Petrofac Limited ( PFC) Petrofac Limited: RESULTS FOR THE YEARED

31 DECEMBER 2022 27-Apr-2023 / 07:00 GMT/BST

-----------------------------------------------------------------------------------------------------------------------

PETROFAC LIMITED

RESULTS FOR THE YEARED 31 DECEMBER 2022

-- Challenges in E&C partially offset by strong performance

in Asset Solutions and IES

-- Business performance EBIT loss of USUSD(205) million(1)

-- Reported net loss of USUSD(310) million(2) inclusive of

separately disclosed items

-- Healthy total Group pipeline of USUSD51 billion scheduled for

award in the period to June 2024

-- Net debt of USUSD349 million(3) and liquidity of USUSD506

million (4) at 31 December 2022

-- Bank facilities extended to October 2024

-- Backlog of USUSD3.4 billion at 31 December 2022

-- Share of EUR13 billion TenneT framework agreement and first

contract award secured in Q1 2023

Year ended 31 December 2022 Year ended 31 December 2021(5)

USUSDm Business Separately disclosed Reported Business Separately disclosed Reported

performance items performance items

Revenue 2,591 n/a 2,591 3,038 n/a 3,038

EBITDA (126) (12) (138) 56 (142) (86)

EBIT (205) (7) (212) (12) (177) (189)

Net loss(2) (284) (26) (310) 3 (248) (245)

Tareq Kawash, Petrofac's Group Chief Executive since 1 April

2023, commented:

"Petrofac's performance for 2022 was severely impacted by the

challenges in the Group's legacy E&C portfolio, which continues

to feel the direct and indirect effects of pandemic delays. We are

working resolutely to put these challenges behind us, and to

rebuild our backlog - such as the recent multi-year, multi-platform

Framework Agreement in support of TenneT's 2GW offshore wind

programme. Meanwhile, IES is performing well and Asset Solutions

continues to provide us with attractive growth opportunities.

"I joined Petrofac because I see the business is a trusted

project delivery partner, with significant opportunity for growth

and value creation. I have known the business for many years and

believe strongly in the business model and Petrofac's

differentiated competitive position. We have an exceptional

Engineering, Procurement, Construction and Operations capability

that is well positioned to deliver and support critical energy

infrastructure. In an increasingly active market, we must be

selective and disciplined as we grow our order book over the coming

years. I am impressed by the people at Petrofac and I'm excited to

work together to deliver the Group's potential." DIVISIONAL

HIGHLIGHTS Engineering & Construction (E&C)

2022 was another challenging year for E&C as we progressed

with the completion of many of the legacy Covid-19 affected

projects in the portfolio and new industry awards were further

delayed. As a result, financial performance was adversely affected

by unrecovered cost overruns and delays to the realisation of

working capital balances.

Cost overruns related principally to two areas: the Thai Oil

Clean Fuels contract and other legacy contracts completed or

substantially completed in the year (6).

On the Thai Oil Clean Fuels contract, due to the scale and

complexity of this project and the schedule delays suffered during

the pandemic, the additional work required to complete the project

and recover lost time led to additional costs. Going forward, we

expect to recover a portion of these additional costs, however, in

the meantime, we remain focussed on working with our client and

partners to safely and successfully deliver this unique

project.

In addition, in a challenging commercial environment, we have in

some cases suffered adverse outcomes on commercial settlements in

the remaining portfolio of contracts to release working

capital.

Following the impact of these challenges, E&C reports the

following financial results for the 12 months ended 31 December

2022 (1)

-- Revenue down 33% to USUSD1.3 billion (2021 restated(5):

USUSD2.0 billion)

-- EBIT loss of USUSD299 million (2021 restated(5): USUSD62

million)

-- EBIT margin down to (22.8)% (2021 restated(5): (3.2)%)

Industry awards were lower than expected again in 2022, and, as

a result, E&C's new order intake for the year was lower than

prior years at USUSD0.5 billion (2021: USUSD1.2 billion),

comprising an EPC contract in Algeria and net variation orders.

In June 2022, Petrofac and Hitachi Energy entered into a

collaboration to provide joint grid integration and associated

infrastructure to support the rapidly growing offshore wind market.

This collaboration led, subsequent to the year end, to the award of

our largest ever Framework Agreement with TenneT, in support of its

2GW offshore wind programme. Worth approximately EUR13 billion to

the partnership, the multi-year Framework Agreement was accompanied

by the first platform contract award which was added to backlog in

Q1 2023.

The market outlook for the remainder of 2023 and beyond remains

positive. Following a decade of underinvestment, a renewed focus in

the sector on secure, affordable, sustainable energy provides a

backdrop for awards in the short and medium-term. E&C's

addressable pipeline remains healthy, with a potential USUSD40

billion in customer opportunities scheduled for award in the period

to June 2024. This includes bids in the proposal process of

approximately USUSD12 billion and a further USUSD1.5 billion where

we remain at preferred bidder stage. Asset Solutions

Asset Solutions delivered another robust performance in 2022, in

line with guidance, with a strong book-to-bill ratio of 1.2x for

the year, with each of the service lines (Asset Operations, Asset

Development and Well Engineering & Decommissioning) delivering

growth. We maintained our core 40% market share in the UK and

renewal rate of 80% for operations and maintenance contracts.

Internationally, we have expanded our operations within new and

existing geographies, with awards across each service line. In

particular, 2022 saw great success in driving forward our late-life

asset management and decommissioning service offerings, with

significant awards in Australia and the Gulf of Mexico.

Operational performance has continued to remain robust, with

healthy margins, albeit reduced compared with the prior year due to

the roll-off of certain historic high-margin contracts and the

impact of an increased proportion of pass-through revenue.

Asset Solutions reports the following financial results for the

12 months ended 31 December 2022(1)

-- Revenue up 4% to USUSD1.2 billion

-- EBIT of USUSD60 million (2021: USUSD74 million)

-- EBIT margin of 5.2% (2021: 6.7%)

-- USUSD1.4 billion of awards (2021: USUSD1.0 billion),

representing a book-to-bill of 1.2x

The strong momentum we have gained over the last two years in

new energies continued in 2022, with a series of early-stage awards

and strategic alliances with technology providers. This leaves us

well positioned over the medium-term to secure engineering,

procurement and construction scopes and other execution phase

project work, as projects reach final investment decision.

Integrated Energy Services (IES)

IES delivered strong financial performance in the year,

reflecting the increased production and higher oil prices realised.

Net production reflected a full year's production from the East

Cendor development, which commenced in June 2021, the reinstatement

of the main Cendor field production and other well workovers. IES

generated positive free cash flow in the year as a result of Block

PM304 performance, as well as receiving USUSD98 million of

consideration from the divestments of the Greater Stella Area and

the Mexico operations.

IES reports the following financial results for the 12 months

ended 31 December 2022(1)

-- Revenue up 174% to USUSD137 million? Average realised oil

price up 49% to USUSD112/boe ? Net production up 97% to

1,261kboe

-- EBITDA up USUSD88 million to USUSD109 million SEPARATELY

DISCLOSED ITEMS (7)

The reported net loss of USUSD310 million (2021 restated(5):

USUSD245 million) includes a net charge of USUSD26 million (2021:

USUSD248 million). This predominantly related to:

-- USUSD(5) million impairment reversal (net) primarily

resulting from a review of the carrying amount of theinvestment in

Block PM304 in Malaysia

-- USUSD(10) million of positive fair value re-measurements

(net), primarily resulting from the improved finalsettlement

relating to the divestment of the Group's operations in Mexico

-- USUSD18 million financing related fair value loss associated

with the embedded derivative in respect of theRevolving Credit

Facility

-- USUSD10 million of cloud ERP software implementation

costs

-- Other net separately disclosed items of USUSD13 million

including: restructuring and redundancy costs, aloss on the sale of

the deferred consideration in relation to the divestment of the

Greater Stella Area operations,and professional service fees in the

Corporate reporting segment CASH FLOW, NET DEBT AND LIQUIDITY

Free cash outflow for the year of USUSD188 million principally

reflected the net cash outflow used in operating activities - which

included the payment of the USUSD104 million SFO court penalty -

and higher interest payments, partially offset by higher divestment

proceeds.

Net debt, excluding net finance leases, increased to USUSD349

million at 31 December 2022 (2021: USUSD144 million), driven by the

free cash outflow in the year.

The Group had USUSD506 million of liquidity(4) available at 31

December 2022 (2021: USUSD705 million).

In the short term, the Group is reliant on a small number of

relatively high value collections in respect of the conclusion of

historical contracts, settlements and new awards. Based on the

recent progress made, the Directors are confident that the expected

timing and realisation of these collections are reasonable and

reflect their assessment of the most likely outcome. However, as

the resolution of these matters is not wholly within Petrofac's

control, there remains a level of uncertainty which is disclosed

within note 2.5 to the consolidated financial statements. EXTENSION

OF DEBT FACILITIES

Following the capital raise and the refinancing completed in

2021, the Group extended its banking facilities in April 2023. The

Group therefore now has facilities consisting of USUSD600 million

of senior secured notes (due 2026), a USUSD162 million revolving

credit facility and two bilateral loan facilities totalling USUSD90

million all of which mature in October 2024. DIVID

The Board recognises the importance of dividends to shareholders

and aims to reinstate them in due course, once the Company's

performance has improved. ORDER BACKLOG

The Group's backlog decreased 15% to USUSD3.4 billion at 31

December 2022 (2021 restated(5): USUSD4.0 billion), reflecting low

new order intake in E&C due to industry delays to awards,

partially offset by strong order intake in Asset Solutions.

31 December 2021

31 December 2022

(restated) 5)

USUSD billion USUSD billion

Engineering & Construction 1.6 2.4

Asset Solutions 1.8 1.6

Group backlog 3.4 4.0 OUTLOOK

The outlook for new awards in E&C remains robust, supported

by high energy demand and increased focus on energy security and

the energy transition. E&C is well positioned on a number of

other near-term prospects as evidenced by the recent multi-year,

multi-platform Framework Agreement award in support of TenneT's 2GW

offshore wind programme. It has USUSD1.5 billion of opportunities

at preferred bidder stage, and a further USUSD3 billion of bids

submitted. Bidding activity remains high, with a total pipeline

scheduled for award by June 2024 of approximately USUSD40 billion,

of which USUSD23 billion is scheduled for award in 2023.

E&C has secured revenue of USUSD0.9 billion for 2023.

Approximately half of this revenue comes from contracts with no

future margin contribution. Furthermore, new awards secured in 2023

are not expected to contribute to margins until next year. Coupled

with the adverse operating leverage due to the small portfolio of

active contracts, we expect a small EBIT loss in E&C in 2023.

Our healthy pipeline and projected order intake in 2023 mean that

we remain confident of delivering a return to profitability and

positive cash flow in 2024 and significant growth in E&C over

the medium term.

Asset Solutions has USUSD2.5 billion of bids submitted as part

of a USUSD11 billion pipeline of opportunities scheduled for award

by June 2024, with USUSD8 billion scheduled for award in 2023.

Asset Solutions has secured revenue of USUSD1.2 billion for

2023. The business is expected to continue to grow, with revenue

growth driven by focused geographic expansion and new order intake

in Well Engineering & Decommissioning in 2022. We expect a

healthy EBIT in 2023 albeit lower than 2022, reflecting the further

roll-off of certain high-margin contracts and a higher proportion

of pass-through revenue.

IES is expected to deliver another robust production performance

in 2023, with production marginally lower than 2022. At USUSD85/bbl

oil price, EBITDA is expected to be in the range USUSD65 million to

USUSD75 million, taking into account hedging.

At Group level, we expect cash flow to be broadly neutral in

2023, with upside potential depending on the progress made in

unwinding working capital balances. Included in the underlying cash

flows are capex of USUSD25-35 million, tax payments of USUSD70-80

million (relating to prior periods) and interest costs of USUSD80

million.

The near-term objectives for the Group are clear: to leverage

our healthy pipeline of opportunities to increase backlog; and to

release existing working capital to support liquidity. Good

progress has been made in the year to date with the TenneT award,

an extension of bank debt facilities and efforts to release working

capital. BOARD CHANGES

Further to the announcement made on 22 November 2022, the

Company welcomed Tareq Kawash as Group Chief Executive and

Executive Director, succeeding Sami Iskander, with effect from 1

April 2023. NOTES 1. Business performance before separately

disclosed items. This measurement is shown by Petrofac as a meansof

measuring underlying business performance (see note 4 to the

consolidated financial statements). 2. Attributable to Petrofac

Limited shareholders. 3. Net debt comprises interest-bearing loans

and borrowings less cash and short-term deposits (i.e. excludesIFRS

16 lease liabilities). 4. Gross liquidity of USUSD506 million on 31

December 2022 consisted of USUSD450 million of gross cash and

USUSD56million of undrawn committed facilities. Gross cash included

USUSD12 million held in certain countries whose exchangecontrols

significantly restrict or delay the remittance of these amounts to

foreign jurisdictions. It also includedUSUSD203 million in joint

operation bank accounts which are generally available to meet the

working capitalrequirements of those joint operations, but which

can only be made available to the Group for its general

corporateuse with the agreement of the joint operation partners. 5.

As referenced in the Trading Update on 12 April 2023, the

consolidated financial statements include prior year adjustments

including one relating to the Thai Oil Clean Fuels project. This

adjustment reduces the 2021EBIT comparator by USUSD48 million. The

full details of the prior year adjustments are detailed in note 2.9

to theconsolidated financial statements. 6. Completed and

substantially completed contracts: contracts where (i) a

Provisional Acceptance Certificate(PAC) has been issued by the

client, or (ii) transfer of care and custody (TCC) to the client

has taken place, or(iii) PAC or TCC are imminent, and no

substantive work remains to be performed by Petrofac. 7. Further

information in relation to the separately disclosed items is

detailed in note 6 to theconsolidated financial statements.

PRESENTATION

Our full year results presentation will be held at 8.30am today

and will be webcast live via: https://

broadcaster-audience.mediaplatform.com/#/event/6436bcfd9455ad2bacfa0dfc

SEGMENTAL PERFORMANCE AND FINANCIAL REVIEW

Click on, or paste the following link into your web browser, to

view our Segmental performance and Financial review for the year

ended 31 December 2022

https://www.petrofac.com/media/f1kpv0rs/petrofac-fy-2022-segmental-performance-financial-review.pdf

GROUP FINANCIAL STATEMENTS

Click on, or paste the following link into your web browser, to

view the Group financial statements of Petrofac Limited for the

year ended 31 December 2022

https://www.petrofac.com/media/zaulcl20/petrofac-fy-2022-financial-statements.pdf

The linked documents are extracts from the Group's Annual Report

and Accounts for the year ended 31 December 2022. Page number

references refer to the full Annual Report when available.

S

Disclaimer:

This announcement contains forward-looking statements relating

to the business, financial performance and results of Petrofac and

the industry in which Petrofac operates. These statements may be

identified by words such as "expect", "believe", "estimate",

"plan", "target", or "forecast" and similar expressions, or by

their context. These statements are made on the basis of current

knowledge and assumptions and involve risks and uncertainties.

Various factors could cause actual future results, performance or

events to differ materially from those expressed in these

statements and neither Petrofac nor any other person accepts any

responsibility for the accuracy of the opinions expressed in this

presentation or the underlying assumptions. No obligation is

assumed to update any forward-looking statements.

For further information contact:

Petrofac Limited

+44 (0) 207 811 4900

James Boothroyd, Head of Investor Relations

James.boothroyd@petrofac.com

Sophie Reid, Group Head of Communications

Sophie.reid@petrofac.com

Teneo (for Petrofac)

+44 (0) 207 353 4200

petrofac@teneo.com

Martin Robinson

LEI 2138004624W8CKCSJ177

NOTES TO EDITORS

Petrofac

Petrofac is a leading international service provider to the

energy industry, with a diverse client portfolio including many of

the world's leading energy companies.

Petrofac designs, builds, manages and maintains oil, gas,

refining, petrochemicals and renewable energy infrastructure. Our

purpose is to enable our clients to meet the world's evolving

energy needs. Our four values - driven, agile, respectful and open

- are at the heart of everything we do.

Petrofac's core markets are in the Middle East and North Africa

(MENA) region and the UK North Sea, where we have built a long and

successful track record of safe, reliable and innovative execution,

underpinned by a cost effective and local delivery model with a

strong focus on in-country value. We operate in several other

significant markets, including India, South East Asia and the

United States. We have 7,950 employees based across 31 offices

globally.

Petrofac is quoted on the London Stock Exchange (symbol:

PFC).

For additional information, please refer to the Petrofac website

at www.petrofac.com

-----------------------------------------------------------------------------------------------------------------------

Dissemination of a Regulatory Announcement, transmitted by EQS

Group. The issuer is solely responsible for the content of this

announcement.

-----------------------------------------------------------------------------------------------------------------------

ISIN: GB00B0H2K534

Category Code: ACS

TIDM: PFC

LEI Code: 2138004624W8CKCSJ177

OAM Categories: 1.1. Annual financial and audit reports

Sequence No.: 239839

EQS News ID: 1618383

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1618383&application_name=news

(END) Dow Jones Newswires

April 27, 2023 02:00 ET (06:00 GMT)

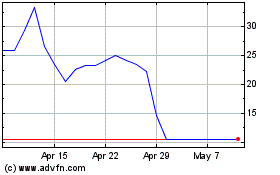

Petrofac (LSE:PFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Petrofac (LSE:PFC)

Historical Stock Chart

From Apr 2023 to Apr 2024