Safestore Holdings plc Safestore acquires remaining share of Benelux JV (6761G)

31 March 2022 - 5:01PM

UK Regulatory

TIDMSAFE

RNS Number : 6761G

Safestore Holdings plc

31 March 2022

31 March 2022

Safestore Holdings plc ("Safestore" or "the Group")

Safestore acquires remaining 80% share of Benelux Joint

Venture

Safestore is pleased to announce that it has acquired the

remaining 80% of the equity owned by Carlyle Europe Realty (CER) in

the Joint Venture formed in 2019 ("the Joint Venture"). The total

consideration paid to Carlyle was EUR67m. The total initial cash

outflow is EUR139m and includes the share purchase (EUR67m),

refinancing of the existing borrowings (EUR67m), transfer tax and

other deal costs (EUR5m) and was funded from the Group's existing

loan facilities. The Joint Venture was acquired based on an

enterprise value of EUR146m.

The Joint Venture was setup in 2019 to acquire and develop

assets in The Netherlands and Belgium in order to leverage

Safestore's operating platform outside our core markets. Since

then, the Joint Venture has grown to a portfolio of 55,000 square

meters (592,000 Sq Ft) of MLA which is currently 74% occupied.

The portfolio is made up of fifteen high quality properties

(twelve freehold properties, two ground leases and one leasehold

property). Nine properties are located in the Netherlands, six of

which are concentrated in the Haarlem / Amsterdam area with

additional properties in The Hague, Het Gooi and the recently

opened Nijmegen store. In Belgium, two stores are located in the

Brussels area, two in the city of Liege and further properties in

Nivelles and Charleroi. Safestore has managed the properties since

acquisition by the Joint Venture

The Group's investment is expected to be marginally accretive to

Group earnings per share in FY2021/22 and will support the Group's

future dividend capacity. The expected initial yield based on total

enterprise value is 3.9%(1) which we expect to grow to Safestore's

normal returns hurdles as the portfolio matures. Post transaction,

the Group's LTV will increase to 31%. Financing capacity under our

RCF and Shelf facilities, combined with our cash reserves, is

expected to be c. GBP219m following this transaction.

Safestore CEO Frederic Vecchioli commented:

"Combining Safestore's highly scalable operating platform and

development experience with Carlyle's investment expertise proved

to be a successful partnership. We are now exploring further

opportunities to work together."

Marc-Antoine Bouyer, Managing Director on the Carlyle Europe

Realty advisory team, commented:

"This transaction marks the culmination of a major acquisition

and asset management effort through our joint venture with

Safestore to assemble an institutional-quality self-storage

portfolio of scale with exposure to prime cities in the Netherlands

and Belgium. We believe that the market fundamentals for European

self-storage remain highly attractive and look forward to working

alongside Safestore in identifying further opportunities on the

continent."

This announcement contains inside information as defined in

Article 7 of the Market Abuse Regulation (EU) No. 596/2014 as

incorporated into UK law pursuant to the European Union

(Withdrawal) Act 2018. Following publication of this announcement,

this information is now considered to be in the public domain.

Ends

Notes

1. For these purposes, Initial Yield is defined as EBITDA after

leasehold rent divided by the total investment on a stand-alone

basis including deal costs and real estate transfer tax.

Enquiries

Safestore Holdings plc 020 8732 1500

Frederic Vecchioli, Chief Executive Officer

Andy Jones, Chief Financial Officer

www.safestore.com

Instinctif Partners

Guy Scarborough / Bryn Woodward 020 7457 2020

Notes to Editors

-- Safestore is the UK's largest self-storage group with 162

stores at 31 January 2022, comprising 129 wholly owned stores in

the UK (including 72 in London and the South East with the

remainder in key metropolitan areas such as Manchester, Birmingham,

Glasgow, Edinburgh, Liverpool, Sheffield, Leeds, Newcastle and

Bristol), 29 wholly owned stores in the Paris region and 4 stores

in Barcelona

-- Safestore operates more self-storage sites inside the M25 and

in central Paris than any competitor providing more proximity to

customers in the wealthiest and densest UK and French markets.

-- Safestore was founded in the UK in 1998. It acquired the

French business "Une Pièce en Plus" ("UPP") in 2004 which was

founded in 1998 by the current Safestore Group CEO Frederic

Vecchioli.

-- Safestore has been listed on the London Stock Exchange since

2007. It entered the FTSE 250 index in October 2015.

-- The Group provides storage to around 80,000 personal and business customers.

-- As at 31 January 2022, Safestore had a maximum lettable area

("MLA") of 7.067 million sq ft (excluding the expansion pipeline

stores) of which 5.708 million sq ft was occupied.

-- Safestore employs around 700 people in the UK, Paris and Barcelona.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQDZGFFRGLGZZM

(END) Dow Jones Newswires

March 31, 2022 02:01 ET (06:01 GMT)

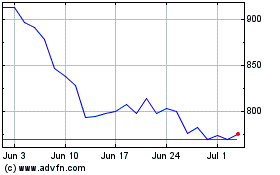

Safestore (LSE:SAFE)

Historical Stock Chart

From Mar 2024 to Apr 2024

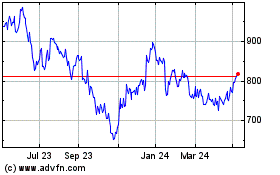

Safestore (LSE:SAFE)

Historical Stock Chart

From Apr 2023 to Apr 2024