Petrofac Limited ( PFC) Petrofac Limited: Publication of a

Supplementary Prospectus (the 'Supplementary Prospectus')

04-Nov-2021 / 15:12 GMT/BST Dissemination of a Regulatory

Announcement, transmitted by EQS Group. The issuer is solely

responsible for the content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

Press Release

4 November 2021

NOT FOR RELEASE, PUBLICATION, TRANSMISSION, DISTRIBUTION OR

FORWARDING, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN OR INTO

THE UNITED STATES, THE COMMONWEALTH OF AUSTRALIA, ITS TERRITORIES

AND POSSESSIONS, EACH PROVINCE AND TERRITORY OF CANADA, JAPAN,

SWITZERLAND AND THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER

JURISDICTION IN WHICH IT WOULD BE UNLAWFUL TO DO SO.

PLEASE SEE THE IMPORTANT INFORMATION AT THE END OF THIS

ANNOUNCEMENT.

THIS ANNOUNCEMENT IS AN ADVERTISEMENT AND DOES NOT CONSTITUTE A

PROSPECTUS OR PROSPECTUS EQUIVALENT DOCUMENT. NOTHING HEREIN SHALL

BE CONSTRUED AS ANY OFFER, INVITATION OR RECOMMENDATION TO

PURCHASE, SELL OR SUBSCRIBE FOR ANY SECURITIES IN ANY JURISDICTION

AND NEITHER THE ISSUE OF INFORMATION NOR ANYTHING CONTAINED HEREIN

SHALL FORM THE BASIS OF OR BE RELIED UPON IN CONNECTION WITH, OR

ACT AS AN INDUCEMENT TO ENTER INTO, ANY INVESTMENT ACTIVITY.

ANY DECISION TO PURCHASE, SUBSCRIBE FOR, OTHERWISE ACQUIRE, SELL

OR OTHERWISE DISPOSE OF SECURITIES MENTIONED HEREIN MUST BE MADE

ONLY ON THE BASIS OF THE INFORMATION CONTAINED IN AND INCORPORATED

BY REFERENCE INTO THE ORIGINAL PROSPECTUS AND THE SUPPLEMENTARY

PROSPECTUS.

Publication of a Supplementary Prospectus (the "Supplementary

Prospectus")

Further to the publication on 26 October of a prospectus

relating to the proposed Firm Placing, Placing and Open Offer (the

"Original Prospectus") by Petrofac Limited (the "Company" or

"Petrofac") and further to the Company's announcement on 1 November

to update on the pricing of the Proposed Bond Offering (as defined

in the Original Prospectus), the Company hereby announces that it

has published a supplementary prospectus giving details of the

terms of the Proposed Bond Offering (the "Supplementary

Prospectus").

The publication of the Supplementary Prospectus is a regulatory

requirement under Article 23 of the UK Prospectus Regulation and

Rule 3.4 of the Prospectus Regulation Rules and has been approved

by the Financial Conduct Authority. The Supplementary Prospectus

should be read in conjunction with the Original Prospectus.

Defined terms in this announcement shall have the meaning

ascribed to them in the Capital Raise Announcement unless otherwise

specified.

A copy of the Supplementary Prospectus will be submitted to the

National Storage Mechanism and will shortly be available for

inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism. The

Supplementary Prospectus will also be available on the Company's

website at: https://www.petrofac.com/investors/refinancing/ subject

to certain exceptions.

Ends

For further information contact:

Petrofac Limited

+44 (0) 207 811 4900

Jonathan Yarr, Head of Investor Relations

jonathan.yarr@petrofac.com

Alison Flynn, Group Director of Communications and

Sustainability

alison.flynn@petrofac.com

The person responsible for arranging the release of this

announcement on behalf of Petrofac is Alison Broughton, Company

Secretary.

Tulchan Communications Group

+44 (0) 207 353 4200

petrofac@tulchangroup.com

Martin Robinson

petrofac@tulchangroup.com

Goldman Sachs

+44 (0) 207 774 1000

Bertie Whitehead

Chris Pilot

Tom Hartley

J.P. Morgan

+44 (0)20 7742 4000

Edmund Byers

Barry Weir

Will Holyoak

NOTES TO EDITORS

Petrofac

Petrofac is a leading international service provider to the

energy industry, with a diverse client portfolio including many of

the world's leading energy companies.

Petrofac designs, builds, manages and maintains oil, gas,

refining, petrochemicals and renewable energy infrastructure. Our

purpose is to enable our clients to meet the world's evolving

energy needs. Our four values - driven, agile, respectful and open

- are at the heart of everything we do.

Petrofac's core markets are in the Middle East and North Africa

(MENA) region and the UK North Sea, where we have built a long and

successful track record of safe, reliable and innovative execution,

underpinned by a cost effective and local delivery model with a

strong focus on in-country value. We operate in several other

significant markets, including India, South East Asia and the

United States. We have approximately 8,500 employees based across

31 offices globally.

Petrofac is quoted on the London Stock Exchange (symbol:

PFC).

For additional information, please refer to the Petrofac website

at www.petrofac.com

IMPORTANT INFORMATION

This announcement (the "Announcement") does not constitute an

offer to sell or a solicitation of an offer to purchase any

securities in any jurisdiction.

Any offer to acquire the Company's securities pursuant to the

proposed Capital Raise referred to in these materials will be made,

and any investor should make his, her or its investment, solely on

the basis of information that will be contained in the Original

Prospectus and the Supplementary Prospectus to be made generally

available in the United Kingdom in connection with such Capital

Raise. When made generally available, copies of the Original

Prospectus and the Supplementary Prospectus may be obtained at no

cost from the Company or through the website of the Company.

This Announcement and the information contained in it is not for

publication, release, transmission, distribution or forwarding, in

whole or in part, directly or indirectly, in or into the United

States, Commonwealth of Australia, its territories and possessions,

each province and territory of Canada, Japan, Switzerland and the

Republic of South Africa or any other jurisdiction in which it

would be unlawful to do so (together, the "Excluded Territories").

This Announcement is for information purposes only and does not

constitute an offer to sell or issue or the solicitation of an

offer to buy, acquire or subscribe for shares in any of the

Excluded Territories. This Announcement has not been approved by

the London Stock Exchange plc (the "London Stock Exchange"). Any

failure to comply with these restrictions may constitute a

violation of the securities laws of such jurisdictions.

The securities mentioned herein (the "Securities") have not been

and will not be registered under the U.S. Securities Act of 1933,

as amended (the "Securities Act") or under the applicable

securities laws of any state or other jurisdiction of the United

States. The Securities may not be offered, sold, pledged, taken up,

exercised, resold, renounced, transferred or delivered, directly or

indirectly, in the United States absent registration under the

Securities Act, except pursuant to an applicable exemption from, or

in a transaction not subject to, the registration requirements of

the Securities Act and in compliance with any applicable securities

laws of any state or other jurisdiction of the United States. There

will be no public offering of the Securities in the United States.

Subject to certain limited exceptions, Application Forms have not

been, and will not be, sent to, and Open Offer Entitlements have

not been, and will not be, credited to the CREST account of, any

Qualifying Shareholder with a registered address in the United

States. None of the Securities, the Application Forms, this

announcement or any other document connected with the Capital Raise

has been or will be approved or disapproved by the U.S. Securities

and Exchange Commission, any state securities commission in the

United States, or any other U.S. regulatory authority, nor have any

of the foregoing authorities passed upon or endorsed the merits of

the offering of the Securities or the accuracy or adequacy of any

of the documents or other information related thereto. Any

representation to the contrary is a criminal offence in the United

States.

There will be no public offering of securities in the Excluded

Territories, which includes any other jurisdiction in which such

offer, solicitation or sale would be unlawful prior to

registration, exemption from registration or qualification under

the securities laws of such jurisdiction.

This Announcement has been issued by, and is the sole

responsibility of, the Company. No representation or warranty,

express or implied, is or will be made as to, or in relation to,

and no responsibility or liability is or will be accepted by J.P.

Morgan Securities plc (which conducts its UK investment banking

activities under the marketing name, J.P. Morgan Cazenove) ("J.P.

Morgan") or Goldman Sachs International ("Goldman Sachs"), or by

any of their respective affiliates or agents as to or in relation

to, the accuracy or completeness of this Announcement or any other

written or oral information made available to or publicly available

to any interested party or its advisers, and any liability

therefore is expressly disclaimed.

J.P. Morgan and Goldman Sachs are each authorised by the

Prudential Regulation Authority and regulated in the United Kingdom

by the Financial Conduct Authority and the Prudential Regulation

Authority. Each of J.P. Morgan and Goldman Sachs (together, the

"Joint Bookrunners") is acting solely for the Company and no one

else in connection with the Capital Raise or any other matter

referred to in this Announcement and will not be responsible to

anyone other than the Company for providing the protections

afforded to their respective clients nor for providing advice in

relation to the Capital Raise and/or any other matter referred to

in this Announcement. Any prospective purchaser of the shares in

the Company is recommended to seek its own independent financial

advice.

(MORE TO FOLLOW) Dow Jones Newswires

November 04, 2021 11:13 ET (15:13 GMT)

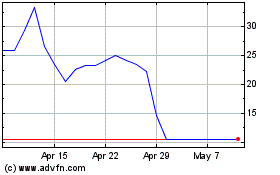

Petrofac (LSE:PFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Petrofac (LSE:PFC)

Historical Stock Chart

From Apr 2023 to Apr 2024