TIDMPTY

RNS Number : 5220M

Parity Group PLC

22 September 2021

PARITY GROUP PLC

INTERIM RESULTS FOR THE SIX MONTHS TO 30 JUNE 2021

22 September 2021

Parity Group plc ("Parity" or the "Group"), the data and

technology focused professional services business, announces its

half year results for the six months ended 30 June 2021 ("H1

2021").

Headlines

-- Adjusted EBITDA for H1 2021 of GBP251k (H1 2020: GBP567k).

-- Loss before tax of GBP491k (H1 2020: GBP383k) due primarily

to one-off change management costs of GBP400k.

-- New systems and processes resulted in a reduction of back-office costs by c.GBP250k.

-- Pension scheme surplus of GBP1.3m (H1 2020: deficit of GBP0.5m).

-- H1 2021 financial results impacted by lower revenue of GBP26m (H1 2020: GBP30m).

-- External contribution of GBP2.3m (H1 2020: GBP2.9m).

-- New management refocusing investment in front line resources

in the Group's core recruitment services business since period

end.

-- The Board expects a return to growth and profitability in FY 2022.

Key Financials

For the six months ended 30 June 2021

Six months Six months Year

to 30.06.21 to 30.06.20 to 31.12.20

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

---------------------------------------- -------------- ------------- -------------

Revenue 25,998 29,949 57,827

External contribution 2,322 2,863 5,561

Adjusted EBITDA(1) 251 567 1,056

Operating profit before non-underlying

items 18 246 470

Adjusted (loss)/profit before tax(1) (91) 61 122

Loss before tax (491) (383) (325)

Net (debt)/cash excluding lease

liabilities (1,112) 654 231

---------------------------------------- -------------- ------------- -------------

(1) Adjusted EBITDA and adjusted profit/loss before tax are

non-IFRS alternative performance measures, defined in Note 1 of the

notes to the interim results.

Mark Braund, Executive Chairman of Parity Group plc, said:

"It has been a tough start to the year for Parity. Whilst the

increase in economic activity has helped to re-energise the

recruitment industry, it has exposed the underinvestment in the

Group's core recruitment business, which has inevitably impacted

our financial results.

We have taken action to address the challenges within the

business by refreshing our strategy and are investing in frontline

resources to capitalise on our reputable brand name during a time

of heightened market opportunity.

The response from colleagues has been tremendous; their

enthusiasm and hard work has already helped us to focus the

business and combined with strong demand in Parity's core markets,

I believe we can re-establish growth and profitability in the

medium term."

Contacts

Parity Group PLC www.parity.net

Mark Braund, Executive Chairman

Mike Johns, CFO + 44 (0) 208 543 5353

finnCap Ltd (Nomad & Broker) https://www.finncap.com/

Jonny Franklin-Adams / Simon

Hicks / Fergus Sullivan +44 (0) 20 7220 0500

This announcement contains certain statements that are or may be

forward-looking with respect to the financial condition, results or

operations and business of Parity Group plc. By their nature

forward-looking statements involve risk and uncertainty because

they relate to events and depend on circumstances that will occur

in the future. There are a number of factors that could cause

actual results and developments to differ materially from those

expressed or implied by such forward-looking statements. These

factors include but are not limited to (i) adverse changes to the

current outlook for the UK IT recruitment and solutions market,

(ii) adverse changes in tax laws and regulations, (iii) the risks

associated with the introduction of new products and services, (iv)

pricing and product initiatives of competitors, (v) changes in

technology or consumer demand, (vi) the termination or delay of key

contracts and (vii) volatility in financial markets.

Overview

During H1 2021 Parity experienced an increase in both sentiment

and activity in the key markets served by the Group. However,

trading was impacted by underinvestment in the core recruitment

solutions business and the inability to establish a sustainable and

scalable consulting division.

A change in leadership has taken place during the period; Mark

Braund was appointed Non-Executive Chairman 21 April 2021, and

subsequently as interim Executive Chairman 9 June 2021.

The management team has since undertaken a review of the

business and refined the strategy to focus on and reinvest in

Parity's core business of recruitment solutions; targeting

in-demand skills in the data and change management sectors of the

market, where the Group has been developing a presence.

The sectors Parity is targeting remain resilient to the

disruption in the wider economy and provide the business with the

opportunity to capitalise on the investment it is making in people

during H2 2021, leveraging its heritage to re-establish growth in a

business with strong demand and in which Parity is considered a

quality brand.

Alongside traditional contract recruitment, Parity aims to

extend its value-added services, including managed services and

statement of work, to new and existing clients, an area of growing

significance as clients seek to mitigate the increasing complexity

of compliance and administration of contract resources, an area

where Parity has a strong reputation and is rebuilding

capacity.

Parity expect the investment being made in frontline resources

to have a positive impact in Q4 2021 and to drive growth and a

return to profitability in 2022.

Financial review

H1 2021 has seen an increase in market activity and with the

pandemic restrictions slowly easing during the period it has

created both opportunity and risk for Parity. The increasing

activity in the market has coincided with unplanned staff attrition

and underinvestment in the core recruitment solutions business,

thereby contributing to a decline in revenue for the period.

Last year (2020) was a year of continued transformation, which,

during the height of the pandemic saw the Group streamline

back-office functions and invest in new systems. This has reduced

costs and increased the ability of the business to adapt to

changing business conditions.

In 2020 the pandemic created uncertainty, and whilst Parity

retained employees without furlough, it shrank resources and

reduced costs materially. Although activity was depressed, the

Group's primary public sector market remained stable; this helped

the business to maximise its financial performance during 2020

despite a reduction in top line revenue.

Following management changes in June 2021 the Group has made the

decision to focus on and reinvest in Parity's core business of

recruitment solutions; targeting in-demand skills in the data and

change management sectors of the market, where the Group has been

developing a presence.

External contribution

During H1, optimism that the worst of the pandemic may be over

has seen an 11% increase in job opportunities within contract

recruitment compared with H2 2020 and many of our key clients

seeking to add to or start new projects. In addition, as businesses

started to hire new staff the number of permanent job opportunities

rose dramatically in Q1 of 2021.

Despite the backdrop of increased activity in recruitment the

Group has seen a decline in total external contribution for the

period to GBP2.3m (H1 2020: GBP2.9m, FY 2020: GBP5.6m) with key

service lines down.

Recruitment

As noted previously the decision by the business to preserve

cash and limit risk during the height of the pandemic in 2020 was a

key driver behind the lack of investment in frontline revenue

generating resources. This combined with higher-than-expected staff

turnover during H1 2021 has meant that the business has been

under-resourced in client and contractor facing roles. The impact

has been:

-- A focus on maintaining and developing key clients, resulting

in growth during the period from 3 of our top 5 clients.

-- 17% of new job opportunities were not actively managed due to resourcing shortages.

-- Less engagement with contractors and an increase in early

terminations during the period (contracts ending before the

contracted end date) by more than 40% compared with the H2

2020.

-- Higher attrition in the long tail of clients (those with less than 5 active contractors).

-- A lack of resource to actively manage permanent recruitment opportunities.

A clear plan of action has since been put in place to address

these challenges, with some immediate improvements beginning to

materialise.

Consulting and Managed Services

Managed services during the period has been in line with

expectations but limited to core contracted services. Historically

(before 2020) core managed services would have been supplemented by

additional client projects. Having seen these disappear during the

pandemic, H1 2021 has seen a revival of discussions on incremental

statements of work but none of these projects have contributed to

H1 2021.

Growing the consultancy pipeline and revenue had been a key

objective for the business in H1 2021. Q1 provided a positive start

with a small number of discrete projects, discussed with clients,

and nurtured during the pandemic, being started during the period.

The Group has been unable to productise its consulting propositions

and as a consequence pipeline development has been slow. With long

lead times and no significant projects closed in Q2 of H1 2021,

revenue and external contribution fell short of our

expectations.

Result before tax

Despite the lower external contribution in the period, the Group

has delivered an adjusted EBITDA of GBP251k (H1 2020: GBP567k, FY

2020: GBP1,056k). Partially offsetting the fall in external

contribution was a reduction in back-office costs by GBP250k

(versus H1 2020). This was a direct result of the restructuring

during 2020 of back-office functions, reducing headcount and

implementing new systems and processes.

During the period the business incurred GBP400k of

non-underlying costs, the majority of which relates to changes in

management (H1 2020: GBP444k, FY 2020: GBP447k).

After the inclusion of non-underlying items, the Group posted a

loss before tax for H1 2021 of GBP491k (H1 2020: GBP383k, FY 2020:

GBP325k).

Cash & net debt

Net debt, excluding adjustments for IFRS 16 lease liabilities,

as at 30 June 2021 was GBP1.11m (30 June 2020: net cash of

GBP0.65m, 31 December 2020: net cash of GBP0.23m).

The Group continues to utilise part of its GBP9m debt facility

secured against billed and unbilled receivables to manage both

intra month and inter month movements in working capital. In April

2021 the Group transferred its ABL facility from PNC to Leumi ABL,

giving it greater flexibility and lower borrowing costs. The new

facility with Leumi ABL runs for an initial period of 3 years until

April 2024.

During H1 2020 the Group maintained a significant headroom on

the facility and as at 30 June 2021 the headroom on the facility

was GBP2.1m.

Net debt has increased during H1 2021, the largest component of

which is an increase in debtor days. Debtor days, which have been

exceptionally low over the last 18 months have increased slightly

during the period from 14 as at 30 December 2020 to 21 as at 30

June 2021. Despite the increase in debtor days conversion of income

to cash remains strong and there have been no bad debts realised

during the period.

Defined benefit pension

The final salary pension scheme surplus was GBP1.3m at 30 June

2021 (30 June 2020: deficit of GBP0.5m; 31 December 2020: surplus

of GBP0.2m). The continuing growth in the surplus during the first

half was primarily due to a positive performance from the scheme's

growth assets.

During the period the Group made GBP161k of contributions to the

pension scheme, this includes GBP72k of costs associated with the

administration of the scheme.

Outlook

Although the Group has seen a further decline in revenue and

external contribution, there is an expectation that in Parity's

core areas of data, technology and change management, the increase

in market activity will be sustained. Parity is on a mission to

rapidly rebuild capacity to deliver growth by positioning itself

strategically to build long-term value.

Refocusing on the core recruitment solutions business has

provided the Group with a clear and achievable goal. The response

from the team has been tremendous; their enthusiasm and hard work

is already beginning to show through and with a much lower and more

flexible cost base across all business functions, as confidence

returns, we will add further scale.

With the existing debt line, flexible cost base, a strong set of

core clients, a refocus on contract recruitment and further

investment in front line resources being made in Q3 and Q4, along

with a general rise in the market, the directors believe that the

business is well placed to stabilise in H2 and be in a position to

generate growth and return to profit in FY 2022.

Consolidated condensed income statement

For the six months ended 30 June 2021

Six months Six months Year

to 30.06.21 to 30.06.20 to 31.12.20

(Unaudited) (Unaudited) (Audited)

Notes GBP'000 GBP'000 GBP'000

---------------------------------------- ------- -------------- ------------- -------------

Revenue 3 25,998 29,949 57,827

Contractor costs (23,676) (27,086) (52,266)

---------------------------------------- ------- -------------- ------------- -------------

External contribution 2,322 2,863 5,561

---------------------------------------- ------- -------------- ------------- -------------

Operating costs before non-underlying

items (2,304) (2,617) (5,091)

---------------------------------------- ------- -------------- ------------- -------------

Operating profit before non-underlying

items 18 246 470

---------------------------------------- ------- -------------- ------------- -------------

Non-underlying items 4 (400) (444) (447)

---------------------------------------- ------- -------------- ------------- -------------

Operating (loss)/profit (382) (198) 23

---------------------------------------- ------- -------------- ------------- -------------

Analysed as:

Adjusted EBITDA(1) 251 567 1,056

Depreciation and amortisation (233) (321) (586)

Non-underlying items 4 (400) (444) (447)

---------------------------------------- ------- -------------- ------------- -------------

Finance costs 5 (109) (185) (348)

---------------------------------------- ------- -------------- ------------- -------------

Loss before tax (491) (383) (325)

---------------------------------------- ------- -------------- ------------- -------------

Analysed as:

Adjusted (loss)/profit before tax(1) (91) 61 122

Non-underlying items 4 (400) (444) (447)

---------------------------------------- ------- -------------- ------------- -------------

Tax (charge)/credit 6 (34) 95 (145)

---------------------------------------- ------- -------------- ------------- -------------

Loss for the period attributable

to owners of the parent (525) (288) (470)

---------------------------------------- ------- -------------- ------------- -------------

Loss per share

Basic 7 (0.51p) (0.28p) (0.46p)

Diluted 7 (0.51p) (0.28p) (0.46p)

--------------- ---- --------- --------- ---------

All activities comprise continuing operations.

(1) Adjusted EBITDA and adjusted profit/loss before tax are

non-IFRS alternative performance measures, defined in Note 1 of the

notes to the interim results.

Consolidated condensed statement of comprehensive income

For the six months ended 30 June 2021

Six months Six months Year

to 30.06.21 to 30.06.20 to 31.12.20

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

------------------------------------------- -------------- ------------- -------------

Loss for the period (525) (288) (470)

Other comprehensive income

Items that will never be reclassified

to profit or loss

Remeasurement of defined benefit pension

scheme 985 400 1,041

Deferred taxation on remeasurement

of defined benefit pension scheme (187) (76) (198)

------------------------------------------- -------------- ------------- -------------

Other comprehensive income for the

period after tax 798 324 843

------------------------------------------- -------------- ------------- -------------

Total comprehensive income for the

period attributable to owners of the

parent 273 36 373

------------------------------------------- -------------- ------------- -------------

Consolidated condensed statement of changes in equity

For the six months ended 30 June 2021

Six months to 30.06.21 (Unaudited)

Share Capital

Share premium redemption Other Retained

capital reserve reserve reserves earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- --------- --------- ------------ ---------- ---------- ---------

At 1 January 2021 2,053 33,244 14,319 34,560 (77,290) 6,886

Share options - value of

employee services - - - - (59) (59)

---------------------------- --------- --------- ------------ ---------- ---------- ---------

Transactions with owners - - - - (59) (59)

---------------------------- --------- --------- ------------ ---------- ---------- ---------

Loss for the period - - - - (525) (525)

Other comprehensive income

for the period - - - - 798 798

At 30 June 2021 2,053 33,244 14,319 34,560 (77,076) 7,100

---------------------------- --------- --------- ------------ ---------- ---------- ---------

Six months to 30.06.20 (Unaudited)

Share Capital

Share premium redemption Other Retained

capital reserve reserve reserves earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- --------- --------- ------------ ---------- ---------- ---------

Revised at 1 January 2020 2,053 33,244 14,319 34,560 (77,753) 6,423

Share options - value of

employee services - - - - 43 43

---------------------------- --------- --------- ------------ ---------- ---------- ---------

Transactions with owners - - - - 43 43

---------------------------- --------- --------- ------------ ---------- ---------- ---------

Loss for the period - - - - (288) (288)

Other comprehensive income

for the period - - - - 324 324

At 30 June 2020 2,053 33,244 14,319 34,560 (77,674) 6,502

---------------------------- --------- --------- ------------ ---------- ---------- ---------

Year to 31.12.20 (Audited)

Share Capital

Share premium redemption Other Retained

capital reserve reserve reserves earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- --------- --------- ------------ ---------- ---------- ---------

At 1 January 2020 2,053 33,244 14,319 34,560 (77,753) 6,423

Share options - value of

employee services - - - - 90 90

---------------------------- --------- --------- ------------ ---------- ---------- ---------

Transactions with owners - - - - 90 90

---------------------------- --------- --------- ------------ ---------- ---------- ---------

Loss for the year - - - - (470) (470)

Other comprehensive income

for the year - - - - 843 843

At 31 December 2020 2,053 33,244 14,319 34,560 (77,290) 6,886

---------------------------- --------- --------- ------------ ---------- ---------- ---------

Consolidated condensed statement of financial position

As at 30 June 2021

As at As at As at

30.06.21 30.06.20 31.12.20

(Unaudited) (Unaudited) (Audited)

Notes GBP'000 GBP'000 GBP'000

------------------------------- ------ ------------- ------------- -----------

Assets

Non-current assets

Goodwill 4,594 4,594 4,594

Other intangible assets 4 17 6

Property, plant and equipment 17 34 23

Right-of-use assets 76 387 247

Trade and other receivables 58 115 87

Deferred tax assets 405 990 627

Retirement benefit asset 8 1,280 - 208

------------------------------- ------ ------------- ------------- -----------

Total non-current assets 6,434 6,137 5,792

------------------------------- ------ ------------- ------------- -----------

Current assets

Trade and other receivables 7,733 5,603 6,062

Cash and cash equivalents 904 3,705 3,172

Total current assets 8,637 9,308 9,234

------------------------------- ------ ------------- ------------- -----------

Total assets 15,071 15,445 15,026

------------------------------- ------ ------------- ------------- -----------

Liabilities

Current liabilities

Loans and borrowings (2,016) (3,051) (2,941)

Lease liabilities (147) (597) (321)

Trade and other payables (5,648) (4,539) (4,610)

Provisions (40) (122) (139)

Total current liabilities (7,851) (8,309) (8,011)

------------------------------- ------ ------------- ------------- -----------

Non-current liabilities

Lease liabilities (78) (115) (87)

Provisions (42) (22) (42)

Retirement benefit liability 8 - (497) -

Total non-current liabilities (120) (634) (129)

------------------------------- ------ ------------- ------------- -----------

Total liabilities (7,971) (8,943) (8,140)

------------------------------- ------ ------------- ------------- -----------

Net assets 7,100 6,502 6,886

------------------------------- ------ ------------- ------------- -----------

Shareholders' equity

Called up share capital 2,053 2,053 2,053

Share premium account 33,244 33,244 33,244

Capital redemption reserve 14,319 14,319 14,319

Other reserves 34,560 34,560 34,560

Retained earnings (77,076) (77,674) (77,290)

------------------------------- ------ ------------- ------------- -----------

Total shareholders' equity 7,100 6,502 6,886

------------------------------- ------ ------------- ------------- -----------

Consolidated condensed statement of cash flows

For the six months ended 30 June 2021

Six months Six months Year

to 30.06.21 to 30.06.20 to 31.12.20

(Unaudited) (Unaudited) (Audited)

Notes GBP'000 GBP'000 GBP'000

-------------------------------------- ------- -------------- ------------- -------------

Cash flows from operating activities

Loss for the period (525) (288) (470)

Adjustments for:

Net finance expense 5 109 185 348

Share-based payment expense (59) 43 90

Income tax charge/(credit) 6 34 (95) 145

Amortisation of intangible assets 2 15 26

Depreciation of property, plant

and equipment 6 9 20

Depreciation and impairment

of right-to-use assets 225 300 540

Lease liability credit - (11) (21)

(208) 158 678

Working capital movements

(Increase)/decrease in trade

and other receivables (1,642) 1,194 764

Increase/(decrease) in trade

and other payables 1,038 (1,473) (1,402)

Decrease in provisions (99) (201) (165)

Payments to retirement benefit

plan 8 (161) (135) (325)

-------------------------------------- ------- -------------- ------------- -------------

Net cash flow used in operating

activities (1,072) (457) (450)

-------------------------------------- ------- -------------- ------------- -------------

Investing activities

Net cash flow used in investing - - -

activities

-------------------------------------- ------- -------------- ------------- -------------

Financing activities

(Repayment)/drawdown of finance

facility (925) 332 222

Principal repayment of lease

liabilities (238) (249) (649)

Interest paid 5 (33) (37) (67)

-------------------------------------- ------- -------------- ------------- -------------

Net cash (used in)/from financing

activities (1,196) 46 (494)

-------------------------------------- ------- -------------- ------------- -------------

Net decrease in cash and cash

equivalents (2,268) (411) (944)

-------------------------------------- ------- -------------- ------------- -------------

Cash and cash equivalents at the beginning

of the period 3,172 4,116 4,116

----------------------------------------------- -------------- ------------- -------------

Cash and cash equivalents at the end

of the period 904 3,705 3,172

----------------------------------------------- -------------- ------------- -------------

Notes to the interim results

1 Accounting policies

Basis of preparation

The condensed interim financial statements comprise the

unaudited results for the six months to 30 June 2021 and 30 June

2020 and the audited results for the year ended 31 December 2020.

The financial information for the year ended 31 December 2020

herein does not constitute the full statutory accounts for that

period. The 2020 Annual Report and Accounts have been filed with

the Registrar of Companies. The Independent Auditor's Report on the

Annual Report and Financial Statements for 2020 was unqualified and

did not contain a statement under 498(2) or 498(3) of the Companies

Act 2006.

The condensed financial statements for the period ended 30 June

2021 have been prepared in accordance with the Disclosure and

Transparency Rules of the Financial Services Authority and with IAS

34 'Interim Financial Reporting'. The information in these

condensed financial statements does not include all the information

and disclosures made in the annual financial statements.

The condensed financial statements have been prepared in

accordance with International Financial Reporting Standards (IFRS)

in a manner consistent with the accounting policies set out in the

Group financial statements for the year ended 31 December 2020.

Going concern

The interim financial statements have been prepared on a going

concern basis. The Directors have reviewed the Group's cash flow

forecasts for the period to 31 December 2022, taking account of

reasonably possible changes in trading performance, including

potential downsides from the ongoing impact of Covid-19. Downside

sensitivities have included reduced levels of new business and in

these scenarios, headroom under the Group's financing facility

meets the Group's funding requirements.

Financial instruments

Unless otherwise indicated, the carrying amounts of the Group's

financial assets and liabilities are a reasonable approximation of

their fair values.

Alternative performance measures

The Group uses certain alternative performance measures to

report its results as stated before non-underlying items. These are

non-IFRS alternative performance measures which the Directors

consider can assist with an understanding of the underlying

performance of the Group and comparison of performance across

periods. They are not a substitute for and are not superior to any

IFRS measure.

Non-underlying items

The presentation of the alternative performance measures of

adjusted EBITDA and adjusted profit/loss before tax excludes

non-underlying items. The Directors consider that an underlying

profit measure can assist with an understanding of the underlying

performance of the Group and comparison of performance across

periods. Items are classified as non-underlying by nature of their

magnitude, incidence or unpredictable nature and their separate

identification results in a calculation of an underlying profit

measure that is consistent with that reviewed by the Board in their

monitoring of the performance of the Group. Events which may give

rise to the classification of items as non-underlying include gains

or losses on the disposal of a business, restructuring of a

business, transaction costs, litigation and similar settlements,

asset impairments and onerous contracts.

Adjusted profit/loss before tax is defined as profit/loss before

tax and non-underlying items.

Adjusted EBITDA is defined as operating profit before finance

costs, tax, depreciation, amortisation and non-underlying

items.

Accounting policies: new standards, amendments and

interpretations

At the date of authorisation of these interim financial

statements, several new, but not yet effective, standards,

amendments to existing standards and interpretations have been

published. None of these have been adopted early by the Group. New

standards, amendments and interpretations not adopted in the

current year have not been disclosed as they are not expected to

have a material impact on the Group.

2 Segmental information

The basis by which the Group is organised and its operating

model is structured is by customer sectors, being the public sector

and the private sector. The reporting of financial information

presented to the Chief Operating Decision Maker, being the Group

board of directors, is consistent with these reporting segments. As

these reporting segments are supported by a combined back office,

there is no allocation of overheads.

Six months to 30.06.21 (Unaudited)

Public sector Private Total

sector

GBP'000 GBP'000 GBP'000

Revenue 18,700 7,298 25,998

Contractor costs (17,034) (6,642) (23,676)

------------------------------------ ---------------- ---------- ---------

External contribution 1,666 656 2,322

------------------------------------ ---------------- ---------- ---------

Six months to 30.06.20 (Unaudited)

Public sector Private Total

sector

GBP'000 GBP'000 GBP'000

Revenue 22,297 7,652 29,949

Contractor costs (20,328) (6,758) (27,086)

------------------------------------ ---------------- ---------- ---------

External contribution 1,969 894 2,863

------------------------------------ ---------------- ---------- ---------

Year to 31.12.20 (Audited)

Public sector Private Total

sector

GBP'000 GBP'000 GBP'000

Revenue 43,283 14,544 57,827

Contractor costs (39,405) (12,861) (52,266)

---------------------------- ---------------- ---------- ---------

External contribution 3,878 1,683 5,561

---------------------------- ---------------- ---------- ---------

3 Revenue

The Group's revenue disaggregated by pattern of revenue

recognition is as follows:

Six months Six months Year to

to 30.06.21 to 30.06.20 31.12.20

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

--------------------------------- ------------- ------------- -----------

Services transferred over time 25,981 29,934 57,790

Services transferred at a point

in time 17 15 37

Revenue 25,998 29,949 57,827

--------------------------------- ------------- ------------- -----------

The Group's revenue disaggregated by primary geographical market

is as follows:

Six months Six months Year to

to 30.06.21 to 30.06.20 31.12.20

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

---------------- ---- ------------- ------------- -----------

United Kingdom 22,707 28,665 55,235

European Union 3,291 1,269 2,577

Other - 15 15

Revenue 25,998 29,949 57,827

---------------------- ------------- ------------- -----------

4 Non-underlying items

Six months Six months Year to

to to 31.12.20

30.06.21 30.06.20 (Audited)

(Unaudited) (Unaudited) GBP'000

GBP'000 GBP'000

------------------------------ ------------- ------------- -----------

Restructuring

- Costs related to employees 366 352 370

- Costs related to premises 34 3 (11)

- Other costs - 89 88

400 444 447

------------------------------ ------------- ------------- -----------

Items are classified as non-underlying by nature of their

magnitude, incidence or unpredictable nature and their separate

identification results in a calculation of an underlying profit

measure that is consistent with that reviewed by the Board in their

monitoring of the performance of the Group. In previous periods,

the Group's results separately presented non-recurring items as a

separate section of the income statement. The directors consider

that all items classified as non-recurring in previous periods are

non-underlying and have reclassified these costs as such.

Non-underlying items during 2021 include costs related to the

restructuring of the Board, including director termination payments

and fees for professional services, along with an impairment to a

right-of-use asset as a result of early vacation of an office

premises.

5 Finance costs

Six months Six months Year to

to to 31.12.20

30.06.21 30.06.20 (Audited)

(Unaudited) (Unaudited) GBP'000

GBP'000 GBP'000

--------------------------------------- ------------- ------------- -----------

Interest expense on financial

liabilities 33 37 67

Interest expense on lease liabilities 4 10 19

Interest income on lease assets (2) (2) (4)

Net finance costs in respect of

post-retirement benefits 74 140 266

109 185 348

--------------------------------------- ------------- ------------- -----------

The interest expense on financial liabilities represents

interest paid on the Group's asset-based financing facilities.

6 Taxation

Six months Six months Year to

to to 31.12.20

30.06.21 30.06.20 (Audited)

(Unaudited) (Unaudited) GBP'000

GBP'000 GBP'000

------------------------------------ ------------- ------------- -----------

Recognised in the income statement

Current tax charge - - -

Deferred tax charge/(credit) 34 (95) 145

------------------------------------ ------------- ------------- -----------

Total tax charge/(credit) 34 (95) 145

------------------------------------ ------------- ------------- -----------

Recognised in other comprehensive

income

Deferred tax charge 187 76 198

------------------------------------ ------------- ------------- -----------

7 Earnings per ordinary share

Basic earnings per share is calculated by dividing the basic

earnings for the period by the weighted average number of fully

paid ordinary shares in issue during the period. Diluted earnings

per share is calculated on the same basis as the basic earnings per

share with a further adjustment to the weighted average number of

fully paid ordinary shares to reflect the effect of all dilutive

potential ordinary shares.

Six months to 30.06.21 Six months to 30.06.20 Year to 31.12.20

(Unaudited) (Unaudited) (Audited)

------------------- ------------------------------- ------------------------------- -------------------------------

Weighted Weighted Weighted

average average average

number Loss number Loss number Loss

Loss of per Loss of per Loss of per

GBP'000 shares share GBP'000 shares share GBP'000 shares share

000's Pence 000's Pence 000's Pence

------------------- ---------- --------- -------- ---------- --------- -------- ---------- --------- --------

Basic loss

per share (525) 102,624 (0.51) (288) 102,624 (0.28) (470) 102,624 (0.46)

Effect of dilutive - - - - - - - - -

options

Diluted loss

per share (525) 102,624 (0.51) (288) 102,624 (0.28) (470) 102,624 (0.46)

As at 30 June 2021 the number of ordinary shares in issue was

102,624,020 (30 June 2020 and 31 December 2020: 102,624,020).

8 Pension commitments

The Group provides employee benefits under various arrangements,

through defined benefit and defined contribution pension plans, the

details of which are disclosed in the 2020 Annual Report and

Accounts. At the interim balance sheet date, the major assumptions

used in assessing the defined benefit pension scheme liability have

been reviewed and updated based on a roll-forward of the last

formal actuarial valuation, which was carried out as at April

2018.

The following estimates have been applied to the IAS 19

valuation:

30.06.21 30.06.20 31.12.20

--------------------------------- --------- --------- ---------

Rate of increase in pensions in 3.7-4.0% 3.6-3.9% 3.6-3.9%

payment

Discount rate 1.8% 1.5% 1.3%

Retail price inflation 3.4% 3.1% 3.2%

Consumer price inflation 2.4% 2.1% 2.2%

--------------------------------- --------- --------- ---------

The surplus has increased by GBP1.1m since 31 December 2020. The

improvement was partly due to a fall in the value of scheme

liabilities and partly as a result of actions taken by the board

and the Trustees to reduce scheme risk.

9 Related party transactions

Transactions between the Company and its subsidiaries, which are

related parties, have been eliminated on consolidation and are

therefore not disclosed.

There were no other related party transactions during the period

(2020: none).

10 Events after the reporting period

There are no events after the reporting period not reflected in

the interim financial statements.

Statement of directors' responsibilities

The directors confirm, to the best of their knowledge:

-- The condensed set of financial statements has been prepared

in accordance with IAS 34 'Interim Financial Reporting';

-- The interim management report includes a fair review of the

information required by DTR 4.2.7R of the Disclosure and

Transparency Rules of the United Kingdom's Financial Services

Authority, being an indication of important events that have

occurred during the first six months of the financial year and

their impact on the condensed set of financial statements, and a

description of the principal risks and uncertainties for the

remaining six months of the year, and gives a true and fair view of

the assets, liabilities, financial position and profit for the

period of the Group; and

-- The interim management report includes a fair review of the

information required by DTR 4.2.8R of the Disclosure and

Transparency Rules of the United Kingdom's Financial Services

Authority, being a disclosure of related party transactions and

changes therein since the previous annual report.

By order of the Board

Mark Braund

Executive Chairman

22 September 2021

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UAOBRAVUKUAR

(END) Dow Jones Newswires

September 22, 2021 02:00 ET (06:00 GMT)

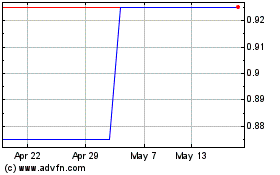

Partway (LSE:PTY)

Historical Stock Chart

From Jan 2025 to Feb 2025

Partway (LSE:PTY)

Historical Stock Chart

From Feb 2024 to Feb 2025