TIDMRBD

RNS Number : 5935P

Reabold Resources PLC

20 October 2021

20 October 2021

Reabold Resources plc

("Reabold" or the "Company")

Victory CPR and Corallian Strategic Review

Reabold, the AIM investing company which focuses on investments

in upstream oil and gas projects, which owns 49.99% of Corallian

Energy Limited ("Corallian"), notes that Corallian has decided to

conduct a formal review of the various strategic options available

to maximise value for all its shareholders.

Corallian has engaged an independent financial adviser, H&P

Advisory Limited ("Hannam & Partners"), to conduct the

strategic review. As part of the review, Hannam & Partners will

approach third parties, who could potentially be interested in

making an offer for up to 100% of the fully diluted share capital

in Corallian.

Corallian holds a 100% interest in the Victory gas discovery in

block 207/1a, located approximately 80km NW of the Shetland Isles,

and 17km from the closest pipeline infrastructure tie in location

(Greater Laggan Area). The Victory project is a relatively simple,

sub-sea tie-back gas development (in 158m water-depth), which has

been fully appraised and requires no additional pre-development

drilling. A Competent Persons Report (CPR) has recently been

completed by RPS Energy Limited (RPS), following the finalisation

of both static and dynamic modelling, together with well / network

optimisation studies for the development. RPS estimates a total

Victory field 2C or best / mid case technically recoverable

resource of 179bcf dry gas (1) . This estimate represents a 14%

increase over the previous interim CPR completed by SLR Consulting

in December 2020 of 157bcf of technically recoverable gas.

Corallian's updated 2C economic valuation (NPV10) of Victory, based

on an historical average gas price valuation of 50p/therm, has

increased from GBP146 million to GBP193 million. Corallian remains

on track to submit its draft Victory Field Development Plan to the

OGA before the end of 2021, together with the Environmental

Statement for the project which will be lodged concurrently with

BEIS (OPRED).

The strategic review is being conducted by Corallian's Board.

Parties with a possible interest in making a proposal should

contact Hannam & Partners on the contact details set out

below.

The strategic review is at an early stage and there is no

guarantee that it will result in any offer being made (in whole or

in part) for Corallian. Reabold remains supportive of Corallian,

its Board, and the timing of this strategic review. Reabold

believes Corallian's flagship Victory gas development presents a

compelling investment opportunity to any prospective investor.

Stephen Williams, co-CEO of Reabold, commented:

"We are extremely pleased with the progress that has been made

on the Victory project over the last year, and the development

opportunity continues to look highly attractive, particularly

against the commodity backdrop we are experiencing at present.

"Reabold is in full agreement with the Corallian board that the

time is right to assess options going forwards via this strategic

review, and that our significant exposure to the Victory project

will at the appropriate time deliver considerable value to Reabold

and our shareholders."

(1) the 2C or best / mid case technically recoverable contingent

resources estimate is a Corallian derived aggregate of "contingent

resources - development pending" (145bcf) and "contingent resources

- development unclarified" (34bcf)" from the RPS CPR (dated October

2021)

Pursuant to the requirements of the AIM Rules - Note for Mining

and Oil and Gas Companies, the technical information contained in

this announcement has been reviewed by Dr Jeremy Jarvis as a

Qualified Person. Jeremy has more than 35 years' experience as a

petroleum geologist, holds a BSc in Geology from the University of

Dundee and a Ph.D. from Imperial College, University of London. He

is a member of the American Association of Petroleum Geologists and

the Petroleum Exploration Society of Great Britain.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as amended by The

Market Abuse (Amendment) (EU Exit) Regulations 2019.

For further information, contact:

Reabold Resources plc c/o Camarco

Sachin Oza +44 (0) 20 3757 4980

Stephen Williams

Strand Hanson Limited - Nomad & Financial

Adviser

James Spinney

Rory Murphy

James Dance +44 (0) 20 7409 3494

Stifel Nicolaus Europe Limited - Joint

Broker

Callum Stewart

Simon Mensley +44 (0) 20 7710 7600

Ashton Clanfield

Panmure Gordon - Joint Broker

Hugh Rich

Nick Lovering +44 (0) 207 886 2733

Camarco

James Crothers

Billy Clegg

Rebecca Waterworth +44 (0) 20 3757 4980

About H&P Advisory Limited

H&P Advisory Limited ("Hannam"), which is authorised and

regulated by the FCA in the United Kingdom, is acting exclusively

as financial adviser to Corallian and no one else in connection

with the subject matter of this Announcement, and shall not be

responsible to anyone other than Corallian for providing the

protections afforded to clients of Hannam, or for providing advice

in connection with the subject matter of this Announcement. Neither

Hannam nor any of its subsidiaries, branches or affiliates owes or

accepts any duty, liability or responsibility whatsoever (whether

direct or indirect, whether in contract, in tort, under statute or

otherwise) to any person who is not a client of Hannam in

connection with this Announcement, any statement contained herein

or otherwise.

H&P Advisory Limited

Samuel Merlin

Sean Nash

+44 (0) 20 7907 8500

Notes to Editors

Reabold Resources plc is an investing company investing in the

exploration and production ("E&P") sector. The Company's

investing policy is to acquire direct and indirect interests in

exploration and producing projects and assets in the natural

resources sector, and consideration is currently given to

investment opportunities anywhere in the world.

As an investor in upstream oil & gas projects, Reabold aims

to create value from each project by investing in undervalued,

low-risk, near-term upstream oil & gas projects and by

identifying a clear exit plan prior to investment.

Reabold's long term strategy is to re-invest capital made

through its investments into larger projects in order to grow the

Company. Reabold aims to gain exposure to assets with limited

downside and high potential upside, capitalising on the value

created between the entry stage and exit point of its projects. The

Company invests in projects that have limited correlation to the

oil price.

Reabold has a highly-experienced management team, who possess

the necessary background, knowledge and contacts to carry out the

Company's strategy.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEAEENFLDFFAA

(END) Dow Jones Newswires

October 20, 2021 02:00 ET (06:00 GMT)

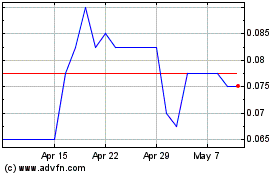

Reabold Resources (LSE:RBD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Reabold Resources (LSE:RBD)

Historical Stock Chart

From Apr 2023 to Apr 2024