthly. The OnTheMarket

Property Sentiment Index is unique as it focuses on buyer and

seller confidence and mover attitudes towards mortgage

borrowing.

The insights contained in the Property Sentiment Index are

determined from consumer responses to questions asked on the

OnTheMarket website, with an average response rate of over 120,000

per month over the three months prior to launch. OnTheMarket

believes this to be the largest monthly consumer sentiment index to

date in terms of buying and selling residential property in the UK.

It provides advertisers and consumers additional market

intelligence to inform their decision making, whilst reinforcing

the OnTheMarket brand as leading player in the UK residential

property industry.

4. Communications and marketing

In March 2021, we signed a commercial media partnership with

Reach plc, the UK's largest commercial news publisher, to increase

our brand exposure and drive consumers to OnTheMarket.com. To date

this has resulted in:

- over 12,000 sign ups to our combined newsletter, with coverage

in local as well as national titles; and

- over 94 million ad impressions from OnTheMarket prospecting

and retargeting display advertising campaigns.

Furthermore, we will soon be launching a bespoke social media

tool for our agents and housebuilders to empower them to increase

their own local reach via our platform. Testing has been completed

on a small number of campaigns for agents and developers and a full

roll out is about to commence.

ESG

OnTheMarket continues to be mindful of the impact its operations

and decisions have on the environment, staff, communities and other

stakeholders.

The Group is reviewing its ESG functions, processes and targets,

in order to establish an ESG strategy and framework with

appropriate goals and structures to achieve them. Further details

will be provided in due course.

For our people, r eflecting our ongoing commitment to staff

development, we have created a learning and development department

to improve performance and satisfaction, just one of the ways we

continue to invest in our staff to ensure that we have a

productive, motivated and inspired team.

Outlook

The Group performed strongly in H1 21/22, delivering revenues

and adjusted operating profits of GBP14.9m and GBP2.1m

respectively.

Revenue growth in H1 21/22 benefited from agent conversions to

paying contracts and an accelerated roll out of agency products,

specifically the Group's Automated Valuation Model, as well as the

impact of COVID-19 customer discounts on prior periods. In H2 21/22

the Group will focus on enhancing and demonstrating the value of

it's offering to customers to support future conversion activity to

full-tariff contracts. Full-year advertising expenditure is

expected to be H2 21/22 weighted, with the rollout of a refreshed

brand and website, designed to further encourage consumer

engagement and provide increased value to our customers, as well as

usual cyclical factors. This increased marketing investment is

expected to result in H2 21/22 adjusted operating profit being

approximately breakeven.

Trading has continued positively into H2 21/22, with a greater

number of agents paying and more listing to trial our offering, and

the Board now anticipates revenues for the full year to 31 January

2022 to be slightly ahead of expectations. Adjusted operating

profit is expected to be substantially ahead of expectations for

the current year, reflecting the Group's positive operating

leverage.

Demand for residential properties in the UK has remained at very

high levels, however sales and lettings instructions remain

subdued. OnTheMarket will continue to focus on providing increasing

value for money, support and competitive advantage to its

customers.

We have scoped and agreed a refreshed proposition for our brand

and website from the ground up, with the consumer front and centre

of everything we do. Alongside new features and innovations, this

is designed to further encourage consumer 'stickiness' to the site

and make OnTheMarket.com an engaging and useful property search

tool for serious buyers, sellers, tenants and landlords. Increasing

consumer engagement with our portal should ensure we continue to

deliver high numbers of good quality leads to our customers at very

competitive rates.

We have a number of new commercial partnerships in the pipeline

that will add further value to our product offering as well as

continuing to differentiate our business as an agent and house

builder focused proposition. We are focussed on continuing to

improve lead quality to customers, particularly in these times of

unprecedented demand.

The Group continues to operate with a strong balance sheet and

disciplined cost management remains key. As at 30 September 2021,

the Group had net cash of GBP9.6m and no borrowings.

With the transformation of OnTheMarket to create a tech-enabled

property business across the broader property ecosystem underway

and accelerating, we are confident that we have a platform from

which to drive long-term profitable growth. I have been encouraged

by the enthusiasm and support for positive change amongst my

colleagues and look forward to working with them to create value

for all our stakeholders.

Jason Tebb

Chief Executive Officer

Financial Review and Key Performance Indicators

Financial review

Revenue for the period was up 46% at GBP14.9 million (H1 20/21:

GBP10.2 million). Adjusting the prior period revenues to add back

COVID-19 related customer support discounts of GBP1.8m, revenue

growth remained strong at 24%. Agency branches listed under paying

contracts increased 3% to 10,190 in the period. 91% of agency

advertisers were on paying contracts at 31 July 2021 (31 January

2021: 93%), which reflects the small number of free of charge

listing periods offered to prospective new agent customers during

the period.

Glanty revenues since acquisition were GBP0.1m. Like-for-like

revenue growth excluding Glanty was 45%.

The reported operating profit of the Group was GBP0.0m (H1

20/21: GBP0.7 million). This includes an operating loss of

GBP(0.1)m attributable to Glanty since acquisition and is further

analysed as follows:

H1 21/22 H1 20/21

GBP'000 GBP'000

Reconciliation of operating profit to

adjusted operating profit:

Operating profit 13 666

Adjustments for:

Share-based employee incentives 174 416

Professional fees incurred net of compensation

received 164 (974)

Share-based agent recruitment charges 1,214 605

Government grant repaid/(received) 449 (325)

Payments in relation to loss of office - 304

Staff related costs 95 133

_________ _________

Adjusted operating profit 2,109 825

_________ ________

The basic and diluted profit per share in the period were 0.66p

and 0.60p respectively (H1 20/21: basic and diluted profit per

share 0.94p and 0.85p respectively).

Operating profit and profit before and after tax for H1 20/21

benefitted from compensation received in relation to litigation

settled in that period.

The Group ended the period with cash of GBP9.9 million and no

borrowings (31 January 2021: GBP10.7 million before deferred

creditor payments of GBP0.4).

Revenue and ARPA by source

The Group reports revenues attributable to products and services

offered to:

-- estate and letting agents;

-- new home developers;

-- other, non-property advertiser customers; and

-- Glanty customers (since its acquisition on 28 May 2021).

Costs, assets and liabilities are not attributed to the

different revenue sources and so segmental reporting under IFRS 8

is not appropriate.

Period ended 31 July 2021 2020 Change

Group revenue

* Agency GBP13.5m GBP9.6m 41%

* New Homes GBP1.1m GBP0.5m 120%

* Other advertisers GBP0.2m GBP0.1m 100%

GBP0.1m N/a N/a

* Glanty

Average advertisers

* Agency 10,900 12,363 (12)%

* New Homes 2,072 1,228 69%

ARPA

* Group GBP188 GBP124 52%

* Agency GBP207 GBP129 60%

* New Homes GBP92 GBP75 23%

Operational KPIs

Group operational KPIs were as follows:

31 July 31 January Change

2021 2021

Total advertisers 13,362 12,687 5%

Agency branches 11,198 10,645 5%

New homes developments 2,164 2,042 6%

-- Average agency branches listed in the period were 12% lower

period-on-period, following the removal in H2 20/21 of those

customers who had enjoyed long-term free listing contracts and who

were not prepared to enter into a paying contract. Average new

homes developments listed grew strongly.

-- ARPA was up 52% to GBP188 and up 28% after adjusting the

prior period revenues to add back the GBP1.8m COVID-19 customer

discounts provided. This growth reflects an increase in agency

ARPA, due to the higher number of agents under paying contracts in

the period, and the growth in new homes developments listed and new

homes ARPA .

-- During the 6 months to 31 July 2021, agency branches and new

homes developments listed grew by 5% and 6% respectively.

-- Visits and average monthly leads per advertiser were up 36%

and 26% to 159 million and 132 in the period respectively (H1

20/21: 117 million and 105), reflecting both the ongoing strength

of engagement with property-active consumers and the decline in

visits and leads during the months of March to May 2021, during

which the national lockdown was in place.

The Group's financial performance is presented in the Condensed

Consolidated Income Statement below. The profit for the period

attributable to the owners of the Group was GBP0.5m (H1 20/21:

GBP0.7m).

Administrative expenses have increased by GBP3.4m to GBP12.8m in

the period to 31 July 2021 (6 months to 31 July 2020: GBP9.4m).

This was driven by an increase in marketing expenditure of GBP2.3m

to GBP4.5m (H1 20/21: GBP2.2m) and staff costs, which rose by GBP1m

to GBP4.7m (H1 20/21: GBP3.7m). The increase in staff costs was in

part driven by voluntary pay waivers and lower commission payments

in H1 20/21 due to the impact of COVID-19 on the business.

A charge of GBP0.2m (H1 20/21: GBP0.4m) was incurred in relation

to share-based employee incentives and the movement in the expected

future employer's national insurance charge based on the period-end

share price.

There was a net charge to professional fees due to one off costs

of the acquisition of Glanty Limited during the period. In the

prior period this was an income as a result of compensation

received following settlement of the litigation with Gascoigne

Halman Limited and Connells Limited.

A share-based agent recruitment charge of GBP1.2m (H1 20/21:

GBP0.6m) was incurred in relation to the issue, or expected issue,

of shares to agents alongside signing new long-term listing

agreements, in line with the Group's strategy to grow the agent

shareholder base.

On 28 May 2021 the Group purchased the remaining 80% of shares

in Glanty Limited. Up until this date, the Group's 20% interest was

accounted for as an associated undertaking, and this resulted in a

GBP0.1m share of loss of associate for the period. An additional

cumulative gain of GBP0.1m arose from the difference in the fair

value of the investment and the carrying value in the accounts at

the acquisition date. Furthermore, from the acquisition date Glanty

is accounted for as a fully owned subsidiary and its results

consolidated within the Group accounts. From the acquisition date

to 31 July 2021, Glanty has contributed GBP0.1m of revenues and a

loss after tax of GBP0.1m.

Intangible assets increased to GBP7.7m (31 January 2021:

GBP4.7m). This was driven by the acquisition of Glanty Limited and

the fair values of acquired customer related intangibles and

technology related intangibles of GBP2.6m. There was also an

increase due to the capitalisation of expenditure on development

activities in relation to the OnTheMarket.com portal of

GBP1.4m.

The acquisition in Glanty Limited created Goodwill of GBP3.5m in

relation, inter alia, to earnings attributable to potential future

new customers of the company.

The deferred tax asset increased from GBP1.6m to GBP2.0m, due to

an increase in the substantially enacted corporate tax rate to 25%

as well as the use of losses to offset the deferred tax liability

of GBP0.2m recognised on the acquisition of Glanty.

Receivables fell to GBP4.2m as at 31 July 2021 (31 January 2021:

GBP4.8m), mainly as a result of the release in the period of

prepayments previously recognised for agent shares issued.

Trade and other payables increased to GBP5.3m as at 31 July 2021

(31 January 2021: GBP4.9m). This was in line with the increase in

marketing expenditure and an additional increase in accrued agent

share expense during the period.

At 31 July 2021, the Statement of Financial Position showed

total assets of GBP28.0m, up from GBP22.9m as at 31 January 2021,

primarily due to the acquisition of Glanty Limited. Total equity

was GBP18.9m at 31 July 2021, up from GBP16.9m as at 31 January

2021, which reflects the profit incurred and the issue of

shares.

Condensed Consolidated Income Statement

For the period ended 31 July 2021

Unaudited Unaudited

6 months to 6 months

31 July to

Notes 2021 31 July

GBP'000 2020

GBP'000

Revenue 6 14,947 10,241

Administrative expenses (12,838) (9,416)

________ ________

Operating profit before specific

professional fees,

share-based payments and non-recurring

items 2,109 825

Specific professional fees, share-based

payments

and non-recurring items: 7

Share-based employee incentives (174) (416)

Professional fees (164) 974

Share-based agent recruitment charges (1,214) (605)

Government grant (repaid)/received (449) 325

Payments in relation to loss of

office - (304)

Staff related costs (95) (133)

________ ________

Operating profit 13 666

Finance income 12 14

Finance expense (2) (4)

Share of loss of associate 10 (104) -

Fair value gain on step acquisition 10 126 -

________ ________

Profit before income tax 45 676

Income tax 440 (12)

________ ________

Profit and total comprehensive

income

for the period attributable to

owners of the parent 485 664

________ ________

Profit per share from continuing

operations Pence Pence

Basic 8 0.66 0.94

Diluted 8 0.60 0.85

The operating profit arises from the Group's continuing

operations.

There is no recognised income or expense for the period other

than the loss shown above and therefore no separate statement of

other comprehensive income has been presented.

Condensed Consolidated Statement of Financial Position

At 31 July 2021

Unaudited Audited

at 31 July at

2021 31 January

2021

Notes GBP'000 GBP'000

ASSETS

Non-current assets

Goodwill 11 3,529 -

Property, plant and equipment 96 103

Right-of-use assets 567 180

Intangible assets 9 7,721 4,685

Investments in associates - 851

Deferred tax asset 1,998 1,558

_________ _________

13,911 7,377

Current assets

Trade and other receivables 4,150 4,793

Cash and cash equivalents 9,912 10,719

_________ _________

14,062 15,512

_________ _________

TOTAL ASSETS 27,973 22,889

_________ _________

LIABILITIES

Current liabilities

Trade and other payables (5,323) (4,934)

Lease liabilities (401) (157)

Provisions (616) (622)

Current tax (16) (16)

_________ _________

(6,356) (5,729)

Non-current liabilities

Lease liabilities (150) (2)

Provisions (253) (258)

Deferred consideration 11 (2,109) -

Deferred tax liability (198) -

_________ _________

(2,710) (260)

_________ _________

TOTAL LIABILITIES (9,066) (5,989)

_________ _________

NET ASSETS 18,907 16,900

EQUITY ATTRIBUTABLE TO OWNERS

OF

THE PARENT

Share capital 149 145

Share premium 48,795 47,453

Merger reserve (71) (71)

Other reserve 791 782

Retained earnings (30,757) (31,409)

_________ _________

TOTAL EQUITY ATTRIBUTABLE TO OWNERS

OF THE PARENT 18,907 16,900

Condensed Consolidated Statement of Changes in Equity

For the period ended 31 July 2021

Share

Share Share based Other Merger Retained Total

capital premium payment reserve reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance as at

1 February 2020 140 46,814 - 701 (71) (34,543) 13,041

Profit for the

financial period - - - - - 664 664

_____ _____ _____ _____ _____ _____ _____

Total comprehensive

income for the

period - - - - - 664 664

Transactions with

owners:

Shares issued

as agent recruitment

shares 1 192 - 78 - - 271

Shares issued

for employee share

options 3 - - - - - 3

Share-based payment

charge on employee

options - - 249 - - - 249

Transfer to retained

earnings - - (249) - - 249 -

_____ _____ _____ _____ _____ _____ _____

Balance as at

31 July 2020 144 47,006 - 779 (71) (33,630) 14,228

____ ____ ____ ____ ____ ____ ____

Balance as at

1 February 2021 145 47,453 - 782 (71) (31,409) 16,900

Profit for the

financial period - - - - - 485 485

_____ _____ _____ _____ _____ _____ _____

Total comprehensive

income for the

period - - - - - 485 485

Transactions with

owners:

Share consideration

for Glanty Limited 4 1,227 - - - - 1,231

Costs incurred

in issue of shares

relating to Glanty (70) (70)

Shares issued

as agent recruitment

shares - 185 - 9 - - 194

Share-based payment

charge on employee

options - - 167 - - - 167

Transfer to retained

earnings - - (167) - - 167 -

_____ _____ _____ _____ _____ _____ _____

Balance as at

31 July 2021 149 48,795 - 791 (71) (30,757) 18,907

_____ _____ _____ _____ _____ _____ _____

Condensed Consolidated Statement of Cash Flows

For the period ended 31 July 2021

Unaudited Unaudited

6 months 6 months

to 31 July to 31 July

2021 2020

GBP'000 GBP'000

Cash flows from operating activities

Profit for the period after income

tax 485 664

Adjustments for:

Income tax (440) 12

Finance income (12) (14)

Finance expense 2 4

Agent recruitment expense 1,214 605

Share-based payment 174 416

Amortisation 1,154 1,051

Depreciation 282 183

Fair value gain on step acquisition (126) -

Share of loss of associate 104 -

Operating cash flows before movements

in working capital 2,837 2,921

Decrease in trade and other receivables 37 619

(Decrease) in trade and other payables (250) (717)

(Decrease)/increase in provisions (11) 50

________ ________

Net cash generated from operating

activities 2,613 2,873

Cash flows from investing activities

Finance income received 12 14

Acquisition of intangible assets (1,509) (1,113)

Acquisition of property, plant and

equipment (20) (182)

Acquisition of associate - (358)

Acquisition of subsidiary net of cash (1,562) -

acquired

________ ________

Net cash used in investing activities (3,079) (1,639)

Cash flows from financing activities

Finance expense paid (2) (4)

Proceeds from issue of shares - 4

Loan repayments (50) -

Repayment of lease liabilities (289) (134)

________ ________

Net cash used in financing activities (341) (134)

________ ________

Net movement in cash and cash equivalents (807) 1,100

Cash and cash equivalents at the beginning

of the period 10,719 8,685

________ ________

Cash and cash equivalents at the end

of the period 9,912 9,785

________ ________

Cash and cash equivalents

For the purposes of the statement of cash flows, cash and cash

equivalents comprise cash at bank and in hand. This is consistent

with the presentation in the Statement of Financial Position.

Notes to the Condensed Consolidated Financial Statements

For the period ended 31 July 2021

1. General information

The principal activity of the Company is that of a holding

company. The principal activity for the Group continued to be that

of providing online property portal services under the trading name

of OnTheMarket.com.

The Company is a public company limited by shares and it is

incorporated and domiciled in the UK. The address of its registered

office is PO Box 450, 155-157 High Street, Aldershot, GU11 9FZ. Its

shares are listed on AIM.

2. Significant changes in the current reporting period

On 28 May 2021 the Group purchased the remaining 80% of shares

in Glanty Limited. Up until this date, the Group's 20% interest was

accounted for as an associated undertaking. From the acquisition

date, Glanty is accounted for as a fully owned subsidiary and its

results consolidated within the Group accounts. The acquisition of

Glanty Limited has been accounted for in line with IFRS 3: Business

Combinations. Further information is set out below in Notes 10 and

11.

The Group repaid in full GBP449k of grants received in 2020

under the Coronavirus Job Retention Scheme.

3. Basis of preparation of half-year report

The interim results for the six months ended 31 July 2021 should

be read in conjunction with the Group's last annual consolidated

financial statements as at and for the year ended 31 January 2021.

These condensed interim financial statements have been prepared in

accordance with the recognition and measurement requirements of

UK-adopted International Accounting Standards (UK-IAS) and adopting

the accounting policies that will be applied in the 31 January 2022

financial statements, but do not contain all the disclosures

required for full compliance with UK-IAS. They should be read in

conjunction with the financial statements for the year ended 31

January 2021 which were prepared in accordance with International

Accounting Standards in conformity with the requirements of the

Companies Act 2006. However, selected explanatory notes are

included to explain events and transactions that are significant to

an understanding of the changes in the Group's financial position

and performance since the last annual financial statements.

The 31 January 2021 full year accounts have been reported on by

the Group's auditors and delivered to the Registrar of companies.

The auditors' report was unqualified and did not contain any

statements under section 498 (2) or (3) of the Companies Act 2006

or any matter to which the auditors drew attention by way of

emphasis.

The interim financial statements were approved by the board of

directors on 11 October 2021. The interim results do not constitute

statutory financial statements within the meaning of section 434 of

the Companies Act 2006. The half year results for the current

period are unaudited.

4. Accounting policies

The same accounting policies, presentation and methods of

computation are followed in these interim condensed set of

financial statements as have been applied in the Group's latest

annual audited financial statements, with the addition of IFRS 3:

Business Combinations, further information on which is set out

below and in Note 11:

Business Combinations

The acquisition of subsidiaries is accounted for using the

acquisition method. The consideration transferred is measured at

the aggregate of the fair values, at the date of exchange, of

assets given, liabilities incurred or assumed, and equity

instruments issued by the Group in exchange for control of the

acquiree. Costs directly attributable to the business combination

are recognised in the income statement in the period they are

incurred. The cost of a business combination is allocated at the

acquisition date by recognising the acquiree's identifiable assets,

liabilities and contingent liabilities that satisfy the recognition

criteria at their fair values at that date.

The acquisition date is the date on which the acquirer

effectively obtains control of the acquiree. Intangible assets are

recognised if they meet the definition of an intangible asset

contained in IAS 38 and their fair value can be measured reliably.

The excess of the cost of acquisition over the fair value of the

Group's share of identifiable net assets acquired is recognised as

goodwill.

Goodwill

Goodwill represents the excess of the fair value of purchase

consideration over the net fair value of identifiable assets and

liabilities acquired. Goodwill is recognised as an asset at cost

and subsequently measured at cost less accumulated impairment.

On disposal of a subsidiary, the attributable amount of goodwill

is included in the determination of the profit and loss on

disposal.

Going concern

The Group made a profit after tax for the period ended 31 July

2021 of GBP0.5m (6 months to 31 July 2021: GBP0.7m). The Group had

a period end net cash balance of GBP9.9m and no borrowings (31

January 2021: GBP10.7m before deferred creditor payments of

GBP0.4m). At 30 September 2021 the Group had a net cash balance of

GBP9.6m and no borrowings.

The Directors have prepared and reviewed cash forecasts and

projections for the Group for the next 12 months. They have also

conducted sensitivity analyses and considered scenarios where there

is an adverse impact on future revenues, together with the

mitigating actions they may take in such circumstances, such as a

reduction in budgeted discretionary expenditure, a significant

proportion of which relates to advertising and marketing cost that

can be reduced materially at short notice.

The Directors are confident that the Group will remain cash

positive and will have sufficient funds to continue to meet its

liabilities as they fall due for a period of at least a period of

12 months from the date of the half year announcement and have

therefore prepared the half year announcement on a going concern

basis.

5. Judgement and Estimates

There have been no changes to the critical accounting judgements

and key sources of estimation uncertainty from those presented in

the 31 January 2021 financial statements, with the exception

of:

Accounting for the investment in associate and associated call

and put options are no longer critical accounting judgements and

key sources of estimation uncertainty following the acquisition of

the remaining 80% holding in Glanty Limited during the period.

The Group has the following additional key sources of estimation

uncertainty:

Business combinations

Management uses valuation techniques when determining the fair

values of certain assets and liabilities acquired in a business

combination (see Note 11). In particular, the fair value of

contingent consideration is dependent on the outcome of many

variables including the acquiree's future profitability.

6. Revenue by source

The Group has determined that the Chief Executive Officer

("CEO") is the chief operating decision maker. Monthly management

numbers are reported and issued to the CEO, which are used to

assess the performance of the business.

Following the acquisition of Glanty Limited in May 2021, the

Group reports revenues attributable to products and services

offered to:

-- estate and letting agents;

-- new home developers;

-- other, non-property advertiser customers; and

-- Glanty customers.

Costs, assets and liabilities are not attributed to the

different revenue sources and so segmental reporting under IFRS 8

is not appropriate.

Period ended 31 July 2021 2020 Change

GBPm GBPm

Group revenue

* Agency 13.5 9.6 41%

* New Homes 1.1 0.5 120%

* Other advertisers 0.2 0.1 100%

0.1 N/a N/a

* Glanty

________ ________

Total 14.9 10.2 46%

Within each source of revenue, there is only one major service

provision line. All revenue relates to services transferred over

the term of the underlying contracts.

Agency sales are predominantly billed monthly in advance and

these are recognised as deferred income. The Group has contract

liabilities as follows in respect of deferred income:

As at 31 July 2021 2020 Change

Contract liabilities GBP1.8m GBP1.1m 64%

The increase in deferred income predominantly reflects the

COVID-19 related discount offered to full-tariff agent customers,

which lowered deferred income at 31 July 2020. Contract liabilities

of GBP1.8m at 31 January 2021 were recognised as revenue in the

period ended 31 July 2021.

New Homes and Other advertiser sales are predominantly billed

monthly in arrears and are recognised as accrued income.

All revenue is generated in the UK for the Group's services.

7. Profit and loss information

Profit for the half-year includes the following costs in

relation to specific professional fees, share-based payments and

one-off events that are not expected to be recurring:

Unaudited Unaudited

6 months 6 months

to 31 July to 31 July

2021 2020

GBP'000 GBP'000

Share-based employee incentives 174 416

Professional fees incurred 164 (974)

Share-based agent recruitment charges 1,214 605

Government grant repaid/(received) 449 (325)

Payments in relation to loss of office - 304

Staff related costs 95 133

________ ________

2,096 159

Share-based employee incentive charges include the movement in

the expected future employer's national insurance charge based on

the period-end share price.

Professional fees incurred in the period relate predominantly to

fees and expenses in relation to the acquisition of the remaining

80% of Glanty Limited. In the prior period, compensation net of

professional fees incurred were in relation to litigation which was

settled in that period. Compensation related to the recovery of

litigation costs.

Agent recruitment charges relate to share-based charges arising

on the issue of shares to agents committing to long-term service

agreements, in line with the Group's strategy to grow the agent

shareholder base.

The government grant costs in the period reflect the repayment

of amounts received in the year to 31 January 2021 (GBP124k was

received after 31 July 2020) under the Coronavirus Job Retention

Scheme.

Payments in relation to loss of office reflect contractual

compensation to Ian Springett for loss of office and associated

legal costs.

Staff related costs in the period relate to costs associated

with termination of employment of employees and costs associated

with employee share-based plans. Staff related costs in the prior

period relate predominantly to professional fees paid in relation

to the search for a permanent Chief Executive Officer following Ian

Springett's departure from the Group.

8. Earnings per share

Unaudited

Unaudited 6 months

6 months to to

31 July 31 July

2021 2020

GBP'000 GBP'000

Numerators: Earnings attributable

to equity

Profit for the period from continuing

operations attributable to owners

of the parent company 485 664

________ ________

Total basic earnings and diluted

earnings 485 664

No. No.

Denominators: Weighted average

number of equity shares

Basic 73,143,265 70,636,577

Diluted 80,377,685 78,186,896

Earnings per share Pence Pence

Basic 0.66 0.94

Diluted 0.60 0.85

9. Intangible assets

Technology Customer Total

Group Development related related

Costs intangibles intangibles

GBP'000 GBP'000 GBP'000

Cost:

At 1 February

2021 13,547 - - 13,547

Acquisition through business

combination 1,671 1,010 2,681

Additions, internally

developed 1,362 - - 1,362

Additions, separately

acquired 147 - - 147

_______ _______ _______ _______

At 31 July 2021 15,056 1,671 1,010 17,737

Amortisation:

At 1 February 2021 8,862 - - 8,862

Charge for the period 1,098 35 21 1,154

_______ _______ _______ _______

At 31 July 2021 9,960 35 21 10,016

Net book value: ________ ________ ________ ________

At 31 July 2021 5,096 1,636 989 7,721

Amortisation is included within administrative expenses in the

income statement.

The development costs relate to those costs incurred in relation

to the development of the Group's online property portal,

OnTheMarket.com, as well as the internal costs incurred in

developing Glanty's technologies since acquisition. The development

costs capitalised above are amortised over a period of 4 years

which represents the period over which the Directors expect the

Group to consume the assets' future economic benefits. The

development costs are amortised from the point at which the asset

is ready for use within the business.

The technology and customer related intangible assets represent

the fair value of those assets acquired as part of the Group's

acquisition of Glanty. They are amortised over a period of 8 years,

which represents the period over which the Directors expect the

Group to consume the assets' future economic benefits.

10. Investment in associate

GBP'000

Group and Company

At 31 January 2021 851

Share of after-tax loss (to 28 May 2021) (104)

Deemed disposal of associate interest in

Glanty Limited (747)

________

At 31 July 2021 -

________

As set out in Note 11 the Group exercised the call option to

acquire the remaining 80% of shares in Glanty Limited on 28 May

2021, thereby obtaining control and from which date Glanty has been

accounted for as a subsidiary undertaking.

The Group's 20% investment in Glanty Limited, previously

accounted for as an investment in associate, was remeasured to fair

value. On 28 May 2021, a cumulative gain of GBP126k arising from

changes in the fair value of the investment was recognised in the

consolidated income statement.

The Group's share of after tax loss in Glanty Limited includes

non-recurring amounts totalling GBP94k relating to pre-acquisition

one-off costs and the payment in the period of staff and other

costs previously deferred in response to COVID-19.

During the period, until 28 May 2021, the Group and Company held

the following investments in associated undertakings:

Class of Nature of Proportion

shares held business of ownership

interest

Glanty Limited Ordinary shares Property services 20%

11. Acquisition of subsidiary

Glanty Limited is a property technology business which

specialises in providing solutions to the UK residential estate and

lettings sectors. It is the owner and developer of software

products and services designed to reduce overheads, maximise

efficiencies and increase revenues for estate and lettings agents.

The acquisition of Glanty was in line with the Group's strategy to

create a tech-enabled property business across the broader property

ecosystem.

OnTheMarket made an initial strategic investment for a 20% share

in Glanty Limited ("Glanty"), in December 2019. As part of that

investment, the Company was granted a call option under which it

had the right, but not the obligation, to enter into a share

purchase agreement to acquire the remaining 80% of Glanty shares.

The call option was exercised on 19 March 2021 and the acquisition

of the remaining 80% of shares in Glanty completed on 28 May 2021.

From that date Glanty has been accounted for as a subsidiary.

Consideration transferred

The initial consideration of GBP1,533,477 (the "Initial

Consideration") required to be paid by OnTheMarket under the share

purchase agreement was satisfied by way of the issue of 1,528,832

ordinary shares of 0.2 pence each in the capital of OnTheMarket in

aggregate and a cash payment of GBP156,000.

The Initial Consideration was subject to an adjustment

post-completion based on Glanty's actual net cash/net debt and

actual working capital position as at completion. This has resulted

in a reduction in the Initial Consideration of GBP147,000, which

will lead to the return to OnTheMarket of 163,154 ordinary shares

of 0.2 pence each in the capital of OnTheMarket. These shares will

not be eligible to be voted and must be cancelled or disposed of

within three years.

The remaining 1,365,678 shares issued as part of the Initial

Consideration (the "Consideration Shares") are subject to lock-in

arrangements which restrict their sale save in limited

circumstances. 423,589 Consideration Shares are locked-in for 3

years post-completion and 942,089 Consideration Shares are

locked-in for 4 years post-completion, relating to certain sellers

actively involved in the business. All Consideration Shares are

subject to orderly market arrangements for a further 12 months

after the above initial lock-in periods have expired.

The purchase agreement includes additional consideration which

may become payable under earn-out arrangements based on revenue and

EBITDA performance in the 12-month period commencing on the day

following the second anniversary of completion (capped at GBP12m

and payable in shares or cash at the Company's discretion) and if

Glanty receives R&D tax credits from HMRC which relate to

periods prior to completion (capped at GBP150k). The Group has

calculated the fair value of the contingent consideration based on

probabilities assigned to forecasts based on different

assumptions.

The provisional fair value of the consideration for the 80% of

Glanty shares acquired is as follows:

GBP'000

Fair value of consideration transferred

Cash consideration 156

Share consideration 1,377

Adjustment to share consideration for net

working capital (147)

Fair value of earn out 2,035

R&D tax credit earn out 75

________

Total purchase consideration 3,496

________

________

Loans repaid on acquisition 1,356

________

________

Fair Value of previously held 20% investment

in Glanty Limited 874

________

________

Total consideration 5,726

________

Amounts provisionally recognised for identifiable

net assets

Technology related intangibles 1,671

Customer related intangibles 1,010

________

Total non-current assets 2,681

Debtors 71

Cash 19

________

Total current assets 90

Deferred Tax Liabilities (198)

________

Total non-current liabilities (198)

Trade and other payables (326)

Bank loan (50)

________

Total current liabilities (376)

________

Identifiable net assets 2,197

________

________

Goodwill 3,529

________

Previously held investment in Glanty Limited

On the acquisition date, the Group's 20% investment in Glanty

Limited, previously accounted for as an investment in associate,

has been remeasured to fair value. On that date, a cumulative gain

of GBP126k arising from difference in the fair value of the

investment and the carrying value in the accounts at the

acquisition date is recognised in the consolidated income

statement. The previously held investment is considered part of

what was given up by the Group to obtain control of Glanty Limited.

Accordingly, the fair value of the investment is included in the

determination of goodwill.

Identifiable net assets

As at the 28 May 2021, the fair values of acquired customer

related intangibles and technology related intangibles amounted to

GBP2,681k.

The fair value of the trade and other receivables acquired as

part of the business combination amounted to GBP71k.

Goodwill

Goodwill of GBP3,529k relates to earnings attributable to future

new customers of the Company, new technologies developed that will

complement/replace the existing suite of products, the highly

skilled assembled workforce (which cannot be separately recognised

as an intangible asset) and an amount for general operational

purposes.

Glanty Limited's contribution to the Group results

From the acquisition date to 31 July 2021, Glanty has

contributed GBP138k of revenues and a loss after tax of

GBP118k.

Had the acquisition occurred on 1 February 2021, Glanty would

have contributed GBP349k of revenues and a loss after tax of

GBP604k. This loss includes GBP600k of one-off costs in relation to

deferred employment payments because of COVID-19 and the

acquisition by OTM. These amounts have been determined by applying

the Group's accounting policies and adjusting the results of Glanty

Limited to reflect additional amortisation that would have been

charged assuming the fair value adjustments to intangible assets

had been applied from 1 February 2021, together with their

consequential tax effects.

12. Related party relationships and transactions

In the ordinary course of business the Group has entered into

transactions with Whiteleys Chartered Certified Accountants, a

company which, up until 30 June 2021, was controlled by a direct

relation of Helen Whiteley, an Executive Director of the Group. Up

until 30 September 2020, Whiteleys Chartered Certified Accountants

provided an outsourced finance function to the Group. From the 1

October 2020 the finance function transferred in-house under the

TUPE regulations. The Group continues to occupy an office space in

the building owned by Whiteleys, paying a monthly rental. During

the period 1 February 2021 to 30 June 2021, when Whiteleys ceased

to be controlled by a direct relation of Helen Whiteley, the Group

purchased services amounting to GBP11K (H1 20/21: GBP382k) and at

the period end the Group owed GBPnil (31 July 2020: GBP82k).

In the ordinary course of business the Group has entered into

transactions with Media Magnifique Limited, a company owned by an

associate of Jason Tebb, Chief Executive Officer of the Group.

Media Magnifique Limited provides an outsourced PR function to the

Group. During the period, the Group purchased services amounting to

GBP36k (H1 20/21: GBPnil) and at the period end the Group owed

GBPnil (31 July 2020: GBPnil).

Associates

Investment in associate is set out in Note 10.

Other related party transactions

There were no further related party transactions during the

period.

13. Post balance sheet events

Option issues

On 24 August 2021, 1,089,308 options were granted under the

employee share scheme, as follows:

Name Position Number of Ordinary

Shares over which

options awarded

Jason Tebb Chief Executive Officer 418,965

Clive Beattie Chief Financial Officer 266,896

Helen Whiteley Chief Commercial Officer 206,896

Morgan Ross Product and Technology Director 196,551

The options are exercisable from 24 August 2026, save in limited

circumstances. All the options have a nil exercise price and are

subject to performance conditions based on the total shareholder

return achieved by the Company relative to the FTSE AIM 100 Index

in the three years from grant.

There were no other significant post balance sheet events.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFIRISLLLIL

(END) Dow Jones Newswires

October 12, 2021 02:00 ET (06:00 GMT)

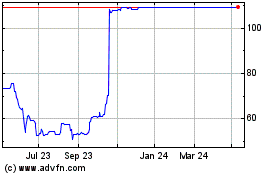

Onthemarket (LSE:OTMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Onthemarket (LSE:OTMP)

Historical Stock Chart

From Apr 2023 to Apr 2024