TIDMRKW

RNS Number : 3334H

Rockwood Strategic PLC

23 November 2022

Rockwood Strategic Plc

("RKW or the "Company")

Interim results for the six months to 30 September 2022

Rockwood Strategic Plc (LSE: RKW) is pleased to announce its

unaudited results for the six months ended 30 September 2022 (the

"Period").

Highlights for the period:

-- Net Asset Value (NAV) Total Return in the Period of -10.4% to

1446.7p/share which compares to the FTSE Small Cap (ex-ITs) of

-20.3% and FTSE AIM All Share of -22.6%

-- Total Shareholder Return in the Period was -0.35%. At Period

end the Company traded at a discount of 2.2% to NAV

-- No. 2 ranked fund by Total Shareholder Return in the AIC UK

Small Companies sector over the last 6 and 12 months, achieving

0.9% positive performance whilst the FTSE Small Cap Index (ex-ITs)

fell 26.6% and the AIM All-share even more, down 35.2% (LTM)

-- NAV Total Return performance in the three years to 30

September 2022 of 44.3% which compares to the FTSE Small Cap

(ex-ITs) of 6%. The Total Shareholder Return in the same three year

period was 65%, ranked No.1 in the AIC UK Small Companies

sector

-- Investment gains realised in the Lakes Distillery Bond

delivered a 21.6% IRR and GBP3.1m cash

-- Net cash of GBP2.4m at the end of the Period (representing

6.6% of NAV)

-- Seven new investments were made across a range of industry

sectors

-- The Investment Manager is comfortable that overall the

portfolio is well financed. In summary 9 holdings have a net cash

position, 4 are lowly leveraged and 2 have elevated debt

Noel Lamb, Chairman of Rockwood Strategic Plc, commented:

"Remaining entirely immune to the tumultuous conditions in

markets is an impossible task for an active small companies

investment strategy. The Board is therefore pleased that the

portfolio is demonstrating relative resilience when compared to

peers and small company indices. We are reassured the multi-cycle

experience of the investment manager is clearly supporting a

proactive approach to identify opportunities to deliver future NAV

growth.

During the Period, shareholders overwhelmingly voted to re-start

actively investing in U.K. small companies under our differentiated

Investment Policy and also to transition from AIM to a premium

listing on the main market of the London Stock Exchange. The

Company was renamed, Paul Dudley joined the Board and a number of

service providers were transitioned to improved and lower cost

solutions. Despite the market challenges the period was one of

significant progress and change for the Company. We are confident

the strategy, portfolio and Investment Manager can continue to

navigate the environment well and deliver future value creation for

shareholders."

Richard Staveley, Fund Manager, Harwood Capital, commented:

" We are excited about the upside potential in the portfolio, a

lot of which, in our view, could be realised through corporate

activity in due course as trade buyers and private equity appraise

the significant undervaluation and profit potential of our

holdings. Our 'value' bias is serving shareholders well, providing

a 'margin of safety' and we are re-building the portfolio with

outstanding investment opportunities to drive NAV over the

medium-term. There is no doubt the economic environment will remain

challenging, but we observe highly depressed valuations, deeply

pessimistic assumptions and even greater inefficiency in our

broadly ignored target universe. We are comfortable our investments

in the overall portfolio remain well financed. This is an

attractive backdrop for investors with capital, patience and value

discipline. We have all three and are clearly aligned with

shareholders."

The full version of the RKW interim report will be available on

its website shortly at www.rockwoodstrategic.co.uk

For further information, please contact:

Rockwood Strategic Plc

Noel Lamb Chairman noellamb@finnebrogue.co.uk

Harwood Capital LLP Christopher

Investment Manager Hart 020 7640 3200

Singer Capital Markets Advisory James Maxwell

LLP Alex Bond

Broker James Fischer 020 7496 3000

About Rockwood Strategic Plc

RKW is an Investment Trust quoted on the London Stock Exchange

that invests in a focused portfolio of smaller UK public companies.

The strategy identifies undervalued shares, where the potential

exists to improve returns and where the company is benefitting, or

will benefit, from operational, strategic or management changes.

These unlock, create or realise shareholder value for investors

About Harwood

Harwood Capital LLP ("HC LLP") was incorporated in 2003 and is

the investment manager for Rockwood Strategic Plc, and of the

Harwood Private Equity funds and of Harwood Private Clients. It is

an investment adviser to North Atlantic Smaller Companies

Investment Trust Plc.

HC LLP is a wholly owned subsidiary of Harwood Capital

Management Limited and is authorised and regulated by the Financial

Conduct Authority ("FCA"), authorisation number 224915.

Led by Christopher Mills, the funds managed and advised by HC

LLP follow an active value approach towards the businesses in which

they invest.

Chairman's statement for the half year to 30 September 2022

There is a marked positive energy about Rockwood Strategic as it

enters a phase of rejuvenation. Following overwhelming shareholder

support at General Meetings in April and post-Period end in

September, our strategy has re-started actively investing for the

future. The team at our investment manager, Harwood Capital, is led

by the returning fund manager Richard Staveley. The Investment

Manager has been able to take advantage of weak markets to initiate

new positions and improve diversification.

Investment performance has been resilient against small cap

indices and better than the UK small companies peer group. The

on-going cost base has been reduced following a thorough review by

the Investment Manager, though some exceptional costs have been

incurred during the period due to the successful migration of the

Company from AIM to a premium listing on the Main Market of the

London Stock Exchange. As part of this transition, the Company also

put in place a placing programme, providing it with additional

flexibility to raise capital to finance future investments. This

move, supported by shareholders at the General Meeting in

September, will improve our tax efficiency and should widen the

potential investor base. The Board would like to build further

scale for the strategy, which would both cast the investment net

wider and improve our cost ratios. It is helpful, therefore, to

observe that the discount during the period narrowed markedly to

2.2% of NAV at the time of writing.

During the period, Graham Bird stepped down from the Board and

was replaced by Paul Dudley. I would like to thank Graham once more

for his service to the Company, welcome Paul to the Board and

express my gratitude to Ken for all his work over the transition

period and his source of corporate knowledge. The Board is also

pleased to observe the formation of Rockwood's Investment Advisory

Group. These highly experienced investors and financial

professionals will act as a sounding board and should enhance the

investment process for selection and holding of our larger

investments. Rockwood Strategic has had an energetic half year of

progress which we seek to build upon in the period ahead.

Noel Lamb

Chairman, Rockwood Strategic Plc, 23 November 2022

Investment Manager's report

Introduction

We were delighted to receive the support of shareholders to

re-start this successful investment strategy during the period. We

are fully aligned with you through our significant shareholding and

performance linked fee arrangement.

The structural benefits of Rockwood Strategic's closed-end

nature are much clearer to see during phases of market weakness

like the one we are experiencing. Many open-ended small cap fund

managers are being forced to generate liquidity to meet investor

redemption requests as risk appetite has waned and sentiment

towards the UK soured. Just when a medium-term investment horizon

is most needed, many are forced to sell thinly traded stocks;

generally a costly exercise prone to generating much future

regret.

The benefits of our differentiated style are also plain to see.

During the period we increased the number of holdings to a still

highly concentrated fifteen. Stock specific risk and hence stock

specific returns are the primary factors producing the NAV result.

This is not a widely diversified small cap fund delivering roughly

the average of an out of favour segment of the market. Crestchic, a

company we have been intimately involved with delivering

shareholder value from, is an excellent example and was up 63.6%

during the period, an 83.9% outperformance of the average FTSE

small cap share. Self-help, operational, management and strategic

improvements and international sales drown out any impact from the

revolving door of UK political leadership. It remains very

undervalued and we expect further outperformance uncorrelated with

market returns.

Our 'Value' bias, discipline and philosophy must be highlighted.

Your Investment Manager has been warning about the over-valuation

of 'growth' stocks for some time. The regime change underway in

monetary policy has provided the catalyst for change. Some

companies will indeed drive shareholder value through earnings

growth going forward. However, there is unlikely to be a return to

the heady valuation multiples of recent years for a long time. The

artificial tide of low interest rates which has lifted all growth

boats, irrespective of quality (or likelihood of long-term

sustainability), has well and truly gone out. Many market

participants are still adjusting to the implications for their

stated styles and holdings. We are excited about our free-cash flow

and rare value focused approach given the deep discounts to

intrinsic value we assess across our investments. We expect

accounting standards, balance sheet detail and the self-financing

capability of corporate strategies to come under enhanced scrutiny

more widely now. More companies in need of swimming trunks will be

exposed in the forthcoming period. The portfolio's holdings will

generate increased profitability through better operational

execution, either recovering a mean reversion in returns or

achieving the appropriate levels of margin validated by relevant

peers. Progress, if ignored, will inevitably lead to shareholder

value realisation via third party interest.

Market commentary

The world's central banks, led by the Federal Reserve, have

embarked on material interest rate rises for the first time in

decades. In the UK interest rates fell from 13.88% in October 1990

to 3.5% in July 2003 (-10.25% over 13 years). They then rose to

5.75% by July 2007 (+2.25% over 4 years). They were then cut to

0.5% in March 2009 (-5.25% over 2 years, back end loaded). In

February 2022 they were still 0.5%, 13 years later, but by the end

of this reporting period had been raised to 2.25%. They are clearly

going higher (and have been raised post period end to 3%). The key

point is, the scale and speed of interest rate rises has not been

experienced by a very large number of market participants either

ever or not for a very long time. Nor has the much changed world

economy and current financial system been tested using 'live fire'

for this level of stress.

Investors, and indeed consumers and businesses, are thus very

nervous and worried. Sentiment surveys of all three are already at

historical lows. The 'cost of money' drives all. It has driven the

'discount rate' which when low has inflated the valuations of

long-duration assets and 'growth' equities. It has driven the cash

interest coverage ratios and hence borrowing capability of

corporates, private equity deal structures, domestic mortgage

borrowers and the 'shadow finance' industry. It drives 'liquidity'

itself. This is being drained out of the financial system and hence

the economy, leading to an inevitable recession. This is actually

desired by the Central Banks whose mandates are dominated by

inflation targeting which has broken loose. Unemployment, reduced

demand and, as Jerome Powell called it, "pain" is needed to re-tame

inflation expectations after they were unleashed by massive

monetary and fiscal policy easing during the COVID-19 pandemic and

exacerbated by supply chain shortages and the Russian invasion of

Ukraine, in particular impacting energy markets.

UK unemployment is 3.6%, the lowest since 1974, so an increase,

whilst difficult for many, will represent a movement back to a

multi-decade mean. Inflation hit 10.1%, the highest since 1982.

Avoiding the destruction to real wealth across the whole

population, if this was to be sustained, is broadly agreed to be

worth the costs created to bring the rate under control. However,

society has not had its pain threshold tested to this extent for a

number of cycles as bail-outs, monetary policy largesse and fiscal

support has targeted periods of stress. Authorities are out of

ammunition whilst inflation remains high. It is likely pressure to

ease the situation will result in a higher level of accepted and

targeted inflation rate.

Crypto has not delivered inflation protection or safety as

billed by its wounded tribe of 'get rich quick' anti-establishment

protagonists. Bond owners must be embarrassed they didn not act in

the face of trillions of obviously overpriced negative yielding

debt and low grade corporate bonds. Equity markets have seen a

severe de-rating of high multiple stock; the "no-brainers" of

yesteryear. 2022 is likely to be the worst year for IPO issuance

for a very long time. Many investors are starting to properly

reflect on the relative attractiveness of low liquidity or leverage

enhanced specialist asset classes and bond-like equities whose main

calling card of a reasonable dividend yield in a world of very low

risk-free rates is now being undermined.

UK equities, dominated by a relatively small group of mega-cap

international businesses and a differentiated sector composition to

the US market, have been outperforming. The market is efficient

enough to know that the Dollar earning, inflation-linked, well

financed UK listed companies are not a fair read through to the

shambles which has been UK political leadership or its stagnant

economy. Moreover, UK equities are very good value when compared to

history, global equities or cash earnings.

We believe in a transparent communication of our appraisal of

markets. Surely sentiment and valuations alone suggest the market

bottom is near? We are not in the business of giving forecasts in

such matters. However, we would anticipate limited sustained market

recovery until 'core' inflation is demonstrably falling and the

market can have real confidence to anticipate the commencement of

monetary easing. One step at a time, though: central banks are

still tightening. We believe the portfolio holdings are deeply

undervalued, almost all are very well financed, all have

operational improvements and many strategic improvements too which

can drive shareholder value irrespective of the doom and gloom. We

do expect takeover interest to emerge for a number of our holdings

due to their attractive cash flow generation and market positions

and expect realisations to produce material NAV uplifts and cash

for re-investment. We do expect a recession and market profit

expectations to fall further and have built this backdrop into the

margin of safety we expect in our holding valuations and the extent

of profit recovery we are expecting from the businesses and their

management teams.

Portfolio performance

The portfolio is very concentrated and therefore it should be

expected that over any shorter period, such as a year, a dominant

stock or two will drive performance.

Performance (all H1 2022 1 year 3 year

indices are excluding

investment trusts)

------------------------ -------- ------- -------

RKW TSR -0.35% 0.9% 65.0%

-------- ------- -------

RKW NAV Total Return -10.4% -8.4% 44.3%

-------- ------- -------

FTSE Small Cap Total

Return (SMXX) -20.3% -26.6% 6.0%

-------- ------- -------

FTSE All Share Total

Return (ASX) -8.3% -4.0% 2.4%

-------- ------- -------

Source: Bloomberg and Company as at 30 September 2022

The NAV fell due to modest weakness across the portfolio despite

good financial results across almost all holdings, and exacerbated

by a profit warning at Pressure Technologies, offset by the very

strong performance of Crestchic.

Portfolio highlights & investment activity

The period ended with 15 holdings, of which the top 10

constitute 82% of NAV.

Seven new investments were made across a range of industry

sectors such as City Pub Group Plc within consumer, Argentex Group

Plc in FX services, Galliford Try Holdings PLC in construction, RM

Plc in educational services and Finsbury Food Group Plc in food

manufacturing. All trade at a deep discount to our assessment of

intrinsic value; all have material upside to historic or industry

profit margins; and all are highly cash generative. We have

identified catalysts to unlock, create or realise shareholder value

in each. We ended the period with net cash of GBP2.4m (representing

6.6% of NAV).

Investment gains were realised in the Lakes Distillery Bond

which delivered a 21.6% IRR and GBP3.1m cash. There were no

unlisted investments in the portfolio at period end. 9 holdings

have a net cash position, 4 are lowly leveraged and 2 have elevated

debt.

Top ten shareholdings (30 September GBPm Shareholding Portfolio

2022) in company NAV

------------------------------------- --------- ------------ ---------

Crestchic Plc GBP10.5m 14.0% 28.7%

--------- ------------ ---------

Flowtech Fluidpower Plc GBP3.7m 5.8% 10.2%

--------- ------------ ---------

Centaur Media PLC GBP3.7m 6.0% 10.1%

--------- ------------ ---------

M & C Saatchi Plc GBP2.9m 1.7% 7.7%

--------- ------------ ---------

Van Elle Holdings Plc GBP2.2m 5.5% 5.9%

--------- ------------ ---------

Smoove Plc GBP1.7m 8.1% 4.6%

--------- ------------ ---------

City Pub Group Plc GBP1.6m 2.8% 4.3%

--------- ------------ ---------

RM Plc GBP1.4m 6.0% 3.7%

--------- ------------ ---------

Bonhill Group GBP1.3m 19.4% 3.5%

--------- ------------ ---------

Galliford Try Holdings PLC GBP1.2m 0.8% 3.3%

--------- ------------ ---------

Other investments GBP4.1m - 11.4%

--------- ------------ ---------

Cash and other working capital items GBP2.4m - 6.6%

===================================== ========= ============ =========

Total NAV GBP36.7m 100%

--------- ------------ ---------

Crestchic Plc - 28.7%NAV, 14% shareholding, key contributor

Crestchic was formerly called Northbridge Industrial Solutions,

changing its name earlier this year. The business manufactures and

hires specialist electrical equipment, primarily 'loadbanks' which

test power reliability.

The company underwent management and Board evolution from 2020

onwards as Stephen Yapp joined the Board as NED, the CEO stepped

down and the Chairman, Peter Harris, took on an executive role and,

in early 2022, Nicholas Mills, of the Rockwood Investment Team was

also appointed an NED. During this period an experienced external

COO was also appointed.

The strategy was re-assessed leading to the sale of the poorly

performing Tasman Division, allowing focus on the Crestchic

business and removing material oil & gas exposure. The Group's

ROCE record had been patchy at best prior to 2020 and this has now

become a key focus for the company, with outstanding results.

Crestchic's markets have been undergoing structural change as

the requirements and impact of 'energy transition' are growing

end-market demand for Loadbanks. At the same time the Data Centre

market has continued to grow at pace and is now a rich source of

on-going customer demand from the behemoths in this sector. This

has created burgeoning order books for the business and supported a

material expansion of the manufacturing footprint with limited

risk. An international business, Crestchic is underrepresented in

the U.S. which offers a long-term growth opportunity, whilst new

European leadership is also having a positive effect on sales.

Despite the investment in the factory expansion and measured

on-going capital expenditure in the hire fleet, the company now has

a strong Balance Sheet and is returning to the dividend list

supported by prodigious free cash flow. The 'spot' valuation

multiples on market forecasts for Crestchic near term profitability

remain low, as there has been only a modest re-rating in the

context of very material profit upgrades. We believe the business

has a very strong future now the recovery phase has concluded and

anticipate further material upside to the shares.

Pressure Technologies Plc - 2.8% NAV, 13.8% shareholding, key

detractor

This has not been a successful investment for the strategy. We

believe the initial assessment of the company's financial position

and cashflow generation capabilities was incorrect and thus the

company has required material equity issuance to support the

business. Management appointed in late 2018 to deliver a turnaround

of the business has therefore had a very challenging situation to

address, which has been exacerbated by negative external

factors.

The core business 'Chesterfield Special Cylinders' is a highly

regarded business with a long-held reputation for quality and a

freehold manufacturing site in Sheffield of over 100,000 sq. ft.

This business makes mid-teen operating margins, when averaged

through the cycle, and has an outstanding client list in defence

where it provides manufactured cylinders of a critical nature to

the Bae Systems run Dreadnought submarine programme and other

allied navies. The problem is that these contracts are very lumpy

and very material and have not been behaving themselves with

regards to expected timelines and Pressure Technologies' accounting

periods. Within a large business this wouldn't be as much of an

issue as for the very small listed Plc that it is. Supply chain

disappointments have regularly caused problems too.

The business has one clearly defined piece of luck though. Its

capabilities are very well suited to the needs of the emergent

Hydrogen economy. Once a pipedream, this is now becoming reality.

Chesterfield cylinder sales into the Hydrogen economy are growing

strongly and may even double in size in the coming year given the

developing pipeline of orders and relationships from major

operators in this end-market.

The PMC division at Pressure Technologies is highly exposed to

oil & gas and was created by the prior management team via a

collection of acquisitions. End markets have been improving and

consequently profitability, aided by restructuring, is beginning to

emerge after many years of disappointment, however, we have long

argued this business should be exited.

Recently a combination of trading issues, working capital

cycles, delayed orders and low PMC profitability have led to

financial stress, again. We are heavily engaged with the company

and will update on progress at Rockwood's full year results. The

business is now capitalised at c.GBP10m, with sales estimated of

c.GBP26m and growth expected next year due to the next imminent

large submarine order and further hydrogen progress.

New Investments - cumulative 19.9% NAV

These were all classified by the manager as either

"springboards" or "opportunities" and as such each individual

investment did not exceed 4% of NAV at inception. We target

eventually 15-25 of these style holdings as Rockwood builds, we

currently have 8. The former are investments which meet our

investment criteria of being able to deliver 15% IRRs over a time

horizon of five years (thereby doubling in value) which have the

opportunity for, or are experiencing, operational, strategic and

management or Board changes which should deliver, unlock or create

shareholder value. Once identified, we ideally want to invest 5-15%

of NAV in order to have material exposure within the strategy and

also a stake in the company of similar size, ensuring an

influential voice with which we can engage with the company and

stakeholders. However, regularly the opportunity to establish such

a stake may not be initially available, hence a 'springboard'

position is purchased with a view to increase in time. The latter

set of 'opportunities' are stocks which meet our investment

criteria but are situations where we do not anticipate taking an

active lead role as a shareholder, often because another party

already is and where the appropriate changes to drive shareholder

value are already underway but the valuation still highly

attractive. These tend to have a higher level of stock liquidity

than the rest of the portfolio.

During the period 7 new positions were established. We will

highlight two at this Interim stage of the year.

City Pub Group

The list of woes befalling the British pub sector is lengthy. If

one goes back far enough it is possible to recall the impact of the

smoking ban, followed not long after with regulation about the use

of 'fruit machines', emptying the swaying wallets of lingering

customers. In recent years cost pressures around the minimum wage

have occurred whilst the competition by high street eateries vs

'good pub grub' intensified. Disruption to EU worker supply post

Brexit further complicated matters. COVID-19 lockdowns, social

distancing and staff absences severely compromised operations and

profitability despite various support packages, but to us, the

public's eagerness to get back to the pub as soon as possible with

friends and family, demonstrated the true value of the social,

tribal, community and entertainment experience the format means and

provides to millions of people. Just as the banging of pans slips

from memories they have entered a huge consumer spending squeeze,

alongside energy cost pressures. If candles and open fires are the

result, then the 'taverns' of old will have come full circle.

City Pub Group consists of 42 establishments and has been

created by Clive Watson. He has a track record of operational and

value delivery in the sector having built and then sold his prior

pub group successfully to Greene King. His growth ambitions were

significant at launch and received material investor support on IPO

in 2017 and consequently a premium valuation rating. The macro

events since have eradicated that and the pace of acquisition has

naturally slowed. Operations are clearly quality with impressive

sites in a range of sought after locations.

Despite the omicron variant of Covid, H1 2022 Ebitda margins

were 16.8%, these pubs are not JD Wetherspoons. A disposal of 4

pubs in March raised GBP17.1m putting the balance sheet in an

almost unleveraged position. The Board's most recent estimate of

the value of the largely Freehold estate based on an independent

valuation exercise was GBP150m. The shares are thus valued on a

deep discount to asset value and have long-term cash generative

capabilities.

We believe strategic evolution is underway. The company has a

minority stake in a small chain of pubs which it is likely to take

full control of at a discount to market values and the new opening

program has been carefully focused with c. 2-4 on the cards during

the next 18 months. A strong balance sheet and tumultuous end

market may provide the opportunity to acquire fantastic new sites

at discounted prices, but the Board has quite rightly observed that

their own shares are valued at even a greater discount and have

thus embarked on a buyback programme. The stock market will need to

start valuing the group fairly, or other avenues for value

realisation will inevitably be considered.

Argentex

This business is targeting a clear opportunity within a very

large market, the provision of Foreign Exchange services to small

and medium sized corporations, nearly 1400 of them most recently

reported. This should be done well by the large banks, but as with

so many services by these bureaucratic behemoths, burdened by

legacy technology, massive scale and huge regulation, it isn't.

Argentex are able to offer better value to their clients and better

service.

Their record speaks for itself with sales growing from GBP13m in

'18 to GBP22m '19, GBP29m in '20, GBP34m in '22, Full year

expectations, appear conservative after first half sales of

GBP27.4m, up 75% on the previous year. Ongoing growth appears

achievable, however it is not this which attracts us (despite the

addressable market being GBP6bn in the UK alone and they are just

getting going in the Netherlands and Australia). It is the

fantastic returns the company generates and the very low valuation.

ROCE in the last financial year was 25.1% up from 21.3% in '21. The

operating margins are comfortably in the 20s but should reach peers

levels of 40% with scale.

Argentex is not a holiday money, app-based FX service, most

transactions require discussion with the client, however technology

enabled services are provided and indeed this is an area that the

company has admittedly needed to improve in, thus making a highly

impressive and experienced senior hire to drive capabilities

forward. It also does not take direct FX risk itself and has a

strong balance sheet to support the service.

A short period of modest growth was not taken well by investors

and the company had allowed itself to have overly stretching IPO

profit forecasts which it subsequently missed. A co-founder

departed and with the general market malaise, a material de-rating

of the shares allowed us to establish a position. Advisers have

been replaced, a new FD also appointed and we expect a period of

delivery to lead to a material re-rating of this highly cash

generative business.

Portfolio Update

Flowtech Fluidpower is a distributor of hydraulic and pneumatic

components into a wide range of customers and industries. Roger

McDowell became Chair in 2020, formerly a NED of past portfolio

'winner' Augean and Jamie Brooke, a member of Rockwood's Investment

Advisory Group joined as a NED earlier this year. The business has

considerable scope to improve its operating performance and returns

as the critical asset turn ratio is markedly below target levels.

The business has spent a period integrating prior acquisitions and

modernising its e-commerce capabilities, however recent stock build

disappointed us and we anticipate a wind-down and strong cash

generation in H2 which would bring elevated debt back down to a

more conservative level. Their H1 produced sales growth of 4.1% and

mild gross margin improvement. We believe the business should be

capable of double-digit operating margins, offering material scope

for profit growth with market expectations of c.7.5% in the current

year. If achieved alongside some further modest growth, GBP12m of

earnings before interest and tax should be achievable, implying a

recovery EV/Ebit multiple of 6.5x, when industry transactions fo

distributors routinely occur in excess of 12x.

Centaur Media provides business training and consultancy,

information and premium content to the Marketing and Legal sectors.

Richard Staveley, of the Rockwood Investment Team, was appointed as

a NED earlier this year. The transformation of the business over

the last few years has almost completed. This involved the exiting

of print (now less than 1% of sale), selling various other assets

in other industry verticals and a material cost-restructuring

programme to build profitability. Management have been targeting a

23% Ebitda margin in 2023. In their H1 sales grew 8% and the Ebitda

margin improved further to 17%. Cash is therefore building, now

over GBP14m. The company offers growth, high levels of

profitability and free cash flow generation from its activities

which include the iconic brand 'The Lawyer'. The EV/Ebitda on

market forecasts for 2023 is c.4.5x. This is an exceptionally low

valuation for a business of this transformed quality.

M&C Saatchi is an internationally renowned advertising and

communications agency. There was considerable change to both

management and the Board in 2020 which coincided with weakness in

the shares due to accounting, financial and acquisition funding

issues. A recovery plan was put in place which was interrupted by

takeover approaches from two parties. These have both been rejected

by shareholders, including ourselves, since period end given their

offers grossly undervalue the business. This has proven a

time-consuming, distracting and expensive process for all, however

the underlying business had been resilient with 9.6% growth in H1

and improved profit margins of 14% (up 3.5%). The company has

reiterated its expectation of GBP31m of profit for the year with

material growth expected in 2023 and a cash balance of nearly

GBP40m. The company is valued at c. GBP165m. The company can now

re-engage with investors articulating its future potential.

Bonhill is an international B2B media business providing

Business Information, Events and Data & Insight propositions to

the global Financial Services community. Flagship brands include:

InvestmentNews, ESG Clarity, Portfolio Adviser, Fund Selector Asia,

Expert Investor Europe, UK Adviser and International Adviser.

Richard Staveley, of the Rockwood Investment Team, was appointed as

a NED earlier this year. During the period a new CEO has been

appointed, a diverse group of non-core smaller media assets have

been sold, unlocking cost savings and the business has entered a

formal sale process. Trading has been challenging, given market

conditions and the US business has undergone material personnel

change to support a turnaround in performance. On-going sales for

the year are expected to be over GBP14m. The business has modest

net cash and Rockwood has extended the company a short term loan

facility at 2% monthly compound interest, if needed, to finance any

near term cashflow needs. The company is clearly subscale for

public markets, yet has proven, established brands and excellent

blue chip clients. We await the outcome of the formal sale process

and note that the company has received a strong level of

interest.

Across the rest of the portfolio robust results were issued by

Galliford Try, ahead of market expectations. Their margins continue

to progress to industry averages whilst their extremely strong

balance sheet is now supporting a stock buy-back. Finsbury Food

also generated resilient results where huge industry cost pressures

were successfully offset through higher pricing and operating

efficiencies. Titon is starting the process of change with new CEO,

FD, and 2 new NEDs appointed during the period. Its current

operating performance is poor and the business has considerable

scope for improved returns, profitability and, we believe,

underappreciated asset value. Van Elle produced excellent results

also ahead of market expectations. 48% revenue growth led to much

over 100% Ebitda improvement, whilst the business retains a net

cash position for investment and enhancing bolt-on acquisitions.

Their market leading position in Rail infrastructure services will

benefit from entering an expected robust phase of industry spend,

not least on HS2. Seraphine has been struggling alongside all

internet based retailers with the huge increases in

customer-acquisition costs. Their stock position is elevated, but

the brand well positioned and gross margins holding firm. Having

listed at GBP150m valuation last year, we see potential to meet our

target returns from the current market value of GBP9m. Finally, we

have purchased RM Plc a leading educational supplies, service and

technology provider. The company has poorly executed an internal IT

project, alongside warehouse consolidation with a consequently

negative impact on financial performance. Rising debt and falling

profits have been punished by a risk averse market. We believe

there is a huge potential for value realisation from strategic and

operational change at the company and have since period end

acquired 7.9% of the company.

Conclusion

We remain confident in our assessment of a large undervaluation

of the portfolio holdings by the stock market. Identified measures

to build profitability should offset, and in many cases exceed,

negative impacts from a challenging external environment. Robust

balance sheets are in evidence, protecting the downside. We have

material influence through our large stakes and Board

representations to help ensure shareholder value remains a focus

and strategies evolve appropriately. We continue to identify new

investments to deliver on our investment objectives and our

pipeline is growing at pace.

Richard Staveley

Investment Manager, Rockwood Strategic Plc, 23 November 2022

Unaudited Condensed Statement of Comprehensive Income

for the six months ended 30 September 2022

Six months Six months

to to Year to

30-Sep-22 30-Sep-21 31-Mar-22

GBP'000 GBP'000 GBP'000

Notes Unaudited Unaudited Audited

--------------------------------------- ------ ----------- --------------------- ----------

(Loss)/gains on investments at

fair value through profit or loss 5 (3,850) 17,845 20,007

--------------------------------------- ------ ----------- --------------------- ----------

Revenue

Bank interest income 35 - 1

Loan note interest income 232 312 563

Portfolio dividend income 226 55 99

493 367 663

Administrative expenses

Investment management fees 10 (52) (562) (593)

Performance fees 6 - (2,567) (2,772)

Director fees and other staff costs 10 (48) (84) (173)

Other costs 11 (827) (612) (1,709)

--------------------------------------- ------ ----------- --------------------- ----------

Total administrative expenses (927) (3,825) (5,247)

--------------------------------------- ------ ----------- --------------------- ----------

(Loss)/profit before taxation (4,284) 14,387 15,423

Taxation 8 - (1,500) (1,580)

--------------------------------------- ------ ----------- --------------------- ----------

(Loss)/profit for the financial period/year (4,284) 12,887 13,843

----------------------------------------------- ----------- --------------------- ----------

Attributable to:

- Equity shareholders of the Company (4,284) 12,887 13,843

Basic and Diluted (loss)/earnings

per ordinary share for profit from

continuing operations and for profit

for the period/year (pence) 9 (168.58p) 370.23p 428.76p

--------------------------------------- ------ ----------- --------------------- ----------

There are no components of other comprehensive income for the

current period (30 September 2021: nil, 31 March 2022: nil), all

income arose from continuing operations.

Unaudited Condensed Statement of Financial Position

as at 30 September 2022

30-Sep-22 30-Sep-21 31-Mar-22

GBP'000 GBP'000 GBP'000

Note Unaudited Unaudited Audited

----------------------------------- ----- ---------- ------------ ----------

Non-current assets

Investments at fair value through

profit or loss 5 34,318 67,987 31,609

----------------------------------- ----- ---------- ------------ ----------

34,318 67,987 31,609

Current assets

Trade and other receivables 125 105 1,019

Cash and cash equivalents 4,970 1,833 10,507

----------------------------------- ----- ---------- ------------ ----------

5,095 1,938 11,526

----------------------------------- ----- ---------- ------------ ----------

Total assets 39,413 69,925 43,135

----------------------------------- ----- ---------- ------------ ----------

Current liabilities

Trade and other payables (1,109) (849) (547)

Tax liability (1,580) (1,500) (1,580)

Performance fee payable - (2,567) -

----------------------------------- ----- ---------- ------------ ----------

Total liabilities (2,689) (4,916) (2,127)

----------------------------------- ----- ---------- ------------ ----------

Net current assets/(liabilities) 2,406 (2,978) 9,399

----------------------------------- ----- ---------- ------------ ----------

Net assets 36,724 65,009 41,008

----------------------------------- ----- ---------- ------------ ----------

Equity

Issued capital 1,281 1,751 1,281

Share premium 13,063 13,063 13,063

Revenue reserve 11,036 39,321 15,320

Capital redemption reserve 11,344 10,874 11,344

----------------------------------- ----- ---------- ------------ ----------

Total equity 36,724 65,009 41,008

----------------------------------- ----- ---------- ------------ ----------

The NAV per share on 30 September 2022 is 1,445.3 pence (30

September 2021: 1,867.6 pence, 31 March 2022: 1,613.8 pence).

These financial statements were approved and authorised for

issue by the Board of Directors on 23 November 2022. Signed on

behalf of the Board of Directors.

Noel Lamb Kenneth Lever

Chairman Director

Unaudited Condensed Statement of Cash Flows

for the six months ended 30 September 2022

Six months Six months

to to Year ended

30-Sep-22 30-Sep-21 31-Mar-22

Notes GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

------------------------------------- ------ ------------- ------------- -------------

Cash flow from operating

activities

Cash outflow from operations a (504) (3,233) (7,306)

Portfolio dividend income 169 43 99

------------------------------------- ------ ------------- ------------- -------------

Net cash outflow from operating

activities (335) (3,190) (7,207)

Cash flow from investing

activities

Purchase of investments 5-- (9,594) (1,457) (1,457)

Sale of investments 5-- 4,392 5,410 43,122

Net cash (outflow)/inflow from

investing activities (5,202) 3,953 41,665

Cash flow from financing

activities

Dividends paid 7 - (535) (535)

Return of Capital B Share

Scheme and Tender Offer - - (25,021)

------------------------------------- ------ ------------- ------------- -------------

Net cash outflow from financing

activities - (535) (25,556)

Change in cash and cash equivalents (5,537) 228 8,902

Opening cash and cash equivalents 10,507 1,605 1,605

------------------------------------- ------ ------------- ------------- -------------

Closing cash and cash equivalents 4,970 1,833 10,507

------------------------------------- ------ ------------- ------------- -------------

Note

a) Reconciliation of profit for the period/year to net cash outflow

from operations

GBP'000 GBP'000 GBP'000

------------------------------------- ------ ------------- ------------- -------------

(Loss)/profit for the period/year (4,284) 12,887 13,843

Rolled up interest (230) (164) (224)

Loss/(gain) on investments 5 3,850 (17,845) (20,007)

Portfolio dividend income (226) (55) (99)

Adjustment for accrued interest

on redemption/conversion - (48) (16)

--------------------------------------------- ------------- ------------- -------------

Operating loss (890) (5,225) (6,503)

Decrease/(increase) in trade and

other receivables 96 5 (65)

Increase/(decrease) in trade and

other payables 290 1,987 (738)

--------------------------------------------- ------------- ------------- -------------

Net cash outflow from operations (504) (3,233) (7,306)

------------------------------------- ------ ------------- ------------- -------------

--The purchase and sale of investments are the cash paid or

received during the period and excludes unsettled investments as at

30 September 2022.

Unaudited Condensed Statement of Changes in Equity

for the six months ended 30 September 2022

Six months to 30

September 2022

------------------------------ ---------- --------- --------- --------- --------- ----------- ---------

B shares D shares Ordinary Share Revenue Capital Total

Share Premium Reserve Redemption Equity

Capital Reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ ---------- --------- --------- --------- --------- ----------- ---------

Balance at 31 March

2022 (audited) - 10 1,271 13,063 15,320 11,344 41,008

------------------------------ ---------- --------- --------- --------- --------- ----------- ---------

Loss and total comprehensive

Income for the period - - - - (4,284) - (4,284)

------------------------------ ---------- --------- --------- --------- --------- ----------- ---------

Total profit and

comprehensive income

for the period - 10 1,271 13,063 11,036 11,344 36,724

------------------------------ ---------- --------- --------- --------- --------- ----------- ---------

Contributions by

and distributions

to owners

Dividends paid - - - - - - -

------------------------------ ---------- --------- --------- --------- --------- ----------- ---------

Balance at 30 September

2022 (unaudited) - 10 1,271 13,063 11,036 11,344 36,724

------------------------------ ---------- --------- --------- --------- --------- ----------- ---------

Six months to 30

September 2021

------------------------- --------- --------- --------- --------- --------- ----------- ---------

B shares D shares Ordinary Share Revenue Capital Total

Share Premium Reserve Redemption Equity

Capital Reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------- --------- --------- --------- --------- --------- ----------- ---------

Balance at 31 March

2021 (audited) - 10 1,741 13,063 29,969 10,874 52,657

------------------------- --------- --------- --------- --------- --------- ----------- ---------

Profit and total

comprehensive

Income for the period - - - - 12,887 - 12,887

------------------------- --------- --------- --------- --------- --------- ----------- ---------

Total profit and comprehensive

income for the period 10 1,741 13,063 39,856 10,874 65,544

------------------------------------ --------- --------- --------- --------- ----------- ---------

Contributions by

and distributions

to owners

Dividends paid - - - - (535) - (535)

------------------------- --------- --------- --------- --------- --------- ----------- ---------

Balance at 30 September

2021 (unaudited) - 10 1,741 13,063 39,321 10,874 65,009

------------------------- --------- --------- --------- --------- --------- ----------- ---------

Year to 31 March

2022

------------------------- --------- --------- --------- --------- --------- ----------- ---------

B shares D shares Ordinary Share Revenue Capital Total

Share Premium Reserve Redemption Equity

Capital Reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------- --------- --------- --------- --------- --------- ----------- ---------

Balance at 31 March

2021 (audited) - 10 1,741 13,063 29,969 10,874 52,657

------------------------- --------- --------- --------- --------- --------- ----------- ---------

Profit and total

comprehensive

Income for the year - - - - 13,843 - 13,843

------------------------- --------- --------- --------- --------- --------- ----------- ---------

Total profit and

comprehensive income

for the year - 10 1,741 13,063 40,812 10,874 66,500

------------------------- --------- --------- --------- --------- --------- ----------- ---------

Contributions by

and distributions

to owners

Share buy back - - (470) - - 470 -

Dividends paid - - - - (535) - (535)

Return of unclaimed

special dividends

and capital payments - - - 64 - 64

Tender Offer - - - (14,578) - (14,578)

Issue of B Shares 10,443 - - (10,443) - - -

Redemption of B Shares (10,443) - - 10,443 (10,443) - (10,443)

------------------------- --------- --------- --------- --------- --------- ----------- ---------

Balance at 31 March

2022 (audited) - 10 1,271 13,063 15,320 11,344 41,008

------------------------- --------- --------- --------- --------- --------- ----------- ---------

Notes to the Unaudited Condensed Interim Financial

Statements

1 - General information

Rockwood Strategic Plc (the "Company") is a company incorporated

in the UK and registered in England and Wales (registration number:

03813450). The information set out in these unaudited condensed

interim financial statements for the periods ended 30 September

2022 and 30 September 2021 does not constitute statutory accounts

as defined in section 435 of Companies Act 2006. Comparative

figures for 31 March 2022 are derived from the financial statements

for that year. The financial statements for the year ended 31 March

2022 have been delivered to the Registrar of Companies and contain

an unqualified audit report and did not contain a statement under

emphasis of matter or statements under section 498(2) or (3) of the

Companies Act 2006. These unaudited condensed interim financial

statements have been prepared in accordance with the AIM rules.

Rockwood Strategic Plc (AIM: RKW) had its entire issued share

capital admitted to listing on the premium segment of the Official

List maintained by the FCA and to trading on the premium segment of

the London Stock Exchange's Main Market on 29 September 2022.

Trading in the existing ordinary shares on AIM was cancelled

simultaneously.

2 - Basis of accounting

These interim financial statements for period ended 30 September

2022 have been prepared in accordance with UK adopted International

Accounting Standards.

The principal accounting policies adopted in the preparation of

the financial information in these unaudited condensed interim

financial statements are unchanged from those used in the Company's

financial statements for the year ended 31 March 2022 and are

consistent with those that the Company expects to apply in its

financial statements for the year ended 31 March 2023.

These unaudited condensed interim financial statements have been

prepared in accordance with IAS 34: Interim Financial Reporting.

They do not include all the information required for full annual

financial statements and should be read in conjunction with the

annual financial statements for the year ended 31 March 2022.

New Standards issued but not yet effective

Standards and amendments will be effective for annual reporting

periods beginning on or after 1 January 2023 and which have not

been early-adopted by the Company include:

-- IAS 1 and IFRS Practice Statement 2 - Disclosure of Accounting Policies

-- IAS 8 - Definition of Accounting Estimates

-- IAS 12 - Deferred Tax Related to Assets and Liabilities Arising from a Single Transaction

3 - Estimates

The preparation of the unaudited condensed interim financial

statements requires management to make judgements, estimates and

assumptions that affect the application of accounting policies and

the reported amounts of assets and liabilities, income and

expenses. The valuation of unquoted investments represents the key

estimate. Actual results may differ from these estimates.

In preparing these unaudited condensed interim financial

statements, the significant judgements made by management in

applying the Company's accounting policies and the key sources of

estimation were the same as those that applied to the Company

financial statements as at and for the year ended 31 March 2022.

The areas involving a high degree of judgement or complexity, or

areas where assumptions and estimates are significant to the

unaudited condensed interim financial statements are disclosed in

note 5 in relation to the valuation of unquoted investments.

4 - Financial risk management

The Company's financial risk management objectives and policies

are consistent with those disclosed in the Company financial

statements as at and for the year ended 31 March 2022.

Notes to the Unaudited Condensed Interim Financial Statements

(continued)

5 - Investments at fair value through profit or loss

The Company's investments are valued using the following

basis:

(a) Quoted investments are recognised on trading date and valued

at the closing bid price at the period end.

(b) Unquoted Investments are valued according to the to the

Directors' best estimate of the Company's share of that

investment's value. This value is calculated in accordance with the

International Private Equity and Venture Capital Valuation

Guidelines (the IPEV guidelines) and industry norms which include

calculations based on appropriate earnings or sales multiples.

The movements in the investments at fair value through profit or

loss are as follows:

Additions Revaluation Transfer

Value Disposal Gain between Value at

at on

1 April proceeds disposals levels* 30 September

2022 2022

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------- -------- ---------- --------- ---------- ------------ --------- -------------

Investments

in quoted

companies

(Level 1) 28,692 9,865 (389) 104 (3,954) - 34,318

Other unquoted

investments

(Level 3) 2,917 230 (3,147) - - - -

Total investments

at fair value

through profit

or loss 31,609 10,095 (3,536) 104 (3,954) - 34,318

------------------- -------- ---------- --------- ---------- ------------ --------- -------------

-- The Lakes Distillery Company Plc Convertible Bond was

purchased on 20 June 2019. It was valued at fair value which

approximated to the bond issue amount plus rolled up "payment in

kind" notes and capitalised interest. The bond was fully matured on

18 July 2022.

Additions Gain Revaluation Transfer

on

Value Disposal disposals/ between Value at

at

1 April proceeds conversion levels* 30 September

2021 2021

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------- -------- ---------- --------- ----------- ------------ ------------- -------------

Investments

in quoted

companies

(Level 1) 47,565 596 (3,428) 725 17,085 1,739 64,282

Other unquoted

investments

(Level 3) 6,323 1,019 (1,933) - 35 (1,739) 3,705

Total investments

at fair value

through profit

or loss 53,888 1,615 (5,361) 725 17,120 - 67,987

------------------- -------- ---------- --------- ----------- ------------ ------------- -------------

* Northbridge Convertible Bond was purchased on 10 April 2018,

and a further investment was made on 3 July 2018. 20% of

Northbridge Industrial Services Plc loan notes were converted into

equity shares and 80% were redeemed on 14 June 2021. The strike

price of each option was 90 pence for every GBP1 nominal value

converted into 433,207 ordinary shares. The accrued interest

(GBP32,045) and redemption premium (GBP389,886) on the loan notes

up to this period were paid at the time of redemption therefore no

further interest was accrued. As a result of this, there was a

transfer from Level 3 to Level 1 of GBP389,886 Northbridge loan

notes converted to equity shares.

* National World Plc Bond was purchased on 11 February 2021. It

was fully converted into 12,263,013 equity shares on 7 May 2021.

The conversion premium and accrued interest up to the date of

conversion were given in the form of equity shares and included in

the above. As a result of this, there was a transfer from Level 3

to Level 1 of GBP1,348,931 National World Plc loan notes converted

to equity shares

Investments in quoted companies have been valued according to

the quoted share price as at 30 September 2022.

Notes to the Unaudited Condensed Interim Financial Statements

(continued)

5 - Investments at fair value through profit or loss

(continued)

The revaluations and gains on disposals are included in the

statement of comprehensive income as gains on investments.

The following table analyses investment carried at fair value at

the end of the period, by the level in the fair value hierarchy

into which the fair value measurement is categorised. The different

levels are defined as follows:

(i) level one measurements are at quoted prices (unadjusted) in

active markets for identical assets or liabilities;

(ii) level two measurements are valuations techniques with all

material inputs observable for the asset or liability, either

directly (that is, as prices) or indirectly (that is, derived from

prices); and

(iii) level three measurements are valuations not based on

solely observable market data (that is, the measurement requires

significant unobservable inputs).

The fair value of the Company's investments is summarised as

follows:

30 September 31 March

2022 2022

GBP'000 GBP'000

--------- ------------- ---------

Level 1 34,318 28,692

Level 2 - -

Level 3 - 2,917

----------- ------------- ---------

34,318 31,609

--------- ------------- ---------

6 - Performance Fee

Under the terms of the restated Investment Management Agreement

(7 April 2022), the Company will pay the Investment Manager a

performance fee equal to 10 per cent. of outperformance over the

higher of a 6 per cent. per annum total return hurdle and the high

watermark. The 6 per cent. per annum compounds weekly and the

performance fee is calculated annually. Provided that the Company's

average NAV is at or below GBP100 million, performance fees in any

performance fee period are capped at 3 per cent. of the Company's

average NAV for the relevant performance fee period. In such

instance, performance fees in excess of the 3 per cent. cap will

not be paid and will instead be deferred into the next performance

fee period. If the average NAV exceeds GBP100million, the

performance fee shall be further limited such that the combined

investment management and performance fees shall not exceed 3 per

cent. of the Company's average NAV. In such instance, performance

fees in excess of the cap will not be deferred and will not become

payable at any future date.

The performance fee is calculated annually for each performance

fee period, which is aligned with the Company's accounting year. It

is accounted for on an accrual basis and is recognised in the

statement of comprehensive income once a performance fee is

triggered during the performance fee period.

30 September 2022 30 September 2021 31 March 2022

GBP'000 GBP'000 GBP'000

----------------- ------------------- ------------------ --------------

Performance Fee - (2,567) (2,772)

------------------ ------------------ ------------------ --------------

- (2,567) (2,772)

------------------------------------- ------------------ --------------

7 - Dividends

The Directors have not recommended the payment of a final

dividend in respect of the year-ended 31 March 2022. A final

dividend for the year ended 31 March 2021 (GBP535,664) was paid on

30 September 2021.

8 - Taxation

The Company has no tax charge for the period ended 30 September

2022 (30 September 2021: GBP 1,500k, 31 March 2022: GBP

1,580k).

Notes to the Unaudited Condensed Interim Financial Statements

(continued)

9 - Earnings per share

Basic earnings per share is calculated by dividing the

profit/loss attributable to ordinary shareholders by the weighted

average number of Ordinary Shares during the period/year. Diluted

earnings per share is calculated by dividing the profit/loss

attributable to shareholders by the adjusted weighted average

number of Ordinary Shares in issue.

Six months Six months

to to Year to

30-Sep-22 30-Sep-21 31-Mar-22

GBP'000 GBP'000 GBP'000

------------------------------------- ----------- ----------- ----------

Earnings

------------------------------------- ----------- ----------- ----------

(Loss)/profit for the period/year (4,284) 12,887 13,843

Number of shares ('000)

------------------------------------- ----------- ----------- ----------

Weighted average number of ordinary

shares in issue for basic EPS 2,541 3,481 3,229

------------------------------------- ----------- ----------- ----------

Weighted average number of ordinary

shares in issue for diluted EPS 2,541 3,481 3,229

------------------------------------- ----------- ----------- ----------

Earnings per share

------------------------------------- ----------- ----------- ----------

Basic and diluted (loss)/earnings

per share (168.58p) 370.23p 428.76p

------------------------------------- ----------- ----------- ----------

As at 30 September 2022, the total number of shares in issue was

2,541,046 (30 September 2021: 3,480,884, 31 March 2022: 2,541,046).

During the period, the Company cancelled nil Treasury shares (30

September 2021: nil, 31 March 2022: nil). No shares were bought

during the period (30 September 2021: nil, 31 March 2022: 939,838).

There are no share options outstanding at the end of the

period.

There are no dilutive or potentially dilutive instruments and

therefore basic and diluted earnings per share are the same.

10 - Related party transactions

The related parties of Rockwood Strategic Plc are its Directors,

persons connected with its Directors, its previous Investment

Manager,

Gresham House Asset Management (GHAM), former significant

shareholder, Gresham House Plc (Gresham), and its new Investment

Manager and significant shareholder Harwood Capital LLP

(Harwood).

The Directors' remuneration paid and payable in respect of each

Director who served during the financial period to 30 September

2022 were as follows:

As at As at 30 As at

31 September 2022 September 2021 31 March 2022

GBP'000 GBP'000 GBP'000

---------------------------------------------- ------------------- ---------------- ---------------

David Potter (Resigned on 11 June 2021) - 24 24

Charles Berry (Resigned on 22 November 2021) - 14 26

Kenneth Lever 14 14 28

Helen Sinclair (Resigned on 5 November 2021) - 22 41

Graham Bird (Resigned on 1 September 2022) 12 9 22

Simon Pyper (Resigned on 31 March 2022) - - 12

Noel Lamb 20 - 8

Paul Dudley (Appointed on 1 September 2022) 2 - -

Social security costs - 1 12

---------------------------------------------- ------------------- ---------------- ---------------

Total 48 84 173

---------------------------------------------- ------------------- ---------------- ---------------

The total maximum aggregate annual fees payable to Directors

under the Company's Articles of Association (Articles) is

GBP250,000. As per the Company's Articles, Directors are entitled

to be paid all reasonable expenses properly incurred in the

performance of their duties as Directors including their expenses

travelling to and from Board and Committee meetings.

Notes to the Unaudited Condensed Interim Financial Statements

(continued)

10 - Related party transactions (continued)

Details of related party transactions between the Company and of

non-salary related transactions involving Directors are detailed

below.

During the half year to 30 September 2022, Rockwood Strategic

Plc was charged management fees of GBP52k to Harwood (30 September

2021: GBP562k by GHAM, 31 March 2022: GBP593k by GHAM). The

management fees of GBP52k remain payable to Harwood as at 30

September 2022.

The total payable to GHAM is as follows:

Particulars As at 30 September 2022 As at 30 September 2021 As at 31 March 2022

Performance fee (including VAT) nil GBP2.57 million nil

------------------------ ------------------------ --------------------

Management fee nil GBP0.10 million nil

------------------------ ------------------------ --------------------

Other miscellaneous nil GBP0.00 million nil

------------------------ ------------------------ --------------------

Total nil GBP2.67 million nil

------------------------ ------------------------ --------------------

The performance fees charged and payable to GHAM were nil as at

30 September 2022 (30 September 2021: 2,566,903 31 March 2022:

nil).

As at 30 September 2022, the following shareholders of the

Company that are related to Harwood and GHAM had the following

interests in the issued shares of the Company:

As at 30 September 2022 As at 30 September 2021 As at 31 March 2022

A L Dalwood N/A* 36,302 Ordinary Shares 21,947 Ordinary Shares

------------------------ ------------------------ ------------------------

G Bird 17,462 Ordinary Shares 26,543 Ordinary Shares 17,462 Ordinary Shares

------------------------ ------------------------ ------------------------

Gresham House Holdings Ltd - 812,913 Ordinary Shares -

------------------------ ------------------------ ------------------------

R Staveley 25,689 Ordinary Shares - 25,689 Ordinary Shares

------------------------ ------------------------ ------------------------

Harwood Holdco Limited 734,000 Ordinary Shares - 734,000 Ordinary Shares

------------------------ ------------------------ ------------------------

*not a related party in the period

The Company signed a co-investment agreement with SPE Fund LP, a

sister fund to the Company launched by GHAM on 15 August 2016.

Under the agreement, the Company undertook to co-invest GBP7.5

million with the SPE Fund LP. This agreement ended after the

Investment Agreement with GHAM was terminated by the Board on 11

October 2021.

There are no other related party transactions of which we are

aware in the six months ended 30 September 2022.

11 - Other Costs

Profit for the year has been derived after taking the following

items into account:

Six months Six months

to to Year to

30-Sep-22 30-Sep-21 31-Mar-22

GBP'000 GBP'000 GBP'000

---------------------------------------- ----------- ----------- -----------

Auditors remuneration

Fees payable to the current auditor

for the audit of the

Company's annual financial statements 15 26 40

Fees payable to the Company's current

auditor and its associates for other

services:

Fees for agreed upon procedures

in relation to financial

Information - - 10

Fees for agreed upon procedures

for performance fee - - 5

Fees for review of interim report - - 3

Other services relating to taxation - 4 5

Under provision of tax fee - - 3

Recharge cost - - 1

Analysis of other costs:

Conversion to an Investment Trust

Company 451 - -

Strategic review expenses - 256 1,012

Stock Brokerage fees 66 68 144

Legal fees 64 57 14

Accounting fee 62 50 117

Filing and Regulatory fees 27 19 42

Depositary fees 18 18 36

Company secretarial 18 19 44

Custodian fees 11 15 24

Other professional fees 51 36 85

Other general expenses 44 44 124

---------------------------------------- ----------- ----------- -----------

827 612 1,709

---------------------------------------- ----------- ----------- -----------

12 - Subsequent events note

There were no material events after the statement of financial

position date that have a bearing on the understanding of these

unaudited interim financial statements.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FIFFDLELVFIF

(END) Dow Jones Newswires

November 23, 2022 02:30 ET (07:30 GMT)

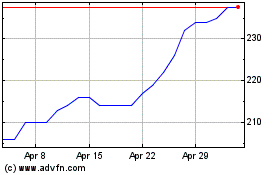

Rockwood Strategic (LSE:RKW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rockwood Strategic (LSE:RKW)

Historical Stock Chart

From Apr 2023 to Apr 2024