TIDMPOS

RNS Number : 2309U

Plexus Holdings Plc

27 March 2023

This announcement contains inside information

Plexus Holdings PLC / Index: AIM / Epic: POS / Sector: Oil

equipment & services

27 March 2023

Plexus Holdings plc

('Plexus' or 'the Group')

Interim Results for the 6 months to 31 December 2022

Plexus Holdings plc, the AIM quoted oil and gas engineering

services business and owner of the proprietary POS-GRIP(R) method

of wellhead engineering, announces its interim results for the six

months to 31 December 2022 ("H1 FY23").

Financial Results

-- Sales revenue GBP709k (2021: GBP734k)

-- Continuing operations EBITDA loss (GBP1,098k) (2021: GBP1,061k loss)

-- Continuing operations operating loss (GBP2,018k) (2021: GBP1,908k loss)

-- Continuing operations loss before tax (GBP2,073k) (2021: GBP1,953k)

-- Basic loss per share from continuing activities (2.06p) (2021: 1.94p loss)

-- Cash of GBP1.14m (2021: GBP3.38m), GBPnil in financial assets (2021: GBP4.7m)

-- Bank Lombard facility repaid in full during the year (2021: GBP3.29m drawn down)

-- Total assets of GBP17.3m (2021: GBP26.3m)

-- Total liabilities of GBP3.7m (2021: GBP5.3m)

Operational overview

-- September 2022 - shortlisted in the 'Environmental

Sustainability Innovation' and 'Significant Contribution to the

Industry' categories of the Offshore Network's OWI Global

Awards.

-- October 2022 - raised GBP1.55m through the issue of

Convertible Loan Notes to Ben van Bilderbeek, CEO of Plexus, and

Jeff Thrall, Non-executive Director of Plexus; with the proceeds to

be used for working capital purposes as the Company seeks to

capitalise on the increasing pipeline of opportunities within

Plexus' target markets - as announced on 20 October 2022.

-- Post period end, March 2023 - agreed sale of Leasehold

Interest along with associated leasehold liabilities of Burnside

House, a building surplus to requirements in Aberdeen for a

consideration of GBP1.05 million in cash.

-- Post period end, March 2023 - secured a GBP5m+ contract for

the rental of proprietary POS-GRIP "HG(R)" wellhead equipment and

sealing technology for a specialised subsea project application

(the "Special Project") to be deployed over the next 12 months.

-- Multiple reports support the fact that the world runs on oil

and gas and will continue to do so for decades. Transocean's CEO

recently stated that "...it is clear that we have finally emerged

from eight exceptionally challenging years and are now in the early

stages of what we believe will be a multi-year upcycle".

Trading Update and Outlook

Despite challenging market conditions, the Company's activity

levels in the financial year to 30 June 2023 ("FY23") have so far

been broadly in line with managements' expectations at the start of

FY23. On 6 March 2023, the Company was pleased to announce that

Plexus had secured a GBP5m+ order for its proprietary POS-GRIP HG

wellhead equipment and sealing technology for a special subsea

project application, and the Company has a growing pipeline of

opportunities and potential orders which it continues to pursue

with customers.

As a consequence of the timing of certain revenues, in

particular approximately GBP2.5m of revenue related to the Special

Project which, as a rental rather than a sold contract, will now be

recognised as deferred revenue in FY23 and sales revenue in the

year ending 30 June 2024 ("FY24"), the Board expects that revenues

in the second half of FY23 will be only slightly higher than

revenue in H1 FY23. Whilst this will result in the Company

generating revenues for FY23 materially lower than market

expectations, the Board is confident that revenues in FY24 will be

significantly higher than FY23 as a result of recognising the full

value of the Special Project, ongoing discussions with customers

regarding rental exploration wellhead projects (for which inventory

is manufactured and ready to deploy at short notice), and an

increased pipeline of near-term opportunities on which to

capitalise.

Chief Executive Ben van Bilderbeek said: "While the first half

of this financial year continued to be challenging with low sales

revenue and trading losses, I am encouraged by a number of positive

internal and external indicators and developments. Most

importantly, we announced earlier this month a major GBP5m+ order

for our HG wellhead equipment and sealing technology for a

specialised subsea project. This is the largest contract Plexus has

won and is a true validation of the technical advantages our

POS-GRIP technology can offer to the industry. I believe that this

order, which underpins visibility for the next financial year,

together with the increasing level of opportunities we are

pursuing, is a turning point, and we will be making every effort to

bring these to fruition.

"At the industry level, in a recent statement relating to the

release of its Global Methane Tracker report published February

2023, the IEA said that there was "no excuse" for the oil and gas

('O&G') industry's failure to cut methane emissions last year,

adding that the technologies are "available and are cheaper than

ever to implement". As the CEO of a company that has committed to

delivering leak free wellhead equipment solutions to O&G

companies for over 20 years, I also believe that there is indeed

'no excuse', and agree with IEA executive director Faith Birol who

recently urged policymakers to double down the energy industry

pressure to clean up its methane pollution, mainly from leakage and

distribution, adding that tackling methane "...is one of the most

important, if not the most important thing, that can be done to

tackle near-term global warming".

"For these reasons it has therefore never been more important to

ensure that equipment used by O&G companies works smarter,

harder and delivers leak proof integrity whenever and wherever

possible, including wellhead annular seals. This need is

particularly apparent as the industry experiences a new lease of

life resulting from the emergence from Covid-19, the impact of the

war in Ukraine demonstrating the need for countries to secure

reliable energy supplies, and the unfolding of the natural gas led

transition towards alternative and renewable energy strategies over

the coming decades.

"As evidence of the industry's revival, GlobalData Energy

expects 494 O&G projects in Europe to commence operations

during the period 2023-2027, of which 147 would be upstream.

Further, according to a recent Rystad Energy report, the O&G

sector is set for its highest growth in a decade with $214 billion

of new project investments lined up, including in the North Sea

where from 2022-2023 spending in the UK and Norway will jump 30%

and 22%, to $7 billion and $21.4 billion respectively. This

increasing level of activity will be a "boon" for the offshore

services market and Plexus is working hard to secure a share of

this opportunity.

"I am encouraged by the increased activity within the oil

services sector, particularly exploration and production drilling,

and this, combined with the raised awareness of the industry's

impact on climate change, strengthens the investment case for

Plexus. This is because Plexus has a suite of disruptive

technologies focused on eliminating wellhead leaks at the well site

due to the integrity that is delivered by its HG(R) metal to metal

annular seals. We believe that our technology driven ability to

prevent leaks rather than just 'detecting and repairing' leaks must

be the optimal way forward for the industry, and one which cannot

logically be ignored.

"While we continue to focus on what had become our core

offering, namely generating revenue from the sale of production

wellheads, we are particularly excited to return to the niche

exploration drilling from Jack-up rigs market and have been working

hard on expanding our new wellhead rental inventory that enables us

to pursue tenders and order opportunities. We are making good

progress with the building and testing of our newly designed

Exact-15 wellhead, in anticipation of securing inaugural rental

orders, and I hope to report further progress on this over the

coming months.

"It should not be forgotten that our proprietary POS-GRIP

friction grip method of engineering has many advantages in the

field including enhanced safety, time savings, and reduced

operational expenditure ("OPEX") costs relating to leak repairs and

down time. The provision of special solutions has also been one of

our strengths for some time, and we were therefore delighted to

secure earlier this month a major rental equipment order with a

value of more than GBP5m for our POS-GRIP "HG(R)" wellhead

equipment and sealing technology for a specialised project

application in a subsea environment, which is to be deployed over

the next 12 months. Although the full value of the contract will be

recognised as sales revenues in the financial year ending 30 June

2024, there will be approximately GBP2.5m of milestone payments to

be received and accounted for as deferred revenue in the current

financial year. Importantly, this contract will help to demonstrate

key elements and functionality of a full "Python(R)" Subsea

Wellhead, including leak proof metal to metal HG seals. Our Python

wellhead was developed within a Joint Industry Project supported by

a number of major operators, and was designed to achieve a new best

in class and safest standard for subsea wellheads. This contract, I

believe, will further develop the potential for the rental of such

specialised wellhead systems.

"Our licensee partnership with SLB (previously Schlumberger) is

also progressing well, with the test marketing of SLB's new

low-cost surface production wellhead design that incorporates

POS-GRIP and HG seal technology expected to commence early in the

next financial year ending 30 June 2024.

"Furthermore, our diversification strategy is gaining traction

as we continue to develop new applications and Plexus Products for

our technology; wherever metal-to-metal annulus sealing is

required, POS-GRIP can deliver a true, leak-proof solution, and

importantly one that can last for the 'field life' of a well,

thereby avoiding expensive remedial and maintenance costs.

"One growing target area is Plug & Abandonment ('P&A') -

the decommissioning of retiring O&G assets, which can have

complex long-term financial and environmental impacts. While Rystad

Energy estimates the cumulative costs involved in this sector may

reach $42 billion by 2024, in the UK Continental Shelf ('UKCS')

alone it suggests that the ratio of decommissioning expenditure to

OPEX by O&G companies operating in the North Sea will increase

from the current level of c.10% to 25-30% in the next two

decades.

"With this background, we were delighted to announce in June

last year a significant new development in the P&A space,

winning an order for equipment and services from subsea engineering

specialist Oceaneering International (NYSE: OII). Feedback has been

encouraging, and we anticipate expanding our presence in the

P&A market both in the North Sea and internationally. In

addition, we continue to provide equipment and services such as

tieback tools and handling equipment to partner companies

undertaking P&A project work and hope to see an increase in

this category of work as well.

"In October 2022, we raised GBP1.55m through the issue of

convertible loan notes, which I supported along with our Chairman,

Jeff Thrall. Additionally, post period end, we agreed to sell the

Leasehold Interest in Plexus' Burnside House property in Aberdeen

along with associated leasehold liabilities to a private company

owned by certain members of my family, for GBP1.05 million in cash.

The cash from these transactions will be used to strengthen Plexus'

working capital position, enabling us to take advantage of the many

opportunities that we are pursuing, as well as enabling capital

expenditure commitments such as those required to build up our

exploration wellhead rental inventory. I hope my support

demonstrates my ongoing confidence and belief in the potential of

Plexus and our POS-GRIP technology.

"For 2023 and beyond, we have a clear growth strategy focused on

leveraging the unique features of POS-GRIP into value creation for

our shareholders. This centres around the pursuit of sales

opportunities in sectors where we believe we can provide superior

technical solutions and responsive service times, including the

rental of exploration wellheads from Jack-up rigs; sale of

production wellheads where superior POS-GRIP HG annular seals can

be proven to provide leak free performance; innovative Plexus

Products solutions for special projects and decommissioning and

P&A, and working closely with our licencee SLB where feedback

on our licenced technology continues to be positive. While t he

O&G industry narrative is clearly complex, challenging and at

times fast changing, as a small, nimble operator with a plethora of

valuable IP, know-how and applications for its core technology, I

believe Plexus is well placed to take advantage of the

opportunities in our markets, and help others succeed in a

sustainable ESG and Net Zero compliant manner."

Chairman's Statement

Business Progress and Operating Review

Just over a year on from Russia's invasion of Ukraine that

triggered the global energy crisis, energy supply chains remain

potentially vulnerable, and countries are scrambling to secure long

term supply relationships, particularly for LNG. In response,

worldwide activity in the O&G sector is increasing, with Wood

Mackenzie suggesting demand for oil will increase by 2.3m barrels

per day in 2023. Indeed, longer term, BP warned in its annual

energy outlook published in January that if the world is to avoid

more shortages, price swings, and economic and social disruptions

as existing production sources decline, upstream O&G

investments will be needed for another 30 years. Most relevantly

for Plexus, Spencer Dale, chief economist at BP said investment in

new wells would therefore be needed until 2050 to ensure the supply

of fossil fuels matches demand, to enable an orderly transition

away from hydrocarbons.

As part of this story, counting the cost of carbon across every

vertical is essential, particularly in the case of natural gas,

where its main constituent methane is now recognised as being many

times worse for the environment and global warming than CO2. In

fact, Yasjka Meijer, a scientist with the European Space Agency,

has estimated that if just "3% to 4% of natural gas produced at

O&G wells leaks into the atmosphere, power produced by natural

gas plants is on par with coal plants in terms of the overall

climate impact". This underlines the importance of minimising

methane emissions, and the value of leak proof annular wellhead

seals which Plexus offers its customers.

Such considerations also have implications for UK energy policy

in relation to backing domestically produced gas versus imports.

Rystad Energy suggests that "LNG production and transport generates

10x the amount of carbon emissions compared with pipeline gas", yet

LNG imports to the UK from the USA are up nearly 150% from 2021 to

October 2022 to 9.7bcm. This may have been essential shorter term,

but longer term it is more detrimental to the environment and no

better measure can be found to encourage increased investment in

local UK gas production.

A sustainable solution therefore must be to invest in and build

more local production in the North Sea, which has some of the

strictest environmental regulations in the world, making UK

hydrocarbons cleaner than those from other parts of the world.

Despite the windfall tax, the North Sea Transition Authority has

begun the process of awarding over 100 new O&G licenses, and

Plexus hopes that this will help underpin opportunities in what has

always been its key market.

Such new drilling activity prospects is where Plexus' return to

the exploration rental wellhead from Jack-up rigs market can excel;

offering proven "through the BOP" technology in an agile and

responsive manner to exploration companies, combined with marketing

support from SLB is a compelling proposition. In anticipation of

such increased activity and with the proceeds from the October 2022

GBP1.55m raise via the issue of convertible loan notes, and the

post period end sale of a surplus property in Aberdeen for

GBP1.05m, Plexus has been building its new wellhead rental

inventory, and hopes to begin to win rental contracts over the

coming months.

Fittingly, post period end, Plexus had won a significant GBP5m+

contract for the rental of our proprietary POS-GRIP "HG(R)"

wellhead equipment and sealing technology, and while lead times can

be lengthy for such specialised projects, we believe that more of

these opportunities will present themselves over time. This major

contract will utilise our leak proof metal to metal seals in a

subsea environment and will demonstrate key elements of a full

Python Subsea Wellhead, which will help our efforts to break into

this growing market, where Wood Mackenzie said in its 2022 global

deepwater report that deepwater "....is the fastest growing oil and

gas theme".

Furthermore, our partnership with SLB continues to strengthen

ahead of the launch of its own low-cost surface production wellhead

that utilises our POS-GRIP technology to offer leak-free

performance for the lifetime of a well. Alongside this, we are

progressing Plexus' diversification strategy by expanding into the

fast-growing decommissioning space and developing our growing range

of Plexus products.

Key functions that support our operations are Human Resources,

Quality Health and Safety, Information Technology and Engineering

through the generation of Intellectual Property (IP').

The Company maintains its Competency Management System through

an internally developed system 'Competency@Plexus' ('C@P'). This is

monitored and accredited by OPITO, the training and qualifications

standards board. The annual monitoring audit was successfully

conducted in July 2022, where full accreditation was maintained

with no findings raised by the auditor. Since outright approval was

achieved, and as the system is robust and well-established, OPITO

has advised that a reduced site audit frequency of every 15 - 24

months will be applied going forward.

Health and Safety remains at the centre of what we do, and

Plexus remains fully committed to continually improving safety

standards, and the safety culture across the business and its

people. This is reflected in the business being once again lost

time injury ('LTI') free this year. Plexus passed its seventh

anniversary of this milestone in September 2022.

Plexus has undertaken a recertification audit with API for API

Q1/ISO 9001 in September 2022 and an annual audit with LRQA for ISO

45001 in December 2022. No major findings were raised in either

audit, resulting in the issue of new certification. Therefore,

Plexus continues to comply with the requirements of API Q1/ISO 9001

and ISO 45001 standards retaining API 6A and 17D Licences. These

accreditations demonstrate Plexus' capability and determination to

operate to the highest standards, and this will assist in gaining

new work.

Plexus has been able to rely on robust IT and security systems,

including its self-written ERP system, which are constantly under

review for improvement.

We continue to develop our suite of IP both through patent

protection, know-how, and ongoing research and development.

Capitalised R&D salary costs for the 6 months ended 31 December

2022 was GBP256k.

Interim Results

Plexus' results for the six months to December 2022, and the

activities carried out during this period, reflect the Group's

ongoing investment in and support of its strategy to grow existing

and new revenue streams organically and with licencing partners.

Progress is being made as demonstrated by the announcement post

period end of a GBP5m+ contract for the rental of POS-GRIP HG

wellhead equipment and sealing technology for a specialised subsea

project application.

Continuing operations revenue for the six-month period ended 31

December 2022 decreased to GBP709k, compared to the previous year's

figure of GBP734k.

During the period, Plexus has looked to conserve Group cash

whilst at the same time ensuring that its engineering capabilities

and operational service to customers was not compromised, and

controlling investment on capex, opex and non-essential R&D,

and post period end secured additional cash resources through the

issue of GBP1.55m of convertible loans, and GBP1.05m from the

disposal of Burnside House, a building which had become surplus to

requirements in Aberdeen.

Continuing activities administrative expenses have increased for

the six months to December 2022 to GBP2.64m (2021: GBP2.51m).

Personnel numbers, including non-executive board members are

broadly in line with the prior year at 36 (2021: 35). The staff

structure provides a mix of skills that balances ongoing and future

organic operational opportunities, particularly in relation to the

ongoing move back into the rental wellhead exploration market, and

development and support for our IP-led strategy involving external

partners and licensees, against the need to carefully manage the

Group's costs and cash resources. The current staff level is

designed to reflect the minimum required to maintain the

operational infrastructure that has been developed to date,

including maintaining the Group's Business Management System, and

retaining all relevant and necessary accreditations, in addition to

meeting operational requirements. Future growth in employee numbers

is anticipated, driven as required by expansion in operational

activities.

The Group has reported a loss of GBP2.07m in the period, which

is broadly in line with the prior year. The loss comes after

absorbing depreciation and amortisation costs of circa GBP0.8m.

Included in the statement of comprehensive income is a charge of

GBP122k to recognise the fair value of the derivative financial

instrument embedded in the convertible loan.

The Group has not provided for a charge to UK Corporation Tax at

the prevailing rate of 19%. This is consistent with the prior

year.

Basic loss per share for continuing operations was 2.06p per

share, which compares to a 1.94p loss per share for the same period

last year.

The balance sheet continues to remain strong, with the current

level of intangible and tangible property, plant and equipment

asset values at GBP8.9m and GBP0.8m respectively illustrating the

amount of cumulative investment that has been made in the business.

Total asset values at the end of the period stood at GBP17.3m.

As at 31 December 2022, the Group had cash and cash equivalents

of GBP1.1m and no bank borrowing.

Outlook

With the resurgence in demand for O&G, we believe that

exploration and production activities should be carried out in as

safe a manner as possible, and that leaks should be prevented

rather than allowed to happen before they are located and repaired;

these repairs are often only temporary fixes and, in many instances

leaks are not identified at all. This is a message we are

determined to continue promoting to the industry as we work to

overcome established practices.

It is encouraging to see a range of statements over the past six

months in relation to the ongoing need for O&G, and that there

are certainly no 'quick fixes' in terms of switching off

hydrocarbon dependence. ExxonMobil CEO Darren Woods has a pragmatic

approach towards exploration and production, recognising that

O&G will be necessary for years to come and that stopping

exploration and production in Europe will lead to higher emissions

when produced elsewhere: "So, asking us to stop investing or

producing diesel and gas... just means that somebody else out there

who is less efficient and more emissions-intensive making it to

meet that demand. Again, the world does not benefit from that.".

Clearly the answer is to produce and consume O&G as cleanly and

as leak free as possible, and Plexus of course believes that this

should include the wellhead and associated equipment.

However, it should be recognised that there are headwinds in

Europe, and particularly in the UK. These take the form of very

high profit windfall taxes, which are showing signs of compromising

investment decisions by operators, and also ongoing pressure from

the green lobby, which does not seem to recognise that it is better

to produce more responsible cleaner O&G locally, rather than

import long distance from parts of the world where standards may

not be quite as high as in Europe, and where transport costs

(financial and environmental) come into play. This is particularly

the case with imported LNG versus locally produced 'pipeline

gas'.

Despite all of the challenges over the past few years, the

global wellhead equipment market is now beginning to thrive, and

this can only be positive for Plexus. I was particularly encouraged

to note that Research and Markets published a report in January

2023 estimating that the Global Wellhead Equipment Market will have

a Compound Annual Growth Rate ("CAGR") of 9.3%, with a global

market value estimated to almost double to $11.8bn by 2030.

Further, the decommissioning sector is also reported as a growth

market, and one where we are already having some success in

relation to POS-GRIP based well P&A solutions. Polaris Market

Research reported in 2022 that it calculated that the global

offshore decommissioning market is expected to grow at a CAGR of

7.6% thereby almost doubling to $10.1 billion by 2030, and that by

2027, around 2,400 wells in the North Sea and West of Shetland are

projected to be decommissioned.

These are great opportunities for Plexus, and it should not be

forgotten that beyond these markets there are numerous other areas

and applications we believe can benefit from our proprietary

technology, which include carbon capture and storage, natural gas

storage, offshore wind, hydrogen and geothermal. These are all

areas where very long-term sealing integrity would be an enormous

advantage if not essential, especially where high temperature, high

pressure and corrosive environments are concerned.

Against this positive industry backdrop, and with a growing

inventory of rental wellhead equipment, a solid partner in SLB, a

strengthened order book, new tender opportunities, an improved

working capital position, and a shift in attitude towards the

O&G sector, all signs point to Plexus as an opportunity that I

believe should be attractive to investors as we advance into 2023

and beyond.

J Jeffrey Thrall

Non-Executive Chairman

24 March 2023

For further information please visit www.plexusplc.com or

contact:

Plexus Holdings PLC info@plexusplc.com

Ben van Bilderbeek, CEO

Graham Stevens, CFO

Cenkos Securities PLC Tel: 0131 220 6939

Derrick Lee

Pete Lynch

------------------------------

St Brides Partners Ltd plexus@stbridespartners.co.uk

Isabel de Salis

Ana Ribeiro

------------------------------

Plexus Holdings Plc

Unaudited Interim Consolidated Statement of Comprehensive

Income

For the Six Months Ended 31 December 2022

Six months Six months Year to

to to 30 June

31 December 31 December 2022

2022 2021

GBP'000 GBP'000 GBP'000

Revenue 709 734 2,306

Cost of sales (91) (130) (813)

------- ------- -------

Gross profit 618 604 1,493

Administrative expenses (2,636) (2,512) (5,784)

Operating loss (2,018) (1,908) (4,291)

Finance income 4 81 164

Finance costs (40) (159) (640)

Other income 38 11 125

Remeasurement of financial instrument (122) - -

Share in profit of associate 115 22 111

------- ------- -------

Non-recurring item

Fair-value adjustment on asset

held for sale (note 10) (50) - (1,025)

Loss before taxation (2,073) (1,953) (5,556)

Income tax credit (note 6) - - (1,901)

------- ------- -------

Loss after taxation from continuing

operations (2,073) (1,953) (7,457)

------- ------- -------

Loss for period/year (2,073) (1,953) (7,457)

Other comprehensive income - - -

------- ------- -------

Total comprehensive income (2,073) (1,953) (7,457)

------- ------- -------

Loss per share (note 7)

Basic from continuing operations (2.06p) (1.94p) (7.42p)

Diluted from continuing operations (2.06p) (1.94p) (7.42p)

Basic from discontinued operations - - -

Plexus Holdings PLC

Unaudited Interim Consolidated Statement of Financial

Position

As at 31 December 2022

31 December 31 December 30 June

2022 2021 2022

GBP'000 GBP'000 GBP'000

ASSETS

Goodwill 767 767 767

Intangible assets 8,948 9,435 9,165

Property, plant and equipment

(note 9) 779 2,798 821

Non-current financial asset - 4,705 101

Investment in associate 838 743 723

Deferred tax asset - 1,899 -

Right of use asset 876 1,093 941

------- ------- -------

Total non-current assets 12,208 21,440 12,518

------- ------- -------

Asset held for sale (note10) 1,050 - 1,100

Inventories 2,109 663 1,394

Trade and other receivables 805 852 971

Cash and cash equivalents 1,142 3,379 5,840

------- ------- -------

Total current assets 5,106 4,894 9,305

------- ------- -------

TOTAL ASSETS 17,314 26,334 21,823

------- ------- -------

EQUITY AND LIABILITIES

Called up share capital (note

12) 1,054 1,054 1,054

Shares held in treasury (2,500) (2,500) (2,500)

Share based payments reserve 674 674 674

Retained earnings 14,234 21,811 16,307

To tal equity attributable ------- ------- -------

to equity holders

of the parent 13,462 21,039 15,535

Convertible loans 1,576 - -

Lease liabilities 782 1,015 761

------- ------- -------

Total non-current liabilities 2,358 1,015 761

Trade and other payables 1,056 670 1,245

Bank Lombard facility - 3,294 3,958

Derivative financial instrument 122 - -

Lease liabilities 316 316 324

------- ------- -------

Total current liabilities 1,494 4,280 5,527

------- ------- -------

Total liabilities 3,852 5,295 6,288

------- ------- -------

TOTAL EQUITY AND LIABILITIES 17,314 26,334 21,823

------- ------- -------

Plexus Holdings Plc

Unaudited Interim Statement of Change in Equity

For the Six Months Ended 31 December 2022

Called Shares Share Based Retained Total

Up Held in Payments Earnings

Share Capital Treasury Reserve

Balance as at 30 June

2021 1,054 (2,500) 674 23,764 22,992

Total comprehensive

loss for the year - - - (7,457) (7,457)

------- ------- ------- ------ ------

Balance as at 30 June

2022 1,054 (2,500) 674 16,307 15,535

Total comprehensive

loss for the period - - - (2,073) (2,073)

------- ------- ------- ------- -------

Balance as at 31 December

2022 1,054 (2,500) 674 14,234 13,462

------- ------- ------- ------- -------

Plexus Holdings Plc

Unaudited Interim Statement of Cash Flows

For the Six months ended 31 December 2022

Six months Six months Year to

to 31 December to 31 December 30 June

2022 2021 2021

GBP 000's GBP 000's GBP 000's

Cash flows from operating activities

Loss before taxation from continuing

activities (2,073) (1,953) (5,556)

------- ------- -------

Loss before tax (2,073) (1,953) (5,556)

Adjustments for:

Depreciation, amortisation and

impairment charges 768 838 1,679

Gain on disposal of property,

plant and equipment - (1) (4)

Remeasurement of financial instrument 122

Fair value adjustment of on financial

assets 1 112 513

Fair value adjustment on asset

held for sale 50 - 1,025

Share in profit of associate (115) (22) (111)

Impairment of associate - - 109

Other income (38) (11) (114)

Investment income (4) (81) (164)

Interest expense 40 47 127

Changes in working capital:

Increase in inventories (715) (88) (819)

Decrease in trade and other receivables 166 199 80

(Decrease) / Increase in trade

and other payables (189) 27 602

------- ------- -------

Cash used in operating activities (1,987) (933) (2,633)

Net income taxes received - - (2)

------- ------- -------

Net cash used in operating activities (1,987) (933) (2,635)

------- ------- -------

Cash flows from investing activities

Funds divested / (invested) in

financial instruments 100 (1,775) 2,428

Other income 38 11 114

Purchase of intangible assets (256) (252) (447)

Interest and investment income

received 4 81 164

Purchase of property, plant and

equipment (102) (62) (253)

Preparation costs for asset held

for sale - - (180)

Net proceeds from of sale of property,

plant and equipment - 2 3

------- ------- -------

Net cash (used) / generated from

investing activities (216) (1,995) 1,829

------- ------- -------

Cash flows from financing activities

(Repayment)/drawdown of banking

facility (3,958) 1,250 1,914

Repayments of lease liability (87) (87) (347)

Convertible loan funding received 1,550 - -

Interest paid - (31) (96)

------- ------- -------

Net cash (outflow) / inflow

from financing activities (2,495) 1,132 1,471

------- ------- -------

Net decrease in cash and cash

equivalents (4,698) (1,796) 665

Cash and cash equivalents at

brought forward 5,840 5,175 5,175

------- ------- -------

Cash and cash equivalents carried

forward 1,142 3,379 5,840

------- ------- -------

Notes to the Interim Report December 2022

1. This interim financial information does not constitute

statutory accounts as defined in section 435 of the Companies Act

2006 and is unaudited.

The comparative figures for the financial year ended 30 June

2022 are not the Company's statutory accounts for that financial

year. Those accounts have been reported on by the company's

auditors, Crowe U.K. LLP, and delivered to the registrar of

companies. The report of the auditors was (i) unqualified, (ii) did

not include a reference to any matters to which the auditors drew

attention by way of emphasis without qualifying their report and

(iii) did not contain a statement under section 498(2) or (3) of

the Companies Act 2006.

The interim financial information is compliant with IAS 34 -

Interim Financial Reporting.

2. Except as described below the accounting policies applied in

these interim financial statements are the same as those applied in

the Group's consolidated financial statements as at and for the

year ended 30 June 2022 and which are also expected to apply for 30

June 2023.

There are a number of standards, amendments to standards, and

interpretations which have been issued by the IASB that are

effective in future accounting. The Directors' have assessed the

impact of these standards and do not expect any significant impact

to the Group on their adoption. The Group financial statements are

presented in sterling and all values are rounded to the nearest

thousand pounds except where otherwise indicated.

3. This interim report was approved by the board of directors on

24 March 2023.

4. The directors do not recommend payment of an interim dividend

in relation to this reporting period.

5. There were no other gains or losses to be recognised in the

financial period other than those reflected in the Statement of

Comprehensive Income.

6. No corporation tax provision has been provided for the six

months ended 31 December 2022 (2021: nil). As a result, there is no

effective rate of tax for the six months ended 31 December 2022

(2021: 0%).

7. Basic earnings per share are based on the weighted average of

ordinary shares in issue during the half-year of 100,435,744 (2021:

100,435,744).

8. The Group derives revenue from the sale of its POS-GRIP

friction-grip technology and associated products, and licence

income derived from its various licensing agreements. These income

streams are all derived from the utilisation of the technology

which the Group believes is its only segment. Business activity is

not subject to seasonal fluctuations.

9. The company accounts for convertible loans having regard to

the specific terms of the instrument. The company considers the

instrument to be made up of a host instrument that it is measured

at amortised cost and a derivative forward contract that is

recognised at fair value through the profit and loss account. The

company has elected to account for the two elements separately

rather than assign a fair value to the instrument as a whole. The

redemption premium is recognised over the life of the instrument

and an accelerated charge will be recognised if a conversion event

occurs prior to the end of the term.

10. Property plant and equipment

Tenant Assets Motor

Buildings Improvements Equipment under construction vehicles Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Cost

------------ -------------- ------------ -------------------- ---------- ---------

As at 30 June

2021 3,740 714 5,561 - 17 10,032

------------ -------------- ------------ -------------------- ---------- ---------

Additions - 130 69 54 - 253

------------ -------------- ------------ -------------------- ---------- ---------

Transfers - - 54 (54) - -

------------ -------------- ------------ -------------------- ---------- ---------

Reclassified to

assets held for

sale (3,055) - (3) - - (3,058)

------------ -------------- ------------ -------------------- ---------- ---------

Disposals - - (321) - - (321)

------------ -------------- ------------ -------------------- ---------- ---------

----- ----- ----- ----- ----- -----

------------ -------------- ------------ -------------------- ---------- ---------

As at 30 June

2022 685 844 5,360 - 17 6,906

------------ -------------- ------------ -------------------- ---------- ---------

Additions - 10 7 85 - 102

------------ -------------- ------------ -------------------- ---------- ---------

Transfers - - 85 (85) - -

------------ -------------- ------------ -------------------- ---------- ---------

----- ----- ----- ----- ----- -----

------------ -------------- ------------ -------------------- ---------- ---------

As at 31 December

2022 685 854 5,452 - 17 7,008

------------ -------------- ------------ -------------------- ---------- ---------

----- ----- ----- ----- ----- -----

------------ -------------- ------------ -------------------- ---------- ---------

Depreciation

------------ -------------- ------------ -------------------- ---------- ---------

As at 30 June

2021 1,643 566 4,851 - 11 7,071

------------ -------------- ------------ -------------------- ---------- ---------

Charge for the

year 153 40 252 - 4 449

------------ -------------- ------------ -------------------- ---------- ---------

Reclassified to

assets held for

sale (1,111) - (3) - - (1,114)

------------ -------------- ------------ -------------------- ---------- ---------

On disposals - - (321) - - (321)

------------ -------------- ------------ -------------------- ---------- ---------

----- ----- ----- ----- ----- -----

------------ -------------- ------------ -------------------- ---------- ---------

As at 30 June

2022 685 606 4,779 - 15 6,085

------------ -------------- ------------ -------------------- ---------- ---------

Charge for the

year - 36 106 - 2 144

------------ -------------- ------------ -------------------- ---------- ---------

On disposals - - - - - -

------------ -------------- ------------ -------------------- ---------- ---------

----- ----- ----- ----- ----- -----

------------ -------------- ------------ -------------------- ---------- ---------

As at 31 December

2022 685 642 4,885 - 17 6,229

------------ -------------- ------------ -------------------- ---------- ---------

----- ----- ----- ----- ----- -----

------------ -------------- ------------ -------------------- ---------- ---------

Net book value

------------ -------------- ------------ -------------------- ---------- ---------

As at 31 December

2022 - 212 567 - - 779

------------ -------------- ------------ -------------------- ---------- ---------

----- ----- ----- ----- ----- -----

------------ -------------- ------------ -------------------- ---------- ---------

As at 30 June

2022 - 238 581 - 2 821

------------ -------------- ------------ -------------------- ---------- ---------

----- ----- ----- ----- ----- -----

------------ -------------- ------------ -------------------- ---------- ---------

11. Asset held for sale

2022

GBP'000

Cost 3,058

Accumulated depreciation (1,114)

-----

Net book value 1,944

Preparation costs 172

Cost of sale 9

-----

Fair value adjustment (1,025)

-----

Fair value at 30 June 2022 1,100

-----

Fair value adjustment (50)

-----

Fair value at 31 December 2022 1,050

-----

The asset held for sale relates to a property which was sold

post period end on 28(th) February 2023.

The Group had agreed a sale in principle prior to the period end

to a related party, with the building having been previously

marketed for sale. In line with IFRS5 the asset was held for sale

at the lower of its carrying value and fair value. A fair value

adjustment to reduce the carrying value of the asset to its fair

value has been recognised as shown above. The fair value was

assessed by reference to an independent property agent.

12. Investments

GBP'000

Investment in associate at 30 June

2021 721

Share of profit for the period 111

Impairment of investment (109)

-----

Investment in associate at 30 June

2022 723

Share of profit for the period 115

-----

Investment in associate at 31 December

2022 838

-----

On 14 December 2018 Plexus Ocean Systems Limited acquired a 49%

interest in Kincardine Manufacturing Services Limited ('KMS') for a

consideration of GBP735k plus associated legal fees. KMS is a

precision engineering company which serves the oil and gas

industry. This is viewed as a long-term strategic investment by

Plexus. KMS is based at Sky House, Spurryhillock Industrial Estate,

Stonehaven, Aberdeenshire AB39 2NH.

Following the investment Graham Stevens, Plexus' Finance

Director was appointed to the board of KMS. The company remains

under the control and influence of the 51% majority

shareholders.

The summary financial information of KMS, extracted on a 100%

basis from the draft accounts for the year to 31 December 2022 is

as follows:

2022

GBP'000

Assets 3,033

Liabilities 1,623

Revenue 4,813

Profit after tax 2 46

13. Share Capital

Six months Six months Year to

to 31 December to 30 June

2022 31 December 2022

2021

GBP'000 GBP'000 GBP'000

Authorised:

Equity: 110,000,000 (June 2022

& Dec 2021: 110,000,000) Ordinary

shares of 1p each 1,100 1,100 1,100

Allotted, called up and fully ----- ----- -----

paid:

Equity: 105,386,239 (June 2022

& Dec 2021: 105,386,239) 1,054 1,054 1,054

----- ----- -----

14. Convertible loans

Non-current liabilities GBP'000

Convertible loan notes issued 1,550

Redemption premium 26

-----

1,556

-----

Current liabilities GBP'000

Fair value of derivative instrument 122

--------

-----

--------

122

--------

-----

--------

On 19th October 2022, the Company issued convertible loan notes

to the value of GBP1,550,000 from OFM Investment Limited (an entity

connected to the van Bilderbeek family), Ben van Bilderbeek and

Jeff Thrall, and represents a related party transaction.

The loan notes are non-interest bearing and have a long stop

maturity date on the second-year anniversary of the date of the

instrument. On conversion, the holders of the loan notes will

receive new ordinary shares at a 20% discount to the prevailing

share price in addition a redemption premium is payable being 20%

of the loan note value. The derivative instrument is remeasured at

each balance date, with any fair value adjustment recognised in the

Income Statement.

At the reporting date the financial instrument has been

remeasured resulting in a charge of GBP122k in the statement of

comprehensive income. Additionally, a charge of GBP26k has been

included in finance costs relating to a redemption premium.

15. Subsequent Event

On 28th February 2023 the Group completed the sale of the

Burnside Property, which at the reporting date is classified as an

asset held for sale, for a consideration of GBP1.05m.

The property was sold to Burnside House Limited, a private

company which has been established for the purpose of the

Transaction and is owned by Ben van Bilderbeek, CEO of Plexus, and

certain members of Mr van Bilderbeek's family, including his

spouse, and thus represents a related party transaction.

NOTES

Plexus Holdings plc (AIM: POS)

Plexus is an IP led company focussed on establishing its

patented leak-proof POS-GRIP(R) wellhead and associated equipment

as the go-to technology for energy markets whilst making a genuine

contribution to the oil and gas industry's ESG and NetZero goals by

championing "through the BOP" (Blow-out Preventer) designs, and

lifetime leak-proof HG(R) metal-to-metal sealing systems. Having

protected the environment for many years through these

technological innovations, the Company was awarded the London Stock

Exchange's Green Economy Mark in July 2021 and continues to place

emphasis on its ability to reduce harmful methane emissions and

unnecessary maintenance and intervention costs.

Headquartered in Aberdeen, the Company has provided leak-free

wellhead performance in over 400 wells worldwide and worked with an

array of blue-chip oil and gas company clients. As well as

generating direct revenues from securing orders for surface

production wellheads particularly in the UK and European North Sea

regions, the Company has several licencing/collaboration agreements

with major partners including FMC Technologies, which is a

subsidiary of TechnipFMC, and SLB (Schlumberger Ltd). SLB has a

non-exclusive licence to use the POS-GRIP and HG(R) metal-to-metal

seal method of wellhead engineering for the development of

conventional and unconventional oil and gas surface wellheads.

Further, Plexus has also entered into a Licencing Agreement with

SLB which enables Plexus to return to the Exploration (Adjustable)

Wellhead rental business from Jack-up rigs for 'through the BOP'

applications, where SLB will help to provide Plexus with sales

leads and market insight through a formal Sales Advisory Board.

Plexus' current suite of products and applications include: "HG"

wellheads, which combine POS-GRIP technology with gas tight leak

free metal-to-metal sealing; the Python(R) subsea wellhead,

developed in a Joint Industry Project with several industry

leaders; the POS-SET(TM) Connector for the de-commissioning and

abandonment market; and Tersus-PCT, an innovative HP/HT tie back

connector product. Having proved the superior uniquely enabling

qualities of POS-GRIP Technology, Plexus is now also focused on

identifying opportunities for its technology and equipment in other

markets such as Plug and Abandonment de-commissioning, carbon

capture, gas storage, hydrogen and geothermal where it can play an

important role in reducing harmful methane emission risks as

operators strive to deliver on ESG commitments and NetZero goals in

a safe and cost-effective way.

For more information visit: https://www.plexusplc.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR VQLFLXXLEBBF

(END) Dow Jones Newswires

March 27, 2023 02:00 ET (06:00 GMT)

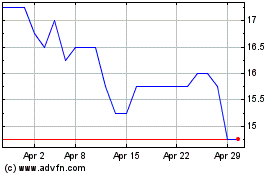

Plexus (LSE:POS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Plexus (LSE:POS)

Historical Stock Chart

From Apr 2023 to Apr 2024